Politics

So you’re not rich, but you argue against increasing taxes on the rich?! Here’s how you’ve been totally brainwashed (by the rich).

If Britain really has “run out of money” – as both Labour and the Conservatives keep childishly claiming – why are neither party actually proposing any ways to raise more money?

Stay in touch!

Sign up to be updated with Evolve’s latest stories, and for opportunities to get involved.

It seems a little strange, doesn’t it!

I mean, both are essentially saying “let’s continue doing exactly the same things that got us into this mess in the first place and hope everything somehow gets better on its own“!

It’s literally the definition of insanity.

However, there’s one surefire way of raising a bit more money that neither politicians or the media talking about: increasing taxes.

But we’re not talking about raising taxes on ordinary people (in fact, I think we should lower taxes on ordinary people considerably).

No. We’re talking about something the billionaire-controlled media, and the entire political class, fiercely avoids mentioning: raising taxes on the very richest (and making damn sure they can’t just avoid them)!

However, it’s not just the media and politicans who consistently reject the idea. Many ordinary people – even though they’re definitely not rich themselves – constantly argue against raising taxes on the rich as well.

“If we raise taxes on the rich, they’ll simply just leave the country or they’ll just find some way to avoid paying it – and anyway, rich people work hard and create jobs, so they deserve low taxes anyway” they claim.

However, every single one of these arguments is complete and utter horse shit, concocted by some Billionaire-backed thinktank, Trust Fund baby “journalist”, or private-schooled posho politician, purely so them and their wealthy chums can simply continue to hoard increasingly massive stacks of cash and assets without paying a penny more in tax.

And yet, for the last half decade, ordinary people have been constantly falling for these completely bogus arguments – totally against their own interests.

So here’s how the hell it happened – and here’s how we can actually start to improve our country again.

50 Years of Tax Cuts for The Rich and Tax Rises for The Poor

First, a little bit of history.

Many people aren’t aware of it, but for the last 50 years or so, successive governments have constantly lowered taxes purely for the very richest people in our society.

And, whilst doing so, numerous progressive wealth taxes have also been scrapped and replaced by regressive taxes which hit ordinary people far harder than those at the top.

And then there are the mountains of tax loopholes that have been intentionally baked into the system, which only the very richest with their fancy pants accountants and high price lawyers can afford to take advantage of.

And, if you don’t believe me, here are the facts:

- In 1972, the Purchase Tax – a progressive tax on luxury goods which stood at 33% – was abolished. It was replaced by VAT, a regressive tax levied on almost all goods which hits the poorest the hardest. VAT has gradually been raised from 10% on its introduction, to 20% presently.

- In 1975, Estate Duty was abolished. It taxed the transfer of estates worth over £5.5m (adjusted for inflation) at 85%. Thatcher replaced Estate Duty with Inheritance Tax, which currently taxes estates worth over £325,000 at a flat rate of 40%. However, there are numerous huge loopholes built into the tax; loopholes which Margaret Thatcher’s children used to avoid paying around £1m in Inheritance Tax on the estate she left to them because the property was registered in an offshore trust. In addition, research shows that the super-rich pay an average rate of just 10% in Inheritance Tax – saving them countless billions each year – whilst ordinary families inheriting average sized estates pay far more.

- In 1979, the top rate of income tax was 83%. By 1988, Margeret Thatcher had more than halved it to 40%. It currently stands at 45%

- In 1979, Corporation Tax was 52%. It has been systematically reduced over the last 40 years, and now stands at just 25%

- In 1984, Thatcher abolished the Surtax – an extra tax levied at 15% for unearned income such as interest from investments, dividends from shareholdings, or rent from investment properties

- In 1990, Thatcher introduced the widely-hated Poll Tax – a regressive flat rate charge on every adult in the country regardless of income. This was replaced by Council Tax in 1993 – a system which is almost as regressive as the Poll Tax, and which still hits lower earners far harder than the rich

(This is by no means a definitive list – and if you have any more examples, please leave them in the comments!)

These tax changes were purposefully designed to shift a large proportion of the tax burden from the very richest onto the rest of us instead – and it worked.

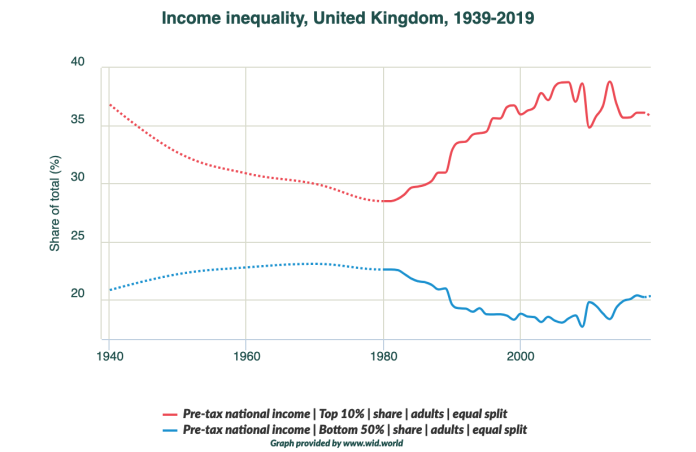

Indeed, from the late 1970s until the present day, the richest 10% of Brits have steadily increased their share of the UK’s wealth, whilst the wealth of the bottom 50% has fallen.

After WWII, high taxes specifically on the super-rich helped to fund the creation of the the NHS, the Welfare State and other progressive public policies, helping to dramatically improve ordinary people’s incomes, reduce inequality, and significantly improve the state of the country (which is why this period is widely know as the ‘post-war boom’).

However, as demonstrated by the graph below, since the late 1970s and the introduction of so-called Trickle Down Economics (or Neoliberalism), the rich have slowly been clawing this lost wealth back, and income equality has become just as bad as it was prior to WWII again.

Tax (The Rich) Avoidance

So, as I’m sure you’ll now agree, the facts are crystal clear: cutting taxes for the rich only benefits the rich.

Yet, despite the state of the UK declining horrendously over the last decade or so, barely anybody is talking about reversing the trend which is quite clearly causing it – especially not the mainstream media.

So why is nobody talking about taxing the rich again?

Well it’s quite simple. The vast majority of our political institutions – including the mainstream media and both main political parties – have been captured by the super-rich and their outriders.

These institutions are simply used as vehicles to further their own interests – and these interests quite obviously include, among other things, keeping their own taxes as low as possible!

Who controls the UK media?

Who controls the UK’s main political parties?

The Conservative Party has been the political vehicle of the rich and powerful since it was formed – as I have previously written about extensively here.

Its donors include a who’s who of billionaires, oligarchs, hedge fund managers, property developers and other extremely wealthy individuals and organisations.

It’s obviously not a coincedence that Tory policies just happene to benefit these people, and that they also often benefit from crony contracts and lifetime peerages – just a few of the numerous examples of legalised corruption that plague our political system.

However, when it comes to the Labour Party – which was created as the political vehicle of the working class, and whose funding comes from a mixture of Trade Unions and private donors – things are a little more complicated.

As you’ve probably heard before, the Labour Party has always been a so-called “broad church” o left-wingers. However, since the 1990s, the party has become increasingly dominated by a right-wing faction funded by vested interests and closely aligned with the interests of the Establishment.

When a Labour leader is elected who doesn’t adequately serve the interests of the Estalishment, they are systematically attacked both internally by careerist MPs who align with the rich and powerful, and externally by the billionaire-controlled media and their outriders – something we saw with both Ed Miliband from 2010-15 and, to a far greater extent, Jeremy Corbyn from 2015-19.

Indeed, the only Labour Prime Minister to be directly elected in the last four decades, Tony Blair, is now a close personal friend of Rupert Murdoch – having made a secret pact with the billionaire media mogul before the 1997 election. And, during his time as PM, rather than reversing any of Thatcher’s tax cuts and privatisation, Blair overwhelmingly served the interests of the Establishment by simply continuing where she left off – something he himself admitted to in 2013.

And now, the current Labour leader Keir Starmer is following this exact playbook: steadfastly refusing to do literally anything which could in any way contradict the interests of the Establishment, and completely reversing on his previous redistributive pledges in an attempt to reassure the rich and powerful that he is not a threat.

Class Interest

With control of virtually the entire media and the two main political parties, the Establishment has untold power to dominate the political narrative and shape public talking points to suit themselves – allowing fierce debate, but only within a tight ‘acceptable’ political spectrum.

Any talk of taxing the rich, reversing privatisation, or tackling inequality, is highly frowned upon – and anyone with any kind of platform who attempts to bring up these subjects is immediately and unrelentingly attacked with the full force of the political and media Establishment.

This hyper-domination of the narrative, added to the demonisation of anyone who strays from it, trickles down into the public conciousness and leads to a rote-learning of arguments and the creation of a false reality where it seems as if there is simply is no alternative.

It’s essentially a case of “So many popular people are saying the same thing that it simply must be true.”

This learned helplessness is routinely displayed by people on social media who clearly aren’t rich, but who routinely mock the idea that taxing the rich could actually work – even though it clearly does!

Hare are some of the more commonly-used arguments, and exactly why they’re complete rubbish:

Argument 1: “If we increased taxes on the rich they’d just find some way of avoiding it anyway!”

Solution 1: Britain controls a huge proportion of the world’s tax havens – and we’re literally the world’s biggest enabler of global tax abuse. We have the power to shut these Tax Havens down any time we want. According to research, Tax Havens based in UK Crown Dependencies and Overseas Territories help the rich avoid a staggering £152 billion in tax every single year – with Jersey and Guernsey adding a further £6.9bn to this total!

Also, regarding our domestic tax laws, we could also just close all the tax loopholes which are intentionally written into our current laws, or just write new laws instead!

Argument 2: “But if we closed all the loopholes, the rich would just move to another country with lower taxes!”

Solution 2: Most rich people who live in the UK have their wealth tied up in fixed assets like land, properties and businesses that they can’t take with them! Even if we raised taxes, they’d still be able to make profits here – but they’d just make slightly less profit. The very worst that could happen is they sell all their fixed assets, uproot their family, and start again somewhere else – but if they did this they’d just leave a gap in the market for someone else to fill and get rich from anyway!

Argument 3: “Taxes are already at their highest levels since WWII!”

Solution 3: Yes, they are. However, ordinary people are now contributing a far higher proportion of the tax burden than they used to due of 40 years worth of tax cuts for the super rich, loopholes that have been built into the system to allow them to avoid tax, and regressive stealth taxes which have been implemented on the rest of us.

In addition, in comparison to other similar countries, the UK actually has a relatively low tax burden – lower than both the EU and G7 average, as shown in the graphs below – meaning there is significant scope to increase taxes on the wealthy.

Argument 4: If we raise taxes on the rich, I might be affected!

Solution 4: But you’re not rich are you?

Argument 4a: No, of course not. But I read the news and they keep warning me that I might be affected. Also, I might actually get rich someday and I wouldn’t want to pay higher taxes even though I’d have more than enough to live comfortably anyway.

Solution 4a: Stop reading the billionaire-owned media, for fuck sake.

How should we tax the rich?

There’s been huge amounts of research conducted into wealth taxes by various charities and progressive think tanks over the past decade or so, looking at as how much money they could raise and the potential positive and negatives effects, but almost all of the research has – surprise surprise – been almost ignored by the mainstream media and polticians.

For instance, a tiny one off 1% wealth tax on millionaire couples could raise a staggering £260bn over five years.

Whilst properly cracking down on tax avoidance and evasion, and closing existing loopholes within legislation, could raise around £30bn a year.

And just a simple policy such as raising Capital Gains Tax – a tax on unearned income from the sale of assets or investment profits which the rich often benefit from – to the same level as income tax, could raise an extra £12.5bn a year.

Then there’s the idea of equalising the tax system so that people who do absolutely nothing for their income are taxed at the same rate as people who actially work for a living. Because, believe it or not, our tax system currently rewards landowners and landlords far better than nurses and teachers.

For instance, we could implement a Land Value Tax – a radical left-wing policy championed by noneother than the world-famous Socialist, err… Winston Churchill.

“Roads are made, streets are made, services are improved, electric light turns night into day, water is brought from reservoirs a hundred miles off in the mountains – and all the while the landlord sits still. Every one of those improvements is effected by the labour and cost of other people and the taxpayers. To not one of those improvements does the land monopolist, as a land monopolist, contribute, and yet by every one of them the value of his land is enhanced. He renders no service to the community, he contributes nothing to the general welfare, he contributes nothing to the process from which his own enrichment is derived.” argued the then Conservative MP in the House of Commons in a rousing speech in favour of a Land Value Tax in 1909.

The fact is that Britain is not broke at all. There’s more than enough wealth to go around. It’s just that tax system has been rigged by the rich in favour of themselves, meaning that wealth is increasingly being siphoned off and stashed away in Tax Havens, laundered through the purchase of economically unproductive assets that gain value over time, or pumped into property in order to generate passive income.

There are countless opportunities to raise money from additional taxes on those who can actually afford to pay them – and absolutely none of the arguments spouted by the billionaire-controlled media against increasing taxes on them and their wealthy chums have any merit whatsoever.

But, for as long as ordinary people continue to be brainwashed against their own interests, the rich and powerful will simply continue to become richer and richer – all at our expense.

Politics

David Gauke: Welcome to the new world of multi party politics – whose entrance was via Gorton

David Gauke is a former Justice Secretary and was an independent candidate in South-West Hertfordshire at the 2019 general election.

Most by-elections do not really matter but Gorton and Denton feels like a by-election of significance – even if the news quickly moved on.

Yes, there are some familiar attributes to the result – Governments do badly; a small party often does well; and, in seats with a large Muslim vote, the most vehemently anti-Israel candidate often wins. At least we were spared George Galloway returning to Parliament.

We know that the Labour government – and Keir Starmer – are unpopular, and that was reflected in their dismal vote. We know that Muslim communities often vote as a block, a tendency that was once very helpful to Labour and now is not.

We also know that tactical voting means that if you are party that does not have a chance of winning, your vote will be squeezed very tightly. Neither the Conservatives nor the Liberal Democrats reached 2 per cent, which is tighter than ever but – where there are three plausible options for a victorious candidate rather than the usual two – not altogether surprising.

Not much will be said about the Liberal Democrats in the context of Gorton and Denton because their low showing was expected, but it is a reminder of the changed political geography compared to a generation ago.

There are some similarities with the Brent East by-election of 2003. Here was an urban, multicultural seat where the Liberal Democrats had little historic presence (I was the Conservative candidate in 2001 and there was next to no Lib Dem activity in the seat in that election) but stormed to victory two years’ later at a time when the Tories were at a very low ebb, and the Government was unpopular with Muslims and younger progressives because of the Iraq war. At that point, the Liberal Democrats were emerging as a real threat to Labour in urban seats and went on to win Manchester Withington (part of which is now in Gorton and Denton) in 2005. The Greens are now the party of protest for urban progressive graduates and Muslims.

This sets the Greens up for a very good set of results in the London local authority elections in May and a realistic challenger in a swathe of urban Labour Parliamentary seats at the next General Election. However awkward this might be for Labour, this is not something Conservatives should celebrate. The Greens’ influence on our politics – whether directly as a Parliamentary force or indirectly by dragging Labour in its direction – will be detrimental to our economic wellbeing, national security, and, on the evidence of their by-election campaign, community cohesion. If there is any consolation in their victory, it will come in the form of greater scrutiny of a party whose policy agenda could, at best, be described as flaky.

The Tories might also be tempted to take some pleasure from the failure of Reform UK to win Gorton and Denton. That is certainly grounds for relief but no more than that. Reform UK must have done well in the white working class areas of Denton and look well-placed to capture the Red Wall but should be kicking themselves for not having done better. Matt Goodwin was an unlikeable candidate who attracted some unsavoury supporters; Nigel Farage spent the weekend before the by-election on a jaunt trying to reach the Chagos Islands which was hardly a priority issue in Manchester.

It was all rather self-indulgent.

A more substantial worry for Reform UK is that it is very effective in motivating people to turn out and vote for whoever is best placed to defeat them. There have now been three by-elections where Reform UK was well-fancied where the result was something of a disappointment. In Runcorn & Helsby, they won but by a whisker as Conservative voters in Helsby voted tactically for Labour. In the Senedd seat of Caerphilly, Plaid Cymru beat them comfortably. Now the Greens have done so in Gorton and Denton. The combination of tactical voting and a high turnout from anti-Farage voters is frustrating their progress.

This is the one crumb of comfort for Labour. It was a terrible result but they can argue that Gorton and Denton is an unusual constituency and that at the next election there will be many seats where it will be a straightforward fight between the Labour incumbent and the Reform challenger. Mid-term by-elections are inevitably a referendum on the Government, rather than a choice between alternative options. In that context, Reform UK should not be viewed as unbeatable.

This, however, is very much looking on the bright side for Labour. They are losing votes in all directions and it is currently hard to see which part of the electorate they can completely rely upon. The decision to block Andy Burnham is once again being questioned. He would have won last week, but a by-election for the Greater Manchester Mayoralty would have been difficult. In any event, Starmer would not have lasted long as leader with Burnham in his Parliamentary party. As it is, the Prime Minister has to hope that falling immigration and an improving economy (assuming both happen) ease his political woes but he will be lucky to survive the aftermath of the May elections.

For the Conservatives, the Gorton and Denton by-election was something of a non-event, notwithstanding the record low share of the vote. The rise of the Greens, as I argued above, is no cause of celebration but it does offer opportunities in that the left’s vote is split and there is scope to define the Tories against them as the pro-enterprise party. A breakthrough for Reform would have been difficult, and a Labour government that drifts leftwards – assuming that is what it does – leaves behind plenty of space to be exploited. There is nothing in these results to support the narrative that the Tories are bouncing back, but there is reason enough to believe that the potential is there.

There is a final point to be made.

This was a by-election that demonstrated that political support is fragmenting. Neither of the two big traditional parties finished in the top two; not unprecedented but very rare. The Greens got over 40 per cent of the vote, which is not particularly low for a winning candidate, but we are in a world where MPs will win with a vote share of just a third or even lower. Majorities become lower at the same time that voters become more volatile, resulting in greater MP churn and a focus on short term thinking. Candidates focus more on winning the tactical voting battle than articulating their policies, leaving the electorate to guess how the rest of the constituency is going to cast their vote before deciding who is best placed to defeat the candidate they least want. At the very least, this raises questions about the viability of the First Past The Post electoral system if this fragmentation is to be maintained.

This takes us back to the significance of this by-election.

It raises questions about our electoral system; it sees a breakthrough for the Greens and (one would hope) more scrutiny for them; it further destabilises the Prime Minister and will provoke a debate about Labour’s future that will likely see them moving leftwards; it highlights that Reform UK is a powerful electoral force, but also exposes its self-indulgence; is a reminder that by-elections in seats like this were once a Liberal Democrat speciality but not anymore. As for the Conservatives, this is not where the recovery was ever going to begin.

The question for the Tories is where exactly that place will be.

Politics

Actor Awards 2026: Full Winners List As Sinners And The Studio Triumph

After an awards season that’s so far been pretty all over the place in terms of who’s won what, Sunday night’s Actor Awards has thrown out some interesting new frontrunners with less than two weeks to go until the Oscars.

Over the last two months, awards in major acting categories have been handed out in pretty much all directions (with the exception of Best Actress, with Jessie Buckley’s win now looking even more locked in).

But this year’s Actor Awards – previously known as the SAG Awards until this year’s name change – has given us a better idea how things could go down at the Oscars later this month.

Sunday’s ceremony saw Amy Madigan and Sean Penn winning for their supporting performances in Weapons and One Battle After Another, respectively.

Meanwhile, Sinners was the top-winning film of the night, triumphing in Outstanding Performance By A Cast In A Motion Picture, with Michael B Jordan’s Best Actor victory making Timothée Chalamet’s Oscar win a little less of a sure thing.

Jordan Strauss/Invision/AP

Over in the TV categories, Seth Rogen’s The Studio picked up three awards in total, including a posthumous honour for the late, great Catherine O’Hara.

Which stars, TV shows and films are on the winners list from the 2026 Actor Awards?

Take a look at the full winners list below…

Film

Outstanding Performance By A Cast

Outstanding Performance By A Male Actor

Michael B Jordan (Sinners)

Outstanding Performance By A Female Actor

Outstanding Performance By A Female Supporting Actor

Outstanding Performance By A Male Supporting Actor

Sean Penn (One Battle After Another)

Outstanding Action Performance By A Stunt Ensemble

Mission: Impossible – The Final Reckoning

TV

Outstanding Performance By An Ensemble In A Comedy

Outstanding Performance By A Female Actor In A Comedy

Catherine O’Hara (The Studio)

Outstanding Performance By A Male Actor In A Comedy

Outstanding Performance By An Ensemble In A Drama

Outstanding Performance By A Male Actor In A Drama

Outstanding Performance By A Female Actor In A Drama

Keri Russell (The Diplomat)

Outstanding Performance By A Female Actor In A TV Movie Or Limited Series

Michelle Williams (Dying For Sex)

Outstanding Performance By A Male Actor In A TV Movie Or Limited Series

Owen Cooper (Adolescence)

Outstanding Action Performance By A Stunt Ensemble In A TV Series

Special Award

Lifetime Achievement Award

Politics

Trump’s ‘Unbelievable’ 9-Word Response To Iran Question Sparks Fury Online

One reporter asked about the operation’s objectives. Another asked who Trump wanted to lead Iran since Supreme Leader Ayatollah Ali Khamenei was killed in the attack.

Instead of answering, Trump stopped to admire new statues of Thomas Jefferson and Benjamin Franklin in the Rose Garden.

“Unbelievable statues,” he said as reporters shouted their questions. “You’ll see. Come and look at them.”

CNN’s Kaitlan Collins reported that Trump also did not speak to reporters on Air Force One during the flight back to Washington from Mar-a-Lago, as he typically does. He did, however, speak to some reporters by phone over the weekend as the operation unfolded.

Trump’s refusal to address the assembled media after igniting a major conflict overseas, but instead praising his new statues, led to harsh criticism on X:

Politics

6 Books To Help Your Teenager Read More Again

We hope you love the products we recommend! All of them were independently selected by our editors. Just so you know, HuffPost UK may collect a share of sales or other compensation from the links on this page if you decide to shop from them. Oh, and FYI – prices are accurate and items in stock as of time of publication.

Daily reading and enjoyment of reading are at a more-than-20-year low among young people, according to new research.

The National Literacy Trust (NLT) surveyed over 80,000 young people aged 11 to 16 years old and found just one in five (18.8% of) boys aged 14 to 16 report enjoying reading, compared to 37.7% of girls.

The same survey, shared with the Guardian, found only 9.8% of boys between the ages of 14 and 16 read every day, compared to 17.6% of girls.

If these stats resonate and you’re hoping to gently steer your teen towards page-turners once more; these thrilling, funny, and ultra-engaging reads might just tempt them.

Politics

Trump: There Will 'Likely Be More' US Troops Killed

!function(n){if(!window.cnx){window.cnx={},window.cnx.cmd=[];var t=n.createElement(‘iframe’);t.display=’none’,t.onload=function(){var n=t.contentWindow.document,c=n.createElement(‘script’);c.src=”//cd.connatix.com/connatix.player.js”,c.setAttribute(‘async’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c)},n.head.appendChild(t)}}(document);(new Image()).src=”https://capi.connatix.com/tr/si?token=19654b65-409c-4b38-90db-80cbdea02cf4″;cnx.cmd.push(function(){cnx({“playerId”:”19654b65-409c-4b38-90db-80cbdea02cf4″,”mediaId”:”96a25667-95d1-4607-95bc-90261e8d5fcb”}).render(“69a4d69ee4b0c426d6a7d49e”);});

Politics

Starmer can’t tell the truth

Just days after the US and Israel’s unprovoked attack on Iran, Keir Starmer has insisted that the UK hasn’t been involved in the invasion.

Less than three minutes later, he then said the UK is allowing the US to use UK air bases to attack Iran. The footage has been edited so you don’t have to suffer him for that long, but the lies are intact:

The old saying that if you tell the truth you don’t have to have a good memory has never been more applicable.

Starmer and his front-benchers, along with all their enablers, are war criminals. Not satisfied with collaborating in Israel’s genocide in Gaza, they are now assisting directly in the US’s and Israel’s murder of Iranian children and illegal regime-change war in Iran.

Featured image via X

Politics

Keir Starmer Gives United States Permission To Use UK Bases To Strike Iranian Targets

Keir Starmer said the UK’s actions did not break international law.

Keir Starmer said the UK’s actions did not break international law.Keir Starmer has given the United States permission to use UK military bases to attack targets in Iran.

The prime minister said he was “protecting British interests and British lives” after Iran launched missile attacks on countries across the Middle East.

That came after the US and Israel bombed Iran in a wave of strikes which killed Iran’s Supreme Leader Ayatollah Ali Khamanei as well as other senior regime officials.

In a statement from Downing Street, Starmer insisted the UK was not involved in the initial attacks on Iran.

He said: “We all remember the mistakes of Iraq. And we have learned those lessons.

“We were not involved in the initial strikes on Iran, and we will not join offensive action now.

“But Iran is pursuing a scorched earth strategy. So we are supporting the collective self-defence of our allies and our people in the region, because that is our duty to the British people.

“It is the best way to eliminate the urgent threat and prevent the situation spiralling further.

“This is the British government protecting British interests and British lives.”

Starmer said there are around 200,000 British citizens in the Gulf region, and that Iran’s actions were putting their lives at risk.

“Over the last two days, Iran has launched sustained attacks across the region at countries who did not attack them,” he said.

“They have hit airports and hotels where British citizens are staying. This is clearly a dangerous situation.”

Iran also hit a military base in Bahrain on Saturday, “narrowly missing British personnel”, the PM said.

British jets are already taking part in “defensive” operations in the region, Starmer said.

But he said the only way to stop the Iranian attacks was to target storage depots and the launchers use to fire missiles.

The PM said: “The US has requested permission to use British bases for that specific and limited defensive purpose.

“We have taken the decision to accept this request, to prevent Iran firing missiles across the region, killing innocent civilians, putting British lives at risk and hitting countries that have not been involved.

“The basis of our decision is the collective self-defence of longstanding friends and allies, and protecting British lives. This is in line with international law.”

Politics

Labour suffer biblical loss of their own making

Holly Valance, Aaron Banks, Rod Stewart, Robert Jenrick, Derek Chisora, Christopher Horborne, Bonnie Blue, Suella Braverman, Charles Bronson, Tommy Ten-Names, Nigel Farage… your boy took one hell of a beating.

Holly Valance though? If you thought her singing was like auto-tuned auditory war crimes and her acting was like a hostage situation with lines, what could you possibly think about the Australian’s choice of British politicians?

I couldn’t care less either.

Labour’s red wall begins to fall under Starmer

Gorton & Denton has been a Labour fortress, in one form or another, for a hundred years. Indeed, the fortress was so reliably red it would make Stalin blush.

Yes, the trouncing of Farage and his crypto-racists was utterly delicious. This is a northern working class constituency and it was ripe for a Reform UK picking. But Reform was only ever in this position because Starmer’s genius centrist strategy alienated the left so hard that the actual fascists started looking like the “change” option.

Gorton & Denton wasn’t just a blip. It was the death-rattle of Starmerism, echoing through every red wall constituency. The only thing more humiliating for Labour would be if the detestable Starmer himself turned up in a hi-vis vest holding a “FOR SALE” sign.

This was the Green’s first ever Westminster by-election win, their first MP in the North of England. And it came with a massive 27% swing from Labour. This wasn’t a protest vote but a proper, majority-delivering “fuck you” with 4,400+ votes clear.

Hannah Spencer just turned a safe Labour seat into flourishing Green turf. Voters preferred a working class woman who believes in rent controls, public ownership, and not boiling the planet over a suit-wearing focus-group zombie.

A plumber just proved you can win big by actually giving a shit about people and planet, instead of donor dinners and three-word soundbites.

Is anyone really that surprised?

Labour is as extinct as a dodo in a coal mine

There is no longer such a thing as a safe Labour seat. The Green party can absolutely win anywhere.

Labour has spent decades treating its traditional constituencies like that one armchair in you gran’s house – faded red, smelling faintly of defeat for the other parties, and are pretty much guaranteed to stay Labour forever. Seats with more than half of the overall vote, misguided generational loyalty, the working-class heartlands, ethnic minority strongholds. Labour had the lot.

Safe seats? They’re as extinct as a dodo in a coal mine.

Labour under Starmer has spent the last couple of years triangulating so fucking hard they’ve almost become the world’s most boring spreadsheet.

Austerity-lite budgets, slow-walking on green investment, hateful immigration rhetoric, foreign policy positions that alienate the progressive youth and Muslim communities, and a general vibe of “we’re not Corbyn, honest!”

Disillusioned left-leaning voters – young people, urban graduates, eco-conscious super recycling types, those absolutely furious about Gaza or the cost of greed crisis – aren’t staying home anymore.

They are going to the Greens in droves, especially where the Greens have built serious local machines.

Starmer’s response was almost as embarrassing as the defeat itself. He muttered something about being disappointed and he will “keep fighting the extremes” despite coming third place in a seat that has been held by his party since before most voters were born.

In reality, Labour just got curb-stomped by the common sense left and the extreme right in the same graveyard. That’s not fighting, Mr Starmer, that’s being the pinata at a funeral.

Time to throw out that old armchair

The swing from Labour to the Greens was a biblical 27.5 percentage points. If this swing was replicated nationwide at a general election, Polanski would be finishing the night with more than 100 seats, and Labour wouldn’t just be facing a bad night.

They would be experiencing total extinction.

Labour is no longer the default party for the left because the party under Keir Starmer has spent the last couple of years systematically alienating every voter who ever give a shit about progressive values. Whilst the Greens have quietly built a machine that actually delivers on them.

The default left party isn’t the one that promises “change” in a shitty PowerPoint to Labour-friendly hacks and staffers. It’s the one that delivers it with a sledgehammer in hope.

Labour’s entire campaign strategy was “only we can stop Reform UK and Farage”. After Gorton & Denton, that lie is well and truly exposed and dead. Voters now see that a Green vote isn’t going to be a wasted vote of protest – it’s winnable, even in the reddest of red heartlands.

Labour’s red wall is now a crumbling ruin overtaken by aggressive green kudzu that grows faster than the excuses flying out of No. 10.

If Labour doesn’t drastically change course, and I am not expecting them to, the Green’s won’t just nibble at the edges, they’ll start carving off whole chunk. Anywhere.

Even your Gran’s armchair might not be safe anymore.

Featured image via the Canary

Politics

Another missile barrage from Iran penetrates Israel, including Haifa

Iran has fired a new barrage of missiles at Israel, with several penetrating Israel’s air defences to hit Haifa. Footage of one of the successful missiles was captured from several angles:

A map of alerts in the region give an idea of the scale of the attack:

Iran fired a barrage of missiles into North Israel

— Resist 🕎🍉 (@antizionistjew.bsky.social) 2026-03-01T18:38:10.263Z

Locals report explosions in Haifa and the area

— Resist 🕎🍉 (@antizionistjew.bsky.social) 2026-03-01T18:41:58.381Z

At least five explosions were heard in Jerusalem, Tel Aviv and surrounding areas following the launch of missiles from Iran toward Israel, an Anadolu correspondent reported Sunday evening.

A strong explosion was also heard in the northern city of Haifa, according to eyewitnesses.

Israel’s Channel 12 reported that sirens sounded in several areas in southern and eastern Israel after a new barrage of missiles was launched from Iran. Additional sirens were later activated in the northern parts of the country.

The barrage comes after the Zionist ‘state’ and the US murdered Iranian leader Ali Khamenei and his family – and slaughtered over 150 schoolgirls, of a total school population of 180, by bombing their school.

Featured image via the Canary

Politics

accusations of invaders targeting left-wing activists

The US and Israel have been specifically targeting the homes of left-wing activists in Iran for bombing, according to well-known writer and journalist Tariq Ali. Ali, quoting Iranian sources, said that the rogue states are trying to ensure that there is no competition for their preferred puppet, US-based ‘shah’ Reza Pahlavi, if they succeed in bringing down Iran’s government:

[T]he US/Israelis are targeting a number of known leftists homes in Teheran and elsewhere in an attempt to make sure there’s no opposition to their favoured candidate once they destroy the regime. What this reveals is the degree of penetration by Mossad in Iran. What it also means is that this is not going to be an easy occupation for the US and its Israeli buddies.

Commenters disagreed with Ali for his closing assumption that there will be any occupation of Iran, easy or otherwise. It is to be hoped he is wrong on that and every likelihood he is.

But the US and Israel routinely target the homes and families of their victims. And given the Trump regime’s attacks on left figures in the US and South America, it’s entirely credible – indeed almost certain – that he will be doing the same in Iran in his criminal war.

Featured image via the Canary

-

Sports6 days ago

Sports6 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Iris Top

-

Politics7 days ago

Politics7 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business5 days ago

Business5 days agoTrue Citrus debuts functional drink mix collection

-

Politics3 days ago

Politics3 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech1 day ago

Tech1 day agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports2 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat16 hours ago

NewsBeat16 hours ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat7 days ago

NewsBeat7 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat1 day ago

NewsBeat1 day agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoPolice latest as search for missing woman enters day nine

-

Business4 days ago

Business4 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Sports7 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Business3 days ago

Business3 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality