News

Israel moves towards ‘general’s plan’ for north Gaza

Israel has launched a major new offensive in northern Gaza and issued evacuation orders for the entire civilian population – moves that could mark the implementation of a controversial “general’s plan” that would involve laying siege to the territory, according to Israeli media and military analysts.

At least 20 Palestinians were killed in an assault with tanks and warplanes that began on Saturday night, according to local medics, which witnesses described as one of the most ferocious of the war.

Israel said it had sent two brigades into north Gaza and carried out dozens of air strikes targeting “terror infrastructure”. Soldiers had “successfully encircled” the Jabalia area on Sunday morning with operations ongoing, the military said.

The Israel Defence Forces (IDF) also dropped leaflets across northern Gaza instructing residents to flee to al-Mawasi on the southern coast, a designated “humanitarian area” where an estimated one million displaced people are already sheltering.

The area has been repeatedly bombed and lacks essential infrastructure, according to aid groups. The UN estimates the population of northern Gaza at between 300,000-500,000.

Israeli media and military analysts suggest the move could mark the start of implementation of a controversial plan to clear and besiege the area, dubbed the “general’s plan”, conceived by retired Major-General Giora Eiland.

The hawkish former commander has argued that only a total siege of northern Gaza will prevent Hamas regaining control of the territory, and civilians should be given an ultimatum to leave or suffer the consequences.

Palestinian militants have repeatedly launched attacks on Israeli forces in areas such as Jabalia that Israel had declared to be under its control.

“The right thing to do is to inform the approximately 300,000 residents who remained in the northern Gaza Strip…we are ordering you to leave,” the general said last month. “In a week, the entire territory of the northern Gaza Strip will become military territory.”

“No supplies will enter it…5,000 terrorists who are in this situation, they can either surrender or starve.”

The plan was reportedly under consideration by Israel’s government in recent weeks, with Reuters reporting comments from Prime Minister Benjamin Netanyahu that it “makes sense”.

Israel’s public broadcaster, Kann, reported that the assault on Jabalia that began on Saturday night could mark the start of the plan’s implementation.

“Division 162 entered Jabalia tonight and began operations to destroy the Hamas infrastructure being renewed there,” the network reported on Saturday. “The entire northern area of the Gaza Strip will be cleansed according to the generals’ plan – the entire population will be evacuated…and the entire northern area of the Gaza Strip will be declared a closed military area.”

“The general’s plan is launched,” wrote Israeli military analyst, Or Fialkov, on Telegram. “The IDF is going to evacuate the entire northern Gaza Strip, informing the population that the area has become a combat zone.”

“A new phase begins in Gaza: evacuate or die.”

Palestinian and international aid groups working in Gaza expressed alarm over the forcible evacuations.

“This morning, the Israeli army dropped a new leaflet to redraw the ‘evacuation map’ of northern Gaza, announcing a ‘new phase of the war’,” said Palestinian group al-Mezan in a statement. “This is a prelude to a new phase of increased mass atrocities against Palestinians and new cycles of forced displacement.”

UK-based charity Medical Aid for Palestinians said Israel was “signalling a new phase of mass forced displacement for around 175,000 people to the south. Many have already been displaced multiple times, stoking fear and uncertainty among the population.”

“The international community must now immediately demand a halt to Israel’s forcible displacement of Palestinians, and ensure civilians are protected if they choose to stay,” the group added.

Professor Kobi Michael, a military analyst at the Israeli think-tanks the Institute for National Security Studies and the Misgav Institute, said it was unclear if implementation of the plan had begun but told i it would happen “in this version or another”.

While some Palestinians have previously refused evacuation orders from the area, civilians would take a “huge risk” if they do not co-operate this time, he added.

“People will have time to leave the war zone through safe passages secured by the IDF and to move to safe zones,” said Dr Michael. “People who will refuse doing that are taking a huge risk upon themselves because after the deadline the IDF will consider everyone in that war zone as Hamas operatives.”

The IDF did not immediately answer an enquiry regarding plans for north Gaza.

CryptoCurrency

The big winner if OpenAI becomes a for-profit business? Microsoft.

OpenAI is considering transitioning from a nonprofit into a for-profit company, and its deep-pocketed benefactor, Microsoft (MSFT), has a lot to gain if the ChatGPT developer gets the green light to act more like a startup.

“Anything that frees up OpenAI to focus on profit is likely to benefit Microsoft’s investment in the company,” said Sarah Kreps, director of the Tech Policy Institute in the Brooks School of Public Policy at Cornell University.

A reconfigured business structure would give Microsoft an opportunity to renegotiate its already generous profit cap, as well as discard a provision that denies Microsoft an interest in OpenAI-created general artificial intelligence (GAI), according to another observer.

“[OpenAI] is clearly saying that the nonprofit will no longer be in control, so presumably that means Microsoft and other investors will have more say about what OpenAI does,” said Rose Chan Loui, founding executive director of the University of California Los Angeles’s Lowell Milken Center for Philanthropy and Nonprofits.

But there are potential snags for Microsoft as OpenAI attempts to shed its charitable cloak.

OpenAI’s huge valuation, labyrinth of for-profit subsidiaries, and potentially risky technology make a for-profit switch legally and publicly complicated — and could invite pushback from regulators.

Still, OpenAI’s investors see plenty of upside. On Wednesday, the company announced it raised some $6.6 billion in its latest funding round, valuing the Sam Altman-helped firm at $157 billion. However, that valuation is largely contingent on OpenAI becoming a for-profit entity.

Whirlwind of change

OpenAI is in the midst of a whirlwind of change.

It is experiencing an extended executive exodus including, most recently, the departure of chief technology officer Mira Murati. It also faces increased competition from rivals including Google (GOOG, GOOGL) and Amazon-backed (AMZN) Anthropic.

The reclassification to a for-profit structure would be yet another seismic shift for OpenAI, upending the way it was established nearly a decade ago.

It began in 2015 as a nonprofit under the name OpenAI Inc., a nod to its mission of advancing humanity instead of pursuing profits.

“The corporation is not organized for the private gain of any person,” OpenAI’s certificate of incorporation stated in its organizing documents, along with a promise to keep its technology as open source for public benefit.

Things evolved in 2019 when OpenAI CEO Sam Altman and his team created a for-profit subsidiary to raise outside venture capital — including billions from Microsoft.

It was structured in such a way that the for-profit subsidiary, technically owned by a holding company owned by OpenAI employees and investors, remained under the control of the nonprofit and its board of directors while giving its biggest backer (Microsoft) no board seats and no voting power.

The inherent tension between these two parts of the enterprise is what contributed to a dramatic boardroom clash in 2023, when Altman was ousted by the board and then brought back five days later.

In the aftermath, Microsoft took a non-voting observer position on OpenAI’s board, only to relinquish that seat this year as both OpenAI and Microsoft came under more regulatory scrutiny.

The idea of upending the current structure has already attracted interest from US and European regulators and exacerbated an ideological divide between scientific and business leaders who warn that machine learning technologies like those developed by OpenAI should remain accessible to the public.

The technology, they argue, poses an existential threat to humankind and, therefore, should be operated in a way that’s subject to public scrutiny.

OpenAI and Microsoft are also part of an ongoing inquiry by the US Federal Trade Commission over concerns that AI market consolidation is “distorting innovation and undermining fair competition.”

And multiple calls have been made for California’s attorney general to probe the legality of OpenAI’s business structure. One came from Elon Musk, who co-founded OpenAI with Altman. He sued OpenAI, Altman and 21 named OpenAI subsidiaries.

Musk said the defendants fraudulently promised that his $100 million in OpenAI investments would be used for public benefit.

A transition by OpenAI to for-profit status could also attract the attention of the Internal Revenue Service, given that OpenAI was granted tax-exempt status as a charitable organization.

‘Did they get fair market value?’

One unknown question is to what extent Microsoft will be able to directly extract profits from its investments.

By law, a nonprofit must use its assets only for its stated charitable purposes. And OpenAI’s assets, which include all of OpenAI’s subsidiaries, may not be sold for anything less than fair market value.

The question regulators will want to confirm is, “Did they get fair market value for the asset at the time?” said Gene Takagi, a principal at NEO Law Group.

Chan Loui added that regulators would require OpenAI to realistically value its assets, including residual interest. And she suspects that figure may be in excess of OpenAI’s latest valuation.

“I think the greatest sensitivity probably is with how they remove the nonprofit’s control,” she said. “And I think their best shot of avoiding conflict relating to restructuring is to compensate the nonprofit enough,” Chan Loui said.

“I think that’s the best way for them to get the public on their side, the states on their side, and the IRS on their side.”

What OpenAI is expected to do as part of its transition is register as a public benefit corporation.

Such entities are like traditional corporations but with more freedom to spend on civically minded initiatives, according to Rick Alexander, a veteran corporate structuring lawyer and founder of the Shareholder Commons,

“It’s a permission structure,” Alexander said.

Other public benefit corporations include Elon Musk’s xAI, Warby Parker (WRBY), Allbirds (BIRD), Lemonade (LMND), and Etsy (ETSY).

And based on the success of Musk’s xAI, OpenAI could benefit handsomely from the change. In May, xAI raised $6 billion.

“This type of transition can generate considerable investor interest quickly,” Kreps said. “This is such a capital-intensive industry, so anything OpenAI can do to attract investment will act as a positive feedback loop and accelerate its advantages.”

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on X @alexiskweed.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance.

CryptoCurrency

This Magnificent 6.5%-Yielding Dividend Stock Adds Another $700 Million of Fuel to Keep its Growth Engine Humming Along

Enbridge (NYSE: ENB) recently unveiled another new expansion project. The Canadian pipeline and utility company will build, own, and operate crude oil and natural gas pipelines to support BP’s (NYSE: BP) recently green-lit Kaskida development. Enbridge’s $700 million projects should come online by 2029 when Kaskida starts producing, further extending the company’s long-term growth outlook.

This will add more fuel to its dividend growth engine. The company has increased its payout, which at current share prices yields more than 6.5%, for 29 straight years.

A growth extender

Enbridge is building two new pipeline systems to support BP’s operations in the Gulf of Mexico. Its Canyon Oil Pipeline System will have the capacity to transport 200,000 barrels per day. It will originate at the Keathley Canyon area and deliver crude oil to the existing Green Canyon 19 platform, operated by Shell Pipeline Company, for delivery to the Louisiana market. Enbridge will also build the Canyon Gathering system, which will have the capacity to transport 125 million cubic feet of gas per day to the company’s existing Magnolia Gas Gathering Pipeline for delivery to its Garden Banks Gas Pipeline.

BP signed long-term contracts to support these pipelines. They will provide Enbridge with low-risk, utility-like cash flows and returns. BP also has the option to connect future production from its emerging Paleogene portfolio into the new pipelines, which Enbridge is designing to accommodate future discoveries. As such, the project will provide Enbridge with stable and predictable cash flow as well as future growth opportunities.

Lots of growth is coming down the pipeline

Enbridge had already secured a lot of growth before adding these new pipeline projects to its backlog. The company ended the second quarter with a secured capital program of 24 billion Canadian dollars ($17.7 billion). Those projects span all four of its core franchises (liquids pipelines, gas transmission, gas distribution and storage, and renewables). It expects those projects will come online through 2028. It has now extended its growth visibility by another year with the addition of the new pipelines in the Gulf of Mexico.

The company has green-lit several new projects this year. In the second quarter, Enbridge and its partners approved building the Blackcomb Pipeline, which will increase gas transportation capacity in the Permian Basin. The company also approved an expansion of its Gray Oak Pipeline, fueled by the growing demand for oil transportation capacity from its customers. In addition, Enbridge will build the Orange Grove solar farm in Texas. That $250 million project will supply power to AT&T under a long-term contract.

Enbridge also enhanced its operations and growth prospects by closing the acquisitions of three gas utilities from Dominion Energy. The deals will be accretive to its earnings and bolster its growth profile, driven by $3.7 billion of planned capital spending over the next three years.

The company’s robust backlog and fortress-like financial profile power its view that it should be able to grow its earnings by around 5% per year over the medium term. That should support continued dividend increases of as much as 5% annually. Given the length of its backlog (and robust investment capacity), Enbridge appears well equipped to continue increasing its payout annually through at least 2029.

An elite dividend growth stock

Enbridge has done a terrific job growing its dividend over the years. That seems highly likely to continue, given its ability to keep adding new expansion projects to its backlog. It how has growth visibility through 2029. With a high dividend yield, low risk profile, and clear growth outlook, Enbridge is a no-brainer stock for those seeking a high-quality dividend payer to own for the long haul.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Matt DiLallo has positions in Enbridge. The Motley Fool has positions in and recommends BP and Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

This Magnificent 6.5%-Yielding Dividend Stock Adds Another $700 Million of Fuel to Keep its Growth Engine Humming Along was originally published by The Motley Fool

CryptoCurrency

An $803-billion company most people have never heard of just knocked Tesla out of the Magnificent 7

With hardly anyone noticing, a tech titan you’ve probably never heard of has booted Tesla out of the heavily-hyped Magnificent Seven. Can it stay there?

The overlooked Magnificent Seventh is Broadcom, a tech company that produces both hardware and software. It’s well known in the infotech world but unfamiliar beyond it. The Magnificent Seven, conceived as a group of stocks in early 2023, are the most valuable U.S. tech companies by market capitalization. In descending order they include Apple (recent market cap: $3.4 trillion), Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla (recent market cap: $768 billion). Yet Broadcom’s market cap slipped past Tesla’s last spring and has stayed ahead of the EV-maker for most of the year. Its market cap is currently around $803 billion.

Broadcom is not guaranteed to stay ahead of Tesla, at least in the near term. Tesla’s stock is notoriously volatile, and its market cap could plausibly beat Broadcom’s for a time. But Broadcom’s long-term outlook is by far the sunnier of the two. Wall Street analysts on average expect its stock price to keep climbing, while they expect Tesla’s to continue to fall. Tesla’s stock has retreated to where it was almost four years ago, while Broadcom’s is up 290% since then.

So how did this quiet giant sneak into the highest reaches of tech royalty? Mostly by a combination of tech savvy and financial acumen. The company is a grandchild of Hewlett-Packard, which in 1999 spun off a company called Agilent Technologies, which in turn spun off a company called Avago to a pair of private equity firms in 2005. Avago began buying up semiconductor firms, in 2015 buying a big one called Broadcom and taking its name.

Broadcom’s PE ancestry has guided it ever since that spinoff. “Broadcom operates pretty much like a PE firm, where it invests in assets that can deliver quick returns,” says Naveen Chhabra, an analyst at the Forrester research and consulting firm. It’s “astute in terms of investing in firms where it can maintain or grow the revenue” and at the same time “can turn the company into a high margin business.”

View this interactive chart on Fortune.com

Exhibit A is Broadcom’s biggest acquisition, the cloud-computing firm VMware, which it bought last November. A Forrester report for VMware customers warns them, “Don’t let the price jumps shock you…. In most cases, customers will find the renewal quotes multiple times higher than what they paid in the past.”

Wall Street approves of Broadcom’s changes. “They appear to be killing it on VMware,” says Bernstein analyst Stacy Rasgon, “which markedly exceeded expectations in the quarter and which seems poised to continue growing.”

Shrewd acquisitions and management are central to Broadcom’s growth but don’t fully explain the company’s phenomenally swelling market cap. The other crucial factor is, not surprisingly, the AI frenzy. One of Broadcom’s most important businesses is designing semiconductors—computer chips—and in the past year, demand has been sky high. Broadcom’s sales of AI chips in fiscal 2023 were $4.2 billion, BofA Securities reports. The firm expects AI chip sales will rocket to $12.1 billion this year and $16.9 billion next year.

Broadcom’s chip expertise along with VMware’s success has propelled Broadcom’s market cap from just above that of McDonald’s when OpenAI released ChatGPT in November 2022, to Magnificent Seven levels today.

A critical element of Broadcom’s success and its future is CEO Hock Tan, who was recruited to run the company when Avago was spun off in 2005. Now age 72, he was born in Malaysia and earned engineering degrees from MIT plus an MBA from the Harvard Business School. He has spent most of his career in tech companies, though he also held finance jobs at PepsiCo and General Motors—thus the company’s joint expertise in technology and finance. In recent years, Tan has been among the most highly paid U.S. CEOs; he made $162 million last year. Succession is an obvious issue for the company, but no successor is apparent. Tan has said he’ll continue to run the company for at least four more years.

Wall Street analysts are mostly cheering for Broadcom. “Numbers look likely to keep going up,” says Bernstein’s Rasgon. “And valuation is looking increasingly attractive.” JP Morgan’s Harlan Sur says the stock “remains our top pick in semiconductors.”

No tree grows to the sky, but for now the sun is shining brightly on this company. Beyond that, the only certainty is that Broadcom can’t be anonymous anymore.

This story was originally featured on Fortune.com

CryptoCurrency

3 Soaring Stocks I’d Buy Now With No Hesitation

Talking yourself into buying stocks priced at highs isn’t easy. It’s even tougher when a stock is outright soaring. The risk of an imminent correction just feels too great.

Sometimes, though, the reason for a rally — and the odds of it continuing — are bigger than the risk. To this end, here’s a closer look at three soaring stocks I’d buy without a second thought. There’s still more than enough upside potential on the table to justify taking a swing at their lofty levels.

1. Costco Wholesale

If membership-based retailer Costco Wholesale (NASDAQ: COST) has an effective limit to its reach, it’s nowhere in sight. The company now boasts 76.2 million paid memberships, providing 136.8 million total cardholders the right to enter its stores, up 7.3% year over year for the three-month stretch ending in early September. That’s yet another record.

Granted, the penetration of new markets helped. In addition to opening 10 new stores in the United States during the quarter in question, it opened another four outside the U.S. There’s no slowdown on the horizon, either. Costco plans on opening 26 new locales in the fiscal year that just got underway, pushing its count up to 916 stores. About half of these openings will be overseas.

Being able to deliver real value here and abroad, however, is the biggest driver of this growth.

People all over the developed world are becoming more cost-effective shoppers. A poll performed by YouGov last year indicates that in the wake of soaring inflation, 94% of the planet’s consumers made a point of employing money-saving tactics when making purchases. More price comparisons and couponing were the most-newly embraced approaches, but switching stores as well as switching brands were popular strategies as well. Given that costs of discretionary goods as well as consumer staples have only grown since then, the sentiment certainly still applies.

It’s a dynamic that plays right into the hand Costco is holding. While buying in bulk hasn’t always been everyone’s preferred method of shopping for basic goods, when budgets are stretched as tightly as they are now — and likely will be for the foreseeable future — consumers are willing to adapt.

That’s what the analyst community appears to believe, anyway. They’re expecting Costco Wholesale’s top line to grow by more than 7% this fiscal year, and improve by nearly as much again next year. This is the key reason Costco shares are just off of record highs hit in early September.

2. Toast

The restaurant business is not only wildly competitive, but incredibly complicated. Restaurant managers routinely deal with short-lived employees, constantly depleted supplies, regulatory inspections, and (hopefully) a steady flow of new customers. In the midst of the madness, they’re also supposed to improve and grow their restaurant’s revenue. It’s a lot to tackle!

A company called Toast (NYSE: TOST) makes it all at least a little easier to manage.

In simplest terms, Toast offers software built from the ground up to specifically serve the restaurant industry. From point-of-sale solutions to online ordering to payroll to marketing, Toast can handle it all. These tools are all integrated into a singular platform, too, making it easy and fast to use them all.

And to date, 120,000 different restaurants are utilizing the Toast platform. For perspective, there are over 700,000 restaurants in the United States alone. Clearly there’s a multitude more outside the U.S., which are just as addressable by Toast as domestic restaurants are.

Restaurants are signing up in droves, too. Toast’s top line improved 27% during the second quarter of this year, extending growth trends that are likely to persist at least for a few more years. At its current growth trajectory, the company’s expected to swing to a full-year profit in 2025 — one of the reasons shares recently reached a new 52-week high, more than doubling its value in less than a year.

But it’s a business model with a limited lifespan? Not so fast.

Toast’s software is rented rather than outright purchased. Its customers are gladly willing to pay this ongoing fee, however, since it provides them with a constantly updated cloud-based platform that meets their unique business needs. Toast is very much a partner with its customers, growing its top and bottom lines as restaurants themselves grow theirs.

3. Apple

Last but not least, add Apple (NASDAQ: AAPL) to your list of soaring stocks to buy. Like Costco, it recently reached a record high, and is up more than 300% for the past five years.

There’s arguably more upside in store dead ahead, though.

Yes, this call has everything to do with the recent launch of the iPhone 16 that’s capable of handling generative artificial intelligence (AI) functions directly from the device itself (as opposed to punting this work to the cloud, which is where most of it is currently handled). While some concern has been raised about the tepid initial demand for the latest iteration of the popular smartphone, that doesn’t eliminate the prospect of a so-called supercycle eventually whipping up some serious demand for the device.

It could just take some time for consumers to come around; they may be waiting for the early reviews of the tech. Indeed, the software that turns the latest iPhones into full-blown artificial intelligence devices isn’t even available yet, and even once it is, the rollout will be gradual in terms of features as well as regions. All this means there’s no particular hurry to purchase new iPhones just yet, if AI is the motivating force.

There’s also no doubt that consumer interest in such a tool is real. Technology market research outfit IDC anticipates worldwide sales of more than 230 million generative AI-capable smartphones this year alone, en route to over 900 million such devices in 2028, when this tech will be the norm.

Given Apple’s brand notoriety, it’s arguably better positioned than any other player to capture more than its fair share of this growth.

More (along with more engaged) iPhone owners of course means sales of more apps, streaming music, and streaming video from Apple’s app store. This in turn translates into more services revenue, which at more than 70% boasts considerably higher gross profit margin rates than the 37% gross profit margin rate on sales of iPhones, iPads, and Mac computers.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Costco Wholesale, and Toast. The Motley Fool has a disclosure policy.

3 Soaring Stocks I’d Buy Now With No Hesitation was originally published by The Motley Fool

CryptoCurrency

Carnival Delivered a Quarter of Records. But Here’s Even Better News for Shareholders (and it Could Supercharge the Stock).

After the tumultuous seas of early pandemic days, Carnival (NYSE: CCL) (NYSE: CUK) has sailed into calm waters. The world’s biggest cruise operator recently reported a quarter filled with records, beat analysts’ earnings estimates, and raised full-year guidance for a third time.

The recipe for such success? Carnival has put the focus on controlled spending, cost savings in key areas such fuel, and has made efforts to increase guests’ onboard spending.

All this has helped Carnival, which had to halt sailings during the first stages of the pandemic, cruise back along the path to financial health — and growth. Investors have recognized the company’s progress, prompting the stock to climb more than 29% over the past year.

Moving forward, the stock could be in for more gains. This is thanks, in part, to Carnival’s fantastic earnings performance, but another element may be even better news for shareholders.

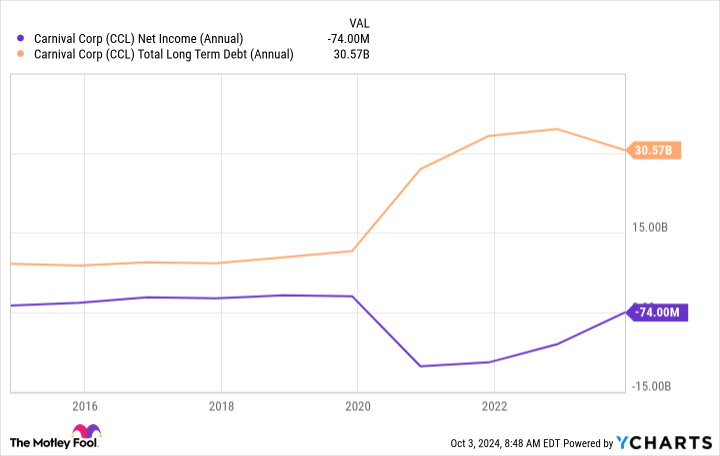

Carnival’s wall of debt

First, let’s take a quick look back in time at the challenges Carnival faced in recent years. The halt in sailings drove the previously profitable company to a loss, and resulted in Carnival building up a wall of debt. This also weighed on the shares, which plunged nearly 60% in 2020.

But Carnival set the sails in motion for recovery through various cost-saving efforts — from limiting new ship orders to designing routes favoring fuel efficiency — and travelers rushed back to this popular type of vacation as coronavirus restrictions eased. All of this has ushered Carnival along the path to this latest quarter’s superstar results.

In the quarter, Carnival reported record operating income of $2.2 billion, record third-quarter revenues of $7.9 billion, and a cumulative advanced booked position for 2025 that’s surpassed this year’s — and that’s at higher cruise prices. Revenue and earnings per share both came in ahead of analysts’ estimates for the quarter, too.

Finally, Carnival lifted its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) guidance for the full year to $6 billion — that’s up by nearly $200 million from guidance, given a few months ago, and represents a 40% increase from last year. And the company also expects adjusted return on invested capital of 10.5%, a half-point better than earlier guidance.

All this is fantastic news and suggests more growth ahead for Carnival. But one other element represents even better news for the company and shareholders because it may help Carnival address its biggest challenge today: reducing debt. And that’s the latest move from the Federal Reserve.

A big move by the Fed

The Fed recently lowered interest rates by 50 basis points — a greater-than-expected move — and suggests it may cut rates two more times before the end of the year. The initial move represents the central bank’s first such move in four years, and marks a path to lower costs for companies with high debt — such as Carnival.

As it stands now, Carnival has managed a complicated situation well, with a focus on paying down variable-rate debt to make itself less vulnerable to interest rate fluctuations. “We will continue to look for more opportunistic refinancings over time,” chief financial officer David Bernstein said in the recent earnings call. This suggests a lower-rate environment could significantly lower Carnival’s costs over time and help the company reach its financial health goals.

Carnival has gradually improved its net debt-to-EBITDA leverage, a measure of a company’s debt in relation to its cash flow, and considers itself “two-thirds” of the way to investment-grade status — which it aims to reach in 2026. (Carnival also has prepaid debt, for example prepaying $7.3 billion in debt since the beginning of 2023.)

So yes, Carnival’s earnings news is great for the company and investors, but the recent move by the Fed — along with the idea that more rate cuts may be on the horizon — could be an even brighter sign. This should offer the cruising giant an additional boost when it comes to reducing debt, an effort that will lead to smoother sailing for Carnival and its shareholders.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

Carnival Delivered a Quarter of Records. But Here’s Even Better News for Shareholders (and it Could Supercharge the Stock). was originally published by The Motley Fool

CryptoCurrency

3 Unstoppable Growth Stocks to Buy Before 2025

Stock market volatility will come and go, but what makes a growth stock truly unstoppable is the strength of the underlying business. Whether a stock is up or down in the near term, if you patiently hold shares of a competitively strong business, you’re going to earn great returns sooner or later.

Three phenomenal growth stocks to buy right now are Amazon (NASDAQ: AMZN), MercadoLibre (NASDAQ: MELI), and Home Depot (NYSE: HD). Here’s what three Motley Fool contributors have to say about these all-star companies.

Amazon’s profitability is piling up

John Ballard (Amazon): Amazon has been a truly wealth-building investment for long-term shareholders. Just over the last five years, the stock has doubled and continues to look strong in 2024.

Amazon is involved in a lot of business opportunities, spanning e-commerce, digital advertising, and cloud computing (e.g., Amazon Web Services, or AWS). E-commerce alone is a multitrillion-dollar market that continues to grow. Trailing-12-month revenue across all these businesses grew 12% year over year to reach $604 billion in the second quarter.

That is a healthy growth rate for such a large business, which speaks to the substantial opportunities ahead. Integrating artificial intelligence (AI) in the shopping experience could allow Amazon to gain share of the online retail market, particularly in areas like apparel. The company is making significant investments in generative AI shopping assistants to make browsing and finding the right items more convenient and easier.

Another reason to consider Amazon an unstoppable growth stock worth owning is the improvement on the bottom line. Amazon is becoming a financial powerhouse, with operating profit nearly doubling year over year in Q2. Its trailing free cash flow has more than doubled over the last five years to $48 billion.

With management focusing on lowering costs, improving operating efficiency, and investing in growth opportunities like AI and cloud services, investors will do very well with Amazon stock in 2025 and for years to come.

Fast-growing in multiple businesses

Jennifer Saibil (MercadoLibre): MercadoLibre is the leading e-commerce retailer in Latin America, and it also has a competitive fintech business. It continues to report high growth and profits despite a volatile Latin American economy and inflation, and if the global economy begins to shape up, it will be well-positioned to benefit even more.

E-commerce is still the company’s main business, and it’s growing at robust levels. Gross merchandise volume increased 20% year over year in Q2, or 83% on a currency-neutral basis. E-commerce remains underpenetrated in Latin America, which is still moving away from being a largely cash-based society, and that leaves MercadoLibre with a long growth runway in this business alone. It serves a population exceeding 500 million, and it continues to activate new customers who are buying more items and buying more frequently. Even if this was its only business, it would be a standout stock.

But there’s so much more. The fintech business is growing even faster and presents massive opportunities. The fintech platform offers digital payments, credit cards, and more on an all-digital app. It has a large credit business with around 20 million users at a cost to serve of less than $1. It’s an asset-light, cash-rich business that creates strong financials for the whole company.

Like Amazon, MercadoLibre is leveraging its extensive e-commerce platform for media and advertising with strong results. It has the No. 3 spot in digital ads market share in its region, and ad revenue increased from $436 million to $705 million in 2023.

Total revenue increased 42% (113% currency neutral) year over year to $5.1 billion in Q4, and net income was up from $262 million last year to $531 million this year. Those are typical growth rates.

MercadoLibre stock is outpacing the S&P 500 this year, up 32%, and it could climb much higher as it continues to demonstrate solid performance.

Capitalize on the housing recovery

Jeremy Bowman (Home Depot): The housing market has been on life support since mortgage rates started rapidly rising in 2022. Home prices remain elevated, and the lock-in effect from low mortgage rates during the pandemic has dissuaded Americans from moving.

However, the Federal Reserve recently lowered the fed funds rate (with more cuts likely) which should lead to lower interest rates, and the housing market is starting to show signs of life. Redfin reported that mortgage rate locks jumped 70% from a month ago after the Fed’s 50 basis-point rate cut, and mortgage-purchase applications also rose 10%.

Meanwhile, Americans have record levels of home equity that they’re eager to tap into for home improvement projects.

Those trends are all good news for Home Depot, the nation’s leading home improvement retailer. Home Depot’s performance has been sluggish while the housing market has been slow, but it should bounce back in the recovery especially as there’s a shortage of millions of homes in the country.

Both presidential candidates have plans to address the housing shortage with proposals that will make it easier to build new homes and make homeownership more accessible, favoring home-improvement retailers like Home Depot.

Additionally, Home Depot is well positioned to capitalize on the rebound after its acquisition earlier this year of SRS Distribution, a leading building-supplies distributor that expanded its addressable market by $50 billion and strengthened its relationship with the pro customer.

Home Depot stock might not look like a bargain right now, trading at a price-to-earnings ratio of 27, but there’s a lot of leverage in its business model. Once it returns to growth, profits could move significantly higher, making the stock a winner in 2025.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in MercadoLibre. Jeremy Bowman has positions in Amazon, MercadoLibre, and Redfin. John Ballard has positions in MercadoLibre. The Motley Fool has positions in and recommends Amazon, Home Depot, MercadoLibre, and Redfin. The Motley Fool recommends the following options: short November 2024 $13 calls on Redfin. The Motley Fool has a disclosure policy.

3 Unstoppable Growth Stocks to Buy Before 2025 was originally published by The Motley Fool

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 weeks ago

Science & Environment2 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

News2 weeks ago

News2 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoQuantum forces used to automatically assemble tiny device

-

News3 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport2 weeks ago

Sport2 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 week ago

Technology1 week ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football1 week ago

Football1 week agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoRethinking space and time could let us do away with dark matter

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

MMA1 week ago

MMA1 week agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Business1 week ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

News3 weeks ago

News3 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Business1 week ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

News2 weeks ago

News2 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News3 weeks ago

News3 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoMeet the world's first female male model | 7.30

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Business3 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoBest Exercises if You Want to Build a Great Physique

-

News2 weeks ago

News2 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

News2 weeks ago

News2 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Technology2 weeks ago

Technology2 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoEverything a Beginner Needs to Know About Squatting

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks ago3 Day Full Body Toning Workout for Women

-

Travel2 weeks ago

Travel2 weeks agoDelta signs codeshare agreement with SAS

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology1 week ago

Technology1 week agoThe best robot vacuum cleaners of 2024

-

Health & fitness1 week ago

Health & fitness1 week agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Sport2 weeks ago

Sport2 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology2 weeks ago

Technology2 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Politics2 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News1 week ago

News1 week agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology1 week ago

Technology1 week agoQuantum computers may work better when they ignore causality

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow one theory ties together everything we know about the universe

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency2 weeks ago

CryptoCurrency2 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business2 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business2 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Politics2 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News2 weeks ago

News2 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News2 weeks ago

The Project Censored Newsletter – May 2024

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoHow Heat Affects Your Body During Exercise

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoKeep Your Goals on Track This Season

-

Womens Workouts2 weeks ago

Womens Workouts2 weeks agoWhich Squat Load Position is Right For You?

-

TV2 weeks ago

TV2 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News2 weeks ago

News2 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology2 weeks ago

Technology2 weeks agoFivetran targets data security by adding Hybrid Deployment

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoSingle atoms captured morphing into quantum waves in startling image

-

Politics2 weeks ago

Politics2 weeks agoLabour MP urges UK government to nationalise Grangemouth refinery

You must be logged in to post a comment Login