Younger tenants in Britain have seen their rents rise by a collective £3.5bn to hit a record high in the past year as landlords pass on their mortgage costs, new analysis suggests.

Under-45s are now paying 66 per cent of all rent in Britain, amounting to a record £56.2bn in 2024, according to Hamptons estate agents.

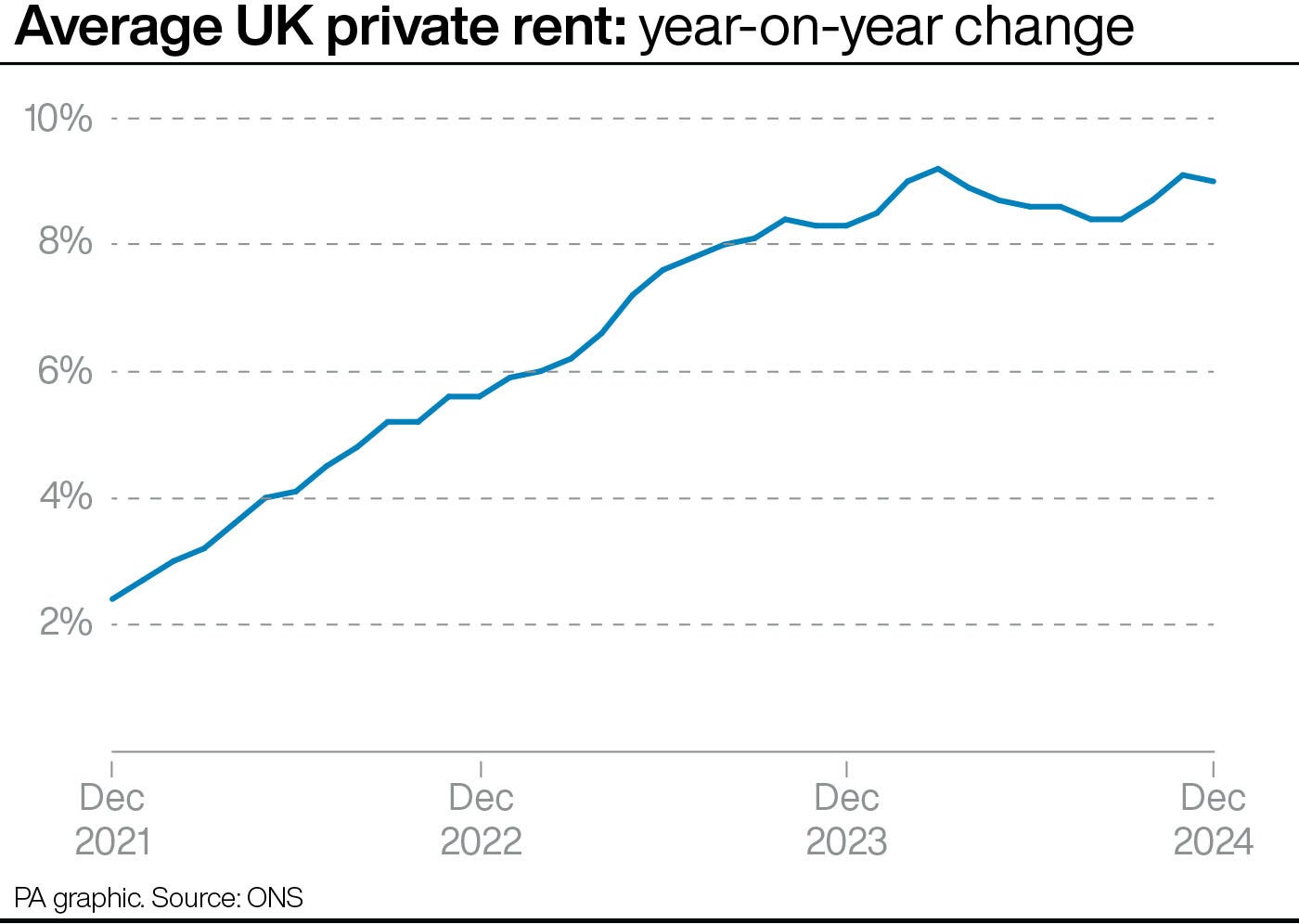

Mortgage costs soared as the Bank of England pushed interest rates to a record high in response to the inflation crisis, causing rent increases to peak in December 2023, with an annual rise of 10.2 per cent, the analysis found, before falling back to 2 per cent.

With the volatility seeing even more young people priced out of buying a home, the number of under-45s renting properties soared by nearly 150,000 last year to hit 3.4 million – marking the fastest surge in a decade.

That surge in the number of younger renters also came as the government’s longstanding Help to Buy scheme was wound up in March 2023, which had been used by nearly a third of first-time buyers over the previous decade.

“Higher mortgage rates have clipped the wings of many young aspiring homeowners in the last couple of years, meaning millennials increasingly outnumber older generations in the rental market,” said Aneisha Beveridge, head of research at Hamptons.

“Renters face saving for longer and earning more to borrow similar amounts of money to buy a home. Just like rapidly rising house prices, higher interest rates will keep younger generations of tenants renting for longer.”

Conversely, the rent burden on older tenants fell by £700m to hit 29.1bn last year, as the number of over-45s renting a home fell by 79,000, according to the Hamptons Monthly Lettings Index.

Despite the pandemic, cost of living crisis, and mortgage market unease in recent years, Halifax reported in December that house prices have risen by 25 per cent over the past five years to hit an average of £300,000 across the UK, albeit with significant local variations in price.

According to the Office for National Statistics, house prices were rising at an annual UK average rate of 3.3 per cent in November – ranging from 3 per cent in England to as high as 6.2 per cent in Northern Ireland.

And on Monday, Rightmove said that the average asking price for new homes coming onto the market rose by 1.7 per cent in January, equating to the largest new year bounce since prior to the pandemic, and taking the average asking price to £366,189.

Hamptons calculates that, over the past decade, the amount of rent paid in the UK has skyrocketed by 71 per cent to exceed £85bn in 2024.

Industry figures have warned that rents are set to continue to rise as landlords are expected to once again pass on their own costs to their tenants in response to Labour’s upcoming bill aiming to strengthen renters’ rights.

The upcoming Bill – due to gain approval later this year – will bring in a host of reforms to the private rental sector, including an end to no-fault eviction notices, stopping bidding wars for tenancies and preventing landlords from demanding more than a month’s rent in advance from a new tenant.

While campaigners have largely welcomed the measures, the National Residential Landlords’ Association claimed that many property owners are now preparing to “price in” additional costs to the rents they charge.

+ There are no comments

Add yours