Science & Environment

Kamala Harris got $1 million from Ripple’s Chris Larsen, crypto warms

Chris Larsen, co-founder of Ripple.

Source: YouTube

SAN FRANCISCO — For months, crypto companies and their executives have been pouring tens of millions of dollars into Donald Trump’s effort to win the White House. Chris Larsen isn’t one of them.

The co-founder and chairman of Ripple recently contributed $1 million worth of XRP tokens, the currency created by Ripple in 2012, to Future Forward, a super PAC that’s supporting Vice President Kamala Harris’ presidential campaign.

Larsen, who’s backed candidates across the aisle for the last few years, told CNBC in an interview on Monday that his comfort level with Harris comes from conversations he’s had with people inside the campaign and what he’s seen from the vice president since she replaced President Biden at the top of the ticket in July.

It helps that Harris is from the Bay Area.

“She knows people who have grown up in the innovation economy her whole life,” Larsen said. “So I think she gets it at a fundamental level, in a way that I think the Biden folks were just not paying attention to, or maybe just didn’t make the connection between empowering workers and making sure you have American champions dominating their industries.”

Larsen’s affection for the Democratic nominee isn’t brand new. In February, he gave the maximum personal contribution of $6,600 to Harris (which would cover the primary and general election), about five months before she became the Democratic presidential nominee, FEC filings show. At the same time, he contributed $100,000 to the Harris Action Fund PAC.

In total, Larsen has given around $1.9 million to support Harris’ campaign directly and through PACs, according to FEC data compiled by crypto market and blockchain analyst James Delmore and independently verified by CNBC.

Larsen, 64, has a net worth of $3.1 billion, according to Forbes, primarily from his ownership of XRP and involvement in Ripple, which provides blockchain technology for financial services companies.

He’s part of an industry that’s become suddenly prominent in political fundraising, though more heavily in support of Republicans. Nearly half of all the corporate money flowing into the election has come from the crypto industry, according to a recent report from the nonprofit watchdog group Public Citizen.

Democratic presidential nominee and U.S. Vice President Kamala Harris waves as she arrives at Erie International Airport ahead of a campaign rally, in Erie, Pennsylvania, U.S., October 14, 2024.

Evelyn Hockstein | Reuters

The sum was raised from a mix of contributors, with Coinbase, Ripple, and venture firm Andreessen Horowitz accounting for most of those business donations. The industry has raised roughly 13 times the amount it brought in during the last presidential election year.

Close to two-thirds of crypto contributions have gone either to supporting Republicans or opposing Democrats, according to Delmore’s compilation of FEC data. Trump has received more than $4 million in virtual tokens, an FEC filing shows, and in July, the ex-president keynoted a major bitcoin conference in Nashville, Tennessee.

‘More pragmatic approach’

Larsen’s recent contributions include $1 million to Democratic Pennsylvania Gov. Josh Shapiro in December, and almost $7,000 in February to John Deaton, the Massachusetts Republican who’s taking on Democratic Sen. Elizabeth Warren, a vocal crypto critic. He also donated $250,000 in 2022 to the Nancy Pelosi Victory Fund and contributed to a pro-Biden PAC in 2020.

Larsen told CNBC that he’s “really confident” that Harris will bring a “more pragmatic approach and clear rules” to the crypto industry, in contrast to the current situation with Gary Gensler running the SEC. Gensler’s open hostility towards much of the crypto industry and his aggressive crackdowns on companies, including Ripple, is a big reason why many in the space say they’re supporting Trump.

In January, Ripple CEO Brad Garlinghouse, who has also donated to members of both parties, called Gensler a “political liability.”

“What we’ve had to date has been almost like purposeful chaos by Gensler to kind of crush the domestic industry,” Larsen said. That “has only empowered sketchier foreign operations. It just doesn’t make any sense,” he said, adding that “Gensler must be the most unpopular person in Washington, D.C.”

CNBC reached out to Gensler’s office for comment and didn’t hear back.

Ripple’s legal chief said in June that the company has spent over $100 million on litigation to defend itself against civil charges brought by the SEC. In 2020, before Biden took office, the SEC accused Ripple, Garlinghouse and Larsen of violating securities laws by acting as unregistered brokers of digital currency tokens, which the SEC regulates as securities. The SEC later dismissed the charges against the two Ripple executives, and the company has denied it broke securities laws. They remain in active litigation.

Earlier this month, the agency filed a notice of appeal in its multi-year case with the Ripple.

Ripple has given about $50 million to the pro-crypto super PAC Fairshake, which has been contributing to candidates up and down the ballot, and on both sides of the aisle.

Harris has been gaining momentum within the crypto community.

Two days after Biden dropped out of the race, Marvin Ammori, legal chief at decentralized exchanged Uniswap, gave money to the Harris Action Fund. Uniswap is also battling claims it violated U.S. securities laws.

Skybridge Capital’s Anthony Scaramucci, who spent 11 days as White House communications director under Trump, has given more than $36,000 to two PACs supporting the Democratic nominee. Scaramucci says he’s among a group of crypto advocates working with Harris to develop her campaign’s policies on digital assets and to help the vice president distance the Democrats from Sen. Warren.

And then there’s venture capitalist Ben Horowitz, who maintains a sizable portfolio of crypto companies. The Andreessen Horowitz co-founder and his partner Marc Andreessen said in July they were planning to make significant donations to PACs supporting Trump’s run for president due to what they characterized as his friendliness to the “little tech agenda.”

That was when Biden was the nominee. By early October, Horowitz appeared to have had a change of heart. He told employees at his firm that he would be making a “significant” personal contribution to Harris’ election bid. Horowitz said that he and his wife, Felicia, “have known Vice President Harris for over 10 years and she has been a great friend to both of us during that time.”

A couple weeks earlier, in late September, Harris finally gave a nod to cryptocurrency in a public address.

“We will encourage innovative technologies like AI and digital assets while protecting our consumers and investors,” she said at a $27 million fundraiser in New York.

On Monday, the Harris campaign unveiled its “Opportunity Agenda for Black Men” in a report. The plan explicitly mentions creating a framework for cryptocurrency in the U.S. designed to safeguard those assets. The campaign said more than 20% of Black Americans own or have owned digital currencies.

Despite Larsen’s track record of donating to Democrats, he took heat on social media after his latest contribution was reported on CNBC on Friday.

“The Ripple community and even the crypto community in general has a lot of skepticism toward Kamala’s candidacy and what policies she would put into place,” Delmore said, reflecting much of the online sentiment

Larsen blew off the criticism, and said he doesn’t pay attention to social media.

Science & Environment

WTI, Brent fall more than 4%

Crude oil futures fell more than 4% on Tuesday, as a looming global oil surplus next year overshadowed the risk of a supply disruption from the conflict between Israel and Iran.

Oil prices spiked earlier this month after Iran hit Israel with a ballistic missile attack, raising fears that Israel would respond by targeting the Islamic Republic’s oil facilities.

The International Energy Agency said Tuesday that its members are prepared to take action if there is a supply disruption in the Middle East.

“For now, supply keeps flowing, and in the absence of a major disruption, the market is faced with a sizeable surplus in the new year,” the IEA said in its monthly report.

Here are today’s energy prices around 5:30 am ET:

- West Texas Intermediate November contract: $70.28 per barrel, down $3.55, or 4.9%. Year to date, U.S. crude oil has fallen 2%.

- Brent December contract: $73.81 per barrel, down $3.65, or 4.8%. Year to date, the global benchmark has declined about 4%.

- RBOB Gasoline November contract: $2.0197 per gallon, down 4.2%. Year to date, gasoline has pulled back nearly 4%.

- Natural Gas November contract: $2.465 per thousand cubic feet, down 1.16%. Year to date, gas has fallen nearly 2%.

World oil demand is expected to grow by just under 900,000 barrels per day in 2024 and 1 million bpd in 2025, a significant slowdown compared to growth of 2 million bpd in post-pandemic period, according to the IEA.

Chinese oil demand is particularly weak, with consumption dropping by 500,000 bpd in August, the fourth monthly decline in a row, according to the agency. Meanwhile, crude production in the Americas, led by the U.S., is poised to grow by 1.5 million bpd this year and next, the IEA said.

OPEC has cut its oil 2024 forecast for the third consecutive month in a row.

Science & Environment

Burning household rubbish now UK’s dirtiest form of power, BBC finds

BBC / Getty Images

BBC / Getty ImagesBurning household rubbish in giant incinerators to make electricity is now the dirtiest way the UK generates power, BBC analysis has found.

Nearly half of the rubbish produced in UK homes, including increasing amounts of plastic, is now being incinerated. Scientists warn it is a “disaster for the climate” – and some are calling for a ban on new incinerators.

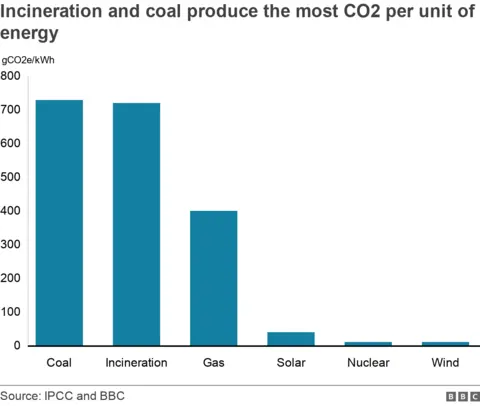

The BBC examined five years of data from across the country, and found that burning waste produces the same amount of greenhouse gases for each unit of energy as coal power, which was abandoned by the UK last month.

The Environmental Services Association, which represents waste firms, contested our findings and said emissions from dealing with waste are “challenging to avoid”.

Nearly 15 years ago, the government became seriously concerned with the gases being produced from throwing away household rubbish in landfill and their contribution to climate change. In response, it hiked the taxes UK councils paid for burying waste.

Facing massive bills, councils turned to energy-from-waste plants – a type of incinerator that produces electricity from burning rubbish. The number of incinerators surged – in the past five years the number in England alone has risen from 38 to 52.

These incinerators were described by the waste disposal industry as a green alternative to landfill.

This is certainly the case for food waste, which produces less harmful greenhouse gases when burned, but it is not the case for plastic waste. Plastic is made of fossil fuels and burning it, rather than burying it in landfill, produces high levels of greenhouse gases.

In the past few years, more plastic has been going to incinerators and less food waste – which councils are now sending to anaerobic digesters or to be composted. But the government’s own calculations continue to assume that we send the same mix of rubbish as we did back in 2017 – potentially underestimating the scale of the issue.

The BBC’s five-year analysis used data on actual pollution levels recorded by operators at their incinerators, and found that energy-from-waste plants are now producing the same amount of greenhouse gases per unit of electricity as if they were burning coal.

For the past three decades, the UK has been reducing its use of coal because of how polluting it is – and last month closed its last coal plant. The government hopes this will help it achieve its target of ensuring electricity generation produces no carbon emissions by 2030.

This now leaves waste incineration as the dirtiest way the UK produces power. According to the BBC analysis, energy produced from waste is five times more polluting than the average UK unit of electricity.

About 3.1% of the UK’s energy comes from waste incinerators – but the government’s independent advisory group, the UK Climate Change Committee, warns that incineration will make up an increasing part of emissions from electricity generation.

It’s an “insane situation”, said Dr Ian Williams, professor of applied environmental science at the University of Southampton.

“The current practice of the burning of waste for energy and building more and more incinerators for this purpose is at odds with our desire to reduce greenhouse gas emissions,” he said.

“Increasing its use is disastrous for our climate.”

Getty Images

Getty ImagesLord Deben, the Conservative environment minister who introduced the landfill tax in 1996, told the BBC: “We’ve got too many [incinerators], and we shouldn’t have any more… they begin to distort our ability to recycle.”

And yet, incinerators are still being built in England. The UK government approved a new £150m site in Dorset last month, overturning the local council’s decision to block it.

Dorset Council leader Nick Ireland told the BBC at the time that it “kneecaps” the county’s efforts to achieve their “net zero” target – the goal of no longer adding to carbon emissions by 2050.

In the past few years, Wales and Scotland have introduced bans on new incinerator plants over environmental concerns, and there have been increasing calls from leading academics and environmental groups for the same to happen in England and Northern Ireland.

These include the UK Climate Change Committee, which has recommended that no more plants be built without efforts to capture all their carbon emissions.

There are currently only four out of 58 incinerators in the UK with approved plans to capture their emissions and one pilot project that is operating. This project at Ferrybridge EfW collects one tonne of carbon dioxide annually – but the site produces more than half a million tonnes of CO2.

Incinerators getting dirtier and bigger

Without action, it is expected that the use of incinerators in the UK will continue to grow and they will probably get more polluting.

There are currently dozens of new plants going through the planning process, and existing ones are growing in capacity. The BBC investigation found nearly half of all incinerators in the UK have managed to get a capacity increase approved by the Environment Agency without applying for a new permit – which requires public consultation.

The waste they are burning is increasingly made up of plastic, according to local government data. Because plastic is produced from fossil fuels, it is the dirtiest type of waste to burn.

According to the government’s own statistics, burning plastic produces 175 times more carbon dioxide (CO2) than burying it in landfill.

Prof Keith Bell, who sits on the UK Climate Change Committee, said after reviewing the BBC’s findings: “If the current government is serious about clean power by 2030 then… we cannot allow ourselves to be locked into just burning waste.”

Getty Images

Getty ImagesIn April, a temporary ban on permits for new incinerators was introduced in England by the previous Conservative government, while it reviewed the role of burning waste, but when the ban lapsed in May it was not continued.

It appears that the current government has yet to decide its position on the issue.

In a letter last month, senior civil servants at the Department for Energy Security and Net Zero said they were unable to decide whether to approve a proposed incinerator in North Lincolnshire until the Department for the Environment, Food and Rural Affairs (Defra) had decided the government’s policy on burning waste for power.

Considering the Dorset incinerator was approved by the Ministry of Housing, Communities and Local Government, this letter raises questions about the consistency of the government’s approach on this issue.

In response to a request for comment, a Defra spokesperson said: “We are considering the role waste incineration will play as we decarbonise and grow the economy.”

Councils ‘locked in’ to burning waste

The challenge is that even if local authorities wanted to move away from the use of energy-from-waste plants they are often unable to due to restrictive, long-term contracts.

The BBC made Freedom of Information requests to every UK local authority responsible for disposing of waste, which revealed that they have at least £30bn-worth of contracts with waste operators involving incinerators, some lasting more than 20 years.

These arrangements have been criticised by the House of Commons public accounts committee for locking councils into financially burdensome arrangements.

Dr Colin Church, who led an independent review of incineration for the Scottish government which resulted in the ban, said: “‘Lock-in’ is a real issue, the energy-from-waste sector swears blind it’s not, but it is.”

In 2019, Derbyshire County Council and Derby City Council terminated their contract with waste company RRS because an incinerator it had built for them did not pass initial tests, with residents complaining about the smell and noise.

Although the plant had never been used, the councils were were ordered to pay £93.5m in compensation to RRS’s administrators for terminating the contract early.

The BBC also found that dozens of councils had clauses in their contracts which demand a minimum amount of waste to be sent to incinerators for burning – known in the industry as “deliver or pay”.

In 2010, Stoke-on-Trent Council was left facing a £329,000 claim from Hanford Waste Services for not sending enough waste to be incinerated.

The council declined to say if it paid the claim but told us the clause has since been removed from its contracts with the operator.

BBC / Jon Parker Lee

BBC / Jon Parker LeeBut the Local Government Association (LGA) – representing local authorities in England and Wales – expressed concerns to the BBC that these contracts have left councils unable to explore the use of more environmental solutions, such as recycling, for fear of a fine for breach of contract.

Joe Harris, vice chair of the LGA and leader of Cotswold District Council, said: “If we can adapt those contracts which allows us to reduce the amount of waste going to incineration and if we can boost recycling we want to do that, but we can’t have councils facing financial penalties.”

For the past 10 years recycling rates have failed to increase, remaining stuck at about 41% in England – despite a previous commitment by the previous Conservative government for 65% of the UK’s household waste to be recycled by 2035. Wales is the only nation to have hit the 65% target.

But the Environmental Services Association, the waste industry body, said burning rubbish for energy has been “complementary to efforts to recycle more” over the past decade and that “stagnant recycling rates are only indicative of a failure to develop recycling policies”.

A Defra spokesperson told the BBC: “We are committed to cutting waste and moving to a circular economy so that we re-use, reduce and recycle more resources and help meet our emissions targets.”

How we calculated the emissions

In order to calculate the emissions produced per unit of energy from England’s incinerators, the BBC needed to obtain the emissions produced and the power output from these sites.

Each incinerator in the UK produces annual monitoring reports, which record key statistics associated with the plant including its total emissions.

But in a few cases the emissions were not recorded in the annual monitoring report and so the figures recorded in the government’s pollution inventory report were used.

The IPCC, the UN climate science body, recommends that “biogenic” emissions – which come from burning organic matter like food – are not included in calculations because they are recorded under the emissions for the land and forestry sector.

So we had to remove these biogenic emissions from the total by working out what share of the waste being burned was organic.

Some operators recorded this, but in the cases where they did not the government guidelines advise applying a factor based on the share of household waste that was recorded as biogenic during a 2017 survey by the environmental NGO WRAP.

This gave the BBC the total fossil emissions – meaning those associated with burning the “fossil” waste (or non-organic waste) at the site, including plastic.

Then we calculated a carbon intensity figure – the carbon emissions per unit of energy generated – for every site, by dividing the total fossil emissions by the energy generated.

Methodological support was provided by Francesco Pomponi, professor of sustainability science at Edinburgh Napier University; Massimiliano Materazzi, associate professor of chemical engineering at University College London; and Dr Jim Hart, sustainability consultant.

Science & Environment

Trump crypto project World Liberty Financial set to open to investors

Collect Trump Cards

Source: Collecttrumpcards.com

With shares of his nascent social media business in the midst of a sharp rebound and with just three weeks until the presidential election, Donald Trump is bringing his latest proposed money-making endeavor to market, this time in crypto.

On Tuesday, the former president and current Republican nominee aims to launch WLFI, the token accompanying his new crypto project called World Liberty Financial. Over the weekend, Trump pumped the sale in a post on X, telling his followers that it’s a “chance to help shape the future of finance.”

Prospective investors can be forgiven for having little idea about what they’re being asked to support.

People involved with WLF have described it as a sort of crypto bank, where customers will be encouraged to borrow, lend and invest in crypto. No official white paper or formal business plan has been released to the public, and about all that’s been disclosed is that investing in the project will give users voting rights over the yet-to-be-launched WLF platform.

In a roadmap given to prospective investors that was first viewed by The Block, the WLF proposal says the coin is looking to raise $300 million at a $1.5 billion valuation in its initial sale. CNBC reached out to WLF for comment but didn’t hear back.

World Liberty Financial is separate and apart from Trump Media & Technology Group, the parent company of social media platform Truth Social. Trump Media, known by ticker symbol DJT, started trading in March, after going public through a special purpose acquisition company (SPAC). It’s been a rocky road for the stock, which peaked at close to $80 in late March, before falling all the way down to $12.15 last month.

But since bottoming on Sept. 23, DJT shares are up close to 150% at $29.95, giving the company a market cap of $6 billion. That’s on revenue of less than $1 million a quarter and after the company lost more than $16 million in the latest period.

The Nasdaq Market site is seen on the day that shares of Truth Social and Trump Media & Technology Group start trading under the ticker “DJT”, in New York City, U.S., March 26, 2024.

Shannon Stapleton | Reuters

While DJT shares can be purchased by anyone, the digital coin WLFI will be a Regulation D token offering, following a provision that makes it possible to raise capital without first registering a security with the SEC. Certain conditions must be met, such as limiting the size of the sale and restricting it to accredited investors, defined in part as having a net worth of over $1 million.

Trump owns about 57% of DJT’s outstanding shares, but his potential control over World Liberty Financial is more opaque. WLF’s website, which is currently a landing page to register for know-your-customer verification to buy the coin, includes some of the fine print that indicates the financial incentive for the founders.

Co-founder Zachary Folkman, who previously had a company called Date Hotter Girls and reportedly helped develop crypto project Dough Finance, has said that 20% of WLF’s tokens would be allotted to the founding team, which includes the Trump family.

And there appears to be another way they can make money.

“DT Marks DEFI, LLC and its affiliates including Donald J. Trump and his family members has or may receive tokens from World Liberty Financial, and will be entitled to receive significant fees for services provided to World Liberty Financial, which amount cannot yet be determined,” the website says.

On Monday, less than 24 hours before the planned token launch, the WLF team convened a conversation on X Spaces to share details of the sale. About 12,000 people tuned in to listen to the more than hourlong chat about the overarching goals of the project.

Folkman reiterated what he said in a prior Spaces event, telling attendees that WLFI is a governance token that allows holders to vote on decisions regarding the protocol, including initiatives like promotional partnerships. He said token ownership “isn’t equity” and “doesn’t represent economic right.”

Folkman said the token sale will exclusively take place on World Liberty’s website, and that only those who had been whitelisted after signing up will be able to participate. He said “well over 100,000 people” are on the whitelist and that it’s not too late to register. Folkman added that WLF would publish the “long-awaited” roadmap for the project on Tuesday, in tandem with the token sale.

Last week, WLF began the process of getting its crypto bank approved by the decentralized finance (DeFi) ecosystem known as Aave.

Aave is open source and, in DeFi, is one of the longest-running and most-trusted crypto lending platforms.

“The protocol itself is permissionless, so I’m kind of less opinionated about integrations, because that’s the whole idea of decentralized finance,” Aave founder Stani Kulechov told CNBC in an interview at the Permissionless Conference in Salt Lake City, Utah.

Kulechov joined Monday’s X event and said he’s “excited that WLF is using and relying on” Aave.

‘”That’s a strong signal that what we build is fairly useful, so we’re super excited,” he said.

In a 400-word post to Aave’s governance forum, the WLF team presented a brief outline of its objectives, which include promoting “DeFi to a wider audience through its marketing efforts,” and introducing “a new class of users to over-collateralized borrowing and lending.” The proposal is currently at the preliminary stage of consideration known as “Temp Check,” and Aave’s users are able to comment on the plan.

In the comments section, a number of users raised concern over the project’s deep ties to the Trump family.

“I believe this proposal poses significant risk to the Aave protocol for little gain,” according to one comment that’s since been deleted. The commenter then questioned the rationale of having “the largest and most trusted protocol in DeFi” working with a group led “by people of questionable backgrounds … including several convicted criminals.”

Folkman helped start WLF with long-time business partner Chase Herro. CoinDesk reported that the pair previously worked on Dough Finance, which was also built on top of Aave and suffered a $2 million hack in July. Herro also launched another crypto trading business a decade ago called Pacer Capital, which appears to now be defunct.

For World Liberty to proceed, it must pass multiple rounds of consideration and approval, each decided by a vote among existing AAVE token holders.

At this stage in the process, the token sale is akin to an IOU. Those who buy in now have a claim to the token if and when the platform is approved and launched.

Science & Environment

Google inks deal with nuclear company as data center power demand surges

People take photos in front of a giant Google logo at Google’s Bay View campus in Mountain View, California on Aug 13, 2024 where the “Made by Google” media event was held today.

Josh Edelson | AFP | Getty Images

Google said Monday that it will purchase power from small modular reactor developer Kairos Power, as tech companies increasingly turn to nuclear power as a way to fulfill the growing energy demands from data centers.

The tech giant said it will purchase power from a fleet of SMRs made by Kairos Power. Google said purchasing from multiple SMRs sends an “important demand signal to the market,” while at the same time making a long-term investment to accelerate commercialization.

“We believe that nuclear energy has a critical role to play in supporting our clean growth and helping to deliver on the progress of AI,” Michael Terrell, senior director for energy and climate at Google, said on a call with reporters. “The grid needs these kinds of clean, reliable sources of energy that can support the build out of these technologies. … We feel like nuclear can play an important role in helping to meet our demand, and helping meet our demand cleanly, in a way that’s more around the clock.”

The company did not disclose the financial terms of the deal.

There are only three SMRs that are operating in the world, and none in the U.S. The hope is that SMRs are a more cost-effective way to scale up nuclear power. In the past, large, commercial-scale nuclear reactor projects have run over budget and behind schedule, and many hope SMRs won’t suffer that same fate. But it is uncharted territory to some extent.

Kairos Power, which is backed by the Department of Energy, was founded in 2016. In July, the company began construction on its Hermes Low-Power Demonstration Reactor in Oak Ridge, Tennessee. Rather than use water as the reactor coolant – as is used in traditional nuclear reactors – Kairos Power uses molten fluoride salt.

Google said the first reactor will be online by 2030, with more reactors going live through 2035. In total, 500 megawatts will be added to the grid. That’s much smaller than commercial reactors — Unit 4 at Plant Vogtle, which came online this year, is 1.1 gigawatts, for example — but there’s a lot of momentum behind SMRs. Advocates point to lower costs, faster completion times, as well as location flexibility as reasons.

Monday’s announcement is another example of the growing partnership between tech companies and nuclear power. Data centers need 24/7 reliable power, and right now nuclear is the only source of emissions-free baseload power. Many hyperscalers have ambitious emissions-reduction targets, which is why they’re turning to nuclear power.

Constellation Energy is restarting Three Mile Island to power Microsoft data centers, while Amazon bought a data center from Talen Energy that’s powered by the Susquehanna nuclear power plant. Bill Gates, Sam Altman and Jeff Bezos have all backed nuclear companies.

Earlier this year, Google said its emissions have grown nearly 50% relative to 2019 thanks in part to an increase in data center power consumption.

“It is an incredibly promising bet, and one that, you know, if we can get these projects to scale and then scale globally, will deliver enormous benefits to communities and power grids around the world,” Terrell added.

Science & Environment

Russian oil trade rises with record volumes of ‘dark fleet’ crude

A Russian-chartered oil tanker in the sea off Morocco in an area identified by maritime technology company Windward as a hub for smuggling oil.

Europa Press | Getty Images

Recent data shows the discount on Russian oil narrowing and exports increasing despite the G-7 price cap on Russian petroleum exports and U.S. sanctions.

According to Clearview Energy Partners, Russian crude prices over the last four weeks have averaged about six cents below the Brent crude price. That is far off the trading discount when the cap was first put in place. When the cap was fully phased in, in February 2023, Russian crude was selling at a 30% discount. A year ago, the discount was about 16%.

Ukraine allies, including the U.S., have banned the import of Russian crude, while a price cap imposed on Russian oil by the G7 countries, the European Union and Australia bans the use of Western maritime services such as insurance, flagging and transportation when tankers carry Russian oil priced at or above $60 a barrel to nations where a ban is not enforced.

In a recent report to clients, Clearview Energy Partners characterized the G-7 price cap on Russian petroleum exports to third countries as “increasingly loose.”

Kevin Book, managing director of research at Clearview Energy Partners, told CNBC that despite the G-7’s June and September calls for improving the price cap, and recent guidance urging parties to Russian petroleum transactions to better scrutinize cargoes, “a U.S. pinch on Russian petroleum seems unlikely until after the election.”

“A cap enforcement crackdown runs the risk of driving up crude prices,” he said. “Plus, using ‘secondary’ sanctions to enforce the cap could push reputable insurers out of the Russian crude game entirely, leaving the market to potentially insolvent stand-ins.”

Book explained that part of the narrowing of the discount is a result of Russian oil finding additional buyers, including India and China.

Record volumes of sanctioned Russian oil were carried by the “dark fleet” and known sanctioned tankers without known insurance over September, according to a recent report from Lloyd’s List.

The Lloyd’s List Intelligence unit analysis of data from energy cargo tracking firm Vortexa revealed that 69% of all crude shipped in September was carried on dark fleet tankers and 18% was carried on tankers owned by Russian government-controlled Sovcomflot. It is the most volume moved since tracking of the monthly dark fleet data began in mid-2022 (measured by deadweight capacity of vessels.) In May, 54% was recorded, the previous high.

Chinese and Indian oil traders, refiners, and port authorities were the drivers of this growth.

Lloyd’s List determines if a tanker is part of the dark fleet based on factors including if the ship is 15 years or older, is anonymously owned or has a corporate structure designed to conceal ownership, is handling sanctioned oil trade, and is using deceptive shipping practices. Its analysis showed a flurry of flag-hopping, where a vessel changes its country registration, as well as ownership and management changes amongst the vessels in the dark fleet to avoid detection.

The dark fleet data does not include Russia’s Sovcomflot or Iran’s National Iranian Tanker Co.

Its data revealed that 5% of all Russian oil in September was transported by 11 tankers, with nine of those vessels sanctioned by the UK or EU between July and September and owned by the Russian government-controlled tanker company Sovcomflot. The remaining vessels were sanctioned by the U.S. Office of Foreign Assets Control for breaching sanctions on Syrian and Iranian oil. Those vessels are the Eternal Peace and Nebulax.

Some of the Sovcomflot tankers that Lloyd’s List identified in its report were sanctioned by the UK or EU between July and September. Some tankers changed vessel names, reflagged the vessel’s origin to Barbados, or redomiciled registered ownership to Seychelles and changed their ship management to a newly incorporated UAE-based ship manager, Avebury Shipmanagement.

Greece-owned tankers have shipped 23% of oil from Russia in September, consistently over the last three months, according to Lloyd’s List. The majority of the UK- and EU-sanctioned tankers have already discharged their oil in China.

Andy Lipow, president of Lipow Oil Associates, said despite the price cap, some ship owners have decided that it was extremely profitable to have their vessels become part of the dark fleet and risk United States and EU sanctions.

“After all, Russian oil continues to be purchased by Chinese and Indian refiners with little repercussions from the U.S. or EU,” said Lipow.

A Treasury spokesperson told CNBC, “Two years since the price cap was implemented, it is unsurprising that Putin is still sinking money into building and maintaining a shadow fleet to escape the Coalition’s sanctions: that evasion costs the Kremlin, and diverts money that would otherwise be going to the battlefield. The Price Cap Coalition continues to engage with industry to ensure compliance with the price cap and to increase Putin’s costs of going outside it.”

The number of uninsured vessels carrying sanctioned oil also increased, according to Lloyd’s List, with some 201 of the 310 tankers tracked not having insurance with the 12 clubs that form the International Group of P&I Clubs. That represented 68% of the vessels when measured by deadweight, and the lowest number of tankers tracked with IG club insurance, surpassing 67% uninsured recorded in July and August.

Lipow said the oil market is pricing in a greater probability of a war between Iran and Israel that could impact supply.

“The biggest risk to the oil market is the closure of the Straits of Hormuz, and while unlikely, if it were to happen, oil prices would rise $30 per barrel,” he said. Despite the hostilities, oil prices remain under pressure, he said, as increased production from the U.S., Canada and Guyana adds to the supply picture while OPEC+ delays the restoration of its production cuts.

The increased use of dark fleet vessels comes with greater maritime safety and environmental risks.

Lloyd’s List warned in a recent note that shipping safety has become a “casualty of economic sanctions” with attempts to enhance sanctions policy leading to greater ranks of tankers determined to evade it.

Insurance giant Allianz said in May that dark fleet tankers had been linked to more than 50 accidents.

Lipow told CNBC if these vessels were to be involved in an accident that resulted in an oil spill, the owners — assuming they could be identified and found — would simply walk away, leaving the mess and subsequently the cleanup for someone else to do.

Science & Environment

WTI, Brent fall after China press briefing

Crude oil futures fell more than 2% on Monday after a press briefing by China’s finance minister disappointed the market.

Traders have been banking on more robust stimulus in China to boost the world’s second-largest economy. Soft demand in the world’s largest crude importer has weighed on the market for months.

“China’s monetary stimulus measures failed to stimulate and the weekend’s pledge from the finance ministry to borrow more was long on cliches and phrases but short on reassuring and convincing details,” Tamas Varga, analyst at oil broker PVM, told clients in a note.

Here are Monday’s energy prices:

- West Texas Intermediate November contract: $73.93 per barrel, down $1.63, or 2.16%. Year to date, U.S. crude oil has gained about 3%.

- Brent December contract: $77.44 per barrel, down $1.60, or 2.02%. Year to date, the global benchmark is little changed.

- RBOB Gasoline November contract: $2.1044 per gallon, down 2.19%. Year to date, gasoline is little changed.

- Natural Gas November contract: $2.572 per thousand cubic feet, down 2.28%. Year to date, gas is ahead more than 2%.

The market, meanwhile, continues to monitor the Middle East in anticipation of a retaliatory strike by Israel against Iran. U.S. officials told NBC News that Israel has narrowed down the targets it plans to hit. These include military and energy infrastructure, the officials told NBC.

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment4 weeks ago

Science & Environment4 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLiquid crystals could improve quantum communication devices

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA slight curve helps rocks make the biggest splash

-

News4 weeks ago

the pick of new debut fiction

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLaser helps turn an electron into a coil of mass and charge

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

News4 weeks ago

News4 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News4 weeks ago

News4 weeks agoYou’re a Hypocrite, And So Am I

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Sport4 weeks ago

Sport4 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News4 weeks ago

News4 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News4 weeks ago

News4 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Technology3 weeks ago

Technology3 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoRethinking space and time could let us do away with dark matter

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

News4 weeks ago

News4 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCardano founder to meet Argentina president Javier Milei

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Technology3 weeks ago

Technology3 weeks agoGet ready for Meta Connect

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists have worked out how to melt any material

-

Sport4 weeks ago

Sport4 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News4 weeks ago

News4 weeks agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Business4 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics4 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

Entertainment1 week ago

Entertainment1 week agoChristopher Ciccone, artist and Madonna’s younger brother, dies at 63

-

News4 weeks ago

News4 weeks agoChurch same-sex split affecting bishop appointments

-

Politics4 weeks ago

Politics4 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

News4 weeks ago

News4 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTiny magnet could help measure gravity on the quantum scale

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

News4 weeks ago

News4 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow one theory ties together everything we know about the universe

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Business4 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News3 weeks ago

News3 weeks agoShocking ‘kidnap’ sees man, 87, bundled into car, blindfolded & thrown onto dark road as two arrested

-

Politics3 weeks ago

Politics3 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

News3 weeks ago

News3 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology4 weeks ago

Technology4 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

You must be logged in to post a comment Login