A dairy farmer has called on Labour to raise the inheritance tax threshold to £5million, warning that current rules threaten the future of family farming.

Ro Collingborn told GB News that smaller family farms face being “absolutely clobbered” by recent changes to inheritance tax rules.

The changes, introduced in last year’s Budget by Chancellor Rachel Reeves, mean farms worth more than £1million will now be liable for a 20 per cent inheritance tax.

Collingborn expressed particular concern for farmers over 75, arguing they should be allowed to continue with the nil rate as they “don’t have time to know that they will live for seven years”.

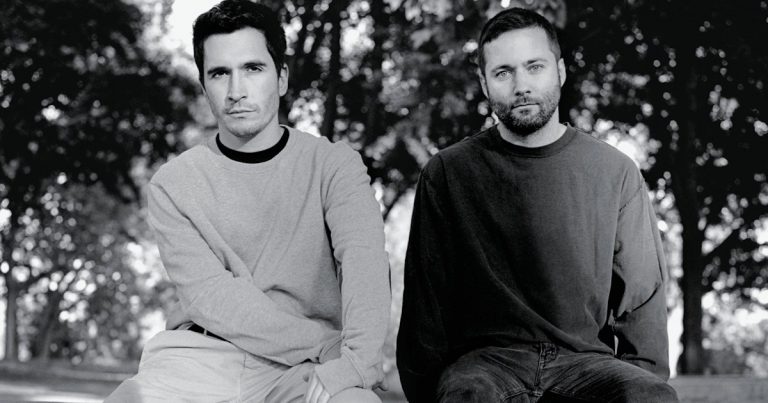

Dairy Farmer Ro Collingborn has urged Labour to raise the threshold on their inheritance tax raid on farmers

PA / GB News

The National Farmers’ Union has found that 75 per cent of farm businesses could be impacted by the inheritance tax changes.

Collingborn, who runs a 180-acre dairy farm, explained that current allowances fail to cover the full value of farming operations.

Collingborn told GB News: “Everybody gets the first million if they’re married, for their house and their gardens and own possessions. But if you take a fairly small farm like ours, 180 acres, the allowance for that is £1.2million.”

“On top of that, there’s all the cattle, all the machinery, all the buildings, it’s easily going to go way over the two million that were allowed on that,” she added.

Farmers To Action staged a recent protest at a Morrisons supermarket in Somerset

GB News / Farmers To Action

The dairy farmer warned this could deter the next generation from entering farming. Speaking to the People’s Channel, the dairy farmer said: “The incomes are so small, and there wouldn’t be the money to pay this tax.”

LATEST DEVELOPMENTS:

Criticising Labour’s lack of effort in modifying or U-turning on the decision, Collingborn stated that the problem could be “easily solved” if Reeves was to change the threshold on the tax raid.

Collingborn claimed: “You could easily solve this for smaller family farms. Just raise that threshold to five million, and say that farmers over 75 can still continue with the nil rate, as it’s really unfair on them.

“That would save a lot of farms a lot of despair.”

NFU president Tom Bradshaw has warned that the inheritance tax changes are having wider implications for rural businesses.

Collingborn told GB News that a change to the threshold would ‘save a lot of despair’ for frightened farmers

GB News

Speaking at an agricultural machinery conference, Bradshaw said farmers were curtailing investments due to concerns about their future.

He said: “From builders, vets and feed merchants, to fencers, machinery dealers and tool manufacturers, there’s been talk of calls drying up and order books looking sparse for the year ahead.”

Reeves has so far rejected calls to modify the tax, despite warnings from farming groups about its impact on family farms.

The Government maintains that only a few farms will be affected, suggesting many family farms will fall below the threshold.

+ There are no comments

Add yours