News

Disguised Sunderland GP poisoned man in will row, court hears

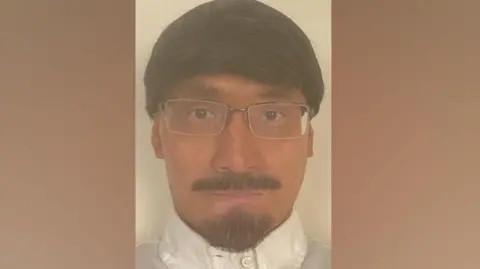

Northumbria Police

Northumbria PoliceA GP disguised himself and injected his mother’s partner with a poison in a row over an inheritance, a court has heard.

Thomas Kwan, 53, went to “extraordinary” lengths to plan and carry out the “audacious” attack by pretending he was giving a coronavirus booster jab to Patrick O’Hara, prosecutors told Newcastle Crown Court.

Mr O’Hara, 71, was lucky to survive after the toxin caused a “rare and life-threatening flesh-eating disease,” the court heard.

Kwan admits injecting Mr O’Hara with a poison, but denies attempted murder, claiming he meant to inflict “no more than mild pain and discomfort”.

Northumbria Police

Northumbria PoliceHe also denies wounding with intent but has admitted administering a noxious substance.

Opening the case, prosecutor Peter Makepeace KC said Kwan was a “respected and experienced” GP with an “encyclopaedic knowledge” of toxins who worked at the Happy House Surgery in Sunderland.

He was estranged from his mother, Wai King also known as Jenny Leung, having fallen out with her over her plans to leave her home in Newcastle to Mr O’Hara – her partner of more than 20 years.

“The effect of the will was that the property would not go to Ms Leung’s children until after Mr O’Hara’s death,” Mr Makepeace said.

The prosecutor said Kwan was “obsessed with money and his anticipated inheritance”.

Northumbria Police

Northumbria PoliceOn 22 January, Kwan, who lived in Ingleby Barwick near Stockton, went to the couple’s home on St Thomas’ Street pretending to be a community nurse on a home visit to give a Covid-19 booster, the court heard.

Mr Makepeace said: “It was an audacious plan. It was a plan to murder a man in plain sight.”

Kwan had previously sent the victim letters with a “chilling authenticity” purportedly from the NHS scheduling the visit so he was expected, the court heard.

Wearing a hat, surgical mask, gloves and tinted glasses and speaking in a broken English Asian accent, Kwan did a medical questionnaire and checked both Mr O’Hara’s and Ms Leung’s blood pressure before saying he would administer the jab, the court heard.

As soon as he had been injected in his left arm, Mr O’Hara felt a “terrible pain” with Kwan hastily packing up his medical supplies and leaving, Mr Makepeace said.

As he left, Ms Yeung remarked that he was the same height as her son causing Mr O’Hara to become suspicious, the court heard.

The victim contacted his GP and the Freeman Hospital to ask about the visit.

Staff said they had never heard of the NHS organisation that arranged the visit so Mr O’Hara went to A&E at the Royal Victoria Infirmary.

After initially being baffled by his symptoms, doctors eventually diagnosed necrotising fasciitis – a “rare, life-threatening flesh-eating disease”, the court heard.

Mr O’Hara had to have multiple surgeries to remove “very considerable portions” of his arm.

He remained in intensive care for several weeks and doctors failed to identify what the toxin was, the court heard.

‘Fake ID’

Mr Makepeace said it was an “extraordinary” and “intricate” plot which included Kwan:

- Forging NHS letters and creating a NHS ID under the name Raj Patel including a picture of himself in a wig and fake facial hair

- Taking a four-day holiday from work to carry out the attack

- Putting fake number plates on his car to travel to Newcastle

- Booking a hotel room under a fake name before the attack

- Using an alternative SIM card to message the victim to confirm the appointment the day before

- Creating a fake company to order toxic chemicals through

Mr Makepeace said while Kwan was on remand in prison awaiting trial, he told his wife he had “been stupid in not disposing of evidence prior to his arrest”.

‘Back-up plan’

The prosecutor said Kwan, a married father of one, had “a deeply disturbing” interest “bordering on obsession” with poisons and chemical toxins and “their use in killing human beings”.

Searches of his Brading Court home revealed extensive research material, including:

- Numerous chemicals including liquid mercury, thallium, sulphuric acid, arsenic and iodomethane stored in his garage along with raw ingredients for making ricin

- Multiple digital books about poisons and criminal investigations, including manuals known to be used by terrorists

- Recipes for toxic chemicals

- A syringe containing the pesticide iodomethane which could have caused Mr O’Hara’s injuries and be difficult for doctors to detect

- Almost 100 internet searches about iodomethane between 6 and 22 January

- Many internet searches about ricin in the three weeks before the attack

- A manual on chemical warfare found in his bedroom

- Videos on how to create certain toxic substances including iodomethane

Kwan also had a “back-up plan” and had created a letter from a fake charity offering Mr O’Hara free drinks and meals, the court heard.

He had also installed spyware on his mother’s computer so he could monitor the couple’s activity and watch them through the in-built camera, Mr Makepeace said.

The trial continues.

CryptoCurrency

This 6.5%-Yielding Dividend Stock Just Closed the Final Phase of a Once-in-a-Generation Opportunity

Last fall, Enbridge (NYSE: ENB) made a bold strike. The Canadian pipeline and utility giant agreed to buy three natural gas utilities from Dominion in a $14 billion deal. The transaction would create the largest natural gas utility franchise in North America.

At the time, Enbridge’s CEO Greg Ebel stated, “Adding natural gas utilities of this scale and quality, at a historically attractive multiple, is a once-in-a-generation opportunity.” While it took a little more than a year, the company has finally closed this generational opportunity to expand its gas utility business. The deal significantly enhances the company’s ability to sustain and grow its 6.5%-yielding dividend.

Closing the final phase

Enbridge recently announced that it has closed its acquisition of Public Service Company of North Carolina (PSNC) from Dominion. The deal adds over 600,000 service customers in the state, which it serves with over 13,000 miles of gas distribution and transmission pipelines and other related gas infrastructure assets.

The utility should supply Enbridge with stable, low-risk cash flow backed by government-regulated rate structures and steady gas demand. That cash flow should grow in the coming years as Enbridge invests in expanding PSNC’s infrastructure to support rising gas demand in its service region.

Closing the PSNC acquisition was the final phase of this transformational transaction. Enbridge previously closed the purchase of The East Ohio Gas Company in March and completed its deal for Questar Gas Company in June.

The trio of gas utilities significantly expands Enbridge’s gas distribution platform. It will supply 22% of the company’s annual adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), up from 12% before the deal. It further diversified the company’s business while increasing its exposure to lower carbon energy.

The new gas utilities also increased the company’s cash flow from stable regulated assets and enhanced its growth profile. Enbridge expects to invest 5 billion Canadian dollars ($3.7 billion) over the next three years into low-risk, quick-return projects, which will increase its earnings from these utilities.

Enhancing an already strong foundation

Enbridge has built one of the lowest-risk businesses in the energy infrastructure sector. The company has a diversified platform focused on four core franchises: liquids pipelines (50% of its EBITDA), gas transmission and midstream (25%), gas distribution and storage (22%), and renewable power (3%).

About 98% of the EBITDA generated from those businesses comes from cost-of-service or contracted assets, which are very predictable and stable. As evidence, Enbridge has achieved its annual financial guidance for 18 straight years, despite two major recessions and two additional periods of oil market turbulence.

The company targets to pay 60% to 70% of its very stable cash flow to investors in dividends. It retains the rest to invest in its large backlog of commercially secured capital projects. The utility acquisitions pushed its backlog to CA$24 billion ($17.8 billion) of projects it should complete through 2028. Those projects give it lots of visibility into its future earnings growth.

The company expects those projects will help grow its EBITDA by about 5% annually. Meanwhile, it has additional investment capacity, thanks to its strong balance sheet, which it can use to sanction additional expansion projects and make accretive acquisitions, further enhancing its growth rate.

With a strong financial profile and visible earnings growth, Enbridge should have plenty of fuel to continue increasing its dividend. It could grow its dividend by as much as 5% per year over the medium term, further extending a streak that is currently at 29 straight years.

An elite dividend stock

Enbridge has closed its once-in-a-generation opportunity to add three high-quality gas utilities to its portfolio. They enhance the stability of its earnings base, increase its diversification, and bolster its growth profile.

Because of that, Enbridge is in an even stronger position to continue growing its dividend. That makes it an excellent dividend stock to buy for the long term.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Matt DiLallo has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

This 6.5%-Yielding Dividend Stock Just Closed the Final Phase of a Once-in-a-Generation Opportunity was originally published by The Motley Fool

CryptoCurrency

Supermicro And Fujitsu Partner For AI-Powered Server: What’s In Store?

Super Micro Computer, Inc. (NASDAQ:SMCI) has entered a long-term strategic partnership with Fujitsu Limited to develop and market a platform that will feature Fujitsu’s future Arm-based “FUJITSU-MONAKA” processor.

The platform is designed for high performance and energy efficiency and is scheduled for release in 2027.

The partnership will also focus on creating liquid-cooled systems for high-performance computing (HPC), generative AI, and next-generation green data centers.

Fujitsu and Supermicro will combine their expertise to create a leading server portfolio.

Supermicro’s flexible Building Block design enables quick customization of servers for AI, HPC, and general computing, supporting both cloud and edge deployments.

The collaboration will involve Fsas Technologies Inc., a Fujitsu subsidiary, to deliver global generative AI solutions using Supermicro’s GPU servers and support services for data centers and enterprises.

“Supermicro is excited to collaborate with Fujitsu to deliver state-of-the-art servers and solutions that are high performance, power efficient, and cost-optimized,” said

Charles Liang, president and CEO of Supermicro.

“These systems will be optimized to support a broad range of workloads in AI, HPC, cloud and edge environments. The two companies will focus on green IT designs with energy-saving architectures, such as liquid cooling rack scale PnP, to minimize technology’s environmental impact.”

Investors can gain exposure to Super Micro through iShares Future AI & Tech ETF (NYSE:ARTY) and Defiance Daily Target 2X Long SMCI ETF (NASDAQ:SMCX).

Price Action: SMCI shares are down 0.26% at $41.89 premarket at the last check Thursday.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Supermicro And Fujitsu Partner For AI-Powered Server: What’s In Store? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CryptoCurrency

Dow, S&P 500, Nasdaq slip with focus on jobs report, wait for Mideast moves

US stocks drifted lower on Thursday as the focus tentatively turned back to the economy and the monthly jobs report. Meanwhile, worries over the Middle East conflict rumbled in the background.

The S&P 500 (^GSPC) dropped 0.2%, while the Dow Jones Industrial Average (^DJI) fell about 0.3%. The tech-heavy Nasdaq Composite (^IXIC) moved roughly 0.4% lower. All three gauges closed Wednesday slightly above the flatline.

Some calm has returned to a market rattled by escalating Mideast tensions that have driven sharp gains in oil prices. Israel has yet to launch its promised retaliation to Iran’s missile strike on Tuesday, amid efforts by Western and regional leaders to stabilize the situation.

Investors are now bracing for the highly anticipated September jobs report on Friday, after a surprise uptick in private payrolls came alongside signs the labor market is loosening up.

Investors received more signs of general cooling in the labor market on Thursday. Weekly jobless claims ticked up slightly from the prior week. Meanwhile, planned layoffs in the US dipped from a five-month high, according to a report from Challenger, Gray and Christmas. But the firm’s vice president said the data showed the labor market is at an “inflection point.”

Any new signs of deterioration in the labor market could prompt the Federal Reserve to follow up its 0.5% interest-rate cut last month with another jumbo move, despite policymakers’ expectation of a 0.25% cut in November.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

Meanwhile, the Israel-Iran crisis helped drive oil prices higher for a third day, another potential drag on economic activity. Brent crude (BZ=F) and West Texas Intermediate (CL=F) futures were both up over 2% on Thursday.

On the corporate front, Levi Strauss (LEVI) shares tumbled over 10% in premarket after the jeans giant posted a disappointing revenue forecast and said it is considering a sale of its Dockers brand. Tesla’s (TSLA) stock continued to slide in the wake of downbeat delivery figures, as Reuters reported the EV maker has halted US online orders for its cheapest Model 3.

Live1 update

-

Stocks open lower with monthly jobs report on deck, Middle East tensions high

Stocks opened lower on Thursday as investors turn their attention this week to monthly jobs data for clues about the health of the economy, while keeping a close eye on the Middle East conflict.

The S&P 500 (^GSPC) fell 0.3%. The Dow Jones Industrial Average (^DJI) fell 0.3% while the tech-heavy Nasdaq Composite (^IXIC) moved lower 0.5% after all three averages closed above the flatline on Wednesday.

Investors await the highly anticipated September jobs report out on Friday morning. Weekly jobless claims releaseed on Thursday ticked up slightly from the prior week.

In commodities, oil prices were up Thursday as the Israel-Iran crisis has raised concerns of supply disruptions in the region. Brent (BZ=F) and West Texas Intermediate (CL=F) each up more than 2% in early trading.

CryptoCurrency

Ripple and Mercado Bitcoin to launch crypto-enabled payments in Brazil

Mercado Bitcoin, one of the largest crypto exchanges in Latin America and a partner of Mastercard, is working with Ripple on crypto-enabled international payments.

CryptoCurrency

This Consumer Defensive Stock Is A Buy, Archer-Daniels-Midland Is A ‘Value Trap’

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said NANO Nuclear Energy Inc. (NASDAQ:NNE) is losing a “lot of money.”

On Oct. 1, NANO Nuclear Energy said Carlos O. Maidana has been named as the company’s head of thermal hydraulics and space program.

Cramer recommended buying McKesson Corporation (NYSE:MKC). “I’m ready to start buying, don’t buy all at once.”

Don’t Miss Out:

On Sept. 25, Deutsche Bank analyst George Hill maintained McKesson with a Buy and lowered the price target from $623 to $579.

Diamondback Energy, Inc. (NASDAQ:FANG) is a “little too much oil for me,” Cramer said.

On Oct 1, Wells Fargo analyst Roger Read maintained Diamondback Energy with an Overweight and lowered the price target from $230 to $219.

“It’s got a huge multiple for its growth rate, and that is worrisome to me. I’m going to have to say we got to come back with something that is less expensive,” Cramer said when asked about Littelfuse (NASDAQ:LFUS).

On Aug. 29, Baird analyst Luke Junk maintained Littelfuse with an Outperform and raised the price target from $300 to $315.

Archer-Daniels-Midland Company (NYSE:ADM) is a “value trap,” Cramer said.

On Sept. 9, UBS analyst Manav Gupta maintained Archer-Daniels Midland with a Neutral and raised the price target from $60 to $64.

Price Action:

-

NANO Nuclear Energy shares gained 14.8% to settle at $16.54 on Tuesday.

-

McKesson shares gained 0.8% to close at $498.48 during the session.

-

Diamondback shares gained 3% to close at $177.52 during Tuesday’s session.

-

Littelfuse shares fell 1.7% to settle at $260.64 on Tuesday.

-

Archer-Daniels-Midland shares fell 0.4% to close at $59.52 on Tuesday.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Your biggest returns may not come from the stock market. Invest the way colleges, pension funds, and the 1% do. Get started investing in commercial real estate today.

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Jim Cramer: This Consumer Defensive Stock Is A Buy, Archer-Daniels-Midland Is A ‘Value Trap’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CryptoCurrency

Bitcoin traders stress 'bullish' market while BTC price threatens $60K

BTC price support may be at risk of a breakdown, but Bitcoin market perspectives see “bullish market structure” prevailing.

-

Womens Workouts1 week ago

Womens Workouts1 week ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology2 weeks ago

Technology2 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

News2 weeks ago

News2 weeks agoYou’re a Hypocrite, And So Am I

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News2 weeks ago

the pick of new debut fiction

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

News2 weeks ago

News2 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Business2 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts1 week ago

Womens Workouts1 week ago3 Day Full Body Toning Workout for Women

-

Travel1 week ago

Travel1 week agoDelta signs codeshare agreement with SAS

-

Politics1 week ago

Politics1 week agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology5 days ago

Technology5 days ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Servers computers1 week ago

Servers computers1 week agoWhat are the benefits of Blade servers compared to rack servers?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Technology1 week ago

Technology1 week agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Science & Environment1 week ago

Science & Environment1 week agoX-rays reveal half-billion-year-old insect ancestor

-

Politics2 weeks ago

Politics2 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoWhich Squat Load Position is Right For You?

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News7 days ago

News7 days agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoIs carbon capture an efficient way to tackle CO2?

-

Technology2 weeks ago

Technology2 weeks agoCan technology fix the ‘broken’ concert ticketing system?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

You must be logged in to post a comment Login