Science & Environment

White blobs washing up on Newfoundland beaches stump experts and worry resident beachcombers

Toronto — Beaches across Canada’s far northeast Newfoundland and Labrador province have increasingly been littered with mysterious white blobs. Their appearance has so far befuddled scientists, and led Canadian officials in the region to launch an investigation.

Beachgoers first noticed the unusual blobs on the shores of Newfoundland and Labrador in September. People quickly started sharing photos of the gelatinous clumps on a Facebook group with more than 40,000 members that is dedicated to exploring the region’s coastal areas.

“Anyone know what these blobs are. They are like touton dough and all over the beach,” wrote Philip Grace on the Beachcombers Facebook group, comparing the finds to a regional dish. “These were in sizes ranging from dinner plate size right down to a toonie [Canadian 2-dollar coin].”

Some people speculated online that the mystery blobs could be the result of ships dumping substances into the ocean. Others suggested they could be whale sperm, whale vomit or even ambergris, a byproduct of sperm whales that’s valued for its use in perfumes and other products.

But the experts weren’t to be dragged into the speculation.

Environment and Climate Change Canada, the government agency responsible for investigating the mystery, simply referred to the blobs as “a mystery substance” when asked by CBS News on Tuesday.

Newfoundland resident David McGrath told The Guardian newspaper that he’d seen hundreds of the items scattered across his local beaches.

“They looked just like a pancake before you flip it over, when it has those dimpled little bubbles. I poked a couple with a stick and they were spongy and firm inside,” he told the newspaper. “I’ve lived here for 67 years, and I’ve never seen anything like this. Never.”

“They sent the Coast Guard over and I asked them how bad it was. They told me they had 28 miles of coastline littered with this stuff and had no idea what it was,” McGrath said. “Is it toxic? It is safe for people to touch?”

Samantha Bayard, a spokesperson for Environment and Climate Change Canada, told CBS News the agency was first informed about the “mystery substance” on beaches on Sept. 7. Environmental emergency officers visited sites at least three times to assess the situation and collect samples.

“To date, ECCC has conducted several aerial, underwater and manual surveys of the beaches and shorelines in the area to determine the extent of the substance, what it is and its potential source,” she said. “At this time, neither the substance nor its source has been identified.”

Bayard said a preliminary laboratory analysis by the agency suggested the material “could be plant-based,” but stressed that additional analysis was required “before a final determination can be made on the substance and its potential impacts.”

Stan Tobin, a local environmentalist, told CBS News’ partner network BBC News that he’d found “hundreds and hundreds of blobs — big blobs, little blobs.”

“Somebody or somebodies know where this came from and how it got there, and knows damn well it’s not supposed to be here,” Tobin told the BBC.

Bayard said the ECCC was committed to addressing pollution incidents and environmental threats with urgency.

“If enforcement officers find evidence of a possible violation of federal environmental legislation, they will take appropriate action in accordance with the applicable Compliance and Enforcement Policy,” she told CBS News.

Science & Environment

Bitcoin hits highest level since July, boosting crypto-related stocks

Avishek Das | Lightrocket | Getty Images

The price of bitcoin neared $68,400 on Wednesday, reaching its highest level since July and sparking a rally across the crypto sector.

Bitcoin is up more than 9% over the last week and ether is up about 7%. Other popular coins have also rallied, with solana up close to 10% in the past seven days and and dogecoin up 15%.

The gains have made their way to crypto-pegged stocks. Digital asset exchange Coinbase climbed almost 7% on Wednesday, bringing its three-day rally to 19%. The stock is at its highest since August.

Bitcoin miners Marathon Digital and Riot Platforms also moved higher on Wednesday.

Bitcoin and Coinbase move higher in the last week.

One reason for bitcoin’s 53% gain so far this year is a host of new spot bitcoin exchange-traded funds that hit the market in January, welcoming in a host of new investors. Ether ETFs followed in July.

Samara Cohen, chief investment officer of ETF and index investments at BlackRock, told CNBC recently that 80% of buyers of its iShares Bitcoin Trust (IBIT) are direct investors. Of those, 75% have never owned a BlackRock ETF, she said.

“We went into this journey with the expectation that we needed to educate ETF investors on crypto and on bitcoin specifically,” Cohen said. “As it turns out, we have done a lot of education of crypto investors on the benefits of the ETP wrapper.”

Science & Environment

Trump-backed crypto token sale raises less than $12 million

It’s been just over twenty-four hours since the launch of the Donald Trump-endorsed digital coin “WLFI,” and the token is failing to deliver on the ambitious fundraising goals set by its founding team.

World Liberty Financial — which bills itself as a crypto bank where customers will be encouraged to borrow, lend and invest in digital coins — began its token sale on Tuesday morning. On Monday, project co-founder Zachary Folkman bragged in a pre-launch stream on X that “well over 100,000 people” were whitelisted to invest.

“We knew that this project was highly anticipated. We knew that there was a lot of excitement in the marketplace,” said Folkman to the 12,000 people tuning into the event on X. “However, these numbers are just, in my opinion, unheard of, and I think we’re setting all sorts of new records in crypto.”

But blockchain data tracked by Etherscan shows that about 9,050 unique wallet addresses hold the token as of Wednesday morning, representing roughly 9% of the total number of people who registered.

Trump pumped the coin in a video post on X on Tuesday evening, promoting the World Liberty website and telling his followers that the token sale was live and that “crypto is the future.”

In a roadmap given to prospective investors first viewed by The Block, the WLF proposal says the coin is looking to raise $300 million at a $1.5 billion valuation in its initial sale. The platform says, so far, it has sold more than 788 million tokens at $0.015 per token.

That is less than 4% of the 20 billion tokens made available for public sale and amounts to around $11.8 million, still well off the $300 million fundraising target.

WLF did not respond to CNBC’s request for comment.

Part of the problem was that the project website, the exclusive marketplace for the new coin, suffered regular, lengthy outages frequently showing a page saying, “We are under maintenance.”

But there are other roadblocks that may have impacted the coin’s debut. WLFI is a Regulation D token offering, which means retail investors have largely been cut out of the process.

This provision makes it possible to raise capital without first registering a security with the U.S. Securities and Exchange Commission, but certain conditions must be met, such as limiting the size of the sale and restricting it to accredited investors, defined in part as having a net worth of more than $1 million. While the offering is one way to reduce legal exposure, it cuts down on the size of the potential investor pool.

The World Liberty team has also been specific in calling WLFI a governance token that allows holders to vote on decisions regarding the protocol, but would not signify equity in the venture itself.

As of now, however, there’s nothing for WLFI token holders to vote on since the crypto bank connected to the digital coin doesn’t yet exist.

Last week, WLF began the crypto bank approval process with Aave, one of the longest-running and most-trusted crypto lending platforms.

World Liberty has not released an official white paper or formal business plan to the public. A 400-word proposal posted to Aave’s governance forum, which is used to discuss and vote on proposed projects such as WLF, is nearly all that’s been disclosed.

Coin holders get a sort of I-O-U until the platform is approved and goes live. In the meantime, investment in the coin goes to the platform’s treasury.

WLF’s website adds in the fine print that Trump and his family members may receive tokens from World Liberty Financial and that they are “entitled to receive significant fees for services provided to World Liberty Financial, which amount cannot yet be determined.”

Science & Environment

New skin research could help slow signs of ageing

Getty Images

Getty ImagesResearchers have made a scientific discovery that in time could be used to slow the signs of ageing.

A team has discovered how the human body creates skin from a stem cell, and even reproduced small amounts of skin in a lab.

The research is part of a study to understand how every part of the human body is created, one cell at a time.

As well as combatting ageing, the findings could also be used to produce artificial skin for transplantation and prevent scarring.

The Human Cell Atlas project is one of the most ambitious research programmes in biology.

One of the project’s leaders, Prof Muzlifah Haniffa, said it would help scientists treat diseases more effectively, but also find new ways of keeping us healthier for longer, and perhaps even keep us younger-looking.

“If we can manipulate the skin and prevent ageing we will have fewer wrinkles,” said Prof Haniffa of the Wellcome Sanger Institute.

“If we can understand how cells change from their initial development to ageing in adulthood you can then try and say, ‘How do I rejuvenate organs, make the heart younger, how do I make the skin younger?’”

That vision is some way off but researchers are making progress, most recently in their understanding of how skin cells develop in the foetus during the early development stage of human life.

When an egg is first fertilised human cells are all the same. But after three weeks, specific genes inside these so-called “stem cells” switch on, passing along instructions on how to specialise and clump together to form the various bits of the body.

Researchers have identified which genes are turned on at what times and in which locations to form the body’s largest organ, skin.

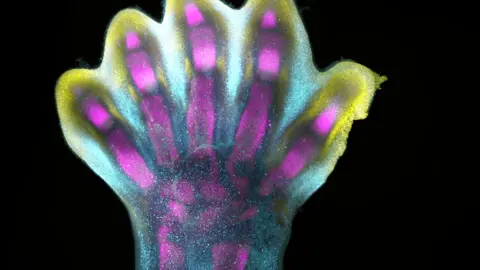

Under the microscope and treated with chemicals they look like tiny fairy lights.

Genes that turn orange form the skin’s surface. Others in yellow determine its colour and there are many others which form the other structures that grow hair, enable us to sweat and protect us from the outside world.

Alain Chédotal and Raphaël Blain, Inserm

Alain Chédotal and Raphaël Blain, InsermThe researchers have essentially obtained the instruction set to create human skin and published them in the journal Nature. Being able to read these instructions opens up exciting possibilities.

Scientists already know, for example, that foetal skin heals with no scarring.

The new instruction set contains details of how this happens, and one research area could be to see if this could be replicated in adult skin, possibly for use in surgical procedures.

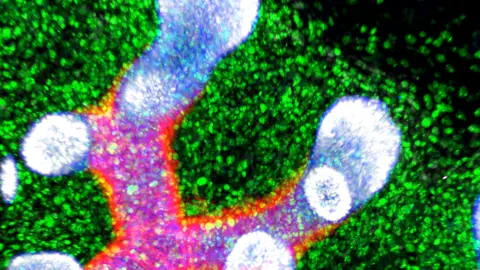

In one major development, scientists discovered that immune cells played a critical role in the formation of blood vessels in the skin, and then were able to mimic the relevant instructions in a lab.

They used chemicals to turn genes on and off at the right time and in the right places to grow skin artificially from stem cells.

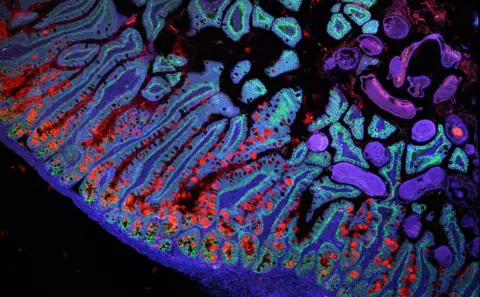

So far, they have grown tiny blobs of skin, out of which have sprouted little hairs.

BBC News

BBC NewsAccording to Prof Haniffa, the eventual aim is to perfect the technique.

“If you know how to build human skin, we can use that for burns patients and that can be a way of transplanting tissue,” she said.

“Another example is that if you can build hair follicles, we can actually create hair growth for bald people.”

The skin in the dish can also be used to understand how inherited skin diseases develop and test out potential new treatments.

Megumi Inoue Alain Chédotal Institut de la Vision

Megumi Inoue Alain Chédotal Institut de la VisionInstructions for turning genes on and off are sent all across the developing embryo and continue after birth into adulthood to develop all our different organs and tissues.

The Human Cell Atlas project has analysed 100 million cells from different parts of the body in the eight years it has been in operation. It has produced draft atlases of the brain and lung and researchers are working on the kidney, liver and heart.

The next phase is to put the individual atlases together, according to Prof Sarah Teichmann of Cambridge University, who is one of the scientists who founded and leads the Human Cell Atlas Consortium.

“It is incredibly exciting because it is giving us new insights into physiology, anatomy, a new understanding of humans,” she told BBC news.

“It will lead to a rewriting of the textbooks in terms of ourselves and our tissues and organs and how they function.”

Genetic instructions for how other parts of the body grow will be published in the coming weeks and months – until eventually we have a more complete picture of how humans are built.

Grace Burgin, Noga Rogel & Moshe Biton, Klarman Cell Observatory, Broad Institute.png

Grace Burgin, Noga Rogel & Moshe Biton, Klarman Cell Observatory, Broad Institute.pngScience & Environment

Amazon goes nuclear, to invest more than $500 million to develop small module reactors

Amazon Web Services is investing over $500 million in nuclear power, announcing three projects from Virginia to Washington State. AWS, Amazon‘s subsidiary in cloud computing, has a massive and increasing need for clean energy as it expands its services into generative AI. It’s also a part of Amazon’s path to net-zero carbon emissions.

AWS announced it has signed an agreement with Dominion Energy, Virginia’s utility company, to explore the development of a small module nuclear reactor, or SMR, near Dominion’s existing North Anna nuclear power station. Nuclear reactors produce no carbon emissions.

An SMR is an advanced type of nuclear reactor with a smaller footprint that allows it to be built closer to the grid. They also have faster build times than traditional reactors, allowing them to come online sooner.

Amazon is the latest large tech company to buy into nuclear power to fuel the growing demands from data centers. Earlier this week, Google announced it will purchase power from SMR developer Kairos Power. Constellation Energy is restarting Three Mile Island to power Microsoft data centers.

“We see the need for gigawatts of power in the coming years, and there’s not going to be enough wind and solar projects to be able to meet the needs, and so nuclear is a great opportunity,” said Matthew Garman, CEO of AWS. “Also, the technology is really advancing to a place with SMRs where there’s going to be a new technology that’s going to be safe and that’s going to be easy to manufacture in a much smaller form.”

Virginia is home to nearly half of all the data centers in the U.S., with one area in Northern Virginia dubbed Data Center Alley, the bulk of which is in Loudon County. An estimated 70% of the world’s internet traffic travels through Data Center Alley each day.

Dominion serves roughly 3,500 megawatts from 452 data centers across its service territory in Virginia. About 70% is in Data Center Alley. A single data center typically demands about 30 megawatts or greater, according to Dominion Energy. Bob Blue, its president and CEO, said in a recent quarterly earnings call that the utility now receives individual requests for 60 megawatts to 90 megawatts or greater. Dominion projects that power demand will increase by 85% over the next 15 years. AWS expects the new SMRs to bring at least 300 megawatts of power to the Virginia region.

“Small modular nuclear reactors will play a critical role in positioning Virginia as a leading nuclear innovation hub,” said Virginia Gov. Glenn Youngkin in a release. “Amazon Web Services’ commitment to this technology and their partnership with Dominion is a significant step forward to meet the future power needs of a growing Virginia.”

AWS plans to invest $35 billion by 2040 to establish multiple data center campuses across Virginia, according to an announcement from Youngkin last year.

“These SMRs will be powering directly into the grid, so they’ll go to power everything, part of that is the data centers, but everything that is plugged into the grid will benefit,” Garman added.

Amazon also announced a new agreement with utility company Energy Northwest, a consortium of state public utilities, to fund the development, licensing and construction of four SMRs in Washington State. The reactors will be built, owned and operated by Energy Northwest but will provide energy directly to the grid, which will also help power Amazon operations.

Under the agreement, Amazon will have the right to purchase electricity from the first four modules. Energy Northwest has the option to build up to eight additional modules. That power would also be available to Amazon and Northwest utilities to power homes and businesses.

The SMRs will be developed with technology from Maryland-based X-energy, a developer of SMRs and fuel. Along with Amazon’s other announcements, Amazon’s Climate Pledge Fund disclosed it is the lead anchor in a $500 million financing round for X-Energy. The Climate Pledge Fund is its corporate venture capital fund that invests in early-stage sustainability companies. Other investors include Citadel Founder and CEO Ken Griffin, affiliates of Ares Management Corporation, NGP and the University of Michigan.

“Amazon and X-energy are poised to define the future of advanced nuclear energy in the commercial marketplace,” said X-energy CEO J. Clay Sell. “To fully realize the opportunities available through artificial intelligence, we must bring clean, safe, and reliable electrons onto the grid with proven technologies that can scale and grow with demand.”

Last spring, AWS invested in a nuclear energy project with Talen Energy, signing an agreement to purchase nuclear power from the company’s existing Susquehanna Steam Electric Station, a nuclear power station in Salem Township, Pennsylvania. AWS also purchased the adjacent, nuclear-powered data center campus from Talen for $650 million.

Science & Environment

WTI, Brent edge lower after selloff

U.S. crude futures edged lower Wednesday to trade below $71 per barrel, after selling off steeply in the previous session on reports that Israel will not attack Iran’s oil facilities.

The U.S. benchmark tumbled more than 4% on Tuesday, after Israel told the U.S. that it will limit its retaliatory strikes to military targets in Iran, senior Biden administration officials told NBC News.

Crude oil prices have given up most of the gains made in the wake of Iran’s Oct. 1 ballistic missile attack on Israel, as fears of an oil supply disruption in the Middle East have eased.

Here are Wednesday’s energy prices:

- West Texas Intermediate November contract: $70.28 per barrel, down 30 cents, or 0.43%. Year to date, U.S. crude oil has fallen nearly 2%.

- Brent December contract: $73.94 per barrel, down 31 cents, or 0.42%. Year to date, the global benchmark has declined about 4%.

- RBOB Gasoline November contract: $2.0378 per gallon, little changed. Year to date, gasoline has decreased about 3%.

- Natural Gas November contract: $2.464 per thousand cubic feet, down 1.36%. Year to date, gas has pulled back about 2%.

Science & Environment

Bullish sentiment and broadening rally in markets

Traders work on the floor of the New York Stock Exchange on April 5, 2024.

Spencer Platt | Getty Images News | Getty Images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Breather from rally

U.S. markets fell Tuesday, weighed down by a drop in semiconductor stocks and a 8.1% slide in UnitedHealth. Asia-Pacific stocks were mostly lower Wednesday. Asian chip stocks, like Tokyo Electron and Taiwan Semiconductor Manufacturing Company, retreated on news of ASML’s disappointing forecast and reports of the U.S. possibly imposing export controls on AI chips.

ASML slumps

Shares of semiconductor equipment manufacturer ASML plunged 16% on a downbeat earnings report. For 2025, the Netherlands-based company thinks net sales will come in at the lower half of its previous projection. ASML missed expectations on net bookings by 3 billion euros for the September quarter, though net sales beat expectations.

Better than ChatGPT

Alibaba updated its artificial-intelligence translation tool, based on a model called Marco MT, on Wednesday. The Chinese e-commerce giant said its product performs better than those by Google and DeepL, according to an assessment by benchmarking tool FLoRes. Fifteen languages are supported by Alibaba’s AI-powered translation tool.

Banks beat expectations

Goldman Sachs, Bank of America and Citigroup beat earnings and revenue estimates for their third quarter. Goldman was the standout performer: Its profit jumped 45% from a year earlier. Year on year, Bank of America experienced a 12% drop in net income and Citigroup’s net income fell 8.6%.

[PRO] Repositioning for slower rate cuts

September’s strong jobs report and higher-than-expected inflation reading mean that the U.S. Federal Reserve is unlikely to repeat its jumbo 50-basis-point rate cut at its November meeting. Here’s how strategists are repositioning in view of changing rate cut expectations.

The bottom line

Despite markets falling Tuesday, there’s still plenty to like about their current state.

Weighed down by ASML’s 16% dive and a report by Bloomberg on potential AI-chip export controls, semiconductor stocks like Nvidia and AMD fell 4.7% and 5.2% respectively. That gave the VanEck Semiconductor ETF its worst day since Sept. 3. As a result, the tech-heavy Nasdaq Composite lost 1.01%.

The Dow Jones Industrial Average, which just yesterday was basking in its accomplishment at closing above the 43,000 level for the first time, fell 0.75% to dip into the 42,000 territory again. UnitedHealth’s 8.1% drop dragged down the Dow.

Last, the S&P 500 retreated 0.76%.

Still, investors are the most bullish in four years, according to the October BofA Global Fund Manager Survey. They’re also optimistic about the economy: 74% investors believe the U.S. will avoid a recession.

Anticipation of more rate cuts by the U.S. Federal Reserve and hopes that Beijing will unleash more stimulus to boost its economy are driving up investor sentiment, according to Michael Hartnett, an investment strategist at BofA.

Indeed, San Francisco Fed President Mary Daly, who’s a member of the Federal Open Market Committee this year, noted that the central bank is “a long way from where [rates are] likely to settle.” That means “the decisions that are really in front of us are ones about how quickly to adjust towards that level” – not whether to keep rates high in light of how strong recent economic data has been.

Another positive sign for markets is how the S&P and Dow hit all-time highs on Monday, but the Nasdaq was still a few percentage points away from its peak. “This subtle divergence is technical evidence that the market has been moving away from the Magnificent Seven mega-caps,” wrote Piper Sandler’s chief market technician Craig Johnson.

– CNBC’s Jeff Cox, Samantha Subin, Yun Li, Lisa Kailai Han and Alex Harring contributed to this story.

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment4 weeks ago

Science & Environment4 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to wrap your mind around the real multiverse

-

News1 month ago

the pick of new debut fiction

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA slight curve helps rocks make the biggest splash

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists are grappling with their own reproducibility crisis

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News4 weeks ago

News4 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News4 weeks ago

News4 weeks agoYou’re a Hypocrite, And So Am I

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Sport4 weeks ago

Sport4 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Technology3 weeks ago

Technology3 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News1 month ago

News1 month agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoRethinking space and time could let us do away with dark matter

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business3 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Football3 weeks ago

Football3 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Technology3 weeks ago

Technology3 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists have worked out how to melt any material

-

News4 weeks ago

News4 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoBeing in two places at once could make a quantum battery charge faster

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCardano founder to meet Argentina president Javier Milei

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Technology3 weeks ago

Technology3 weeks agoGet ready for Meta Connect

-

Sport4 weeks ago

Sport4 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

News1 month ago

News1 month agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Business4 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics4 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Entertainment1 week ago

Entertainment1 week agoChristopher Ciccone, artist and Madonna’s younger brother, dies at 63

-

Technology2 weeks ago

Technology2 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Business2 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

TV2 weeks ago

TV2 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

Technology2 weeks ago

Technology2 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

News2 weeks ago

News2 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Politics4 weeks ago

Politics4 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBlockdaemon mulls 2026 IPO: Report

-

MMA4 weeks ago

MMA4 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoEverything a Beginner Needs to Know About Squatting

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

News4 weeks ago

News4 weeks agoChurch same-sex split affecting bishop appointments

-

Technology4 weeks ago

Technology4 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News4 weeks ago

News4 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTiny magnet could help measure gravity on the quantum scale

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

News4 weeks ago

News4 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

You must be logged in to post a comment Login