Crypto World

Bitcoin ETFs Hold On Amid Price Plunge, Analyst Says

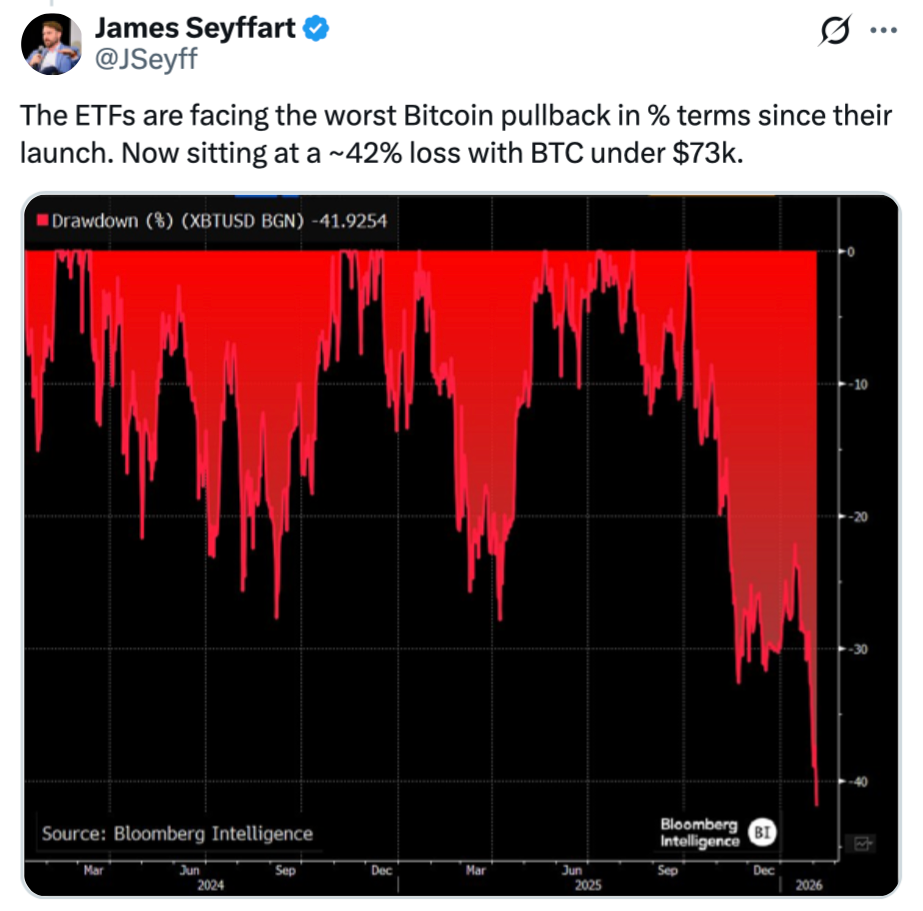

US-based spot Bitcoin ETF holders are showing resilience despite a four-month downtrend in Bitcoin (CRYPTO: BTC), according to ETF analyst James Seyffart. In a recent post on X, he noted that the ETFs are “hanging in there pretty good,” even as the underlying asset has endured a prolonged slide. While acknowledging the pain of the current stretch—Bitcoin trading below $73,000 has left ETF holders with what he described as their largest paper losses since the January 2024 launch—the way flows have behaved contrasts with the height of the market cycle. The narrative is nuanced: inflows have cooled from peak levels, but the existing positions remain broadly intact as investors weather the drift in price.

Key takeaways

- Spot Bitcoin ETF holders are currently underwater but continuing to hold positions, signaling a degree of conviction despite the drawdown.

- Net ETF inflows had reached roughly $62.11 billion before the October downturn, and have since cooled to around $55 billion, according to preliminary data from Farside Investors.

- Bitcoin’s price trajectory has contributed to paper losses for ETF holders, with the broader market down about 24% over a 30-day window and the spot price near $70,537 at the time of reporting.

- Industry observers highlight a pattern of extended outflows, noting that three consecutive months of withdrawals marked a first in the history of higher-frequency ETF data monitoring.

- Industry voices emphasize a longer-term perspective, arguing that Bitcoin’s performance since 2022 has outpaced traditional assets in several periods, challenging the sentiment of a uniformly bearish cycle among analysts.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. ETF holders remain underwater as Bitcoin’s price decline drags on, though the net inflow dynamics offer a counterpoint to pure price Action.

Trading idea (Not Financial Advice): Hold. The combination of persistent holdings by ETF investors and improving inflows relative to peak levels suggests patience may be warranted amid ongoing price volatility.

Market context: The ETF landscape sits at the intersection of liquidity, risk appetite, and macro flows. Inflows into BTC-linked vehicles have cooled after a major cycle, while on-chain and market indicators show divergent signals about near-term momentum. The mix of price pressure and ongoing institutional participation shapes a cautious but not collapsing narrative for Bitcoin-focused ETFs.

Why it matters

The behavior of spot BTC ETFs helps illuminate a broader dynamic in crypto markets: institutional vehicles can provide a stabilizing, if not yet growth-driven, channel for price discovery. Even as price declines stretch across several weeks, the fact that ETF inflows remain sizable—albeit down from the peak—suggests that investors are maintaining exposure rather than exiting en masse. This matters for market liquidity, as ETF flows can dampen sharp price moves when buying or selling pressure intensifies, particularly in a sector as sensitive to macro headlines as crypto.

The discourse around investor sentiment is nuanced. On one hand, there is acknowledgment of substantial paper losses among ETF holders during the recent downturn, with Bitcoin navigating lower levels and volatility elevated. On the other hand, observers highlight that Bitcoin’s recovery potential remains tethered to macro risk appetite and the pace of flows into crypto vehicles. The conversation is further complicated by longer-term performance comparisons: Bitcoin has, in multiple cycles, outperformed traditional assets over extended horizons, which some argue justifies a longer view despite the near-term pain.

Analysts and researchers stress that focusing solely on near-term drawdowns can obscure the more complex picture of investor behavior and market structure. For instance, a well-known market observer suggested that Bitcoin’s strength in previous years—particularly its outsized gains through 2023 and 2024—remains a reference point for evaluating current demand. While the market may appear to be in a risk-off phase, the longer arc of Bitcoin’s price action has historically included substantial rallies following consolidation periods, underscoring the difficulty in drawing conclusions from a single quarter’s results.

Another thread in the discussion centers on the prudence of staying invested when ETF holders are effectively “underwater and collectively holding,” as some observers phrase it. This stance mirrors a broader crypto investing paradigm where conviction and time horizons matter as much as timing. In a space where episodic headlines can swing prices, the behavior of ETF holders offers a degree of reflexivity: ongoing participation from established vehicles can support price resilience, even when volatility remains elevated.

The discourse also touches on narrative risk—whether market participants are overly pessimistic about BTC’s near-term prospects. Some voices argue that evaluating Bitcoin’s performance in a post-2022 context should consider its outsized gains relative to gold and traditional assets, suggesting that the market’s recovery potential remains intact even after a difficult stretch. While sentiment among analysts fluctuates, the fact that a broad spectrum of commentators continues to discuss Bitcoin’s long-term trajectory hints at a market that is more nuanced than a straightforward bullish or bearish verdict.

The price action is clear: Bitcoin has shed nearly a quarter of its value in the last 30 days, with BTC trading around $70,537, according to CoinMarketCap. The linkage between ETF flows and price remains an evolving interplay, and investors are watching for how upcoming data and regulatory signals might shape the next leg of the cycle.

In the broader ecosystem, crypto analytics firms and market researchers have highlighted a pattern that may be drawing attention beyond immediate price moves. A widely cited analyst pointed out that the current period marks a historic phase in which consecutive outflows have occurred, raising questions about the implications for liquidity, volatility, and the resilience of BTC-linked products. Yet, this is not the first time the market has faced a testing environment, and some observers emphasize that Bitcoin’s fundamental narratives—scalability, network activity, and institutional adoption—remain central to the longer-term thesis.

Meanwhile, voices from the analytics community caution against a purely short-term lens. The market’s reaction to liquidity shifts, regulatory signals, and ETF flows can diverge from what is visible in day-to-day price movements. By examining the total inflows and outflows relative to the size of the market, investors can form a more balanced view of risk and opportunity in the BTC ETF space, rather than focusing solely on immediate losses or gains.

Eric Balchunas, a veteran ETF analyst, has emphasized that Bitcoin’s performance since 2022 has delivered outsized gains compared with gold and silver, arguing that those who judge BTC on a single year’s performance may be missing the broader arc. His comment underscores the importance of framing BTC’s story within a multiyear horizon, especially for investors considering exposure through spot BTC ETFs rather than direct spot markets. The ongoing debate about risk and return continues to shape how market participants approach BTC-focused ETFs and related products.

Ki Young Ju, CEO of CryptoQuant, summed up a meta-view that reflects a cautious mood among market participants: “every Bitcoin analyst is now bearish,” a remark that underscores the prevailing mood while leaving room for a counterpoint in a market that has historically proven contrarian at pivotal moments. The tension between bearish sentiment and the potential for a longer-term rebound remains a defining feature of BTC discourse as traders weigh the odds of a renewed upshift in price against continued macro uncertainty.

What to watch next

- Next wave of ETF flow data from Farside Investors and other researchers, which could show whether the contraction in inflows accelerates or stabilizes.

- Bitcoin price behavior over the next several weeks, particularly in response to macro cues and any regulatory developments impacting crypto markets.

- Further commentary from major ETF analysts and researchers on whether the current drawdown is a pause or the onset of a deeper correction.

- Updates on institutional participation in BTC-linked products, including any changes in flows into other crypto ETFs or related vehicles.

Sources & verification

- Preliminary net inflows data for spot BTC ETFs from Farside Investors (as cited in the article).

- Public X posts by James Seyffart discussing ETF holders’ performance and sentiment.

- Public X posts by Jim Bianco and Rand analyzing ETF holder underwater percentages and historical comparisons.

- Price data for Bitcoin from CoinMarketCap at the time of publication (BTC price around $70,537).

- Comments from Eric Balchunas regarding BTC’s performance since 2022 relative to other assets.

- Ki Young Ju’s remarks from CryptoQuant on market sentiment.

Bitcoin ETF flows and price action amid a four-month decline

US-based spot BTC ETFs are navigating a difficult phase that has stretched over several months, marked by a meaningful rally-to-correction cycle that has dragged prices lower while inflows have not collapsed as some bears expected. The conversation among analysts centers on a paradox: even as many investors sit underwater, the aggregate posture remains constructive enough to sustain a broad layer of market liquidity and investor confidence. From the vantage point of ETF market structure, the persistence of holdings and the scale of inflows before October point to a durable base of participants who view BTC exposure as a core, long-term component of a diversified portfolio rather than a speculative, short-term bet.

As price action remains volatile, the ETF community continues to balance risk and opportunity. The data show that, despite the downturn, the community of ETF holders has not rushed to exit en masse. This behavior aligns with a longer-run thesis that Bitcoin, despite reputational cycles, has established a persistent presence in institutional portfolios. The tension between near-term losses and longer-term potential remains a central theme in assessing BTC’s role within the ETF ecosystem, with analysts urging caution not to conflate short-term price dynamics with the asset’s ultimate trajectory.

In practical terms, the ongoing observation is that ETF inflows, while reduced from peak levels, still reflect a non-negligible demand for BTC exposure. The numbers suggest a market that is not capitulating, even as the price declines continue. For traders and investors, the key takeaway is that the ETF framework provides a stable, regulated channel for exposure that can influence liquidity dynamics in ways that are distinct from the spot market alone. The evolving narrative around ETF flows—alongside Bitcoin’s price path and macro signals—will continue to shape market psychology and the pace of the next leg in BTC’s cycle.

For readers who want to verify the underlying data and quotes, the linked posts and price data points in this report provide direct sources. The discussion around ETF flows, price levels, and analyst commentary reflects a broad cross-section of market voices, each contributing to a composite view of a market that remains highly reactive to both micro and macro catalysts. As regulation, classification of crypto assets, and ETF product design continue to mature, observers anticipate that flows into BTC-linked vehicles will adjust in response to evolving expectations for risk, return, and liquidity in the crypto space.

The subscription template at the end of the article is included to reflect ongoing engagement opportunities for readers seeking deeper insights into crypto market dynamics.

Notes: The coverage above preserves the factual statements and linked references as presented, while restructuring them into a professional, journalistic narrative. No promotional boilerplate from the publisher is included in this rewritten article.

Crypto World

BlackRock Moves Millions in BTC and ETH to Coinbase Amid Market Decline

BlackRock has moved millions of dollars in Bitcoin (BTC) and Ethereum (ETH) to Coinbase Prime, sparking speculation about its intentions. The transfer of approximately $170 million comes at a time when BTC is on a downward trend in the market. With the price of Bitcoin falling, questions have emerged regarding whether BlackRock is preparing to sell its assets or purchase more.

The transfer follows a series of similar moves in the past, adding to the ongoing market uncertainty. In January, BlackRock transferred $600 million in BTC and ETH to Coinbase, which later saw an outflow of $142 million. This has raised concerns about potential sell-offs, with some fearing BlackRock may be offloading assets in response to the market downturn. However, it remains unclear whether the funds are being moved for selling or for reinvestment purposes.

Bitcoin Price Continues to Struggle as ETF Outflows Persist

The price of Bitcoin has continued its decline, with the BTC price falling below $100,000 for the first time since April 2025. This comes as Bitcoin ETFs experience significant outflows, with total assets under management (AUM) for Bitcoin ETFs now standing at approximately $97 billion. The drop in the AUM is the lowest it has been in nearly two years.

BTC ETF funds, such as the ones managed by BlackRock, have seen daily outflows. Experts point out that these outflows coincide with the price of Bitcoin being well below the cost of creation for the ETFs. The cost of creating the ETFs stands at around $84,000 per Bitcoin. Given this disparity, there are concerns that the situation could lead to further declines in ETF investments.

While these ongoing outflows have raised concerns, it is important to note that the market is experiencing a wider trend of consolidation and realignment. Despite the challenges faced by Bitcoin ETFs, BlackRock is looking to expand its offerings. The firm has filed for a Bitcoin Premium Income ETF, signaling its continued interest in the cryptocurrency space.

Other Institutions Follow BlackRock’s Lead with Large Transfers

BlackRock is not the only institution to have moved large amounts of cryptocurrency to Coinbase. GameStop Holdings recently transferred all of its Bitcoin holdings, valued at around $450 million, to Coinbase. The transfer, however, was not without its challenges. The value of GameStop’s Bitcoin holdings has decreased by approximately $70 million from their initial purchase price.

GameStop’s move aligns with statements from its CEO, Ryan Cohen, who hinted that the company is looking to diversify its investment strategy. This decision reflects the broader trend of traditional financial institutions and corporations adjusting their positions in the crypto market. BlackRock’s latest move, paired with GameStop’s, could signal a shift in how these firms approach their digital asset portfolios.

This shift in strategy could have wider implications for the market as more institutions look to rebalance or shift their cryptocurrency holdings. While the future of Bitcoin and Ethereum remains uncertain, these movements show how large institutions are responding to ongoing market fluctuations.

Crypto World

Google’s Gemini AI Predicts the Price of XRP, Ethereum and Solana By the End of 2026

Google’s Gemini AI leverages big data for its analyses, and when using a carefully structured prompt, the LLM generates eye-catching 2026 price projections for XRP, Ethereum, and Solana.

According to Gemini’s analysis, an extended crypto bull market combined with clearer and more constructive regulation in the United States could propel leading digital assets to fresh all-time highs faster than many market participants anticipate.

Below is Gemini’s projected outlook for the three biggest altcoins over the next eleven months.

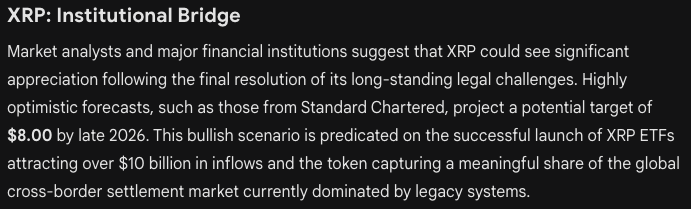

XRP ($XRP): Gemini AI Predicts a Run Toward $8 by 2027

Ripple’s XRP ($XRP) began 2026 with strong upward momentum, gaining roughly 19% in the first week of the year. With the token currently trading around $1.55, Gemini estimates that a sustained bullish trend could push XRP as high as $8 by the end of 2026. That would represent gains of roughly 420%, more than quadrupling.

XRP was one of the top-performing cryptocurrencies last year. In July, it reached its first new all-time high (ATH) in seven years, surging to $3.65 after Ripple secured a decisive legal victory over the U.S. Securities and Exchange Commission.

That ruling removed a significant regulatory cloud hanging over XRP and helped calm broader concerns about altcoins getting treated as unlicensed securities

From a technical standpoint, XRP’s Relative Strength Index (RSI) currently sits near 26, placing it in oversold territory. This suggests the recent selloff may be nearing exhaustion, with buyers likely to step in over the weekend to accumulate at lower price levels.

Meanwhile, support and resistance lines throughout January form an unresolved bullish flag pattern. As XRP re-converges with its 30-day moving average, positive developments could ignite a gold rush in the coming weeks or months.

When combined with ETF inflows and expectations surrounding the U.S. CLARITY bill, a proposed comprehensive framework for crypto regulation, these factors suggest that Gemini’s target is largely conceivable.

Ethereum ($ETH): Gemini Sees an Easy 4x for Current HODLers

Ethereum ($ETH), the leading platform for smart contracts, decentralized applications, and decentralized finance, remains the foundational layer for much of the Web3 economy.

With a market capitalization of around $263 billion and over $59 billion in total value locked (TVL) across DeFi protocols, Ethereum serves as the primary hub of on-chain economic activity.

Its strong security history, dependable settlement layer, and early leadership in stablecoins and real-world asset tokenization position Ethereum favorably for deeper institutional adoption.

This trend could accelerate if U.S. lawmakers pass the CLARITY bill, providing the regulatory certainty institutions need to deploy capital using Ethereum-based infrastructure.

ETH is currently trading just below $2,172, with significant resistance expected near the $5,000 level after reaching an all-time high of $4,946.05 in August.

If Gemini’s bullish scenario materializes, a clear break above $5,000 could set the stage for multiple new highs this year, with potential upside targets ranging far beyond $8,000 in a bull run.

Solana (SOL): Gemini AI Suggests SOL Has 440% Upside by 2027

The Solana ($SOL) ecosystem now supports more than $7.2 billion in TVL and carries a market capitalization of around $53 billion, underpinned by consistent growth in both developer engagement and user adoption.

Investor interest in SOL has intensified following the introduction of Solana-based ETFs by major asset managers such as Bitwise and Grayscale.

After experiencing a sharp pullback in late 2025, SOL has spent recent months in the $130 to $145 support range until Greenland and Iran scares plunged the price down to the $90 to $100 support range. At $93, Solana appears to be in hot water, but its oversold RSI of 25 indicates a sharp bounce could begin before the weekend.

Under Gemini’s most bullish assumptions, Solana could climb to $500 by 2027. That scenario would imply approximately 440% upside from current prices and would place SOL well above its previous all-time high of $293, recorded last January.

Institutional adoption continues to reinforce Solana’s long-term outlook. The network is increasingly being used for real-world asset tokenization, with firms such as Franklin Templeton and BlackRock pointing to Solana’s expanding role within traditional financial infrastructure.

Maxi Doge (MAXI): Move Over Dogecoin! Memesville Has a New Alpha

While not included in Gemini’s core forecasts, Maxi Doge ($MAXI) has quickly become one of the most discussed meme coin presales of 2026, raising approximately $4.6 million ahead of its public debut.

The project features an over-the-top, high-energy parody mascot loosely inspired by Dogecoin (a distant relative, according to the lore), Maxi Doge combines gym-bro aesthetics with unapologetic degen humor.

Loud, exaggerated, and intentionally chaotic, Maxi Doge leans fully into the speculative spirit that originally fueled the meme coin boom.

MAXI is an ERC-20 token running on Ethereum’s proof-of-stake network, giving it a significantly smaller environmental footprint compared with Dogecoin’s proof-of-work model.

During the presale, buyers can stake MAXI tokens for yields of up to 68% APY, with rewards gradually decreasing as more tokens enter the staking pool.

The token is currently selling at $0.0002802 in the latest presale phase, with automatic price increases at each funding milestone. Purchase via MetaMask and Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new alpha in Memesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post Google’s Gemini AI Predicts the Price of XRP, Ethereum and Solana By the End of 2026 appeared first on Cryptonews.

Crypto World

Bitcoin Price Rises as Spot Bitcoin ETFs Attract $1.42B in Inflows

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has jumped by a fraction of a percentage in the last 24 hours to trade at $95,324, as spot Bitcoin ETFs saw a strong return recording $1.42 billion in net inflows over the past week.

ETF activity was heavily concentrated in the middle of the week. Data shows that Wednesday delivered the largest single-day inflow of approximately $844 million, followed closely by $754 million on Tuesday. Although momentum cooled toward the end of the week, including a notable $395 million outflow on Friday, the strong midweek buying was enough to push total weekly inflows to their highest level since early October. At that time, spot Bitcoin ETFs attracted around $2.7 billion, highlighting the scale of the renewed interest.

The latest inflow trend suggests that institutional investors are gradually returning to Bitcoin through regulated investment products after a period of caution. Vincent Liu, chief investment officer at Kronos Research, said that ETF inflows indicate long-only allocators re-entering the market. He added that ETF buying, combined with reduced selling from large Bitcoin holders, or whales, is helping tighten effective supply.

On-chain data shows whale selling pressure has eased compared to late December, reducing a key source of distribution and downside risk. Ethereum ETFs also posted positive inflows, though at more modest levels compared to Bitcoin. The strongest inflow day occurred on Tuesday, with approximately $290 million, followed by $215 million on Wednesday. However, late-week selling weighed on performance, with Friday seeing roughly $180 million in outflows, trimming total weekly inflows to around $479 million.

Despite the improved flow data, analysts remain cautious. Market observers note that short-lived spikes in ETF inflows have historically led to brief price rebounds rather than sustained rallies. Analysts argue that Bitcoin will likely need several consecutive weeks of strong and consistent ETF demand to support a durable uptrend. Without sustained inflows, price gains may continue to face resistance and fade during periods of weaker demand.

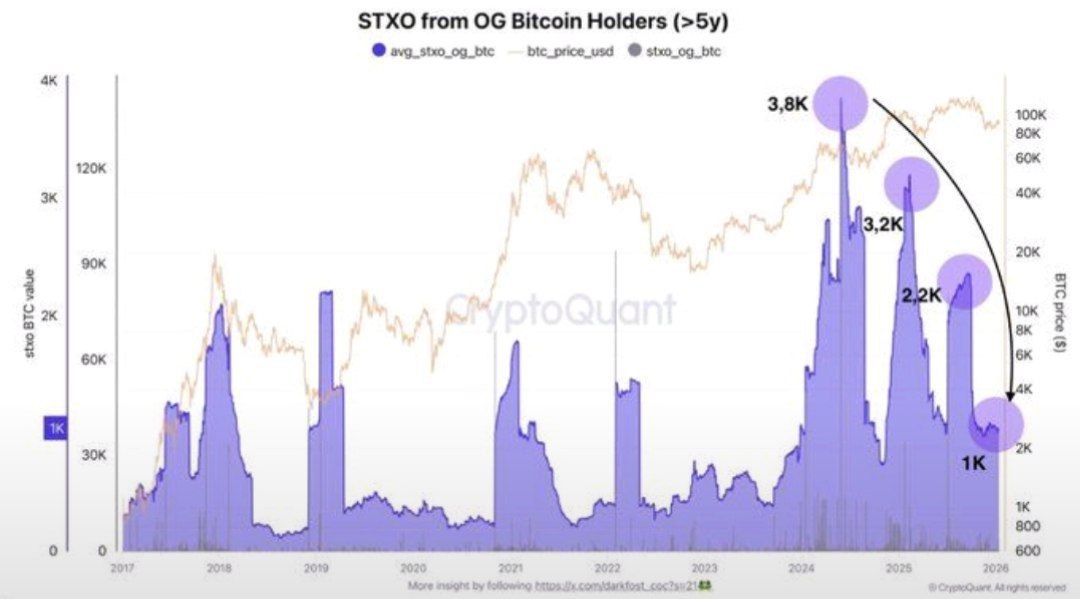

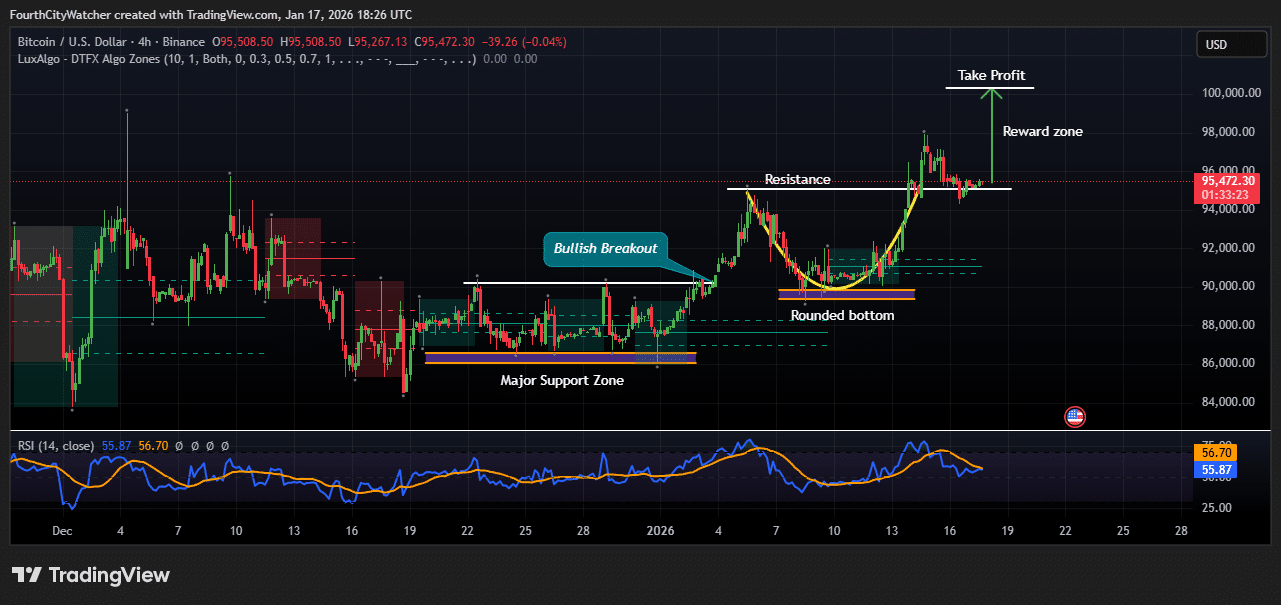

Bitcoin Price Consolidates Above Key Support After Bullish Breakout

Bitcoin (BTC) shows steady consolidation after a strong bullish breakout, according to the latest 4-hour chart, as price trades at $95,470 at the time of writing. The chart highlights a major support zone near the $86,000–$88,000 range, where Bitcoin previously formed a solid base.

This area acted as a demand zone, absorbing selling pressure and setting the stage for a rebound. From this level, BTC began forming a rounded bottom pattern, a classic bullish structure that often signals a gradual shift from bearish to bullish momentum. The bullish bias was confirmed after the price broke above a key resistance zone around $91,000–$92,000, labeled as a bullish breakout on the chart. Following the breakout, Bitcoin rallied sharply toward the $97,000–$98,000 area, where sellers temporarily stepped in. This level now acts as short-term resistance.

Currently, BTC is moving sideways just below resistance, suggesting healthy consolidation rather than weakness. Price is holding above the former resistance zone, which has now flipped into support around $94,500–$95,000. This behavior often indicates that buyers are defending higher levels while preparing for a possible continuation move.

BTCUSD Chart Analysis Source: Tradingview

The chart also marks a reward zone targeting the $100,000 psychological level, aligning with the projected take-profit area. A clean break and close above the $96,000–$97,000 resistance could open the door for a retest of six-figure prices in the near term.

Momentum indicators support this outlook, with the Relative Strength Index (RSI) is hovering around the mid-50s, indicating a neutral-to-bullish momentum. Notably, RSI is neither overbought nor oversold, leaving room for further upside if buying pressure increases.

The technical structure remains constructively bullish, as long as Bitcoin holds above the $94,000 support zone. A drop below this level could invite short-term pullbacks toward $92,000, but unless BTC loses the major support near $88,000, the broader trend continues to favor the bulls.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Pi Network Price Predictions for this Week

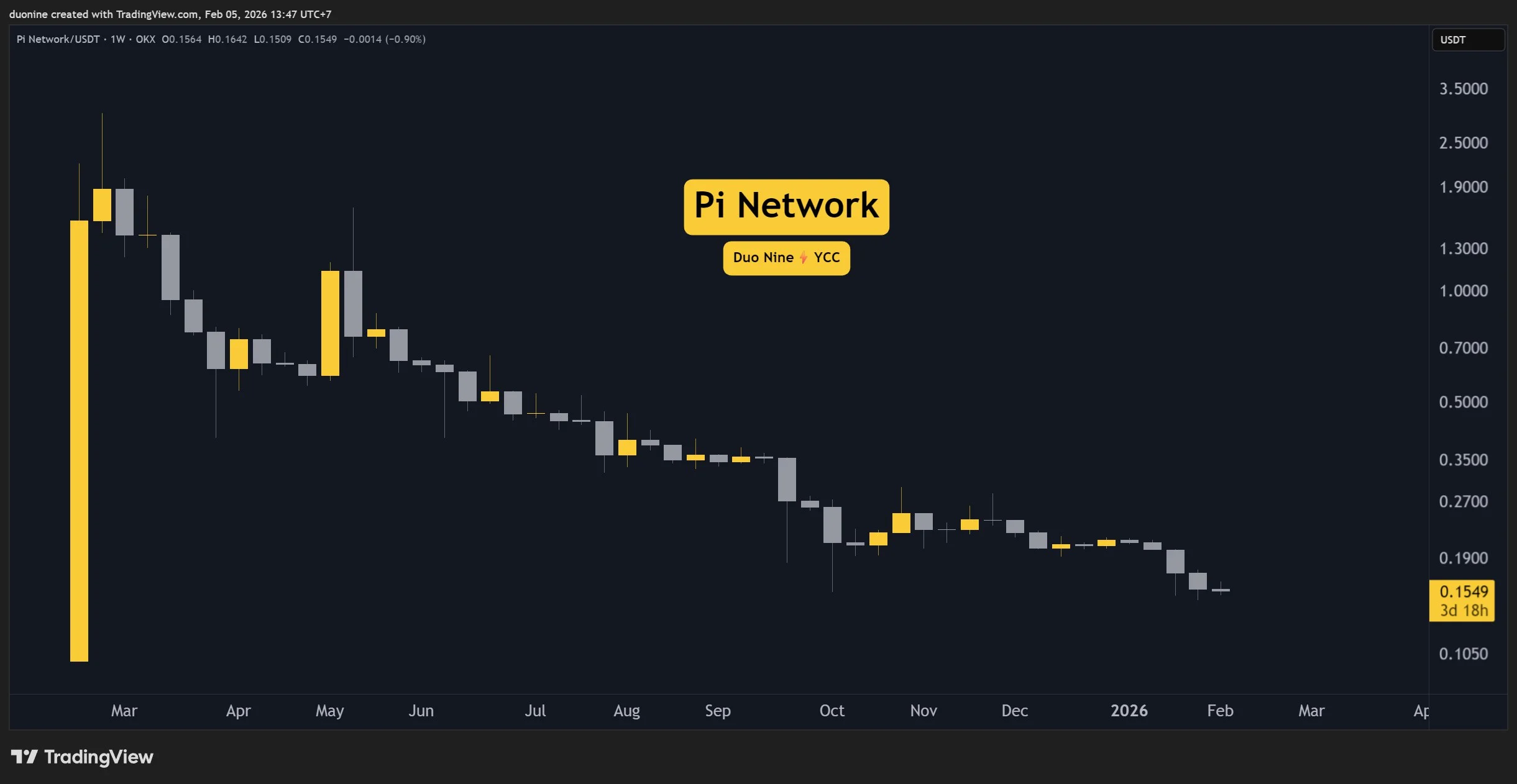

Let’s have a look at some important PI price targets as the cryptocurrency continues to fall toward new all-time lows.

PI reached a new all-time low at 14.6 cents. Is this the bottom?

PI Network (PI) Price Predictions: Analysis

Key support levels: $0.15

Key resistance levels: $0.2

PI Downtrend Accelerates

PI closed January with a new all-time low after briefly touching $0.146. Since then, buyers have pushed the price above 15 cents, but this is unlikely to hold if the downtrend continues.

Worst, there is no sign of a possible bottom yet, especially when major market leaders such as BTC and ETH continue to fall.

Aggressive Selloff since the start of 2026

As soon as the new year started, PI bears intensified their presence on the orderbook with massive sell orders. This led to a sharp 25% crash in mid-January. This pressure appears to continue in February, as can be seen on the chart.

Daily RSI Extremely Oversold

The daily RSI has been in the oversold region (below 30) since the start of the year, and it has not moved out of it. This is an extremely bearish signal, but it does hint at a possible bounce in the future, since prices rarely remain in extremes for long.

You may also like:

Should a bounce materialize later, watch the resistance at 20 cents, which could stop any relief rally.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Bitcoin Sees First $69,000 Dip in 15 Months as ‘Someone Enormous’ Sells

Bitcoin (BTC) fell below $70,000 on Thursday as suspicions over coordinated selling boiled over.

Key points:

-

Bitcoin tumbles below 2021 highs for the first time since November 2024.

-

Gold and silver volatility spark copycat BTC price maneuvers as lower targets stay in play.

-

Market participants say that large entities are selling BTC on a schedule.

Bitcoin collapses to $69,000 in fresh cascade

Data from TradingView captured new 15-month BTC price lows of $69,100 on Bitstamp during the Asia trading session.

The latest plunge marked Bitcoin’s first trip to the $60,000 range since early November 2024. In doing so, it sparked $130 million of crypto long liquidations over four hours, per data from monitoring resource CoinGlass.

Bitcoin moved in step with a flash reversal on precious metals.

Gold, which the day prior had seen a relief bounce to $5,100 per ounce, fell as low as $4,789 Thursday before again targeting the $5,000 mark.

Silver, meanwhile, gyrated between $90 and $73 per ounce as volatility stayed in control.

“$BTC has entered a key support zone,” trader CW warned in a post on X.

“If it fails to support the 69k level, another significant decline could occur.”

Earlier, traders gave various BTC price bottom targets of interest, with these including the area around $50,000. Directly below $69,000, meanwhile, lies the key 200-week exponential moving average (EMA) support trend line.

Reacting, crypto entrepreneur Alistair Milne agreed with observations from longtime trader Peter Brandt. Bitcoin, the latter argued, was the victim of “campaign selling.”

“Agree with this take. Someone enormous is unloading to a deadline,” Milne responded on X.

The post likened the current sell-side pressure to when the government of Germany distributed its BTC holdings to the market, suggesting that coins were being “handed over to OTC desks who simply execute.”

“For me it started 14th Jan,” he added.

Coinbase Premium undercuts Liberation Day low

Nic Puckrin, CEO of crypto education resource Coin Bureau, likewise flagged “large selling” by whales during US hours.

Related: Bitcoin, crypto ‘winter’ soon over, says Bitwise exec as gold retargets $5K

As Cointelegraph reported, the negative Coinbase Premium, which measures the difference in price between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs, highlighted the lack of overall US Bitcoin demand.

“The Coinbase Premium is the lowest it has been in over a year. It’s even lower than post liberation day tariffs,” Puckrin noted.

He added that selling pressure would continue until the premium changed course.

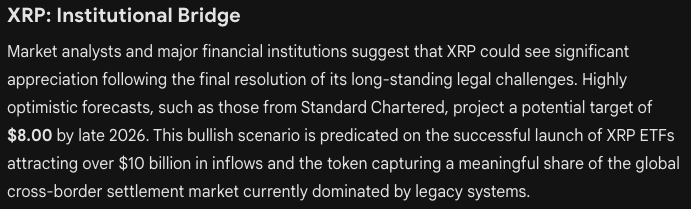

Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, said that “OG” whales were behaving as if BTC/USD were at all-time highs.

Bitcoin’s at $72K and the OG whales continue to dump like we’re still at $125K pic.twitter.com/prL68L8Lhi

— Charles Edwards (@caprioleio) February 5, 2026

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

WTI Oil Prices Volatile Ahead of Potential Talks

As the XTI/USD chart shows, the price of a barrel rose above $65 yesterday, reacting to the risk of talks between Iran and the United States on the nuclear deal breaking down. These negotiations could begin on Friday.

According to Axios, Arab world leaders have urged Donald Trump not to follow through on his threats to withdraw from the talks and shift towards military action after demands put forward by Iran. This news prompted a pullback in prices below $64.

The news backdrop is further complicated by conflicting reports regarding India’s refusal to purchase Russian oil, alongside other global factors. All of this is contributing to heightened volatility in the oil market, a trend also confirmed by the ATR indicator.

Technical Analysis of XTI/USD

On 14 January, we:

→ analysed swings in WTI crude prices to identify a breakout from a descending channel (shown in red) and outline an upward trajectory (shown in blue);

→ noted that the breakout level (around $58.35) was acting as support;

→ suggested that the market was vulnerable to a corrective move.

Indeed, on the same day (as indicated by the blue arrow), the price formed a bearish impulse towards this support, where the market found some balance.

However, geopolitical developments since the second half of January have supported higher prices, providing grounds to draw a broad ascending channel (shown in purple). In this context:

→ its lower boundary is acting as support, with the long lower wick on the 3 February candle confirming aggressive buying interest;

→ the $65 level appears to be a key resistance. Broad price swings formed there on 29–30 January — a sign of “smart money” activity — after which prices declined. Yesterday, the market again reversed sharply from this level.

It is therefore reasonable to assume that this resistance will pose a significant hurdle for bulls if they attempt to keep prices within the ascending purple channel. At the same time, the further direction of WTI oil price movements will most likely be determined by developments surrounding Friday’s Iran–US nuclear talks in Oman.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Crypto Cards Rival Stablecoin Transfers as Spending Tops $18 Billion: Artemis

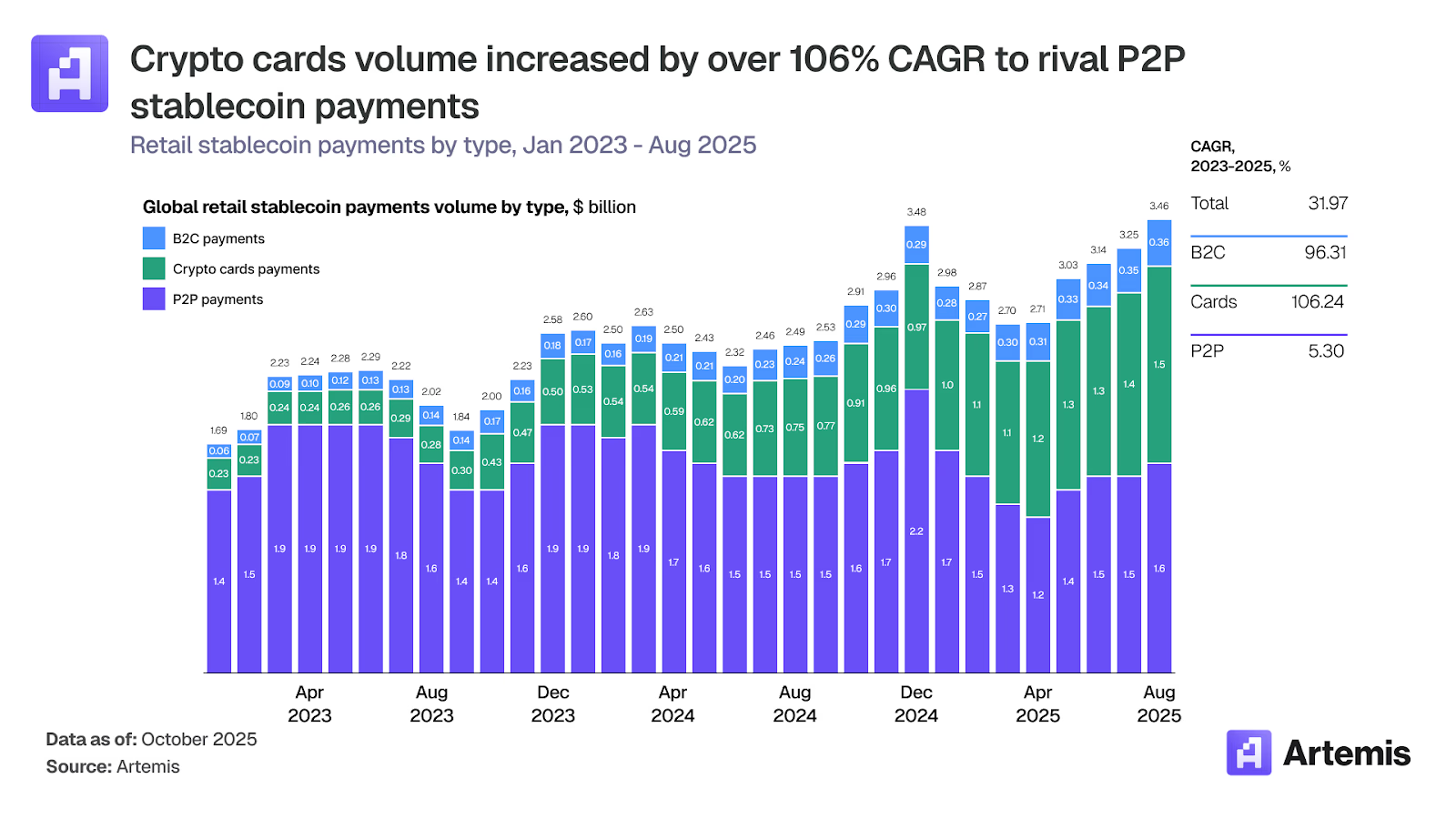

Crypto-linked cards are emerging as a key channel for stablecoin usage, with annualized volumes now catching up to peer-to-peer on-chain transfers.

Crypto-linked payment cards have become one of the fastest-growing bridges between stablecoins and everyday commerce, according to Artemis, a blockchain analytics firm.

In a Jan. 15 research report compiling estimates from on-chain settlement data and card network disclosures, Artemis found that monthly crypto card volume surged from about $100 million in early 2023 to more than $1.5 billion by late 2025.

“Annualized, the market now exceeds $18 billion, rivaling peer-to-peer stablecoin transfers ($19 billion), which grew just 5% over the same period,” the report reads.

While crypto cards can be funded with a range of assets, the report notes that Circle’s USDC and Tether’s USDT account for nearly 96% of deposited collateral on cards issued via Rain, an infrastructure platform that enables businesses to issue Visa cards.

Visa has also emerged as the dominant payment network in the sector, capturing more than 90% of on-chain card volume despite having a similar number of programs as Mastercard. As Artemis explains, this divergence is likely thanks to Visa’s “early partnerships with infrastructure providers.”

Visa’s stablecoin-linked card spending alone reached a $3.5 billion annualized run rate in late 2025, growing about 460% year over year, according to the report.

A geographic breakdown of stablecoin usage shows India and Argentina as “true global outliers,” where USDC accounts for 47.4% and 46.6% of usage, respectively.

By comparison, USDT dominates stablecoin activity across most other markets, including Turkey, China and Japan, according to the data.

However, even with the rapid growth of crypto cards, Artemis doesn’t expect direct crypto acceptance to fully replace card networks in the near term, citing their “slow relative growth in volume in comparison to cards.”

Crypto World

Bitcoin back up above $71,000

Bitcoin clawed its way back above $71,000 on Thursday after a sharp selloff earlier in the day dragged prices briefly below the $70,000 mark, mirroring tentative stabilization across global markets.

The move came as a broader rout in technology stocks showed signs of fatigue. Futures tied to the Nasdaq 100 edged higher after two bruising sessions that erased the index’s gains for the year, while European stocks steadied and Asian markets trimmed losses.

Bitcoin had fallen as much as 7% over the previous 24 hours as investors reduced risk across assets tied to growth and leverage. The slide coincided with renewed pressure in precious metals, where silver plunged as much as 17%, extending a brutal reversal after last month’s record rally.

Gold also slipped, underscoring how quickly speculative trades across markets have been unwound.

In crypto, the bounce above $71,000 appears more like short covering than a renewed rush of buyers. Trading volumes remain elevated, but demand in the spot market has thinned, according to analysts.

Stablecoin balances on exchanges have also been drifting lower, suggesting fresh capital is staying on the sidelines rather than stepping in aggressively on dips.

Macro uncertainty continues to weigh on sentiment. Investors are recalibrating expectations around US interest rates amid speculation over Federal Reserve leadership and the risk of a stronger dollar, which typically pressures assets like bitcoin that thrive on easy liquidity.

Some firms remain cautious. Galaxy Digital has warned that, without a clear catalyst, bitcoin could still revisit lower levels if selling resumes.

Others see the bulk of the drawdown as already behind the market, with estimates clustering around a potential bottom in the low-to-mid $60,000 range.

Crypto World

CFTC Formally Withdraws Biden-Era Proposal to Ban Sports and Political Prediction Markets

The agency called the 2024 rule a “frolic into merit regulation” and said it will pursue new rulemaking grounded in the Commodity Exchange Act to provide clarity for prediction market operators.

Commodity Futures Trading Commission Chairman Michael S. Selig has formally withdrawn a 2024 notice of proposed rulemaking that would have banned political, sports and war-related event contracts, marking the clearest signal yet that the agency intends to regulate prediction markets rather than restrict them.

Key Takeaways:

– The CFTC scrapped both its 2024 proposal to ban event contracts and a 2025 staff advisory that had warned firms away from sports-related markets.

– Chairman Selig dismissed the earlier ban as a politically driven “frolic into merit regulation” and committed to building a new rules-based framework.

– The move lands as Kalshi, Polymarket and Coinbase fight a wave of state lawsuits alleging their sports contracts amount to unlicensed gambling.

The agency also rescinded CFTC Staff Letter 25-36, a September 2025 advisory that had warned regulated entities to exercise caution when facilitating sports-related event contracts due to ongoing litigation. In the remarks following the decision, Selig said:

“The 2024 event contracts proposal reflected the prior administration’s frolic into merit regulation with an outright prohibition on political contracts ahead of the 2024 presidential election.”

The CFTC does not intend to issue final rules under the withdrawn proposal, according to the press release.

Instead, the commission will advance a new rulemaking framework anchored in the Commodity Exchange Act, aiming to establish clear standards for event contracts and provide legal certainty for exchanges and intermediaries.

Selig Frames Withdrawal as First Step Toward Comprehensive Event Contracts Rulemaking

The announcement follows remarks Selig delivered on January 29 at a joint CFTC-SEC harmonization event alongside Securities and Exchange Commission Chairman Paul Atkins. As reported, Selig used his first public speech as chairman to outline a broader reset of the agency’s approach to prediction markets.

“For too long, the CFTC’s existing framework has proven difficult to apply and has failed our market participants,” Selig said. “That is something I intend to fix by establishing clear standards for event contracts that provide certainty to market participants.”

Selig also directed staff to reassess the commission’s participation in pending federal court cases where jurisdictional questions are at issue, signaling that the CFTC may intervene to defend its exclusive authority over commodity derivatives.

Prediction Market Platforms Navigate Booming Growth and State-Level Legal Battles

The withdrawal arrives as prediction markets experience rapid expansion and intensifying regulatory friction. Combined trading volumes on Polymarket and Kalshi, the two largest platforms, reached $37 billion in 2025, drawing in major exchanges eager to compete.

Coinbase launched prediction markets through a partnership with Kalshi, a federally regulated designated contract market, in late January. Crypto.com recently spun out its prediction business into a standalone platform called OG. Polymarket returned to the U.S. market in December after receiving CFTC no-action relief, and Gemini secured a designated contract market license for its Titan platform.

Meanwhile, state gaming regulators have pushed back. Nevada filed a civil enforcement action against Coinbase this week, arguing that event contracts tied to sports constitute unlicensed gambling. Coinbase has sued regulators in Michigan, Illinois and Connecticut over similar claims.

The NCAA has also urged the CFTC to halt college sports prediction trading, warning that the sector exposes student-athletes to integrity risks and operates outside state-level safeguards.

Selig, who was sworn in on December 22, has not provided a firm timeline for the new rulemaking, but positioned event contracts as a priority alongside the agency’s broader “Project Crypto” initiative with the SEC.

The post CFTC Formally Withdraws Biden-Era Proposal to Ban Sports and Political Prediction Markets appeared first on Cryptonews.

Crypto World

Bitcoin ETFs ‘Hanging In There’ Despite Price Plunge: Analyst

US-based spot Bitcoin exchange-traded fund (ETF) holders are showing relatively firm conviction despite a four-month Bitcoin downtrend, according to ETF analyst James Seyffart.

“The ETFs are still hanging in there pretty good,” Seyffart said in an X post on Wednesday.

While Seyffart said that Bitcoin (BTC) ETF holders are facing their “biggest losses” since the US products launched in January 2024 — at a paper loss of around 42% with Bitcoin below $73,000 — he argues the recent outflows pale in comparison to the inflows during the market’s peak.

Bitcoin ETF holders are “underwater and collectively holding.”

Before the October downturn, spot Bitcoin ETF net inflows were around $62.11 billion. They’ve now fallen to about $55 billion, according to preliminary data from Farside Investors.

“Not too shabby,” Seyffart said.

Meanwhile, investment researcher Jim Bianco said in an X post on Wednesday that the average spot Bitcoin ETF holder is 24% “underwater and collectively holding.”

Bitcoiners are being “very short-sighted.”

Crypto analytics account Rand pointed out in an X post on Tuesday that this is “the first time in history there have been three consecutive months of outflows.”

The extended outflows come as Bitcoin’s spot price has fallen 24.73% over the past 30 days, trading at $70,537 at the time of publication, according to CoinMarketCap.

Some analysts argue that Bitcoin investors are overlooking the bigger picture.

Related: XRP traders more optimistic as BTC, ETH mood turns sour: Santiment

ETF analyst Eric Balchunas said on Jan. 28 that Bitcoiners are being “very short-sighted,” given that Bitcoin’s performance since 2022 has been up over 400%, compared with gold at 177% and silver at 350%.

“In other words, bitcoin spanked everything so bad in ’23 and ’24 (which ppl seem to forget) that those other assets still haven’t caught up even after having their greatest year ever and BTC being in a coma,” Balchunas said.

Meanwhile, CryptoQuant CEO Ki Young Ju said in an X post on Wednesday that “every Bitcoin analyst is now bearish.”

Magazine: South Korea gets rich from crypto… North Korea gets weapons

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards

Gemini Clears Key CFTC Approval to Launch Prediction Market Platform in US

Gemini Clears Key CFTC Approval to Launch Prediction Market Platform in US

![Tom Lee Just Said The UNTHINKABLE About Bitcoin & Ethereum! [2026 New Prediction]](https://wordupnews.com/wp-content/uploads/2026/02/1770284050_maxresdefault-80x80.jpg)