Qualcomm’s Snapdragon Elite chips have been the star of many AI PCs released to market in 2024, greatly enhancing performance and battery life compared to their previous gen iterations. However, the manufacturer’s recent endeavor to improve on one of its negative points hasn’t panned out.

Qualcomm has canceled its dev kit, a Snapdragon mini-PC powered by Windows on Arms. Originally, it was planned for a June 2024 release window but missed that entirely. Now, as part of an official announcement, Qualcomm has stated that the kit has been canceled because it “has not met our usual standards of excellence.”

Interestingly enough, The Verge spotted that multiple developers had already received the mini-PC including YouTuber Jeff Geerling, who reviewed the product and performed a detailed hardware teardown of it. Despite Qualcomm not providing any specific reasons for why the PCs had been canceled, the conclusions from Geerling’s review are that despite it matching the Apple M3 Pro’s performance, it lacks Linux support and had restrictions around reselling the device.

There’s another theory for the cancellation as well, which comes down to the HDMI port — or lack thereof. Though the shipped mini-PCs all came with the chips for internal DisplayPort to HDMI conversion, the actual port was missing for some reason.

According to Richard Campbell, founder of DEVIntersection, the HDMI port could have been the cause of the massive delays if it failed FCC compliance testing. This seems to be supported by the fact that Qualcomm emailed anyone who ordered the PC in September that they would be sent a USB-C to HDMI dongle with their dev kit.

But what does this mean for the consumer?

One of the most well-known drawbacks to anything Qualcomm is that Windows on Arms still has compatibility issues with some Windows programs, tools, and apps. The manufacturer has improved this by leaps and bounds to the point that the average user wouldn’t know the difference, but for gamers and others using specialized programs, those compatibility problems can be quite difficult to parse.

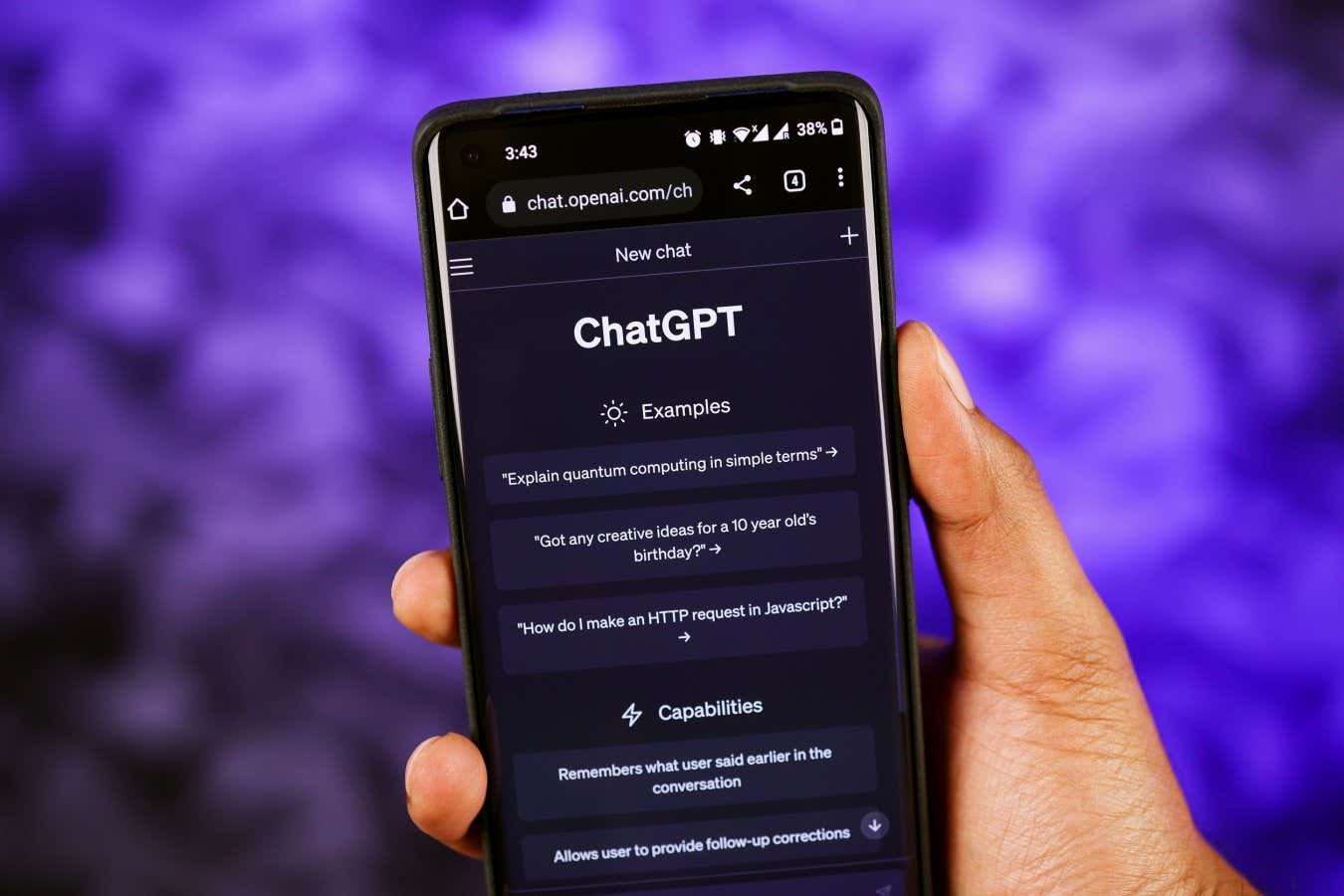

In comes the Qualcomm mini-PC dev kit, which would have been the perfect tool for developers to port their apps to Windows on Arms. This potentially could have introduced a large amount of apps to the OS that otherwise would have never seen the light of day on Arm chips. This is especially important for the consumers who have been left in the dark due to the lack of app support for tools that they need themselves, limiting Qualcomm’s sales of its AI PCs to them in turn.

And with fellow industry rivals Intel and AMD teaming up to form the “x86 Ecosystem Advisory Group,” in response to Qualcomm and other competitors, the latter must figure out either how to fix the issues with the dev kits or figure out another way to resolve these app compatibility issues if it wants to see Arms continue to thrive.

You must be logged in to post a comment Login