Crypto World

Nvidia (NVDA) Stock Drops as H200 Export Negotiations Remain Unresolved

TLDR

- Nvidia stock fell 1.4% to $177.74 as H200 chip export negotiations with the Trump administration remain stuck over Know-Your-Customer requirements and other licensing conditions.

- The U.S. signaled approval for ByteDance’s chip purchase two weeks ago, but commercially practical terms have not been finalized.

- Nvidia warns restrictive conditions could drive Chinese customers to foreign chip suppliers as China has already granted preliminary approval to ByteDance, Tencent, Alibaba, and Deepseek.

- Stock trades below key resistance levels at $182-$184 with critical support at the 200-day moving average near $168.

- Commerce Department’s January 15 regulation requires third-party lab testing and rigorous customer screening to prevent military access.

Nvidia shares dropped 1.4% to $177.74 on February 5 as the chipmaker’s negotiations with the Trump administration over H200 AI chip exports remain unresolved. The regulatory uncertainty is weighing on investor sentiment as both sides work to finalize commercially viable licensing terms.

The Trump administration indicated roughly two weeks ago it would approve ByteDance’s license to purchase H200 chips. However, Nvidia has not agreed to the proposed conditions. The main sticking point involves Know-Your-Customer procedures designed to prevent Chinese military entities from accessing advanced AI technology.

Nvidia clarified its position through a spokesperson. “We aren’t able to accept or reject license conditions on our own,” the company said. “Although KYC is important, KYC is not the issue. For American industry to make any sales, the conditions need to be commercially practical, else the market will continue to move to foreign alternatives.”

Regulatory Framework Takes Shape

The Commerce Department published new regulations on January 15 that formally loosened licensing policy for advanced AI chips. But the framework includes strict requirements. Applicants must certify their customers will implement rigorous screening procedures to prevent unauthorized remote access.

Companies must also provide lists of remote users connected to countries of concern including Iran, Cuba, and Venezuela. A U.S. third-party lab must test the chips before shipment. This testing requirement is viewed as the mechanism for collecting the U.S. government’s 25% fee on sales.

President Trump announced the chip export arrangement in December. The same terms apply to comparable chips from Advanced Micro Devices and Intel. China hawks criticized the decision as a national security risk.

China has granted preliminary approval to ByteDance, Tencent, Alibaba, and AI startup Deepseek to import the chips. Regulatory conditions on China’s side are still being finalized.

Technical Picture Shows Weakness

Nvidia stock is trading below its 20-day moving average at $184 and 50-day moving average at $182. Both levels now act as resistance zones. The 200-day moving average near $168 represents the key support level that would preserve the broader uptrend.

The Relative Strength Index sits in the low 30s, approaching oversold conditions without confirming a reversal. Volume has been moderate during the decline, suggesting a corrective move rather than panic selling.

Near-Term Outlook

Analysts expect Nvidia to trade in a $170 to $185 range until regulatory clarity emerges. A break above $185 would require positive developments on export approvals or strength across the AI sector. That could push shares toward $195-$200.

One source indicated some chips are likely to reach China before Trump’s planned April meeting with Chinese President Xi Jinping. The Commerce Department typically circulates pending licenses to State, Defense, and Energy departments before finalizing terms.

Nvidia emphasized it serves as an intermediary between U.S. regulators and end customers. The company cannot unilaterally modify license conditions but can provide feedback on commercial viability. The prolonged approval process has delayed H200 orders as Chinese customers await clarity on national security requirements.

Crypto World

Aave Delegate Platform Proposes Pausing Three L2 Deployments Citing Weak Revenue

The proposal also includes requiring any new deployment to guarantee at least $2 million in annual revenue to Aave.

A governance delegation platform for Aave, the largest decentralized lending platform, with more than $29 billion in total value locked (TVL), has proposed pausing three underused Layer 2 deployments of Aave V3.

In a Jan. 29 governance proposal that moved to a snapshot vote on Feb. 3, the Aave Chan Initiative (ACI) proposed that Aave freeze its V3 deployments on Ethereum L2s zkSync Era, Metis, and Soneium to cut costs.

“Over time, it has become clear that a small subset of instances contributes very little user activity, TVL, and revenue, while still requiring a non-trivial amount of attention from service providers and governance participants,” ACI wrote in the prospal.

The proposed reduction in L2 deployments aims “to reduce operational overhead and governance burden by addressing instances that are clearly non viable today.”

Among the three networks, zkSync currently has the largest TVL at about $26 million, followed by Soneium with $21.6 million and Metis with $11.7 million, according to DefiLlama data.

Over the past 30 days, Aave generated just $714 in revenue on zkSync, $679 on Metis, and just $150 on Soneium, per DefiLlama. For comparison, within the same timeframe Aave made over $7.7 million on Ethereum and nearly $298,000 on Base.

Now, ACI is pushing for stricter terms on future expansions. The proposal calls for any new chain deployment to guarantee Aave a minimum of $2 million in annual revenue, arguing that the protocol’s liquidity is often underpriced given the “upfront and recurring costs.”

The snapshot vote on the proposal, which runs through Feb. 7, has so far drawn unanimous support, with 257,300 votes in favor and none against.

Voting kicked off the same day that Ethereum’s broader scaling strategy came under renewed scrutiny. As The Defiant reported earlier this week, Ethereum co-founder Vitalik Buterin published an X post arguing that the rollup-centric roadmap for the network “no longer makes sense,” and arguing that L2s should focus on other use cases.

Crypto World

Roubini Predicts a ‘Crypto Apocalypse’ Amidst Bitcoin’s Plunge Under Trump-Era Policies

Roubini said that Bitcoin behaves like a leveraged bet, rising and falling alongside high-risk equities rather than hedging uncertainty.

Economist Nouriel Roubini, who is known for his anti-crypto rhetoric, predicted a looming “crypto apocalypse.” He explained that the future of money and payments will evolve gradually rather than undergo the revolutionary transformation promised by cryptocurrency advocates.

In a recent post, Roubini said Bitcoin and other cryptocurrencies’ latest price plunge demonstrates the extreme volatility of what he calls a “pseudo-asset class,” and expressed hope that policymakers recognize the risks before further damage occurs.

He recalled that one year earlier, Donald Trump had returned to the US presidency after courting retail crypto investors and receiving significant backing from crypto industry figures. This led several evangelists to predict that Bitcoin would reach at least $200,000 by the end of 2025 and become “digital gold.”

Roubini: Bitcoin Isn’t a Hedge

According to Roubini, Trump followed through by dismantling most crypto regulations, signing the Guiding and Establishing National Innovation for US Stable Coins (GENIUS) Act, pushing the Digital Asset Market Clarity (CLARITY) Act, profiting from domestic and foreign crypto deals, promoting a meme coin bearing his name, pardoning crypto criminals allegedly linked to terrorist organizations, and hosting private White House dinners for crypto insiders.

Roubini noted that crypto was also expected to benefit from macroeconomic and geopolitical risks, including rising public debt, fiat currency debasement, trade wars, and increased tensions involving the US, Iran, and China, factors that coincided with gold rising more than 60% in 2025.

Bitcoin, however, fell 6% that year and, as of the time of writing, was down 42% from its October peak and below its level at Trump’s election, while the TRUMP and MELANIA meme coins had dropped 95%. Roubini said Bitcoin repeatedly declined during periods when gold rallied, and argued that it behaves as a leveraged risk asset correlated with speculative stocks rather than a hedge.

He reiterated his long-standing view that crypto does not function as a currency, as it is neither a unit of account, a scalable payment system, nor a stable store of value, while citing El Salvador’s experience, where Bitcoin accounts for less than 5% of transactions. He further argued that crypto is not a true asset because it lacks income streams or real-world utility.

You may also like:

On Stablecoins and Regulations

Roubini said the only widely adopted crypto application after 17 years is the stablecoin, which he described as a digital form of fiat money already replicated by traditional finance, and maintained that most blockchain-based systems are centralized, permissioned, and privately controlled. He asserted that fully decentralized finance will never scale because governments will not permit anonymous transactions, and that AML and KYC requirements undermine claims of lower costs.

While speaking about regulation, Roubini warned the GENIUS Act risks recreating the instability of 19th-century free banking, as stablecoins lack narrow bank regulation, lender-of-last-resort access, or deposit insurance, making them vulnerable to runs. He also criticized proposals allowing stablecoins to pay interest, and claimed that this could destabilize fractional reserve banking unless payments and credit creation are structurally separated.

Roubini’s comments come as Bitcoin continues its downward trajectory, falling a fresh 6% on Thursday and trading below $71,600 at the time of writing. The latest decline has added to broader market unease, and analysts are warning that continued weakness in BTC could have wider implications. Market experts have increasingly raised concerns that firms holding large BTC reserves may face massive balance-sheet stress and systemic risk if prices continue to slide.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Sovcombank launches bitcoin-backed loans for Russian miners and businesses

Sovcombank, the ninth-largest Russian bank by assets, said it became the first financial institution in the country to offer bitcoin-backed loans to individuals and corporations who legally own digital assets.

The move follows a pilot program by state-owned Sberbank, which in late December issued the first such product to mining firm Intelion Data. While crypto-secured lending remains limited amid regulatory uncertainty, Russian banks have increasingly shown interest in borrowing against bitcoin as mining firms and crypto-holding businesses look to unlock liquidity while retaining their digital assets.

“Specifically, we offer bitcoin-secured lending, allowing our clients to raise financing for business development without having to sell their assets,” Marina Burdonova, Sovcombank’s compliance director, said in a statement. Only companies and individuals who legally own digital assets will have access to the bitcoin-backed lending products, she said.

Crypto mining in Russia became legal Nov. 1, 2024 after the government introduced a law allowing legal entities and entrepreneurs registered with the Ministry of Digital Development to engage in the activity. Unregistered miners could operate only if they do not exceed energy consumption limits.

A month later, the government imposed a six-year ban on crypto mining in 10 regions due to the industry’s high power consumption. In December 2025, it reopened the cryptocurrency market to the public with new rules laid out by the country’s central bank.

“Mining has ceased to be a niche ‘bitcoin mining’ activity. It has become an investment class with predictable returns, a payback period and manageable risks,” Burdonova said. “Sovcombank sees potential in partnerships with all crypto industry participants, from miners and data center operators to crypto exchanges and money changers.”

Crypto World

Binance price eyes $615 fibonacci support as oversold conditions build

Binance’s price is approaching the $615 support zone as oversold conditions intensify, placing it at a critical technical inflection point.

Summary

- $615 is a major confluence support combining the 0.618 Fibonacci, VWAP, and prior value area high

- Rejection at $932 confirms bearish structure, keeping pressure on price in the short term

- Oversold conditions raise bounce probability, but confirmation is needed for reversal

Binance (BNB) price has entered a sharp corrective phase following its recent swing high, with bearish momentum accelerating across multiple timeframes. After failing to sustain upside continuation, price has rotated lower in an impulsive fashion, signaling a clear shift in short- to medium-term market structure.

As BNB continues to unwind recent gains, attention is now turning toward a key high-timeframe support region near $615, where technical confluence suggests this level may play a decisive role in determining the next directional move.

Binance price key technical points

- $615 marks a major confluence support zone, aligning with the 0.618 Fibonacci retracement and VWAP support

- High-timeframe resistance at $932 remains intact, reinforcing the broader corrective structure

- Oversold conditions increase the probability of a relief bounce, provided structural support holds

The current corrective move began after Binance Coin established a new high at a time-frame resistance near $932.

This level acted as a decisive rejection point, where bullish momentum stalled and sellers regained control.

The failure to reclaim acceptance above this resistance confirmed a structural low and initiated the current impulsive move to the downside.

Since that rejection, price action has remained consistently bearish, with lower highs and expanding downside candles reflecting aggressive selling pressure. This behavior suggests that the move lower is not merely a shallow pullback, but a broader corrective rotation within the prevailing market cycle.

$615 support zone comes into focus

As price continues to decline, the $615 region has emerged as the most important technical level in the near term.

This zone represents a high-confluence area where multiple technical factors align, including the 0.618 Fibonacci retracement of the broader move and VWAP-based support.

Additionally, this region sits above the previous range value area high, strengthening its relevance as a structural support level.

Historically, when price revisits such confluence zones after an impulsive move, the market often pauses to reassess value. If buyers step in to defend this area, it increases the likelihood that prices will stabilize and form a base for a corrective rebound.

Oversold conditions signal potential exhaustion

Momentum indicators are now beginning to reflect oversold conditions following the extensive selling seen over recent days and weeks. While bearish trends can persist longer than expected, oversold readings often signal that downside momentum may be nearing exhaustion, especially when price approaches major support.

Importantly, oversold conditions alone do not confirm a reversal. However, when combined with strong structural support, they increase the probability of at least a short-term relief bounce. Any such bounce would likely be corrective in nature unless accompanied by a clear reclaim of higher resistance levels.

What to expect in the coming price action

From a technical, price action, and market structure perspective, the $615 region represents a critical make-or-break level for Binance Coin. A successful defense of this support could allow BNB to establish a higher low and trigger a rotation back toward higher price targets. Conversely, failure to hold this zone would expose the market to deeper corrective levels and extend the bearish structure.

Until confirmation emerges, traders should closely monitor volume behavior and price reaction around support. A strong bullish response would signal improving demand, while continued weakness would reinforce downside risk. For now, all eyes remain on $615 as the market approaches a pivotal moment in Binance Coin’s corrective cycle.

Crypto World

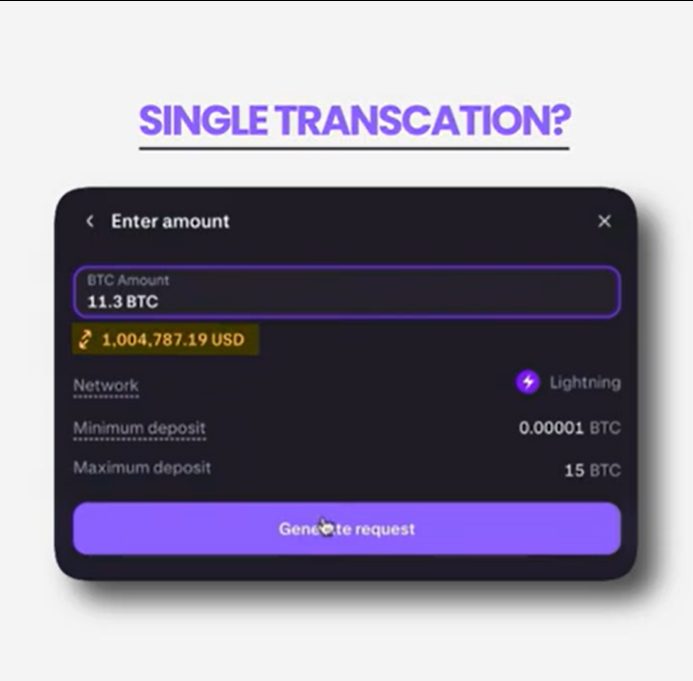

$1M Lightning Payment Tests Bitcoin’s Institutional Rails

Institutional trading and lending desk Secure Digital Markets (SDM) said it sent a $1 million payment to cryptocurrency exchange Kraken over the Lightning Network on Jan. 28.

SDM claimed in a Thursday statement shared with Cointelegraph that it is the largest publicly reported Lightning transaction to date and a proof‑of‑concept for seven‑figure transfers between regulated counterparties.

The payment cleared in 0.43 seconds and was routed via Voltage’s managed Lightning infrastructure, which provides node management, pre‑provisioned liquidity, and uptime guarantees aimed at exchanges and trading desks.

The previously publicized “record” single payment milestone was about 1.24 Bitcoin (BTC), roughly $140,000 at the time, highlighting the rarity of six‑figure Lightning payments, let alone a clean, seven‑figure transfer in one shot.

Voltage CEO Graham Krizek called the transaction an “important moment for Lightning and for institutional Bitcoin payments,” saying that a $1 million Lightning transfer highlighted the “its ability to meet enterprise requirements.”

Related: Lightning Network could nab 5% of stablecoin flows by 2028: Voltage CEO

Lightning metrics remain small, but growing

The transfer comes against a backdrop of mixed Lightning metrics. Capacity on public Lightning channels fell from over 5,400 BTC in late 2023 to about 4,200 BTC by mid 2025, before rebounding to a new all-time high capacity of over 5,600 BTC by December.

That’s still a small pool of capital relative to Bitcoin’s market value, and most documented usage has skewed toward smaller payments.

Bitfinex, for example, had long capped Lightning deposits at 0.04 BTC before recently lifting limits to 0.5 BTC per payment and 2 BTC per channel.

In a statement shared with Cointelegraph, Paolo Ardoino, CEO of Tether and chief technology officer at Bitfinex, called the Lightning Network a “powerful solution for all Bitcoin users” that began as a retail payments experiment

He said that Bitfinex had seen Lightning handle higher volumes with predictable settlement, lower costs and reduced onchain congestion, “all of which matter for institutional use cases.”

Fidelity and Blockstream see institutional potential

Fidelity Digital Assets, which published a 2025 report on Lightning using Voltage data, argued that the Lightning Network not only enhanced Bitcoin’s utility but also bolstered its investment case.

Related: Tether leads $8M funding for Lightning startup focused on stablecoins

Fidelity noted that average Lightning capacity had increased by 384% since 2020, adding that the network presented a “transformative opportunity for both new and existing financial institutions.”

Blockstream, a Bitcoin‑focused infrastructure company, pushed a similar narrative in its Q4 2025 quarterly update.

The company highlighted Core Lightning releases focused on latency reduction and Lightning Service Provider (LSP) support, and pitched its Greenlight platform as a way for apps, exchanges and services to offer trust‑minimized Lightning functionality with minimal infrastructure burden, with an explicit roadmap for enterprise‑focused Lightning deployments.

Big questions: Would Bitcoin survive a 10-year power outage?

Crypto World

How Borderless Markets Are Unlocking Frictionless Access and Liquidity via Digital Asset Tokenization

For decades, global financial markets have been shaped by geographic boundaries, jurisdiction-specific regulations, and legacy infrastructure designed for localized participation. Even in mature economies like the United States, access to high-value or alternative assets is often restricted by capital requirements, lengthy settlement cycles, and reliance on multiple intermediaries. While digitization has improved operational efficiency, it has not eliminated the structural friction that limits who can participate in markets or how freely capital can move across borders.

While digitization increased operational efficiencies, it did not remove the structural impediments to market participation or the unfettered ability of capital to move cross-border. With emerging borderless markets, financial institutions will overcome these barriers by providing a shared digital infrastructure, rather than siloed regional systems. In essence, borderless markets create an ecosystem where assets will be accessible, transferable, and traded on a global scale; additionally, these new types of markets will enable continuous accessibility, transparency of ownership, and seamless participation from all participants relative to each asset.

Central to this recent transformation of who can access the market, or what level of liquidity is available in the market, is the digital asset tokenization. Through the development of sophisticated tokenizing assets, real-world and financial assets can be converted from physical form to a programmable digital representation that can be transacted across multiple markets without being subject to geographic limits. Tokenizing assets, combined with the use of enterprise-level tokenization platforms and the pending development of specialized tokenization development services, creates a mechanism for frictionless access to the market and provides the necessary level of liquidity to maintain a level of market efficiency.

What Are Borderless Markets and Why Do They Matter to U.S. Investors?

Borderless markets are financial ecosystems where assets are created, accessed, and traded without being constrained by geography or legacy financial rails. These markets rely on digital asset tokenization to standardize ownership, enable real-time settlement, and allow global participation through a unified digital infrastructure. Rather than operating through fragmented regional systems, borderless markets are built on tokenized frameworks that support seamless access and liquidity across jurisdictions.

For U.S. investors and enterprises, borderless markets are increasingly relevant because they align directly with modern capital efficiency and scalability goals. Through structured asset tokenization development, traditionally restricted or illiquid assets can be redesigned to support broader participation while maintaining transparency and control.

1. Expanded Market Access

The traditional investment paradigm has limited participation due to the high minimum thresholds associated with investments, jurisdiction restrictions, and complicated procedures for onboarding investors. Tokenization enables borderless marketplaces, providing Americans access to multiple asset classes around the world—like real estate, private credit, infrastructure, etc.—through fractional digital ownership models.

2. More Accessible Capital Movement

capital currently invested in legacy markets are usually tied up for long periods, depending on how long each transaction takes to settle and all intermediate steps in the process between the time a person sends money and receives it back. Borderless marketplaces facilitate capital mobility in that they accelerate – or complete – transaction processing so there is less time between transaction completion, and since they allow investors to redeploy capital across the entire marketplace, they shorten traditional holding periods.

3. Increased Liquidity Opportunities

Because the liquidity of an asset is no longer dependent on a specific location and only one buyer and instead can be accessed through a tokenized asset’s availability on multiple marketplaces globally for anyone to buy at any time, it necessarily increases the velocity of transactions being completed, leading to improved price discovery.

Competitive Advantage for U.S.-based Enterprise

U.S. companies employing borderless market principles to attract financing will not only have access to potential sources of capital, but also will be able to conduct business with that capital in a manner aligned with the laws and regulations of the state or country where they were originally incorporated: creating a significant competitive advantage when it comes to raising funds, monetizing an asset, and expanding into international markets.

Therefore, borderless markets are not just about monetary access; instead, they redefine how markets are structured by providing the infrastructure for establishing market operations through tokenized assets across all geographic regions.

Build a Tokenization Platform with Antier

How Digital Asset Tokenization Enables Borderless Market Access

Digital asset tokenization involves representing ownership rights, economic value, and transfer conditions of an asset as blockchain-based tokens governed by smart contracts. Unlike traditional digitization, tokenization embeds access and transferability directly into the asset’s design.

Tokenization for Improved Market Access

Tokenization for improved market access transforms participation models in several critical ways:

- Lower Investment Thresholds: High-value assets can be divided into smaller units, allowing broader participation from both retail and institutional investors.

- Always-On Accessibility: Tokenized assets operate on blockchain networks that function continuously, removing time-zone and market-hour restrictions.

- Direct Asset Interaction: Investors can engage with assets through digital wallets and platforms, reducing reliance on layered intermediaries.

- Global Distribution: Asset issuers can reach international investors without duplicating infrastructure or market-specific issuance processes.

For U.S.-based issuers, digital asset tokenization enables controlled global exposure while preserving governance, reporting, and transparency standards.

Asset Tokenization Development as the Foundation for Liquidity

Liquidity challenges are often embedded in the structural design of assets rather than market demand. Many traditional assets are illiquid due to high unit values, long settlement cycles, and limited secondary trading opportunities. Asset tokenization development addresses these limitations by redesigning assets specifically for liquidity.

How Tokenization Improves Liquidity

Understanding how tokenization improves liquidity requires examining its impact on market mechanics:

- Expanded Buyer Participation: Fractional ownership increases the number of potential buyers, creating deeper and more active markets.

- Secondary Market Enablement: Tokenized assets are inherently compatible with digital trading venues, supporting ongoing liquidity beyond primary issuance.

- Reduced Settlement Risk: Near-instant settlement minimizes counterparty risk and capital lock-up, encouraging higher transaction volumes.

- Programmable Liquidity Controls: Smart contracts automate compliance, transfer restrictions, and corporate actions, enabling liquidity without regulatory compromise.

For U.S. enterprises managing traditionally illiquid assets, asset tokenization development unlocks liquidity while maintaining institutional-grade controls.

Tokenization Platform Development for Seamless Global Participation

While tokenized assets form the foundation, scalable borderless markets rely on sophisticated tokenization platform development. Platforms serve as the operational layer that manages issuance, onboarding, trading, and lifecycle events.

Core Capabilities of Enterprise Tokenization Platforms

Effective tokenization platforms support frictionless access through:

- Integrated Investor Onboarding: Identity verification and eligibility checks aligned with U.S. regulatory expectations.

- Automated Issuance Workflows: Streamlined token creation, allocation, and distribution processes.

- Cross-Border Trading Infrastructure: Support for global participation without duplicating regional systems.

- Real-Time Transparency: Continuous visibility into ownership records, transaction history, and asset performance.

Tokenization platform development ensures that borderless markets operate reliably at scale, supporting both institutional performance and long-term growth.

Why Enterprises Choose Tokenization Development Services in the U.S.

Implementing tokenization is not a plug-and-play initiative. It requires deep expertise across blockchain engineering, asset structuring, compliance alignment, and scalability planning. As a result, enterprises increasingly rely on specialized tokenization development services.

Role of a Tokenization Development Company

Partnering with an experienced tokenization development company enables organizations to:

- Design asset-specific token models aligned with liquidity and access goals

- Build scalable tokenization platforms capable of supporting multiple asset classes

- Align tokenization strategies with U.S. regulatory expectations

- Accelerate deployment timelines while maintaining security and performance

For U.S. enterprises, tokenization development services provide the foundation needed to operationalize borderless market strategies with confidence.

Use Cases Driving Borderless Markets Through Tokenization

Tokenized Real-World Assets

Real estate, commodities, and infrastructure assets benefit from fractional ownership, improved liquidity, and global investor participation.

Private Markets and Alternative Investments

Tokenization improves access to traditionally opaque private assets while enabling secondary trading opportunities.

Cross-Border Capital Formation

Issuers can raise capital globally while maintaining centralized governance and reporting frameworks.

These use cases demonstrate how borderless markets move from concept to execution through structured tokenization initiatives.

Strategic Considerations for U.S. Enterprises Entering Borderless Markets

Before launching tokenization initiatives, enterprises must evaluate:

- Asset suitability for tokenization

- Target investor demographics

- Platform scalability requirements

- Long-term liquidity and governance strategy

A structured approach to asset tokenization development ensures sustainable outcomes rather than short-term experimentation.

Frictionless Access and Liquidity as the New Market Standard

Borderless markets are redefining how value is accessed, transferred, and monetized in the global economy. Through digital asset tokenization, enterprises can overcome geographic limitations and legacy inefficiencies that have historically constrained participation and liquidity. By investing in robust asset tokenization development, scalable tokenization platform development, and expert tokenization development services, U.S. enterprises can unlock frictionless access and sustainable liquidity across global markets. Tokenization is no longer a future concept—it is the infrastructure shaping the next generation of borderless financial markets.

Crypto World

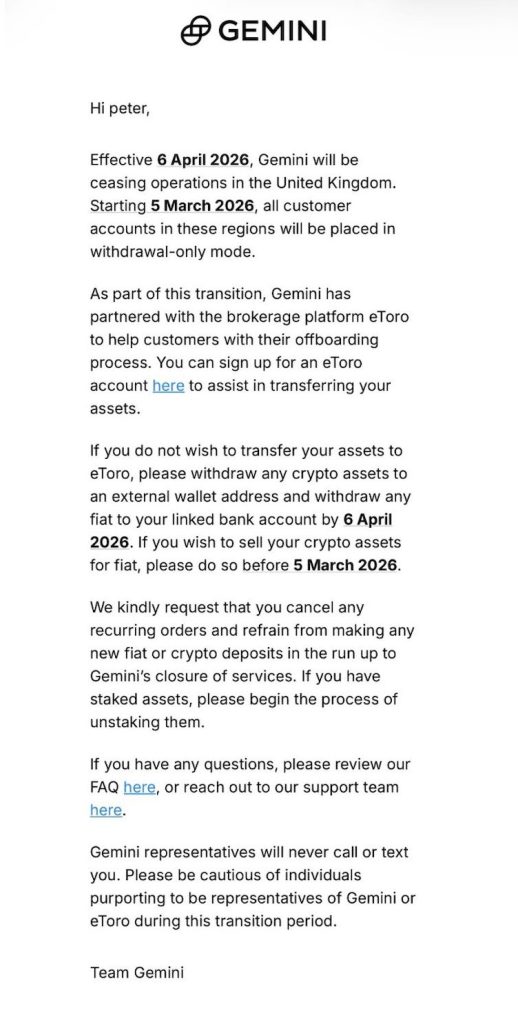

Gemini to Exit UK Market, Shifts Accounts to Withdrawal-Only From March 5

Gemini has announced it will cease operations in the United Kingdom, marking another high-profile exit as the country transitions to a stricter regulatory regime for digital asset firms.

In a notice sent to customers, Gemini said UK operations will formally end on 6 April 2026, with all UK customer accounts placed into withdrawal-only mode from 5 March 2026.

The exchange advised users to either transfer assets to an external wallet or offboard via a partner platform ahead of the deadline.

Accounts Shift to Withdrawal-Only Mode

Under the transition plan, Gemini said customers will no longer be able to trade or make new deposits after 5 March. Users who wish to liquidate crypto holdings into fiat must do so before that date, while all crypto and fiat withdrawals must be completed by 6 April.

As part of the offboarding process, Gemini has partnered with eToro, offering customers the option to open an eToro account to assist with transferring assets. Gemini also urged users to cancel recurring orders and begin unstaking any staked assets ahead of the shutdown.

The company warned customers to remain vigilant against potential scams, stating that Gemini representatives will not contact users directly by phone or text during the transition.

Regulatory Pressure in the UK Market

Gemini’s exit comes as the UK moves from an interim crypto registration regime into full authorisation under the Financial Services and Markets Act (FSMA). The shift represents a material tightening of expectations around governance, operational resilience, and senior management accountability for digital asset firms operating in the country.

While the UK has positioned itself as open to financial innovation, the new framework introduces deeper regulatory scrutiny and ongoing supervisory engagement — a dynamic that has prompted several global crypto firms to reassess their UK footprint.

A Selective Regime Takes Shape

“Gemini’s decision to exit the UK raises a bigger question than any single firm’s strategy,” said one industry observer. “What does participation look like once the UK moves from a registration regime into full FSMA authorisation?”

The transition, they noted, is not merely about meeting higher standards on paper, but about sustained oversight, historical scrutiny, and personal accountability at the senior management level. For global firms, the calculus increasingly hinges on whether the UK market justifies that level of regulatory exposure in a fast-evolving sector. Some firms will decide the trade-off makes sense. Others may not.

Implications for the UK Crypto Landscape

Gemini’s departure does not necessarily signal failure of the UK’s regulatory approach, but it does suggest the regime is intentionally selective. As authorisation moves from theory into delivery, success may depend less on scale and more on regulatory experience, judgement, and willingness to operate under continuous supervision.

Gemini was contacted for comment at press time but did not respond.

The post Gemini to Exit UK Market, Shifts Accounts to Withdrawal-Only From March 5 appeared first on Cryptonews.

Crypto World

Kalshi expands surveillance, enforcement efforts ahead of Super Bowl 60

The Kalshi logo arranged on a laptop in New York, US, on Monday, Feb. 10, 2025.

Gabby Jones | Bloomberg | Getty Images

Kalshi on Thursday announced new initiatives to expand its surveillance and enforcement frameworks as skepticism builds around the booming predictions market space.

The announcement comes days before Super Bowl 60, which has already drawn more than $160 million in prediction market trading volume, according to Kalshi. The platform and its peers allow users to buy event contracts for outcomes in politics, pop culture, financial markets and sports.

Prediction trades on predetermined outcomes — like, for example, on which companies will air Super Bowl ads on Sunday — have prompted questions of possible insider trading. New York Attorney General Letitia James on Monday issued a warning about what she called “unregulated prediction markets.”

“Being federally regulated means that Kalshi bans market manipulation, insider trading, has limits on the types of markets it lists, runs Know-Your-Customer (KYC) and Anti-Money Laundering (AML) checks on every user before they can trade, and publicly reports all trades to the CFTC daily,” the company said in a release. “Kalshi also spent years building custom prediction market trade surveillance and enforcement systems that are similar to those used in the stock market.

Kalshi said Thursday it has taken further steps, forming an independent surveillance advisory committee, which will provide quarterly analysis to the company’s outside counsel and publish statistics on investigations into suspicious activity on its platform. The company also announced surveillance partnerships with Solidus Labs and the Director of the Wharton Forensic Analytics Lab.

The prediction market will also now work with the former Under Secretary of the Treasury for Terrorism and Financial Intelligence to advise Kalshi on “market integrity, trading surveillance and financial compliance matters.”

Kalshi lawyer Robert DeNault has also been appointed to the role of Head of Enforcement, where the company said he will work with the advisory committee to identify insider trading and market manipulation.

Lastly, Kalshi said it has created hubs on its website to provide resources for consumers on responsible trading and market integrity.

In a post on X, CEO Tarek Mansour said if the company finds any wrongdoing, the penalties include fines and referrals to the Commodity Futures Trading Commission — which regulates event contracts in the U.S. — and the Department of Justice for prosecution.

“In the past year, we ran over 200 investigations and froze relevant accounts,” Mansour wrote. “Of these, over a dozen have become active cases and several have been referred to law enforcement.”

Mansour added that Kalshi has based its market surveillance system on those used by the New York Stock Exchange and the Nasdaq, flagging suspicious behavior by running trades through pattern recognition models.

“All industries have bad actors and no system is perfect, Kalshi’s included,” Mansour wrote. “But we are committed to improving daily. Lots of work ahead!”

Disclosure: CNBC has a commercial relationship with Kalshi.

Crypto World

Liquidations Top $1.3 Billion as BTC Plummets Below $67K, ETH Loses $2K Support

Most other altcoins like BNB and XRP have joined the ride south with massive declines of their own.

Bitcoin can’t catch a break in the past several days, marking consecutive multi-month lows, with the latest coming minutes ago at well under $67,000.

The last time the cryptocurrency traded at such low levels was in early November, just as the US presidential elections took place and the country elected the so-called ‘crypto president,’ Donald Trump.

The past few weeks have been brutal for BTC. It challenged $90,000 just eight days ago, last Wednesday, but the rejection at that level brought unimaginable pain for the market leader and most of the altcoin followers.

Bitcoin first dumped to $81,000 last Thursday, then continued south to under $75,000 during the weekend, but the bears kept the pressure on. The past several hours have been violent as well, with BTC plunging to $66,900 (as of press time). This means that the asset has lost well over $20,000 in just over a week.

The altcoins have not been spared. ETH continues with its massive decline, with another 9% daily decline to under $2,000 – its lowest level since last April. BNB has plunged by 10% to $660, while XRP is down by a whopping 15% in the past 24 hours alone to $1.32.

Further losses are evident from the likes of ZEC (-19%), MORPHO (-14%), NEXO (-14%), XMR (-12%), LEO (-12%), SUI (-11%), and many others. As such, it’s no wonder that over-leveraged traders have been harmed severely.

Data from CoinGlass shows that the 24-hour liquidations have rocketed to over $1.3 billion. In the past hour alone, the wrecked positions are up to $350 million. The number of wiped out traders is close to 300,000 daily, with the single-largest position taking place on Aster, which was worth over $11 million.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Uniform Labs’ Multiliquid and Metalayer Launch RWA Redemption Facility on Solana

Multiliquid and Metalayer Ventures have launched a facility that allows instant redemption (liquidity) for tokenized real-world assets (RWAs) on Solana.

In a press release shared with CryptoNews, the firm said the facility is positioned as the first dedicated vehicle intended to solve one of tokenization’s most persistent challenges: liquidity at redemption.

Raised and managed by Metalayer Ventures with support from Uniform Labs, it is designed to scale over time based on market feedback and performance, offering a blueprint for future redemption-liquidity deployments across tokenized markets.

The RWA Liquidity Gap

The launch comes as Solana’s tokenized RWA ecosystem surpasses $1 billion in on-chain assets, making it the third-largest blockchain network for tokenization.

Despite rapid growth, much of the RWA market—particularly non-Treasury assets such as private credit, private equity, and real estate—remains structurally illiquid. Redemptions are typically limited to issuer-controlled windows, rather than continuous secondary markets.

This mismatch is becoming more visible even in ostensibly “cash-like” products. The Bank for International Settlements has warned that tokenized money market funds face liquidity mismatches between on-chain instruments and off-chain settlement, a dynamic that could amplify stress during periods of elevated redemption demand.

“Traditional finance has repo markets, prime brokerage, and overnight lending facilities. Tokenized markets have had nothing comparable, until now,” said Will Beeson, founder and CEO of Uniform Labs.

How the Facility Works

Metalayer Ventures acts as the capital provider, raising and managing the pool of capital that allows instant redemptions. Multiliquid—developed by Uniform Labs—supplies the smart contract infrastructure, issuer relationships, and liquidity platform that underpin pricing, compliance enforcement, interoperability, and swaps.

Instead of waiting days or weeks for issuer-led redemptions, holders can convert supported tokenized assets into stablecoins instantly, 24/7. The facility purchases assets at a dynamic discount to net asset value (NAV), compensating liquidity providers for offering immediate access to capital.

Institutional-Grade Infrastructure on Solana

Uniform Labs expects a two-layer liquidity ecosystem to emerge: active market participants pricing real-time exits, and larger balance-sheet allocators warehousing assets to redemption for steadier yield.

The model is expected to gain traction as tokenized assets are increasingly used as collateral across DeFi and institutional venues.

The facility will initially support assets from issuers including VanEck, Janus Henderson, and Fasanara, spanning tokenized Treasury funds and select alternative assets. Integrations with Solana DeFi protocols such as Kamino are under discussion.

Nick Ducoff, head of institutional growth at the Solana Foundation, said reliable redemptions are becoming “critical infrastructure” as Solana’s RWA market scales, positioning the network as a leading venue for issuance, trading, and redemption of tokenized assets.

The post Uniform Labs’ Multiliquid and Metalayer Launch RWA Redemption Facility on Solana appeared first on Cryptonews.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat5 hours ago

NewsBeat5 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report