This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

In today’s newsletter:

-

South America’s ‘made in China’ megaport

-

Trump’s controversial cabinet picks

-

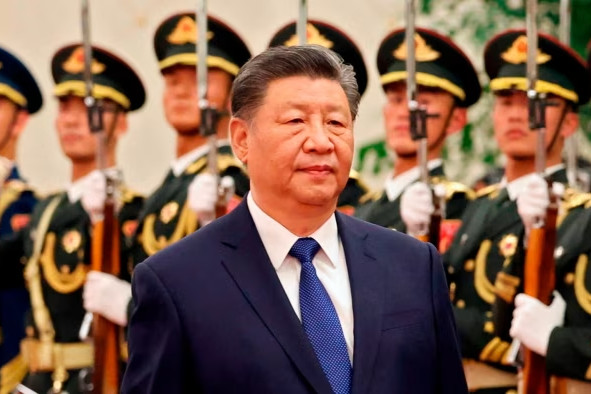

Xi faces heat over attacks on Chinese workers overseas

Good morning. Our top story comes from Peru, where Xi Jinping will today inaugurate a Chinese-built megaport that is set to transform transpacific trade.

The Port of Chancay will upend maritime trade along the continent’s Pacific coast as it can accommodate larger vessels in its deep waters. It will also significantly reduce the transit time for vessels voyaging to Asia from Peru.

But it has not been without controversy. Analysts and officials raised concerns that the $3.6bn port in effect represents a ceding of Peruvian sovereignty over the port.

China’s Cosco Shipping, which built the port with a local junior partner, will be the sole operator when it opens after Peru dropped a lawsuit challenging its exclusive status.

Meanwhile the US, which views Beijing’s growing influence in Latin America as a strategic challenge, has warned that the port could be used by Chinese warships. The development may present an area of contention with president-elect Donald Trump as he takes a tougher line against China.

Andean correspondent Joe Daniels has the full story on the Chancay port, where “everything is made in China”.

Here’s what else we’re keeping tabs on today:

-

Economic data: Australia publishes labour force data for October.

-

Sri Lanka parliamentary election: Left-wing President Anura Kumara Dissanayake, elected in September, hopes to consolidate his party’s power in today’s vote to help him implement his campaign promises.

-

Results: Foxconn and Japan’s three largest banks report their latest results.

Five more top stories

1. Donald Trump has nominated Matt Gaetz, the incendiary Republican congressman from Florida, to be US attorney-general in his second administration. The controversial pick comes as the president-elect vows retaliation for the criminal investigations and indictments launched against him by federal prosecutors in recent years.

-

More cabinet selections: Trump has chosen Tulsi Gabbard, a former Democratic congresswoman known for her pro-Russian views, to be the director of national intelligence.

-

Trump’s nominee for defence secretary: Pete Hegseth, a rightwing television personality and US army veteran, is set to be in charge of the world’s largest, most powerful and probably most bureaucratic military.

-

More US news: South Dakota senator John Thune has been elected the next Republican leader in the Senate during Trump’s second term, in a rebuke to Trump allies who had pushed for another candidate to get the job.

2. Seven & i Holdings has ended months of stonewalling and begun negotiations with Canada’s Alimentation Couche-Tard over a $47bn takeover bid for the 7-Eleven store owner. The long-awaited talks started just as a potential “white knight” bidder emerged, adding to the frenzy around a deal that if successful would transform Japan’s market for corporate mergers and acquisitions.

3. US inflation rose to 2.6 per cent in October, as the Federal Reserve debates whether to cut interest rates at its last meeting before Trump takes office. Sarah House, senior economist at Wells Fargo, said the figures showed that “it’s difficult to wring out this last bit of inflation”.

4. The detention in Mali of an international mining boss and two colleagues has raised alarm across the industry about growing personal risks for executives in the gold-rich west African nation. The three executives of Resolute Mining, an Australian gold producer, are among seven western mining executives to have been held in the past two months as tensions rise between the industry and the military junta.

5. Elon Musk’s support for Trump is set to boost X’s flagging business, with some marketers poised for a return to the social media platform in order to seek favour with the incoming administration. Media executives told the FT that some brands were preparing to advertise on X once again and would seek to get in the “good graces of Elon”.

News in-depth

Chinese leader Xi Jinping is under pressure to better secure his country’s interests in volatile regions around the world after a bomb attack by Pakistan separatists last month claimed the lives of two Chinese engineers. A spike of violence by the Balochistan Liberation Army poses a risk to the China Pakistan Economic Corridor, the largest cluster of projects under Xi’s Belt and Road Initiative with total Chinese investments estimated at $62bn.

We’re also reading . . .

-

US-China ties under Trump: The range of possible outcomes for the relationship is wider than ever before, writes Evan Medeiros, a professor at Georgetown University.

-

Sentient AI: As companies race to build machines that are more like us, Anjana Ahuja asks: should we be fretting over artificial intelligence’s feelings?

-

‘The planet’s most badass airline’: Lebanon’s Middle East Airlines is the only carrier serving the country in the midst of conflict.

Chart of the day

Investors have poured record sums into exchange traded funds this year, even before a buying spree that was ignited by the election of Trump. As of October 31, global net flows into the ETF industry had hit $1.4tn, according to data from BlackRock.

Take a break from the news

Samantha Harvey has won the 2024 Booker Prize for fiction for her novel Orbital, a sharp, lyrical meditation on the state of the Earth and humanity as viewed from space. Edmund de Waal, the chair of the judges, said “Harvey makes our world strange and new for us”.

You must be logged in to post a comment Login