Crypto World

Bitcoin May Dip Below $64K as Veteran Warns of ‘Campaign Selling’

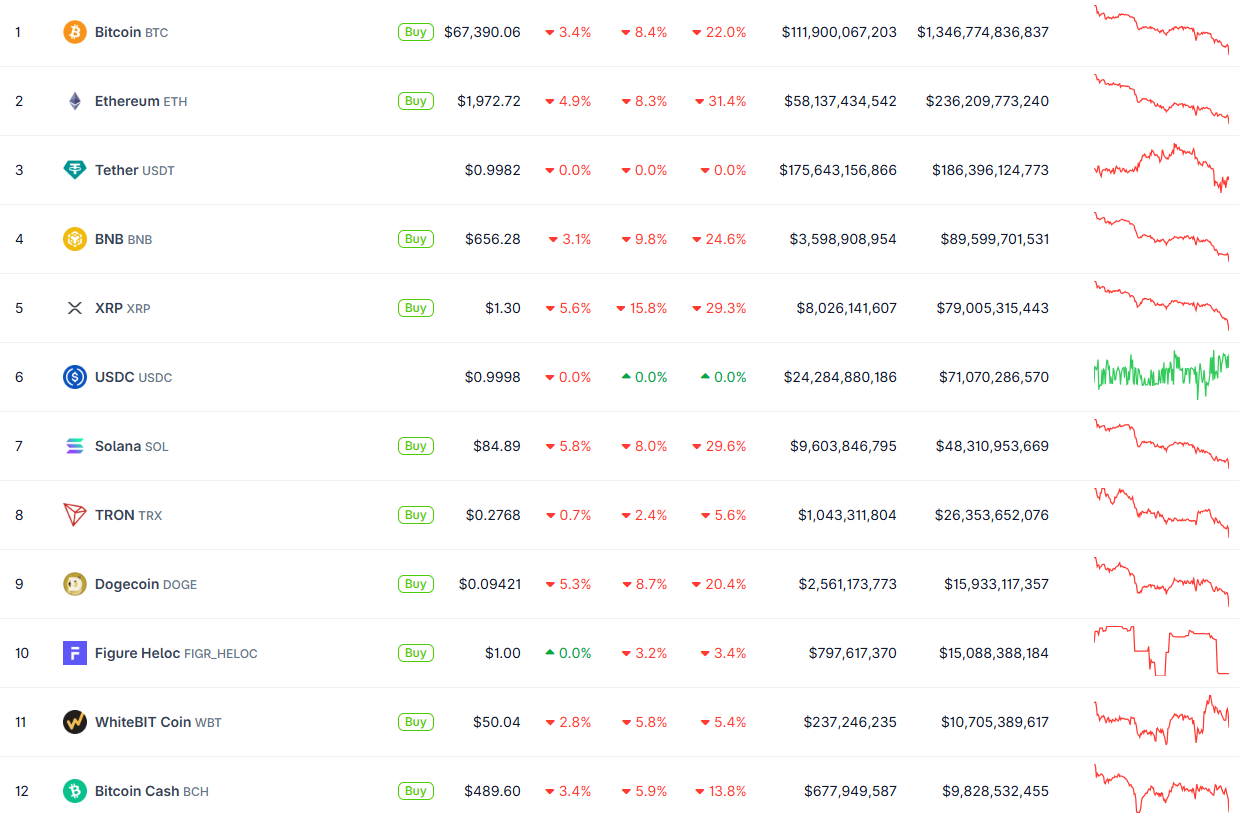

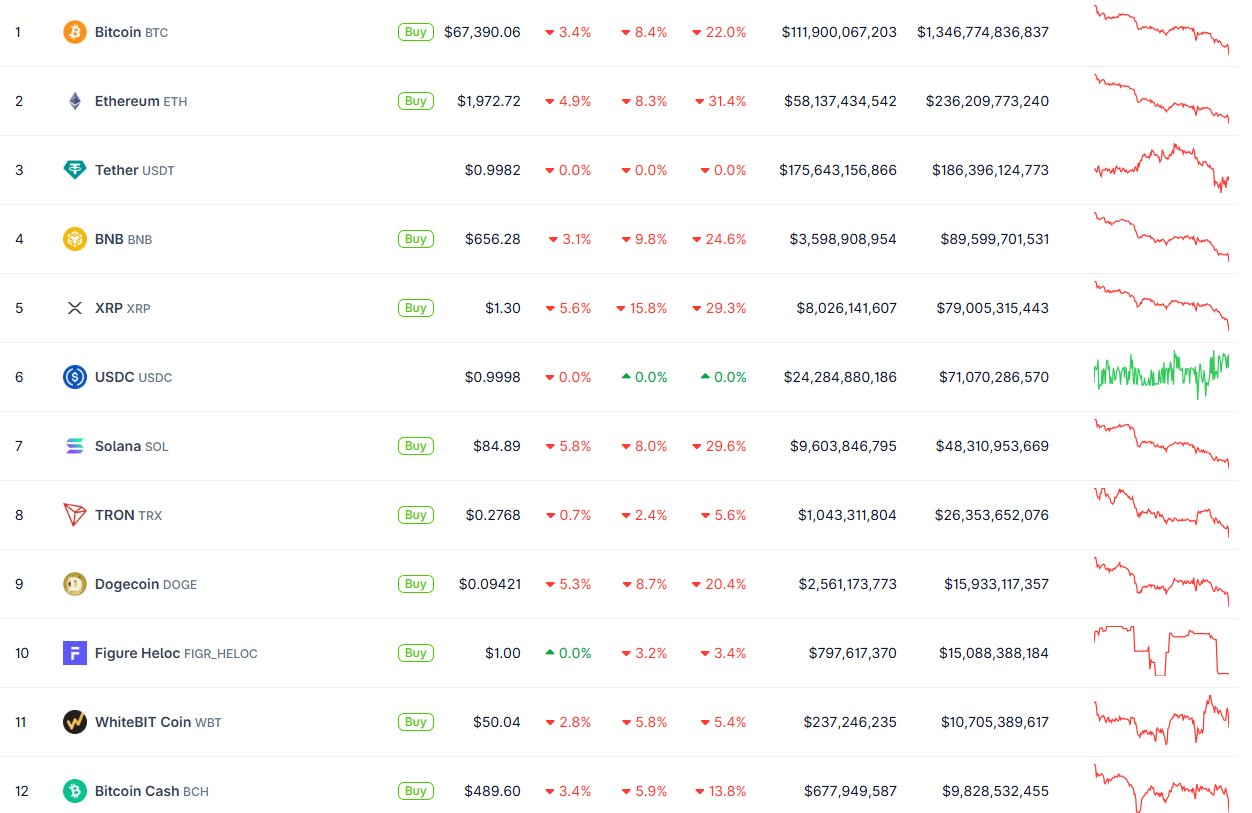

Bitcoin (CRYPTO: BTC) extended its pullback, slipping more than 22.5% over the past week to hover around $69,000 as traders weigh supply and demand dynamics. The retreat follows a period in which miners and US spot BTC ETFs trimmed exposure, adding modest selling pressure to an already fragile downtrend. The market has shown little appetite for a rebound, underscoring how thin liquidity and cautious sentiment can magnify losses in a risk-off environment. On-chain data and fund flows paint a nuanced picture: distribution signals from large holders sit alongside episodes of fading demand, complicating bets on a swift recovery.

Key takeaways

- Campaign selling by institutions, particularly miner-related activity and ETF exposure reductions, is pressing BTC lower rather than providing a floor.

- A potential bottom zone remains visible in the $54,600–$55,000 area, but confirmation requires sustained demand and stabilizing on-chain metrics.

- On-chain data shows miners shifting toward net distribution, signaling that fresh supply is hitting the market as January closes.

- Bitcoin spot ETF balances have declined to about 1.27 million BTC, echoing cooled institutional exposure and a potential headwind for price recovery.

- Market indicators, including the Coinbase premium, have retreated to yearly lows, suggesting waning institutional interest in this phase of the cycle.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The combination of ongoing distribution by miners and reduced ETF exposure signals further near-term downside risk.

Trading idea (Not Financial Advice): Hold. The current setup implies caution until there are clearer signs of demand and a firmer base forming around key support zones.

Market context: The BTC move unfolds amid a broader risk-off environment and evolving ETF flows that continue to influence spot prices. With liquidity patterns tightening and macro uncertainty lingering, price action remains highly data-dependent, with on-chain signals and fund flows providing mixed signals about when a durable bottom might form.

Why it matters

The ongoing pressure on Bitcoin highlights how interlinked the crypto market has become with macro liquidity and institutional participation. As miners and spot ETFs pull back, the supply-demand balance tilts toward hodlers and short-term traders, potentially elevating the risk of sharper moves if selling accelerates. The situation underscores the importance of on-chain dynamics—especially miner behavior and exchange balances—in gauging how much selling pressure the market can absorb before a meaningful rebound takes hold. For participants watching risk, the dynamics around BTC’s supply chain—miner distributions and ETF outflows—remain a critical lens for assessing whether the market is merely digesting a correction or entering a more extended phase of weakness.

From a technical perspective, several indicators point to a challenging landscape ahead. Veteran analyst Peter L. Brandt has highlighted what he describes as “campaign selling”—a deliberate, sustained distribution by large institutions rather than a reflexive, retail-led decline. The observation aligns with an impairment of bid strength as price trends lower highs and lower lows. While this framing does not guarantee further downside, it does suggest that the near term could remain precarious absent a meaningful change in buying interest or a reinterpretation of macro catalysts. The price path toward potential targets, such as the bear-flag scenario around the $63,800 level and the broader zone near mid-$50,000s, remains a focal point for traders watching for a possible inflection.

On-chain temperature checks reinforce the sense of a market in flux. Data indicate that miners have shifted from a net accumulation posture to distribution in January, sending BTC toward exchanges. Such movements can amplify selling pressure if capitulation accelerates or if external demand does not step in to absorb the newly minted supply. This dynamic dovetails with the retreat in the Coinbase premium, a gauge closely watched for institutional appetite; the premium slipping to yearly lows implies that institutions may be pulling back from aggressive entry points that previously provided steadying support. The mix of on-chain distribution and weakened exchange inflows contributes to a narrative in which BTC could spend additional time testing support levels rather than staging a rapid rebound.

Two additional threads bear watching. First, the official balance of Bitcoin held by spot ETFs has continued to drift lower, with total BTC under management dipping to about 1.27 million as of the latest reads. Second, some analysts point to a possible longer-horizon accumulation window that could materialize later in the cycle—potentially around mid-2026—driven by timing dynamics in credit spreads and historical lag effects between price bottoms and accumulation phases. These lines of inquiry do not imply an imminent rally, but they offer a framework for understanding where and when demand might re-enter with more conviction. For context, historical analysis has surfaced instances where price convergences toward accumulation bands signaled times of capitulation followed by assertive recoveries, albeit on longer horizons than immediate, intraday moves.

Looking back, the market has shown that the path from capitulation to accumulation can be gradual. In 2022, for instance, BTC dipped into a zone near $20,000 before a bottom formed and a subsequent rally pushed prices higher in the following year. The current cadence—sliding into a zone around $54.6K as an accumulation signal emerges—has prompted some to suggest that the asset is nearing a decisive juncture: the point at which sellers exhaust and buyers begin to re-enter, setting the stage for a more sustained recovery if macro conditions improve and institutional participation returns.

As one analyst put it, the convergence toward a band signaling the start of the accumulation phase around $54.6K could indicate we are transitioning from capitulation to accumulation. Such a reading does not guarantee a reversal on the immediate horizon, but it frames a potential pause in the downtrend and a setup for a more deliberate, value-oriented accumulation once conditions improve. The broader framework also includes a comparative timing signal that some researchers say could push a renewed cycle of accumulation toward mid-2026, a view anchored in widening credit spreads and other macro timing data. Taken together, the signals suggest that investors should monitor rather than chase, awaiting more robust evidence of demand and a firmer foundation beneath prices.

Ultimately, the market’s sensitivity to institutional flows and on-chain movements means BTC’s fate remains tethered to the behavior of large players and the health of the broader liquidity environment. While there is recognition of potential relief points—whether from a stabilization around the $55k zone or a delayed uptick in ETFs’ appetite—the current configuration favors caution. For traders, the narrative remains one of careful risk management, waiting for clearer catalysts that could flip the narrative from bear to bull—or at least reduce the downside risk to a more manageable level.

What to watch next

- Watch BTC price behavior around the $54,600–$55,000 support zone for signs of accumulation or further breakdown.

- Monitor miner activity and distribution trends as January closes, weighing any shift back toward net accumulation against ongoing selling pressure.

- Track US spot BTC ETF balances for continued outflows or stabilization that could influence price direction.

- Observe the Coinbase premium and other institutional indicators for renewed appetite from large buyers.

- Follow commentary and data on the potential mid-2026 accumulation window linked to credit-spread timing and macro liquidity cycles.

Sources & verification

- Peter L. Brandt’s commentary on “campaign selling” and its implications for price structure (as discussed on X).

- On-chain signals showing miner net position change shifting toward distribution in January (Glassnode data).

- Bitcoin ETF balances and trends indicating reduced exposure among spot ETFs.

- Coinbase premium readings signaling shifts in institutional demand.

- Analyses projecting a potential accumulation window around mid-2026 based on credit-stress timing data.

Market reaction and near-term risks for BTC

Bitcoin (CRYPTO: BTC) faced a renewed test of support as miners and spot ETFs reduced their BTC exposure, intensifying near-term supply pressure in a market already sensitive to liquidity and macro cues. The price moving through the mid-to-lower $60k range would not be surprising if current distribution persists, particularly given a backdrop of subdued buying interest from institutions and cautious sentiment among traders. The bear-case scenario identified by technical observers centers on a continuation toward the bear-flag target around $63,800, a level that could become a catalyst for new momentum if sellers accumulate pressure without a compelling counterparty bid. Conversely, a stabilization near $55,000 could pave the way for a measured recovery if institutional demand returns and miners slow their distribution cycles.

In this context, the on-chain picture remains a critical barometer. Miners’ net position changes have shifted to a net outflow pattern in January, suggesting that fresh BTC supply is entering the market at a pace that could sustain pressure on prices near key supports. This dynamic aligns with a decline in spot ETF balances and a cooling of the Coinbase premium, both of which imply that institutional demand has yet to reassert itself with vigor. For traders, the combination of persistent distribution signals and softening buy-side signals means the price could hinge on the next wave of macro and liquidity catalysts—the kind of inputs that often determine whether a market tests lower supports or finds a foothold for a multi-week bounce.

At the same time, several analysts point to potential longer-term inflection opportunities. A subset of commentary highlights the possibility of an accumulation window emerging after mid-2026, tied to timing patterns around widening credit spreads and the historical cadence of BTC market bottoms. While such forecasts are inherently probabilistic, they offer a framework for considering how a cycle may pivot from capitulation to accumulation, even if the timing remains uncertain. For now, the dominant narrative remains one of vigilance: a phase in which buyers must demonstrate conviction and where the absence of a clear catalyst keeps risk balanced on the knife-edge between a renewed rally and a deeper drawdown.

https://platform.twitter.com/widgets.js

Crypto World

Cardano faces deeper plunge as Bitcoin breaches $70K amid bear-cycle fears

- Cardano price dropped to near $0.26 as cryptocurrencies continued to struggle.

- ADA bulls face further pain if the price breaks below $0.25.

- Bitcoin’s crash to under $70,000 amid bear cycle fears is a major trigger.

Cardano price fell more than 9% to extend its downturn, with this coming as Bitcoin tumbled to below the $70,000 support level.

With BTC dragging the broader crypto market into turmoil, Cardano (ADA) dropped to lows of $0.26, signaling prolonged downside risks in this bear cycle.

Other altcoins had it even rougher, with XRP plummeting 14% to under $1.40 and Solana breaching support at $90.

Altcoins slide as BTC tanks amid market panic

Bitcoin sank further on Thursday, with bears breaking below $70,000 to plunge the whole sector into fresh turmoil.

The 8% drop from a retest of $73,000 came as Strategy, the world’s largest corporate holder of Bitcoin, sank into unrealized losses worth billions of dollars.

Treasury Secretary Scott Bessent had also noted on Wednesday that the government would not “bail out” Bitcoin.

However, despite confirmation that the US will not sell its BTC holdings, Cardano, alongside all the top altcoins, nosedived as BTC touched lows of $69,500.

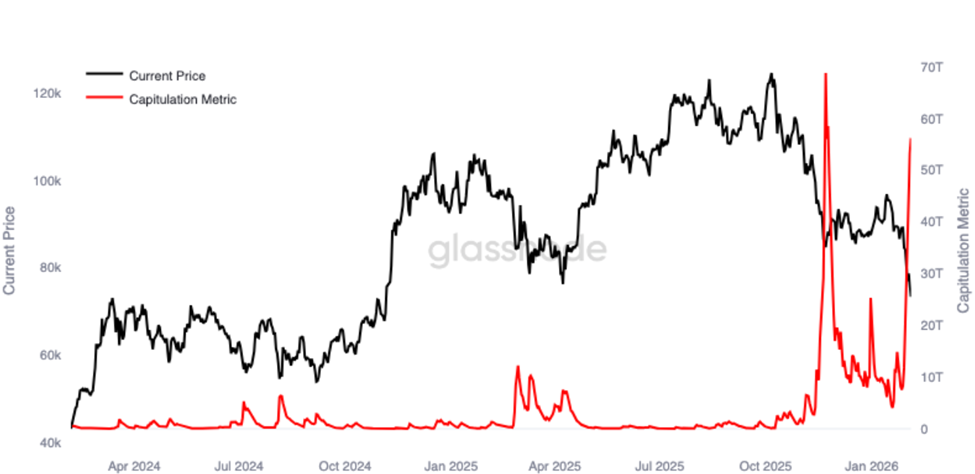

Analysts at Glassnode pointed out that forced selling is escalating.

The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling.

These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning.… pic.twitter.com/mcvVqXJcYq— glassnode (@glassnode) February 5, 2026

Cardano ADA price dives to $0.26

Cardano traded at $0.27 at the time of writing on February 5, 2026, down nearly 9% on the day.

Recent declines mean Cardano price has dived 21% in the past week and 36% in the past month.

The plunge from the $0.8 peak in October 2025 has only accelerated in the past month, with bulls failing to hold onto notable bounces above the $0.30 level.

ADA’s move aligns with bear cycle indicators, including a Fear & Greed Index in extreme fear territory and negative funding rates across exchanges.

Retail and institutional outflows have also amplified the slide, with macroeconomic conditions fueling further pain in a brutal start to the year for buyers.

Given Bitcoin’s outlook, analysts see the current support level of $0.26 as a fragile one for Cardano.

Bearish technicals signal further ADA downtrend

ADA’s daily chart gives a largely bearish outlook after the token’s dip below $0.30 and $0.28.

The dump across risk assets saw buyers fail to hold the 50-day moving average mark, while daily RSI hovers near oversold but lacks bullish divergence.

Data from Coinglass also shows a sharp decline in open interest, and negative funding rates reinforce the outlook.

If the altcoin carnage accelerates amid a broader bear cycle crash, ADA could revisit $0.20 or lower.

On the upside, a shift in macro conditions and regulatory tailwinds could spark bullish bets.

Catalysts like network upgrades or ETF approvals also favour bulls, with short-term targets at $0.50 and $1.

Crypto World

Can It Pump Even More?

Will HYPE continue its uptrend or will it follow the broader market downtrend?

It’s quite difficult to spot a popular cryptocurrency whose price hasn’t tumbled by 20% or even more in the last few weeks.

Hyperliquid (HYPE), though, is an evident exception, and its solid performance has caused analysts to envision further gains in the near future.

The Lone Survivor

Bitcoin (BTC) has crashed to a 14-month low of around $69,000, Ethereum (ETH) is struggling to keep the $2,000 level, while Ripple’s XRP and Solana (SOL) have plummeted by 27% in the past seven days. However, Hyperliquid (HYPE) has somehow defied the ongoing massacre and currently trades at around $32, representing a 50% increase on a two-week scale.

Its strong performance comes amid a string of positive developments surrounding the ecosystem. Earlier this week, Ripple announced that its institutional prime brokerage platform (called Ripple Prime) enabled support for Hyperliquid. Meanwhile, Grayscale recently revealed that it was encouraged by the rise in perpetual futures trading for non-crypto assets on the decentralized exchange.

Before that, on-chain data revealed growing interest in HIP-3 activity amid skyrocketing trading volume and open interest. These metrics continued to increase as the market tumbled in the past few days, reaching new peaks of $1B in OI and $4.8B in 24-hour volume.

HYPE has been the subject of numerous optimistic predictions, and many analysts believe there’s fuel left for additional gains. The analyst, using the X moniker Crypto General, expects volatility ahead and an eventual explosion above $100 later this year. Speaking on the matter was also Zach, who argued there are “so many reasons to buy and hold HYPE.”

There are so many reasons to buy and hold $HYPE.

The more it takes over market share and volume, the bigger the buybacks are, which is one of the reasons it’s so strong.

Really would love to get a spot entry around yearly open of $25 but who knows if it’ll come

— Zach (@CryptoZachLA) February 4, 2026

You may also like:

The popular analyst Crypto Tony chipped in, too, suggesting that HYPE could do “magical things when the market conditions are right.” Those interested in additional bullish forecasts for the token can read our dedicated article here.

Can It Follow the Pack?

It is important to note that the broader crypto market remains shaky, and sustained bearish conditions could eventually weigh in on HYPE as well.

Some analysts believe this is a likely outcome. The one using the X handle, Greeny, predicted that the native token of Hyperliquid could plummet to $20 later in 2026.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Cosmos Powers Real World Asset Tokenization for Institutional Capital Markets

TLDR:

- Tokenized U.S. Treasuries reached $5.6 billion by April 2025, growing five times year over year.

- Cosmos powers 150+ blockchains including Provenance, Progmat, and institutional RWA platforms.

- Ondo Finance moved $95 million into BlackRock’s BUIDL fund, enabling continuous redemptions.

- Lombard’s LBTC token surpassed $1 billion in three months with Franklin Templeton backing.

Capital markets are shifting toward blockchain infrastructure as tokenization gains traction across traditional finance.

Asset managers and banks now issue tokenized treasuries, credit instruments, and securities through distributed ledgers.

Stablecoins represent $250 billion in circulating value, while tokenized U.S. Treasuries reached $5.6 billion in assets under management by April 2025.

Citi analysts project tokenized assets could reach $4 to $5 trillion by 2030. Cosmos has emerged as preferred infrastructure for institutions seeking on-chain capital markets solutions.

Cosmos Architecture Addresses Institutional Requirements

Cosmos provides institutions with blockchain infrastructure that balances operational control and market connectivity.

The framework allows financial firms to build custom chains with internal governance, security protocols, and compliance automation.

Over 150 interoperable blockchains currently operate on Cosmos technology, with regulated institutions increasingly adopting the stack for capital markets applications.

Provenance powers Figure’s non-bank home equity lending platform, which leads the U.S. market in this segment. Progmat, a joint venture of Japan’s MUFG, Mizuho, and SMB, operates the country’s largest regulated tokenization platform on Cosmos infrastructure.

These deployments validate the technology for high-stakes financial operations requiring regulatory compliance and institutional-grade security.

The Inter-Blockchain Communication protocol enables asset distribution across networks while preserving issuer sovereignty.

Institutions can issue securities on proprietary chains and connect to external liquidity venues without surrendering control over core asset rules.

This separation of governance and distribution resolves a fundamental tension in institutional blockchain adoption.

Ledger-based settlement reduces reconciliation costs across custodians, transfer agents, and clearing systems. Asset managers achieve faster liquidity access, while banks minimize counterparty exposure.

Tokenization expands distribution by enabling asset fractionalization across regions without reconstructing product structures for each venue.

These operational benefits have accelerated adoption in cash equivalents, credit products, and exchange-traded instruments.

Production-Scale Implementations Demonstrate Market Readiness

Injective addresses digital securities market fragmentation through purpose-built financial infrastructure. The platform provides native primitives for tokenized asset issuance and trading at institutional scale.

DigiShares and publicly listed Valereum deployed their digital securities platform on Injective using the ERC-7943 interoperability standard for single-asset tokenization.

The integration supports real estate, pre-IPO equity, and alternative assets with institutional-grade settlement. Valereum’s secondary trading platform leverages Injective’s on-chain order book and cross-chain capabilities.

Institutions can perform due diligence, execute investments, and trade digital securities through a unified interface built on Cosmos-compatible infrastructure.

Ondo Finance solves liquidity constraints that limited early tokenized markets. The platform connects tokenized assets to public exchange liquidity through direct acquisition mechanisms.

Users fund purchases with stablecoins, Ondo acquires underlying securities on regulated venues, and redemption processes maintain price alignment.

In March 2024, Ondo moved $95 million into BlackRock’s BUIDL tokenized money market fund. This enabled continuous redemptions instead of T+2 settlement delays.

Ondo Global Markets, built on the Cosmos Stack, now offers hundreds of tokenized equities and ETFs. Partnerships with Franklin Templeton and BlackRock position the platform as a bridge between traditional finance and on-chain markets.

Lombard Finance demonstrates Bitcoin’s evolution as capital markets collateral through its liquid-staked LBTC token.

The product surpassed $1 billion in total value locked within three months, with supply actively deployed across on-chain financial markets.

Franklin Templeton participated in the $16 million seed round, while Wintermute, Galaxy, and DCG provide security oversight.

ZIGChain combines brokerage rails with blockchain settlement to extend retail access to global tokenized equities.

Announced in 2024 with a $100 million ecosystem fund, the platform recently partnered with Apex Group to launch regulated on-chain fund structures.

The $3.4 trillion fund administrator collaboration demonstrates institutional confidence in Cosmos infrastructure for real-world asset tokenization at scale.

Crypto World

Bitcoin’s $70,000 Support Shatters as ‘Warsh Shock’ Triggers Massive Liquidity Exodus

Bitcoin collapsed below the psychological $70,000 support level Thursday, marking a 15-month low as markets aggressively repriced the liquidity outlook under incoming Federal Reserve Chair Kevin Warsh.

The world’s largest cryptocurrency fell as low as $67,619. The rout erased $40 billion from open interest in under 48 hours, showing a capitulation of leveraged longs.

The catalyst? The market’s digestion of President Trump’s nomination of Kevin Warsh. While Warsh is historically pro-crypto, calling Bitcoin “new gold,” traders are fleeing his well-known stance on balance sheet reduction.

The Liquidity Vacuum

Spot ETF flows exacerbated the decline, with total assets under management sinking below $100 billion for the first time in Q1.

The technical damage is severe, as the $70,000 level had served as a fortress for bulls throughout 2025. Its failure has exposed the lack of bid depth below, with order books thinning out toward the mid-$60k range.

The divergence is stark: Gold shattered records Thursday, crossing $5,100/oz. Investors are rotating from “risk-on” stores of value (BTC) to “safety” stores of value (Gold), anticipating that Warsh’s restrictive monetary policy will strengthen the dollar and drain the excess liquidity that fuels crypto rallies.

The Warsh Paradox: Pro-Bitcoin, Anti-Liquidity

This sell-off represents a sophisticated pricing of the “Warsh Paradox.” Retail sees a pro-Bitcoin nominee; institutions see a hawk who despises quantitative easing.

Warsh has explicitly argued that the Fed’s swollen balance sheet distorts asset prices. The desk view? The “Fed Put” is dead. Warsh may support Bitcoin’s legality, but he will not print the dollars required to pump it. Expect volatility to persist until the market finds a price floor based on utility rather than liquidity overflow.

The post Bitcoin’s $70,000 Support Shatters as ‘Warsh Shock’ Triggers Massive Liquidity Exodus appeared first on Cryptonews.

Crypto World

What next for XRP price after the $128 billion wipe out?

XRP price continued its strong downward momentum and lost a crucial support level as the crypto market crash gained steam.

Summary

- XRP price has dropped for five consecutive weeks and moved to the lowest level since November 2024.

- The decline coincided with the ongoing crypto market crash.

- It dropped and moved below the key support level at $1.5463.

The Ripple (XRP) token continued to fall, reaching a low of $1.3495, its lowest level since November 2024. It has been in a free fall after falling from the record high of $3.6650.

The ongoing XRP crash has led to a $128 billion wipeout, with the market capitalization dropping from a record high of $210 billion in July last year to the current $82 billion.

The main reason for the ongoing drop is the ongoing performance of Bitcoin and other cryptocurrencies as concerns about a potential strike on Iran, which may happen at any time. Data on Polymarket shows that odds of this attack have risen since Trump sent an armada to the region.

An attack would increase geopolitical risks and drive up crude oil prices. Data shows that Brent and the West Texas Intermediate rose to $67 and $66, respectively. Higher oil prices would lead to higher inflation and make it hard for the Federal Reserve to cut interest rates.

More data shows that demand for spot XRP ETFs has waned in the past few weeks as investors have remained on the sidelines. According to SoSoValue, spot XRP ETFs have added over $28 million in inflows this month, down from over $666 million in November.

On the positive side, the XRP Ledger network is doing well, with the amount of assets on Ripple USD growing to over $1.4 billion. Its volume has continued growing in the past few months. Similarly, the amount of assets in its real-world asset tokenization ecosystem has jumped by over 270% in the last 30 days.

XRP Ledger is also preparing to launch a permissioned decentralized exchange platform that will be useful for financial institutions.

XRP price prediction: Technical analysis

The weekly chart shows that the XRP price continued its strong downward trend in the past few months, moving from a high of $3.6650 to the current level of $1.3565.

Most importantly, the coin has now moved below the important support level at $1.5465, its lowest level in April last year and the 50% Fibonacci Retracement level. Moving below that level is a sign that bears have prevailed.

The coin is now attempting to move below the 200-week Exponential Moving Average, which will confirm the bearish outlook.

At the same time, the Relative Strength Index and the Stochastic Oscillator have continued moving downwards.

Therefore, the most likely XRP price prediction is where it continues falling, potentially to the 78.6% Fibonacci Retracement level at $1, which is about 26% below the current level.

Crypto World

Zcash price falls 20% to hit 4-month lows under $220

- Zcash price plunged to $217, hitting a four-month low amid a 20% dip.

- The privacy coin dumped as bears pushed Bitcoin under $70,000.

- ZEC traded around $228 at the time of writing, but risks breaching support at $200.

Zcash (ZEC) has declined by more than 20% in the past 24 hours, accelerating its sharp descent amid an increasingly bearish cryptocurrency market.

The privacy coin’s dip to below $220, the first time in four months, came as Bitcoin crashed to $69,500 and Ethereum fell to lows of $2,070.

Among other top altcoin losers on the day was Cardano, which broke to $0.26.

Monero, Dash, and Decred all tanked as privacy coins suffered the bearish flip, hurting cryptocurrencies.

Notably, BTC’s dip has Michael Saylor’s Strategy sitting on approximately $4.5 billion of unrealised losses on the company’s 713,502 BTC.

Meanwhile, BitMine’s 4.2 million ETH currently has about $7.5 billion in unrealised losses.

Top privacy coin turns bearish

Zcash’s plunge stands out among privacy coins, especially after the ZEC price recently jumped to highs above $744 as Bitcoin struggled.

Headwinds amid waning demand now see Zcash changing hands at lows of $217, just a few weeks after it topped $540.

The more than 20% dip in the past 24 hours and 40% nosedive in the past week put Zcash at risk of further technical breakdown.

Capitulation among holders has accelerated sell volumes, with a 36% spike to $538 million in the past day.

Despite the losses, Zcash tops Bitcoin, Bitcoin Cash, and Monero in terms of overall performance over the past year.

Bitwise CIO Matt Hougan shared this view via X.

The relative returns of different monetary crypto assets since Jan. 1, 2025, is remarkable:

Bitcoin (BTC): -22%

Bitcoin Cash (BCH): +23%

Monero (XRM): +97%

Zcash (ZEC): +347%Lots of confounding variables here, including that BTC holders were sitting on the biggest…

— Matt Hougan (@Matt_Hougan) February 5, 2026

Zcash risks plunge below $200

Bears have relentlessly pressured ZEC bulls since the cryptocurrency’s 2025 peak above $740, when early privacy hype drove explosive growth.

Now, after dipping to $217 on February 5, 2026, ZEC risks testing sub-$200 levels.

On Feb. 5, the altcoin came close to the critical psychological support after failing to recover following Electric Coin Company’s core team exit.

Continued regulatory scrutiny on privacy tokens and market-wide profit-taking amid Bitcoin’s latest price crash are key negative triggers.

While ZEC has shattered its key trendline support at $250, a daily RSI deep in oversold territory suggests a rebound is likely.

However, the downturn highlights the privacy coin’s struggles amid broader market volatility, and breaching $200 might result in a new downtrend.

Key support levels beneath this would be $173 and $125 – levels reached in October 2025 before the parabolic surge to the multi-year highs above $700.

Per CoinMarketCap data, ZEC traded around $228 across major exchanges during the early US session on Thursday.

This aligned with Bitcoin’s slight bounce above $70,500, and Monero looked to hold $345.

Crypto World

JPMorgan Issues Bold Bitcoin Prediction Amid Crash

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in — the market’s been on a rollercoaster lately. Bitcoin is moving, stocks are shifting, and headlines are coming fast. While some investors are hitting pause, others are watching closely, trying to read the signals beneath the noise.

Crypto News of the Day: Bitcoin Slides Below $68,000 Amid Forced Deleveraging

Bitcoin fell below $70,000 on Thursday, before extending a leg down to levels below $68,000, an area last tested on October 28, 2024. The move came as intensified selling swept across crypto markets.

Sponsored

Sponsored

The decline marks roughly a 45% drop from October highs, fueled by ETF outflows, fading demand, and a “forced deleveraging” phase in futures markets.

“…with demand fading, ETF inflows drying up, and futures markets entering a “forced deleveraging” phase. Analysts say weak volumes and sustained selling are prompting investors to exit at a loss, despite technical indicators signaling oversold conditions,” wrote Walter Deaton.

Weak volumes and sustained selling pressure have prompted many investors to exit positions at a loss, even as technical indicators signal oversold conditions.

Despite the short-term turbulence, JPMorgan is increasingly bullish on Bitcoin’s long-term potential relative to gold.

The bank highlighted that BTC is now trading well below its estimated production cost of $87,000, a level historically considered a soft floor, and that its volatility relative to gold has dropped to record lows.

“…large outperformance of gold vs. Bitcoin since last October, coupled with the sharp rise in gold volatility, has left Bitcoin looking even more attractive compared to gold over the long term,” MarketWatch reported, citing JPMorgan’s quantitative strategist Nikolaos Panigirtzoglou.

According to the bank, this improved risk-adjusted profile suggests significant upside for investors willing to hold over a multi-year horizon.

Market stress metrics highlight the fragility of the current environment. Glassnode data shows that Bitcoin’s capitulation metric has recorded its second-largest spike in two years. This reflects sharp forced selling and accelerated de-risking by market participants.

Sponsored

Sponsored

Meanwhile, it is worth noting that Bitcoin has erased all gains since Donald Trump won the election, wiping out a 78% post-election rally and highlighting ongoing volatility.

Crypto Stocks Tumble Amid Bitcoin Sell-Off and Rising Economic Uncertainty

Crypto equities mirror the broader weakness in Bitcoin. Shares of Coinbase, Riot, Marathon, and Strategy fell between 5% and 7% premarket after the drop below $70,000, with ETF holdings also down more than 5%.

The crypto downturn comes amid broader macroeconomic headwinds. US January layoffs surged 205% year-over-year to 108,435, the highest January total since 2009, according to Challenger, Gray & Christmas.

Job cuts were concentrated in transportation — led by UPS — and tech, with Amazon announcing 16,000 layoffs. Healthcare also saw notable reductions.

Sponsored

Sponsored

Meanwhile, federal job protections were overhauled, with the Trump administration finalizing reforms affecting 50,000 civil service workers. Continuing claims remain elevated at 1.84 million, highlighting ongoing economic uncertainty.

Equity markets are also witnessing a similarly complex backdrop, with the BMO Capital Markets projecting the S&P 500 could reach 7,380 by the end of 2026, implying an 8% expected return.

The firm favors cyclical sectors such as industrials, materials, energy, and financials, while underweighting defensive sectors. Inflation remains a principal risk, though global monetary and fiscal stimulus provide support.

With all these in mind, Bitcoin and broader financial market investors face a delicate balancing act:

- Technical oversold conditions and low relative volatility suggest a long-term opportunity

- Yet, immediate pressures from leveraged positions, ETF outflows, and macro uncertainty continue to weigh on sentiment.

JPMorgan’s analysis points to potential gains for patient holders, but the short-term outlook remains volatile, reflecting a market in the midst of recalibration.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 4 | Pre-Market Overview |

| Strategy (MSTR) | $129.09 | $120.78 (-6.58%) |

| Coinbase (COIN) | $168.62 | $159.42 (-5.46%) |

| Galaxy Digital Holdings (GLXY) | $20.16 | $19.10 (-5.26%) |

| MARA Holdings (MARA) | $8.28 | $7.81 (-5.68%) |

| Riot Platforms (RIOT) | $14.14 | $13.36 (-5.51%) |

| Core Scientific (CORZ) | $16.15 | $15.50 (-4.02%) |

Crypto World

Aave Delegate Platform Proposes Pausing Three L2 Deployments Citing Weak Revenue

The proposal also includes requiring any new deployment to guarantee at least $2 million in annual revenue to Aave.

A governance delegation platform for Aave, the largest decentralized lending platform, with more than $29 billion in total value locked (TVL), has proposed pausing three underused Layer 2 deployments of Aave V3.

In a Jan. 29 governance proposal that moved to a snapshot vote on Feb. 3, the Aave Chan Initiative (ACI) proposed that Aave freeze its V3 deployments on Ethereum L2s zkSync Era, Metis, and Soneium to cut costs.

“Over time, it has become clear that a small subset of instances contributes very little user activity, TVL, and revenue, while still requiring a non-trivial amount of attention from service providers and governance participants,” ACI wrote in the prospal.

The proposed reduction in L2 deployments aims “to reduce operational overhead and governance burden by addressing instances that are clearly non viable today.”

Among the three networks, zkSync currently has the largest TVL at about $26 million, followed by Soneium with $21.6 million and Metis with $11.7 million, according to DefiLlama data.

Over the past 30 days, Aave generated just $714 in revenue on zkSync, $679 on Metis, and just $150 on Soneium, per DefiLlama. For comparison, within the same timeframe Aave made over $7.7 million on Ethereum and nearly $298,000 on Base.

Now, ACI is pushing for stricter terms on future expansions. The proposal calls for any new chain deployment to guarantee Aave a minimum of $2 million in annual revenue, arguing that the protocol’s liquidity is often underpriced given the “upfront and recurring costs.”

The snapshot vote on the proposal, which runs through Feb. 7, has so far drawn unanimous support, with 257,300 votes in favor and none against.

Voting kicked off the same day that Ethereum’s broader scaling strategy came under renewed scrutiny. As The Defiant reported earlier this week, Ethereum co-founder Vitalik Buterin published an X post arguing that the rollup-centric roadmap for the network “no longer makes sense,” and arguing that L2s should focus on other use cases.

Crypto World

Roubini Predicts a ‘Crypto Apocalypse’ Amidst Bitcoin’s Plunge Under Trump-Era Policies

Roubini said that Bitcoin behaves like a leveraged bet, rising and falling alongside high-risk equities rather than hedging uncertainty.

Economist Nouriel Roubini, who is known for his anti-crypto rhetoric, predicted a looming “crypto apocalypse.” He explained that the future of money and payments will evolve gradually rather than undergo the revolutionary transformation promised by cryptocurrency advocates.

In a recent post, Roubini said Bitcoin and other cryptocurrencies’ latest price plunge demonstrates the extreme volatility of what he calls a “pseudo-asset class,” and expressed hope that policymakers recognize the risks before further damage occurs.

He recalled that one year earlier, Donald Trump had returned to the US presidency after courting retail crypto investors and receiving significant backing from crypto industry figures. This led several evangelists to predict that Bitcoin would reach at least $200,000 by the end of 2025 and become “digital gold.”

Roubini: Bitcoin Isn’t a Hedge

According to Roubini, Trump followed through by dismantling most crypto regulations, signing the Guiding and Establishing National Innovation for US Stable Coins (GENIUS) Act, pushing the Digital Asset Market Clarity (CLARITY) Act, profiting from domestic and foreign crypto deals, promoting a meme coin bearing his name, pardoning crypto criminals allegedly linked to terrorist organizations, and hosting private White House dinners for crypto insiders.

Roubini noted that crypto was also expected to benefit from macroeconomic and geopolitical risks, including rising public debt, fiat currency debasement, trade wars, and increased tensions involving the US, Iran, and China, factors that coincided with gold rising more than 60% in 2025.

Bitcoin, however, fell 6% that year and, as of the time of writing, was down 42% from its October peak and below its level at Trump’s election, while the TRUMP and MELANIA meme coins had dropped 95%. Roubini said Bitcoin repeatedly declined during periods when gold rallied, and argued that it behaves as a leveraged risk asset correlated with speculative stocks rather than a hedge.

He reiterated his long-standing view that crypto does not function as a currency, as it is neither a unit of account, a scalable payment system, nor a stable store of value, while citing El Salvador’s experience, where Bitcoin accounts for less than 5% of transactions. He further argued that crypto is not a true asset because it lacks income streams or real-world utility.

You may also like:

On Stablecoins and Regulations

Roubini said the only widely adopted crypto application after 17 years is the stablecoin, which he described as a digital form of fiat money already replicated by traditional finance, and maintained that most blockchain-based systems are centralized, permissioned, and privately controlled. He asserted that fully decentralized finance will never scale because governments will not permit anonymous transactions, and that AML and KYC requirements undermine claims of lower costs.

While speaking about regulation, Roubini warned the GENIUS Act risks recreating the instability of 19th-century free banking, as stablecoins lack narrow bank regulation, lender-of-last-resort access, or deposit insurance, making them vulnerable to runs. He also criticized proposals allowing stablecoins to pay interest, and claimed that this could destabilize fractional reserve banking unless payments and credit creation are structurally separated.

Roubini’s comments come as Bitcoin continues its downward trajectory, falling a fresh 6% on Thursday and trading below $71,600 at the time of writing. The latest decline has added to broader market unease, and analysts are warning that continued weakness in BTC could have wider implications. Market experts have increasingly raised concerns that firms holding large BTC reserves may face massive balance-sheet stress and systemic risk if prices continue to slide.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Sovcombank launches bitcoin-backed loans for Russian miners and businesses

Sovcombank, the ninth-largest Russian bank by assets, said it became the first financial institution in the country to offer bitcoin-backed loans to individuals and corporations who legally own digital assets.

The move follows a pilot program by state-owned Sberbank, which in late December issued the first such product to mining firm Intelion Data. While crypto-secured lending remains limited amid regulatory uncertainty, Russian banks have increasingly shown interest in borrowing against bitcoin as mining firms and crypto-holding businesses look to unlock liquidity while retaining their digital assets.

“Specifically, we offer bitcoin-secured lending, allowing our clients to raise financing for business development without having to sell their assets,” Marina Burdonova, Sovcombank’s compliance director, said in a statement. Only companies and individuals who legally own digital assets will have access to the bitcoin-backed lending products, she said.

Crypto mining in Russia became legal Nov. 1, 2024 after the government introduced a law allowing legal entities and entrepreneurs registered with the Ministry of Digital Development to engage in the activity. Unregistered miners could operate only if they do not exceed energy consumption limits.

A month later, the government imposed a six-year ban on crypto mining in 10 regions due to the industry’s high power consumption. In December 2025, it reopened the cryptocurrency market to the public with new rules laid out by the country’s central bank.

“Mining has ceased to be a niche ‘bitcoin mining’ activity. It has become an investment class with predictable returns, a payback period and manageable risks,” Burdonova said. “Sovcombank sees potential in partnerships with all crypto industry participants, from miners and data center operators to crypto exchanges and money changers.”

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat6 hours ago

NewsBeat6 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

Trump nominates Kevin Warsh to be the new head of the federal reserve.

Trump nominates Kevin Warsh to be the new head of the federal reserve.