Getty Images

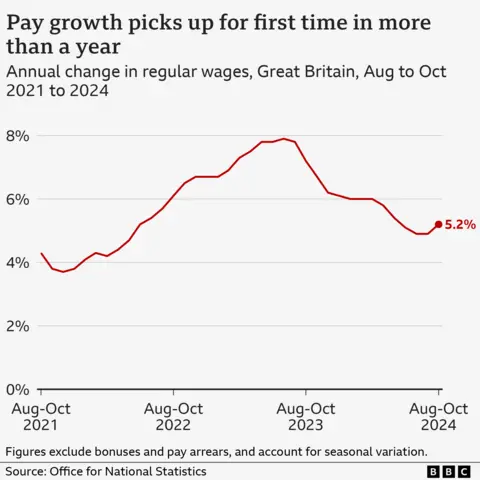

Getty ImagesPay growth has picked up for the first time in more than a year, according to the latest official figures.

Regular pay grew at a faster-than-expected annual pace of 5.2% between August and October, the Office for National Statistics (ONS) said.

Wages are continuing to increase faster than the price of goods. Analysts say the latest figures have reduced the chances of the Bank of England cutting interest rates when it meets this week.

Other ONS data suggested the jobs market is weakening, with job vacancies falling again and a drop in the number of people on payrolls.

The unemployment rate was unchanged at 4.3%, although there are questions over the reliability of the jobs figures from the ONS due to issues with how it gathers the data.

“After slowing steadily for over a year, growth in pay excluding bonuses increased slightly in the latest period driven by stronger growth in private sector pay,” said Liz McKeown, director of statistics at the ONS.

Private sector pay grew at an annual pace of 5.4%, the ONS said.

The Bank of England watches the pay and jobs data closely when making decisions on interest rates.

It has cut rates twice this year as inflation – which measures the rate at which prices are increasing – has fallen.

The Bank meets to discuss rates again this week, but it is not expected to make a further cut given the strength in pay growth.

“The latest UK jobs report provides yet more justification, if any were needed, for the Bank of England to keep rates on hold at its meeting this week,” said James Smith, developed markets economist at ING.

Mr Smith noted that the jump in wage growth was entirely down to the private sector.

“This matters for the Bank, because private sector pay trends tend to be more reflective of the wider situation in the jobs market than in the public sector,” he said.

The number of job vacancies fell by 31,000 to 818,000 in the September-to-November period, the ONS said, although the total remains above pre-pandemic figures.

The ONS also said provisional data indicated that the number of staff on payrolls fell by 35,000 in November 2024, although some analysts said this figure is volatile and can be subject to large revisions.

Many firms have argued the increase in National Insurance Contributions for employers that was announced in the Budget will hit jobs.

At the weekend, the boss of Reed, one of the UK’s largest recruitment firms, told the BBC the economy was “cooling”, suggesting a recession may be “around the corner”.

A separate survey released on Monday indicated that private sector employment December had fallen at the fastest rate for nearly four years.

Work and Pensions Secretary Liz Kendall said: “Today’s figures are a stark reminder of the work that needs to be done.

“To get Britain growing again, we need to get Britain working again – so people have good jobs which pay decent wages and offer the chance to progress.”

+ There are no comments

Add yours