Crypto World

Bitcoin’s (BTC) 21 million supply cap won’t help stop the selloff: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

With bitcoin’s bear market raging and the price dropping to the lowest since November 2024, its core pitch, a hard cap of 21 million supply, faces fresh skepticism.

Some observers say that alternative investment vehicles like ETFs, cash-settled futures and options and other services like prime-broker lending have diluted that scarcity appeal. These tools let investors access bitcoin without owning the real thing, creating a “synthetic supply” that floods the market.

“Once you can synthetically manufacture the supply, the asset is no longer scarce, and once scarcity is gone, price becomes a derivatives game, not a supply-and-demand market. This is exactly what has happened to Bitcoin,” veteran analyst and writer of The Kendall Report, Bob Kendall, wrote on X.

Gold, silver, oil and equities saw a similar structural change with the debut of alternative investment vehicles, Kendall wrote. In 2023, CoinDesk highlighted how financialization of BTC creates paper claims that mimic abundance in a market defined by raw scarcity.

This is also why investors should tread carefully with onchain metrics like the “percentage of illiquid supply,” because these don’t account for massive “paper supply” from ETFs and futures that dilute the 21 million cap.

In the market, bitcoin lost even more ground, falling below $70,000 for the first time in more than a year.

According to veteran chart analyst Peter Brandt, the selloff has all the hallmarks of campaign selling, or coordinated selling by institutions and large traders rather than retail capitulation. Brandt is not sure at what level or when the decline will halt.

Most observers expect a slide to under $60,000 while firms like Stifel fear a more profound decline to $38,000, given the strengthening correlation with tech stocks, which have also taken a beating lately.

Hyperliquid’s HYPE remains the only consistent hideout. The token is up 11% on the year, while BTC is down nearly 19%. One other interesting token is TRX, which is down just 2%, outperforming the broader market possibly, on the back of dip buying by treasury firm Tron Inc.

In traditional markets, Wall Street’s so-called fear gauge, the VIX index, is revisiting January highs above 20.00, signaling risk aversion. U.S. Treasury market action suggests expectations for a smaller Fed balance sheet. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 5: Zilliqa to undergo its hardfork enabling Cancun.

- Macro

- Feb. 5, 2 p.m.: Mexico interest-rate decision (Prev. 7%)

- Feb, 5, 4:30 p.m.: Fed balance sheet for the period ending Feb. 4

- Earnings (Estimates based on FactSet data)

- Feb. 5: Bullish (BLSH), pre-market, $0.15

- Feb. 5: Strategy (MSTR), post-market, -$18.64

- Feb. 5: IREN Limited (IREN), post-market, -$0.18

- Feb. 5: CleanSpark (CLSK), post-market, -$0.02

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 5: PancakeSwap to host an ask me anything (AMA) session with Arbitrum.

- Feb. 5: Olympus to host a community call with a live Q&A session.

- Feb. 5: Aster to host an AMA session with its CEO.

- Unlocks

- Token Launches

- No major launches scheduled.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

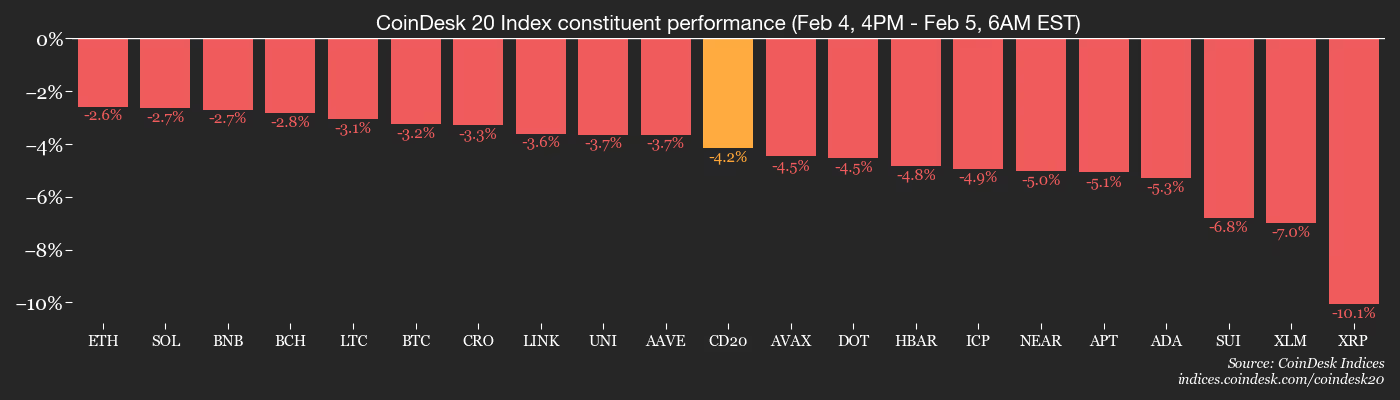

- BTC is down 1.62% from 4 p.m. ET Wednesday at $71,467.00 (24hrs: -6.52%)

- ETH is up 0.24% at $2,130.50 (24hrs: -5.93%)

- CoinDesk 20 is down 1.68% at 2,077.53 (24hrs: -7.15%)

- Ether CESR Composite Staking Rate is up 18 bps at 3.01%

- BTC funding rate is at 0.0008% (0.8793% annualized) on Binance

- DXY is up 0.29% at 97.90

- Gold futures are down 1.22% at $4,890.20

- Silver futures are down 7.55% at $78.02

- Nikkei 225 closed down 0.88% at 53,818.04

- Hang Seng closed up 0.14% at 26,885.24

- FTSE is down 0.43% at 10,357.59

- Euro Stoxx 50 is down 0.36% at 5,949.05

- DJIA closed on Wednesday up 0.53% at 49,501.30

- S&P 500 closed down 0.51% at 6,882.72

- Nasdaq Composite closed down 1.51% at 22,904.58

- S&P/TSX Composite closed up 0.56% at 32,571.55

- S&P 40 Latin America closed down 2.89% at 3,653.05

- U.S. 10-Year Treasury rate is down 0.8 bps at 4.27%

- E-mini S&P 500 futures are unchanged at 6,904.75

- E-mini Nasdaq-100 futures are up 0.14% at 25,033.50

- E-mini Dow Jones Industrial Average Index futures are down 0.25% at 49,466.00

Bitcoin Stats

- BTC Dominance: 59.26% (-0.39%)

- Ether-bitcoin ratio: 0.02981 (1.56%)

- Hashrate (seven-day moving average): 913 EH/s

- Hashprice (spot): $32.02

- Total fees: 3.22 BTC / $240,320

- CME Futures Open Interest: 114,080 BTC

- BTC priced in gold: 14.6 oz.

- BTC vs gold market cap: 4.77%

Technical Analysis

- The chart shows daily price swings in decentralized exchange Hyperliquid’s HYPE token.

- HYPE’s price has surged past the trend line that characterizes the decline from September highs.

- The breakout indicates that the path of least resistance is to the higher side and shifts focus to resistance at $50.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $168.62 (-6.14%), -1.51% at $166.07 in pre-market

- Circle Internet (CRCL): closed at $55.05 (-1.98%), -1.25% at $54.36

- Galaxy Digital (GLXY): closed at $20.16 (-8.28%), -1.49% at $19.86

- Bullish (BLSH): closed at $27.20 (-1.59%), -0.51% at $27.06

- MARA Holdings (MARA): closed at $8.28 (-8.51%), -1.81% at $8.13

- Riot Platforms (RIOT): closed at $14.14 (-7.82%), -1.34% at $13.95

- Core Scientific (CORZ): closed at $16.15 (-8.96%), +0.37% at $16.21

- CleanSpark (CLSK): closed at $10.22 (-10.04%), -1.47% at $10.07

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.29 (-11.06%)

- Exodus Movement (EXOD): closed at $10.70 (+2.20%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $129.09 (-3.13%), -3.24% at $124.91

- Strive (ASST): closed at $0.59 (-13.20%), -6.74% at $0.55

- SharpLink Gaming (SBET): closed at $7.08 (-7.57%), -2.54% at $6.90

- Upexi (UPXI): closed at $1.36 (-12.26%), -2.21% at $1.33

- Lite Strategy (LITS): closed at $1.06 (-7.83%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$544.9 million

- Cumulative net flows: $54.73 billion

- Total BTC holdings ~1.28 million

Spot ETH ETFs

- Daily net flows: -$79.4 million

- Cumulative net flows: $11.94 billion

- Total ETH holdings ~5.92 million

Source: Farside Investors

While You Were Sleeping

Miners are being squeezed as bitcoin’s $70,000 price fails to cover $87,000 production costs (CoinDesk): Bitcoin is now some 20% below its estimated average production cost, increasing financial pressure across the the crypto mining industry.

Precious metals, oil slide as global tensions ease; copper down (Reuters): Prices of commodities from silver and gold to crude oil and copper dived on Thursday as global tensions eased after talks between China and the U.S., which is also set to sit down with Iran.

Trillion-dollar tech wipeout ensnares all stocks in AI’s path (Bloomberg): Hundreds of billions of dollars were wiped off the value of stocks, bonds and loans of companies big and small across Silicon Valley, with software stocks at the epicenter.

Crypto World

Uniform Labs’ Multiliquid and Metalayer Launch RWA Redemption Facility on Solana

Multiliquid and Metalayer Ventures have launched a facility that allows instant redemption (liquidity) for tokenized real-world assets (RWAs) on Solana.

In a press release shared with CryptoNews, the firm said the facility is positioned as the first dedicated vehicle intended to solve one of tokenization’s most persistent challenges: liquidity at redemption.

Raised and managed by Metalayer Ventures with support from Uniform Labs, it is designed to scale over time based on market feedback and performance, offering a blueprint for future redemption-liquidity deployments across tokenized markets.

The RWA Liquidity Gap

The launch comes as Solana’s tokenized RWA ecosystem surpasses $1 billion in on-chain assets, making it the third-largest blockchain network for tokenization.

Despite rapid growth, much of the RWA market—particularly non-Treasury assets such as private credit, private equity, and real estate—remains structurally illiquid. Redemptions are typically limited to issuer-controlled windows, rather than continuous secondary markets.

This mismatch is becoming more visible even in ostensibly “cash-like” products. The Bank for International Settlements has warned that tokenized money market funds face liquidity mismatches between on-chain instruments and off-chain settlement, a dynamic that could amplify stress during periods of elevated redemption demand.

“Traditional finance has repo markets, prime brokerage, and overnight lending facilities. Tokenized markets have had nothing comparable, until now,” said Will Beeson, founder and CEO of Uniform Labs.

How the Facility Works

Metalayer Ventures acts as the capital provider, raising and managing the pool of capital that allows instant redemptions. Multiliquid—developed by Uniform Labs—supplies the smart contract infrastructure, issuer relationships, and liquidity platform that underpin pricing, compliance enforcement, interoperability, and swaps.

Instead of waiting days or weeks for issuer-led redemptions, holders can convert supported tokenized assets into stablecoins instantly, 24/7. The facility purchases assets at a dynamic discount to net asset value (NAV), compensating liquidity providers for offering immediate access to capital.

Institutional-Grade Infrastructure on Solana

Uniform Labs expects a two-layer liquidity ecosystem to emerge: active market participants pricing real-time exits, and larger balance-sheet allocators warehousing assets to redemption for steadier yield.

The model is expected to gain traction as tokenized assets are increasingly used as collateral across DeFi and institutional venues.

The facility will initially support assets from issuers including VanEck, Janus Henderson, and Fasanara, spanning tokenized Treasury funds and select alternative assets. Integrations with Solana DeFi protocols such as Kamino are under discussion.

Nick Ducoff, head of institutional growth at the Solana Foundation, said reliable redemptions are becoming “critical infrastructure” as Solana’s RWA market scales, positioning the network as a leading venue for issuance, trading, and redemption of tokenized assets.

The post Uniform Labs’ Multiliquid and Metalayer Launch RWA Redemption Facility on Solana appeared first on Cryptonews.

Crypto World

Multiliquid, Metalayer Roll Out Instant Redemptions for Tokenized RWAs

Multiliquid and Metalayer Ventures have launched an institutional liquidity facility to provide instant redemptions for tokenized real-world assets (RWAs) on Solana.

The facility allows holders of tokenized assets to convert positions into stablecoins instantly. The vehicle is raised and managed by Metalayer Ventures, with infrastructure and market support provided by Uniform Labs, the developer behind the Multiliquid protocol, according to an announcement shared with Cointelegraph.

“Traditional finance has repo markets, prime brokerage and overnight lending facilities. Tokenized markets have had nothing comparable, until now,” said Will Beeson, founder and CEO at Uniform Labs. “This is the liquidity infrastructure that institutional RWA markets will require at scale.”

Last year, the Bank for International Settlements warned that tokenized money market funds face liquidity mismatches that could amplify stress during periods of elevated redemption demand.

Related: Startale, SBI launch blockchain for institutional FX, RWA trading

Standing buyer delivers instant RWA liquidity

Metalayer’s facility functions as a standing buyer of tokenized RWAs, purchasing assets at a dynamic discount to net asset value.

Metalayer Ventures supplies and manages the capital backing redemptions, while Multiliquid provides the smart contract infrastructure used for pricing, compliance enforcement and settlement.

The vehicle will initially support tokenized assets issued by companies including VanEck, Janus Henderson and Fasanara, covering tokenized Treasury funds and select alternative investment products.

Related: True tokenization demands asset composability, not wrapped bubbles

Solana gains ground in tokenized RWAs

Solana (SOL) has emerged as a growing venue for tokenized RWAs. It ranks eighth among blockchains by total RWA value with about $1.2 billion represented across 343 assets, according to RWA.xyz data. While its market share remains modest at 0.31%, Solana is showing steady momentum, with RWA value up by more than 10% in the past month.

Canton Network, Ethereum (ETH) and Provenance are the three largest blockchains for tokenized RWAs by total value.

Canton dominates the market with more than $348 billion in RWAs and over 88% market share. Ethereum ranks second with $15 billion in tokenized assets, while Provenance also holds $15 billion with fewer assets.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Tether Makes $100M Strategic Equity Investment in Anchorage Digital

Tether, issuer of the stablecoin USDT, said it has made a $100 million equity investment in Anchorage Digital, deepening an existing relationship between the two firms.

In a blog post the firm said the investment is being made through Tether Investments and reflects growing focus between stablecoin issuers and federally regulated financial institutions as digital assets continue to integrate into mainstream finance.

Strengthening Regulated Digital Asset Infrastructure

Anchorage Digital Bank N.A. is the first federally chartered digital asset bank in the United States, providing institutions with custody, staking, governance, settlement, and stablecoin issuance services.

Tether said the investment reflects its view that Anchorage plays a critical role in enabling digital assets to operate safely and at scale within established regulatory frameworks.

Both firms said they are focused on the foundational infrastructure that supports institutional participation in crypto markets especially as regulatory scrutiny intensifies globally.

Strategic Focus Beyond Capital

Tether said its growth has been made by a stronger emphasis on regulatory focus and collaboration with institutions operating under clear legal oversight.

Anchorage Digital’s position at the intersection of regulation and security made it a natural partner as Tether looks to support long-term market integrity.

The relationship between the two companies predates the investment. Anchorage Digital Bank is the issuer of USAT giving Tether direct experience operating within Anchorage’s compliance, custody, and banking framework. That operational familiarity has informed Tether’s decision to take an equity stake.

Institutional Confidence in Stablecoin Infrastructure

“Tether exists to challenge the status quo and build global infrastructure for freedom,” said Paolo Ardoino, CEO of Tether. “Our investment in Anchorage Digital reflects a shared belief in the importance of secure, transparent, and resilient financial systems.”

Anchorage Digital CEO and co-founder Nathan McCauley said the investment validates the firm’s long-term approach. “We’ve believed from day one that digital assets would only scale through secure, regulated foundations,” he said.

Positioning for the Next Phase of Adoption

For Tether the investment reinforces a broader strategy centered on long-term partnerships with regulated institutions that are helping define how stablecoins function within existing financial systems.

As policymakers and institutions continue to shape the future of digital money, infrastructure providers like Anchorage Digital are increasingly seen as critical intermediaries.

Tether and Anchorage Digital said they aim to support broader participation in digital assets while promoting stability, transparency and confidence — pillars they view as essential for the next phase of global digital asset adoption.

The post Tether Makes $100M Strategic Equity Investment in Anchorage Digital appeared first on Cryptonews.

Crypto World

BTC price news: Bitcoin falls under $68,000

Bitcoin slid under the $68,000 level in U.S. morning hours Thursday, extending a week-long selloff that has tracked weakness across global risk assets and deepened concerns about near-term downside.

Crypto liquidations crossed $1 billion over the past 24 hours, wiping out about $980 million million in bullish leveraged bets as the slide forced traders to close positions they could not keep funded.

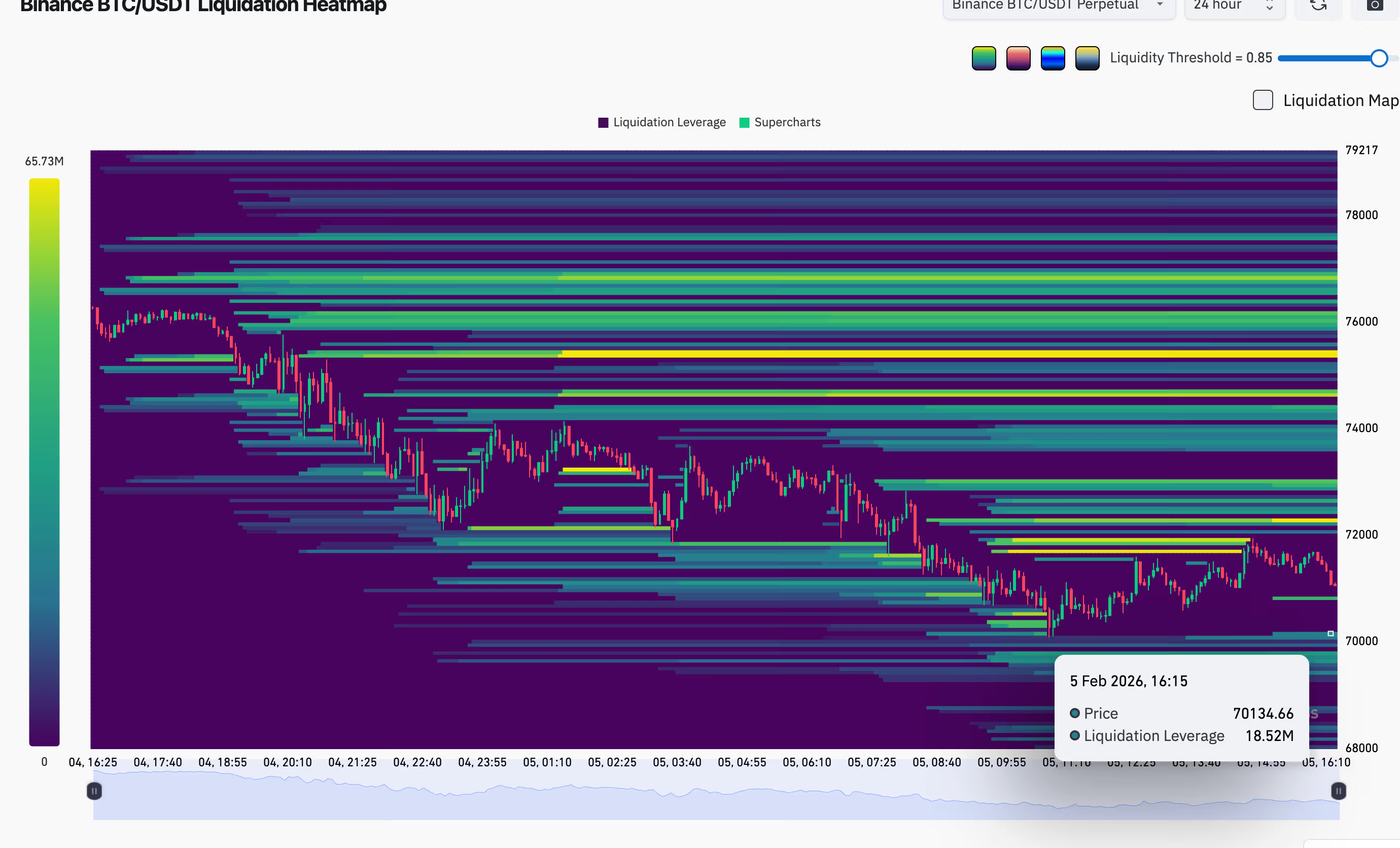

Price fel lunder $70,000 earlier in the day, with liquidity heatmaps pointing to further downside.

Liquidity thins out quickly until just under $70,000, per Coinglass data, where another smaller cluster appears. That makes $70,000 a mechanically important level. If price pushes cleanly through it, there’s less forced buying from liquidations to slow the move, raising the risk of a faster flush toward the high $60,000s.

A liquidation heatmap is a map of where leveraged traders are most likely to get forced out. Bright bands mark price levels with lots of estimated liquidation points, which can act like short term magnets for price moves. Traders use it to spot crowded zones and likely volatility pockets, not exact turning points.

Crypto World

Tether invests $100 million in U.S.-regulated crypto bank Anchorage

Tether, the company behind the world’s largest stablecoin USDT said it has invested $100 million in Anchorage Digital, a federally regulated digital asset bank.

Anchorage, which holds a national banking charter in the U.S., offers custody, staking, settlement and stablecoin issuance services to institutional clients.

The two companies already had a working relationship, with Anchorage serving as the banking partner behind Tether’s USAT stablecoin, designed specifically for the U.S. market to comply with local regulations.

The investment gives Tether a foothold in the fast-growing U.S. stablecoin infrastructure, which is moving towards regulated players after the GENIUS Act was written into law last year. Tether, headquartered and regulated in El Salvador, traditionally focuses on offshore users and emerging markets with its $185 billion USDT token.

“Tether exists to challenge the status quo and build global infrastructure for freedom,” said Paolo Ardoino, CEO of Tether, said in a statement. “Our investment in Anchorage Digital reflects a shared belief in the importance of secure, transparent, and resilient financial systems.”

Crypto World

Michael Saylor missed out on a $33 billion profit at Strategy

Strategy (formerly MicroStrategy) managed to turn an unrealized bitcoin (BTC) profit of $32.6 billion into a $2.2 billion loss thanks to founder Michael Saylor’s reluctance to sell.

To be specific, four months ago on October 6, the company owned 640,031 BTC acquired for $73,983 apiece but worth $125,000 apiece at prevailing market prices.

As of yesterday’s Nasdaq close, however, Strategy now owns 713,502 BTC acquired for $76,052 and worth just $72,925.

In other words, Strategy had an unrealized BTC profit of $32.6 billion on October 6 that has turned into a $2.2 billion loss.

Even excluding the last four months of purchases to restrict yesterday’s figure to the original 640,031 BTC, that still recalculates to an equally embarrassing swing from a $32.6 billion profit to a $670 million loss on only the BTC the company owned four months ago.

Read more: Michael Saylor is running out of ways to boost Strategy’s BTC per share

New lows across multiple metrics

Management’s choice to not sell means Strategy’s balance sheet has $33 billion less in assets than it could have, less capital gains tax.

This figure also ignores the effects on BTC’s price of Strategy selling such large sums.

As of yesterday’s close, the company’s common stock MSTR had a market capitalization of just 0.82x the value of the company’s BTC holdings — down 75% from its November 2024 high of 3.4x.

In addition to a 76% loss since its November 2024 high, including its latest 52-week decline of 61%, Strategy leadership has also failed to capture those tens of billions of dollars of investment income along the way.

It might seem tempting, given these losses, to point to a reminder of Saylor’s previously devout and confident proclamations that he never intended to sell Strategy’s BTC.

Unfortunately, he did say those things in the distant past, but even that promise has been deteriorating along with most other metrics at Strategy.

Indeed, Saylor now discusses the possibility of selling Strategy’s BTC, including official statements from the company and its CEO, albeit in euphemisms such as raising capital or covering dividend obligations.

Moreover, the company recently diluted equity holders for $1.44 billion with $0 in associated BTC purchases in order to shore up USD, not BTC, for a rainy day. That day might be arriving soon.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Playnance unveils Web2-to-Web3 gaming ecosystem after years in stealth mode

- Playnance unveils Web2-to-Web3 gaming infrastructure after years operating privately at scale.

- The platform processes 1.5 million daily on-chain transactions with over 10,000 active users.

- Playnance focuses on simplifying blockchain access through Web2-style onboarding systems.

Playnance has made its first public announcement, revealing itself as a Web3 infrastructure and consumer platform company that has been operating a live ecosystem aimed at onboarding mainstream Web2 users into blockchain-based environments.

The announcement was made on February 5, 2026, from Tel Aviv, marking the company’s first formal introduction after several years of developing and running its technology and platforms privately.

Founded in 2020, Playnance has positioned itself as a Web2-to-Web3 gaming infrastructure layer.

The company integrates with more than 30 game studios and enables the conversion of thousands of games into fully on-chain experiences, where all gameplay actions are executed and recorded directly on blockchain networks.

Infrastructure built to simplify blockchain adoption

Playnance’s core offering focuses on removing technical barriers commonly associated with blockchain usage.

The company’s products are designed to allow users to interact with on-chain systems without needing direct knowledge of blockchain mechanics.

Instead, users access platforms through familiar Web2-style interfaces, including standard account creation and login processes, while blockchain functionality operates in the background.

The company stated that its live platforms currently process approximately 1.5 million on-chain transactions daily and support more than 10,000 daily active users.

According to Playnance, a significant portion of its user base originates from traditional Web2 environments.

These users are reportedly able to onboard and interact with blockchain-based systems without using external wallets or managing private keys, suggesting continued on-chain engagement from audiences outside the traditional crypto sector.

The company’s ecosystem also includes the G Coin initiative, which is currently operating in pre-sale mode and is accessible through the Playnance official website.

Consumer platforms showcase operational ecosystem

Playnance operates several consumer-facing platforms designed to demonstrate its infrastructure capabilities.

Among these are PlayW3, Up vs Down, and other products that run on shared on-chain infrastructure and wallet systems.

The integrated structure allows users to move between platforms without repeating onboarding procedures.

All user interactions across these platforms are executed and recorded on-chain while remaining non-custodial, aligning with the company’s focus on user control and blockchain transparency.

The shared wallet and infrastructure framework also supports cross-platform engagement within the broader Playnance ecosystem.

“Our focus was on building systems that people could use without needing to understand blockchain mechanics,” said Pini Peter, CEO of Playnance. “We prioritized live operation and user behavior over public announcements, and this is the first time we are formally introducing the company after reaching scale.”

Expansion strategy centred on user behaviour

Playnance stated that its infrastructure is designed to support high-volume consumer activity and continuous on-chain execution.

The company’s approach reflects a broader industry shift toward practical blockchain applications targeting mainstream audiences.

Looking ahead, Playnance indicated that its ecosystem expansion will be guided by observed user behaviour and platform performance.

The company emphasised that its development roadmap will focus on real usage data rather than speculative adoption models.

Playnance describes itself as a company focused on reducing friction between user behaviour and blockchain execution by operating consumer platforms at scale.

Crypto World

Hex Trust Adds Custodial FXRP Minting and FLR Staking for Institutions

Institutional custodian Hex Trust has expanded its long-standing partnership with Flare through a new collaboration aimed at delivering institutional access to native FLR staking and FXRP minting.

Under the agreement, Hex Trust said it will provide custody, governance, and compliance infrastructure, while Flare supplies the underlying protocol layer.

The update is now live for Hex Trust’s institutional clients and positions Hex as a primary gateway into the Flare ecosystem, offering a standardized and secure interface for interacting with Flare-native assets.

Gateway Into the Flare Ecosystem

The partnership allows institutions to mint and redeem FXRP — a non-custodial 1:1 representation of XRP on Flare — and to participate in native FLR staking directly through Hex Trust’s platform.

These activities underpin economic activity on Flare, supporting network security, liquidity and decentralized finance use cases. By firm combines Flare’s protocol infrastructure with Hex Trust’s regulated custody and operational controls.

In December, Hex Trust announced the launch of Wrapped XRP (wXRP) on Thursday, deploying the token across Ethereum, Solana, Optimism, and HyperEVM with $100 million in initial liquidity.

The move aims to anchor Ripple’s RLUSD stablecoin pairs on EVM chains. XRP remained flat on the news, while RLUSD supply held steady at 1.3 billion.

Solving Institutional Risk and Custody Constraints

The firm claims many institutions, direct engagement with staking or bridging has been constrained by the need for hot wallet connections and limited governance controls. As a result, assets such as XRP and FLR have often remained sidelined, despite growing onchain demand.

Hex Trust said it addresses this by maintaining a strict chain of custody while allowing participation in Flare’s DeFi ecosystem via WalletConnect. This structure allows institutions to access native FLR staking and XRP-based DeFi strategies through FXRP minting without compromising internal risk frameworks.

Turning Idle Assets Into Productive Collateral

“The expansion of token wrapping to assets like XRP marks a significant shift in market structure,” said Giorgia Pellizzari, CPO and head of custody at Hex Trust.

She notes that the integration allows traditionally static assets to become productive, liquid collateral while remaining within an enterprise-grade governance framework.

Hugo Philion, co-founder and CEO of Flare, said the partnership is designed to unlock smart contract utility for assets that lack native programmability. “Working with Hex Trust empowers institutions to put their assets to work without compromising on security or compliance,” he said.

Institutional-Grade DeFi Infrastructure

Flare’s FAssets system enables non-smart contract assets to be represented on-chain in a trust-minimized manner, supporting use cases such as staking and lending.

The system has been built with institutional requirements in mind, incorporating external audits, continuous monitoring and safeguards to protect solvency and system integrity.

Minting and redemption actions under the collaboration are governed by Hex Trust’s transaction policy engine, which supports customizable, multi-approval workflows.

As Flare expands support for other assets such as BTC, Hex Trust said it will continue to provide the secure infrastructure enabling institutions to participate at scale.

The post Hex Trust Adds Custodial FXRP Minting and FLR Staking for Institutions appeared first on Cryptonews.

Crypto World

Bitcoin May Dip Below $64K as Veteran Warns of ‘Campaign Selling’

Bitcoin (CRYPTO: BTC) extended its pullback, slipping more than 22.5% over the past week to hover around $69,000 as traders weigh supply and demand dynamics. The retreat follows a period in which miners and US spot BTC ETFs trimmed exposure, adding modest selling pressure to an already fragile downtrend. The market has shown little appetite for a rebound, underscoring how thin liquidity and cautious sentiment can magnify losses in a risk-off environment. On-chain data and fund flows paint a nuanced picture: distribution signals from large holders sit alongside episodes of fading demand, complicating bets on a swift recovery.

Key takeaways

- Campaign selling by institutions, particularly miner-related activity and ETF exposure reductions, is pressing BTC lower rather than providing a floor.

- A potential bottom zone remains visible in the $54,600–$55,000 area, but confirmation requires sustained demand and stabilizing on-chain metrics.

- On-chain data shows miners shifting toward net distribution, signaling that fresh supply is hitting the market as January closes.

- Bitcoin spot ETF balances have declined to about 1.27 million BTC, echoing cooled institutional exposure and a potential headwind for price recovery.

- Market indicators, including the Coinbase premium, have retreated to yearly lows, suggesting waning institutional interest in this phase of the cycle.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The combination of ongoing distribution by miners and reduced ETF exposure signals further near-term downside risk.

Trading idea (Not Financial Advice): Hold. The current setup implies caution until there are clearer signs of demand and a firmer base forming around key support zones.

Market context: The BTC move unfolds amid a broader risk-off environment and evolving ETF flows that continue to influence spot prices. With liquidity patterns tightening and macro uncertainty lingering, price action remains highly data-dependent, with on-chain signals and fund flows providing mixed signals about when a durable bottom might form.

Why it matters

The ongoing pressure on Bitcoin highlights how interlinked the crypto market has become with macro liquidity and institutional participation. As miners and spot ETFs pull back, the supply-demand balance tilts toward hodlers and short-term traders, potentially elevating the risk of sharper moves if selling accelerates. The situation underscores the importance of on-chain dynamics—especially miner behavior and exchange balances—in gauging how much selling pressure the market can absorb before a meaningful rebound takes hold. For participants watching risk, the dynamics around BTC’s supply chain—miner distributions and ETF outflows—remain a critical lens for assessing whether the market is merely digesting a correction or entering a more extended phase of weakness.

From a technical perspective, several indicators point to a challenging landscape ahead. Veteran analyst Peter L. Brandt has highlighted what he describes as “campaign selling”—a deliberate, sustained distribution by large institutions rather than a reflexive, retail-led decline. The observation aligns with an impairment of bid strength as price trends lower highs and lower lows. While this framing does not guarantee further downside, it does suggest that the near term could remain precarious absent a meaningful change in buying interest or a reinterpretation of macro catalysts. The price path toward potential targets, such as the bear-flag scenario around the $63,800 level and the broader zone near mid-$50,000s, remains a focal point for traders watching for a possible inflection.

On-chain temperature checks reinforce the sense of a market in flux. Data indicate that miners have shifted from a net accumulation posture to distribution in January, sending BTC toward exchanges. Such movements can amplify selling pressure if capitulation accelerates or if external demand does not step in to absorb the newly minted supply. This dynamic dovetails with the retreat in the Coinbase premium, a gauge closely watched for institutional appetite; the premium slipping to yearly lows implies that institutions may be pulling back from aggressive entry points that previously provided steadying support. The mix of on-chain distribution and weakened exchange inflows contributes to a narrative in which BTC could spend additional time testing support levels rather than staging a rapid rebound.

Two additional threads bear watching. First, the official balance of Bitcoin held by spot ETFs has continued to drift lower, with total BTC under management dipping to about 1.27 million as of the latest reads. Second, some analysts point to a possible longer-horizon accumulation window that could materialize later in the cycle—potentially around mid-2026—driven by timing dynamics in credit spreads and historical lag effects between price bottoms and accumulation phases. These lines of inquiry do not imply an imminent rally, but they offer a framework for understanding where and when demand might re-enter with more conviction. For context, historical analysis has surfaced instances where price convergences toward accumulation bands signaled times of capitulation followed by assertive recoveries, albeit on longer horizons than immediate, intraday moves.

Looking back, the market has shown that the path from capitulation to accumulation can be gradual. In 2022, for instance, BTC dipped into a zone near $20,000 before a bottom formed and a subsequent rally pushed prices higher in the following year. The current cadence—sliding into a zone around $54.6K as an accumulation signal emerges—has prompted some to suggest that the asset is nearing a decisive juncture: the point at which sellers exhaust and buyers begin to re-enter, setting the stage for a more sustained recovery if macro conditions improve and institutional participation returns.

As one analyst put it, the convergence toward a band signaling the start of the accumulation phase around $54.6K could indicate we are transitioning from capitulation to accumulation. Such a reading does not guarantee a reversal on the immediate horizon, but it frames a potential pause in the downtrend and a setup for a more deliberate, value-oriented accumulation once conditions improve. The broader framework also includes a comparative timing signal that some researchers say could push a renewed cycle of accumulation toward mid-2026, a view anchored in widening credit spreads and other macro timing data. Taken together, the signals suggest that investors should monitor rather than chase, awaiting more robust evidence of demand and a firmer foundation beneath prices.

Ultimately, the market’s sensitivity to institutional flows and on-chain movements means BTC’s fate remains tethered to the behavior of large players and the health of the broader liquidity environment. While there is recognition of potential relief points—whether from a stabilization around the $55k zone or a delayed uptick in ETFs’ appetite—the current configuration favors caution. For traders, the narrative remains one of careful risk management, waiting for clearer catalysts that could flip the narrative from bear to bull—or at least reduce the downside risk to a more manageable level.

What to watch next

- Watch BTC price behavior around the $54,600–$55,000 support zone for signs of accumulation or further breakdown.

- Monitor miner activity and distribution trends as January closes, weighing any shift back toward net accumulation against ongoing selling pressure.

- Track US spot BTC ETF balances for continued outflows or stabilization that could influence price direction.

- Observe the Coinbase premium and other institutional indicators for renewed appetite from large buyers.

- Follow commentary and data on the potential mid-2026 accumulation window linked to credit-spread timing and macro liquidity cycles.

Sources & verification

- Peter L. Brandt’s commentary on “campaign selling” and its implications for price structure (as discussed on X).

- On-chain signals showing miner net position change shifting toward distribution in January (Glassnode data).

- Bitcoin ETF balances and trends indicating reduced exposure among spot ETFs.

- Coinbase premium readings signaling shifts in institutional demand.

- Analyses projecting a potential accumulation window around mid-2026 based on credit-stress timing data.

Market reaction and near-term risks for BTC

Bitcoin (CRYPTO: BTC) faced a renewed test of support as miners and spot ETFs reduced their BTC exposure, intensifying near-term supply pressure in a market already sensitive to liquidity and macro cues. The price moving through the mid-to-lower $60k range would not be surprising if current distribution persists, particularly given a backdrop of subdued buying interest from institutions and cautious sentiment among traders. The bear-case scenario identified by technical observers centers on a continuation toward the bear-flag target around $63,800, a level that could become a catalyst for new momentum if sellers accumulate pressure without a compelling counterparty bid. Conversely, a stabilization near $55,000 could pave the way for a measured recovery if institutional demand returns and miners slow their distribution cycles.

In this context, the on-chain picture remains a critical barometer. Miners’ net position changes have shifted to a net outflow pattern in January, suggesting that fresh BTC supply is entering the market at a pace that could sustain pressure on prices near key supports. This dynamic aligns with a decline in spot ETF balances and a cooling of the Coinbase premium, both of which imply that institutional demand has yet to reassert itself with vigor. For traders, the combination of persistent distribution signals and softening buy-side signals means the price could hinge on the next wave of macro and liquidity catalysts—the kind of inputs that often determine whether a market tests lower supports or finds a foothold for a multi-week bounce.

At the same time, several analysts point to potential longer-term inflection opportunities. A subset of commentary highlights the possibility of an accumulation window emerging after mid-2026, tied to timing patterns around widening credit spreads and the historical cadence of BTC market bottoms. While such forecasts are inherently probabilistic, they offer a framework for considering how a cycle may pivot from capitulation to accumulation, even if the timing remains uncertain. For now, the dominant narrative remains one of vigilance: a phase in which buyers must demonstrate conviction and where the absence of a clear catalyst keeps risk balanced on the knife-edge between a renewed rally and a deeper drawdown.

https://platform.twitter.com/widgets.js

Crypto World

Bitcoin May Drop Below $64K as Veteran Raises ‘Campaign Selling’ Alarm

Bitcoin risks a deeper slide as miners and US spot ETFs cut BTC exposure, adding supply pressure during a fragile downtrend.

Bitcoin (BTC) price dropped by more than 22.5% in the past week to $69,000 on Thursday, wiping out 15 months of gains entirely. However, the downtrend may not be over, according to veteran trader Peter Brandt.

Key takeaways:

-

Brandt says “campaign selling” is pressuring BTC, with miners and ETFs also cutting exposure.

-

A potential bottom zone is near $54,600–$55,000.

Bitcoin may drop another 10% as miners, ETFs cut BTC exposure

BTC’s decline left behind a sequence of daily lower highs and lower lows. Simply put, the lack of even modest rebounds suggests few traders are stepping in to buy the dip, at least for now.

This structure, according to Brandt, had “fingerprints of campaign selling,” a deliberate, sustained distribution by large institutions, not retail liquidation.

Onchain data supports Brandt’s outlook. For instance, as of Thursday, the BTC miner net position change metric was showing a clear shift into net distribution throughout January, with miners consistently sending more BTC to the market.

US spot Bitcoin ETFs also reduced their exposure, with net BTC balances falling to 1.27 million BTC as of Wednesday from 1.29 million at the beginning of the year.

Related: Bhutan makes second Bitcoin transfer in a week, worth $22M

The Coinbase premium, a barometer linked to institutional interest, also fell to yearly lows.

This distribution boosted Bitcoin’s chances of reaching its bear flag target of around $63,800, down 10% from current levels, as shown below, based on Brandt’s technical setup.

Bitcoin may bottom below $55,000

Bitcoin risks a deeper drop toward $54,600 amid continued institutional selling, according to onchain analyst GugaOnChain.

The downside target is aligned with the lower zone (red) highlighted in the BTC DCA Signal Cycle metric below. This zone reflects Bitcoin’s one-week to one-month realized price and helps identify periods when BTC is structurally undervalued.

In 2022, the signal turned bullish as BTC fell below the same red zone near $20,000, forming a bottom around the level, before rallying to over $30,000 a year later.

GugaOnChain said:

“The current price convergence toward the band signaling the start of the accumulation phase, situated around $54.6K, suggests we are in the critical transition between Capitulation and Accumulation.”

Meanwhile, another analysis highlights a potential accumulation window emerging after July 2026, based on historical lag effects between widening credit spreads and Bitcoin market bottoms.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 hours ago

NewsBeat4 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

With

With

All actions are governed by…

All actions are governed by…