Good morning. Last night EU leaders wrapped up a migration-dominated summit with a joint statement that shifted the bloc’s position firmly to the right. They called for “new ways” to crack down on irregular border crossings, fresh legislation to speed up deportations, and effectively gave a green light to Poland’s recent announcement that it plans to suspend asylum claims on its eastern border.

Today, I have an exclusive interview with Ukrainian President Volodymyr Zelenskyy, where he explains why it’s crucial that western allies endorse all the elements of his Victory Plan. And our excellent eastern Europe correspondent reports from Moldova ahead of the country’s double-vote this weekend that will decide its geopolitical future.

Have a fantastic weekend.

Volodymyr’s pitch

Volodymyr Zelenskyy outlined his five-point Victory Plan to EU leaders in Brussels yesterday, seeking their support for what proposals he says can end the war with Russia. He told me that it was the only way to protect Ukraine, end the war — and ensure the future protection of Europe.

Context: Russia launched a full-scale invasion of Ukraine in February 2022, seeking to conquer the country. That initial effort failed, but President Vladimir Putin’s troops still occupy around a fifth of the country’s territory.

Zelenskyy’s key message was that an invitation to join Nato — the first of his plan’s five elements — was “the only way” Ukraine could survive.

But he also said that more advanced weaponry — the second point — was critical for Ukraine to survive another winter of Russian bombardment.

“These two things go together,” he told the Financial Times. “The answer is lying on the table. They attack us with long-distance weapons . . . Mostly [energy] blackouts are due to long-distance missiles, ballistics and Iranian drones.”

“We cannot destroy their air fields with only [our] drones. To stop them . . . we need huge long-distance weapons,” he added.

The US and Germany oppose both a formal Nato invitation and the use of their long-range missiles to hit targets deep inside Russian territory, such as bomber bases.

“We must continue on the pro-Ukrainian path, more sanctions, implementation effectively and more military and humanitarian assistance,” Roberta Metsola, the president of the European parliament, told the FT, alongside Zelenskyy.

“We are approaching 1,000 days of war. 1,000 days mean a fourth winter. It will be a difficult winter,” said Metsola, adding that on November 21, the biggest parties in the chamber will “recommit themselves” to support for Ukraine.

Zelenskyy also stressed that the fifth point of his plan, deploying battle-hardened Ukrainian troops in other European Nato states to help defend them, would be crucial for the continent’s long-term security as the US pivots towards Asia and redeploys troops stationed in Europe.

“This is very important. [My troops] are not afraid of Russians,” he said. “If Nato countries are ready . . . our soldiers can be [ready].”

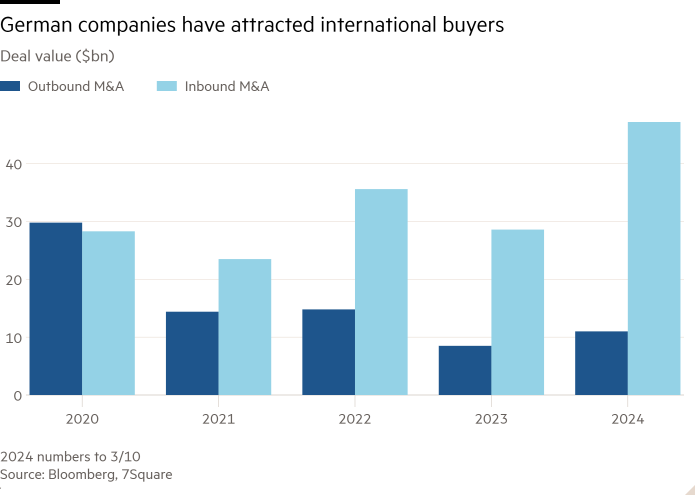

Chart du jour: Germany for sale

“Deutschland im Ausverkauf” is the phrase used by some observers to describe the fact that German companies have become relatively small and relatively cheap, writes Lex.

Decision time

Moldovans will head to the polls on Sunday to take part in two votes at once that mark a historic juncture for the 2.5mn strong nation, but have also left it fending off an unprecedented onslaught of illegal Russian cash, writes Polina Ivanova.

Context: The country is holding a referendum on committing to join the EU after starting membership talks earlier this year. It is also holding a presidential election, in which pro-western incumbent Maia Sandu is hoping to secure a second term.

It marks a momentous choice for Moldova, analysts say, between a European path or a potential return for the ex-Soviet nation to the Russian fold. While polls are showing a majority of Moldovans favour EU accession, local authorities say Russia is proving unwilling to let it go without a fight.

Police have intercepted schemes funnelling money from Russia directly into the bank accounts of over 130,000 Moldovans and describe battling a hydra-like network of proxies inside the country, largely co-ordinated, they say, by fugitive oligarch Ilan Șor, who now resides in Moscow.

“The Kremlin has unimaginable resources to buy votes, while people are poor and vulnerable . . . I hope we don’t get left behind on the other side of a new iron curtain,” says Mihai Duca, the manager of a 100-year-old distillery in the village of Bardar. “It’s our only chance to develop this country.”

The EU has extended a package of €1.8bn to support Moldova’s growth as it works to join the bloc. Eight EU foreign ministers were in Chișinău, the capital, this week.

What to watch today

-

French President Emmanuel Macron, British Prime Minister Keir Starmer and US President Joe Biden hold talks with German Chancellor Olaf Scholz in Berlin.

-

Italian Prime Minister Giorgia Meloni visits Jordan and Lebanon.

Now read these

-

Return of the bank merger: Rising rates have boosted profits and policymakers want banks that can compete with US rivals. M&A is back.

-

Beyond ‘Mamma Fiat’: Italy’s cradle of carmaking is looking beyond the storied brand after a painful EV transition and an acrimonious spat with Rome.

-

Postcard from Greece: FT Weekend tracks down architect Nicos Valsamakis, the 100-year-old guru behind some iconic totems of Greek modernism.

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: europe.express@ft.com. Keep up with the latest European stories @FT Europe

You must be logged in to post a comment Login