The severe economic and potential human costs of Rachel Reeves’ budget have been exposed by family businesses in a series of poignant speeches at the London Palladium.

Ed Rogers, who co-runs a family transport and storage company, said that thanks to Labour’s changes to inheritance tax rules, he now faces a bill of £6million when his father dies.

The businessman warned his family’s company will have to shelve investment plans, sell assets and make redundancies to foot the bill.

But he also shared a glimpse into the terrible human impact Reeves’ policy could have.

Rogers said: “I want share conversation I had with my father two weeks ago whilst discussing the best way forward.

“Dad’s here in the audience today. Let me remind you, this is a man that has given his all to the family business for 50 years. Always paid his taxes, wanted the business to be strong to pass on to his family.

“He said, ‘Ed, it’s probably best for the business if I head to Switzerland in March 2026 and don’t come home.’”

This is because March 2026 is when Reeves’ tax raid comes into force, meaning anyone who died before that date could hand down their business without being clobbered by inheritance tax.

It comes after Chancellor Reeves capped the amount of relief family businesses could claim from inheritance tax at £1million.

Asset-rich but cash-poor businesses, such as haulage companies with expensive lorries and warehouses, will have to pay 20 per cent tax on assets over £1million in the event of a death from April 2026.

The same rules will apply to farmers who use BPR to claim relief for parts of their businesses like machinery and sheds.

Businessman issues heartbreaking message to Reeves over her tax raid: ‘Dad said …

Businessman issues heartbreaking message to Reeves over her tax raid: ‘Dad said …

Rogers warned the move will severely hamper businesses like his and lead to ‘sleepless nights’.

He said: “Why would we want to grow our business now?

“Instead of continuing to grow and pay our corporation tax on profits, we are now looking at ways of protecting our business from being destroyed when eventually our shareholders die.

“Instead of investing in growing that business, we are looking to put aside money for when the inevitable happens.

“When sadly my uncle and father died, with the proposed legislation, we will need to find £6 million to continue running our business that we have worked on for 25 years. We will need to sell assets.

“Assets that are crucial for running our business. Our yards, our warehouses, our trucks. Like farms without land, a transport company without vehicles does not transport many goods.

“This in turn will inevitably lead to redundancies. We wouldn’t need the same staffing levels, this in turn would shrink our business, we would pay less corporation tax and therefore we would employ less people.

“We employ 115 people from our site in Northampton. This includes all four members of one family, three generations of another family, and I point out specifically that over the years we have employed 20 sets of brothers and 15 father and sons. Family isn’t just our family.

“Overnight, our National Insurance Bill has increased by £165,000.”

Asked what message he would give to Rachel Reeves, Rogers said: “I think she needs to reel back on this.

“She needs to encourage growth. This is just going to destroy many family businesses; it needs to change.

“Taxation in this way does not encourage growth. So please go back, have a look, and change.”

LATEST FROM MEMBERSHIP:

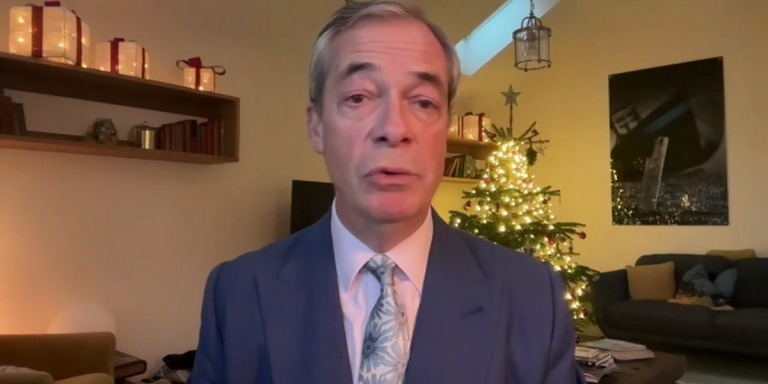

Ed Rogers speaking at the BPR summit at the London Palladium

GBN

This comes after economists have warned that Reeves’ inheritance tax raid will cost the Treasury over £1billion more than it makes.

Analysis by CBI Economics shows the Treasury has ‘underestimated the impact’ of changes to business property relief (BPR), namely the majority of family businesses being forced to cut investment because of the raid.

The complete shelving of any plans for growth in the face of such large tax bills (even downsizing in some cases) will lead to the loss of 125,678 jobs, argues researchers.

The government will lose £2.6billion in tax revenue as the take from things like corporation tax, income tax and national insurance falls drastically over the next five years.

Farmers have been highlighting this since the budget capped their inheritance tax relief at £1million, a measly figure when a combine harvester costs up to £750,000.

Labour’s raid on farmers will raise £520million a year by 2030, a small amount capable of funding the NHS for one day and five hours.

But as farmers shelve all plans for investment and growth and even scale back elements of the business to protect them from death duties, the tax take from revenue generating means will likely fall more than the amount raised in the first place.

The summit, which was organised by the same group who arranged the #SaveFamilyFarms rally in London on 19th November, brought family businesses from across the country to discuss and highlight the crippling effect of Reeves’ Budget.

It was sponsored by Andrew Lloyd Webber hence why it was held at the London Palladium.

Labour’s changes to inheritance tax come into effect in April 2026.

+ There are no comments

Add yours