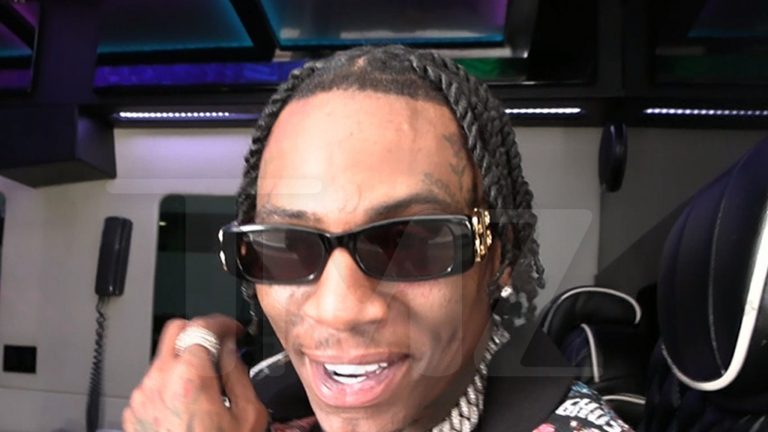

Marcus Johnson

Marcus JohnsonBy his own admission, Marcus Johnson’s metallic blue Suzuki Swift was an unremarkable car – a little runaround bought after passing his driving test.

But how this run-of-the-mill vehicle was sold is now at the heart of a far more remarkable, multi-billion pound saga.

Lenders and dealers have been accused of hiding commission payments made when cars were bought on finance deals.

A recent Court of Appeal ruling in the case of Mr Johnson, and two other car buyers, raised the possibility of millions of motorists receiving compensation.

Not everyone agrees with that conclusion.

As MPs prepare to quiz the boss of the financial regulator over its role, there seems to be an industry consensus that only the highest court in the land should settle this affair.

That, were it to happen, could put payouts in greater doubt, or at least delay them for many months.

Marcus Johnson

Marcus JohnsonMr Johnson from Cwmbran, Torfaen in south Wales was aged 27 when he was on the lookout for his first car in 2017.

He had been cycling to and from his job as a factory supervisor. He and his fiancee, now wife, Kirsty, were taking buses and taxis to visit family and friends after they had moved home.

Buying a car made sense. So too did going to a dealership whose advert he “heard 10 to 15 times every day” on the radio at work.

He took the Suzuki for a test drive, decided to buy it and paid a deposit.

“I thought it was a financially sound decision to get a newer car, so it would have fewer problems,” he says.

‘Ridiculous’ commission

Mr Johnson earned just over £13,000 a year, so finance involved a hire-purchase agreement and an extra personal loan.

He was unaware that the finance provider would pay the dealer a commission of £1,650 – about a quarter of the amount he borrowed.

“I had always thought that car dealerships made their money by making a profit on the cars that they sell rather than by arranging finance,” he said in his witness statement.

Later, he spotted a post on Facebook prompting him to fill in a claim form about such a deal. After discussion with a lawyer, he says he realised that that commission was “ridiculous”.

“I had no idea before then. Commission as part of the industry is not necessarily a bad thing,” he says. “But it was kept out of sight. If they are deceiving customers then, to me, that’s disgusting.”

Getty Images

Getty ImagesHis case went to court. He says he almost missed the date after the notification went into his email junk folder. He lost.

But at the higher Court of Appeal, his case was bunched with two similar ones, and the three judges found unanimously in their favour.

The other two car buyers involved were Andrew Wrench, described as “a postman with a penchant for fast cars”, and student nurse Amy Hopcraft.

Mr Wrench has since spoken about how shocked he was at the impact of the ruling, but it was the principle of fairness that fired him up.

The same is true of a surprised Mr Johnson, who never thought his case would even get to court. But he says he is someone who doesn’t like to think of people losing out.

“And lots of people who did not have the money to buy a car were ripped off,” he says.

Wider impact

The judges’ decision was a win for the trio, but – more significantly – opened the door for claims from many, many more motorists.

In the conclusions of a clear, 46-page judgement are three even clearer words: “fully informed consent”.

They ruled it would be illegal for the lender to pay any commission to the dealer without the fully informed consent of the buyer.

In other words, customers should be told clearly how much commission would be paid, and agree to it, without those details being buried in the terms and conditions of the loan.

Bearing in mind that something like 80% or 90% of cars are bought on finance – that is about two million vehicles a year, then the potential for many deals past and present failing that test is high.

Analysts have suggested millions of buyers could each receive hundreds of pounds in compensation. Estimates of the total bill are up to £30bn.

Banks have set aside hundreds of millions of pounds for potential compensation. Some lenders also temporarily paused new deals. The case sent shockwaves through the car industry and the finance sector too.

Some commentators have suggested this could extend further than cars to other “big ticket” items bought on finance.

‘Justice delayed’

Kevin Durkin from HD Law, who represents Mr Johnson, says the Court of Appeal decision was clear, and redress payments should start to be made where necessary.

Failing to do so means “justice delayed is justice denied”, he says.

“The bottom line in all of this is that it is the customer who continues to suffer financially,” he says.

However, the story is far from over.

David Postings, chief executive of UK Finance, which represents lenders, told MPs last week that “the ruling is subject to different interpretations”.

The defendants in the case involving Mr Johnson, Mr Wrench and Ms Hopcraft have requested the Supreme Court take a look at it.

Banks have seen success before at the Supreme Court regarding mass compensation claims. In 2009, it found in their favour over the issue of bank overdraft charges.

However, banks did have to pay out billions of pounds over the PPI (payment protection insurance) scandal.

The City regulator, the Financial Conduct Authority, has written to the Supreme Court requesting a speedy decision on motor finance, given the potential impact on the market and consumers.

In the meantime, it will face questions – starting when leading figures, including chief executive Nikhil Rathi, appear before the Treasury Committee on Tuesday.

Did the FCA go far enough?

In 2021, the FCA banned deals in which the dealer received a commission from the lender, based on the interest rate charged to the customer. It said this provided an incentive for a buyer to be charged a rate that was higher than necessary.

By banning these so-called discretionary commission arrangements, it declared it would save drivers £165m a year.

Since January, it has been considering whether compensation should be paid to people with these deals before 2021.

However, it didn’t decide to ban commissions or fees on a wider scale, or stipulate how dealers should disclose they were receiving payments from lenders.

It may now face the ire of motorists who say it should have done more to protect them, as well as lenders and dealers who feel the regulator gave them the green light to carry on paying commission in the same way.

It is planning to extend the time dealers have to deal with complaints.

It wants any mass compensation, should that come to pass, to be administered in an orderly fashion. The nature of any such redress is currently uncertain.

So, for now, disgruntled drivers who believe they may have a claim are stuck at a red with no clear idea when the lights will change.

+ There are no comments

Add yours