Science & Environment

Oil slides over 4% as Israel’s attack on Iran unlikely to disrupt supplies

View of Iran’s oil industry installations in Mahshahr, Khuzestan province, southern Iran.

Kaveh Kazemi | Getty Images

Oil prices will remain under pressure for the rest of this year, it may be difficult to see Brent crude oil prices reaching $80 in the foreseeable future.

Andy Lipow

president at Lipow Oil Associates

“The recent Israel military action is unlikely to be seen by the market as leading to an escalation that impacts oil supply,” Citi analysts wrote in a note on Monday, cutting the bank’s Brent oil forecast by $4 to $70 per barrel over the next three months.

Oil markets are also staring at an oversupply. “With Israel deliberately, and perhaps with some American encouragement, avoiding the targeting of crude oil facilities, the oil market is back to looking at an oversupplied market,” said Andy Lipow, president at Lipow Oil Associates.

Oil production has been increasing not just in key countries such as U.S., Canada and Brazil, but even among smaller players such as Argentina and Senegal, he added.

“Oil prices will remain under pressure for the rest of this year, it may be difficult to see Brent crude oil prices reaching $80 in the foreseeable future,” Lipow told CNBC via email.

The risk premium has come off a few dollars a barrel as the more limited nature of the strikes, including avoiding oil infrastructure, have raised hopes for a de-escalatory pathway, said Saul Kavonic, an energy analyst at MST Marquee.

Oil prices year-to-date

The spotlight now will be on whether Iran will counter the attack in the coming weeks, which would see risk premium rise again, Kavonic told CNBC, noting that the overall trend still remains one of escalation, with the scope for another round of attacks remaining high.

During a cabinet meeting on Sunday, Iranian President Masoud Pezeshkian emphasized Iran’s right to react to Israel’s attack, but maintained that they do not seek war.

“We do not seek war, but we will defend our country and the rights of our people. We will give a proportionate response to the aggression,” he said.

Market attention will turn to Hamas‑Israel and Israel‑Hezbollah ceasefire talks that resumed over the weekend, director of mining and energy commodities research at Commonwealth Bank of Australia, Vivek Dhar said.

“Despite Israel’s choice of a low‑aggression response to Iran, we have doubts that Israel and Iran’s proxies (i.e. Hamas and Hezbollah) are on track for an enduring ceasefire,” Dhar wrote in a note.

Science & Environment

Big cut in UK emissions needed, says watchdog

Reuters

ReutersThe UK needs to make huge cuts to its greenhouse gas emissions this decade to help the world avoid the worst impacts of rising temperatures, the government’s climate watchdog has said.

The Climate Change Committee (CCC) says the UK has the technologies to do this, but meeting the goal would require much greater investment in renewable energy, electric cars and heat pumps.

While the UK has already cut its emissions by more than 50% since 1990, the CCC says it should extend this to 81% by 2035, which would make a “credible contribution” to the international goal of limiting global warming to 1.5C.

A spokesperson said the government would carefully consider the CCC’s advice.

If the government commits to the suggested target, it would represent a significant advance on the UK’s current international pledge to cut emissions by 68% by 2030.

It is, however, broadly in line with the UK’s legally-binding carbon-cutting path towards net zero emissions by 2050.

These figures do not include emissions from products manufactured abroad and imported, nor those from international flights and shipping, in line with UN standards.

The UK’s relative success so far has been largely down to cleaning up electricity, with progress in other areas, such as home heating, proving more difficult.

But the CCC is confident that the UK’s targets are still possible.

“All the core technologies have got cheaper, and they keep getting cheaper, and that’s what gives us more and more confidence that we’ll be able to achieve this very ambitious level of emissions reductions,” Nigel Topping, member of the CCC, told BBC News Climate Editor Justin Rowlatt.

‘Climate leadership’ ahead of COP29

As part of global agreements to tackle climate change, countries have to submit new carbon-cutting targets by early next year.

But the government is expected to announce its new target early, at the upcoming UN climate conference (COP29) in Azerbaijan in November.

It hopes this will set the ball rolling and encourage other nations to ramp up their plans.

“Britain is back in the business of climate leadership,” a spokesperson for the Department for Energy Security and Net Zero said.

The focus of COP29, though, will be money.

There are hopes for a new deal on the funds that richer countries – largely responsible for global warming – should give to poorer nations to help them tackle climate change.

The CCC calls for the UK to commit its fair share of money in line with its leadership ambitions.

It also says that the government should improve preparations for the impacts of rising temperatures back home.

Science & Environment

How to play the market for small nuclear reactors that tech is creating

Science & Environment

Jim Cramer’s top 10 things to watch in the stock market Friday

Hand bags are displayed at Macy’s Herald Square store on December 17, 2023 in New York City.

Kena Betancur | Corbis News | Getty Images

My top 10 things to watch Friday, Oct. 25

1. Wall Street is on pace for a higher open as the yield on the benchmark 10-year Treasury note was little changed, hovering just below 4.2%. The bond market has been a thorn in the side of equities lately. The Nasdaq, S&P 500 and Dow enter Friday lower for the week.

2. The Federal Trade Commission picked up a huge win when a U.S. judge blocked the $8.5 billion merger between Tapestry, which owns brands including Coach and Kate Spade, and Capri Holdings, which owns Versace and Michael Kors. The judge said the tie-up would reduce competition in the market for so-called affordable luxury handbags.

3. Tesla shares have more room to run, even after posting their best day in more than a decade Thursday, up nearly 22% in response to earnings. The reason is Elon Musk’s electric vehicle maker is much further along on self-driving technology than people think. Club holding Nvidia‘s chips help power Tesla’s self-driving systems.

Science & Environment

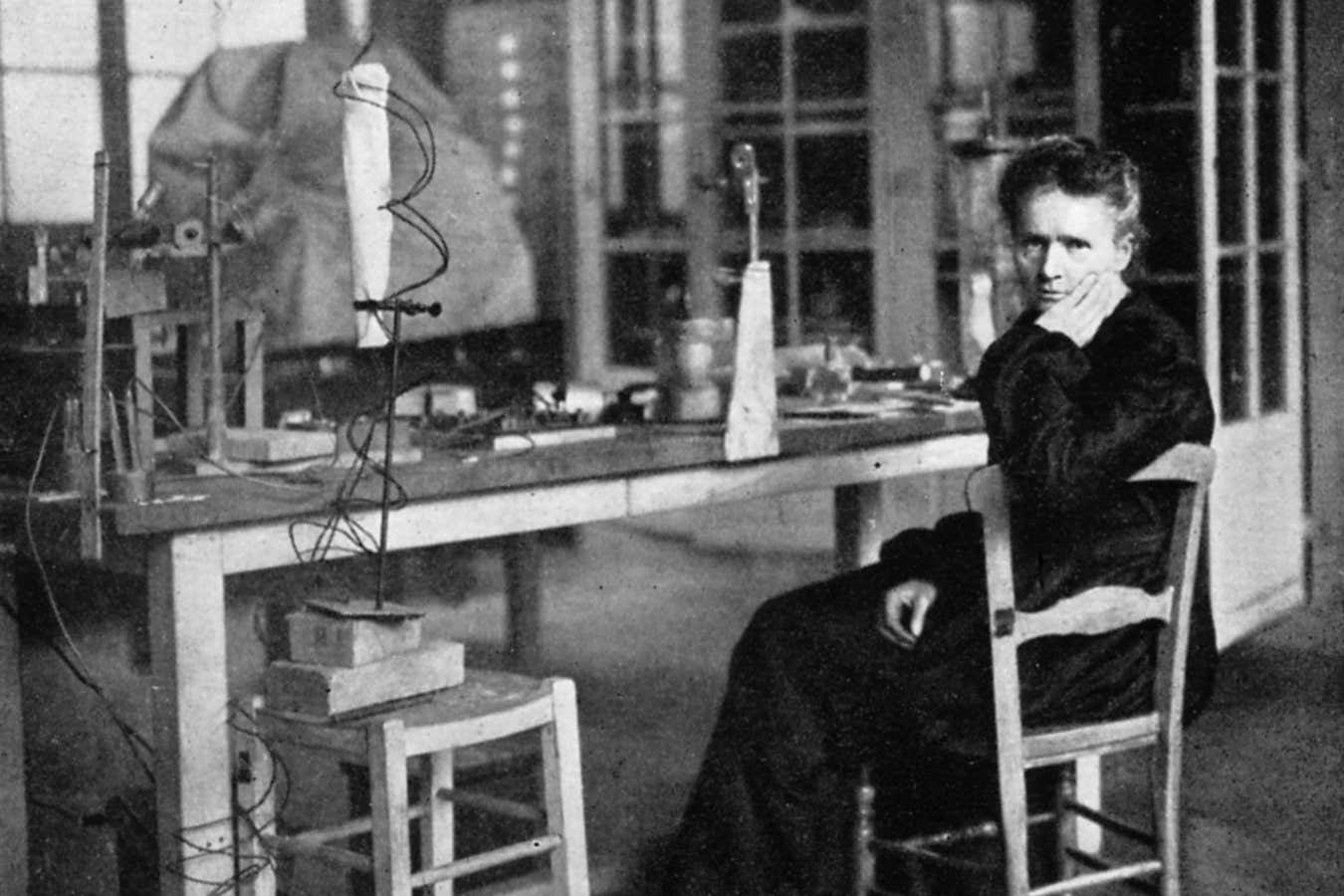

The Elements of Marie Curie review: Dava Sobel’s biography of Marie Curie shows how she helped women into science

Marie Curie pictured at work in her laboratory in Paris, in 1912

Universal History Archive/Getty Images

The Elements of Marie Curie

Dava Sobel (Fourth Estate, UK; Grove Atlantic, US)

ON 7 November 1867, Marya Salomea Sklodowska was born in Warsaw, then part of the Russian Empire. She was the youngest of five children, and became known as “Manya” by her family.

She was a voraciously curious child who learned to read at the age of 4 and developed a fascination with science, thanks in large part to her father, a teacher of physics and mathematics. Even so, no one could…

Science & Environment

China’s steel exports expected to falter in 2025 as pain from tariffs spread

JIUJIANG, CHINA – JUNE 17: A worker manufactures seamless steel gas cylinders for export at the workshop of Sinoma Science & Technology (Jiujiang) Co., Ltd. on June 17, 2024 in Jiujiang, Jiangxi Province of China.

Wei Dongsheng | Visual China Group | Getty Images

China’s steel exports will soon hit an eight-year high, before sweeping tariffs sink in and drag down the industry in 2025, industry watchers said.

As the biggest exporter of steel, China accounts for about 55% of the world’s steel production. The country’s steel exports have been surging this year and are expected to smash through the 100 million metric ton mark, matching levels last seen in 2016.

Strategists at Macquarie Capital predicted that China’s steel exports will reach 109 million tons this year, before declining to 96 million tons in 2025. Trade tariffs could further curb China’s steel exports, “albeit this may require a while to play out,” analysts from the the investment bank told CNBC.

Their predictions were echoed by analysts interviewed by Citigroup. China’s steel shipment is “skewed to the downside” from next year and onwards due anti-dumping measures, Ren Zhuqian, an analyst from steel consultancy Mysteel, said in a Citigroup note this month.

Foreign markets have been particularly crucial amid a domestic supply glut, as China’s economy grapples with a prolonged property crisis and slowdown in manufacturing activities.

In September, China’s steel exports jumped 26% from a year ago to 10.2 million tons, surpassing the 10-million ton a month benchmark that was last hit in June 2016. In the first nine months of the year, exports rose 21.2% year on year to 80.7 million tons, according to the customs data last week.

After hitting a record high of 112 million tons in 2015, the country’s steel exports had been on a multi-year slide before it started improving in 2020.

Steel export growth has accelerated ever since, propelled by a lack of domestic demand, even as overall export growth in China slowed sharply in September on the back of a series of disappointing data that pointed to a weak economy.

Anti-dumping ‘Wac-A-Mole’

Floods of cheap steel from China had sparked concern among its trading partners of unfair competition for domestic steelmakers. More and more have ramped up anti-dumping measures, including hefty tariffs.

Steel producers in importing countries have been “under massive strain,” said Chim Lee, senior analyst at the Economist Intelligence Unit, especially those in Southeast Asia and the Middle East.

Thailand expanded anti-dumping duties to 31% on hot-rolled coil, high-strength steel used for critical infrastructure construction, from China in August. Mexico imposed a nearly 80% tariff on some Chinese steel imports late last year.

This month, Brazilian government imposed 25% tariffs on all steel products from the country. And Canada’s 25% surtax on Chinese steel products, which it announced in August, came into effect on Tuesday.

These kinds of protectionism measures tend to have short-lived impacts, said Tomas Gutierrez, head of data at consultancy Kallanish Commodities, as steel exporters resort to measures such as “circumvention,” shaking off the China-label by making transits through a third-party country.

We see a ‘whac-a-mole’ scenario: when one country starts to limit steel imports from China, Chinese steel producers are likely to redirect them to another country until that market, too, imposes new trade restrictions.

Chim Lee

Senior analyst, Economist Intelligence Unit

But Vietnam’s ongoing anti-dumping probe into hot-rolled coil could derail China’s export momentum as it “impacts a much higher volume of Chinese steel,” Gutierrez said.

Vietnam is a major importer of Chinese steel, consuming about 10% of the country’s steel exports in 2023, according to a Mysteel report. Other top destination markets include Thailand, India and Brazil.

Last month, Indian government ordered tariffs of between 12% and 30% on some steel products imported from China and Vietnam, escalating an anti-dumping duty it imposed on Chinese steels last year.

“We see a Whac-A-Mole scenario,” EIU’s Chim said. The tariffs lead Chinese steel producers to redirect to alternative markets, “until that market, too, imposes new trade restrictions.”

U.S. President Joe Biden’s administration called for tripling tariffs on Chinese steel in April, and Republican presidential nominee Donald Trump said he could raise tariffs by 60% on Chinese goods if re-elected next month.

But the impact of these threats from Washington would be rather limited, as less than 1 percent of Chinese steel exports, worth $85 billion, were shipped to the U.S. in 2023.

Dwindling demand

For the first time in six years, the World Steel Association this month forecast that China’s domestic steel demand this year would account for less than half of global demand, citing “the ongoing downturn” in the country’s real estate sector.

China’s property-related steel demand may not see a substantial improvement until 2025 or 2026, EIU’s Chim said, as Beijing seeks to curb new housing supplies while clearing existing housing inventories.

New construction starts, the most steel intensive part of the property construction process, will continue to be very weak, Chim said.

Meanwhile, he added, state-led infrastructure investment, which has increasingly pivoted away from roads and railways to energy infrastructure, is unlikely to fill the gap left by home builders.

More domestic steelmakers had scaled back production given poor profitability on steel sales. Almost three-quarters of Chinese steel companies reported losses in the first six months this year, with many at risks of bankruptcy.

China’s production of medium-thick hot-rolled coil — a proxy of flat steel products — fell 5.4% from the prior month in September, and 6.4% on year, according to S&P Global, which cited official customs data.

On escalating trade tensions, a spokesperson for China’s customs administration said a majority of Chinese steel products were to meet domestic demand, before receding that the hard-rolled coils “would have broad appeal in overseas market,” due to continuous innovation and product upgrades in the industry.

A possible tax crackdown

Beijing’s possible crackdown on value-added tax could make matters worse for China’s steel industry.

This year, steel mills have been under pressure from regulators over allegations that they skirted taxes to make exports even cheaper.

Authorities had set up an investigative team to crack down on these “illegal” steel exports, Luo Tiejun, vice president of the state-backed Iron and Steel Industry Association, said in a meeting last week.

“If China really followed through [with the investigation], Chinese exports would be much less competitive and export volumes could come down,” Gutierrez said. But the government may not have the “confidence” for that yet.

Science & Environment

‘consistent and coherent energy policy’ matters

With a historic presidential election just around the corner, Chevron CEO Mike Wirth told CNBC’s Jim Cramer what kind of government action is important for his company.

“What really matters is consistent and coherent energy policy,” he said. “Affordable and reliable energy is essential to keeping inflation at a level that economies can handle — and that’s why we need investments, and we need stable policy to encourage that investment.”

Wirth stressed that energy is a vital part of the global economy, saying that if supplies are constrained by political actions, it can trigger inflationary reactions across the board. The price of energy, he continued, is “embedded in everything,” and he said other countries are looking to the U.S. for long term commitments about energy and investment in the global supply.

According to Wirth, Chevron is apolitical and tries to work with both parties. He said there are legislators from both sides of aisle — usually from energy producing states — that understand his company’s needs. He said Chevron wants to see people elected to office that believe in free markets, competition and “the economic vitality of this country.”

He also stressed that electricity demand in the U.S. will continue to grow, saying there will be a need for all kinds of power, including wind, solar and natural gas. He added that even though electric vehicles are becoming more popular, combustion engines remain important and produced en masse. And Chevron’s oil has purposes beyond gasoline, he continued. For example, he said, oil helps create petrochemicals which are used for a variety of manufacturing purposes, including to create materials for EVs.

“There’s room for all of it. We’re going to need all of it,” he said, “I want to see every solution that is economic and feasible come to bear.”

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Technology4 weeks ago

Technology4 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

TV4 weeks ago

TV4 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Sport4 weeks ago

Sport4 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Football4 weeks ago

Football4 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

MMA4 weeks ago

MMA4 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology4 weeks ago

Technology4 weeks agoGmail gets redesigned summary cards with more data & features

-

Football4 weeks ago

Football4 weeks agoWhy does Prince William support Aston Villa?

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology4 weeks ago

Technology4 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Technology4 weeks ago

Technology4 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Business4 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology4 weeks ago

Technology4 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology4 weeks ago

Technology4 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News4 weeks ago

News4 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Sport4 weeks ago

Sport4 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Technology4 weeks ago

Technology4 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Business4 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

News3 weeks ago

News3 weeks agoCornell is about to deport a student over Palestine activism

-

Sport4 weeks ago

Sport4 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

MMA4 weeks ago

MMA4 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

News4 weeks ago

News4 weeks agoRwanda restricts funeral sizes following outbreak

-

Business4 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business4 weeks ago

Business4 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Business4 weeks ago

Business4 weeks agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Technology3 weeks ago

Technology3 weeks agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Technology3 weeks ago

Technology3 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Technology4 weeks ago

Technology4 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

MMA3 weeks ago

MMA3 weeks ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Sport4 weeks ago

Sport4 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMarkets watch for dangers of further escalation

-

Football4 weeks ago

Football4 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Politics4 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Business4 weeks ago

how UniCredit built its Commerzbank stake

-

MMA4 weeks ago

MMA4 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

News4 weeks ago

News4 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology4 weeks ago

Technology4 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Technology4 weeks ago

Technology4 weeks agoSingleStore’s BryteFlow acquisition targets data integration

-

Sport4 weeks ago

Sport4 weeks agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Technology3 weeks ago

Technology3 weeks agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

You must be logged in to post a comment Login