Tech

Best Fan 2026: Prepare for the summer heatwaves

There are few things worse than finding yourself in the middle of a heatwave, cursing the fact that you didn’t buy a competent fan ahead of time, but the fact that you’re reading this list at all means that you’re looking to avoid this situation at all costs, and we’re more than happy to help. After all, there’s so much choice out there that it can be all too easy to buy a fan that doesn’t really get the job done, but our testers have whittled down the very best fans to buy.

Before deciding on which fan to buy, the best bit of advice we can give is that there isn’t really an all-in-one fan that works for every scenario. There are plenty of options that each excel in one or two specific areas, which is why it’s worth having a think about where you’ll most need a fan to be placed.

For example, when talking about the best fan for a bedroom, you’ll want a tall standing fan or tower fan that packs enough power to throw a sizeable gust around the room, ensuring that you stay cool no matter which side of the bed you’re on. Offices tend to get on a lot better with bladeless fans as they’re quieter and safer to have out in the open, whilst anyone working from home will need a small desk fan that doesn’t take up much space.

There’s quite a lot to consider, but the best part is that thanks to the hard work of our tech experts, you don’t have to take a punt on a cheap fan that ends up being a waste of money. With every fan sent to our testing facility, we measure the decibels emitted from them as well as the strength of the airflow at various distances, so you can know right away if a fan fits your intended room.

At this point, we’ve reviewed more fans than we can count but only a handful have made their way into this list, ensuring that no matter which one you go for, you’ll be getting an excellent device in return. For when things get a bit too hot, you can also check out our round-up of the best electric heaters, while the best power stations can keep your fans ticking on even when you’re away from a power outlet.

Best fans at a glance

-

Best fan:

Shark TurboBlade TF200SUK – check price -

Quietest fan:

Duux Whisper Flex 2 – check price -

Best fan for circulation:

MeacoFan Sefte 10 Pedestal Air Circulator – check price -

Best smart desktop fan:

Dyson Cool CF1 – check price -

Best indoor/outdoor fan:

Shark FlexBreeze Portable Fan FA220UK – check price -

Best budget tower fan:

Dr. Prepare 13-inch Dual Oscillating Tower Fan – check price -

Best fan and heater:

Princess Smart Heating and Cooling Tower – check price -

Best fan for flexibility:

MeacoFan 260C Cordless Air Circulator – check price -

Best fan for power:

VonHaus 35" Tower Fan – check price -

Best budget tower fan with natural air flow:

Netta 32-inch Tower Fan – check price -

Best personal evaporative cooler:

Evapolar evaSMART – check price -

Best evaporative cooler:

Princess Smart Air Cooler – check price -

Best desktop fan for power:

Duux Globe – check price -

Best fan and air purifier:

Acerpure Cool AC551-50W – check price -

Best fan for home working:

Duux Rize – check price -

Best portable desk fan:

MeacoFan Sefte 8" Portable Battery Air Circulator – check price -

Best year-round fan:

Shark TurboBlade Cool + Heat TH200UK – check price

SQUIRREL_ANCHOR_LIST

All fans are put through their paces in the same way, so that we can accurately compare the performance of each one. We start by measuring air flow in metres per second (m/s). We measure at 15cm and 1m, to see how performance drops off, and at minimum and maximum fan speeds, to see what the range is. Ideally, a fan should offer a good range of speeds, ranging from a gentle breeze to a full on blast of air.

We also measure how loud fans are, at minimum and maximum speeds. You can find out more in our detailed guide to how we test fans.

Best fan

It’s taken some time but Shark has managed to match Dyson when it comes to putting out a fan that’s not only powerful but great to look at and a conversation piece in its own right. For all this and more, the Shark TurboBlade TF200SUK is easily one of the best fans you can buy right now. While the TurboBlade does have a wonderfully appealing aesthetic, it’s the fan’s malleable frame that harbours its true selling point. The key portion of the fan that delivers airflow can be rotated from its default vertical position to a horizontal one, which makes it brilliantly suited for when you have multiple people sitting on a sofa, all in need of cooling.

The TurboBlade can even oscillate up to 180° which is almost unheard of and just makes the Shark fan better suited than most when it comes to successfully cooling an entire room. For a smaller room however you can always set the oscillation to either 45° or 90° in a pinch.

There are 10 airflow speeds in total so you have a good amount of flexibility over the style of cooling available, although for the moments when a heatwave is in full swing, you can toggle the boost mode to go even further. If you’re coming in from outside and you’re struggling to cool down then this is exactly the type of fan that gets you back to feeling comfortable in almost no time at all.

If you have the TurboBlade set up in your bedroom then you can easily toggle the various modes from the comfort of your covers, all thanks to the included remote control. With the control in hand you can tweak the settings to have a cooling breeze throughout the night, and set a timer to go along with it to help conserve power. Quietest fan

Dutch brand Duux has put out some strong contenders for this very list over the last few years, but none of them can hold a candle to the outstanding Duux Whisper Flex 2. While its name might be a bit of a mouthful, there is one key giveaway that alludes to one of the fan’s best features: it is whisper quiet when in operation. At the lower stages of airflow, you’d have to be fairly close to the fan in order to pick up on any sound at all, and even cranking the intensity all the way up to the maximum, the Flex 2 emits the type of sound that can easily blend into the background after a few minutes, making it ideal for an office environment or a bedroom.

Also working in the Flex 2’s favour is the amount of control you have over the airflow itself. There are 30 levels of speed available, so you can have a slight breeze or a full-on gust, depending on what your needs are. There’s also a ‘Natural Wind’ mode that more closely mimics the feeling of wind touching your skin when you’re outdoors.

On top of the power available here, the Flex 2 also works great in cooling an entire room thanks to both horizontal and vertical oscillation. This is particularly helpful if you have an office where some people are sat down at their desks, whilst others utilise a standing set-up.

You also have no shortage of control options with the Whisper Flex 2, with a responsive touch panel on the device itself, a remote control and an accompanying app which lets you tweak all of the available settings entirely from your smartphone. You can even set schedules for when you would like the fan to switch on, and at what intensity, so the Flex 2 can work around your routine. Best fan for circulation

A fan isn’t just about direct cooling, it’s about shifting stuffy, stale air around and refreshing a room. That’s where the MeacoFan Sefte 10 Pedestal Air Circulator comes in. A completely new design from the company’s previous air circulators, the new model has a new motor, and a refreshed design. Cleverly, the fan comes with two columns that lock into place. You can use none of these columns for desktop mode, or one or two to adjust the height of the fan. It’s a little slow moving between different heights and modes, but the flexibility is appreciated.

The main fan has an on/off button and fan speed selector, but you need the remote for the main features, which include three modes each of vertical and horizontal oscillation, fan speed, a night mode and eco mode (the fan speed is adjusted based on the ambient temperature).

With 12 fan speeds on offer, the MeacoFan Sefte 10 Pedestal Air Circulator can deliver everything from a gentle breeze (2m/sec at 1m) to a full-on intense stream of air (4.2m/s at 1m). Impressively this fan is quiet, moving between 36.9dB on its quietest setting (effectively background noise) and 53.8dB on its highest setting.

If you want the widest range of fan speeds and the best air circulation, this is the fan to buy. Best smart desktop fan

A welcome upgrade to a classic design, the Dyson Cool CF1 Desk Fan is a new version of a classic. While the fan retains the classic desktop design, with the round head and fanless design, there’s an immediate welcome change: physical controls on the front of the fan’s body.

Rather than having to use the remote (although one is still provided), the fan’s controls allow for physical control over fan speed, the sleep timer and oscillation.

This fan is also compatible with the MyDyson app, which gives full remote control (including more granular sleep controls) – it’s a welcome addition.

The Dyson Cool CF1 Desk Fan is a brilliant desktop fan, with air speeds varying between a very gentle breeze to a 2.5m/s gust of fresh, stable air. It’s also a quiet fan, ranging from 37dB on its lowest setting (background noise) up to 59.5dB on its highest setting. There are cheaper fans, but the quality of the airflow, the range of speeds and silent operation make this the best if you’ve got the money for it.

Best indoor/outdoor fan

If you’re looking for a versatile cooling fan that can be used in a variety of different ways and boasts genuinely useful extras then the Shark FlexBreeze Portable Fan (FA220UK) is one for you.

The FA220UK can be set up as both a pedestal or desktop fan, providing either a whole-room or a personal cooling. To enable desktop mode, simply lift out the fan head and place it wherever you need.

This adjustable fan head is also useful as it allows you to angle and direct the airflow, regardless of what mode it’s in.

Not only that but the fan has been designed for both indoor and outdoor use, and even includes a misting attachment which gently sprays you with a cooling mist of air when you’re outdoors. For even more convenience, the FA220UK works either when connected to mains, or solely on battery power, with an LCD battery indicator showing you when it’s time to recharge. We found that, perhaps unsurprisingly, battery life varies depending on how you use the fan, surviving up to 24-hours on the lowest fan speed and just two hours when set to the maximum.

Controlling the fan is simple and, naturally, there are a couple of ways to do this. Either use the buttons on top of the device or the included remote control which usefully sticks magnetically to the back of the fan itself.

There are five fan speeds to choose from, ranging from a gentle breeze to what our reviewer described as a “full-on wind tunnel”. On its lowest setting, we measured airflow at 1.1 metres per second when 15cm away and found the fan reached just 32.1dB of noise.

With the maximum setting enabled, we measured the airflow at 4.6 metres per second with sound peaking to 50dB which, although noticeable, is certainly not loud enough to distract or disturb. If you’re looking for a truly versatile fan that can be used in numerous ways, has multiple speed levels and boasts extra features then we’d seriously recommend the Shark FlexBreeze Portable Fan FA220UK.

Best budget tower fan

The Dr. Prepare 13-inch Dual Oscillating Tower Fan is a relatively small tower fan that’s as at home on a desk as it is on the floor. Rather than having one set of fan blades, this model has two that work together. The result is more powerful airflow than you might expect from such a model.

Measured on its highest setting, we detected air flor at 1.7m/s at 1m away. At this kind of power, this fan can cool more than one person. Impressively, the fan is also quiet: just 48.5dB from 1m away, and 40.8dB on its minimum speed: that’s barely a whisper. Our only complaint is that the fan makes a slightly waspy noise in operation.

Controls are simple on this device: three power settings and three timers (two, four or eight hours). There’s no remote control or oscillation; if you want those features, look elsewhere on the list. If you want a cheap, small, tower fan, this is a great choice.

Best fan and heater

The Princess Smart Heating and Cooling Tower is a powerful fan and heater that can be used year-round, has an accompanying smartphone app and is compatible with Alexa and Google Assistant.

Although the Tower itself is tall, it doesn’t take up as much floor space as the Dyson Purifier Hot+Cool Formaldehyde, making it much better suited for small and mid-sized rooms. Controlling the Tower is easy with either the included remote control or the Climate smartphone app. While both allow you to adjust the fan speed, switch between cooling and heating modes and set timers in one-hour increments, the app also lets you to set schedules and routines with Alexa and Google Assistant.

Overall we found the Tower to be impressively powerful across both heating and cooling abilities, although it does have the edge when in Heat mode. In fact when Heat mode was enabled we found that airflow from 15cm away was 40°C in both the highest and even the lowest setting.

With cooling (fan) mode, we measured air speed at 3.08m/s at its maximum setting which then fell to 1.31m/s at 1m which, although are decent scores, are trumped by more powerful fans such as the VonHaus 35″ Tower Fan. Best fan for flexibility

If you need a fan where cables won’t reach, say to a garden on a hot day or in a tent when you go camping, the MeacoFan 260C Cordless Air Circulator is the model for you. Thanks to its integrated battery, charged via USB, you can run this model for up to 14 hours without having to go anywhere near a power socket.

We’ve seen small, portable models before, and they’ve usually been a bit rubbish. Not so with the MeacoFan 260C Cordless Air Circulator, which has a lot of power, reaching a maximum air speed of 2.3m/s from 15cm away. That’s enough air to give you a cooling dose of air. There are four fan speeds in total, with the lowest running at 49.7dB, or quiet enough to sleep through. As this is a portable model, you lose out on some features that bigger models have: you don’t get a remote, there are only four fan speeds and there’s no oscillation. If you need any of these options, look elsewhere, but if you want a flexible fan you can take everywhere this is the best model that we’ve reviewed.

Best fan for power

Tower fans are a great space saver but they often sacrifice power to get a slimmer body. Not so with the VonHaus 35″ Tower Fan, which manages to deliver some of the best fan performance that we’ve seen, both up close and across a room.

At full power, the fan delivered air speed at 4.8m/s, which only dropped at 2.8m/s at one metre and an effective 1.6m/s at two metres. That’s enough air speed to keep you cool at a distance, making the VonHaus 35″ Tower Fan a suitable fan to cool an entire room. Our one minor complaint about fan speed is that the lowest setting is still a relatively powerful 4m/s at 1m – we’d have liked a slightly lower minimum speed.

High fan speeds often come with noise, but that’s a trap that the VonHaus 35″ Tower Fan avoids. At 53.9dB on maximum, this fan is pretty quiet for the fan speed; however, at minimum, the fan is still 53.1dB, which is a little loud for sleeping with.

There is a remote control and a display that shows you what the current temperature and fan setting is. This display is a little hard to read, but we can forgive this minor issue, given how good the fan is. Even better, the VonHaus 35″ Tower Fan is one of the cheapest fans that we’ve tested, too. If you’re after a powerful tower fan at a great price, look no further. Best budget tower fan with natural air flow

At just under £40, the Netta 32-inch Tower Fan is a little cheaper than many other products on this list, yet it’s packed with features. As well as three regular speed settings, there are two types of airflow: natural wind mode varies fan speed to make it feel more natural; wind mode uses one fan speed. Alongside these controls, there’s a timer (one, two or four hours) and oscillation mode (65° angle). If you don’t want to walk to the fan, then there’s also a remote control that attaches magnetically when not in use.

We found this a good fan for small- to medium-sized rooms. On its high setting, the fan reached an airspeed of 3.2m/s at a distance of 15cm. That’s good but there are more powerful fans that are better suited to larger rooms. At this speed, we found that the fan wobbled slightly, too. At 1m distance, the fan speed was still a decent 2.2m/s, providing a noticeable cool airflow. We were impressed with how quiet this fan was: at 15cm, we measured it at 66.2dB, and at 1m, it was just 50.3dB.

If you want a well-priced fan for a medium-sized room, then this one is a good choice.

Best personal evaporative cooler

We’ve been impressed with Evapolar’s previous personal evaporative coolers, and the Evapolar evaSMART is the best yet. It’s a little expensive compared to other evaporative coolers, but its smart features and envelope of cold air make it well worth the cash.

This model uses a water tank, which lasts for between four and nine hours, depending on the temperature and humidity level. In either case, it’s enough water to get you through most of a hot night. Unlike a fan, which can’t affect the actual temperature, the evaSMART can reduce the temperature of the air it blows at you: we measured a 3C drop. This is a small amount, but the cooling envelope of air around us made us feel much cooler than if we’d just used a fan.

Air flow isn’t particularly fast. At full speed, just 15cm from the grille, we measured air at 1.9m/s, but the wind speed was unmeasurable by 1m. As this is a personal fan that physically cools the air, the evaSMART doesn’t need to blow air any faster. In fact, at times it felt too cold sitting in front of this cooler.

Although you can control the fan from its on-body controls, there’s also a smart app for remote control (including changing the colour of the light), plus Amazon Alexa and Google Assistant Skills.

It’s a touch on the expensive side, but if you want a small cooler that can keep you comfortable while you work or sleep, this one is very effective. Best evaporative cooler

Sitting somewhere between an air conditioning unit and a fan, the Princess Smart Air Cooler uses a tank of water to cool the air through evaporation. This makes it more effective than just a fan on a hot summer’s day, although this model is also a powerful fan in its own right. Externally, this looks like a regular fan, although there’s a difference when you look at the base: this holds a 3.5-litre water tank, which can also hold the two provided ice packs (these go in your freezer and cool the water in the fan).

A small pump sucks up water and trickles it down a membrane inside. As the fan blows air over the water, it evaporates, cooling the air. We measured a drop in air temperature blown of 2°C, which isn’t as powerful an effect as with an air conditioner, but is an improvement over a fan.

Plus, the Princess Smart Air Cooler costs a lot less to run than an air conditioner. We measured power and this air conditioner will cost around 2p per hour to run at current costs.

The Princess Smart Air Cooler is a powerful fan, too. At 1m away, the fan is capable of blowing air at between 2.5m/s and 4.1m/s, so you can feel its full effect even in a larger room. We didn’t find this fan noisy, but it does have a slightly annoying whine to it. We found the Princess Smart Air Cooler easy to control, with all of the options you need on the front panel and the remote. Plus, this is a smart fan, so you can control it via the decent app, which also provides voice control via Amazon Alexa and Google Assistant.

If you’re looking for a powerful fan that will blow colder-than-room-temperature air and doesn’t cost a fortune to run, this is a great choice.

Best desktop fan for power

If you’re looking for a compact table fan that’s easy to use and powerful, yet quiet enough so that it shouldn’t disturb you, then the Duux Globe is a fantastic choice.

While the Globe does lack some of the smart features found in its pricier counterparts, it sports everything you need to keep cool and comfortable at home. With a curved fan head that rests on a neat conical base, the Globe can sit atop desks and most surfaces without taking up much space.

Although we deemed its touch-sensitive controls basic, with only three speeds to choose from and a timer that only counts down from just one or three hours, the included remote control does cover more features, including adjusting the swing. Overall we were left impressed by the Globe’s airflow and measured its windspeed at 2m/s from 15cm away at its lowest setting, which fell to a gentle 1.1m/s when measured from a metre’s distance.

At full power however, the Globe propelled air at up to a whopping 4.6m/s from 15cm away. At this speed, the Globe sounded at 65dB, making it a reasonably quiet fan for the level of power provided. In fact, we found that when out of the air flow, the figures fell to 35.9dB, making it a seriously quiet fan with the level of power included.

Even with such power, the Globe is extremely efficient and consumes just 6W of energy when set to full speed.

Best fan and air purifier

The Acerpure Cool AC551-50W is a mighty two-in-one appliance that works as both a fan and an air purifier.

Its appearance might appear somewhat clunky, with a small fan on top of a fairly big purifier but this is actually a thoughtful design that enables the fan to oscillate horizontally and vertically. While this version doesn’t have a germicidal UV-C lamp like the AC553-50W alternative, it still sports a four-stage filter with PM2.5, PM1 and volatile organic compound (VOC) sensors. At this price, these filters are seriously impressive.

Controlling both the fan and purifier is via touch-sensitive controls and display on the device, which enables you to configure different speeds for both. While the fan can be turned off independently, there isn’t an option to switch the air filter off which means it’s always running unless you turn the whole device off.

You can also connect the air purifier to the Acerpure app via a shared Wi-Fi network, however we must say this proved to be a seriously underwhelming and frustrating process. Not only was it tricky to set up but the app was slow to reflect air quality readings from the purifier’s onboard sensors. Hopefully an update will fix this in the future.

Otherwise, we were seriously impressed with the purifier’s performance. During our testing we found the Acerpure Cool managed to bring the PM2.5 sensor down from the maximum 999 level within just four minutes. After eight minutes, the room air was deemed “moderate” and, finally, after 13 minutes the room was almost free of particulates. If you don’t want to splurge on a standalone fan, then the Acerpure Cool AC551-50W is a brilliant option as its built-in purifier can be used year-round. While we had difficulties with the app, the purifier improved a room’s air quality within 15 minutes while the fan’s 10 speed settings offered versatility.

Best fan for home working

If you regularly move between working from home and working in an office, and you just want a reliable desk fan that can be easily transported between those two locations then the Duux Rize is one of the best picks out there. With a built-in battery that’s rechargeable via USB-C, this is one of those rare fans that can truly operate anywhere.

You don’t have to worry about it running out of power either as it can last for up to 15-hours on a single charge, which is more than enough to get you through the working day. Even though it’s small enough to fit within a tote bag, you can lengthen the stem and tilt the fan upwards, giving you more range of airflow that works well if you have a standing desk.

Of course, regardless of any extra capabilities, every desk fan needs to bring the power where it counts and thankfully the Duux Rize is no slacker when it comes to keeping you cool. There are four stages of airflow but even at the lowest setting, you’ll still be getting a wonderfully cooling breeze that covers a good amount of space.

When cranking the power all the way up to its maximum setting, we were able to pick up on a powerful 3.1m/s air flow from 15cm away, which can bring your temperature down in next to no time. It’s also surprisingly quiet too, so you won’t run the risk of annoying your coworkers whilst the Duux Rize is on. As a final point, there is an on/off oscillation mode available on the Duux Rize which, when paired with the added height available via the stem, can allow the device to take on the persona of a room fan when needed. Alternatively, this means that you can help to spread the airflow across two desks rather than just one.

Best portable desk fan

While the Duux Rize is arguably the best portable fan on this list, the MeacoFan Sefte 8″ Portable Battery Air Circulator is a great alternative that trades some portability in favour of more powerful airflow and a few extra settings. You won’t be fitting MeacoFan’s device into a tote bag anytime soon, but we think the trade-off is well worth it.

Even just to look at the MeacoFan Sefte 8”, you can tell that this is a desk fan that means business. It has no less than 12 airflow settings, so you have a wide range of options to suit a light breeze or a full-on gust depending on how hot the room is. One feature we absolutely loved, and would appreciate more manufacturers adopting, is the Eco mode which automatically sets the airflow based on the room’s temperature.

Although being a larger desk fan, the Sefte 8” still boasts a stylish design that uses a wonderful two-tone aesthetic to stand out. You can even angle the fan upwards to offer a reprieve from the heat if you’re at a standing desk.

In spite of its many features, what arguably impressed us the most was MeacoFan’s consumer-friendly practices. For starters, the battery on the Sefte 8” is fully replaceable so there’s no need to upgrade to an entirely different fan once the battery starts to go, and there’s a three-year warranty included as standard. There’s even a remote that magnetically attaches to the centre of the fan itself when not in use. With the remote in tow, you can change the airflow levels, activate oscillation and more. If you do misplace the remote however then the built-in control panel on the base of the Sefte 8” can also do the job.

Best year-round fan

As much as we love the Shark TurboBlade TF200UK, there’s no denying that when the winter months start to rear their head, much like with any fan, it goes largely unused or simply put away until the following year. Thankfully, the Shark TurboBlade Cool + Heat TH200UK solves this problem by providing a device that can be used all year round, regardless of the temperature.

Aside from looking a lot cooler than your average fan, the blade system works really well for directing airflow to where you need it to be. Just rotate the fan to your liking and you’ll enjoy a cooling gust right away. In fact, when using the fan at full power, we were impressed to see 1.9m/s of airflow from a distance of one metre, and when you factor oscillation into the mix, this fan works well for cooling a bedroom or living room.

Of course, during the colder months of the year, you can just swap over to the heat mode and feel the chill slip away as you settle in and relax. If you live in a flat or house without heaps of storage then having an all-in-one device like this can be a big win, and it’ll save you from having to pick up a fan and a heater separately.

One handy feature where energy consumption is concerned is the built-in thermostat which helps to regulate the temperature between 16°C and 32°C. This is especially helpful when using the heating element as you won’t need to have it switched on constantly as it’ll trigger when it’s needed. For anyone looking to keep better tabs on their energy consumption, this is a big win. There’s no app to use with this device, although that might be preferable to some who don’t want yet another smart home app installed on their phone. Instead, the TH200UK has a remote control included which makes thing easy, giving you quick access to the various modes and airflow speeds onboard. While the TH200UK is definitely a bit pricier than most options on this list, its year-round versatility is hard to match which is why it’s a solid investment.

Learn more about how we test fans

Shark TurboBlade TF200SUK

Pros

Cons

Duux Whisper Flex 2

Pros

Cons

MeacoFan Sefte 10 Pedestal Air Circulator

Pros

Cons

Dyson Cool CF1

Pros

Cons

Shark FlexBreeze Portable Fan FA220UK

Pros

Cons

Dr. Prepare 13-inch Dual Oscillating Tower Fan

Pros

Cons

Princess Smart Heating and Cooling Tower

Pros

Cons

MeacoFan 260C Cordless Air Circulator

Pros

Cons

VonHaus 35" Tower Fan

Pros

Cons

Netta 32-inch Tower Fan

Pros

Cons

Evapolar evaSMART

Pros

Cons

Princess Smart Air Cooler

Pros

Cons

Duux Globe

Pros

Cons

Acerpure Cool AC551-50W

Pros

Cons

Duux Rize

Pros

Cons

MeacoFan Sefte 8" Portable Battery Air Circulator

Pros

Cons

Shark TurboBlade Cool + Heat TH200UK

Pros

Cons

Shark TurboBlade TF200SUK

Pros

Highly adjustable

Very powerful

Quiet

Cons

Basic LED read-out

Relies on remote control

Duux Whisper Flex 2

Pros

Supremely powerful airflow

Plenty of oscillation options

Very quiet at the lower levels

Absolutely no shortage of smart features

Cons

Battery pack is sold separately

The remote control can sometimes be fiddly

MeacoFan Sefte 10 Pedestal Air Circulator

Pros

Very powerful

Lots of fan speeds

Very quiet

Vertical and horizontal oscillation

Cons

Fiddly to convert between desktop and pedestal modes

Dyson Cool CF1

Pros

One of the best looking desk fans you can buy

Easy to use controls

Brilliantly silent oscillation

Cons

Not the best buy for those on a budget

Airflow is a bit more spread out than most desk fans

Shark FlexBreeze Portable Fan FA220UK

Pros

Pedestal or desktop modes

Integrated battery

Very quiet

Mister helps cool you down

Cons

Hard-to-read LCD

Basic fan speed control

Dr. Prepare 13-inch Dual Oscillating Tower Fan

Pros

Compact

Powerful air flow

Excellent value

Cons

Slightly waspy noise

Princess Smart Heating and Cooling Tower

Pros

Powerful heating and cooling

Useful smart app and voice control

Doesn't take up much space

Cons

Doesn't display fan mode on LCD

Could do with a lower fan speed

For a device that can be used all year round, the Princess Smart Heating and Cooling Tower is a versatile choice. Although the Dyson Purifier Hot+Cool Formaldehyde can heat, cool and even act as an air purifier, the Princess Smart Heating and Cooling Tower is a much more budget-friendly option.

MeacoFan 260C Cordless Air Circulator

Pros

Light and small

Long-lasting internal battery

Powerful air movement

Cons

No oscillation

VonHaus 35" Tower Fan

Pros

Powerful air circulation

Reasonably quiet performance

Ioniser, three wind modes, and a remote

Comparatively narrow base

Two-year warranty (with registration)

Cons

Could do with a lower fan speed

Netta 32-inch Tower Fan

Pros

Good value

Lots of control options

Remote control

Cons

Not ideal for larger rooms

Evapolar evaSMART

Pros

Super-quiet

Effective cooling

Useful smart features

Cons

Expensive

No temperature-based smart actions

Princess Smart Air Cooler

Pros

Powerful fan

Subtly effective cooling

Smart features including scheduling and voice control

Cons

No temperature or other sensors

No dedicated remote control

Not as effective as aircon

Duux Globe

Pros

Quiet and powerful

Horizontal and vertical oscillation

Low power consumption

Cons

On-fan controls are confusing

Only three speeds

Acerpure Cool AC551-50W

Pros

Powerful fan

Excellent air purifier

PM2.5, PM1 and volatile gas sensors

Cons

Unreliable app

Duux Rize

Pros

Super long battery life

Extendable stem

Decent power

Cons

No timer function

No smart features

MeacoFan Sefte 8" Portable Battery Air Circulator

Pros

One of the quietest desk fans around

Slick design

Replaceable battery

Magnetic holster for the remote

Cons

Not the most portable desk fan

No USB-C charging

Shark TurboBlade Cool + Heat TH200UK

Pros

Powerful fan

Hugely flexible design

Smart remote control

Powerful heating

Cons

Can't turn lights off

Can't switch mode using the remote

FAQs

A fan can’t change a room’s temperature; it merely circulates air. However, the breeze from a fan on your body aids sweat evaporation, which makes you cooler. In humid environments, fans don’t work so well, as less sweat evaporates.

For this reason, you may want to think about buying a dehumidifier, too, which will improve a fan’s performance and make your room feel more comfortable. The increased air circulation can also stop a room from feeling stuffy.

To actually cool a room you need something that can lower the air temperature. Air conditioning is the main option in this instance, but a second option is to use an evaporative cooler. These feature a tank of water, which slowly evaporates to help cool the air, and work best in dry, hot climates.

Fans make you feel cooler by helping sweat evaporate from your body. How effective a fan is, depends largely on how humid it is. When there’s high humidity, it’s hard for sweat to evaporate, so a fan doesn’t do much to help cool you. This is why on humid days we tend to think of them as being hot and sweaty. Conversely, when humidity is lower, it’s much easier for evaporation to happen, which is when fans feel the most effective.

You can use this knowledge to your advantage and purchase a dehumidifier for those sweltering days. With a dehumidifier sucking moisture out of the air, the effectiveness of fans goes up. A dehumidifier will also make an evaporative cooler more effective, too.

Air conditioning units can also operate as dehumidifiers. So, if you have a portable unit but find it too loud to sleep with, you can run it before you go to bed in dehumidifier or cooling mode, and then switch to a fan at night. That way, you get the best of both worlds: a cool and less humid environment to go to sleep in with a fan to keep you cool during the night

Desktop fans are the traditional models. These let you tilt the fan to direct airflow; you turn on the oscillation mode to let the fan sweep from side to side.

Pedestal fans look like tall desktop fans, and are designed to stand on the floor. Typically, they have larger blades, so take up more room, but this makes them more powerful. With most models offering height adjustment, in addition to pivot and oscillation, pedestal fans are easier to configure for the perfect cooling breeze.

Tower fans take up very little floor space and blow air out of a tall column. For the reduction in size you do sacrifice some power, and you don’t get height or pivot adjustments either – just oscillation. As a result, you may need to use a tower fan closer to you, but they’re a great choice where space is at a premium.

Noise is important, particularly if you want to sleep with a fan turned on. We’ve measured every fan’s sound levels at both maximum and minimum to help you decide.

A fan with a remote control can be a good option if you want to adjust settings on the fly. This is particularly true in the bedroom, where you may not want to get out of bed to turn off your fan. On that note, look for a fan with a sleep timer so that it will shut off after a set time.

More advanced options on high-end fans include air filters to help clean the air, or heating elements so that you can keep warm in the winter.

Evaporative coolers use a tank of water and a pump. As water evaporates it cools the air, letting these fans blow out air that’s colder than the ambient temperature: think of how it feels if you spray yourself with water on a hot day. The good thing about evaporative coolers is that they’re cheaper to run than an air conditioner and work with windows open. The downside is that they don’t work very well where it’s humid and water can’t evaporate.

Performance also differs depending on the level of humidity: evaporative coolers work best in very dry environments where the effect of evaporation is to also increase humidity for a more comfortable environment. Fortunately, UK summers tend to be hot but not that humid, so evaporative coolers work fairly well. However, they don’t reduce the temperature of a room as air conditioning will and work best when you’re in the cooling line of the fan.

Air purifiers are a good way to boost the internal comfort of your home. They’re designed to filter out impurities in the air, including pollutants, allergens, dust and, in some cases, gasses. By filtering these out of your air, you get cleaner, purer air inside your home, which is beneficial to all but particularly those with respiratory problems or allergies.

While you can buy standalone air purifiers, it means that you end up with multiple boxes around your home. Having an air purifier built into a fan gives you a dual-purpose design. The main thing to watch out for is whether or not there’s a diffuse mode, where air can be directed out the back of the fan: that way, you can use the purification features in the colder months, without getting a blast of cold air.

Smart features don’t change what a fan is capable of, but they do let you control them automatically via an app and, possibly, via voice using Amazon Alexa or Google Home. The benefit, for most people, is one of laziness, as you can control your fan without having to stand up and move. However, some models let you do some clever things. For example, with Dyson smart fans, you can programme automatic routines, such as automatically turning the fan off when a motion sensor detects that nobody is in the room, helping save energy. The downside of smart fans is that they’re typically more expensive. A cheap workaround is to use an old fan with physical controls connected to a smart plug: this won’t let you choose the fan speed but will let you turn the fan on and off remotely.

All fans can adjust the amount of air that comes out of them by adjusting how fast their blades spin: the slower they go, the lower the air flow. Having control over the air flow is very important for different situations, and where you sit. So, as our tests show, the slower the fan speed, the less the impact is at distance, so if you sit further from the fan or want to cool more people, you need a higher fan speed. Conversely, if you’re sitting at a desk and just want to cool yourself, then you can get by with a lower fan speed, which will also mean that you don’t blow papers around on your desk.

There’s also a difference in noise at different fan speeds, with lower fan speeds quieter, and faster louder. This is important at night, where you may want a slower, more gentle and quieter fan speed, rather than roar of full cooling power.

Generally speaking, the more fan speeds a fan has, the greater the difference between minimum and maximum power, giving you a greater range of options for cooling. Some fans, on the other hand, have few cooling speeds, so you get little difference between full power and low power.

Test Data

| Shark TurboBlade TF200SUK | Duux Whisper Flex 2 | MeacoFan Sefte 10 Pedestal Air Circulator | Dyson Cool CF1 | Shark FlexBreeze Portable Fan FA220UK | Dr. Prepare 13-inch Dual Oscillating Tower Fan | Princess Smart Heating and Cooling Tower | MeacoFan 260C Cordless Air Circulator | VonHaus 35" Tower Fan | Netta 32-inch Tower Fan | Evapolar evaSMART | Princess Smart Air Cooler | Duux Globe | Acerpure Cool AC551-50W | Duux Rize | MeacoFan Sefte 8" Portable Battery Air Circulator | Shark TurboBlade Cool + Heat TH200UK | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sound (low) | 38.5 dB | – | 36.9 dB | 37.0 dB | 32.1 dB | 40.8 dB | 48.5 dB | 40.8 dB | 31.5 dB | 43 dB | 31 dB | 59.7 dB | 37.5 dB | – | 38.7 dB | 34.8 dB | 38.5 dB |

| Sound (medium) | 42.9 dB | – | 41 dB | 46.5 dB | 38.1 dB | 45.5 dB | – | – | – | 46.5 dB | 47.5 dB | 67.7 dB | – | – | 51.7 dB | 43.5 dB | 42.9 dB |

| Sound (high) | 55.2 dB | – | 53.8 dB | 59.5 dB | 50 dB | 48.5 dB | 60.1 dB | 59.5 dB | 53.1 dB | 50.3 dB | 47.5 dB | 62.1 dB | 63 dB | – | 62.2 dB | 54.0 dB | 54.5 dB |

| Time to clear smoke | – | – | – | – | – | – | – | – | – | – | – | – | – | 600 sec | – | – | – |

| Air speed 15cm (low) | 1.07 m/s | 1.4 m/s | 2.48 m/s | 0.0 m/s | 1.1 m/s | 2 m/s | 1.31 m/s | 1.6 m/s | 4 m/s | 2.6 m/s | – | 5.2 m/s | 2 m/s | – | 1.4 m/s | 0.0 m/s | 1.2 m/s |

| Air speed 15cm (medium) | 2.42 m/s | 2.6 m/s | 3.84 m/s | 2.2 m/s | 3.2 m/s | 2.5 m/s | – | – | – | 2.9 m/s | – | 6.6 m/s | – | – | 2.0 m/s | 2.0 m/s | 2.4 m/s |

| Air speed 15cm (high) | 5.5 m/s | 3.7 m/s | 5.7 m/s | 2.5 m/s | 4.6 m/s | 2.8 m/s | 3.08 m/s | 2.3 m/s | 4.8 m/s | 3.2 m/s | 1.9 m/s | 7.7 m/s | 4.6 m/s | – | 3.1 m/s | 3.1 m/s | 3.7 m/s |

| Air speed 1m (low) | 0 m/s | 1.0 m/s | 2 m/s | 0.0 m/s | 0.8 m/s | 1.1 m/s | – | 0 m/s | 2.2 m/s | 1.7 m/s | – | 2.5 m/s | 1.1 m/s | – | 0.0 m/s | 0.0 m/s | – |

| Air speed 1m (medium) | 1.14 | 2.2 | 3 | 1.0 | 2.4 | 1.5 | – | – | – | 1.9 | – | 3.2 | – | – | 1.0 | 1.8 | 1.1 |

| Air speed 1m (high) | 2.27 m/s | 3.0 m/s | 4.2 m/s | 2.0 m/s | 3.6 m/s | 1.7 m/s | 1.31 m/s | 1.2 m/s | 2.8 m/s | 2.2 m/s | – | 4.1 m/s | -0.4 m/s | – | 2.0 m/s | 2.6 m/s | 1.9 m/s |

| Air volume 1m (low) | – | 31.9 m³/h | – | – | – | – | 0.4 m³/h | – | – | – | – | – | – | – | – | – | – |

| Air volume 1m (high) | – | 52.8 m³/h | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – |

Full Specs

| Shark TurboBlade TF200SUK Review | Duux Whisper Flex 2 Review | MeacoFan Sefte 10 Pedestal Air Circulator Review | Dyson Cool CF1 Review | Shark FlexBreeze Portable Fan FA220UK Review | Dr. Prepare 13-inch Dual Oscillating Tower Fan Review | Princess Smart Heating and Cooling Tower Review | MeacoFan 260C Cordless Air Circulator Review | VonHaus 35" Tower Fan Review | Netta 32-inch Tower Fan Review | Evapolar evaSMART Review | Princess Smart Air Cooler Review | Duux Globe Review | Acerpure Cool AC551-50W Review | Duux Rize Review | MeacoFan Sefte 8" Portable Battery Air Circulator Review | Shark TurboBlade Cool + Heat TH200UK Review | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| UK RRP | – | £177.99 | £179.99 | £248.99 | £199.99 | £42.99 | £199.99 | £29.99 | £40 | £59.99 | £239 | £129.84 | £69.99 | £111 | £79.99 | £79.99 | – |

| USA RRP | – | – | – | $1 | $199.99 | – | – | – | – | – | $229 | Unavailable | Unavailable | Unavailable | – | – | – |

| EU RRP | – | €159.99 | – | – | – | – | – | – | – | – | €238 | Unavailable | €83.99 | Unavailable | €69.99 | – | – |

| CA RRP | – | – | – | – | – | – | – | – | – | – | Unavailable | Unavailable | Unavailable | Unavailable | – | – | – |

| AUD RRP | – | – | – | – | – | – | – | – | – | – | Unavailable | Unavailable | Unavailable | Unavailable | – | – | – |

| Manufacturer | Shark | Duux | Meaco | – | Shark | – | Princess | Meaco | VonHaus | – | Evapolar | Princess | Duux | Acer | Duux | Meaco | – |

| Quiet Mark Accredited | – | Yes | – | – | – | – | – | – | – | – | – | No | – | No | Yes | No | – |

| Size (Dimensions) | 750 x 750 x 1120 MM | 34 x 34 x 95 CM | 340 x 340 x 1098 MM | 35.5 x 14.7 x 55 CM | 35 x 35 x 94 CM | 109 x 381 x 109 MM | 230 x 230 x 1020 MM | 166 x 140 x 268 MM | 280 x 280 x 800 MM | 20 x 20 x 80 CM | 217 x 184 x 207 MM | 280 x 220 x 760 MM | 260 x 260 x 330 MM | 253 x 253 x 850 MM | 18.4 x 20.6 x 34 CM | 261 x 211 x 384 MM | 350 x 299 x 1167 MM |

| Weight | – | 4.2 KG | 5.4 KG | 1.8 KG | 5.67 KG | 889 G | – | – | – | 3.56 KG | 1.8 KG | 4.3 KG | 2.5 KG | 6.34 KG | 1 KG | 2.3 KG | 9.2 KG |

| ASIN | – | – | – | – | – | B081RFZ17K | B09443QC51 | B07DTHYKPP | B099FL132N | B082Y949L2 | B079ZYLWRM | B09XBJYM9Q | B0922L4FNY | B0BBRF984W | – | – | B0FM9CR2RF |

| Release Date | 2025 | 2025 | 2024 | 2025 | 2024 | 2019 | 2021 | 2021 | 2021 | 2023 | 2020 | 2021 | 2021 | 2024 | 2025 | 2025 | 2025 |

| First Reviewed Date | 26/06/2025 | 17/06/2025 | 24/06/2024 | 16/06/2025 | 25/06/2024 | 06/07/2023 | 27/01/2022 | 19/06/2020 | 05/07/2019 | 21/08/2023 | 06/07/2021 | 28/07/2022 | 06/07/2021 | 05/08/2024 | 16/06/2025 | 23/06/2025 | 05/11/2025 |

| Model Number | TF200SUK | – | MeacoFan Sefte 10 Pedestal Air Circulator | – | Shark FlexBreeze Portable Fan FA220UK | Dr. Prepare 13-inch Dual Oscillating Tower Fan | Princess Smart Heating and Cooling Tower | MeacoFan 260C Cordless Air Circulator | VonHaus 35″ Tower Fan | Netta 32-inch Tower Fan | Evapolar evaSMART | 01.357250.02.001 | Duux Globe | AC551-50W | – | – | – |

| Voice Assistant | – | – | – | – | – | – | – | – | – | – | – | – | – | No | – | – | – |

| Modes | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | Heating, cooling |

| Stated Power | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | 2200 W |

| Remote Control | Yes | Yes | Yes | Yes | Yes | – | Yes | – | Yes | Yes | – | Yes | Yes | – | – | Yes | Yes |

| App Control | – | Yes | – | Yes | – | – | Yes | – | – | – | Yes | Yes | – | Yes | – | – | – |

| Filter type | – | – | – | – | – | – | – | – | – | – | – | – | – | HEPA13 | – | – | – |

| Max room size | – | – | – | – | – | – | – | – | – | – | – | – | – | 45 m2 | – | – | – |

| Smoke CADR | – | – | – | – | – | – | – | – | – | – | – | – | – | 306 | – | – | – |

| Number of speeds | 10 | 30 | 12 | 10 | 5 | 3 | 10 | 4 | 3 | 3 | 100 | 3 | 3 | 4 | 4 | 12 | 10 |

| Auto mode | – | – | – | – | – | – | – | – | – | – | – | – | – | Yes | – | – | – |

| Filter replacement light | – | – | – | – | – | – | – | – | – | – | – | – | – | Yes | – | – | – |

| Fan Type | Tower | Room fan | Pedestal or desktop fan | Personal fan | Battery or mains powered, desktop or pedestal fan | Tower fan | Heater and fan | Cordless desktop | Tower | Tower | Evaporative cooler | Tower | Desktop | – | Personal fan | Desk fan | Fan heater |

| Oscillation | Yes (45°, 90°, 180°) | 90 degrees | Yes (20°, 30° and 65° vertical, 30°, 75° or 120° horizontal) | 15, 40, 70 degrees | Yes (up to 180°) | No | Yes | No | 70-degrees horizontal | Yes | No | Yes, horizontal | 90-degrees horizontal, 80-degrees vertical | – | 90 degrees | 70 degrees | Yes (45°, 90°, 180°) |

| Timer | Yes (one, two, four, eight and 12 hours) | 1-12 hours | Yes (one-hour intervals up to 12 hours) | Yes | Yes (one-hour intervals up to five hours) | Yes (two, four and eight hours) | Up to 24 hours | No | Up to eight hours | Yes | Yes | Yes, 1-24 hours | 1,3 hours | – | No | No | Yes (1, 2, 4 and 8 hours) |

| Night Mode | Yes | Yes | Yes | Yes | – | Yes | Yes | – | Yes | – | Yes | – | Yes | – | – | Yes | Yes |

| Water tank size | – | – | – | – | – | – | – | – | – | – | 1.3 | 3.5 | – | – | – | – | – |

| Heat mode | – | No | No | No | No | – | Ceramic heater with thermostat | No | No | No | No | No | No | – | No | No | Yes (16°C to 18°C) |

| Heater type | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | Fan heater |

| Heat settings | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | Three |

| Thermostat | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | Yes |

| Safety features | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | Overheat protection, tip-over protection |

The post Best Fan 2026: Prepare for the summer heatwaves appeared first on Trusted Reviews.

Tech

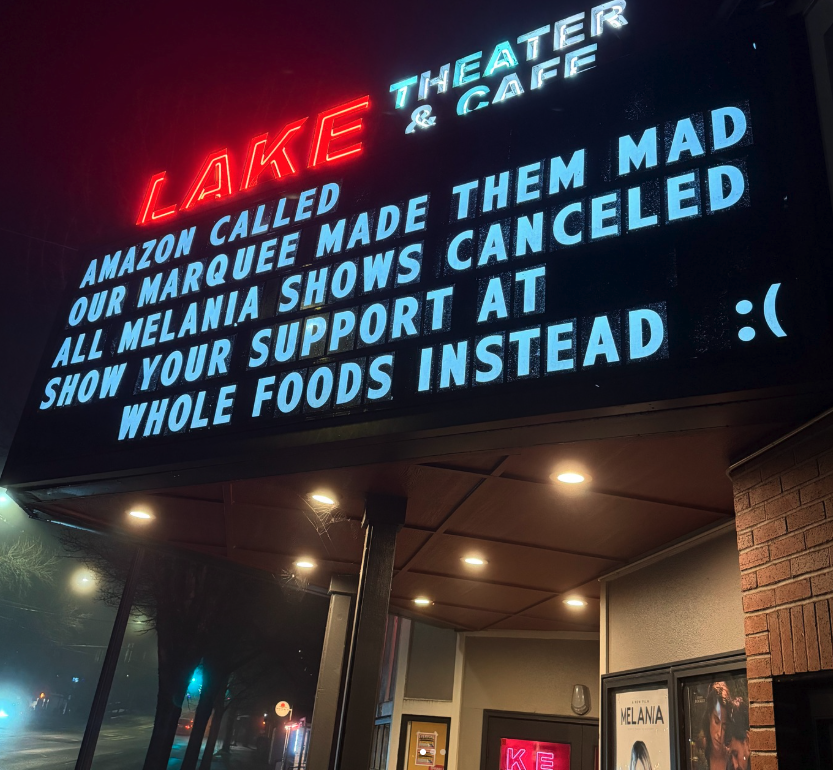

Oregon theater marquee joked about ‘Melania’ movie, and manager says Amazon pulled the film

The new “Melania” documentary film was released by Amazon MGM Studios to 1,778 theaters across the country. Make that 1,777 now.

The manager of the Lake Theater & Cafe in Lake Oswego, Ore., just outside of Portland, said a marquee he put up for the theater’s screening of the film about First Lady Melania Trump managed to upset Amazon enough that the company pulled the film.

“To defeat your enemy, you must know them. Melania starts Friday,” read the marquee, as seen in a photograph accompanying a story in The Oregonian.

In an Instagram post on Monday, Lake Theater & Cafe said “the higher ups” at Amazon were upset with the marketing move and that Sunday was the last showing of “Melania” at the theater. A new marquee said Amazon got “mad” and all “Melania” shows were canceled, and that patrons could show their support instead at a nearby Amazon-owned Whole Foods Market.

GeekWire reached out to Amazon for comment, and we’ll update if we hear back.

Marquee messages are apparently a running joke at the Lake Theater. On the theater’s website about page, there are numerous voicemails from passersby reacting to previous messages. The page also has a photo of a marquee that read, “Not getting the Taylor Swift movie because her music’s not even good.”

In a blog post, manager Jordan Perry expounded on why the theater even booked a two-week run of “Melania,” the reaction from both sides of the political spectrum, and how much money the screening made for Amazon founder Jeff Bezos.

“To fill a screen, why not get this inexplicable vanity piece from the current president’s wife?” Perry wrote. “I mean, it just seems so weird that it even exists (who wants a movie about Melania lol?), and wouldn’t it then be exponentially weirder, to the point of being funny, to show it here, at your obviously anti-establishment, occasionally troublemaking, neighborhood cinema?”

Perry said he had no interest in trying to get people to vote one way or another. He said he was more interested in helping people be more “open-minded, compassionate, and well-informed.” He added that for each $11 ticket sold, $5.50 went to Amazon MGM Studios.

“We contributed, in all, $196 to the Jeff Bezos Trust Fund this week (far more to the ‘Hamnet’ Trust Fund, thank you, ‘Hamnet’ lovers),” Perry said.

“Melania” pulled in much more than that in a total weekend box office of $7 million — the largest opening haul for a non-concert documentary in 14 years, according to The New York Times. The film finished third for the weekend behind horror thriller “Send Help” ($20 million) and horror sci-fi mashup “Iron Lung” ($18 million).

Amazon spent $75 million to acquire the rights and market the film, which was directed by Brett Ratner (“Rush Hour,” “X-Men: The Last Stand”) and provides an inside look at the 20 days leading up to the 2025 presidential inauguration.

Backlash around the film was not limited to a small theater in Oregon. Critics torched the film as propaganda in early reviews. Bus stop ads and billboards in Los Angeles have been defaced. And Amazon CEO Andy Jassy and Apple CEO Tim Cook were among those who took heat for attending a private White House screening of the film on the same day protester Alex Pretti was killed in Minneapolis by federal agents.

Watch the “Melania” trailer below:

Tech

The OnePlus 16 could have a much better zoom camera and a massive battery

OnePlus is tipped to deliver a major camera upgrade with its upcoming flagship, the OnePlus 16, expected later in 2026.

According to a new leak, the device will feature a 200MP telephoto sensor measuring 1/1.56 inches, a significant jump from the 50MP 1/2.76-inch telephoto lens found on the OnePlus 15. This change could dramatically improve zoom performance and image detail, while also introducing telephoto macro capabilities for close-up shots.

The leak, shared by @OnePlusClub on X, suggests OnePlus is finally addressing criticism of the OnePlus 15’s scaled-down camera system. That model shipped with smaller sensors and lacked Hasselblad colour tuning, leaving photography enthusiasts underwhelmed despite strong performance elsewhere.

The OnePlus 16’s rumoured telephoto upgrade would put it in line with rivals such as Oppo’s Find X9 series, which already offers telephoto macro functionality.

Beyond the camera, the OnePlus 16 is rumoured to pack a 9,000mAh battery, up from 7,300mAh on its predecessor, alongside a display refresh rate exceeding 200Hz. These specifications suggest OnePlus is targeting both endurance and gaming performance.

The handset is also expected to run Qualcomm’s next flagship chipset, though it remains unclear whether it will use the rumoured Snapdragon 8 Gen 6 or the top-end 8 Elite Gen 6. For those weighing up their next upgrade, our best Android phones guide offers a broader look at the competition.

Leaks around the OnePlus 16 highlight a shift in priorities. The OnePlus 15 impressed with raw performance thanks to the Snapdragon 8 Elite Gen 5 and a larger battery, but its camera compromises were seen as a step back from the OnePlus 13.

Therefore, the rumoured 200MP telephoto sensor could mark a return to form, especially for users who value versatile photography. However, until OnePlus confirms details, these specifications remain speculative.

These leaks suggest OnePlus is preparing to position the OnePlus 16 as a more balanced flagship, combining performance with meaningful camera improvements. If accurate, the upgrade could make the device one of the most compelling Android options in 2026, particularly for those who demand strong zoom capabilities without sacrificing everyday usability.

Tech

Seeking Candidates for Top IEEE Leadership Positions

Strong leadership is essential for IEEE to advance technology for humanity. The organization depends on the dedicated service of its volunteers to advance its mission.

Each year, the Nominations and Appointments (N&A) Committee is responsible for recommending candidates to the Board of Directors and the IEEE Assembly for volunteer leadership positions, including president-elect, corporate officers, committee chairs, and committee members. See below for the complete list.

By nominating qualified, experienced, committed volunteers, you help ensure continuity, good governance, and thoughtful decision-making at the highest levels of the organization. We encourage nominators to take a deliberate approach and align nominations with each candidate’s demonstrated experience and the specific qualifications of the role.

To nominate a person for a position, complete this form.

The N&A Committee is currently seeking nominees for the following positions:

2028 IEEE President-Elect (who will be elected in 2027 and will serve as President in 2029 )

2027 IEEE Corporate Officers

• Secretary

• Treasurer

• Vice President, Educational Activities

• Vice President, Publication Services and Products

2027 IEEE Committees Chairs and Members

• Audit

• Awards Board

• Collaboration and Engagement

• Conduct Review

• Election Oversight

• Employee Benefits and Compensation

• Ethics and Member Conduct

• European Public Policy

• Fellow

• Fellow Nominations and Appointments

• Governance

• History

• Humanitarian Technologies Board

• Industry Engagement

• Innovations (formerly New Initiatives)

• Nominations and Appointments

• Public Visibility

• Tellers

Deadlines for nominations

15 March

- Vice President, Educational Activities

- Vice President, Publication Services and Products

- Committee Chairs

15 June

- President-Elect

- Secretary

- Treasurer

- Committee Members

Deadlines for self-nominations

30 March

- Vice President, Educational Activities

- Vice President, Publication Services and Products

- Committee Chairs

30 June

- President-Elect

- Secretary

- Treasurer

- Committee Members

Who can nominate

Anyone may submit a nomination. Self-nominations are encouraged. Nominators need not be IEEE members, but nominees must meet specific qualifications. An IEEE organizational unit may submit recommendations endorsed by its governing body or the body’s designee.

A person may be nominated for more than one position, however nominators are encouraged to focus on positions that align closely with the candidate’s qualifications and experience. Nominators need not contact their nominees before submitting the form. The IEEE N&A committee will contact eligible nominees for the required documentation and for their interest and willingness to be considered for the position.

How to nominate

For information about the positions, including qualifications, estimates of the time required by each position during the term of office, and the nomination process check the IEEE Nominations and Appointments Committee website. To nominate a person for a position, complete this form.

Nominating tips

Make sure to check eligibility requirements on the N&A committee website before submitting a nomination as those that do not meet the stated requirements will not be advanced.

Volunteers with relevant prior experience in lower-level IEEE committees and units are recommended by the committee more often than volunteers without such experience.

Individuals recommended for president-elect and corporate officer positions are more likely to be recommended if they possess a strong track record of leadership, governance experience, and relevant accomplishments within and outside IEEE. Recommended president-elect candidates must have served on the IEEE Board of Directors for at least one year.

Contact nominations@ieee.org with any questions.

From Your Site Articles

Related Articles Around the Web

Tech

We Retested Every Meal Kit Service. This Underdog Is Our New Favorite in 2026

Pros

- Thoughtful recipes you won’t find everywhere

- Even the quick recipes felt special

- Extremely fresh ingredients

- Not a lot of plastic waste

Cons

- On the expensive side when you factor in shipping

- Market add-ons are not the best

Meal kits have been around for more than a decade. HelloFresh, Blue Apron, and Home Chef have been the most visible, blasting ads on social media and during your favorite podcast — but are they the best?

After testing and retesting every meal kit service (here’s how we do it), crafting dozens of these meals-by-mail in our own kitchens, we’ve picked a new favorite for 2026, and it’s not one of the “big three.”

If you’re looking for excellent meal kits that are anything but boring, there’s a new top dog in town.

Marley Spoon offers creative and tasty meals, which may come as no surprise when you learn who the woman behind the recipes is: kitchen maven herself, Martha Stewart.

Marley Spoon caters to adventurous home cooks and food enthusiasts with creative recipes that appeal to both beginners and more refined palates. Unlike some meal kit services that target newcomers with straightforward, quick-prep dishes, Marley Spoon offers more elevated fare featuring Martha’s own recipes. Many come straight from her cookbooks or personal collection, yet they remain accessible — you won’t need advanced techniques or professional training to pull them off.

Read more: Your Guide to Meal Kits: The Essential Tools You’ll Need to Get Started

Curious as we are at CNET about all things meal kits, we wanted to know just how good they are — and whether they’re worth the money. We tested a week’s worth of recipes for a third time to bring you this review of Marley Spoon’s meal kit delivery service.

How Marley Spoon works

A selection of Marley Spoon recipes as of 2025.

Marley Spoon operates similarly to most others in the category and offers both meal kits with recipes that you cook and prepared meals that only require reheating.

After choosing between those two options, you will then answer the question, “What kid of meals do you like?” Meal kit options include everyday variety, low calorie, low carb, quick and easy, vegetarian, pescatarian and Mediterranean for two or four people and you can choose between two and six meals per week. The single-serving prepared meal options include everyday variety, low calorie or low carb and you can choose 6, 8, 10, 12, 14 or 18 meals per week.

Your box of meal kit ingredients is delivered once a week — unless you skip a week, which is easy to do — and you can either manually select recipes or let Martha Stewart personally choose them for you. OK, just kidding: She’s not your personal meal concierge, but you can let the brand select meals if you prefer a little mystery. You can select any day of the week for delivery, and the boxes will arrive between 8 a.m. and 9 p.m.

There are now more than 100 recipes each week, ranging in difficulty. Before you choose a recipe for delivery, you’ll see all the steps involved, the estimated time it takes to complete, and detailed nutritional information to help you decide.

Marley Spoon meal kit pricing

Number of people

Recipes per week

Total servings per week

Price per serving

2

2

4

$12.99

2

3

6

$11.99

2

4-6

8-12

$10.99

4

2

8

$10.99

4

3

12

$10.49

4

4-5

16-20

$9.99

4

6

24

$8.99

Prepared meals are $12.99 each and shipping is $10.99 per box.

What are Martha Stewart & Marley Spoon meals like

As you might imagine, since Martha Stewart helped design the concept and created many of the recipes, there are some really interesting, high-end and gourmet dishes to choose from. Luckily, though, most are still fairly simple to make.

There are plenty of healthy recipes, along with dietary preferences to choose from. However, there are only between four and six vegan options each week so if you want more options, Purple Carrot may be a better choice for you. Other services that feature built-in diet meal plans include Green Chef, Home Chef or HelloFresh.

Skillet chicken Parmesan ingredients.

At Marley Spoon, you’ll find plenty of warming comfort dishes like French onion chicken breast and beef stroganoff, plus desserts you can add on to your box, such as baked gingerbread doughnuts and French-style cheesecake.

On the prepared-meal side, the recipes are just as creative. Some meals include tilapia with smoky tomato sauce and black bean street corn and merlot chicken meatballs with orzo pasta and green beans.

How easy are Martha Stewart & Marley Spoon meals to prepare?

The beef empanadas were fun to make from scratch and a new experience for me.

Our meals ran the gamut from the super simple to a bit more complicated and time-intensive, but the good news is that it’s really up to you on how difficult you want the meals to be when you make your recipe selections.

The skillet chicken Parmesan, for instance, had a number of steps like preparing the chicken, cooking it, making the sauce and preparing the pasta (which had its own ingredients). For someone with a decent amount of cooking experience, this isn’t challenging, but some beginners might not be ready for such an involved meal. Other meals, such as the butternut squash pizza, were quite simple, tasty, and perfect for a weeknight when you don’t feel like fussing much or taking time to cook.

Read more: Meal Kits Taught Me How to Cook. Now I Get to Test Them for a Living

What we cooked and how it went

Beef picadillo pockets with bell peppers and cilantro chimichurri: This meal was not only delicious but also fun to make. It was the first time I used raw dough in a meal kit recipe, and the results were well worth the effort. Although the empanadas were filling, I still would have liked it to have come with a side other than the chimichurri sauce.

The beef empanadas were filling and tasty.

Butternut squash pizza with ricotta, almonds and hot honey: I had never had butternut squash on a pizza before this meal, but I can definitely see myself making this again. It was a perfect fall meal with the onions, squash, rosemary and almonds added on top.

The butternut squash used the same type of dough as the empanadas.

Seared salmon and citrus butter sauce with smashed potatoes and shaved Brussels salad: The Brussels sprout salad helped elevate this simple meal and take it to the next level. I cooked the salmon on the stovetop and the smashed potatoes in my air fryer.

I loved making smashed potatoes for this meal.

Skillet chicken Parmesan with casarecce and sautéed spinach: This recipe was good and very comforting, though it certainly had a healthy share of carbs and calories. The red sauce was very simple and the chicken cutlets weren’t breaded so it felt a little healthier than normal chicken Parm but not quite enough to be really, truly healthy. I had lots of leftovers, which was nice.

Honey miso salmon with roasted carrots and Brussels sprouts: This one was great and healthy, but it wasn’t particularly out-of-the-box. The salmon was high-quality and tasted super fresh.

Restorative chicken soup with sweet potato kale and quinoa: A very tasty and hearty soup I made and ate all week. The shredded chicken was already cooked, which surprised me but I appreciated, as it was still moist and flavorful. This entire meal was simple to prepare and felt like nourishing medicine, thanks to all those superfoods.

I was eating chicken Parm and pasta leftovers all week.

Marley Spoon support materials

I found the recipes clear, concise and easy to follow. There’s some nice background on the ingredients, too: my salmon recipe, for instance, provided context on miso for anyone unfamiliar with the fermented paste. The Marley Spoon app is also helpful with lots of information about each recipe and gives you the ability to order, pause, cancel or skip a week right from your mobile device.

All the ingredients for a healthy miso salmon with roasted veggies.

What makes Marley Spoon different from other meal kit services?

One thing to like about this service is it doesn’t try to be anything other than good. There’s no pandering to fad diets or giving users too much autonomy to change recipes or swap out meats. The meal kit service’s proposition is that the culinary team has come up with thoughtful, mostly healthy recipes they think you’ll enjoy — and they ask you to put your trust in them. I wouldn’t go so far as to call it stuffy or stubborn, but there is something very Martha Stewart about it.

In that respect, it reminds me a bit of Sunbasket. That meal kit service also tries to keep the integrity of the original recipes they’ve created and while it might not please everyone, I think it pays off in the end for those who appreciate good food.

The finished product.

Who is Marley Spoon good for?

This is one of the best meal kit services for foodies and experienced cooks looking to shake up their weeknight dinner rotation. If you’re looking for interesting new recipes that are both gourmet and approachable, Martha Stewart’s meal kits are a good pick. It’s also a solid choice for a home cook who’s looking to hone new skills or work with new ingredients.

A lot of the recipes are kid-friendly, so these meal kits would also work well for families of up to four people. And with as many as seven plant-based recipes each week, this is a good meal kit service for vegans, vegetarians or those trying to sprinkle in a few more non-meat dinners per week.

A healthy chicken soup that fed me for a few days.

Who is Martha Stewart & Marley Spoon not good for?

If you’re an extremely picky eater, a very new cook, or are trying to keep a gluten-free diet, I would not suggest this meal kit. It’s also not a good meal delivery service if you’re simply looking to get dinner on the table each week and don’t care about the cooking process, since some of the recipes are involved.

Packaging and environmental friendliness

I found Martha Stewart & Marley Spoon to be on the eco-friendly side of the meal kit spectrum. There was some single-use plastic waste, as there always is, but nothing excessive — and the ingredients were not individually packed in disposable bags as of 2025. The boxes, coolers and ice packs were also recyclable.

Changing, skipping or canceling your meal kit order

Between the website and mobile app, Marley Spoon makes it very easy to skip weeks, change out recipes or pause your subscription. Any changes must be made six days prior to the delivery date.

The final verdict on Martha Stewart & Marley Spoon

Being a Martha Stewart-conceived meal kit project, I had lofty expectations for this service and it mostly met them. When I flip through the menu each week, it boasts one of the highest percentages of recipes that make me go “ooh, that sounds good” right up there with Sunbasket. Most importantly, all the recipes we made delivered on the promise of a tasty and interesting meal. There wasn’t much blah factor, and we very much appreciate that.

The meal kit service also includes some thoughtful touches that others don’t, like quick ingredient explainers for new chefs and different chefs behind some of the recipes. The produce, meats and fish were also some of the freshest we’d received from a meal kit service and that goes a long way in creating a truly delicious dinner. The pricing is fair for what you get, and if you’re cooking for a large group, it actually gets rather affordable per serving. The market add-ons have also grown over the years.

If you’ve been wanting to try a meal kit service with a range of healthy, hearty and comforting meals and you already have the cooking basics down, I’d say give Martha’s meals a whirl.

Tech

The best VR headsets for 2026

Stepping into VR is about more than strapping on a headset and loading a game. The best VR headsets today are gateways to fully realized experiences, whether that’s gaming, fitness, creative work or simply spending time inside a richly rendered virtual world. As the hardware has improved, so has the sense of presence, with sharper displays, wider fields of view and tracking systems that make movement feel more natural and responsive. The result is VR that feels less like a novelty and more like a platform you can actually spend time in.

That said, not every headset is built for the same function. Some prioritize ease of use and standalone play, while others demand a powerful PC in exchange for higher fidelity. Compatibility also matters more than ever, especially as VR begins to overlap with mixed reality and early smart glasses experiments. Whether you want a simple way to explore virtual spaces or a high-end rig that pushes immersion as far as possible, this guide breaks down the best VR headsets you can buy in 2026 and explains who each one is really for.

Table of contents

Best VR headsets for 2026

Read our full Meta Quest 3 VR headset review

Storage capacity: 128GB | Battery life: 2.2 hours | Field of view: 110 degrees (horizontal), 96 degrees (vertical) | Max refresh rate: 120Hz

The long-awaited follow-up to the Quest 2 is an upgrade in every respect: It’s more comfortable to wear, it has higher quality screens and it has full-color mixed reality cameras, allowing you to see the real world alongside virtual elements. While it’s more expensive at $500, it’s also a far more capable headset than the Quest 2 and the new Quest 3S, with hardware and optics that will keep you happily immersed in VR for years.

The Quest 3 is powered by Qualcomm’s Snapdragon XR2 Gen 2 chip, which Meta says has double the graphics power of the Quest 2. That additional power is noticeable in games like Red Matter 2, which feature updated textures that deliver an experience closer to PC VR. The Quest 3’s new displays run at 2,064 by 2,208 pixels per eye, offering an even better experience than the PlayStation VR2. Its mixed reality cameras also let you easily see the real world, in case you need to quickly answer a text or Slack message. And they enable games that can be built around your room.

What makes the Quest 3 interesting is that it offers more than just solid VR: It also gives you a glimpse at what a mixed reality future could be, blurring the line between the real world and a virtual world. While it’s not as sharp or capable as Apple’s Vision Pro, that’s understandable. And just like previous Quest headsets, you can also plug it into a gaming PC for higher quality VR experiences, expanding its compatibility beyond standalone use.

- Sharp new screens and lenses

- Faster performance

- Mixed reality cameras make it easier to see the real world

- Adjustable for glasses

- More expensive than before

- Only 128GB of storage to start

- No battery life improvements

Read our full Apple Vision Pro M5 review

Storage capacity: Up to 1TB | Battery life: 2.5 hours | Field of view: 100 degrees | Max refresh rate: 120Hz

Apple’s first update for the Vision Pro is basically just a spec bump, but it’s at least a sign that the company hasn’t forgotten about its whole spatial computing endeavour. It’s faster and more power efficient, thanks to the M5 chip, and it also ships with a more comfortable Dual Knit Band that does a better job of balancing such a heavy headset.

With its additional power, the M5 Vision Pro can render 10 percent more pixels than the original model, and it can reach up to a faster 120Hz refresh rate for smoother scrolling. I couldn’t see a major difference in our testing, but I can confirm its Micro OLED screens still look phenomenal. They’re crisp enough for reading text on websites and a mirrored Mac, plus can also scale to extreme heights for stunning Immersive Video content.

Given its high $3,500 price and limited content, though, the Vision Pro is still clearly not meant for typical consumers, with its primary function leaning more toward development and experimentation than everyday VR use. Instead, like the original, it’s basically just a highly polished developer kit for people interested in building visionOS apps. Apple diehards will likely get a kick out of it too, but practically most people interested in AR and VR are better off buying a Meta Quest 3 alongside a gaming PC, especially as lighter smart glasses concepts continue to evolve separately from full headsets.

- Faster M5 chip

- Excellent displays

- Hand and eye tracking work well

- Support for PS VR2 controllers

- Expensive

- Limited immersive video and apps

- Relatively heavy

Read our full Meta Quest 3S VR headset review

Storage capacity: 128GB, 256GB | Battery life: 2-3 hours | Field of view: 96 degrees | Max refresh rate: 120Hz

The Quest 3S is Meta’s latest entry-level VR headset, but don’t let its reasonable $300 price fool you: It’s also a remarkable achievement for the company. It sports the same Qualcomm Snapdragon XR2 Gen 2 chip as the Quest 3, as well as a healthy 8GB of RAM, allowing it to power the same experiences as its pricier sibling. It also features Meta’s excellent Touch Plus controllers, which deliver solid motion controls, as well as responsive joysticks and buttons.

The only major downside is that the Quest 3S isn’t nearly as sharp as the Quest 3. It features the same 1,830 by 1,920 pixel per eye screen from the Quest 2, while the Quest 3’s screen offers 30 percent more pixels (2,264 by 2,208 pixels per eye), to deliver a sharper and more realistic image.

VR newbies probably won’t notice the difference much though, and that’s what really matters. The Quest 3S is just as comfortable as the Quest 3 to wear, and it can easily access the same apps and games on the Meta Quest Store. There’s no headphone jack either, but its built-in speakers deliver solid enveloping audio for games like Maestro, and you could also plug in a USB-C to 3.5mm adapter, or just pair wireless headphones.

The Quest 3S can connect to gaming PCs over USB-C or wirelessly to play more intense VR experiences, giving it strong compatibility with both standalone and PC-based setups. It can also wirelessly stream your gameplay to Chromecast devices, or to AirPlay devices by mirroring the Quest app from an iPhone. If you’re still holding onto the Quest 2, or an original Quest, the Quest 3S is precisely the inexpensive upgrade you’ve been waiting for.

- Fast performance

- Comfortable to wear

- Excellent controllers

- Large app library

- Older Fresnel lenses lead to artifacts

- No headphone jack

- Average mixed reality cameras

Read our full PlayStation VR2 headset review

Storage capacity: 128GB, 256GB | Battery life: 3 hours | Field of view: 110 degrees | Max refresh rate: 120Hz