Sir Keir Starmer’s VAT raid on private schools comes into effect on Wednesday – a move the Treasury says will give state schools a £1.7bn yearly boost by the end of the decade.

Despite warnings from private schools over the impact of the policy, the prime minister is ploughing ahead and will charge 20 per cent VAT on independent school fees from the start of 2025.

The Treasury has earmarked £2.6bn of extra funding for state schools next year to invest in improving special education provision and hire 6,500 new teachers, with £1.5bn of this coming from the policy change.

The amount raised by the move will increase to £1.7bn each year by 2029/30, it added.

But private school leaders have warned the combination of tax hikes in the Budget and the removal of their charitable status, which saw fees exempted from VAT, could lead the sector to “fall apart”.

They have also argued that the hike in school fees as a result of the policies will force more children into the state sector, overwhelming already stretched schools and wiping out any gains to the public finances.

And, ahead of the policy coming into force, Liberal Democrat education spokesperson Munira Wilson said: “Students and teachers across our education system are crying out for support, but we’ve been clear the Government’s decision to tax education is the wrong approach.

“The Government should now lay out what effect this misguided policy will have on the families of the 100,000 children with special educational needs currently at independent schools who do not have education, health and care plans.”

The Independent revealed in October that smaller independent schools, already struggling financially, had seen more than a quarter of parents offered places for the upcoming academic years for their children choosing not to accept them by the end of July – compared with a usual figure of 10-15 per cent. Most blamed the “VAT shock”.

And, after the move was confirmed in the chancellor’s Budget, the Independent Schools Council, which represents private schools in the UK, said it would launch a legal action against the decision.

Labour has also sparked fury in a row over the policy, with shadow health secretary Wes Streeting brushing off private school leaders’ concerns and telling them to “cut their cloth in the way state schools have to”.

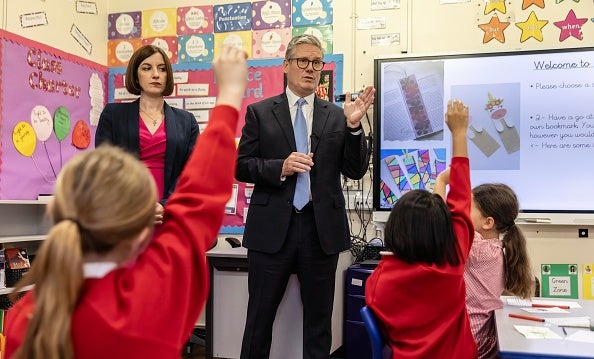

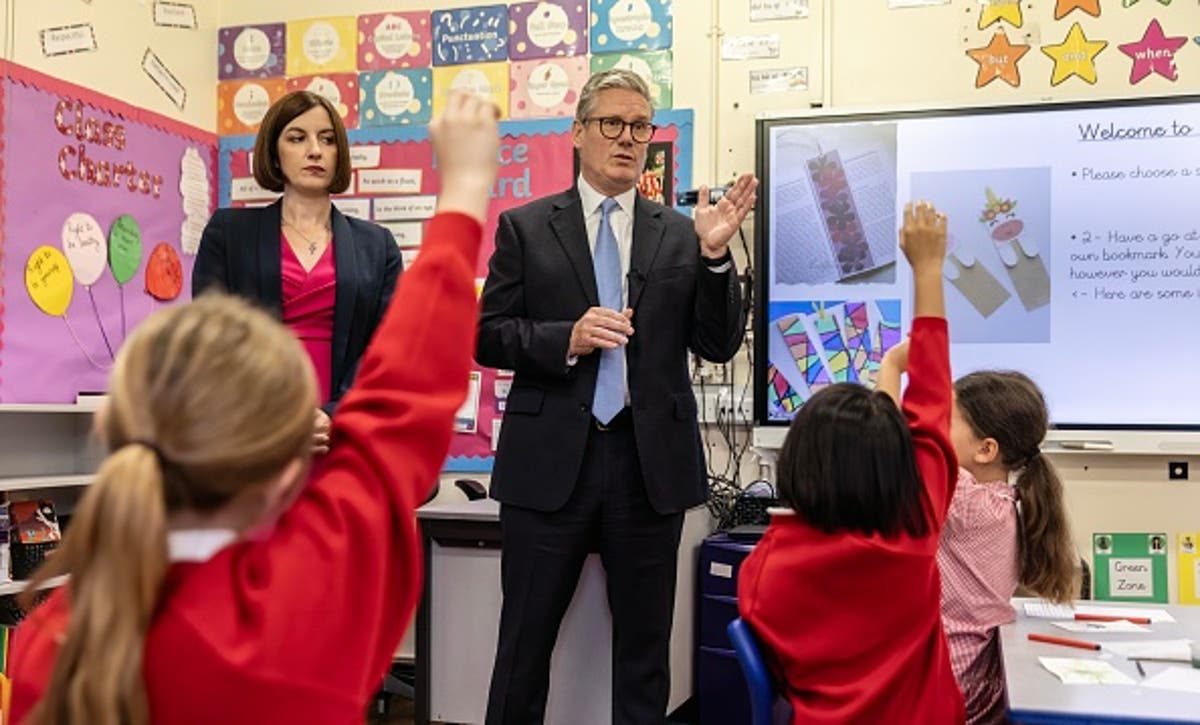

And Sir Keir has made “giving children the best start in life” a key milestone for his government, urging voters to judge him against it ahead of the next general election.

And, ahead of the tax shakeup coming into force, Rachel Reeves said: “It’s time things are done differently. Ending the VAT break for private schools means an additional £1.7 billion a year that can go towards our state schools where 94 per cent of this country’s children are educated.

“That means more teachers. Higher standards. And the best chance in life for all our children as we deliver on our Plan for Change.”

And education secretary Bridget Phillipson said: “High and rising standards cannot just be for families who can afford them, and we must build an education system where every child can achieve and thrive.”

She said the policy would help “break the link between background and success”. “Ending the VAT break enjoyed by private schools will provide much needed investment in our state schools, to help recruit and retain expert teachers,” she added.

The policy will cover all fees paid after July 29, when it was first announced, that relate to the term beginning in January, in a bid to catch parents who attempted to dodge the tax by paying their fees in advance.

As part of the shakeup, private schools will also lose their ability to access business rates relief for charities, raising an additional £140m per year.

+ There are no comments

Add yours