It’s now almost exactly a quarter-century since the economists Barry Eichengreen and Ricardo Hausmann first argued that the “original sin” of the developing world was borrowing in overseas currencies like the dollar.

For centuries, this led to periodic financial crises. But countries like China, India, Brazil, Mexico and smattering of other smaller developing countries such as Chile and Poland have worked hard to develop their own local bond markets over the past two decades. This is arguably one of the under-appreciated developmental success stories of the past generation.

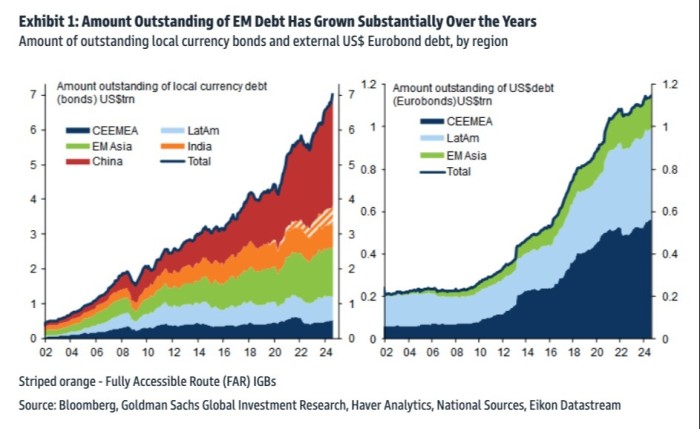

As Goldman Sachs highlights in a new report on “lessons from two decades of EM fixed income investing”, EM local bonds are now a $7tn asset class, vastly outstripping the ca $1.2tn EM dollar bond universe.

Of course, progress is not uniform. Many smaller emerging markets remain dependent on overseas borrowing, and probably always will, as they lack the scale to build healthy local debt markets.

And as we’ve noted before, the growing international involvement in local bond markets comes with downsides The currency mismatch risk has simply migrated from borrowers to lenders. That’s better, but it doesn’t eliminate the dangers of financial crises.

But after weathering a lot of major shocks over the past two decades, what was once a risky asset class has now grown up.

Goldman Sachs notes that while local-currency EM bonds have had a cruddy decade, they actually did no worse than developed market bonds when the Fed started jacking up interest rates, and have now recovered more of the lost ground. Likewise with dollar EM bonds.

Goldman has made the report public for us, so you can read the whole thing here. But here are its main points:

-

What have we learnt from two decades of performance? A more mature asset class, with less outperformance but more resilience. Growing up is not all it’s made out to be. After a blistering start in the 2000s, returns across EM fixed income have been more modest over the past decade. But while that outperformance has faded, EM fixed income has demonstrated an impressive resilience in the face of several large shocks, including the Global Financial Crisis, the Covid pandemic and the subsequent inflation surge.

-

In what macro/markets environment does EM fixed income flourish? Differentiated risk betas with a high yield. EM debt offers a high yield — indeed, a higher yield than for many other sovereign fixed-income assets — but uniquely embeds positive cyclical exposure. At the same time, EM fixed income tends to benefit more from global rate relief than other cyclical fixed-income assets. So the best periods often tend to be a combination where rates are stable or easing and growth prospects are being re-rated higher.

-

What role can EM fixed income play in broader portfolios? Hard currency EM, in particular, allows for higher returns primarily for somewhat higher volatility/risk tolerance portfolios. For local currency EM, however, the more differentiated risk exposure compared with other non-US Dollar fixed income portfolios implies that there are benefits of holding GBI-EM even in portfolios that target lower volatility outcomes.

-

To hedge or not to hedge? Mind the currency risk. For EM local debt investors, management of FX risk has been a key consideration, especially through long persistent periods of Dollar strength. Hedging Dollar risk has been important to total returns in EM and DM. But for EMs, hedging currency exposure completely comes at the cost of giving up cyclical upside.

You must be logged in to post a comment Login