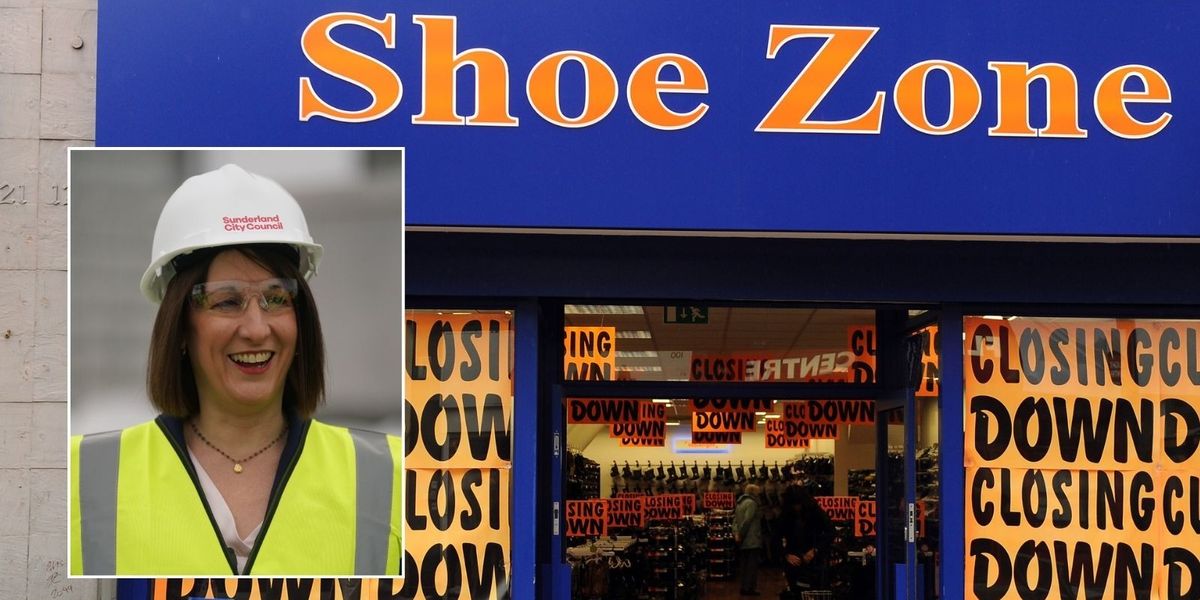

A major retailer has confirmed that store closures are in its future following Chancellor Rachel Reeves’s decision to launch a tax raid on businesses as part of her Autumn Budget.

Shoe Zone, which currently operates 297 stores with around 2,250 employees, has announced many of its locations will be forced to shut down as a result of the hike to National Insurance. This would make the retailer the first to link store closures to the policies rolled out during the Chancellor’s Budget.

In recent years, Britain’s high streets have been decimated by a wave of store closures with nearly 10,500 locations permanently closing in 2023 alone, according to the Centre for Retail Research. Stores understood to be closing include Burnham-on-Sea in Somerset, Boscombe in Dorset and Burgess Hill in Sussex.

During her fiscal statement in October, Reeves confirmed that the rate paid by employers would increase from 13.8 per cent to 15 per cent for employers in April next year.

This has been slammed as a “tax on jobs” by major high street businesses and supermarkets with Labour being urged to make a U-turn on its decision-making as soon as possible.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Shoe Zone has claimed it will close its stores due to Reeves’s National Insurance raid

PA

Earlier this morning, Shoe Zone issued a profit warning and admitted the business has experienced “very challenging trading conditions” since the Autumn Budget announcement.

According to the shoe retailer, sales and profits were already under pressure due to weak consumer confidence following the Autumn Budget amid the ongoing cost of living crisis.

Furthermore, Shoe Zone cited the impact of wet weather in the weeks leading up to the Chancellor’s speech which likely led to a drop in footfall for its high street locations.

However, the company took particular aim at Reeves’s move to raise National Insurance rates on employers and hike the National Living Wage in a double whammy hit to businesses.

Britain’s high streets have been hit by a wave of store closures as of late PA

Britain’s high streets have been hit by a wave of store closures as of late PAIn a statement, Shoe Zone stated: “Consumer confidence has weakened further following the Government’s Budget in October 2024, and as a result of this Budget, the Company will also incur significant additional costs due to the increases in National Living Wage and National Insurance.

“These additional costs have resulted in the planned closure of a number of stores that have now become unviable. The combination of the above will have a significant impact on our full-year figures.”

As a result of this, the high street shoe shop estimates profits for the year to September 27, 2025, to be “not less than” £5million. This would be half the £10million previously projected.

Within its wider retail portfolio, Shoe Zone is made up of 112 high street store and 185 larger format stores. The organisation sells brands such as Skechers, Hush Puppies, Rieker and Lilly & Skinner.

Based on official figures, it is estimated that Shoe Zone sells around 13.9 million pairs of shoes annually to British consumers at an average retail price of around £13.30.

David Maslen, the head of Tax at Old Mill, broke down why raising the rate paid by employers on National Insurance is not the biggest change to the tax that businesses will feel.

LATEST DEVELOPMENTS:

Reeves has previously ade clear that the party’s manifesto pledge not to hike National Insurance Contributions (NICs) only related to those paid by employees

GETTY

He explained: “Rachel Reeves’a 30 October Budget contained significant changes to employer’s National Insurance which are due to take effect from 6 April 2025. But the big kicker for employers is that the secondary threshold will reduce from £9,100 to £5,000.

“The impact of this on employers can be understood when one looks at an employee earning a salary of £9,100. Under current rules, the employer’s National Insurance liability for that employee is zero. Under the new rules, the burden is £1,600 per year.

“The additional burden to employers is, therefore, huge. It is a tax on employment and is a general disincentive to employing staff. However, there are categories of employees where this additional NIC burden will not arise, and this does not appear to be widely understood.”

GB News has contacted Shoe Zone and the Treasury for comment.

+ There are no comments

Add yours