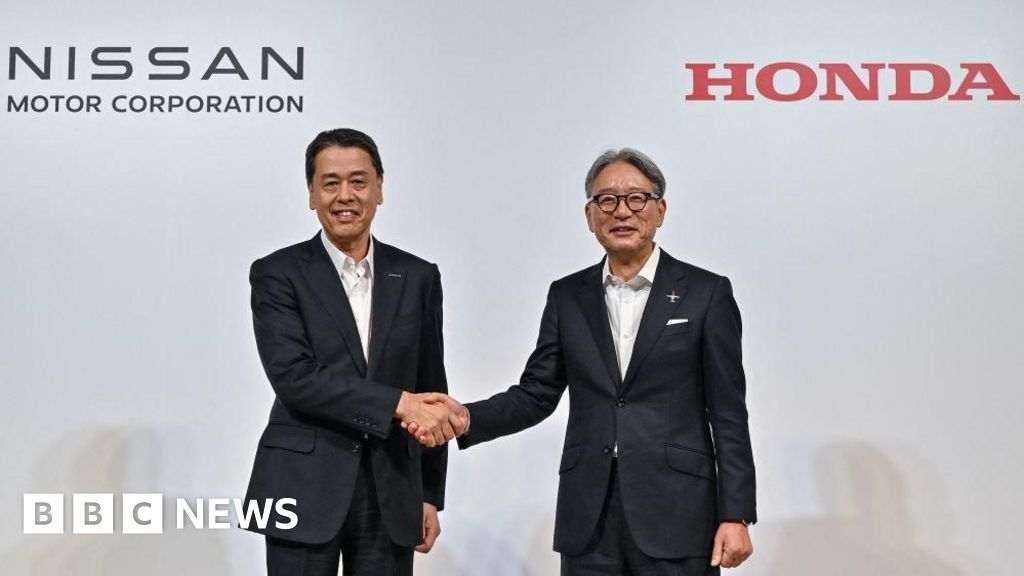

Honda and Nissan are reportedly holding exploratory talks about a potential merger to help them compete against electric vehicle (EV) makers, particularly in China.

In March, the two Japanese car makers agreed to explore a strategic partnership for EVs.

Both firms responded to the BBC with identical statements, which said: “As announced in March of this year, Honda and Nissan are exploring various possibilities for future collaboration, leveraging each other’s strengths.”

It comes as many car brands grapple with growing competition as the industry shifts from petrol and diesel vehicles to electric, with production in China booming.

Honda and Nissan have been losing market share in China, which accounted for almost 70% of global EV sales in November.

The two brands had combined global sales of 7.4 million vehicles in 2023, but are struggling to compete with cheaper EV makers such as BYD, which has seen its quarterly revenues soar, beating Tesla’s for the first time in October.

Honda and Nissan have not denied the story, which was first reported by Japanese business newspaper The Nikkei, but said it was “not something that has been announced by either company”.

“If there are any updates, we will inform our stakeholders at the appropriate time.”

A potential merger between Japan’s number two and number three car manufacturers could be complicated for several reasons.

Any deal is likely to come under intense political scrutiny in Japan as it may lead to major job cuts. Nissan is also likely to be faced with unwinding its alliance with French vehicle manufacturer Renault.

Honda and Nissan agreed in March to cooperate in their EV businesses, and in August deepened their ties, agreeing to work together on batteries and other technology.

In August, the two companies also announced an agreement with Mitsubishi to discuss intelligence and electrification.

“The thought that some of these smaller players can survive and thrive is getting more challenging, especially when you add on the complexity of all the additional Chinese manufacturers who have come in and are competing quite strongly,” said Edmunds analyst Jessica Caldwell.

“It’s just sort of necessary to survive, not only to survive, but also just to afford the future.”

+ There are no comments

Add yours