Science & Environment

Polar bears face higher risk of disease in a warming Arctic

USGS

USGSAs the Arctic warms, polar bears face a growing risk of contracting viruses, bacteria and parasites that they were less likely to encounter just 30 years ago, research has revealed.

In a study that has provided clues about how polar bear disease could be linked to ice loss, scientists examined blood samples from bears in the Chukchi Sea – between Alaska and Russia.

They analysed samples that had been gathered between 1987 and 1994, then collected and studied samples three decades later – between 2008 and 2017.

The researchers found that significantly more of the recent blood samples contained chemical signals that bears had been infected with one of five viruses, bacteria or parasites.

USGS

USGSIt is difficult to know, from blood samples, how the bears’ physical health was affected, but wildlife biologist Dr Karyn Rode from the US Geological Survey said it showed that something was changing throughout the whole Arctic ecosystem.

The researchers tested for six different pathogens in total – viruses, bacteria or parasites that are primarily associated with land-based animals but have been recorded before in marine animals, including species that polar bears hunt.

The study covered three decades, Dr Rode said, “when there had been a substantial loss of sea ice and there’s been increased land use in [this population of polar bears]”.

“So we wanted to know if exposure had changed – particularly for some of these pathogens that we think are primarily land-oriented.”

The five pathogens, as disease-causing agents are collectively called, that have become more common in polar bears, are two parasites that cause toxoplasmosis and neosporosis, two types of bacteria that cause rabbit fever and brucellosis, and the virus that causes canine distemper.

“Bears in general are pretty robust to disease,” explained Dr Rode. “It’s not typically been known to affect bear population, but I think what it just highlights is that things [in the Arctic] are changing.”

Key polar bear facts

- There are about 26,000 polar bears left in the world, with the majority in Canada. Populations are also found in the US, Russia, Greenland and Norway

- Polar bears are listed as vulnerable to extinction by the International Union for Conservation of Nature, with climate change a key factor in their decline

- Adult males can grow to be around 3m long and can weigh close to 600kg

- Polar bears can eat up to 45kg of blubber in one sitting

- These bears have a powerful sense of smell and can sniff out prey from up to 16km away

- They are strong swimmers and have been spotted up to 100km offshore. They can swim at speeds of around 10km per hour, due in part to their paws being slightly webbed

USGS

USGSIn the US, polar bears are classified as a threatened species; scientists say the biggest threat to their future is the continuing loss of sea ice habitat, which they depend on as a platform from which to pounce on their marine prey.

Previous research using collar cameras on bears has shown that, as they spend more of the year on land – when there is no available sea ice to hunt from – the bears are unable to find enough calories.

Dr Rode explained that polar bears are top predators: “Our study suggested that they’re getting their exposure to some pathogens primarily through their prey species.

“So what we saw as changes in pathogen exposure for polar bears is indicative of changes that other species are also experiencing.”

The findings are published in the scientific journal PLOS One.

Science & Environment

What happened when a rock as big as London hit Earth?

Getty Images

Getty ImagesA huge meteorite first discovered in 2014 caused a tsunami bigger than any in known human history and boiled the oceans, scientists have discovered.

The space rock, which was 200 times the size of the one that wiped out the dinosaurs, smashed into Earth when our planet was in its infancy three billion years ago.

Carrying sledge hammers, scientists hiked to the impact site in South Africa to chisel off chunks of rock to understand the crash.

The team also found evidence that massive asteroid impacts did not bring only destruction to Earth – they helped early life thrive.

“We know that after Earth first formed there was still a lot of debris flying around space that would be smashing into Earth,” says Prof Nadja Drabon from Harvard university, lead author of the new research.

“But now we have found that life was really resilient in the wake of some of these giant impacts, and that it actually bloomed and thrived,” she says.

The meteorite S2 was much larger than the space rock we are most familiar with. The one that led to the dinosaurs’ extinction 66 million years ago was about 10km wide, or almost the height of Mount Everest.

But S2 was 40-60km wide and its mass was 50-200 times greater.

It struck when Earth was still in its early years and looked very different. It was a water world with just a few continents sticking out of the sea. Life was very simple – microorganisms composed of single cells.

Nadja Drabon

Nadja DrabonThe impact site in Eastern Barberton Greenbelt is one of the oldest places on Earth with remnants of a meteorite crash.

Prof Drabon travelled there three times with her colleagues, driving as far as possible into the remote mountains before hiking the rest of the way with backpacks.

Rangers accompanied them with machine guns to protect them against wild animals like elephants or rhinos, or even poachers in the national park.

They were looking for spherule particles, or tiny fragments of rock, left behind by impact. Using sledge hammers, they collected hundreds of kilograms of rock and took them back to labs for analysis.

Prof Drabon stowed the most precious pieces in her luggage.

“I usually get stopped by security, but I give them a big spiel about how exciting the science is and then they get really bored and let me through,” she says.

Nadja Drabon

Nadja DrabonThe team have now re-constructed just what the S2 meteorite did when it violently careened into Earth. It gouged out a 500km crater and pulverised rocks that ejected at incredibly fast speeds to form a cloud that circled around the globe.

“Imagine a rain cloud, but instead of water droplets coming down, it’s like molten rock droplets raining out of the sky,” says Prof Drabon.

A huge tsunami would have swept across the globe, ripped up the sea floor, and flooded coastlines.

The 2004 Indian Ocean tsunami would have paled in comparison, suggests Prof Drabon.

All that energy would have generated massive amounts of heat that boiled the oceans causing up to tens of metres of water to evaporate. It would also have increased air temperatures by up to 100C.

The skies would have turned black, choked with dust and particles. Without sunlight penetrating the darkness, simple life on land or in shallow water that relied on photosynthesis would have been wiped out.

Nadja Drabon

Nadja DrabonThese impacts are similar to what geologists have found about other big meteorite impacts and what was suspected for S2.

But what Prof Drabon and her team found next was surprising. The rock evidence showed that the violent disturbances churned up nutrients like phosphorus and iron that fed simple organisms.

“Life was not only resilient, but actually bounced back really quickly and thrived,” she says.

“It’s like when you brush your teeth in the morning. It kills 99.9% of bacteria, but by the evening they’re all back, right?” she says.

The new findings suggest that the big impacts were like a giant fertiliser, sending essential ingredients for life like phosphorus around the globe.

The tsunami sweeping the planet would also have brought iron-rich water from the depths to the surface, giving early microbes extra energy.

The findings add to a growing view among scientists that early life was actually helped by the violent succession of rocks striking Earth in its early years, Prof Drabon says.

“It seems that life after the impact actually encountered really favourable conditions that allowed it to bloom,” she explains.

The findings are published in the scientific journal PNAS.

Science & Environment

NextEra sees strong data center interest in restarting Iowa nuclear plant, CEO says

John Ketchum, chairman, president and chief executive officer of Nextera Energy, speaks during the 2023 CERAWeek by S&P Global conference in Houston, Texas, US, on Wednesday, March 8, 2023.

F. Carter Smith | Bloomberg | Getty Images

NextEra Energy is seeing strong interest from data center customers in restarting the Duane Arnold nuclear plant in Iowa, CEO John Ketchum said Wednesday.

“We are very busy looking at Duane Arnold,” Ketchum told investors during the company’s third-quarter earnings call. “We’re very interested in recommissioning the plant.”

NextEra is conducting engineering assessments on the plant and is working with the Nuclear Regulatory Commission and local stakeholders on evaluating a possible restart, the CEO said.

“Obviously, it goes without saying, there’s very strong interest from customers, really data center customers in particular around that site,” Ketchum said.

The CEO said in July that NextEra was weighing whether to restart Duane Arnold. He cautioned at the time, however, that the company would only do so if the project was “essentially risk free.”

The Duane Arnold Energy Center northwest of Cedar Rapids, Iowa ceased operations in 2020 after more than 40 years of service. The nuclear industry in the U.S. faced a wave of reactor shutdowns over the past decade as they struggled to compete against cheap natural gas.

But power companies are pressing ahead with restarting recently shuttered nuclear plants as electricity demand surges from data centers, manufacturing and the electrification of the economy.

Ketchum’s comments on Duane Arnold come a month after Constellation Energy unveiled plans to restart the Three Mile Island nuclear plant in Pennsylvania in 2028 through an agreement with Microsoft.

Tech giants such as Microsoft are grappling with massive power needs as they scale up artificial intelligence. Nuclear is attracting growing interest from tech companies because reactors provide large quantities of reliable, carbon-free power. Alphabet’s Google and Amazon recently announced investments in next-generation small nuclear reactors.

Holtec International, a privately held nuclear technology company, blazed the trail for restarting reactors with the Palisades plant in Michigan. Holtec expects that plant to come back online toward the end of 2025. It would be the first nuclear plant in U.S. history to restart after shutting down.

Science & Environment

Big Tech is driving a nuclear power revival, energy guru Dan Yergin says

In this aerial view, the shuttered Three Mile Island nuclear power plant stands in the middle of the Susquehanna River near Middletown, Pennsylvania, on Oct. 10, 2024.

Chip Somodevilla | Getty Images

Nuclear power may be making a comeback in the U.S. after years of setbacks — and big tech is the driving force.

As tech giants like Microsoft, Amazon and Google compete to take the lead in the AI revolution, the data centers needed to power the burgeoning technology consume an ever-increasing amount of energy.

In the last two months, those three companies have penned deals to generate more nuclear power — perhaps most notably, Microsoft struck a 20-year agreement with Constellation Energy to restart a reactor at Three Mile Island in Pennsylvania, the site of the most serious nuclear meltdown in U.S. history in 1979. The reopening is planned for 2028.

Speaking to CNBC at the annual International Monetary Fund meetings in Washington, long-time energy market veteran Dan Yergin described the turnaround as nothing short of extraordinary.

“It’s amazing, the change. The nuclear industry was in the doldrums,” Yergin told CNBC’s Karen Tso on Tuesday, describing the reopening of the Three Mile Island power plant as “symbolic.”

“Big Tech is saying, ‘We need reliable 24 hour electricity. We can’t get it just from wind and solar’,” he said.

Yergin, who has written several books on energy including “The Prize” and “The New Map,” pointed to the booming funding going into the sector. He cited $7 billion in venture capital going into nuclear fusion alone — which does not include financing for nuclear fission, a different energy-generating process.

“This is a really big change, and it reflects in this country, in the United States, a sense that — we’ve had for, really, a generation of flat demand [for] electricity,” Yergin said. “Now it’s going to grow, and there’s real anxiety about, how do you grow it? And nuclear [energy] is back in form, and people are talking about small nuclear reactors. And, of course, you have big tech actually seeking to contract for the output of the electricity from existing nuclear power plants. It’s an amazing change.”

Electricity demand is surging after staying largely flat for some 15 years, fueled by new data centers, factories, electric vehicles, and hotter and longer summers. A recent Energy Department memo cited in numerous press reports projected that U.S. power grids could see as much as 25 gigawatts of new data center demand by 2030.

Recently, the U.S. Department of Energy announced it had closed a $1.5 billion loan for the revival of the Holtec Palisades nuclear plant in Michigan in late 2025, which would make it the first American nuclear plant to be restarted. Google in mid-October said it would purchase power from Kairos Power, a developer of small modular reactors, to help “deliver on the progress of AI.”

Global electricity consumption from data centers, artificial intelligence and the cryptocurrency sector is expected to double from an estimated 460 terawatt-hours (TWh) in 2022 to more than 1,000 TWh in 2026, according to a research report from the International Energy Agency.

— CNBC’s Ryan Browne contributed to this report.

Science & Environment

Stripe’s $1.1 billion deal for Bridge marks much-needed win for VC

The Stripe logo on a smartphone with U.S. dollar banknotes in the background.

Budrul Chukrut | SOPA Images | LightRocket via Getty Images

In March 2022, venture capitalist Chris Ahn was pushing to get into a hot crypto startup that was trying to make it easy for businesses to transact using digital currencies.

The company was Bridge Network. As part of his pitch, Ahn flew to a small town in northern Montana with a term sheet in hand for founders Zach Abrams and Sean Yu, who had both previously worked at Coinbase and Block.

“Nobody else had flown out to see them in person,” Ahn, who was a partner at Index Ventures at the time, recounted in an interview on Tuesday.

The three of them hiked together on a path with melting snow, and then conversed over drinks and dinner, as Ahn aimed to convince the founding duo that they should take Index’s money. At the restaurant, he looked to seal the deal.

“I told them I was going to the bathroom, and I ran over to my car, grabbed the term sheet and came back,” Ahn said. “It’s hard to fit a piece of paper in a jacket without crumbling it, and I didn’t want to give them a crumpled piece of paper, so I left it in the car.”

Index landed the investment, getting into Bridge’s seed round in 2022. The firm was part of a more recent round, in August of this year, that included Sequoia and Ribbit Capital and valued Bridge at about $350 million, according to a person with knowledge of the matter who asked not to be named because the valuation was confidential. Also in the deal was Haun Ventures, founded by former Andreessen Horowitz partner Katie Haun.

Ahn left Index to join Haun in 2022. Both his old firm and his new employer have reason to celebrate this week, after Stripe agreed to buy Bridge for $1.1 billion. With that outcome, Index and Haun are poised to triple their investment in a matter of months.

An Index spokesperson declined to comment.

It’s a particularly notable exit for venture investors during an extended IPO drought, and marks a big win for crypto, which has had few of them despite bundles of cash pouring into the industry.

For Stripe, one of the most richly valued tech startups, the Bridge purchase will be its largest to date. Bridge said the transaction is still subject to regulatory approvals and other conditions and is expected to close in the coming months.

‘Serious about stablecoin’

Bridge describes itself as the Stripe of crypto, specializing in making it easier for businesses to accept stablecoin payments without having to directly deal in digital tokens. Stablecoins are a type of cryptocurrency whose value is pegged to the value of a real-world asset like the U.S. dollar. Customers include Coinbase and SpaceX.

“It’s a sign that Stripe is serious about stablecoins and crypto,” Ahn said. “Payments were the original use case for crypto, and it’s finally here.”

Stripe is paying a hefty premium.

Investors familiar with Bridge’s financials said annual revenue is in the range of $10 million to $15 million. At the low end of the range, that’s a multiple of 110 times revenue, and at the high end, it’s a revenue multiple of over 70.

“The reason why Bridge is so valuable is because it’s prohibitively difficult for a company to use this new stablecoin tech without developer tools that makes the tech easy to use,” said Ahn.

Nic Carter of Castle Island Ventures said that while Bridge has rivals in the category, it’s the most successful stablecoin infrastructure business in the world, excluding the issuers like Circle and Tether.

“Almost every stablecoin startup we talk to is building on Bridge in some capacity whether it’s orchestration or issuance,” said Carter. “They are totally ubiquitous.”

Stripe saw its valuation plummet from $95 billion in 2021 to $50 billion last year, as private tech companies across the board took a major hit from the recalibration of the public markets. Its valuation reportedly rebounded to $70 billion this year as part of a secondary share sale.

Patrick Collison, chief executive officer and co-founder of Stripe Inc., left, smiles as John Collison, president and co-founder of Stripe Inc., speaks during a Bloomberg Studio 1.0 television interview in San Francisco, California, U.S., on Friday, March 23, 2018.

Bloomberg | Bloomberg | Getty Images

Brothers Patrick and John Collison, who founded Stripe in 2010, have intentionally steered clear of the IPO process and have given no indication that an offering is on the near-term horizon. They’ve got a big business, with total payment volume surpassing $1 trillion in 2023.

Given private market demand for the company’s stock, the company has been able to offer some liquidity to early investors and employees in other ways.

“The private markets have been so generous with providing capital and secondary liquidity to shareholders that, if I’m the Collison brothers and I’m sitting around the table, I’m thinking, ‘Why do I want to go public?’” said David Golden, a partner at Revolution Ventures who previously led JPMorgan Chase’s tech investment banking practice. “Why bother if the private markets are willing to reward you with basically public market premiums and valuations and let you have secondary sales to keep your employees happy?”

When asked to comment, Stripe referred CNBC to CEO Patrick Collison’s post on X about the deal.

Collison called stablecoins “room-temperature superconductors for financial services” in his post, and said that Stripe is going to build the world’s best stablecoin infrastructure.

Bernstein analysts are bullish on what the deal means for the $160 billion U.S. dollar-pegged stablecoin market, noting in a report that the acquisition “validates the usage and growth of stablecoins as a legit use case for public blockchains.”

WATCH: Ripple’s XRP drops as Chris Larsen reveals $10 million donation to Harris campaign

Science & Environment

Lilium faces insolvency as air taxi firm struggles to raise cash

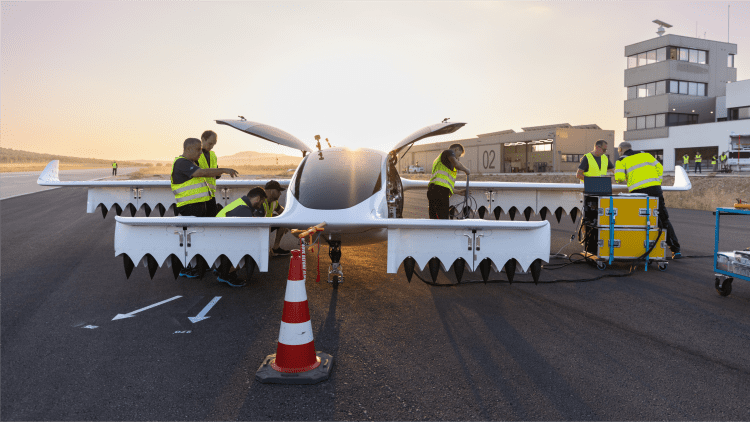

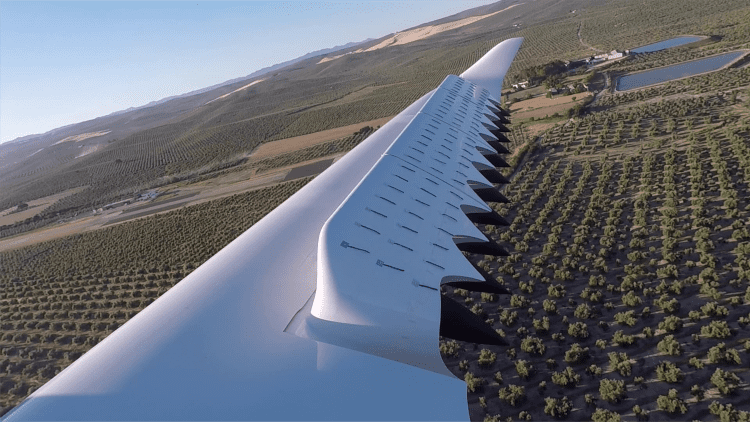

German company Lilium produces flying electric passenger drones.

Lilium

German aerospace startup Lilium faces insolvency if it doesn’t raise emergency funding from the state government for the southeastern state of Bavaria.

Insolvency would mark a dramatic fall for a startup once touted as Europe’s best chance at building the 21st-century equivalent of “cars” that can fly.

Lilium is one of a series of firms trying to build “eVTOLs,” or electric vertical take-off and landing, vehicles.

Popularly known as flying cars or air taxis, these vehicles are being developed by startups in the United States, Europe and Asia.

Today, however, Lilium is in trouble. The company is desperately trying to raise taxpayer funds in Germany. And so far, it’s been unsuccessful.

What happened?

Lilium has been negotiating an emergency capital injection with both Germany’s federal government and the Bavarian state government.

The firm had requested 50 million euros ($54 million) of loans from the federal government. However, its request was rejected by German lawmakers.

In a regulatory filing released last week, Lilium said it had “received indication that the budget committee of the parliament of the Federal Republic of Germany will not approve a €50 million guarantee of a contemplated €100 million convertible loan.”

The proposed state aid would have been issued by KfW, the German state-owned development bank.

Lilium is “continuing discussions with the Free State of Bavaria with respect to a guarantee of at least €50 million,” Lilium added in its filing.

A Lilium spokesperson told CNBC the company doesn’t plan to comment further beyond the statement outlined in its 6K filing.

In response to Germany’s decision to deny Lilium state aid, Hubert Aiwanger, Bavaria’s economy minister, criticized the move, saying it was “regrettable” that the federal government opted not to support the firm.

Danijel Višević, co-founder of Berlin-based climate technology investors World Fund, said that though it was “understandable” lawmakers denied Lilium support over concerns around the government supporting one single company over another, there was a misguided notion among politicians that air taxis are a “toy for millionaires.” This idea, he said, was “too short-sighted.”

Višević suggested it was unfair that U.S. electric car manufacturer Tesla — which burned through billions of dollars before making a profit — was once able to receive a U.S. government loan, but Lilium was not.

What Lilium tried to build

“Flying cars” perhaps isn’t the right term. But what Lilium was ultimately trying to bring to the world was a vertical take-off and landing aircraft that could fly people from one city to another to ease congestion on the roads.

The company initially wanted to roll out its own digital “hailing” service that would have seen users order rides on its jets from designated areas where it would be possible for the vehicle to take off and land.

Lilium subsequently decided to change its business model.

Rather than develop the whole service on its own, the company opted to partner up with airlines and airport operators, which would build out the service product and infrastructure needed to power its ambitions.

Lilium’s jets can cost as much as $9 million. The company also had a six-seater version in development, which would have set a buyer back about $7 million.

Lilium struck major deals with the likes of Lufthansa in Germany and Saudia in Saudi Arabia. It also agreed a tie-up with Groupe ADP, an international airport operator based in Paris.

Rise and fall

Founded by four university students in 2015, Lilium rapidly gained a reputation as one of Europe’s best-funded air taxi firms.

The company managed to raise hundreds of millions of dollars from investors including China’s Tencent, Atomico and Earlybird.

In September 2021, Lilium went public on the Nasdaq via a merger with a special purpose acquisition company called SPAC Qell.

At its height, Lilium was worth as much as $3.3 billion. Its shares have tanked to less than 50 cents — a more than 95% plunge from its stock market debut.

Science & Environment

COP16: What is biodiversity and how are we protecting it?

From 21 October until 1 November, delegates are meeting in Cali, Colombia to take stock of national pledges to protect nature, amid concerns countries are back-sliding on their promises.

Recent analysis suggests, external most countries are set to miss the deadline to submit new national action plans for preserving nature.

Key issues include the scale of ambition in meeting specific targets, finance for biodiversity projects in poorer countries and making sure profits from genetic resources are shared fairly.

Colombian environment minister, Susana Muhamad, who is overseeing the meeting, has set the theme, ‘Peace with Nature’, a call to rethink our relationship with the natural world.

Several presidents are expected to attend, including Brazil’s Luiz Inacio Lula da Silva and Mexico’s incoming president, Claudia Sheinbaum.

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Technology3 weeks ago

Technology3 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Technology4 weeks ago

Technology4 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

Business3 weeks ago

Can liberals be trusted with liberalism?

You must be logged in to post a comment Login