Science & Environment

Bullish sentiment and broadening rally for markets

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., May 17, 2024.

Brendan McDermid | Reuters

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Breather from rally

U.S. markets fell Monday, weighed down by a drop in semiconductor stocks and a 8.1% slide in UnitedHealth. The pan-European Stoxx 600 index lost 0.8% as sectors diverged in performance. Tech stocks fell 6.36%, while telecoms stocks rose 1.97%. Separately, euro zone industrial production increased 1.8% between July and August, according to Eurostat.

Banks beat expectations

Goldman Sachs, Bank of America and Citigroup beat earnings and revenue estimates for their third quarter. Goldman was the standout performer: Its profit jumped 45% from a year earlier. Year on year, Bank of America experienced a 12% drop in net income and Citigroup’s net income fell 8.6%.

ASML slumps

Shares of semiconductor equipment manufacturer ASML plunged 16% on a downbeat earnings report. For 2025, the Netherlands-based company thinks net sales will come in at the lower half of its previous projection. ASML missed expectations on net bookings by 3 billion euros for the September quarter, though net sales beat expectations.

Israel might not hit oil facilities

After Israel reportedly told the U.S. it’s not planning to strike Iran’s oil facilities, prices for both West Texas Intermediate and Brent futures fell more than 4%. Earlier this week, OPEC cut its forecast for daily oil demand growth in 2024 to 1.9 million barrels per day from 2 million bpd. That was the third consecutive time this year it’s lowered expectations.

[PRO] S&P 500 at 6,400?

Stocks seem unstoppable. Two years into a bull market, the S&P 500 has been constantly hitting new closing highs. History suggests the bull tends to stall, or at least trip on itself, in its third year. But UBS thinks the S&P can buck the trend in 2025 and soar to 6,400, implying an upside of 10% from Tuesday’s close.

The bottom line

Despite markets falling Tuesday, there’s still plenty to like about their current state.

Weighed down by ASML’s 16% dive and a report by Bloomberg on potential AI-chip export controls, semiconductor stocks like Nvidia and AMD fell 4.7% and 5.2% respectively. That gave the VanEck Semiconductor ETF its worst day since Sept. 3. As a result, the tech-heavy Nasdaq Composite lost 1.01%.

The Dow Jones Industrial Average, which just yesterday was basking in its accomplishment at closing above the 43,000 level for the first time, fell 0.75% to dip into the 42,000 territory again. UnitedHealth’s 8.1% drop dragged down the Dow.

Last, the S&P 500 retreated 0.76%.

Still, investors are the most bullish in four years, according to the October BofA Global Fund Manager Survey. They’re also optimistic about the economy: 74% investors believe the U.S. will avoid a recession.

Anticipation of more rate cuts by the U.S. Federal Reserve and hopes that Beijing will unleash more stimulus to boost its economy are driving up investor sentiment, according to Michael Hartnett, an investment strategist at BofA.

Indeed, San Francisco Fed President Mary Daly, who’s a member of the Federal Open Market Committee this year, noted that the central bank is “a long way from where [rates are] likely to settle.” That means “the decisions that are really in front of us are ones about how quickly to adjust towards that level” – not whether to keep rates high in light of how strong recent economic data has been.

Another positive sign for markets is how the S&P and Dow hit all-time highs on Monday, but the Nasdaq was still a few percentage points away from its peak. “This subtle divergence is technical evidence that the market has been moving away from the Magnificent Seven mega-caps,” wrote Piper Sandler’s chief market technician Craig Johnson.

– CNBC’s Jeff Cox, Samantha Subin, Yun Li, Lisa Kailai Han and Alex Harring contributed to this story.

Science & Environment

Bullish sentiment and broadening rally in markets

Traders work on the floor of the New York Stock Exchange on April 5, 2024.

Spencer Platt | Getty Images News | Getty Images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Breather from rally

U.S. markets fell Tuesday, weighed down by a drop in semiconductor stocks and a 8.1% slide in UnitedHealth. Asia-Pacific stocks were mostly lower Wednesday. Asian chip stocks, like Tokyo Electron and Taiwan Semiconductor Manufacturing Company, retreated on news of ASML’s disappointing forecast and reports of the U.S. possibly imposing export controls on AI chips.

ASML slumps

Shares of semiconductor equipment manufacturer ASML plunged 16% on a downbeat earnings report. For 2025, the Netherlands-based company thinks net sales will come in at the lower half of its previous projection. ASML missed expectations on net bookings by 3 billion euros for the September quarter, though net sales beat expectations.

Better than ChatGPT

Alibaba updated its artificial-intelligence translation tool, based on a model called Marco MT, on Wednesday. The Chinese e-commerce giant said its product performs better than those by Google and DeepL, according to an assessment by benchmarking tool FLoRes. Fifteen languages are supported by Alibaba’s AI-powered translation tool.

Banks beat expectations

Goldman Sachs, Bank of America and Citigroup beat earnings and revenue estimates for their third quarter. Goldman was the standout performer: Its profit jumped 45% from a year earlier. Year on year, Bank of America experienced a 12% drop in net income and Citigroup’s net income fell 8.6%.

[PRO] Repositioning for slower rate cuts

September’s strong jobs report and higher-than-expected inflation reading mean that the U.S. Federal Reserve is unlikely to repeat its jumbo 50-basis-point rate cut at its November meeting. Here’s how strategists are repositioning in view of changing rate cut expectations.

The bottom line

Despite markets falling Tuesday, there’s still plenty to like about their current state.

Weighed down by ASML’s 16% dive and a report by Bloomberg on potential AI-chip export controls, semiconductor stocks like Nvidia and AMD fell 4.7% and 5.2% respectively. That gave the VanEck Semiconductor ETF its worst day since Sept. 3. As a result, the tech-heavy Nasdaq Composite lost 1.01%.

The Dow Jones Industrial Average, which just yesterday was basking in its accomplishment at closing above the 43,000 level for the first time, fell 0.75% to dip into the 42,000 territory again. UnitedHealth’s 8.1% drop dragged down the Dow.

Last, the S&P 500 retreated 0.76%.

Still, investors are the most bullish in four years, according to the October BofA Global Fund Manager Survey. They’re also optimistic about the economy: 74% investors believe the U.S. will avoid a recession.

Anticipation of more rate cuts by the U.S. Federal Reserve and hopes that Beijing will unleash more stimulus to boost its economy are driving up investor sentiment, according to Michael Hartnett, an investment strategist at BofA.

Indeed, San Francisco Fed President Mary Daly, who’s a member of the Federal Open Market Committee this year, noted that the central bank is “a long way from where [rates are] likely to settle.” That means “the decisions that are really in front of us are ones about how quickly to adjust towards that level” – not whether to keep rates high in light of how strong recent economic data has been.

Another positive sign for markets is how the S&P and Dow hit all-time highs on Monday, but the Nasdaq was still a few percentage points away from its peak. “This subtle divergence is technical evidence that the market has been moving away from the Magnificent Seven mega-caps,” wrote Piper Sandler’s chief market technician Craig Johnson.

– CNBC’s Jeff Cox, Samantha Subin, Yun Li, Lisa Kailai Han and Alex Harring contributed to this story.

Science & Environment

Big Tech turns to nuclear energy to fuel power-intensive AI ambitions

The OpenAI app icon displayed along with other AI applications on a smartphone.

Jonathan Raa | Nurphoto via Getty Images

Technology giants are turning to nuclear energy to power the energy-intensive data centers needed to train and run the massive artificial intelligence models behind today’s generative AI applications.

Microsoft and Google are among the firms agreeing deals to purchase nuclear power from certain suppliers in the U.S. to bring additional energy capacity online for its data centers.

This week, Google said it would purchase power from Kairos Power, a developer of small modular reactors, to help “deliver on the progress of AI.”

“The grid needs these kinds of clean, reliable sources of energy that can support the build out of these technologies,” Michael Terrell, senior director for energy and climate at Google, said on a call with reporters Monday.

“We feel like nuclear can play an important role in helping to meet our demand, and helping meet our demand cleanly, in a way that’s more around the clock.”

Google said its first nuclear reactor from Kairos Power would be online by 2030, with more reactors going live through 2035.

The tech giant isn’t the only firm looking to nuclear power to realize its AI ambitions. Last month, Microsoft signed a deal with U.S. energy firm Constellation to resurrect a defunct reactor at the Three Mile Island nuclear power plant in Pennsylvania, whose reactor has been dormant for five years.

The Three Mile Island plant was the location of the most serious nuclear meltdown and radiation leak in U.S. history in March 1979, when the loss of water coolant through a faulty valve caused a reactor to overheat.

Why they’re turning to nuclear

Tech companies are under pressure to find energy sources to power data centers — a key piece of infrastructure behind modern-day cloud computing and AI applications.

Many developers rent out servers equipped with GPUs (graphics processing units), which would typically be too expensive to own outright, from so-called cloud “hyperscalers” — such as Amazon, Microsoft and Google.

These tech giants have benefited from a surge of interest in generative AI applications such as OpenAI’s ChatGPT. But that increase in demand has also led to an unintended effect: correspondingly large spikes in the amount of energy required.

Global electricity consumption from data centers, artificial intelligence and the cryptocurrency sector is expected to double from an estimated 460 terawatt-hours (TWh) in 2022 to more than 1,000 TWh in 2026, according to a research report from the International Energy Agency.

Researchers at the University of California, Riverside, published a study in April last year that found ChatGPT consumes 500 milliliters of water for every 10 to 50 prompts, depending on when and where the AI model is deployed. That equates to roughly the amount of water in a standard 16-ounce bottle.

As of August, there were more than 200 million people submitting questions on OpenAI’s popular chatbot ChatGPT every week, according to OpenAI. That’s double the 100 million weekly active users OpenAI reported last November.

Environmental opposition

Nuclear energy isn’t without its controversy. Many climate activists oppose such supplies, citing their hazardous environmental and safety risks, and the fact that they do not offer a genuine source of renewable power.

“Nuclear power is incredibly expensive, hazardous and slow to build,” the climate charity Greenpeace says on its website.

“It is often referred to as ‘clean’ energy because it doesn’t produce carbon dioxide or other greenhouse gases when electricity is generated but the reality is that it isn’t a plausible alternative to renewable energy sources.”

Proponents of nuclear energy, on the other hand, say that it offers a nearly carbon-free form of electricity and is more reliable than renewable sources like solar and wind.

“If it is built and securitized in the right way, I do think nuclear is the future,” Rosanne Kincaid-Smith, chief operating officer of Northern Data Group, a global data center provider, told CNBC at a tech conference in London last week.

“People are scared of nuclear because of the disasters we’ve had in the past. But what’s coming, I just don’t see traditional grids being the sustainable power that’s ongoing in the development of AI,” Kincaid-Smith added.

While Northern Data Group isn’t using nuclear energy — nor is it actively exploring plans to use nuclear as a power source for its AI data centers — the firm does want to “contribute to that conversation because it’s important for the wider ecosystem, the wider economy,” Kincaid-Smith told CNBC.

– CNBC’s Pippa Stevens contributed to this report

Science & Environment

Flies, rats and hush money

BBC / Jon Parker Lee

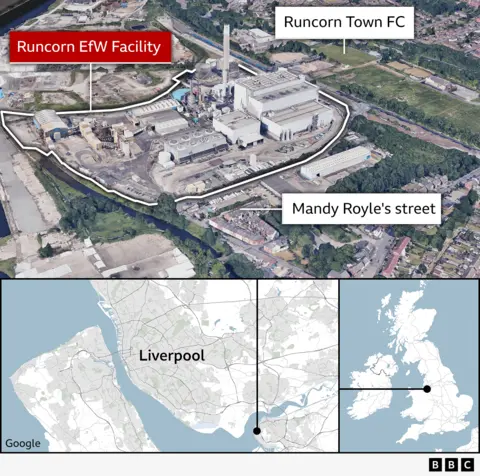

BBC / Jon Parker Lee“We have been inundated with flies, rats, smell, noise. It’s just been horrendous,” says Mandy Royle, who lives in the closest home to the UK’s biggest waste incinerator at Runcorn in Cheshire.

The facility generates electricity from burning nearly a million tonnes of household rubbish every year – but much of that waste doesn’t come from Ms Royle’s local area. Like many incinerators, deliveries come from hundreds of miles away.

BBC analysis suggests the burden of the UK’s waste is disproportionately falling on deprived areas such as Runcorn, which are 10 times more likely to have an energy-from-waste incinerator in their midst than in the wealthiest areas.

Many families nearby shared a £1m settlement after 180 of them launched a legal action over the pollution and disturbances from the Runcorn incinerator, the BBC can reveal.

But Ms Royle was one of a handful of people who did not sign the agreement, allowing her to speak out about life in the shadow of one of the UK’s giant waste plants.

“I’m just stuck in this little corner with a big monster staring at me and throwing what it does over me,” she says.

The others who took the cash, worth about £4,500 per family after legal costs, had to sign a strict non-disclosure agreement (NDA).

“Well, I think they’re being unfair in what they’re paying, and completely unfair in what they are doing,” says George Parker, who runs a local garage and also refused to sign the deal.

“It’s a million-pound hush fund and a gagging order. That’s why they’re doing it, they’re keeping everybody quiet.”

Viridor, which runs the Runcorn plant, said it would not comment on the settlement or on the non-disclosure agreement.

It said that noise and odour remained within permitted levels – regulated by the Environment Agency – and any complaints were fully investigated with feedback provided to residents.

Incinerators put in deprived areas

Energy-from-waste incinerators have boomed over the past decade as local councils have faced higher charges to bury rubbish in landfill sites.

This shift, though, has come at a big cost to the environment, with a BBC investigation showing that these plants now produce as much carbon per unit of energy than as if they were burning coal.

It also comes at a cost to those who live near them, say Ms Royle and Mr Parker.

“They put them in deprived areas, so people won’t complain because they know the majority of the people are in such a state they don’t know how to complain basically,” Mr Parker says.

Our investigation found breaches of air quality controls increased both at Runcorn and across incinerators in England between 2019 and 2023.

These controls restrict the levels of gases such as carbon dioxide that can be emitted.

The number of these permit breaches has risen from an average of 3.4 in 2019 to 5.5 per incinerator in 2023. Last year 73% of facilities in England reported transgressions.

Runcorn’s energy-from-waste site breached its permit 17 times in the past five years.

“The Runcorn Energy Recovery Facility (ERF) operates within a strict Environmental Permit and is heavily regulated by the Environment Agency, meaning it must comply with all the necessary regulations and permit conditions,” Viridor said in a statement.

“Should a permit limit be exceeded, a full and thorough investigation into the cause is carried out.”

Household waste is also being sent hundreds of miles across the country to be burned, or even sent abroad, BBC analysis of UK council data showed.

BBC / Jon Parker Lee

BBC / Jon Parker Lee In one of the worst examples, waste from Derby City Council and Derbyshire Council ended up at 19 different incinerators in one year – from Milton Keynes to North Yorkshire.

The increased movement of waste by train and lorry is producing even more carbon emissions and worsening local air pollution.

A spokesperson for Derby City Council and Derbyshire County Council said the councils had signed a new contract which will reduce this number to 13, and that “reducing waste miles is a key part of our strategy.”

In another case, County Durham sent 1,300 tonnes of waste last year to an undisclosed incinerator facility in Cyprus, even though there are incinerators nearby in north-west England. The council said it was “standard industry practice to divert waste from landfill through energy-from-waste facilities”.

‘The rubbish backyard of England’

While Runcorn is home to the UK’s biggest incinerator, a significant proportion of the town’s local rubbish is not burned at the site.

Instead, some of the waste from the borough of Halton, where Runcorn is located, and from other Merseyside towns, is sent by train about 150 miles across the country to the east coast, to be burned on Teesside.

This whole area along the River Tees has emerged as a UK hotspot for energy-from-waste. The region is now home to three active incinerators, with three more in various stages of planning.

“We have become a dumping ground for everybody else’s rubbish by stealth,” says a Liberal Democrat councillor in Redcar, Dr Tristan Learoyd.

He says that incinerators in the area are tied into long-term contracts with councils across the country, which he believes will see large amounts of carbon emitted every year for decades to come.

“There’s a potential here for the number of incinerators to be in double figures,” he says.

“For my hometown, which has suffered a massive decline over the years, it’s just another kick in the face. We’re becoming the rubbish backyard of England.”

Linda Martin lives on the nearest street to the Wilton 11 incinerator in Billingham, Teesside, which burns more than 400,000 tonnes of rubbish every year.

She questions whether people in the locality are seeing any direct economic benefit from the facility.

“This is our home and our area. Why should we have to put up with everything that we’re putting up with?” she says. “You know, we hear the noise constantly. We’ve got double glazing in, but it don’t work. You still hear the noise!”

For Eddie Thompson MBE, who runs a busy food bank in Runcorn, the psychological impact of locating large-scale incinerators in poor areas is very important.

“Mentally, people feel as though, in some cases, they are worthless. They have no sense of a future that they can see ahead of them.

“I don’t blame Viridor, but are we getting it right? Putting all the bad stuff in one place?”

Science & Environment

Trump PAC has raised about $7.5 million in crypto donations

(L to R) Eric Trump, former US President and Republican presidential candidate Donald Trump and Donald Trump, Jr. attend a remembrance ceremony on the 23rd anniversary of the September 11 terror attack on the World Trade Center at Ground Zero, in New York City on September 11, 2024.

Adam Gray | Afp | Getty Images

A political action committee supporting former President Donald Trump has raised about $7.5 million in cryptocurrencies.

Contributors to the Trump 47 joint fundraising committee donated bitcoin, ether and XRP, as well as the U.S. dollar pegged stablecoins tether and USDC, to the GOP presidential nominee’s campaign, according to a Federal Election Commission filing submitted on Tuesday.

The PAC said the latest filing covered donations in the period of July 1 through Sept. 30, but numbers included cumulative contributions.

With the 2024 election just three weeks away and the contest in a virtual dead heat according to polling averages, Trump is counting on a hefty dose of funding from the crypto community. The former president positioned himself as the pro-crypto candidate in this election, a reversal from his previous stance during his time in the White House. In May, he became the first major presidential candidate to accept donations in digital tokens.

Nearly half of all the corporate money flowing into the election has come from the crypto industry, according to a recent report from the nonprofit watchdog group Public Citizen. The sum was raised from a mix of contributors, with Coinbase, Ripple, and venture firm Andreessen Horowitz accounting for most of those business donations. The industry has raised roughly 13 times the amount it brought in during the last presidential election year.

At least 18 donors gave more than $5.5 million in bitcoin to Trump 47, the filing shows. Another seven people gave around $1.5 million in ether.

Contributors hailed from more than 15 states, including a few battlegrounds, plus the American territory of Puerto Rico. Their professions include Lockheed Martin software engineer, Duthie Power Services sales engineer, and a producer for Esperanza Entertainment.

David Bailey, CEO of media group BTC Inc., gave more than $498,000 in bitcoin. Bailey was part of a small army of bitcoin fanatics who indoctrinated Trump in all things bitcoin and helped turned him from a skeptic to an evangelist. The process culminated in Trump headlining the biggest bitcoin conference of the year in Nashville in July.

Trump said in his keynote that his campaign had raised $25 million from the crypto industry, though he didn’t specify the split between digital tokens and dollar donations.

Among the new donors is Chase Herro, one of the co-founders of the Trump family’s new crypto project World Liberty Financial. The platform, which has been described as a decentralized bank where customers will be encouraged to borrow, lend and invest in crypto, launched its token sale on Tuesday.

So far, more than $10.2 million worth of WLFI tokens have been sold, far short of the initial fundraise goal of $300 million. The launch was plagued with technical issues, including the repeated crashing of the website where the sale was taking place.

Mike Belshe, CEO of digital asset security company BitGo, has contributed almost $100,000 in bitcoin.

Brian Murray, a partner at Craft Ventures, gave $6,560 in bitcoin. Craft was founded by pro-Trump venture capitalist David Sacks.

Kresus Labs founder Trevor Traina gave over $25,000 in ether, Chainstone Labs CEO Bruce Fenton donated $60,000 in bitcoin, and Gary Cardone of Cardone Digital Ventures contributed over $840,000 in bitcoin.

Ripple legal chief Stuart Alderoty contributed $300,000 in XRP, as CNBC previously reported. Alderoty attended a Trump fundraising event hosted by Sacks in San Francisco in June.

Alderoty is at odds with Ripple’s billionaire co-founder Chris Larsen, who gave $1 million worth of XRP tokens to Future Forward, a super PAC that’s supporting Vice President Kamala Harris’ run for the White House. Future Forward began accepting donations in crypto in September.

While Larsen shares the crypto industry’s criticism of SEC Chair Gary Gensler and the aggressive approach the Biden administration has taken towards companies in the space, the Ripple chairman said he has more confidence in Harris, in part because she’s from the Bay Area.

“She knows people who have grown up in the innovation economy her whole life,” Larsen told CNBC in an interview this week. “So I think she gets it at a fundamental level, in a way that I think the Biden folks were just not paying attention to, or maybe just didn’t make the connection between empowering workers and making sure you have American champions dominating their industries.”

In addition to Larsen, Uniswap legal chief Marvin Ammori gave money to the Harris Action Fund. Like Ripple, Uniswap is battling claims it violated U.S. securities laws.

On the pro-Trump side, billionaire twins Tyler and Cameron Winklevoss have led the charge, with an aggregate contribution of nearly $1.1 million each. Some of that money was refunded in September because it exceeded the maximum allowed.

Science & Environment

Quantum theory is challenging long-standing ideas about entropy

Quantum theory is poking holes in our understanding of entropy

VICTOR de SCHWANBERG/SCIENCE PHOTO LIBRARY

Measuring disorder in the quantum realm is creating a bit of a mess. A mathematical study found that three different definitions for entropy that were previously thought to be equivalent don’t always match for quantum objects.

When two objects are connected – say a container of hot gas is linked to a colder gas reservoir – the entropy of the colder one can increase because the two will exchange quantities like particles and heat. For almost 200 years, physicists have used the same set…

Science & Environment

Trump’s coin sale misses early targets as crypto website crashes

U.S. President Donald Trump looks at a debit card to be used to distribute Covid-19 relief funds to the public during a cabinet meeting in the East Room of the White House in Washington, D.C., U.S., on Tuesday, May 19, 2020.

Kevin Dietsch | Bloomberg | Getty Images

Donald Trump’s new crypto project is off to a rough start.

World Liberty Financial, which aspires to be a sort of crypto bank, launched its token sale on Tuesday, a day after project co-founder Zachary Folkman said that “well over 100,000 people” are on the whitelist to invest.

But WLF’s website suffered regular and lengthy outages for much of the morning and early afternoon, contributing to a limited number of sales. Only about 4,300 unique walled addresses hold the token as of Tuesday afternoon, according to blockchain data tracked by Etherscan, representing roughly 4% of the total number of people who registered.

The platform says it has sold more than 532 million tokens at 15 cents per token. That’s less than 3% of the 20 billion tokens made available for public sale.

Over the course of the day, the website frequently showed a page saying, “We are under maintenance.”

WLF didn’t immediately respond to a request for comment.

The glitchy launch is a potential setback to the Republican presidential nominee with just three weeks until the election. Trump and his family have been touting the project since August, branding it as “The DeFiant Ones,” a play on DeFi, which is short for decentralized finance.

Source: World Liberty Financial

In a roadmap given to prospective investors that was first viewed by The Block, the WLF proposal says the coin is looking to raise $300 million at a $1.5 billion valuation in its initial sale. Folkman, who previously had a company called Date Hotter Girls and reportedly helped develop crypto project Dough Finance, has said that 20% of WLF’s tokens would be allotted to the founding team, which includes the Trump family.

The digital coin WLFI will be a Regulation D token offering, following a provision that makes it possible to raise capital without first registering a security with the SEC. Certain conditions must be met, such as limiting the size of the sale and restricting it to accredited investors, defined in part as having a net worth of over $1 million.

While few details have been announced about the project’s aspirations, people involved with WLF have said customers will be encouraged to borrow, lend and invest in crypto. No official white paper or formal business plan has been released to the public, and about all that’s been disclosed is that investing in the project will give users voting rights over the yet-to-be-launched WLF platform.

Last week, WLF began the process of getting its crypto bank approved by the DeFi ecosystem known as Aave.

Aave is open source and, in DeFi, is one of the longest-running and most-trusted crypto lending platforms.

— CNBC’s Kaan Oguz and Jordan Smith contributed to this report.

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Technology4 weeks ago

Technology4 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment4 weeks ago

Science & Environment4 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLiquid crystals could improve quantum communication devices

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA slight curve helps rocks make the biggest splash

-

News4 weeks ago

the pick of new debut fiction

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News4 weeks ago

News4 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News4 weeks ago

News4 weeks agoYou’re a Hypocrite, And So Am I

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Sport4 weeks ago

Sport4 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoRethinking space and time could let us do away with dark matter

-

News4 weeks ago

News4 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Technology3 weeks ago

Technology3 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business3 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Football3 weeks ago

Football3 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Technology3 weeks ago

Technology3 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

News4 weeks ago

News4 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists have worked out how to melt any material

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCardano founder to meet Argentina president Javier Milei

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Technology3 weeks ago

Technology3 weeks agoGet ready for Meta Connect

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

Entertainment1 week ago

Entertainment1 week agoChristopher Ciccone, artist and Madonna’s younger brother, dies at 63

-

Sport4 weeks ago

Sport4 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News1 month ago

News1 month agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Business4 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics4 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Politics4 weeks ago

Politics4 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe maps that could hold the secret to curing cancer

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBlockdaemon mulls 2026 IPO: Report

-

MMA4 weeks ago

MMA4 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoEverything a Beginner Needs to Know About Squatting

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

News4 weeks ago

News4 weeks agoChurch same-sex split affecting bishop appointments

-

Technology4 weeks ago

Technology4 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News4 weeks ago

News4 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTiny magnet could help measure gravity on the quantum scale

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

News4 weeks ago

News4 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News3 weeks ago

News3 weeks agoShocking ‘kidnap’ sees man, 87, bundled into car, blindfolded & thrown onto dark road as two arrested

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

News3 weeks ago

News3 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology3 weeks ago

Technology3 weeks agoThe best robot vacuum cleaners of 2024

-

Technology2 weeks ago

Technology2 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Business2 weeks ago

LVMH strikes sponsorship deal with Formula 1

You must be logged in to post a comment Login