Good morning. Yesterday UPS reported a strong increase in package volumes for the second quarter in a row after a long post-pandemic slump. Whether this is a victory of the US goods economy, for Shein and Temu, or for all three remains to be seen. Tell us what you have been ordering: robert.armstrong@ft.com and aiden.reiter@ft.com.

Is yen carry funding the US stock rally?

Dhaval Joshi at BCA Research thinks that the yen carry trade is an important — indeed, the important — factor in the US tech stock rally, and that the biggest risk to the rally is therefore a strengthening yen.

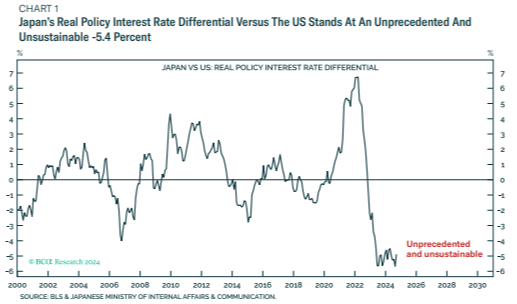

His argument is based on the historically wide differential between US and Japanese real rates. Here is his chart of the gap between the two countries’ real policy rates:

It was at just the moment this differential blew out in mid-2022 — and yen financing for US assets became correspondingly cheap — that US tech stock valuations recovered from the beating they took in the first half of that year, when the Fed began to raise interest rates. Joshi provides this tidy chart showing how tech valuations decoupled from 30-year bond yields and started to track yen weakness (the brown yen plot is flipped; up means the yen is weaker relative to the dollar):

Joshi concludes from all this that

Borrowing in yen at deeply negative real rates has fuelled the latest inflation in US tech valuations . . . the biggest risk to the bull market is not a US recession. The biggest risk is the end of the deeply negative real rates in Japan versus the US.

Interestingly, the end could come from trouble at either end of the trade:

The causality could run either way. Higher real rates in Japan versus the US and the associated stronger yen would deflate US tech stock valuations, as happened in July and August this year. Or a puncturing of the hype and hope surrounding generative AI would unwind yen funded leveraged exposure to US tech, and thereby result in a stronger yen.

Joshi suggests investors hedge this risk by being long the yen.

This theory appeals to Unhedged for several reasons. It is contrarian. And it is nice to have a story about why US stock valuations have risen and stayed high in the face of rising bond yields (a puzzle we discussed yesterday). And we don’t have a particularly good alternative story, other than some “animal spirits” hand waving, or some mumbling about the resilience of the US economy.

But correlations can deceive. And we wonder whether, in a world where Japanese official policy is (by fits and starts) hawkish and US policy has recently shifted in a dovish direction, whether many investors out there would have the courage to put on the kind of trade Joshi describes — especially after the carry trade scare this summer, and given the volatility of the rate environment ahead of the US election.

We tried to reproduce Joshi’s policy rate differential chart using data we gathered elsewhere; this is what we got:

Our version shows that the rate cap has already closed by 1.3 percentage points, and the trend is clear.

James Malcolm, a UBS FX strategist focused on Japan, says that

The carry trade itself got wiped out so much [this summer]. We had a dramatic move there. What always happens after these events [is] risk limits get tightened up . . . I spend a lot of time every day talking to people who trade Japan. On the whole, FX guys have had a poor few months, and very little profit and loss cushion. They have no capacity to take risks at the moment.

FX consultant Mark Farrington agrees: “Given how high volatility is, it makes it less likely” that traders are still taking advantage of yen carry, he says. “There are too many unrelated risks floating around.”

If there are any brave carry traders out there, email us.

(Armstrong and Reiter)

Housing

A few months ago we said that the US housing market was just plain awful. Inventories were rising, yet prices were unaffordable and rising. The situation has gotten worse since. Inventories of new homes have now reached their highest in more than a decade. Chart from John Burns Consulting:

Meanwhile, more existing homes are coming on to the market after years of homeowners being unwilling to give up cheap mortgages. “The [mortgage] lock-in effect is slowly waning,” says Rick Palacios at John Burns Consulting, “And you have select markets, like Texas and Florida, where people are starting to put homes on the market for unique reasons, [such as] property and hazard insurance.”

In a market with high inventories, you might expect prices to fall. Not in the broken US housing market. According to Troy Ludtka at SMBC Nikko Securities America, we are seeing more supply come “at a time when there is no demand”. Prices have ticked down for new homes but sales are subdued. For existing homes, prices are still increasing.

Homebuilders are pulling back. Housing permits and housing starts remain weak:

With builders building less and the decline in mortgage rates stalling, new supply is not on the way.

An economic slowdown would bring rates down and help unlock the market — and rising housing inventories and discouraged homebuilders make a slowdown more likely. Residential fixed investment is an important “swing factor” in GDP growth. The Bureau of Economic Analysis highlighted the downturn in housing investments in the second quarter, when there was more building than there is now. But no one will celebrate a looser housing market that is triggered by a recession.

(Reiter)

One good read

PMSR.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

You must be logged in to post a comment Login