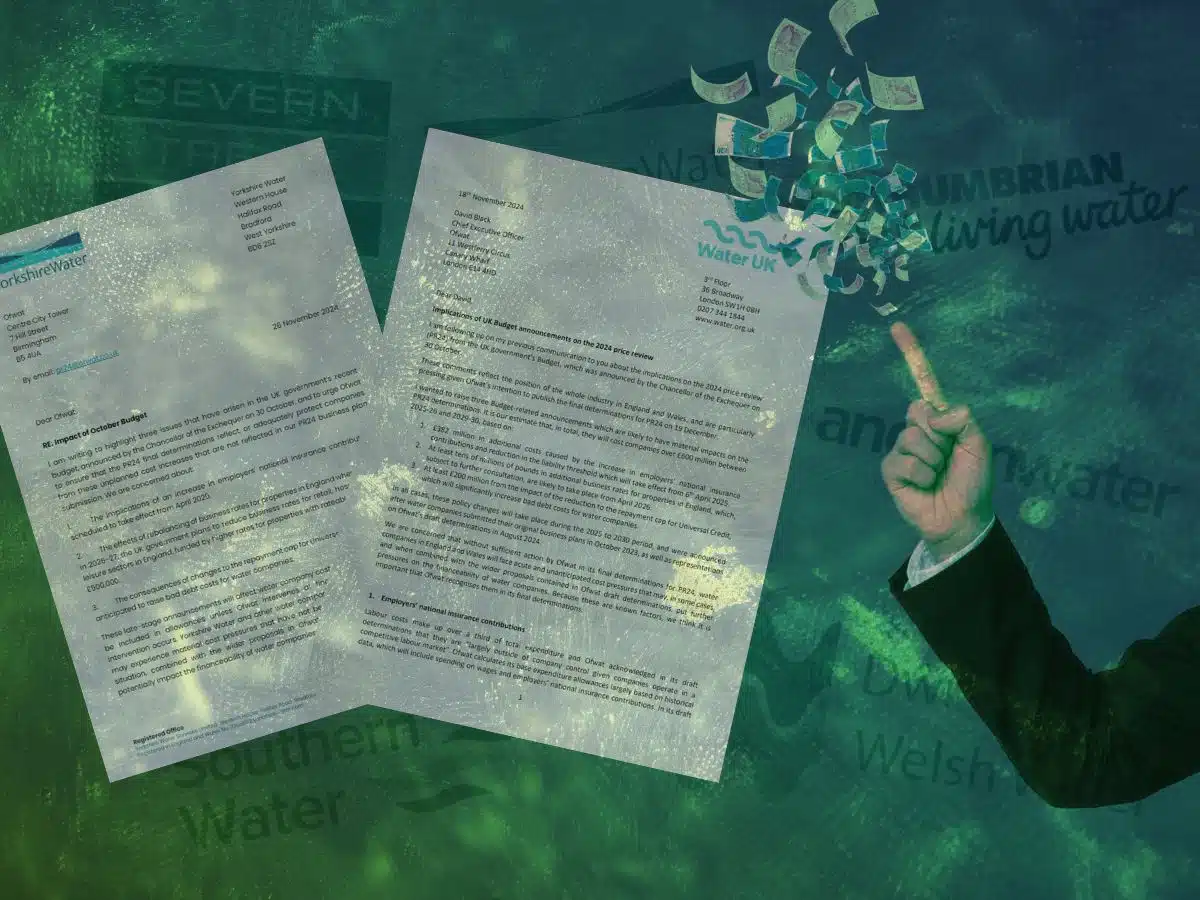

The UK’s water and sewerage industry weaponised Labour’s Universal Credit deductions cap to lobby for higher bill hikes – all with the aid of the Department for Work and Pensions (DWP).

Documents the Canary obtained via Freedom of Information (FOI) request reveal how industry body Water UK and Yorkshire Water separately lobbied regulator Ofwat ahead of Labour implementing the 15% cap on Universal Credit deductions.

What’s more, figures they relied on to call for raising bills majorly conflict with data the Canary previously acquired from the DWP. Notably, Water UK cited a figure for the industry’s annual deductions that was over four times the amount shown by the official government data.

So the documents exposed that not only did the industry cynically exploit the new deductions cap – but it appears it also inflated figures to do so.

DWP cap aiding greedy water companies

The Labour Party government first announced its so-called Fair Repayment Rate plans in the 2024 Autumn Budget.

In April 2025, the DWP brought the new cap into effect. It reduced the deductions the DWP can take on monthly payments for various debts to 15%.

However, as the Canary already highlighted, the half-assed measure amounted to little more than tinkering around at the edges of a vicious debt chasing mechanism. In effect, it merely extends claimants periods of indebtedness, instead of actually removing the debt. To make matters worse, built-in loopholes mean that for many, DWP deductions will still exceed the cap.

Nevertheless, in theory, it means that some claimants in debt will have more of their Universal Credit each month.

So of course, private sector corporations cashing in from the deductions regime weren’t happy about this. Unsurprisingly, the water and sewage companies – sixth in line for deductions – was one such industry.

Water industry will lose out? Cry me a river

Less than a month after Labour announced the new cap, Water UK CEO David Henderson wrote to head of Ofwat David Black. He laid out how it would cause the industry to lose out on £200m in deductions over the next five years.

Naturally, the industry body also couldn’t help but play the victim even more where migration to Universal Credit was concerned. In particular, it noted how people moving from legacy benefits like Employment and Support Allowance (ESA) would “become eligible” for the new cap. It argued that this could “increase bad debt further” for water firms. The implication was that the industry wouldn’t be able to rob as many claimants of their welfare.

Following this, Yorkshire Water lobbied the regulator on 26 November 2024. In a letter headed RE: Impact of October Budget, the water firm wrote:

With the cap lowered to 15%, water charge arrears, ranked low in priority, face reduced success rates.

In the last year, we received £11 million from DWP payments, which could decrease by 50%.

Although this doesn’t directly translate into bad debt, mitigating the impact will require increased debt recovery efforts and promotion of social tariffs, resulting in higher costs.

Predictably, both demanded greater ‘allowances’ to account for this. In simple terms, this would mean Ofwat increasing what it allows companies to charge – ergo, bill hikes for customers.

Bogus figures

Of course, the disparity between Water UK and Yorkshire Water’s figures with the data the Canary obtained from the DWP also raises significant questions.

Water UK claimed industry deductions for 2024 sat at £100m. Meanwhile, Yorkshire Water suggested its slice of this alone came in at £11m.

By comparison, the DWP’s data for a similar twelve-month period (March 2024 – February 2025) showed total deductions at £22m.

The first cause of the disparity could be because the department itself provided erroneous data.

However, the more plausible explanation is that Water UK and Yorkshire Water both inflated their figures to press for larger bill increases.

And notably, even Ofwat wasn’t buying their calculations. Specifically, in its ‘final determinations’ for its 2024 price review of the industry, the regulator challenged the credibility of Water UK’s claim that:

190,000 households were subject third-party deductions via Universal Credit in 2023-24, equivalent to around £100 million revenue.

Because, as it pointed out, on average this would work out at a £526 annual deduction per household. It commented how this:

seems very high relative to the average water bill.

This would be just shy of £44 a month. By contrast, the DWP’s data showed that water company deductions were £20 a month on average.

Moreover, as Ofwat also highlighted:

Water UK also seem to assume that water companies can recover all the water bill through third party provision, which would be surprising given water companies are 6th in line behind other service providers (housing, accommodation, hostel, rent and service charges, gas and electricity).

Blaming welfare claimants for bill hikes

Already, the DWP’s data is also throwing cold water on its far-fetched claims. The idea that the cap would cause the industry to lose out on £40m in Universal Credit deductions is preposterous. This is obviously not least because, according to official government data, 12 months of deductions are barely just over half of this in total. Furthermore, even the 40% drop in deductions is implausible.

Crucially, we now have the first few months worth of data that shows the effect the new cap is having on deductions. June saw a decrease of 22% from £1.8m to £1.4m. For July and August, the decrease was around 28% from £1.8m to £1.3m in each month respectively.

At the end of the day, the industry’s figures don’t add up. However, what’s clear is that it tried to use welfare claimants to hike customer bills. And it sure seems like it attempted to wilfully mislead Ofwat to do this.

Of course, for the shameless profiteers that are privatised water, exploiting the hardships of its poorest customers is all-too on-brand.

Featured image via author

lead image

lead image

![Who's your favorite girl in Digital Circus? [Money Money Green green meme] #shorts #trend](https://wordupnews.com/wp-content/uploads/2026/02/1771002718_maxresdefault-80x80.jpg)