Consumer confidence in Britain has fallen to its lowest this year as households and businesses “hold their breath” for tax rises in next week’s Budget.

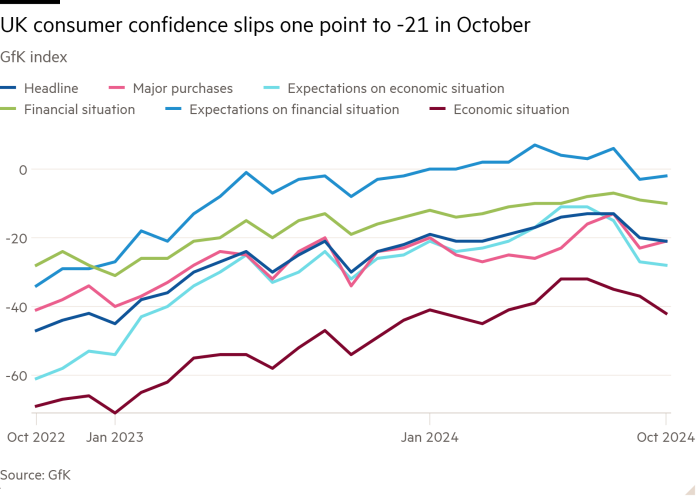

The GfK consumer confidence index — a measure of how people view their personal finances and broader economic prospects — fell to minus 21 in October, according to data published by the research company on Friday.

Consumer confidence is an indication of how likely households are to spend income on goods and services.

The index has not been lower since December 2023. With October’s one-point fall, it is at the same level as February and March, before consumer confidence rebounded mid-year.

A separate survey this week showed business confidence also falling to its weakest since last year.

Neil Bellamy, GfK consumer insights director, said consumers were “in a despondent mood” ahead of the October 30 Budget. Chancellor Rachel Reeves is expected to largely rely on tax increases to close what the government says is a funding gap of about £40bn.

The latest snapshot of consumer confidence gives “a picture of people holding their breath to see what’s in store”, Bellamy added.

Business confidence is also falling, with the S&P Global flash UK PMI composite output index slipping to an 11-month low of 51.7 and companies cutting staff numbers for the first time in 2024.

Chris Williamson, chief business economist at S&P Global Market Intelligence, which compiles the PMI index, said “gloomy government rhetoric and uncertainty ahead of the Budget” had “dampened business confidence and spending”.

While Reeves has pledged not to increase rates of income tax, national insurance or VAT, she is expected to prolong a freeze on personal tax thresholds beyond 2028 in a “stealth” tax move that could raise £7bn a year. She has also not ruled out increasing employers’ national insurance contributions.

In an article for the Financial Times this week, Reeves said the Budget would highlight a choice between investment and decline.

“I am choosing to invest in Britain so we can turn the page on 14 years of slow growth and start making the country better off,” she wrote.

Reeves also confirmed she will change the UK’s fiscal rules in the Budget as she seeks to fund about £20bn a year of extra investment with increased borrowing.

The chancellor said her “investment rule” would ensure Britain avoided “the falls in public sector investment that were planned under the last government”.

But the deterioration in consumer and business confidence comes despite falls in inflation and mortgage rates.

The consumer confidence index had previously fallen seven points in September, reversing improvements since the start of the year.

Official figures last month showed that household consumption has been weak so far this year, despite a fast rebound in wage growth as anxious consumers prioritise saving over spending.

The GfK data indicates that the uncertainty over the government’s tax plans means that consumer morale has yet to benefit from the better economic data.

Households’ assessment of the economy fell 5 points to minus 42, the lowest reading since March, with a smaller decline in expectations for the year ahead, according to the index, which is based on interviews conducted in the first two weeks of the month.

After two years of sharp price rises that hit household finances, inflation fell to 1.7 per cent in September, the lowest in more than three years. It was also the first time inflation has dipped below the Bank of England’s 2 per cent target since early 2021.

Markets have increased bets on BoE interest rate cuts this year on the back of the inflation data, after policymakers lowered the benchmark rate from 5.25 per cent to 5 per cent in August, the first reduction in more than four years.

Separate analysis published by the National Centre for Social Research on Friday indicated that concern about public services was outweighing worries about levels of taxation. Almost half of Britons surveyed in July said taxes and public spending should go up, while dissatisfaction with the NHS hit an all-time high of 61 per cent.

You must be logged in to post a comment Login