Crypto World

BlackRock Moves Millions in BTC and ETH to Coinbase Amid Market Decline

BlackRock has moved millions of dollars in Bitcoin (BTC) and Ethereum (ETH) to Coinbase Prime, sparking speculation about its intentions. The transfer of approximately $170 million comes at a time when BTC is on a downward trend in the market. With the price of Bitcoin falling, questions have emerged regarding whether BlackRock is preparing to sell its assets or purchase more.

The transfer follows a series of similar moves in the past, adding to the ongoing market uncertainty. In January, BlackRock transferred $600 million in BTC and ETH to Coinbase, which later saw an outflow of $142 million. This has raised concerns about potential sell-offs, with some fearing BlackRock may be offloading assets in response to the market downturn. However, it remains unclear whether the funds are being moved for selling or for reinvestment purposes.

Bitcoin Price Continues to Struggle as ETF Outflows Persist

The price of Bitcoin has continued its decline, with the BTC price falling below $100,000 for the first time since April 2025. This comes as Bitcoin ETFs experience significant outflows, with total assets under management (AUM) for Bitcoin ETFs now standing at approximately $97 billion. The drop in the AUM is the lowest it has been in nearly two years.

BTC ETF funds, such as the ones managed by BlackRock, have seen daily outflows. Experts point out that these outflows coincide with the price of Bitcoin being well below the cost of creation for the ETFs. The cost of creating the ETFs stands at around $84,000 per Bitcoin. Given this disparity, there are concerns that the situation could lead to further declines in ETF investments.

While these ongoing outflows have raised concerns, it is important to note that the market is experiencing a wider trend of consolidation and realignment. Despite the challenges faced by Bitcoin ETFs, BlackRock is looking to expand its offerings. The firm has filed for a Bitcoin Premium Income ETF, signaling its continued interest in the cryptocurrency space.

Other Institutions Follow BlackRock’s Lead with Large Transfers

BlackRock is not the only institution to have moved large amounts of cryptocurrency to Coinbase. GameStop Holdings recently transferred all of its Bitcoin holdings, valued at around $450 million, to Coinbase. The transfer, however, was not without its challenges. The value of GameStop’s Bitcoin holdings has decreased by approximately $70 million from their initial purchase price.

GameStop’s move aligns with statements from its CEO, Ryan Cohen, who hinted that the company is looking to diversify its investment strategy. This decision reflects the broader trend of traditional financial institutions and corporations adjusting their positions in the crypto market. BlackRock’s latest move, paired with GameStop’s, could signal a shift in how these firms approach their digital asset portfolios.

This shift in strategy could have wider implications for the market as more institutions look to rebalance or shift their cryptocurrency holdings. While the future of Bitcoin and Ethereum remains uncertain, these movements show how large institutions are responding to ongoing market fluctuations.

Crypto World

XRP Sentiment Beats Bitcoin and Ethereum Despite Price Drop

TLDR

- XRP sentiment beats BTC and ETH even as price drops and sell pressure rises

- Strong XRP optimism clashes with losses and heavy exchange inflows

- XRP mood surges above rivals while on-chain data signals weakness

XRP shows stronger trader sentiment than major rivals even as prices slide across the crypto market. Recent analytics place XRP well above Bitcoin and Ethereum on social mood indicators. Price action and on-chain signals still reflect pressure, and momentum remains uneven.

XRP Sentiment and Market Structure

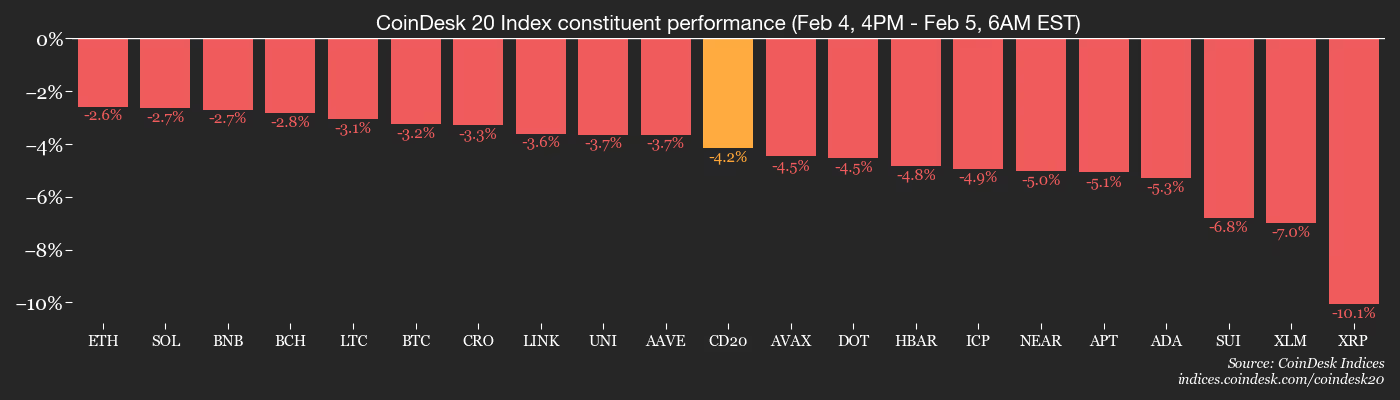

Santiment data ranks XRP with a Positive/Negative sentiment score far above competing large-cap assets. The reading stands above Ethereum and Bitcoin even after a notable weekly decline. Yet XRP lost more value than both peers during the same period.

The price fell over six percent during the past week, and losses exceeded market averages. However, social platforms continue to reflect higher confidence around XRP than other major tokens. This divergence creates tension between sentiment readings and real trading behavior.

On-chain metrics add pressure because unrealized losses now outweigh profits across many wallets. Glassnode data shows XRP approaching levels associated with capitulation cycles in past downturns. Meanwhile, loss-heavy transactions dominate flows, and panic selling continues to outpace profitable exits.

Bitcoin Holds Preference During Market Weakness

Bitcoin sentiment trails XRP, yet market structure still favors Bitcoin during broad risk-off conditions. The Altcoin Season Index places the market firmly inside a Bitcoin-dominated phase. Traders prefer relative stability, and capital rotates toward larger assets during stress.

The Crypto Fear and Greed Index recently printed one of its lowest readings in months. That score signals strong fear, and it reflects hesitation across the wider crypto environment. Such conditions often appear near short-term bottoms, yet volatility remains elevated.

Market commentators note that weakness has persisted for several weeks across major tokens. Some analysts frame the period as an extended cooling phase after earlier rallies. Even so, Bitcoin continues to anchor liquidity, and it attracts defensive positioning during uncertainty.

Ethereum Tracks Broader Risk Sentiment

Ethereum sentiment sits between Bitcoin and XRP, yet it fails to match XRP’s social strength. Weekly performance shows Ethereum declining close to five percent alongside Bitcoin. This parallel movement confirms Ethereum’s alignment with overall market direction.

Network activity remains steady, yet speculative appetite has cooled across decentralized finance segments. Lower transaction enthusiasm reflects reduced risk tolerance, and capital rotates toward safer positions. Ethereum mirrors that caution because traders scale back aggressive exposure.

Exchange flows across major assets show rising balances that often precede additional selling pressure. XRP recorded significant inflows, and Ethereum followed a similar exchange pattern. Unless buying activity returns, both assets may struggle to establish firm support levels.

Crypto World

Vitalik Buterin Offloads Nearly $6.6M in ETH Amid Price Decline

Ethereum co-founder Vitalik Buterin has sold a significant amount of his personal ETH holdings over the past several days.

Summary

- Ethereum co-founder Vitalik Buterin has sold nearly 3,000 ETH worth about $6.6 million, according to on-chain data shared by Lookonchain, with sales reported to be ongoing.

- The transactions follow Buterin’s disclosure that he has set aside 16,384 ETH to fund long-term open-source and infrastructure projects, easing concerns of an abrupt sell-off.

According to blockchain analytics shared by Lookonchain, Vitalik has offloaded 2,961.5 Ethereum (ETH), worth approximately $6.6 million, at an average price of around $2,228 per ETH. The selling is reported to be ongoing.

Lookonchain’s alert on X highlighted the on-chain movements from an address publicly associated with Vitalik, noting multiple smaller swap transactions likely routed through decentralized protocols to limit market impact.

This activity has coincided with increased market volatility. Ethereum was trading at $2,075 at press time, down 7.5% over the past 24 hours. ETH price has recently traded lower, and sales by major holders can influence short-term sentiment among traders.

Sales by founders and early contributors tend to draw heightened scrutiny in crypto markets, as they are often viewed as confidence signals rather than routine liquidity events. While the amount sold represents a small fraction of Ethereum’s total supply, on-chain transparency means such moves are immediately visible and widely discussed.

Vitalik Buterin’s ETH sales linked to planned long-term funding

The recent ETH sales are not an isolated or abrupt decision. Last week, Buterin publicly announced that he had set aside 16,384 ETH from his personal holdings, roughly $44–$45 million at current prices, to support long-term initiatives.

In a detailed post on X, Buterin said the allocation is part of his broader vision to fund open-source, secure, and verifiable technology, including infrastructure and public-goods research. The disclosure has led some market participants to view the recent sales as part of a planned funding strategy rather than a sudden sell-off.

Crypto World

Ethereum price slips further as Vitalik Buterin dumps $6.6M ETH

- Ethereum price drops to $2,127 amid market weakness and high volatility.

- Vitalik Buterin sells $6.6M ETH, part of planned funding moves.

- Key support at $2,007, with resistance targets at $2,133 and $2,274.

Ethereum (ETH) is under pressure as the cryptocurrency continues to face a significant pullback.

The price of ETH has dropped to $2,098.91, down 5.6% in the last 24 hours.

This decline is part of a broader downtrend, with Ethereum losing around 28% over the past week and nearly 34% over the past three months.

Trading volume, however, remained elevated at $54.5 billion in the last 24 hours, highlighting strong market activity despite the falling prices.

Vitalik Buterin’s ETH trades

Adding to the market concerns, Ethereum co-founder Vitalik Buterin has sold millions in ETH.

Reports indicate that wallets linked to Buterin moved roughly 2,961.5 ETH, valued at approximately $6.6 million at the time of sale.

vitalik.eth(@VitalikButerin) is dumping $ETH fast!

Over the past 3 days, Vitalik has sold 2,961.5 $ETH($6.6M) at an average price of $2,228 — and the selling is still ongoing.https://t.co/Q9G1lEsdiP pic.twitter.com/C1vBn5UimJ

— Lookonchain (@lookonchain) February 5, 2026

These transactions attracted attention due to the timing of the Ethereum downturn.

Additional reports highlight a separate $29 million ETH transfer, part of a planned reallocation by Buterin.

The movement included converting ETH to wrapped ETH (wETH) and sending smaller amounts to his Kanro charity, which focuses on biotechnology and infectious disease research.

Analysts stress that these transfers are likely strategic funding moves, not panic selling.

Nevertheless, the market has interpreted these large movements as bearish signals.

ETH price analysis

Ethereum has been under pressure due to broader crypto market weakness.

The 24-hour price range for ETH is currently $2,077.42 to $2,258.21, reflecting volatility and uncertainty.

Ethereum’s market capitalisation stands at $257 billion, with a circulating supply of 120.6 million ETH.

The cryptocurrency is still down 57% from its all-time high of $4,946.05 in August 2025.

Despite the decline, Ethereum remains a major player in the crypto ecosystem, with investors closely monitoring large wallet movements.

Ethereum price forecast

Traders are watching key levels for signs of market direction.

The first support level to monitor is $2,007.

If ETH fails to hold this level, it could drop further to the next support at $1,800.

On the upside, $2,133 is the initial resistance level.

A sustained break above this could push Ethereum toward $2,274, with the third resistance at $2,396.

Analysts like CoinLore suggest that maintaining a price above the $2,007 support is critical for any potential recovery.

Conversely, breaking below this level could accelerate selling pressure and test lower price floors.

In conclusion, Ethereum faces a challenging period as both founder wallet activity and broader market trends weigh on the price.

Traders should pay close attention to the support and resistance levels, as these will likely guide short-term movements in ETH.

Crypto World

Bitcoin’s (BTC) 21 million supply cap won’t help stop the selloff: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

With bitcoin’s bear market raging and the price dropping to the lowest since November 2024, its core pitch, a hard cap of 21 million supply, faces fresh skepticism.

Some observers say that alternative investment vehicles like ETFs, cash-settled futures and options and other services like prime-broker lending have diluted that scarcity appeal. These tools let investors access bitcoin without owning the real thing, creating a “synthetic supply” that floods the market.

“Once you can synthetically manufacture the supply, the asset is no longer scarce, and once scarcity is gone, price becomes a derivatives game, not a supply-and-demand market. This is exactly what has happened to Bitcoin,” veteran analyst and writer of The Kendall Report, Bob Kendall, wrote on X.

Gold, silver, oil and equities saw a similar structural change with the debut of alternative investment vehicles, Kendall wrote. In 2023, CoinDesk highlighted how financialization of BTC creates paper claims that mimic abundance in a market defined by raw scarcity.

This is also why investors should tread carefully with onchain metrics like the “percentage of illiquid supply,” because these don’t account for massive “paper supply” from ETFs and futures that dilute the 21 million cap.

In the market, bitcoin lost even more ground, falling below $70,000 for the first time in more than a year.

According to veteran chart analyst Peter Brandt, the selloff has all the hallmarks of campaign selling, or coordinated selling by institutions and large traders rather than retail capitulation. Brandt is not sure at what level or when the decline will halt.

Most observers expect a slide to under $60,000 while firms like Stifel fear a more profound decline to $38,000, given the strengthening correlation with tech stocks, which have also taken a beating lately.

Hyperliquid’s HYPE remains the only consistent hideout. The token is up 11% on the year, while BTC is down nearly 19%. One other interesting token is TRX, which is down just 2%, outperforming the broader market possibly, on the back of dip buying by treasury firm Tron Inc.

In traditional markets, Wall Street’s so-called fear gauge, the VIX index, is revisiting January highs above 20.00, signaling risk aversion. U.S. Treasury market action suggests expectations for a smaller Fed balance sheet. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 5: Zilliqa to undergo its hardfork enabling Cancun.

- Macro

- Feb. 5, 2 p.m.: Mexico interest-rate decision (Prev. 7%)

- Feb, 5, 4:30 p.m.: Fed balance sheet for the period ending Feb. 4

- Earnings (Estimates based on FactSet data)

- Feb. 5: Bullish (BLSH), pre-market, $0.15

- Feb. 5: Strategy (MSTR), post-market, -$18.64

- Feb. 5: IREN Limited (IREN), post-market, -$0.18

- Feb. 5: CleanSpark (CLSK), post-market, -$0.02

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 5: PancakeSwap to host an ask me anything (AMA) session with Arbitrum.

- Feb. 5: Olympus to host a community call with a live Q&A session.

- Feb. 5: Aster to host an AMA session with its CEO.

- Unlocks

- Token Launches

- No major launches scheduled.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 1.62% from 4 p.m. ET Wednesday at $71,467.00 (24hrs: -6.52%)

- ETH is up 0.24% at $2,130.50 (24hrs: -5.93%)

- CoinDesk 20 is down 1.68% at 2,077.53 (24hrs: -7.15%)

- Ether CESR Composite Staking Rate is up 18 bps at 3.01%

- BTC funding rate is at 0.0008% (0.8793% annualized) on Binance

- DXY is up 0.29% at 97.90

- Gold futures are down 1.22% at $4,890.20

- Silver futures are down 7.55% at $78.02

- Nikkei 225 closed down 0.88% at 53,818.04

- Hang Seng closed up 0.14% at 26,885.24

- FTSE is down 0.43% at 10,357.59

- Euro Stoxx 50 is down 0.36% at 5,949.05

- DJIA closed on Wednesday up 0.53% at 49,501.30

- S&P 500 closed down 0.51% at 6,882.72

- Nasdaq Composite closed down 1.51% at 22,904.58

- S&P/TSX Composite closed up 0.56% at 32,571.55

- S&P 40 Latin America closed down 2.89% at 3,653.05

- U.S. 10-Year Treasury rate is down 0.8 bps at 4.27%

- E-mini S&P 500 futures are unchanged at 6,904.75

- E-mini Nasdaq-100 futures are up 0.14% at 25,033.50

- E-mini Dow Jones Industrial Average Index futures are down 0.25% at 49,466.00

Bitcoin Stats

- BTC Dominance: 59.26% (-0.39%)

- Ether-bitcoin ratio: 0.02981 (1.56%)

- Hashrate (seven-day moving average): 913 EH/s

- Hashprice (spot): $32.02

- Total fees: 3.22 BTC / $240,320

- CME Futures Open Interest: 114,080 BTC

- BTC priced in gold: 14.6 oz.

- BTC vs gold market cap: 4.77%

Technical Analysis

- The chart shows daily price swings in decentralized exchange Hyperliquid’s HYPE token.

- HYPE’s price has surged past the trend line that characterizes the decline from September highs.

- The breakout indicates that the path of least resistance is to the higher side and shifts focus to resistance at $50.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $168.62 (-6.14%), -1.51% at $166.07 in pre-market

- Circle Internet (CRCL): closed at $55.05 (-1.98%), -1.25% at $54.36

- Galaxy Digital (GLXY): closed at $20.16 (-8.28%), -1.49% at $19.86

- Bullish (BLSH): closed at $27.20 (-1.59%), -0.51% at $27.06

- MARA Holdings (MARA): closed at $8.28 (-8.51%), -1.81% at $8.13

- Riot Platforms (RIOT): closed at $14.14 (-7.82%), -1.34% at $13.95

- Core Scientific (CORZ): closed at $16.15 (-8.96%), +0.37% at $16.21

- CleanSpark (CLSK): closed at $10.22 (-10.04%), -1.47% at $10.07

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.29 (-11.06%)

- Exodus Movement (EXOD): closed at $10.70 (+2.20%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $129.09 (-3.13%), -3.24% at $124.91

- Strive (ASST): closed at $0.59 (-13.20%), -6.74% at $0.55

- SharpLink Gaming (SBET): closed at $7.08 (-7.57%), -2.54% at $6.90

- Upexi (UPXI): closed at $1.36 (-12.26%), -2.21% at $1.33

- Lite Strategy (LITS): closed at $1.06 (-7.83%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$544.9 million

- Cumulative net flows: $54.73 billion

- Total BTC holdings ~1.28 million

Spot ETH ETFs

- Daily net flows: -$79.4 million

- Cumulative net flows: $11.94 billion

- Total ETH holdings ~5.92 million

Source: Farside Investors

While You Were Sleeping

Miners are being squeezed as bitcoin’s $70,000 price fails to cover $87,000 production costs (CoinDesk): Bitcoin is now some 20% below its estimated average production cost, increasing financial pressure across the the crypto mining industry.

Precious metals, oil slide as global tensions ease; copper down (Reuters): Prices of commodities from silver and gold to crude oil and copper dived on Thursday as global tensions eased after talks between China and the U.S., which is also set to sit down with Iran.

Trillion-dollar tech wipeout ensnares all stocks in AI’s path (Bloomberg): Hundreds of billions of dollars were wiped off the value of stocks, bonds and loans of companies big and small across Silicon Valley, with software stocks at the epicenter.

Crypto World

Private credit meltdown fears: Why BondBloxx isn’t worried

BondBloxx ETFs has been making a big bet in private credit.

Even with Wall Street fears of an impending meltdown in the space, the firm’s co-founder and chief operating officer is confident private credit is a sensible way for investors to pursue income.

“What you’re seeing in the press… maybe a fund of one manager and one manager’s assets [are] being marked down, and that’s going to happen. There may be a concentration in that manager’s approach or in the loans and the companies that are in their fund,” Joanna Gallegos told CNBC’s “ETF Edge” this week.

Gallegos, who’s the former head of global ETF strategy at J.P. Morgan Asset Management, contends BondBloxx’s approach to private credit protects investors because it’s designed to give “immense diversification.”

“Because of the way it’s [BondBloxx Private Credit CLO ETF (PCMM)] structured, you’re getting exposure to almost over 7,000 of those loans,” she said. “It gives you a pure play to private credit because 80% of the exposure in that product is private credit. And I think there’s been a lot of discussion about other vehicles and ETFs that there may not be 100% private credit.”

The firm launched its BondBloxx Private Credit CLO ETF in December 2024 — promoting it as the first-ever ETF that offers investors direct exposure to private credit.

As of Wednesday’s market close, FactSet reports the fund is up 7% since its inception and up 2% over the past three months.

‘There’s good reason to look at private credit’

Gallegos finds the yield generated by private credit is still attractive.

“That’s a good reason to look at private credit. The reality is that more companies are private than they used to,” said Gallegos, who added that the fund spreads exposure across many loans and managers rather than relying on a single manager or a concentrated pool of credits.

In the same “ETF Edge” interview, Strategas Securities’ Todd Sohn said he didn’t see broad stress across credit markets right now, too.

“Credit spreads are still on multi-decades lows, whether it’s high yield or investment grade,” the firm’s senior ETF and technical strategist said.

However, a “credit event” is on his watch list.

“If any of this private credit in the illiquid space starts to leak into other areas of the financial system… that would be my kind of a glaring sign of risk I think that’s out there. Quite frankly, everything else so far seems all right,” Sohn said. “Banks are still okay. The consumer seems all right. But I think it would be some sort of credit then out of left field that leaks into other areas that we’re not maybe focused on.”

Crypto World

Bitcoin ETFs Slide Further as Daily Outflows Hit $545M

Bitcoin (CRYPTO: BTC) exchange-traded funds extended losses on Wednesday as the spot price hovered near the $70,000 threshold, underscoring ongoing headwinds across digital-asset markets. SoSoValue data show spot Bitcoin ETFs posting $545 million in outflows for the session, contributing to a negative weekly cadence of about $255 million. Year-to-date inflows have totaled roughly $3.5 billion, yet redemptions in the same period reached $5.4 billion, leaving net outflows of about $1.8 billion and total assets under management near $93.5 billion.

Key takeaways

- Spot Bitcoin ETFs recorded $545 million in daily outflows, extending a weekly net drain of approximately $255 million.

- Year-to-date, cumulative inflows stand around $3.5 billion, but redemptions total about $5.4 billion, yielding a net negative of roughly $1.8 billion.

- Total assets under management for spot BTC ETFs sit near $93.5 billion.

- Broader market breadth has deteriorated, with the overall crypto market capitalization down about 20% year-to-date to around $2.5 trillion per CoinGecko.

- Investor behavior appears cautiously resolute: about 6% of ETF assets have exited, while a heavyweight ETF issuer’s exposure has retreated from a peak near $100 billion to around $60 billion.

Tickers mentioned: $BTC, $ETH, $XRP, $SOL, $IBIT

Sentiment: Neutral

Price impact: Negative. The ongoing outflows from BTC ETFs and a broader market pullback contributed to downside pressure, with the crypto market cap retreating roughly 20% YTD.

Trading idea (Not Financial Advice): Hold. Market participants have, on balance, remained invested through the current downturn, suggesting a cautious, patient stance rather than aggressive repositioning.

Market context: ETF flows continue to reflect a liquidity-constrained environment and a shift in risk appetite as macro signals and regulatory developments influence investor decisions in crypto assets.

Why it matters

The ongoing pressure on Bitcoin ETFs matters because these products are among the most liquid conduits to gain regulated exposure to digital assets. The persistent outflows indicate a dissonance between investor expectations for ETF-driven liquidity and the prevailing risk-off sentiment that has cooled appetite for risk assets. While inflows remain in positive territory for the year, the magnitude of redemptions underscores the fragility of demand in a challenging macro backdrop.

Industry analysts have observed a paradox: despite the outflows, the cohort of ETF holders has largely stayed put. In comments cited by market watchers, some analysts described the BTC ETF ecosystem as resilient in the face of volatility, with a relatively small portion of assets exiting funds. The dynamics at play point to a nuanced landscape where big-name issuers, like the iShares Bitcoin ETF (IBIT), have seen their asset bases retreat from peak levels yet still maintain a substantial footprint. This juxtaposition—scarcity of new inflows against a backdrop of stubborn existing holders—speaks to the complexity of crypto-asset exposure via regulated wrappers in a volatile market regime.

Altcoin funds, meanwhile, delivered a mixed signal. Ethereum (CRYPTO: ETH) ETFs registered meaningful outflows, while XRP (CRYPTO: XRP) funds drew modest inflows and Solana (CRYPTO: SOL) saw small withdrawals. These patterns illustrate that capital is not uniformly fleeing all digital-asset exposures; rather, it is rebalancing within the broader lattice of crypto instruments as traders reassess risk, duration, and yield prospects in a high-stakes environment.

As discussed by several market observers, the sector’s longer-term trajectory will hinge on how regulatory and policy signaling evolves, and whether large institutions can sustain long-hold strategies through drawdowns. The cumulative inflows for spot BTC ETFs—neatly summarized at around $54.8 billion since inception, and just a shade below the prior peak of $62.9 billion—reflect a tempered but persistent demand for regulated crypto exposure despite periodic bouts of stress. The narrative remains one of guarded optimism: potential upside for ETF products if risk sentiment improves, tempered by the reality that macro headwinds and competition from non-regulated venues continue to pressure flows.

In context, Bitcoin’s price dynamics remain a critical influence on ETF behavior. If the market sustains a move back toward prior highs, ETF inflows could accelerate, reinforcing a favorable feedback loop for price discovery. However, negative signals—whether from macro data, regulatory developments, or a renewed round of capital outflows—could precipitate further reductions in new fund subscriptions and redemptions from existing positions. Investors and issuers alike will be watching closely how the balance between demand for regulated crypto exposure and risk-off sentiment evolves in the weeks ahead.

What to watch next

- Upcoming spot BTC ETF flow data releases to gauge whether the current outflows persist or reverse in the next reporting window.

- Regulatory and product announcements from major issuers (including IBIT) that could affect investor demand for exchange-traded crypto exposure.

- BTC price action relative to the $70,000 level and its potential impact on ETF inflows and selling pressure.

- Altcoin ETF flow trajectories, with attention to Ethereum, XRP, and Solana funds, over the near term.

- Analysts’ updates on market breadth and investor behavior in the wake of ongoing macro volatility and regulatory scrutiny.

Sources & verification

- SoSoValue data on spot BTC ETF flows for the cited session and weekly period.

- CoinGecko metrics documenting the approximate 20% year-to-date decline in total crypto market capitalization to around $2.5 trillion.

- Public comments from James Seyffart on ETF inflows versus peak inflows in the BTC ETF space.

- Eric Balchunas commentary on investor behavior within BTC ETFs and the IBIT asset trajectory.

Bitcoin ETFs in retreat as spot flows remain negative and risk appetite dampens

Bitcoin (CRYPTO: BTC) exchange-traded funds continue to retreat as the spot market trades near pivotal levels, highlighting how a risk-off stance is shaping fund flows. The latest data show spot BTC ETFs registering a $545 million outflow on a single session, intensifying a broader weekly draw of roughly $255 million. While year-to-date inflows have totaled around $3.5 billion, redemptions have climbed to about $5.4 billion, resulting in a net negative of nearly $1.8 billion and an assets-under-management tally around $93.5 billion. This backdrop mirrors a wider contraction in crypto liquidity, with the total market cap down about 20% year-to-date to roughly $2.5 trillion, according to CoinGecko.

Among the ETF universe, investor behavior has shown a blend of caution and resolve. The data imply that a small minority has exited positions—approximate turnover sits near 6% of total assets—while the bulk of holders remain invested despite repeated bouts of price volatility. The dynamics at play are further illustrated by the performance of the iShares Bitcoin ETF (EXCHANGE: IBIT), which has seen its assets retreat from a recent peak close to $100 billion to around $60 billion as risk sentiment waxes and wanes. As one Bloomberg analyst noted, the scale of inflows during the peak period was substantial, and the current retreat does not erase the earlier strength of demand for regulated exposure.

Against this backdrop, altcoin funds have shown a mixed complexion. Ethereum (CRYPTO: ETH) ETFs posted outflows of roughly $79.5 million, while XRP (CRYPTO: XRP) funds attracted about $4.8 million in net inflows. Solana (CRYPTO: SOL) ETFs also faced outflows, totaling around $6.7 million. The divergence within the altcoin cohort underscores the sophisticated nature of investor preference in a risk-off environment, where different narratives and fundamental updates across projects can drive uneven demand for ETF wrappers and direct exposure alike.

For investors and market watchers, the BTC ETF story remains a barometer of wider liquidity conditions and the pace at which regulated vehicles can deliver accessible exposure to a volatile asset class. The narrative will likely hinge on whether macro conditions improve enough to spur new inflows, or whether the market’s risk-off tilt persists, dampening appetite for crypto risk assets across the board.

https://platform.twitter.com/widgets.js

Crypto World

Tron extends USDT lead over Ethereum as TRX price decouples from network boom

Tron tightens its USDT lead over Ethereum as network activity and BTC reserve plans climb, yet TRX price lags, retracing into a multi‑month consolidation range.

Summary

- Tron’s share of USDT supply has grown, with on-chain data showing rising active addresses and record weekly transaction volumes tied to stablecoin usage.

- Justin Sun has signaled plans to increase Tron’s Bitcoin reserves, echoing Binance’s $1 billion SAFU conversion toward BTC as both networks tilt their treasuries to Bitcoin.

- Despite stronger fundamentals, TRX has retraced recent gains and is back in its late‑2025 consolidation zone, with price action tracking broader market conditions more than network growth.

The Tron network has surpassed Ethereum in stablecoin supply, marking a shift in the competitive landscape between the two blockchain platforms that have competed for USDT dominance in recent years.

USDT stablecoin supply on Tron has risen significantly, giving it a larger share of the USDT supply than Ethereum, according to data from DeFiLlama.

The increased USDT liquidity on Tron reflects the network’s faster and cheaper transaction capabilities compared to competing platforms. The growth corresponds with key network performance metrics, according to blockchain analytics data.

Tron on the radar

Address activity on the Tron network has surged alongside the rise in USDT supply. Active addresses maintained an upward trend over recent years and accelerated in recent weeks, with weekly active addresses rising sharply during this period, according to DeFiLlama data.

Transaction activity has followed a similar pattern. The Tron network recently recorded its highest weekly transaction volume, while the network’s stablecoin count reached a new historic high during the same week. Industry analysts have attributed the robust network growth to stablecoin transaction activity.

Tron has been accumulating Bitcoin reserves and may execute another large purchase, according to public statements. Binance recently announced plans to convert part of its Secure Asset Fund for Users (SAFU) into Bitcoin. Tron founder Justin Sun has indicated plans for a similar move, though the exact amount of Bitcoin currently held by Tron remains undisclosed.

Despite positive network activity and Bitcoin acquisition plans, Tron’s native cryptocurrency TRX has not experienced corresponding price gains. TRX began January with an upward price movement but has since retraced most gains, experiencing a decline over recent weeks.

The TRX token was not in oversold territory despite the price drop, according to technical indicators. The retracement brought the token back to the consolidation zone where it traded between November and December of the previous year. The TRX price movement has shown limited correlation with Tron network activity, with the cryptocurrency’s performance appearing to track broader market conditions rather than network-specific demand.

Long-term price charts indicate a natural retracement following a parabolic price movement from November 2022 to August 2025, according to market data.

Crypto World

Altcoins That Can Benefit If Bitcoin Crashes Below $70,000

Bitcoin has slipped nearly 7% in the past 24 hours and is now drifting closer to the critical $70,000 mark, a psychological level that could deepen fear across the broader crypto market if it breaks. As traders prepare for a possible downturn, attention is shifting toward specific altcoins that can benefit. Ones that may stay resilient if Bitcoin crashes below $70,000.

While most tokens tend to fall alongside BTC during major sell-offs, BeInCrypto analysts have identified three cryptocurrencies that are showing strong negative correlation, healthier chart structures, and improving capital flows. These signals suggest they could possibly outperform during market stress, making them potential opportunities even in a risk-off environment.

The White Whale (WHITEWHALE)

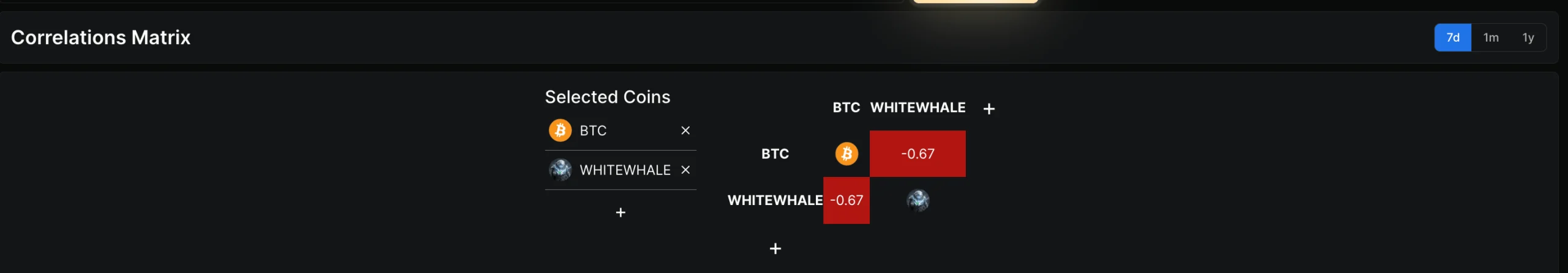

The White Whale (WHITEWHALE) is emerging as one of the few altcoins that can benefit if Bitcoin crashes under $70,000. All thanks to its growing independence from broader market trends. While most tokens have followed Bitcoin lower, the Solana-based WHITEWHALE has remained resilient.

Sponsored

Sponsored

It gained nearly 17% over the past seven days and rose close to 20% in the past 24 hours. This relative strength suggests that traders are possibly rotating into the token despite wider market weakness.

Over the last week, The White Whale has posted a strong negative correlation of –0.67 with Bitcoin. This means it has often moved in the opposite direction. This decoupling is important in a risk-off environment.

If Bitcoin crashes below $70,000, assets with low or negative correlation tend to attract speculative capital. And that makes WHITEWHALE one of the altcoins that can benefit from such a move. At the same time, the token is trading inside a bullish ascending channel on the 4-hour chart.

From a technical view, resistance sits near $0.127 and $0.143. A sustained move above this zone would confirm a breakout and open the path toward $0.226, implying upside of nearly 58% and a potential move into price discovery. On the downside, support lies at $0.098, with a deeper invalidation below $0.087. A break under these levels would weaken the bullish case and expose the price to a pullback toward $0.070.

Overall, The White Whale’s negative correlation, strong short-term performance, and bullish chart structure position it as a high-risk, high-reward candidate if Bitcoin enters a deeper correction.

Sponsored

Sponsored

Bitcoin Cash (BCH)

Bitcoin Cash is emerging as one of the altcoins that can benefit if Bitcoin crashes below $70,000, especially as it continues to show relative strength during broader market weakness. While the wider crypto market has slipped nearly 7% in recent sessions, BCH is down just over 1%, highlighting early signs of resilience. Over the past three months, it has also been up nearly 8%, making it one of the few large-cap altcoins still holding gains on a medium-term basis.

On-chain data supports this defensive setup. The Spent Coins Age Band metric, which tracks how many previously dormant coins are being moved, shows a sharp decline in activity.

Since early February, this figure has fallen from around 18,900 coins to roughly 8,278, a drop of nearly 56% in just a few days. This means far fewer long-held BCH tokens are being sold, even as prices remain under pressure. When coins stay inactive during market stress, it often reflects growing holder confidence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Chaikin Money Flow (CMF) indicator, which measures whether large capital is entering or leaving an asset using price and volume, has risen steadily between January 29 and February 5. CMF has climbed back toward, and briefly above, the zero line, showing that large buyers are quietly increasing exposure despite weak sentiment elsewhere.

Sponsored

Sponsored

From a technical perspective, BCH needs to hold above $523 to maintain this structure. A daily close above $558 would strengthen the bullish case and open the path toward $615 and $655, with $707 as an extended target if conditions improve.

However, failure to reclaim $523 could expose the price to a deeper pullback toward $466.

Hyperliquid (HYPE)

Hyperliquid’s native token, HYPE, stands out as one of the altcoins that can benefit if Bitcoin crashes below $70,000. It is mainly because it has been moving in the opposite direction to BTC. Over the past month, HYPE is up nearly 28%, while Bitcoin has dropped around 24%.

Sponsored

Sponsored

During the same period, its correlation with BTC stands at –0.71, showing a strong inverse relationship. This means that when Bitcoin weakens, HYPE has recently tended to rise, making it a candidate for traders looking for relative strength during market stress.

The HYPE price chart supports this divergence. After rallying toward the $38.43 zone earlier, HYPE entered a consolidation phase that now resembles a bullish flag-and-pole pattern. This structure usually forms when an asset pauses after a strong rally before attempting another upward move. If the upper trendline breaks, the pattern projects a potential upside of around 87%.

Capital flow data also remains supportive. The Chaikin Money Flow (CMF) is still positive, showing that large buyers are active. However, CMF is moving below a descending trendline, meaning stronger inflows are still needed to confirm a new flag breakout.

For bullish confirmation, HYPE needs a clean daily close above $34.87. Clearing this level would open the path toward $38.43 first, and potentially toward the $65.70 zone if momentum builds. On the downside, weakness below $28.21 would damage the setup, while a fall under $23.82 would invalidate the bullish structure.

If Bitcoin crashes under $70,000 and HYPE maintains its negative correlation, strong structure, and inflow support, it remains one of the altcoins that can benefit from market stress rather than suffer from it.

Crypto World

EUR/USD and GBP/USD Consolidate After Pullback From Yearly Highs

The euro and the pound have retreated after setting new yearly highs and are now trading near key levels, reflecting a wait-and-see stance as markets look ahead to major events in the coming sessions. Following a strong upward move over recent weeks, traders opted to lock in part of their profits, triggering a corrective pullback and a shift into consolidation. Additional caution is being driven by today’s Bank of England meeting, the outcome of which could influence sterling and set the tone for European currencies ahead of more important US data releases.

Overall, EUR/USD and GBP/USD appear to be in a state of balance after a sharp rally. Today’s Bank of England decision and tomorrow’s US labour market reports are seen as key reference points for assessing the next directional move. A more measured stance from policymakers and weak or neutral employment data could support a resumption of the upward trend, while a more hawkish tone or strong US figures may increase pressure on the pairs and lead to a deeper correction from recent highs.

EUR/USD

After rebounding from 1.2080, EUR/USD has remained within a narrow range, showing no clear readiness either to resume strong gains or to extend the correction. The market is assessing whether the recent cooling in the US labour market — which previously underpinned expectations of Fed policy easing — will persist. Upcoming employment data are viewed as a decisive factor: they could either confirm conditions for further upside or weigh on the euro if signs of US economic resilience emerge.

Technical analysis of EUR/USD points to potential strengthening towards 1.1900–1.1920, as a bullish harami pattern has formed on the daily chart. Should the pair settle below 1.1760, a continuation of the decline towards 1.1720–1.1670 becomes possible.

Key events for EUR/USD:

- Today at 09:00 (GMT+2): German factory orders

- Today at 15:30 (GMT+2): US initial jobless claims

- Today at 17:00 (GMT+2): US JOLTS job openings

GBP/USD

GBP/USD has also entered a consolidation phase after pulling back from its yearly highs. The pair is currently trading within a range that capped gains for much of last year. If buyers manage to keep GBP/USD above 1.3600 in the coming sessions, a renewed test of the 1.3800–1.3850 area is possible. A move below 1.3600 would open the door to a deeper correction towards 1.3470–1.3520.

Key events for GBP/USD:

- Today at 14:00 (GMT+2): Bank of England interest rate decision

- Today at 14:30 (GMT+2): Speech by Bank of England Governor Bailey

- Tomorrow at 15:30 (GMT+2): US unemployment rate

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Oracle (ORCL) Shares Fall Below $150

The start of February has been negative for technology stocks, weighed down by a wave of pessimism driven by several factors, including:

→ “AI spending fatigue.” Results from Microsoft and Alphabet highlighted massive capital expenditure (CapEx). Tens of billions of dollars are being poured into servers and chips, and the market appears increasingly concerned that these costs may not be justified by actual AI-related revenues.

→ The launch of new “agent-based” AI tools (such as those released by Anthropic in early February), which has fuelled fears that AI could begin to replace software itself rather than enhance it. This has put pressure across the software sector, including Salesforce, Adobe and Oracle.

For Oracle, the situation is further complicated by plans to finance a large-scale programme in 2026 worth $45–50bn, which the company intends to fund by: 1) taking on debt; 2) issuing additional shares.

As a result:

→ analysts have downgraded their target prices for ORCL;

→ the share price has fallen below $150 for the first time since May 2025.

On 18 December, we noted that technical analysis of the ORCL share chart pointed to four reasons why a rebound towards the resistance area marked in blue was possible.

As the blue arrow shows, since then ORCL shares have:

→ shown signs of recovery;

→ however, a false bullish break above the psychological $200 level led to a resumption of the downtrend within the previously identified descending red channel.

The accelerating bearish momentum over the past three days may:

→ prompt weaker holders, gripped by panic, to sell ORCL shares;

→ attract “smart money”, which may view prices below $150 as appealing.

In addition, attention should be paid to the intersections of trend-channel lines from different timeframes. These may act as a cluster of support and slow the decline, giving the market a pause ahead of the quarterly earnings release scheduled for early March.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 hour ago

NewsBeat1 hour agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report