Science & Environment

Crypto spend on election hits $190 million, led by Winklevoss twins

Tyler Winklevoss and Cameron Winklevoss (L-R), creators of crypto exchange Gemini Trust Co., on stage at the Bitcoin 2021 Convention, a cryptocurrency conference held at the Mana Convention Center in Wynwood in Miami, Florida, on June 4, 2021.

Joe Raedle | Getty Images

Cameron and Tyler Winklevoss are the biggest individual crypto donors this election cycle, giving a combined $10.1 million, or slightly over $5 million each, according to Federal Election Commission data compiled by crypto market and blockchain analyst James Delmore and independently verified by CNBC.

With 50 days to go until the November general election, political donations from, or in support of, the crypto industry are up to around $190 million, as some of the biggest names in the sector open their digital wallets to help elect candidates sympathetic to their interests.

The Winklevoss twins gave around $1.7 million combined in bitcoin to the Trump 47 Committee, which raises money for Republican former President Donald Trump, over $700,000 combined to the pro-Trump Make America Great Again PAC, $250,000 each to the pro-Trump America PAC, and $4.9 million to the bipartisan pro-crypto Fairshake PAC.

Top executives from blockchain giant Ripple Labs have collectively given more than $3 million to candidate committees and super PACs so far this cycle, with co-founder Chris Larsen donating nearly $2.4 million of that, mostly to help Democratic candidates. Ripple CEO Brad Garlinghouse has donated more than $384,000 to multiple PACs and candidates, including to Rep. Ro Khanna (D-Calif.) and John Deaton, a Republican running against Democratic Sen. Elizabeth Warren in Massachusetts. The company’s chief legal officer, Stuart Alderoty, gave $300,000 to the Trump 47 Committee.

At a fundraiser for Trump in June, Alderoty explained how Ripple had spent over $100 million litigation to defend itself against civil charges brought by the SEC. The event was held at the San Francisco mansion of venture capitalist David Sacks.

The Winklevoss twins and Coinbase didn’t respond to requests for comment. Ripple referred CNBC to prior comments from executives, including a June post from Garlinghouse on X, where he wrote that “candidates will only gain votes for being pro-crypto, and absolutely lose them for being anti-crypto.”

The month after the San Francisco fundraiser, Trump promised to fire SEC Chair Gary Gensler if he were elected, even though U.S. presidents do not have the authority to fire members of independent commissions without cause. While the incoming president could unseat Gensler from his position as chairman, he would remain on as a commissioner until the end of his term.

Under Gensler, the SEC has taken on major industry players, including centralized cryptocurrency exchanges Kraken and Coinbase.

Executives from the two companies have been spending big this cycle. Coinbase CEO Brian Armstrong has given over $1.3 million to a mix of PACs including Fairshake and JD Vance for Senate Inc., as well as directly to Democrats and Republicans running for both House and Senate seats. Chief Legal Officer Paul Grewal has attended at least two Trump fundraisers, including one in Nashville on the sidelines of the biggest bitcoin event of the year.

Kraken co-founder and Chairman Jesse Powell has donated just over $1 million to the Trump campaign.

Individual crypto contributors include ex-Bitfinex strategy chief Phil Potter (over $1.6 million), Multicoin Capital’s Kyle Samani ($878,600), Paradigm co-founder Fred Ehrsam ($735,400), Union Square Ventures partner Fred Wilson ($1,4 million), Paxos CEO and co-founder Charles Cascarilla ($198,500), BitGo CEO Mike Belshe ($119,825), Solana co-founder Anatoly Yakavenko ($67,100), and Gibraltar-based Xapo Bank founder Wences Casares ($374,899).

According to Delmore’s report, no known donations have been made in cryptocurrency to the Future Forward PAC, which is raising funds for Vice President Kamala Harris, the Democratic nominee for president. Future Forward began accepting crypto donations this month through a partnership with Coinbase Commerce. It appears the donation page on the website still doesn’t offer a crypto option.

CNBC reached out to two representatives from Future Forward listed on the PAC’s FEC filing to ask about the tally of crypto donations thus far and when it plans to add a crypto payment option on its website. They didn’t immediately respond.

Harris’ fundraising operation has taken off since President Biden dropped out of the race, with her campaign raising $47 million in the first 24 hours after her first, and perhaps only, debate against Trump on Tuesday.

Huge jump from 2020

Delmore, who has been assembling reports on crypto donations in the 2024 election for blockchain analytics platform Breadcrumbs, told CNBC that industry spending is nearly double where it was in the mid-terms — more than $190 million in the 2024 election versus $98 million in the 2022 election. It’s nearly 13 times spending in 2020 of $15 million — a figure based on a mix of data from FEC and OpenSecrets filings.

Unlike the past two election cycles, which featured spending from the now-bankrupt crypto exchange FTX and founder Sam Bankman-Fried, this year’s contributor list is more robust and diverse. Bankman-Fried was sentenced to 25 years in prison in March for stealing $8 billion worth of customer money through FTX.

“Most of the crypto donations in 2022 were from FTX and SBF and almost all of them went to Democrats or PACs that support Democrats,” Delmore said.

Delmore said that spending is more balanced between the two parties, but “more has definitely gone to Republican candidates and PACs that supported Republicans and opposed Democrats.”

A Public Citizen report last month found that nearly half of all the corporate money flowing into this year’s election has come from the crypto industry, with Coinbase and Ripple leading the pack.

There is a lot of overlap between crypto’s biggest corporate and individual spenders.

The majority of funds for Fairshake, one of the top-spending PACs this year, can be traced to four sources: Coinbase, Ripple, Jump Crypto and venture firm Andreessen Horowitz.

Widening the category to all of crypto, Delmore’s research finds that billions of dollars are at play, including more than $20 million in sales generated by non-fungible tokens (NFT) released by Trump, according to Bloomberg reporting, Trump-branded meme tokens, the $190 million in political donations from or in support of crypto, and another $1.1 billion on betting on the platform Polymarket.

So far, $922 million in bets have been placed on who will be the winner of the election, and another $206 million on who will win the popular vote.

Electing pro-crypto candidates ultimately comes down to turning out the vote.

The Stand With Crypto Alliance, launched by Coinbase last year, is in the midst of a cross-country bus tour through battleground states to get people registered to vote. The campaign culminates in an event on DC on Wednesday that will include speeches by members of Coinbase’s C-suite, as well as a live performance by music duo The Chainsmokers.

Science & Environment

How to see the Taurid Meteor Shower

Viewing the Taurids may be affected by the illumination of the Moon, which could obscure some of the fainter meteors. The Moon will be in a waxing gibbous phase – going from half moon to full moon.

Plus, as we have seen recently, it is hard to see anything in the sky if there is a blanket of low cloud. However, there could be some timely changes in cloud amounts at the time of peak viewing.

A weather front crossing the UK on Sunday will bring a change in air mass. Even though an area of high pressure will build again, it may not contain as much cloud.

It is possible that the clouds will part on Monday night and give us a better chance of seeing some spectacular meteor displays.

Keep across your local forecast on the BBC Weather website or app.

Science & Environment

Fintechs Upstart and Toast soar on earnings

Chris Comparato, CEO, the Toast, Inc. IPO at the New York Stock Exchange, on September 22, 2021.

Source: NYSE

Upstart, which uses artificial intelligence to inform online lending decisions, soared 46% on Friday, its best day in over three years. Toast, which sells payments technology to restaurants, jumped 14%, closing at its highest since 2021.

Both companies reported better-than-expected results, sparking the rallies.

Upstart’s revenue jumped 20% in the third quarter to $162 million, easily beating analyst estimates. CEO David Girouard said on the company’s earnings call that, “we’re in growth mode.”

Toast is still well off its pandemic highs of 2021, but the stock has now more than doubled this year. The company’s adjusted earnings forecast of $90 million to $100 million for the current quarter sailed past estimates.

The two stocks were part of a huge rally on Wall Street this week that followed Donald Trump’s election victory on Tuesday night. All three major indexes closed at records, with the tech-heavy Nasdaq finishing the week up 5.7%, its second-best week of the year.

Within fintech, companies tied to crypto were some of the top performers, after candidates funded by the crypto industry won races up and down the ballot.

Coinbase shares jumped 48% for the week, their strongest performance since January 2023. Coinbase was one of the top corporate donors in the election cycle, giving more than $75 million to Fairshake and its affiliate PACs, including a fresh pledge of $25 million to support the pro-crypto super PAC in the 2026 midterms.

Trump has vowed to oust SEC Chair Gary Gensler, which potentially bodes well for companies like Coinbase fighting the regulator in court over alleged securities offenses.

Robinhood, which allows users to buy and sell a number of digital currencies, rose 27% for the week. The online brokerage received a Wells Notice from the SEC in May, a move that often precedes formal charges.

Bitcoin hit a new intraday high above $77,300, ending the week 11% higher. Ether, solana, and dogecoin outpaced bitcoin’s gains.

Not all fintechs rallied.

Block, the parent company of Square, reported third-quarter revenue on Thursday that trailed Wall Street’s expectations, leading to a slight drop in the stock on Friday. Shares of Jack Dorsey’s company underperformed the boarder tech market for the week, rising 3.3%.

Affirm, the provider of buy now, pay later loans, beat on the top and bottom line, but the stock still dropped 4.7% on Friday, leaving it slightly ahead of the Nasdaq for the week.

WATCH: Robinhood Crypto general manager reacts to bitcoin rally

Science & Environment

Why did the UK’s first satellite end up thousands of miles from where it should have been?

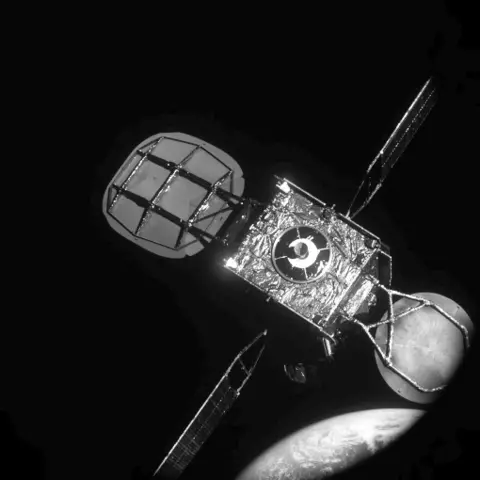

BBC/Gerry Fletcher

BBC/Gerry FletcherSomeone moved the UK’s oldest satellite and there appears to be no record of exactly who, when or why.

Launched in 1969, just a few months after humans first set foot on the Moon, Skynet-1A was put high above Africa’s east coast to relay communications for British forces.

When the spacecraft ceased working a few years later, gravity might have been expected to pull it even further to the east, out over the Indian Ocean.

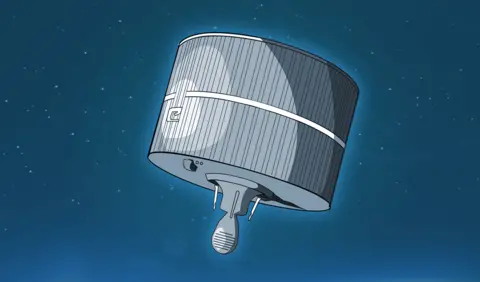

But today, curiously, Skynet-1A is actually half a planet away, in a position 22,369 miles (36,000km) above the Americas.

Orbital mechanics mean it’s unlikely the half-tonne military spacecraft simply drifted to its current location.

Almost certainly, it was commanded to fire its thrusters in the mid-1970s to take it westwards. The question is who that was and with what authority and purpose?

It’s intriguing that key information about a once vital national security asset can just evaporate. But, fascination aside, you might also reasonably ask why it still matters. After all, we’re talking about some discarded space junk from 50 years ago.

“It’s still relevant because whoever did move Skynet-1A did us few favours,” says space consultant Dr Stuart Eves.

“It’s now in what we call a ‘gravity well’ at 105 degrees West longitude, wandering backwards and forwards like a marble at the bottom of a bowl. And unfortunately this brings it close to other satellite traffic on a regular basis.

“Because it’s dead, the risk is it might bump into something, and because it’s ‘our’ satellite we’re still responsible for it,” he explains.

BBC/Gerry Fletcher

BBC/Gerry FletcherDr Eves has looked through old satellite catalogues, the National Archives and spoken to satellite experts worldwide, but he can find no clues to the end-of-life behaviour of Britain’s oldest spacecraft.

It might be tempting to reach for a conspiracy theory or two, not least because it’s hard to hear the name “Skynet” without thinking of the malevolent, self-aware artificial intelligence (AI) system in The Terminator movie franchise.

But there’s no connection other than the name and, in any case, real life is always more prosaic.

What we do know is that Skynet-1A was manufactured in the US by the now defunct Philco Ford aerospace company and put in space by a US Air Force Delta rocket.

“The first Skynet satellite revolutionised UK telecommunications capacity, permitting London to securely communicate with British forces as far away as Singapore. However, from a technological standpoint, Skynet-1A was more American than British since the United States both built and launched it,” remarked Dr Aaron Bateman in a recent paper on the history of the Skynet programme, which is now on its fifth generation.

This view is confirmed by Graham Davison who flew Skynet-1A in the early 70s from its UK operations centre at RAF Oakhanger in Hampshire.

“The Americans originally controlled the satellite in orbit. They tested all of our software against theirs, before then eventually handing over control to the RAF,” the long-retired engineer told me.

“In essence, there was dual control, but when or why Skynet-1A might have been handed back to the Americans, which seems likely – I’m afraid I can’t remember,” says Mr Davison, who is now in his 80s.

Sunnyvale Heritage Park Museum

Sunnyvale Heritage Park MuseumRachel Hill, a PhD student from University College London, has also been scouring the National Archives.

Her readings have led her to one very reasonable possibility.

“A Skynet team from Oakhanger would go to the USAF satellite facility in Sunnyvale (colloquially known as the Blue Cube) and operate Skynet during ‘Oakout’. This was when control was temporarily transferred to the US while Oakhanger was down for essential maintenance. Perhaps the move could have happened then?” Ms Hill speculated.

The official, though incomplete, logs of Skynet-1A’s status suggest final commanding was left in the hands of the Americans when Oakhanger lost sight of the satellite in June 1977.

But however Skynet-1A then got shifted to its present position, it was ultimately allowed to die in an awkward place when really it should have been put in an “orbital graveyard”.

This refers to a region even higher in the sky where old space junk runs zero risk of running into active telecommunications satellites.

Graveyarding is now standard practice, but back in the 1970s no-one gave much thought to space sustainability.

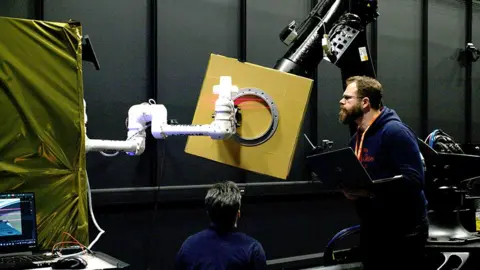

Astroscale

AstroscaleAttitudes have since changed because the space domain is getting congested.

At 105 degrees West longitude, an active satellite might see a piece of junk come within 50km of its position up to four times a day.

That might sound like they’re nowhere near each other, but at the velocities these defunct objects move it’s starting to get a little too close for comfort.

The Ministry of Defence said Skynet-1A was constantly monitored by the UK’s National Space Operations Centre. Other satellite operators are informed if there’s likely to be a particularly close conjunction, in case they need to take evasive action.

Northrop Grumman

Northrop GrummanUltimately, though, the British government may have to think about removing the old satellite to a safer location.

Technologies are being developed to grab junk left in space.

Already, the UK Space Agency is funding efforts to do this at lower altitudes, and the Americans and the Chinese have shown it’s possible to snare ageing hardware even in the kind of high orbit occupied by Skynet-1A.

“Pieces of space junk are like ticking time bombs,” observed Moriba Jah, a professor of aerospace engineering at the University of Texas at Austin.

“We need to avoid what I call super-spreader events. When these things explode or something collides with them, it generates thousands of pieces of debris that then become a hazard to something else that we care about.”

Science & Environment

Jack Dorsey dramatically shutters Block’s TBD crypto unit

Jack Dorsey, co-founder of Twitter Inc., speaks during the Bitcoin 2021 conference in Miami, Florida, U.S., on Friday, June 4, 2021.

Eva Marie Uzcategui | Bloomberg | Getty Images

During the crypto-crazed summer of 2021, when memecoins like dogecoin and Shiba Inu were rocketing alongside bitcoin and ethereum, Square founder Jack Dorsey announced that his payments company was starting a new business unit, with the goal of “making it easy to create non-custodial, permissionless, and decentralized financial services.”

“Our primary focus is #Bitcoin,” Dorsey proclaimed on Twitter. The name of the business unit would be TBD.

In December of that year, Dorsey went a step further, changing the name of Square Inc. to Block, a reference, he said, to a number of things, including blockchain, the technology underpinning bitcoin. The Square Crypto business became known as Spiral.

Three years later, Dorsey is in retreat.

On Block‘s third-quarter earnings call on Thursday, CFO Amrita Ahuja said Block has “made some recent decisions with respect to some of our emerging initiatives” and is “winding down our TBD efforts.”

Block continues to own a hefty amount of bitcoin on its balance sheet, with the current value of its holdings swelling to $630 million. And the company said it will be investing in a bitcoin mining initiative as well as Bitkey, its bitcoin wallet, while continuing to allow users to buy bitcoin through Cash App.

It’s a notable change of tune.

TBD was designed to be Block’s platform for developers. Block called it Web5 and said the mission was to create a more decentralized, secure and private internet. Dorsey said in a tweet in mid-2022 that Web5 “will likely be our most important contribution to the internet.”

Square’s five-year stock chart

But Wall Street’s view on crypto was starting to sour dramatically. With inflation soaring in 2022 and interest rates on the rise, shareholders demanded quicker returns on their investments. After peaking in 2021, Block shares lost more than 80% of their value before bottoming in October of last year.

Block said in late 2023 that it would cut its headcount — then about 13,000 staffers — by as much as 1,000 by the end of 2024. Fortune reported that Block laid off employees at TBD in recent weeks. And in the third-quarter shareholder letter, Block said it was “scaling back” its investment in Tidal, the music-streaming service founded by Jay-Z, after spending about $300 million on a majority stake in the business in 2021. Tidal was part of TBD.

Dorsey was asked by an analyst on Thursday’s call about the company’s current bitcoin strategy.

“What we’re focused on in terms of our strategy overall on bitcoin is making it more accessible, making sure that more people can access bitcoin, buy, sell it, obviously, but also send it peer-to-peer,” Dorsey said.

Dorsey added that he wants “the internet to have a native currency,” because that would allow Block to move money faster and offer Cash App and other products in more markets.

A Block spokesperson reiterated the company’s public statement and pointed to Dorsey’s comments from the earnings call.

What’s become clear is that Dorsey can only do so much with crypto while trying to appease a more discerning Wall Street. Shares of Block were down about 1% at market close on Friday, after the company reported revenue that trailed estimates and issued weaker gross profit guidance than some analysts were expecting.

In his 1,400-word letter to shareholders, Dorsey focused entirely on the company’s lending offerings for small businesses. A significant chunk of that is the buy now, pay later product from Afterpay, which Block acquired for $29 billion in 2021.

Dorsey didn’t mention crypto or bitcoin once.

Science & Environment

Tesla was the top ‘Trump Trade’ of the week, along with some energy and financial stocks

Science & Environment

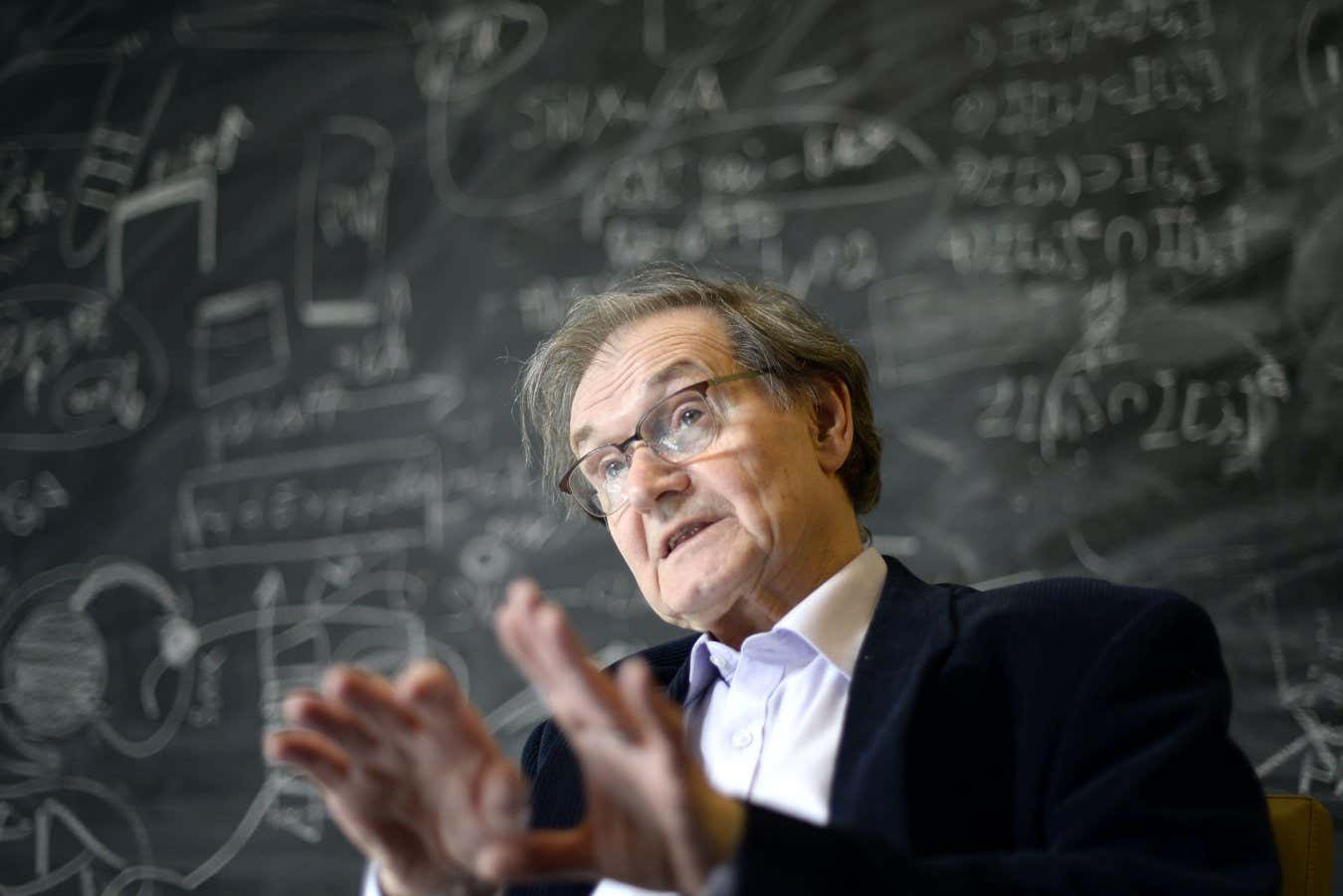

The Impossible Man review: What is the price of genius, asks biography of Roger Penrose

Roger Penrose, at the Institute of Science and Technology, Austria

APA-PictureDesk/Alamy

The Impossible Man

Patchen Barss (Atlantic Books (UK, 14 November); Basic Books (US, 12 November))

Many people still believe (and many scientists tell themselves) that genius is a solitary affair, that what they do is so important it merits exemption from everyday life and the obligations of intimate relationships.

As his subtitle suggests, Patchen Barss doesn’t endorse this notion in The Impossible Man: Roger Penrose and the cost of genius, as he charts the life of one of the most influential physicists of the 20th century. The biography…

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 months ago

Science & Environment2 months agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology1 month ago

Technology1 month agoUkraine is using AI to manage the removal of Russian landmines

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Money1 month ago

Money1 month agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

Technology2 months ago

Technology2 months agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Sport1 month ago

Sport1 month agoAmerica’s Cup: Great Britain qualify for first time since 1964

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 month ago

Technology1 month agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

News1 month ago

News1 month agoHarry vs Sun publisher: ‘Two obdurate but well-resourced armies’

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Womens Workouts2 months ago

Womens Workouts2 months ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

-

Sport1 month ago

Sport1 month agoFans say ‘Moyes is joking, right?’ after his bizarre interview about under-fire Man Utd manager Erik ten Hag goes viral

-

Politics1 month ago

‘The night of the living dead’: denial-fuelled Tory conference ends without direction | Conservative conference

-

Technology1 month ago

Technology1 month agoNintendo’s latest hardware is not the Switch 2

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Technology1 month ago

Technology1 month agoQuoroom acquires Investory to scale up its capital-raising platform for startups

-

Football1 month ago

Football1 month agoFifa to investigate alleged rule breaches by Israel Football Association

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

-

Sport1 month ago

Sport1 month agoHow India became a Test cricket powerhouse

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

News1 month ago

News1 month agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

Sport1 month ago

Sport1 month agoWales fall to second loss of WXV against Italy

-

Technology1 month ago

Technology1 month agoSamsung Galaxy Tab S10 won’t get monthly security updates

-

Science & Environment2 months ago

Science & Environment2 months agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 months ago

Science & Environment2 months agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Business1 month ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology1 month ago

Technology1 month agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Business1 month ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Business1 month ago

‘Let’s be more normal’ — and rival Tory strategies

-

Technology1 month ago

Technology1 month agoThe best shows on Max (formerly HBO Max) right now

-

News1 month ago

News1 month agoTrump returns to Pennsylvania for rally at site of assassination attempt

You must be logged in to post a comment Login