Science & Environment

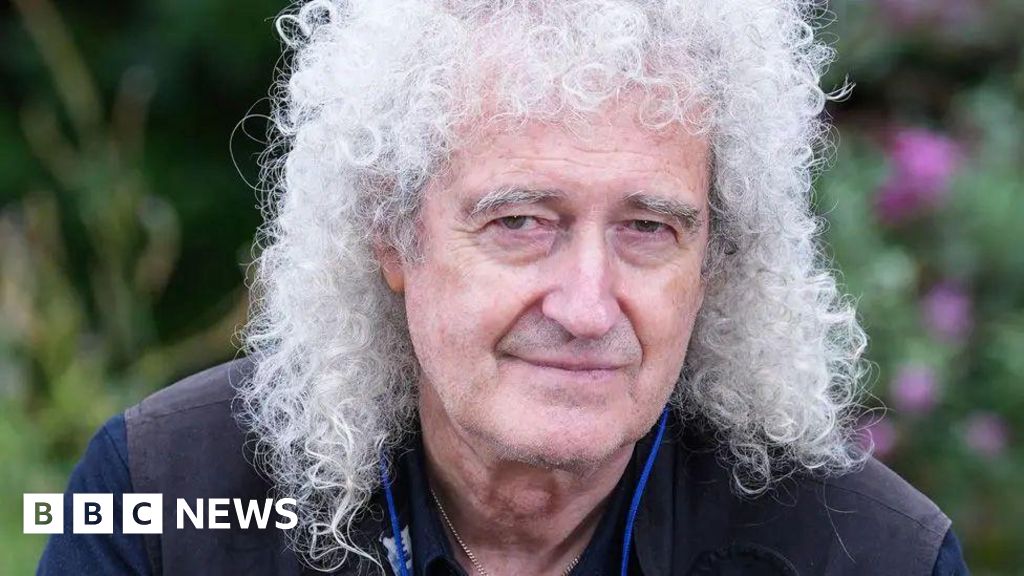

Queen guitarist Brian May quits as VP over food label

PA Media

PA MediaQueen guitarist Sir Brian May has quit as the RSPCA’s vice-president over what he called “damning evidence” of animal welfare failings related to its food certification label.

BBC News reported on Thursday that the association had to run spot checks on more than 200 ‘RSPCA Assured’ farms to ensure they met its own standards.

Animal welfare activists say their own undercover investigations found the scheme covering around 4,000 farms was failing to ensure even basic legal standards. They also want RSPCA president Chris Packham to stand down.

The RSPCA said it had “different views from Brian on how best to approach this complex challenge”.

The BBC has reached out to conservationist and TV presenter Mr Packham for comment.

Sir Brian, who has long campaigned on animal welfare issues and against the culling of badgers to protect farms from bovine TB, published his letter of resignation on Instagram.

In it, he said: “It is with profound sadness and not without massive soul-searching that today I have to offer my resignation as a vice-president of the RSPCA.”

He said he had been kept informed “of complaints that have been levelled in recent months at the RSPCA over appallingly bad standards of animal welfare in member farms of the RSPCA Assured scheme.

“I have understood that the RSPCA needed time to evaluate the evidence and make decisions on action to be taken.

Getty Images

Getty Images“But as more and more damning evidence comes to light, I find the RSPCA’s response completely inadequate.”

He added that as the supervision of the scheme had “failed”, it needed to be dismantled.

Allegations against around 40 farms in the RSPCA Assured scheme that were investigated by animal welfare activists included overcrowding, poor hygiene and in some cases, physical abuse of livestock by farm workers.

Chris Packham has also called for the scheme to be suspended but has not yet commented on his future in the role.

Claire Palmer, director of Animal Justice Project, one of 60 groups that sent an open letter on Thursday calling for the scheme to be abandoned, told the BBC that they were “relieved that Brian May has made the responsible decision to step down as Vice President”.

‘Robust action’

“Years of undercover investigations have revealed the systemic failures of the RSPCA Assured scheme. The RSPCA must be bold and take decisive action now,” she added.

The RSPCA Assured scheme – originally known as Freedom Food – was launched 30 years ago and covers meat, fish, eggs and dairy. Certified farms have to follow strict welfare standards that are set out by RSPCA welfare scientists and are higher than is legally required in the UK.

An RSPCA spokeswoman said it respects Sir Brian’s “views and understands his decision” before adding: “His ongoing and devoted work campaigning on issues such as the badger cull and hunting have been invaluable for all animals and we look forward to speaking up on these issues with him in the future.”

The spokeswoman also called farming “hard, and farmed animal welfare is even harder”.

But, she added, the RSPCA wanted to “give our supporters, partners and the public confidence that RSPCA Assured is consistently delivering better welfare than standard farming practices.

“So, we launched an independent review of RSPCA Assured, which has been carried out over several months, including unannounced visits to more than 200 members of the scheme.

“Once we have analysed our findings, we will take any robust action necessary.”

Science & Environment

WTI heads for weekly loss as supplies rise

U.S. crude oil on Friday was on pace for its first weekly loss in three weeks, as the prospect of growing oil supplies from Saudi Arabia overshadowed China’s efforts to stimulate its economy.

The U.S. benchmark West Texas Intermediate is down nearly 6% this week, while global benchmark Brent has pulled back nearly 4%. Prices have fallen even as conflict in the Middle East escalates, with Israel and Hezbollah trading blows in Lebanon.

“It is amazing to see that … war doesn’t affect the price, and that’s because there’s been no disruption,” Dan Yergin, vice chairman of S&P Global, told CNBC’s “Squawk Box” Friday.

“There’s still over 5 million barrels a day of shut in capacity in the Middle East,” Yergin said.

Here are Friday’s energy prices:

- West Texas Intermediate November contract: $67.51 per barrel, down 16 cents, or 0.24%. Year to date, U.S. crude oil is down more than 5%.

- Brent November contract: $71.37 per barrel, off 23 cents, or 0.32%. Year to date, the global benchmark is down about 7%.

- RBOB Gasoline October contract: $1.9596 per gallon, little changed. Year to date, gasoline is down about 7%.

- Natural Gas November contract: $2.774 per thousand cubic feet, up 0.76%. Year to date, gas is up about 10%.

Oil sold off Thursday on a report that Saudi Arabia is committed to increasing production later this year, even if it results in lower prices for a pro-longed period.

OPEC+ recently postponed planned output hikes from October to December, but analysts have speculated that the group might delay the hikes again because oil prices are so low.

The oil selloff erased gains from earlier in the week after China unveiled a new round of economic stimulus measures. Soft demand in China has been weighing on the oil market for months.

“The thing that’s dominated the market is the weakness in China. Half the growth in world oil demand over a number of years has simply been in China, and it hasn’t been happening,” Yergin said.

“The big question is, stimulus, will you see a recovery in China,” he said. “That’s what the market is struggling with.”

Science & Environment

Sycamore Gap sapling gifted in memory of boy with cancer

Dan Monk Kielder Observatory

Dan Monk Kielder ObservatoryRuth lost her only child Fergus to cancer when he was just 12.

“Your worst fear after your child dies is that he’ll be forgotten,” she explains.

They had long been searching for a tree with special meaning to plant in Fergus’ memory and to draw attention to all the children affected by childhood cancer.

The Sycamore Gap tree was cut down a year ago, sparking national outrage. Now, Fergus’ community in Backwell, near Bristol, will be one of the first to be gifted a sapling grown from it.

Stories of these first saplings to be promised are being shared to inspire others to apply for a ‘Tree of Hope’ from the National Trust. They have now grown to about 5ft tall, the BBC discovered on a visit to the top-secret greenhouse where they are kept.

Yard family photo

Yard family photoOn a bank, overlooking an open green space, Fergus’ parents share the spot where his tree will go – a prominent place in the landscape.

Their son came to this recreational ground nearly every day – a boy, on the cusp of becoming a teenager, who had a love of the outdoors.

It was his walk to school. He played cricket and other games here with his dad Ian, who described it as place filled with “fun”.

Father and son were planning to walk Hadrian’s Wall, along which the Sycamore Gap tree was nestled.

They postponed because of the pandemic with the hope of visiting once life went back to ‘normal’.

But Fergus was diagnosed with Osteosarcoma (bone cancer) in January 2021 and was just 12 years old when he died in May 2022.

Andy Alcroft/BBC

Andy Alcroft/BBC Two years on, his mum Ruth contacted the National Trust after hearing about the seedlings and grafts successfully grown from seeds and young twigs rescued from the felled tree.

“There’s something about the story of the new life being created from the Sycamore Gap. It made me think of all the children affected by childhood cancer. And how they deserve so much better. They deserve a second chance of life.”

A Sycamore Gap sapling seemed a fitting tribute as it was the trip planned, but never taken.

Since Fergus died, nature has been a constant source of strength to the family, Ruth tells me: “Its power to regenerate. And to console.”

She stresses that cancer in children is “horrendous, brutal and life-changing” and that bone cancer in children is something “no one really talks about”.

“We need to do more. We need to know more.” So her hope for the tree is to draw attention to the challenges these children face.

Ross James/BBC

Ross James/BBCThe original tree was 49ft (15m) when it was chopped down, and so 49 of its saplings will be released to communities across the UK who successfully apply.

The Sycamore Gap stood in a dip in Hadrian’s Wall in Northumberland, attracting visitors, proposals and was even featured in the Hollywood blockbuster Robin Hood: Prince of Thieves.

But on the morning of 28 September 2023, news spread internationally that the tree had been chopped down overnight.

Two men accused of damaging the tree and wall both deny the offence.

There was excitement over the summer when shoots started to emerge from the stump itself.

Currently its ‘baby trees’ are being nurtured and protected in a secret greenhouse, a site of biosecurity because of the rare specimens grown there – including a copy of Newton’s Apple Tree.

The first of the seedlings to pop up has been gifted to King Charles.

It was the wrong time of year to grow the material that was salvaged from the iconic tree and things have been “touch and go”, Darryl Beck, who has been tending to the seedlings explains.

Reuters

ReutersBut now the small team here are caring for about 100 saplings, some taller than 1.5m, and more seedlings are coming on.

There are also “nine or so grafts and budded plants” Chris Trimmer who runs the site explains. They are genetic copies of the original tree.

The trees wont be ready for planting until next year.

“We’re only a very small part of the story, but these trees will be around for the next 200 to 500 years. So, they’ll be around a long time and give a lot of hope to people,” says Chris.

The National Trust wants these saplings to be symbols of hope and healing, with each tree going to a very special place.

Another is promised to Tina’s Haven at Easington on the County Durham Coast.

Some 34 hectares (84 acres) of coastal fields are set to become a landscape of rolling meadows, hedgerows, ponds and woodlands overlooking the North Sea.

“My daughter Tina was absolutely a unique human being,” Sue Robson explains. “Through her life, although she had issues with childhood trauma and addiction and mental health, she was bold, she was strong, she was beautiful.”

Sue Robson

Sue RobsonTina died in 2020, age 35, following these struggles. After her death, Sue wanted to create a wild sanctuary – a place of recovery for others dealing with the problems Tina faced.

The National Trust says it’s spent the last 40 years cleaning up the beaches that neighbour the former coalfield sites near where Tina’s Haven will be established.

The hope is not only to restore nature here, but to help women recover from addiction and trauma through rewilding projects.

Sue describes the pilgrimages she made to the Sycamore Gap, just 58 miles away, and how seeing it chopped down felt like an act of “violence against mother nature itself”.

“When Tina died, my hope died with her,” Sue says. “And equally, when that beautiful tree was cut down. It was a violent, devastating act.”

But she sees a “parallel” when it comes to themes of “hope, of nature, of recovery and connection.”

“So, having the tree, such a significant symbol of hope here, is absolutely massive.”

For Sue, the story of nature bouncing back, symbolises that even after being subject to the worst adversity, there can be recovery, healing and new beginnings.

“And hope can grow in abundance.”

Additional Reporting by Kristian Johnson

Science & Environment

WTI below $68 as Saudi committed to higher output

U.S. crude oil prices fell nearly 3% on Thursday on a report that Saudi Arabia is committed to pressing ahead with production increases later this year.

Saudi is prepared to ditch its unofficial oil price target of $100 per barrel, people familiar with the kingdom’s thinking told The Financial Times. Saudi officials are ready to increase oil production in December even if the move results in a prolonged period of low oil prices, the people said.

Here are Thursday’s energy prices:

- West Texas Intermediate November contract: $68.15 per barrel, down $1.54, or 2.21%. Year to date, U.S. crude oil is down about 5%.

- Brent November contract: $71.86 per barrel, down $1.60, or 2.2%. Year to date, the global benchmark is down nearly 7%.

- RBOB Gasoline October contract: $1.964 per gallon, down 1.7%. Year to date, gasoline is down about nearly 6%.

- Natural Gas October contract: $2.628 per thousand cubic feet, up 0.3%. Year to date, gas is up more than 4%.

Prices are also under pressure on the expectation that oil production will rise in Libya. Factions in the North African country reached a deal Wednesday to appoint a new central bank governor. A political dispute over who should lead the bank has led to production disruptions.

The prospect of rising production is set against a backdrop of soft demand in China, the world’s largest crude importer and second-largest consumer. Oil prices rallied earlier in the week after Beijing announced a new stimulus package.

Science & Environment

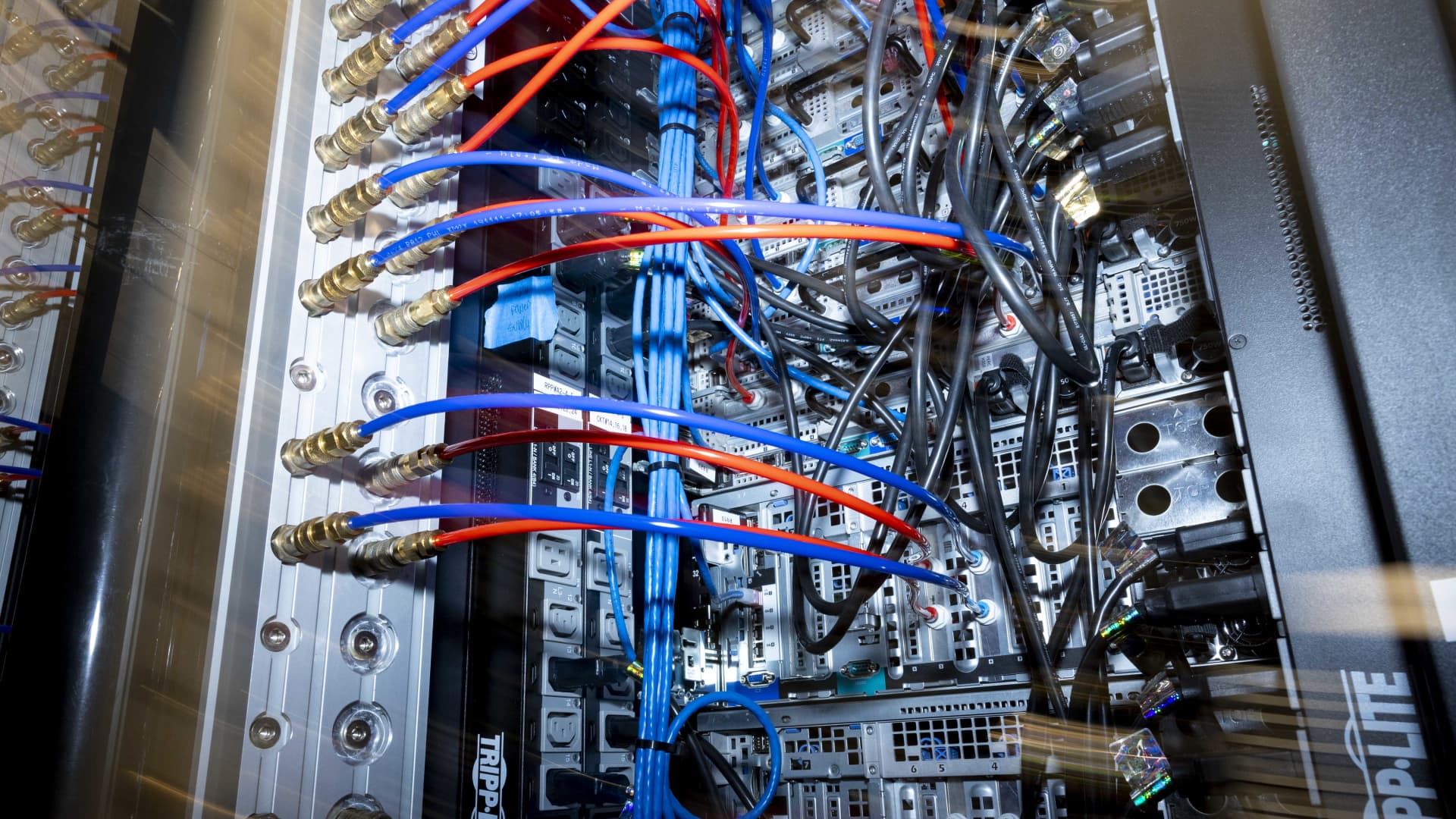

AI-adjacent companies may be the next big play

Inside one of Equinix’s internal operations at Equinix Data Center in Ashburn, Virginia, on May 9, 2024.

Amanda Andrade-Rhoades | The Washington Post | Getty Images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

U.S. markets slipped as Asian stocks rise

U.S. stocks mostly fell Wednesday. The S&P 500 lost 0.19% and the Dow Jones Industrial Average slipped 0.7%, while the Nasdaq Composite closed near the flatline. Asian markets rose Thursday, with Hong Kong, Japanese and Korean markets adding more than 2%. They were buoyed by a semiconductor rally, led by SK Hynix shares which surged around 8%.

OpenAI might be open to profit

OpenAI’s board is considering plans to restructure the firm as a for-profit business, according to a source who asked to remain anonymous. OpenAI will retain its non-profit segment as a separate entity, the source said. The news follows a slew of high-profile departures from the company, like CTO Mira Murati and research chief Bob McGrew.

Support for semiconductor plans

Indian Prime Minister Narendra Modi plans to turn the country into a semiconductor powerhouse. Modi wants to grow the electronics sector from $155 billion currently to $500 billion by 2030. Experts CNBC talked to are divided over whether that target’s feasible. They are unanimous, however, on the fact that India can’t do it alone.

Turning VR into reality

Meta took another step in making virtual reality part of our everyday life. The company’s Reality Labs division announced the Quest 3S, its latest VR headset, which starts at $299 and goes on sale Oct. 15. Meta also showed off a prototype of augmented reality glasses called Orion. It hopes to sell the next version to consumers.

[PRO] Look at India’s ‘micros’

India’s economy and stock market have been booming over the past year. But it’s a mistake to invest based solely on that fact, said Blackstone Private Equity’s head of Asia. Instead, investors should focus on “certain micros” to make money.

The bottom line

The initial frenzy in generative artificial intelligence was triggered when OpenAI released ChatGPT in 2022. Institutions poured billions into OpenAI.

While OpenAI, the company behind ChatGPT, is not listed publicly, several companies have gained immensely from the generative AI boom that it sparked.

Nvidia was the first beneficiary of gen AI. Its stock rocketed in 2023, a year after ChatGPT was released, when it became clear the semiconductor company’s chips were the brains behind chatbots.

Then Big Tech companies jumped on the bandwagon. Microsoft, Meta and Google-parent Alphabet released their own versions of chatbots and gen-AI-infused tools. Those features helped bump up share prices, though of course it’s difficult to attribute a single cause to stock movement.

It seems the tailwinds of AI are starting to propel a third wave of AI-adjacent companies forward.

If chips are the brains of AI, then data centers are its body. Hewlett Packard Enterprise rose more than 5% after Barclays upgraded the company on strong AI data center demand. And recall Oracle’s surge this year, driven mainly by the company’s AI cloud services powered by its data centers.

Next in line to be juiced by AI appear to be energy companies.

Oracle’s founder Larry Ellison said a new data center that the company is designing “will rely on three modular nuclear reactors.”

Vistra Corp, a power company based in Texas, jumped almost 6% on expectations the company will power an AI data center with one of its nuclear plants. Likewise, Constellation Energy popped about 22% Friday after it announced plans to restart a nuclear plant and sell the power to Microsoft.

All that is to say: The AI wave will continue rippling throughout the ocean for some time. Big Tech or semiconductors are juicy catches, but a wider net might reel in other prizes.

– CNBC’s Kif Leswing, Jonathan Vanian, Jordan Novet, Brian Evans and Jesse Pound contributed to this story.

Science & Environment

Time to look at AI-adjacent plays

An Amazon Web Services data center in Stone Ridge, Virginia, US, on Sunday, July 28, 2024.

Nathan Howard | Bloomberg | Getty Images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Falling from highs

U.S. stocks mostly fell Wednesday. The S&P 500 lost 0.19% and the Dow Jones Industrial Average slipped 0.7%, after scaling record highs earlier in the session. The Nasdaq Composite closed near the flatline. Europe’s regional Stoxx 600 index retreated 0.11%. The Stoxx Europe 600 Bank Index fell 0.73% as investors monitored UniCredit’s potential merger with Commerzbank.

Google vs. Microsoft

Google on Wednesday filed an antitrust complaint with the European Commission, the executive arm of the European Union, over Microsoft’s practices in the cloud computing industry. Google alleged that Microsoft employs unfair licensing contracts to “lock in” clients and exert control over the cloud market.

Done selling Nvidia

Nvidia CEO Jensen Huang is done selling the company’s stock for now. In March, Huang set out a plan to sell up to six million Nvidia shares by first quarter of 2025. He has hit that threshold ahead of schedule. Separately, AI chips like those Nvidia manufactures could face a global shortage as demand ramps up, according to a Bain & Company report.

Turning VR into reality

Meta took another step in making virtual reality part of our everyday life. The company’s Reality Labs division announced the Quest 3S, its latest VR headset, which starts at $299 and goes on sale Oct. 15. Meta also showed off a prototype of augmented reality glasses called Orion.

[PRO] It’s time for you to buy

That little green bird — Duolingo’s logo — can seem a tad annoying when it reminds you for the hundredth time to practice your Japanese, but analysts are taking a shine to it. Duolingo, among other stocks like Hewlett Packard Enterprise and Roblox, is one of the names on the “buy” list of Wall Street banks.

The bottom line

The initial frenzy in generative artificial intelligence was triggered when OpenAI released ChatGPT in 2022. Institutions poured billions into OpenAI.

While OpenAI, the company behind ChatGPT, is not listed publicly, several companies have gained immensely from the generative AI boom that it sparked.

(Speaking of OpenAI, the company’s CTO Mira Murati announced Wednesday she’s leaving the company. OpenAI is also planning to restructure to a for-profit business.)

Nvidia was the first beneficiary of gen AI. Its stock rocketed in 2023, a year after ChatGPT was released, when it became clear the semiconductor company’s chips were the brains behind chatbots.

Then Big Tech companies jumped on the bandwagon. Microsoft, Meta and Google-parent Alphabet released their own versions of chatbots and gen-AI-infused tools. Those features helped bump up share prices, though of course it’s difficult to attribute a single cause to stock movement.

It seems the tailwinds of AI are starting to propel a third wave of AI-adjacent companies forward.

If chips are the brains of AI, then data centers are its body. Hewlett Packard Enterprise rose more than 5% after Barclays upgraded the company on strong AI data center demand. And recall Oracle’s surge this year, driven mainly by the company’s AI cloud services powered by its data centers.

Next in line to be juiced by AI appear to be energy companies.

Oracle’s founder Larry Ellison said a new data center that the company is designing “will rely on three modular nuclear reactors.”

Vistra Corp, a power company based in Texas, jumped almost 6% on expectations the company will power an AI data center with one of its nuclear plants. Likewise, Constellation Energy popped about 22% Friday after it announced plans to restart a nuclear plant and sell the power to Microsoft.

All that is to say: The AI wave will continue rippling throughout the ocean for some time. Big Tech or semiconductors are juicy catches, but a wider net might reel in other prizes.

– CNBC’s Kif Leswing, Jonathan Vanian, Jordan Novet, Brian Evans and Jesse Pound contributed to this story.

Science & Environment

How did Titan hull come apart? Safety experts weigh in

An analysis of the wreckage of OceanGate’s Titan submersible has revealed how its hull came apart.

Images of the craft’s pieces scattered across the sea floor show the carbon fibre hull had separated into multiple layers – a known problem with the material.

The evidence was presented on Wednesday to the US Coast Guard at a public hearing into the catastrophic failure of the sub in June 2023, which killed all five people on board.

It was not confirmed that the hull was the first part of the sub to fail, but the details suggest it is a key focus of the investigation.

Investigators are seeking to uncover the details of what led to the tragedy and find recommendations that could prevent future deadly voyages.

Titan, operated by OceanGate, imploded less than two hours into its descent during a dive to the wreckage of the Titanic.

Titan’s hull was made from numerous layers of carbon fibre mixed with resin.

It’s a highly unusual material for a deep sea sub because it is unreliable under pressure – most crafts are made from metals like titanium.

Don Kramer, an engineer at the National Transportation Safety Board, showed the US Coast Guard a series of images of sections of the hull on the sea floor.

He described how in some fragments, the carbon fibre layers had come apart – a known process called delamination.

In other places, the material was cracked.

It was not confirmed whether the damage to the hull had caused the implosion.

“I’m not offering any analysis at this point as to whether [the damage] occurred before or after the implosion,” he said.

Mr Kramer also described how his team had analysed samples of Titan’s hull left over from its construction. They looked at offcuts from when the sub was made.

He described that the samples showed areas where the carbon fibre layers had separated, as well as wrinkles, voids and gaps.

Any irregularities in the material would have affected how the hull performed under the immense pressures under water.

The US Coast Guard was also told how a loud bang heard during a dive a year before the disaster may have damaged the sub’s structure.

Passengers had reported it while the sub was returning to the surface after a dive to the Titanic in 2022. One passenger described it as an “alarming sonic event” while giving evidence last week.

At the time, OceanGate CEO Stockton Rush said he thought it was the sub shifting in the metal frame that surrounded it.

But a new analysis of sensor data by the National Transportation Safety Board suggested that the noise signalled some kind of change to the fabric of the hull.

This may have altered the way the sub was able to respond to the pressures of the deep.

Mr Kramer pointed to several other issues with the sub’s design including the viewport window was not being rated to dive to the depths of the Titanic and the hull’s unusual shape preventing pressure from being distributed equally.

-

Womens Workouts4 days ago

Womens Workouts4 days ago3 Day Full Body Women’s Dumbbell Only Workout

-

News5 days ago

News5 days agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

News1 week ago

News1 week agoYou’re a Hypocrite, And So Am I

-

Technology1 week ago

Technology1 week agoWould-be reality TV contestants ‘not looking real’

-

Sport1 week ago

Sport1 week agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment1 week ago

Science & Environment1 week agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 week ago

Science & Environment1 week agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 week ago

Science & Environment1 week agoHow to wrap your mind around the real multiverse

-

Science & Environment1 week ago

Science & Environment1 week agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 week ago

Science & Environment1 week agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 week ago

Science & Environment1 week agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 week ago

Science & Environment1 week agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 week ago

Science & Environment1 week ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 week ago

Science & Environment1 week agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment1 week ago

Science & Environment1 week agoWhy this is a golden age for life to thrive across the universe

-

News1 week ago

News1 week agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Womens Workouts6 days ago

Womens Workouts6 days agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts6 days ago

Womens Workouts6 days agoEverything a Beginner Needs to Know About Squatting

-

Science & Environment5 days ago

Science & Environment5 days agoMeet the world's first female male model | 7.30

-

Science & Environment1 week ago

Science & Environment1 week agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 week ago

Science & Environment1 week agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

News1 week ago

News1 week agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News5 days ago

News5 days agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Science & Environment1 week ago

Science & Environment1 week agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 week ago

Science & Environment1 week agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment1 week ago

Science & Environment1 week agoLaser helps turn an electron into a coil of mass and charge

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoSEC asks court for four months to produce documents for Coinbase

-

Sport1 week ago

Sport1 week agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBlockdaemon mulls 2026 IPO: Report

-

Business1 week ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Technology1 week ago

Technology1 week agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Womens Workouts7 days ago

Womens Workouts7 days agoKeep Your Goals on Track This Season

-

Womens Workouts4 days ago

Womens Workouts4 days ago3 Day Full Body Toning Workout for Women

-

Travel3 days ago

Travel3 days agoDelta signs codeshare agreement with SAS

-

Science & Environment1 week ago

Science & Environment1 week agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment1 week ago

Science & Environment1 week agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

News1 week ago

News1 week agoChurch same-sex split affecting bishop appointments

-

Technology1 week ago

Technology1 week agoFivetran targets data security by adding Hybrid Deployment

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Business1 week ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics1 week ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News1 week ago

News1 week agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts7 days ago

Womens Workouts7 days agoHow Heat Affects Your Body During Exercise

-

News5 days ago

News5 days agoWhy Is Everyone Excited About These Smart Insoles?

-

Health & fitness1 week ago

Health & fitness1 week agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

News1 week ago

News1 week ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment1 week ago

Science & Environment1 week agoBeing in two places at once could make a quantum battery charge faster

-

Science & Environment1 week ago

Science & Environment1 week agoHow one theory ties together everything we know about the universe

-

Science & Environment1 week ago

Science & Environment1 week agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment1 week ago

Science & Environment1 week agoTiny magnet could help measure gravity on the quantum scale

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

News1 week ago

News1 week agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Womens Workouts7 days ago

Womens Workouts7 days agoWhich Squat Load Position is Right For You?

-

News6 days ago

News6 days agoBangladesh Holds the World Accountable to Secure Climate Justice

-

Politics1 week ago

Politics1 week agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology1 week ago

Technology1 week agoCan technology fix the ‘broken’ concert ticketing system?

-

Health & fitness1 week ago

Health & fitness1 week agoThe maps that could hold the secret to curing cancer

-

Science & Environment1 week ago

Science & Environment1 week agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 week ago

Science & Environment1 week agoSingle atoms captured morphing into quantum waves in startling image

-

Science & Environment1 week ago

Science & Environment1 week agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

Fashion Models1 week ago

Fashion Models1 week agoMixte

-

Politics1 week ago

Politics1 week agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Money1 week ago

Money1 week agoBritain’s ultra-wealthy exit ahead of proposed non-dom tax changes

-

Womens Workouts7 days ago

Womens Workouts7 days agoWhere is the Science Today?

-

Womens Workouts7 days ago

Womens Workouts7 days agoSwimming into Your Fitness Routine

-

News1 week ago

News1 week agoBrain changes during pregnancy revealed in detailed map

-

Science & Environment1 week ago

Science & Environment1 week agoA slight curve helps rocks make the biggest splash

-

News1 week ago

News1 week agoRoad rage suspects in custody after gunshots, drivers ramming vehicles near Boise

-

Science & Environment1 week ago

Science & Environment1 week agoHow Peter Higgs revealed the forces that hold the universe together

-

Science & Environment1 week ago

Science & Environment1 week agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Politics1 week ago

Politics1 week agoLib Dems aim to turn election success into influence

You must be logged in to post a comment Login