Crypto World

Bitcoin sinks further due to tariff turmoil, bearish sentiment

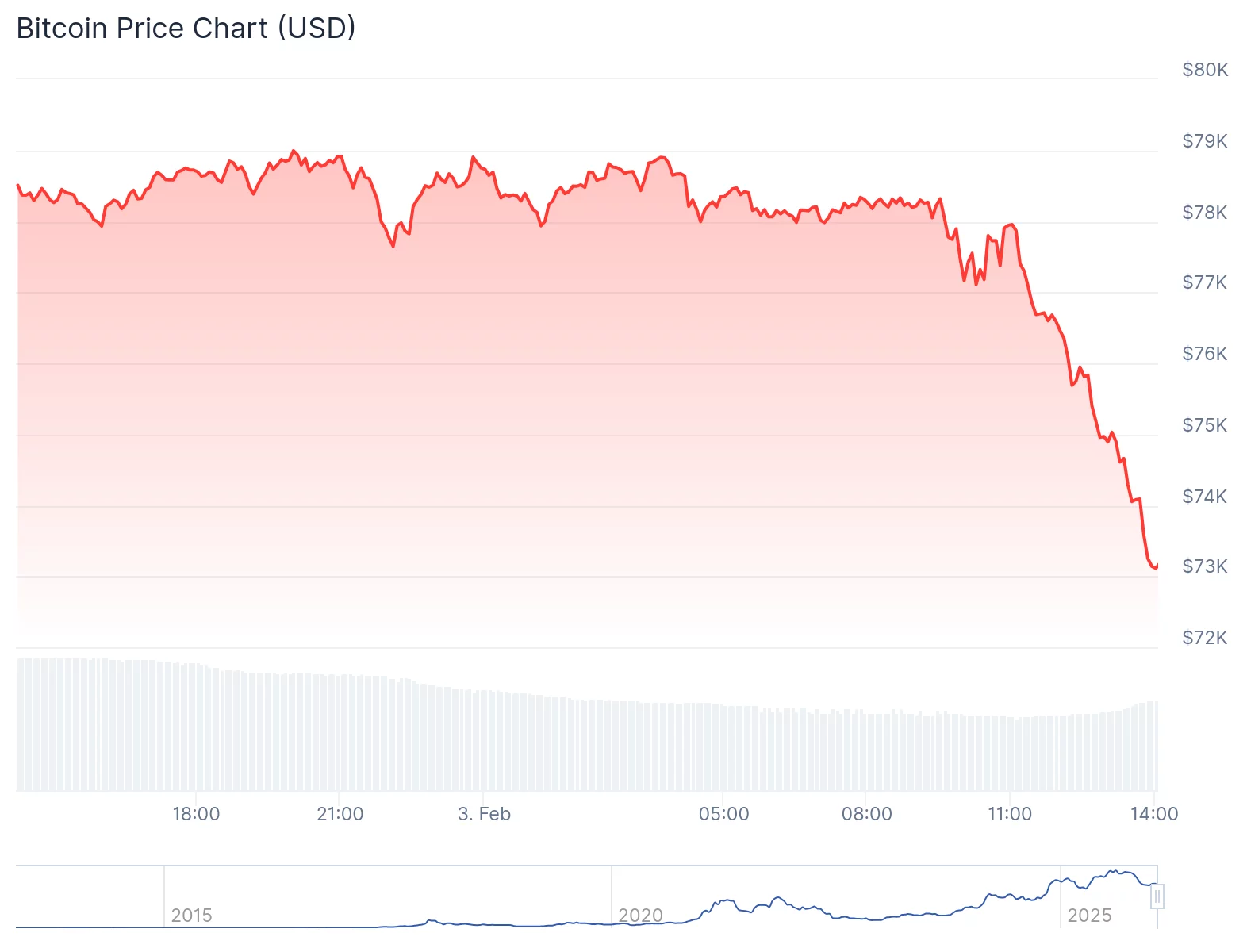

Bitcoin dropped to fresh lows around $73,000 on Tuesday, its lowest point since early 2025, and is now down more than 15% year-to-date.

Summary

- Bitcoin has continued its downward trend since its October 2025 record high, partly triggered by President Trump’s tariff comments.

- Despite supportive policies from a pro-crypto White House and strong institutional interest, Bitcoin’s market has been under pressure.

- Bitcoin still trading more like a high-risk asset than “digital gold.”

Gold, meanwhile, posted its largest single-day gain since November 2008, recovering from a sharp decline earlier in the week, while silver surged by as much as 15% after a dramatic 27% crash on Friday.

Both metals’ sell-offs were triggered by President Trump’s Fed Chair nomination, Kevin Warsh, which tightened expectations on rate cuts and balance-sheet policy.

Meanwhile, Bitcoin’s (BTC) drop, over 6% on the day, following a broader crypto slump, with Ethereum falling to $2,100.

The $65,000 level is now emerging as a focal point for market participants. This area represents not just a psychological round number, but a dense cluster of technical confluences that historically attract demand.

Bulls need to reclaim the $87,551 level to reverse the bearish trend, though that seems unlikely in the current market environment. Immediate resistance sits at $80,000 and $84,000.

Massive Selloffs

The cryptocurrency’s drop follows a turbulent year, marked by a steep decline from its October 2025 peak, when it hit a record high.

A series of market-moving events, including President Trump’s tariff comments, triggered a massive selloff that wiped out $19 billion in leveraged bets, with Bitcoin tumbling over 40% since then, according to Bloomberg.

Despite supportive policies from Trump, who pledged to turn the U.S. into the world’s “crypto capital,” Bitcoin has struggled to regain momentum, now testing critical support levels below $75,000.

Crypto World

Ethereum Dust Attacks Have Increased Post-Fusaka

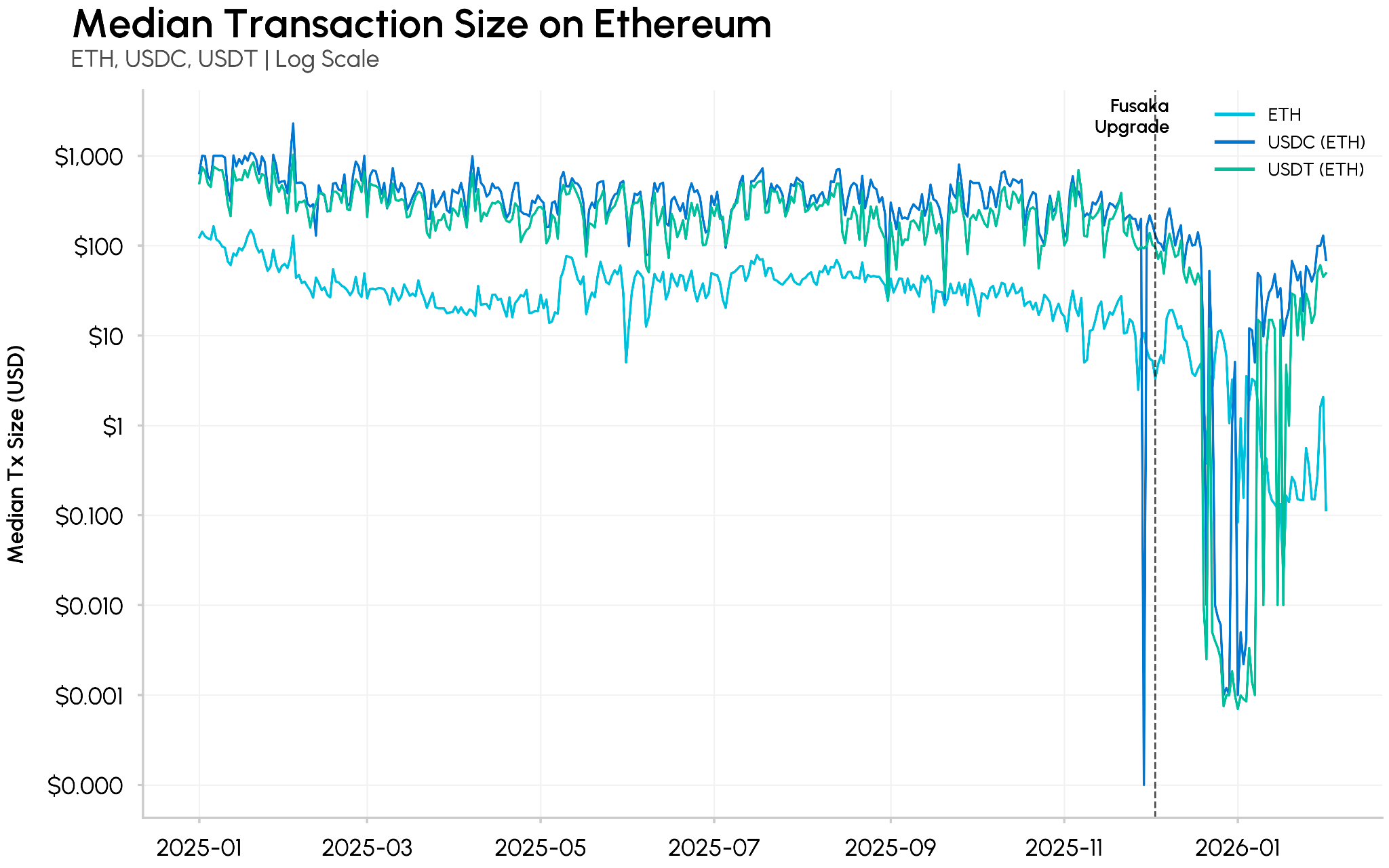

Stablecoin-fueled dusting attacks are now estimated to make up 11% of all Ethereum transactions and 26% of active addresses on an average day, after the Fusaka upgrade made transactions cheaper, according to Coin Metrics.

Ethereum is now seeing more than 2 million average daily transactions, spiking to almost 2.9 million in mid-January, along with 1.4 million daily active addresses — a 60% increase over prior averages.

The Fusaka upgrade in December made using the network cheaper and easier by improving onchain data handling, reducing the cost of posting information from layer-2 networks back to Ethereum.

Digging through the dust on Ethereum

Coin Metrics said it analyzed over 227 million balance updates for USDC (USDC) and USDt (USDT) on Ethereum from November 2025 through January 2026.

It found that 43% were involved in transfers of less than $1 and 38% were under a single penny — “amounts with insignificant economic purpose other than wallet seeding.”

“The number of addresses holding small ‘dust’ balances, greater than zero but less than 1 native unit, has grown sharply, consistent with millions of wallets receiving tiny poisoning deposits.”

Pre-Fusaka, stablecoin dust accounted for roughly 3 to 5% of Ethereum transactions and 15 to 20% of active addresses, it said.

“Post-Fusaka, these figures jumped to 10-15% of transactions and 25-35% of active addresses on a typical day, a 2-3x increase.”

However, the remaining 57% of balance updates involved transfers above $1, “suggesting the majority of stablecoin activity remains organic,” Coin Metrics stated.

Users need to be wary of address poisoning

In January, security researcher Andrey Sergeenkov pointed to a 170% increase in new wallet addresses in the week starting Jan. 12, and also suggested it was linked to a wave of address poisoning attacks taking advantage of low gas fees.

These “dusting” attacks typically involve malicious actors sending fractions of a cent worth of a stablecoin from wallet addresses that resemble legitimate ones, duping users into copying the wrong address when making a transaction.

Related: Ethereum activity surge could be linked to dusting attacks: Researcher

Sergeenkov said $740,000 had already been lost to address poisoning attacks. The top attacker sent nearly 3 million dust transfers for just $5,175 in stablecoin costs, according to Coin Metrics.

Dust does not represent genuine economic usage

Coin Metrics reported that approximately 250,000 to 350,000 daily Ethereum addresses are involved in stablecoin dust activity, but the majority of network growth has been genuine.

“The majority of post-Fusaka growth reflects genuine usage, though dust activity is a factor worth noting when interpreting headline metrics.”

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

Trading Bot Bankr Expands to Solana with Token Launches on Raydium

Creators can now launch tokens on Solana via Solana DEX Raydium.

Crypto World

Ethereum Scaling Must Move Beyond L2s

Ethereum (CRYPTO: ETH) co-founder Vitalik Buterin has reversed his long-held view that layer-2 solutions should be the primary engine for scaling the network, arguing that the approach no longer makes sense in its current form. In a concise post on X, he said a “new path” is needed as the Ethereum mainnet continues to scale through ongoing gas-limit enhancements and the advent of native rollups. The comments reflect a broader rethinking within the ecosystem about how best to relieve congestion, cut fees, and maintain robust security while enabling developers to push the boundaries of on-chain applications.

Buterin’s stance stands in contrast to years of rhetoric positioning L2s as the principal scaling lever for Ethereum. He noted that many rollups have fallen short of the decentralization and security ideals originally envisioned, and that the mainnet’s capacity is approaching a scale where a pivot toward other architectural approaches may be warranted. “Both of these facts, for their own separate reasons, mean that the original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path,” he wrote, underscoring the complexity of balancing throughput with trust minimization.

Layer-2 networks—such as Arbitrum, Optimism, Base, and Starknet—were conceived as fast, low-cost extensions that inherit Ethereum’s security properties. The goal was to create block space that remains secured by the L1 mainnet, ensuring transactions could be validated and final, uncensored. But Buterin contends that many L2 designs rely on bridges and mediations that can undermine true scaling if critical security guarantees are mediated by complex cross-chain mechanisms rather than being anchored to base-layer security.

While the narrative around scaling has often centered on throughput, the discussion has also touched on the security and decentralization characteristics of L2 ecosystems. Buterin’s comment that a 10,000 TPS “EVM” connected to L1 through a multisig bridge does not represent real scaling sparked renewed debate about whether the path to higher capacity lies primarily in more efficient rollups or in a broader reconfiguration of how Ethereum processes transactions.

In related commentary, prominent voices within the ecosystem weighed in on the pivot. Max Resnick, a former Ethereum infrastructure researcher who shifted toward the Solana ecosystem when scaling emphasis cooled around mainnet improvements, argued that focusing scaling efforts on the mainnet could yield more tangible benefits for developers and users. His stance underscores a perennial tension within Ethereum’s community: should efforts concentrate on pushing more work through the base layer, or should they continue to rely on rollups to provide modular scaling while maintaining strong security guarantees?

Not all reactions were muted. Ryan Sean Adams, co-host of the Ethereum-focused program Bankless, welcomed Buterin’s pivot, calling it a clear signal for strategic realignment. “This is ‘the pivot.’ I’m glad it’s now being said. Strong ETH, Strong L1,” he wrote in a post that resonated with a segment of the community seeking a refocused emphasis on mainnet engineering and foundational security. The dialogue underscores a pragmatic reassessment of the roadmap that has long prioritized L2-centric scaling as the default path forward.

Native rollups, gas limit rises key scaling Ethereum mainnet

Buterin argues that native rollups—where certain scaling logic is effectively embedded in Ethereum’s own protocol stack—will play a central role as scaling advances mature. He emphasized the importance of native rollups that can be verified directly by Ethereum validators, a distinction from traditional off-chain rollups whose security relies on bridges and cross-layer data availability. The emphasis is on deeper integration and trust assumptions that align more closely with Ethereum’s base layer, especially as zk-based technology matures.

One of the pivotal technical developments underpinning this shift is the anticipated integration of zero-knowledge Ethereum Virtual Machine (zkEVM) proofs into the base layer. zkEVM technology promises to enable more private, scalable, and provable computations, potentially unlocking new use cases while preserving security guarantees. As zkEVM proofs become more mature and broadly integrated, the consensus is that the mainnet could handle larger volumes of transactions with stronger cryptographic assurances, reducing the reliance on peripheral L2 constructs.

Historically, rollups have functioned by batching transactions off-chain and posting summary data back to Ethereum, thereby creating a balance between speed and security. The native-rollup approach, by contrast, weaves rollup logic into the core protocol, allowing transactions to be validated by Ethereum nodes directly rather than via bridging channels. This distinction is central to the argument that true scaling may hinge on deeper, more secure mainnet integration rather than layering on external validators and bridges. The idea is to maintain Ethereum’s finality and censorship-resistance while expanding throughput more aggressively than through isolated L2 ecosystems.

Looking back at the roadmap, Ethereum developers have previously discussed expanding the mainnet’s gas capacity as a mechanism to raise throughput. In late 2025 and into early 2026, discussions circulated about increasing the gas limit from roughly 60 million to 80 million per block, contingent on the successful deployment of the blob-parameter feature and subsequent hard forks. The blob fork, designed to increase block space without sacrificing security, began rolling out in December and was fully enacted in January, enabling more complex smart contracts and higher transaction throughput per block. This capacity uplift has the potential to lessen the perceived urgency for ever-larger L2 ecosystems if efficiency gains materialize quickly enough.

Industry researchers have long projected dramatic improvements in throughput. In July of the previous year, Justin Drake proposed a 10-year plan to reach approximately 10,000 transactions per second on the Ethereum mainnet once all scaling features are in place—a figure that would mark a substantial leap over today’s throughput levels and push Ethereum closer to truly global-scale usage. While ambitious, the plan continues to anchor the debate around how best to realize scalable, secure, and decentralized computation on the chain.

As the conversation evolves, the ecosystem remains split between doubling down on the mainnet’s capabilities and leveraging rollups that can be designed for specialized use cases. Proponents of L2-heavy scaling argued that external networks could unlock rapid innovation while preserving Ethereum’s security through data availability on the mainnet. Buterin’s pivot suggests a more nuanced approach: scale on multiple layers while ensuring core security guarantees are not compromised and user trust remains central to long-term adoption.

Ultimately, the path forward may combine elements of both strategies. Native rollups could become a cornerstone of the scaling architecture, with zkEVM and other zero-knowledge proofs enabling more efficient verification on the base layer. Meanwhile, mainstream L2s could concentrate on niches—privacy-centric features, identity services, financial primitives, social apps, and even AI-driven use cases—without becoming the sole mechanism for scaling the network. The evolving stance signals a broader trend toward a more integrated, security-focused scaling framework for Ethereum.

As the debate continues, observers will watch for concrete milestones: the progress of zkEVM integration into the base layer, the deployment milestones for native rollups, and the practical impact of the upcoming gas-limit expansion on transaction costs and throughput. The dialogue also highlights the importance of maintaining a balance between innovation and security, ensuring that scaling advances do not come at the expense of decentralization or user protections. The ecosystem’s ability to execute on these milestones could shape Ethereum’s competitive position in a rapidly evolving crypto landscape.

Related: Arbitrum, Optimism, Base and Starknet are among the L2s most discussed in this pivot, but the broader question remains: can native, deeply integrated scaling finally deliver on the long-promised combination of speed, cost-efficiency, and security on the mainnet? The coming quarters are likely to reveal how far the community is willing to go in redefining Ethereum’s layering strategy, and whether the market responds to a more unified approach that prioritizes mainnet scalability and cryptographic assurances over modular, bridge-dependent solutions.

— Sources: Vitalik Buterin’s X post; zkEVM integration discussions and related zk-tech articles; discussions on gas-limit increases and blob hard forks; commentary from Max Resnick; reactions from Ryan S. Adams; and historical plans like Justin Drake’s Lean Ethereum proposal.

- Sources & verification

- Vitalik Buterin’s X post: https://x.com/VitalikButerin/status/2018711006394843585

- Zero-knowledge Ethereum Virtual Machine (zkEVM) proofs and scaling: https://cointelegraph.com/news/2026-is-the-year-ethereum-starts-scaling-exponentially-with-zk-tech

- Gas limit rise discussions: https://cointelegraph.com/news/ethereum-could-get-faster-gas-limit-rise-january

- Blob parameter hard fork and January implementation: https://cointelegraph.com/news/ethereum-blob-limit-raised-to-21-layer-2-cheaper

- Lean Ethereum concept: https://blog.ethereum.org/2025/07/31/lean-ethereum

- Max Resnick’s perspective: https://cointelegraph.com/magazine/great-enemies-ethereum-solana-anza-economist-max-resnick/

- Ryan S Adams’ reaction: https://x.com/RyanSAdams/status/2018727620624384059

- Arbitrum, Optimism, Base context: https://cointelegraph.com/news/these-5-blockchains-led-2025

Crypto World

Wirex Powers Chimera Card Launch for Self-Custodial Bitcoin Spending

Wirex, a full-stack crypto card issuer and Banking-as-a-Service (BaaS) provider, today announced it is powering the launch of the Chimera Card — a Bitcoin-funded debit card that brings practical, everyday Bitcoin spending to users worldwide.

Wirex BaaS: One Integration, Complete Infrastructure

Through a single API integration, Chimera Wallet gains access to Wirex’s complete BaaS stack:

- Non-Custodial Card Issuance — Virtual and physical debit cards that let users spend while maintaining full control of their assets. Includes seamless Apple Pay and Google Pay integration.

- EUR & USD IBAN Accounts — Named virtual IBANs with SEPA Instant and Faster Payments connectivity for seamless fiat on/off ramping across 30+ countries.

- Unified Balance Management — Real-time stablecoin-to-fiat conversion at point of sale, with zero prefunding requirements.

- DeFi Yield with Enterprise Controls — Integrated yield opportunities on idle balances with full compliance and risk management.

“Our BaaS platform exists so that innovators like Chimera can focus on building great products instead of navigating payment infrastructure complexity,” said Daniel Rowlands, General Manager, Onchain Finance at Wirex.“With a single integration, Chimera gets non-custodial cards, banking rails, and DeFi — everything needed to launch a world-class Bitcoin spending experience globally. That’s the power of full-stack BaaS.”

Rapid Global Deployment

By leveraging Wirex BaaS, Chimera avoids the complexity of building payment infrastructure from scratch — no separate card issuers, banking partners, or compliance frameworks to manage. The result: a debit card accepted at 80+ million merchants worldwide, with users maintaining self-custody of their Bitcoin throughout.

The Chimera Card is a natural extension of our vision to make Bitcoin usable in everyday life without compromising self-custody,” said Simone De Gaspari, Chimera Chief Strategy Officer.

“By enabling direct wallet-based funding and pairing it with global debit card acceptance, we’re giving users a transparent way to spend Bitcoin while remaining in control of their assets.

Key Features of the Chimera Card

- Direct wallet-based funding via Bitcoin or the Lightning Network

- Global acceptance at any merchant accepting debit and credit cards worldwide

- Truly self-custodial, with card balances held fully onchain with private keys managed by the end users — eliminating commingling risk and providing protection in the event of issuer insolvency

- Bitcoin-to-fiat conversion at prevailing market rates with transparent pricing

- Permanent 1.5% transaction fee for pre-order customers (vs. 2% standard), with zero monthly and top-up fees for life

- Travel-friendly FX rates and ATM access for global spending

- The card also features seamless Apple Pay and Google Pay integration for contactless payments, along with travel-friendly FX rates and ATM access for global spending.

Pre-Orders Now Open

Pre-orders for the Chimera Card are now open for a limited time. Customers who reserve their card during the pre-order period will receive permanent fee protection. Both virtual and physical cards are expected to be available by the end of Q1 2026.

Reservation link | Pre-order fee: 20 CHF

About Wirex

Wirex is a global payments platform serving both consumers and businesses, offering card-based payment products alongside card issuance and banking infrastructure for partners. For end users, Wirex provides payment cards and banking features designed for everyday spending.

For businesses, Wirex offers Banking-as-a-Service APIs, card issuance, and payment rails that enable digital platforms to launch compliant, globally accepted card programs. Trusted by over 7 million users since 2014, Wirex has processed $20 billion+ in transactions across 130 countries. As a principal Visa and Mastercard member, it makes crypto spendable anywhere — instantly and effortlessly.

About Chimera Wallet

Chimera Wallet is a next-generation Bitcoin wallet focused on usability, transparency, and real-world functionality. Built on Bitcoin’s VTXO technology, Chimera enables users to manage their Bitcoin, fund everyday spending through an integrated Visa card, access gift cards, and participate in referral programs — all within a single interface.

Chimera Wallet is designed to bridge native Bitcoin infrastructure with practical financial tools, making Bitcoin easier to use in everyday life without unnecessary complexity. For more information, visit chimerawallet.com.

Crypto World

Cathie Wood’s Ark Invest Leans Into Crypto Dip With Fresh Bitmine And Circle Purchases

Cathie Wood’s Ark Invest kept buying into the crypto slump, adding to positions tied to digital assets as Bitcoin steadied in the mid $70,000s and sentiment stayed fragile.

Trade disclosures showed the firm’s ETFs bought about $3.25M of Bitmine Immersion Technologies on Tuesday, adding exposure to a stock that has tracked the broader slide in crypto-linked names.

The firm also added roughly $2.4M of Circle Internet Group through its funds, according to the same filings.

In addition, Ark picked up about $3.5M of Bullish, and it bought about $630,606 of Coinbase.

Ark Steps Up Buying As Bitcoin Slips And Risk Appetite Weakens

The purchases landed in a market still shaped by deleveraging and shaky risk appetite. Bitcoin had slipped below $80,000 earlier in the week, and the pullback kept pressure on crypto-related equities as investors reassessed how much risk they wanted to carry.

Ark’s Tuesday trades followed a heavier round of buying on Monday, when the firm disclosed about $24.8M of added exposure across several crypto-exposed names, with Robinhood and Bitmine among the biggest adds.

That earlier filing included roughly 235,077 shares of Robinhood valued at about $21.1M, alongside 274,358 shares of Bitmine worth roughly $6.2M, based on the disclosed figures.

Long-Term Crypto Thesis Drives Ark’s Buy-The-Dip Strategy

The buying fits Ark’s long-running view that steep drawdowns can create entry points in public markets linked to crypto infrastructure, trading and stablecoins, especially when liquidity thins and volatility shakes out fast money.

In its Big Ideas 2026 report, Ark laid out the upside it still sees in the sector. The firm said the market “could grow at an annual rate of ~61% to $28 trillion in 2030”.

The firm also expects Bitcoin to dominate that mix. “We believe Bitcoin could account for 70% of the market,” it said, with the remainder led by smart contract networks such as Ethereum and Solana.

The post Cathie Wood’s Ark Invest Leans Into Crypto Dip With Fresh Bitmine And Circle Purchases appeared first on Cryptonews.

Crypto World

Bitcoin Price Prediction: Is the $100K “Moon Mission” Back on After the $74K Flush?

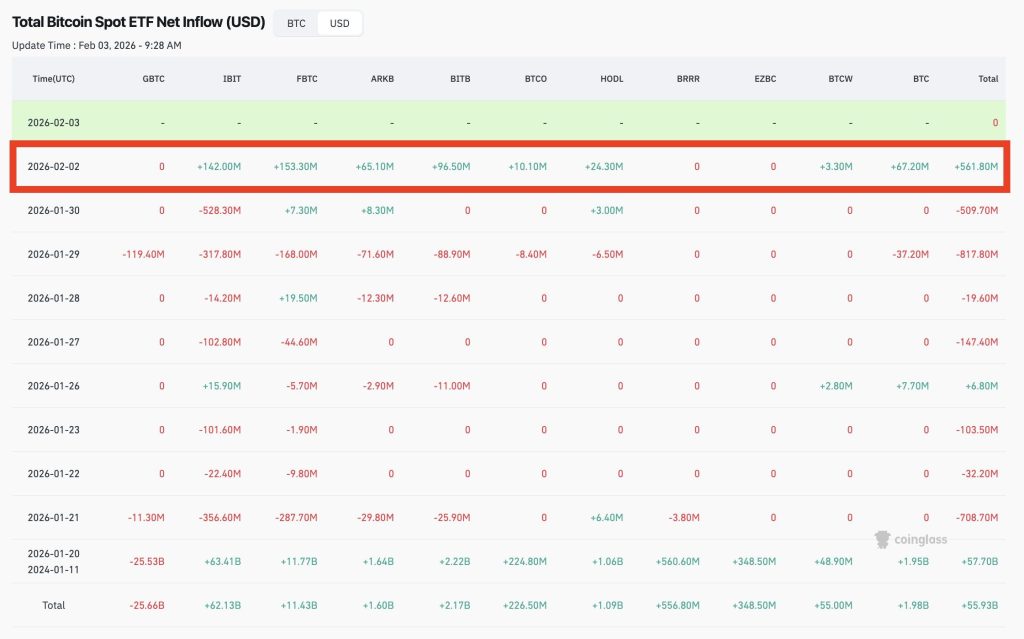

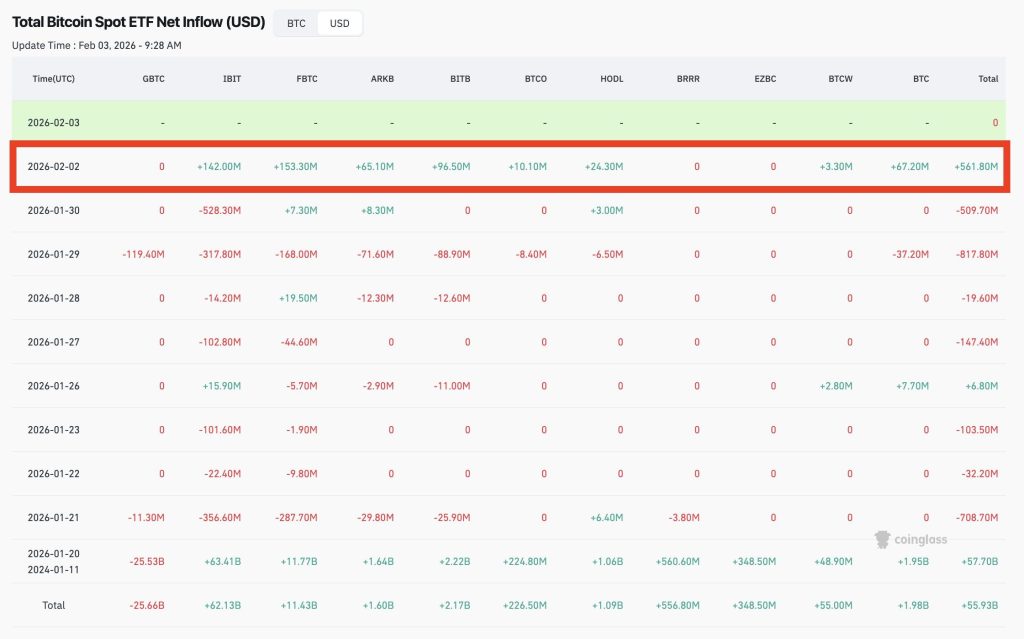

Bitcoin (BTC) is trying to hold steady at $76,273 after dropping 3% in the past 24 hours, as the market reacts to a sharp increase in volatility. Even with the recent dip, spot Bitcoin ETFs saw $562 million in new investments as buyers took advantage of lower prices, showing that large institutional investors remain active.

Daily trading volume has reached $67.8 billion, setting up a contest between traders betting against Bitcoin and companies looking to buy more.

LSE’s New King: SWC Becomes Britain’s Largest Bitcoin Holder

This week, The Smarter Web Company (SWC) made its official debut on the Main Market of the London Stock Exchange, marking a significant moment for UK finance. Now the largest publicly listed Bitcoin holder in Britain, the company’s treasury has 2,674 BTC, making it 29th in the world among public companies.

CEO Andrew Webley aims for the company to join the FTSE 250 by 2026, highlighting a major move toward corporate Bitcoin adoption in the UK.

ETF Warriors: The $562 Million “Dip Buy”

After four days in a row of withdrawals spot Bitcoin ETFs had a robust comeback on Monday bringing in $562 million in new investments. This shows that some investors are “buying the dip” as Bitcoin recovers from weekend weakness partially offsetting last week’s massive $1.5 billion sell-off.

Institutional Conviction: Analysts note that Bitcoin is currently trading below the ETF average cost basis of $84,000, which is acting as a magnetic support zone for major funds.

Recovery Rally: The recovery from weekend lows below $75,000 back toward the $79,000 mark helped reignite demand, though macro uncertainty around US monetary policy remains a looming headwind.

The Gold Token Surge: A $6 Billion Market Test

The market for digital gold tokens such as PAX Gold and Tether Gold has grown four times larger since late 2024.

Flight to Safety: As spot gold hit a record $5,594.82, tokenized gold demand surged, though a recent historic one-day decline in precious metals is putting these assets to the test.

Custody Concerns: Experts warn that extreme price swings could trigger a rush for physical gold, raising questions about audits and actual ownership in the digital space.

Bitcoin (BTC/USD) Technical Analysis: Bulls Defend the $74,000 “Line in the Sand”

Bitcoin price prediction is currently navigating a period of stabilization after a “liquidity hunt” pushed prices to a nine-month low of $74,500. Before the correction, BTC was coiled in a massive symmetrical triangle. While the breach below $80,000 weakened the immediate bullish case, the long-term resolution target remains a psychological $100,000.

The Daily RSI has dipped into the 28–30 range, which typically signals an oversold market ripe for a reversal. A bullish Stochastic crossover further suggests that selling exhaustion is setting in.

Immediate structural support is anchored at $74,420–$74,666, while a reclaim of the $78,400 (0.236 Fibo) level is necessary to retest the $84,000 overhead resistance.

Conclusion

The current market setup points to a healthy reset of over-leveraged positions. With the Smarter Web Company leading corporate adoption on the LSE and ETF inflows picking up again, the main reasons for a bullish outlook remain strong. If buyers can keep Bitcoin above $74,000, reaching $100,000 may be more achievable than it appears.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

d for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31.2 million, with tokens priced at just $0.013675 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Is the $100K “Moon Mission” Back on After the $74K Flush? appeared first on Cryptonews.

Crypto World

Payward Revenues Soar 33% as Traders Flock to Kraken

Kraken’s parent company, Payward, reported 2025 revenue of $2.2 billion, a 33% increase from the prior year, driven by a combination of higher trading activity and strong performance from newly integrated businesses. For the year, total transaction volumes reached $2 billion, up 34% year over year, signaling robust activity across the platform as it leveraged a strategic wave of acquisitions to broaden its revenue base. Payward described the mix of income as well balanced, with about 47% derived from trading revenue and the remaining 53% from asset-based and other sources. The results come as the group advances toward a potential public listing after filing confidentially for an IPO in November, underscoring a broader push to diversify beyond traditional exchange services into broader financial technology offerings.

Key takeaways

- 2025 revenue rose to $2.2 billion, up 33% from $1.6 billion in 2024, reflecting gains across trading and asset-backed activities.

- Total transaction volumes climbed to $2 billion, a 34% year-over-year increase, signaling stronger platform usage.

- Revenue mix remained balanced: roughly 47% from trading activity and 53% from asset-based and other revenues, indicating diversified income streams.

- Strategic acquisitions—NinjaTrader, Breakout, Small Exchange, Capitalise.ai, and Backed—expanded product offerings and supported a 119% rise in daily average revenue trades.

- Assets on the platform grew to $48.2 billion, with funded accounts increasing 50% to 5.7 million, highlighting growing user engagement and custody depth.

Sentiment: Bullish

Market context: The results align with a crypto ecosystem where exchange activity remains sensitive to macro trends and regulatory developments, while diversified product lines help firms capture a broader share of trading and asset-management activity. Payward’s performance underscores a shift toward modular offerings and cross-segment efficiency within a consolidating market.

Why it matters

The 2025 performance marks a notable inflection for Payward as it monetizes scale and breadth. By deriving nearly half of its revenue from trading while more than half comes from asset-based and ancillary services, the group appears to be hedging against volatility in a single segment. This balance matters for users and investors who seek a platform capable of weathering cyclical swings in crypto markets while continuing to generate recurring income from tokenized assets, derivatives, and automated trading tools.

Central to this shift is Payward’s active pursuit of product-level specialization. The company has drawn inspiration from tech giants in how it segments its offerings so each product tackles a distinct customer segment. This approach—designed to boost usage by making each product a tailored solution—addresses both retail and institutional needs, from advanced traders seeking derivative exposure to users exploring tokenized stock concepts. The acquisitions carried out over 2025 are the operational backbone of that strategy, providing Payward with more tools to engage users across geographies and risk appetites.

The 119% increase in daily average revenue trades underscores the impact of integrating platforms like NinjaTrader and Breakout, which broaden trading capabilities and expand the client base. While NinjaTrader’s ecosystem emphasizes futures and active trading, Breakout adds a proprietary-trading edge that helps Payward capture higher-margin activity. Together, these assets contribute to a more resilient revenue engine by feeding more orders through Payward’s systems and enabling a wider set of use cases for clients. The full effect of these acquisitions—along with Small Exchange and Capitalise.ai—appears in the asset mix and in the expansion of both trading and automation-enabled workflows on the platform.

Beyond trading desks, Payward’s foray into tokenized assets and AI-driven automation signals a broader strategic convergence. The purchase of Backed—a company active in tokenized stocks and the backbone of the xStocks platform—signals Payward’s intent to offer institutional-grade access to tokenized equity products. This kind of diversification aligns with industry trends toward hybrid models that blend traditional financial instruments with digital representations, expanding the addressable market for crypto-enabled finance. The company’s asset base, reported at $48.2 billion, and its burgeoning funded account base—5.7 million—indicate a growing footprint that could attract further liquidity and potential listing interest from a broader investor audience.

In addition to the earnings figures, Payward’s leadership emphasized a long-term, risk-adjusted throughput strategy over chasing short-term cyclic metrics. Arjun Sethi, Payward’s co-CEO, described a path focused on compound efficiency across a single system rather than pursuing a handful of standalone products. This philosophy suggests a framework where future growth hinges on the integration of existing platforms, the cross-pollination of product capabilities, and the sustained scaling of operations across multiple asset classes and jurisdictions. The company’s public-listing ambitions, having progressed to a confidential IPO filing in November, indicate that Payward seeks to translate its internal efficiencies into external value for a wider pool of investors while continuing to evolve its platform economics.

The disclosed results also reflect a broader industry pattern where sizable crypto-focused platforms are layering revenue streams to reduce reliance on a single line item, all while expanding product suites to attract diverse participant cohorts. The highlighted acquisitions demonstrate Payward’s appetite for strategic bets that can be integrated into a unified operating model, enabling cadence and scale without sacrificing the quality of user experience.

Looking ahead, Payward’s management continues to frame growth as a systemic improvement—an emphasis on operational efficiency, cross-product usage, and geographic diversification rather than chasing isolated performance metrics. The confidential IPO filing from November remains a key milestone, offering a framework for how Payward intends to position its diversified platform to investors. The earnings narrative, underpinned by rising assets and a widening product footprint, suggests a company that is betting on a longer horizon where liquidity, product breadth, and disciplined integration drive sustainable returns rather than a single blockbuster quarter.

What to watch next

- Progress and timing of the confidential IPO filing: any updates on the path to a public listing and the anticipated markets open date.

- Performance of key acquisitions (NinjaTrader, Breakout, Small Exchange, Capitalise.ai, Backed) and their contribution to trading volumes and revenue mix in 2026.

- Trends in assets under custody and funded accounts, with any new geography or client segments adding material volume.

- Regulatory developments and macro conditions that could influence liquidity, market structure, or crypto-adjacent financial products.

Sources & verification

- Payward/ Kraken 2025 financials report, detailing revenue, volumes, and the asset mix.

- Confidential IPO filing status and coverage in November, outlining the company’s listing trajectory.

- Breakout acquisition and related product diversification mentioned in Kraken’s filings.

- Small Exchange and Capitalise.ai acquisitions and their impact on the platform’s trading and automation capabilities.

- Backed and tokenization-related developments within the Payward ecosystem and their role in the xStocks framework.

Crypto World

XRP holders can now earn yield or borrow against FXRP without selling their holdings

The Flare blockchain has introduced lending and borrowing for XRP-linked assets through an integration with Morpho, a crypto lending protocol that runs across multiple Ethereum compatible chains.

The update lets users lend and borrow with FXRP, a version of XRP designed for use on Flare, the team behind the blockchain said on Monday. Flare pitched the move as a step toward giving XRP holders more ways to earn yield and use their tokens beyond holding or trading.

For years, XRP has had fewer decentralized finance (DeFi) options than tokens built on smart contract networks. Flare has been trying to change that by building tools that let XRP be used in onchain apps while keeping the original XRP on the XRP Ledger.

FXRP holders can now deposit their tokens to earn interest, or use FXRP as collateral to borrow other assets such as stablecoins.

Flare said these positions can also be combined with other features on the network, including staking and yield products, for users who want more active strategies.

Morpho works differently from older lending apps that mix many assets into one shared pool. Each lending market is set up with one collateral asset and one borrowed asset, and the rules for that market are set when it is created. This structure is meant to keep problems in one market from spilling into others.

The first access point is Mystic, a separate app that shows the available vaults and lets users deposit funds or borrow against collateral. Flare said more ways to access the markets may be added later, including through Morpho’s main app.

Some vaults are being offered by independent curators, including Clearstar. These vaults include options backed by FXRP, Flare’s own token FLR and USDT0.

The rollout is part of a broader push by several networks to bring lending and borrowing to large token communities that have mostly stayed outside of onchain finance.

Read More: XRP Ledger Upgrade Lays Groundwork for Lending, Tokenization Expansion

Crypto World

Asia Market Open: Bitcoin Slips 3% To $76K As Asian Stocks Track US Tech-Led Selloff

Bitcoin slipped 3% on Wednesday to $76,000 as investors carried a sour mood into the Asia session after a tech-led sell-off hit US benchmarks and encouraged a shift toward more economically sensitive industries.

In early trade, Japan and Australia opened lower, and futures pointed to losses in Hong Kong.

Market snapshot

- Bitcoin: $78,719, up 2%

- Ether: $2,334, up 1.8%

- XRP: $1.61, up 0.5%

- Total crypto market cap: $2.72 trillion, up 2.6%

Software Rout Drags US Indexes Lower As Rotation Away From Big Tech Deepens

Overnight, falling software names pulled down the S&P 500 and the Nasdaq 100, even as most stocks in the S&P 500 finished higher and value shares continued to outpace growth in 2026 amid a broader rotation away from the “Magnificent Seven”.

The damage started with legal software and data services. Experian, London Stock Exchange Group and Thomson Reuters tumbled, and the selling spread across the wider software sector, sending the iShares Expanded Tech-Software Sector ETF down about 4.5%.

The slide picked up pace late in the session after Advanced Micro Devices sank in after-hours trade on a disappointing sales forecast. Traders also stayed cautious ahead of earnings from Alphabet and Amazon later this week, as investors demanded clearer payoffs from costly AI spending.

Crypto Markets Mirror Global Risk Aversion As Bitcoin Slips

Crypto traders watched the same risk-off undercurrent spill into digital assets. Bitcoin fell for a second day and extended an almost four-month slide, and investor Michael Burry warned that a drop through key thresholds could trigger cascading liquidations and wipe out value.

Tony Severino, market analyst at YouHodler, said Bitcoin remains locked in a tightening range, and he pointed to a signal building on longer timeframes.

“Bollinger Bands on the monthly chart are the tightest they have ever been, reflecting an extreme level of volatility compression,” he said. “At the same time, Bitcoin continues to trade below the monthly basis line, with only days left before a monthly close that would confirm acceptance beneath it.”

Across markets, the shared theme this week looks less about direction and more about pressure building under the surface. Currency volatility has risen. The dollar has softened.

Software Stocks Slide As AI Competition Spurs Fresh Investor Jitters

Metals have held extreme levels without a clear break, and Bitcoin has stayed stuck in one of the tightest volatility regimes in its history, conditions that tend to frustrate short-term traders while signalling markets are working off time rather than trend, he said.

On Wall Street, the focus tightened on software makers seen as vulnerable to AI-driven competition after Anthropic rolled out a legal tool for its Claude chatbot. Nvidia and Microsoft each fell almost 3% as the S&P 500 software and services index slid 3.8% for a fifth straight session.

Away from tech, pockets of the market showed more resilience. FedEx extended a record-breaking rally, and Walmart pushed past $1 trillion in market value. Palantir jumped almost 7% after strong quarterly results, while PepsiCo gained 4.9% after announcing price cuts on core brands like Lay’s and Doritos.

In other moves, oil climbed after the US Navy shot down an Iranian drone heading toward an aircraft carrier in the Arabian Sea.

Federal Reserve officials kept the rate outlook in play. Tom Barkin said policy easing has bolstered the jobs market as officials turn back to getting inflation to target, and Stephen Miran said the absence of strong price pressures means rates need to be lowered again this year.

The post Asia Market Open: Bitcoin Slips 3% To $76K As Asian Stocks Track US Tech-Led Selloff appeared first on Cryptonews.

Crypto World

Payward Revenues Jump 33% as Traders Flock to Kraken

Crypto exchange Kraken’s parent company, Payward, reported 33% revenue growth in 2025 as transaction volumes rose and the business capitalized on its acquisitions.

The company’s revenues rose to $2.2 billion last year, up from $1.6 billion in 2024 due to “broad-based performance across trading and asset-based businesses,” with total transaction volumes rising 34% over the year to $2 billion, Kraken co-CEO Arjun Sethi said in a report on Tuesday.

He added that revenues were “well balanced,” with around 47% coming from trading-based revenue and 53% from asset-based and other revenues.

The report comes as investors closely watch out for Kraken’s public launch, after the company confidentially filed for an initial public offering in November.

Acquisitions helped diversify income

Sethi said Payward’s acquisitions in 2025 helped boost its revenues, and it has taken inspiration from tech giants such as Meta and Amazon to separate its products to increase their usage, allowing “each product to be designed for a specific customer segment.”

Last year, Payward acquired the futures trading platform NinjaTrader, the prop trading firm Breakout, the derivatives trading platform Small Exchange and the trading automation software Capitalise.ai.

Payward also acquired Backed last month, a company operating in the tokenized stocks space that backs the popular xStocks platform.

Sethi said these acquisitions, especially NinjaTrader and Breakout, led to a 119% boost in daily average revenue trades.

Related: Galaxy Digital reports $482M net loss in Q4 2025

The report added that assets on the platform saw an 11% increase to $48.2 billion, while funded accounts grew 50% to 5.7 million, he added.

Sethi said that looking ahead, Payward’s focus is “not on maximizing any single metric in isolation. It is on maximizing long-run, risk-adjusted throughput across a growing set of asset classes and geographies.”

“The company’s strategy is not driven by adding standalone products or chasing short-term cycles. It is driven by compounding efficiency across a single system,” he added.

Magazine: Sharplink exec shocked by level of BTC and ETH ETF hodling — Joseph Chalom

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports3 days ago

Sports3 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread – Corporette.com

-

Crypto World3 days ago

Crypto World3 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World4 days ago

Crypto World4 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business4 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat20 hours ago

NewsBeat20 hours agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World5 hours ago

Crypto World5 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech4 days ago

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined