Crypto World

EU Tokenization Companies Urge Fixes to DLT Pilot Rules

A group of European tokenization operators has urged EU policymakers to swiftly amend the bloc’s DLT Pilot Regime, warning that current asset limits, volume caps and time-limited licenses are preventing regulated onchain markets from scaling as the United States advances toward industrial-scale tokenization and near-instant settlement.

In a joint letter coordinated ahead of an upcoming parliamentary debate, tokenization and market infrastructure companies Securitize, 21X, Boerse Stuttgart Group, Lise, OpenBrick, STX and Axiology called for targeted changes to the DLT Pilot Regime, the EU’s regulatory sandbox for tokenized securities markets.

The companies said the EU’s broader Market Integration and Supervision Package sets the right long-term direction, but warned that existing constraints are already limiting the growth of regulated tokenized products in Europe. Pointing to the United States as a key contrast, they wrote:

Without timely action on the DLT Pilot Regime, the EU risks losing market relevance. The structural inertia of this package delays effective application until at least 2030 — creating not a temporary setback, but a critical strategic vulnerability.

They added that “global liquidity will not wait” if Europe remains constrained, warning it could migrate permanently to US markets as onchain settlement infrastructure matures.

Rather than calling for deregulation, the companies proposed a narrow technical “quick fix” that would keep existing investor protections intact. The changes would expand the scope of eligible assets, raise current issuance caps and remove the six-year limit on pilot licenses to allow regulated operators to scale products already live in other jurisdictions.

The group said the adjustments could be adopted quickly through a standalone technical update without reopening the EU’s broader market-structure reforms.

It warned that prolonged delays risk weakening the euro’s competitiveness in global capital markets as settlement and issuance activity shifts toward faster, fully digital market infrastructure.

Related: Gemini announces exit from UK, EU, Australia, slashes workforce

US regulators and exchanges advance tokenization framework

The US has taken regulatory steps toward tokenization by clarifying how tokenized securities can be issued, custodied and settled within existing market infrastructure.

On Dec. 11, 2025, the Securities and Exchange Commission (SEC) Trading and Markets Division outlined how broker-dealers can custody tokenized stocks and bonds under existing customer protection rules, signaling that blockchain-based securities will be governed within the traditional regulatory framework rather than treated as a new asset class.

The SEC issued a no-action letter on the same day to a subsidiary of Depository Trust & Clearing Corporation, clearing the way for a new securities market tokenization service. DTCC said its Depository Trust Company unit has been authorized to launch a service that tokenizes real-world assets already held in DTC custody.

On Jan. 28, the SEC issued guidance clarifying how it views tokenized securities, splitting them into two categories: those tokenized by issuers and those tokenized by unaffiliated third parties, a move aimed at giving companies a clearer regulatory footing as tokenization activity expands.

Alongside clearer US regulatory guidance, Nasdaq and the New York Stock Exchange have begun exploring tokenization within traditional market infrastructure.

In November 2025, Nasdaq said securing SEC approval for its September proposal to list tokenized stocks was a top priority, noting that the exchange was responding to public comments and regulator questions as the review process continued.

On Jan. 17, the NYSE said it is developing a platform to trade tokenized stocks and exchange-traded funds, pending regulatory approval, that would support 24/7 trading and near-instant settlement using blockchain-based post-trade systems.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Bitcoin has lost all of its gains since Trump’s election

Donald Trump has embraced bitcoin (BTC) as a core part of his second administration, creating a strategic BTC reserve, insisting all BTC should be made in the United States, and destroying or disabling huge portions of the regulatory apparatus that had previously pursued cryptocurrency firms.

Additionally, both he and his sons have vigorously embraced the industry in ways that continue to generate massive profits for this family.

Many Bitcoiners and crypto enthusiasts were similarly ecstatic for the opportunity to support Trump and free themselves from the perceived tyranny of the Joseph Biden administration and the enforcement work of then-SEC head Gary Gensler.

Jesse Powell, Tyler Winklevoss, and Cameron Winklevoss all ended up making donations to Trump that would have been illegal had they not been refunded.

Read more: Who is behind World Liberty Financial, Trump’s new crypto?

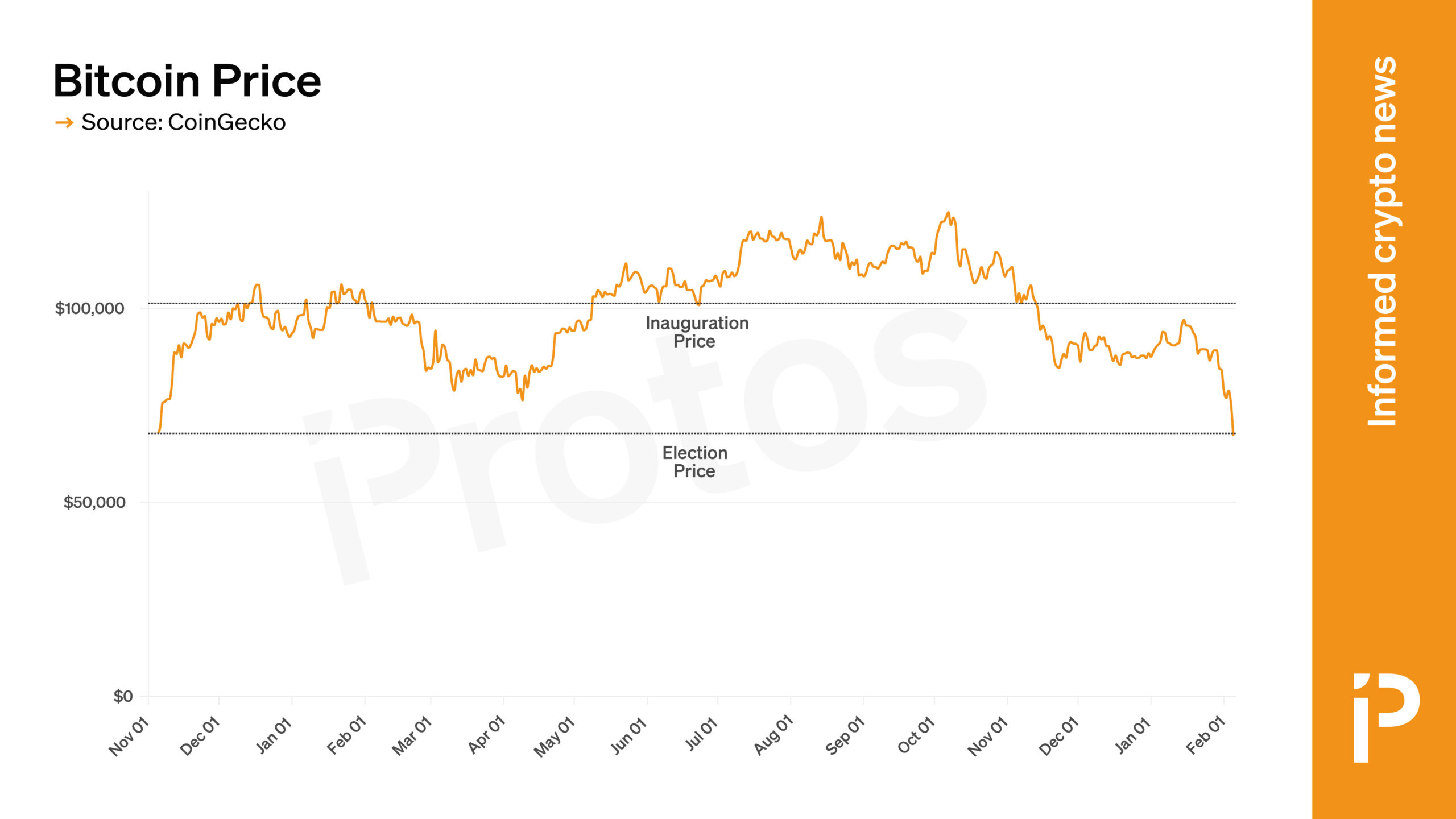

Despite this mutual embrace, the price of BTC hasn’t benefitted from the Trump administration.

When Trump was inaugurated as president, BTC was trading for approximately $101,000.

Today, it trades for approximately $67,000, a fall of approximately 33%.

Even if we imagine that the value of BTC began increasing as soon as Trump was elected, before he had any real power, in anticipation of what he might do, BTC is still down since then.

On November 5, 2024, the date of the presidential election, BTC was trading for approximately $67,800.

Today, as mentioned before, it’s several hundred dollars less than that.

Despite all the hopes Bitcoiners may have pinned on Trump, he’s done little to benefit their portfolios.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

BitMEX Launches Hyperliquid Copy Trading for PerpDEX Alpha

BitMEX, one of the safest exchanges, announced today the launch of Hyperliquid Copy Trading, giving its users the ability to copy the best Hyperliquid perps traders. The release allows traders to enjoy the best of both worlds, combining access to Hyperliquid’s best traders with the user experience and safety of the BitMEX platform.

Hyperliquid Copy Trading marks a major expansion to BitMEX’s existing Copy Trading feature, which allows users to automatically replicate the trading strategies and positions of elite traders. This ensures access to the sharpest trader strategies without any exposure to underlying DeFi risk. Designed for effortless trading, BitMEX Copy Trading saves time by enabling less experienced traders to follow the wisdom of profitable professionals.

Hyperliquid remains a dominant force in the decentralized perpetual exchange (PerpDEX) landscape, capturing over 60% of all open interest. It combines features of futures contracts with spot trading flexibility, allowing traders to speculate on asset prices without an expiration date.

Users who navigate to BitMEX’s Copy Trading Marketplace will see a Hyperliquid sub-tab. This displays a leaderboard of the top Hyperliquid traders that they can copy or reverse copy trade. Positions are automatically opened on BitMEX, replicating the strategy of the Hyperliquid trader in question. Each Hyperliquid trader is ranked by metrics such as PnL, Drawdown, Win Ratio, and AUM (Assets Under Management), making it easy to identify top-performing traders.

BitMEX CEO Stephan Lutz said:

“BitMEX pioneered the perpetual swap, which has since become the industry standard for futures trading. The launch of Hyperliquid Copy Trading completes the circle, bringing the alpha available on the world’s leading PerpDEX to BitMEX users and incorporating it into their existing workflow.”

Up to five Hyperliquid traders can be copied simultaneously using BitMEX’s Copy Trading Marketplace, with users able to customize their preferred risk management settings for each, such as by implementing Take Profits and Stop Loss. Choosing a Copy Leader that suits their needs allows them to automate their crypto derivatives trading and make more informed decisions.

To celebrate the launch, BitMEX is offering a 100,000 USDT prize pool for eligible users who trade Copy Trade on their platform. Additional educational resources and product guides are available through the BitMEX website and blog.

About BitMEX

BitMEX is the OG crypto derivatives exchange, providing professional crypto traders with a platform that caters to their needs with low latency, deep crypto native and especially BTC liquidity and unmatched reliability.

Since its founding, no cryptocurrency has been lost through intrusion or hacking, allowing BitMEX users to trade with confidence that their funds are secure and that they have access to the products and tools required to be profitable.

BitMEX was also among the first exchanges to publish on chain Proof of Reserves and Proof of Liabilities data. The exchange continues to publish this data twice a week, providing assurance that customer funds are safely stored and segregated.

For more information, users can visit the BitMEX Blog or www.bitmex.com and follow Discord, Telegram and Twitter.

Crypto World

Wormhole Records $17.6B in 2025 Volume as Institutions Drive Multichain Adoption

TLDR:

- Wormhole processed $17.6B in 2025 volume, bringing cumulative transactions beyond $70B milestone.

- BlackRock, Apollo Global, and VanEck deployed tokenized funds across chains via Wormhole infrastructure.

- Over 100 tokens worth $170B in market cap launched using Wormhole’s NTT standard across 40+ blockchains.

- Ripple’s RLUSD and Sky’s USDS adopted NTT for native multichain expansion without liquidity fragmentation.

Wormhole has emerged as a leading multichain protocol, processing $17.6 billion in volume throughout 2025 and surpassing $70 billion in cumulative transactions.

The platform expanded its reach across more than 40 blockchains while securing partnerships with major institutions, including BlackRock, Apollo Global, and VanEck.

This growth reflects increasing demand for secure, cross-chain infrastructure as real-world assets move onchain.

Institutional Players Deploy Real-World Assets Through Wormhole Infrastructure

BlackRock’s BUIDL fund expanded operations across Solana and BNB Chain using Wormhole’s multichain infrastructure.

Securitize powered the tokenization process for this expansion, marking a notable milestone in institutional crypto adoption.

Apollo Global chose Wormhole through Securitize for the multichain tokenization of its Apollo Diversified Credit Securitize Fund, known as ACRED.

This selection demonstrates growing confidence in Wormhole’s ability to handle regulated financial products across multiple blockchain networks.

VanEck launched its first tokenized treasury fund spanning Solana, Avalanche, BNB Chain, and Ethereum. The asset manager relied on Securitize for tokenization while Wormhole provided the necessary interoperability between chains. “2025 marked a clear shift in how institutions approached multichain systems,” Wormhole noted in its annual report.

Hamilton Lane expanded its flagship SCOPE fund to Optimism and Ethereum via Securitize, designating Wormhole as the exclusive interoperability provider.

Meanwhile, Transfero Group adopted Wormhole’s Native Token Transfers (NTT) standard to expand BRZ, the world’s largest non-USD stablecoin, across different chains.

Mercado Bitcoin, a leading Latin American digital asset platform, selected Wormhole as its exclusive interoperability provider for a tokenized assets platform supporting over $200 million in assets.

NTT Standard Powers Over 100 Tokens Across Stablecoins and Major Assets

Wormhole’s NTT standard gained significant traction in 2025, with more than 100 tokens launching across 40-plus chains.

These tokens represented a combined market capitalization exceeding $170 billion, establishing NTT as an infrastructure for multichain asset issuance.

“NTT became the go-to infrastructure for issuing multichain assets without breaking liquidity, fragmenting supply, or losing issuer control,” the protocol stated.

Ripple’s RLUSD, regulated by the New York Department of Financial Services, adopted the NTT standard for expansion to Base, Optimism, Ink, and Unichain.

Sky Ecosystem’s USDS expanded to Solana via Wormhole NTT, transferring more than $880 million across the multichain economy.

M0, a decentralized stablecoin infrastructure layer, expanded to Arbitrum, Base, Solana, and Optimism using NTT. This enabled day-one native multichain launches for assets including MetaMask’s mUSD and Noble’s USDN.

Mento Labs selected Wormhole as its exclusive interoperability provider for multichain trading between 17-plus stablecoins. The platform emphasized that stablecoins “became one of the clearest signals of multichain maturity” during the year.

Beyond stablecoins, major assets adopted NTT for multichain expansion. Stacks brought sBTC and STX across Solana and Sui Network.

DOGE became a canonical multichain asset through NTT, while Hyperliquid’s HYPE expanded to Solana and Unichain. Lido Finance expanded wstETH to BNB Chain following community approval.

The Uniswap Foundation collaborated with Wormhole to enable native access to assets like SOL and HYPE on Unichain. Ethereum remained the leading destination chain with $4.5 billion in inflows, closely followed by Solana and BNB Chain.

Crypto World

Bloomberg analyst warns Bitcoin price could dip to $10K

A senior Bloomberg Intelligence strategist has warned that Bitcoin could face a severe collapse toward $10,000 as global markets show signs of stress similar to past financial crises.

Summary

- A Bloomberg analyst warned bitcoin price could fall toward $10,000.

- The call is linked to market stress and reduced liquidity.

- Bitcoin is trading near $63,000 after recent losses.

In recent social media posts in early Feb. 2026, Bloomberg Intelligence senior commodity strategist Mike McGlone shared the outlook, comparing current conditions to the 2008 financial crisis and the 2000–2001 dot-com downturn.

At press time, Bitcoin was trading near $63,000 after falling to around $60,000 on Feb. 5. Since its 2025 peak of over $126,000, the asset has dropped by almost 50%. Pressure on the cryptocurrency market has increased due to large liquidations, exchange-traded fund withdrawals, and low risk appetite.

McGlone links Bitcoin risk to macro stress

According to McGlone, 2026 will be challenging for traders due to reduced liquidity, slower growth, and fading speculative excess.

In his recent commentary, he pointed to what he described as “post-inflation deflation,” reduced central bank support, and years of aggressive risk-taking that are now being unwound. He also cited potential shifts in U.S. monetary policy, including hawkish appointments and slower rate cuts, as factors limiting liquidity.

According to McGlone, these conditions resemble periods that preceded major asset crashes in the past. In that context, he said Bitcoin could revisit levels near $10,000, which would represent an additional drop of more than 85% from current prices.

He has made similar warnings before. In late 2025, McGlone raised concerns about bubble-like behavior in crypto and warned of deep corrections. While those earlier calls did not play out in full, his latest comments link the risk more directly to wider market weakness.

McGlone has also highlighted persistent ETF outflows, lower speculative activity, and what he calls a “great reversion” after years of easy money and rising asset prices.

Signs of capitulation raise short-term uncertainty

Other analysts see growing evidence that the market is entering a capitulation phase, even if they do not share McGlone’s extreme downside target.

In a Feb. 6 post on X, Jamie Coutts, a crypto market analyst at Real Vision, said pressure in derivatives and spot markets is intensifying. He noted that Bitcoin’s Implied Volatility Index has reached 88.55, close to the level of 105 recorded during the FTX collapse.

Coutts also pointed to Coinbase’s eighth-largest daily trading volume on record at $3.34 billion, or roughly 54,000 BTC, as traders rushed to re-position. At the same time, daily relative strength index fell to 15.64, below levels seen during the March 2020 pandemic crash.

“The current margin calls and forced liquidations are typical of a capitulation phase,” Coutts wrote, adding that market bottoms often form over days or weeks rather than in a single session.

Based on past averages and actual price levels, some analysts argue that Bitcoin may find support in the $50,000 to $60,000 range. Some believe that the current decline is not the beginning of a complete collapse, but rather a reset following sharp gains in 2024 and 2025.

However, the risks are still high. If prices decline once more, large corporate holders, mining companies, and highly leveraged traders may experience additional strain. As the market looks for stability, traders are bracing themselves for more volatility in the coming weeks due to limited liquidity and fading confidence.

Crypto World

Multiliquid Metalayer Roll Out Instant Redemptions for Tokenized RWAs

Multiliquid and Metalayer Ventures have launched an institutional liquidity facility designed to unlock instant redemptions for tokenized real-world assets on Solana. The arrangement, raised and managed by Metalayer, with Uniform Labs providing the underlying infrastructure via Multiliquid’s protocol, aims to replicate traditional finance liquidity tools for crypto-backed RWAs. The facility acts as a standing buyer, ready to purchase tokenized assets at a dynamic discount to net asset value, enabling holders to swap into stablecoins immediately. The move comes as BIS warned last year that liquidity mismatches in tokenized money-market funds could amplify stress during heavy redemption periods. Initial assets include tokenized Treasuries and products from VanEck, Janus Henderson, and Fasanara.

Key takeaways

- The facility functions as a standing buyer of tokenized RWAs, purchasing assets at a dynamic discount to NAV to enable instant redemptions for holders.

- Metalayer Ventures provides and manages the capital backing redemptions, while Multiliquid supplies the smart contract infrastructure used for pricing, compliance enforcement and settlement.

- Initial inclusions encompass tokenized Treasuries and select alternative investment products issued by VanEck, Janus Henderson and Fasanara.

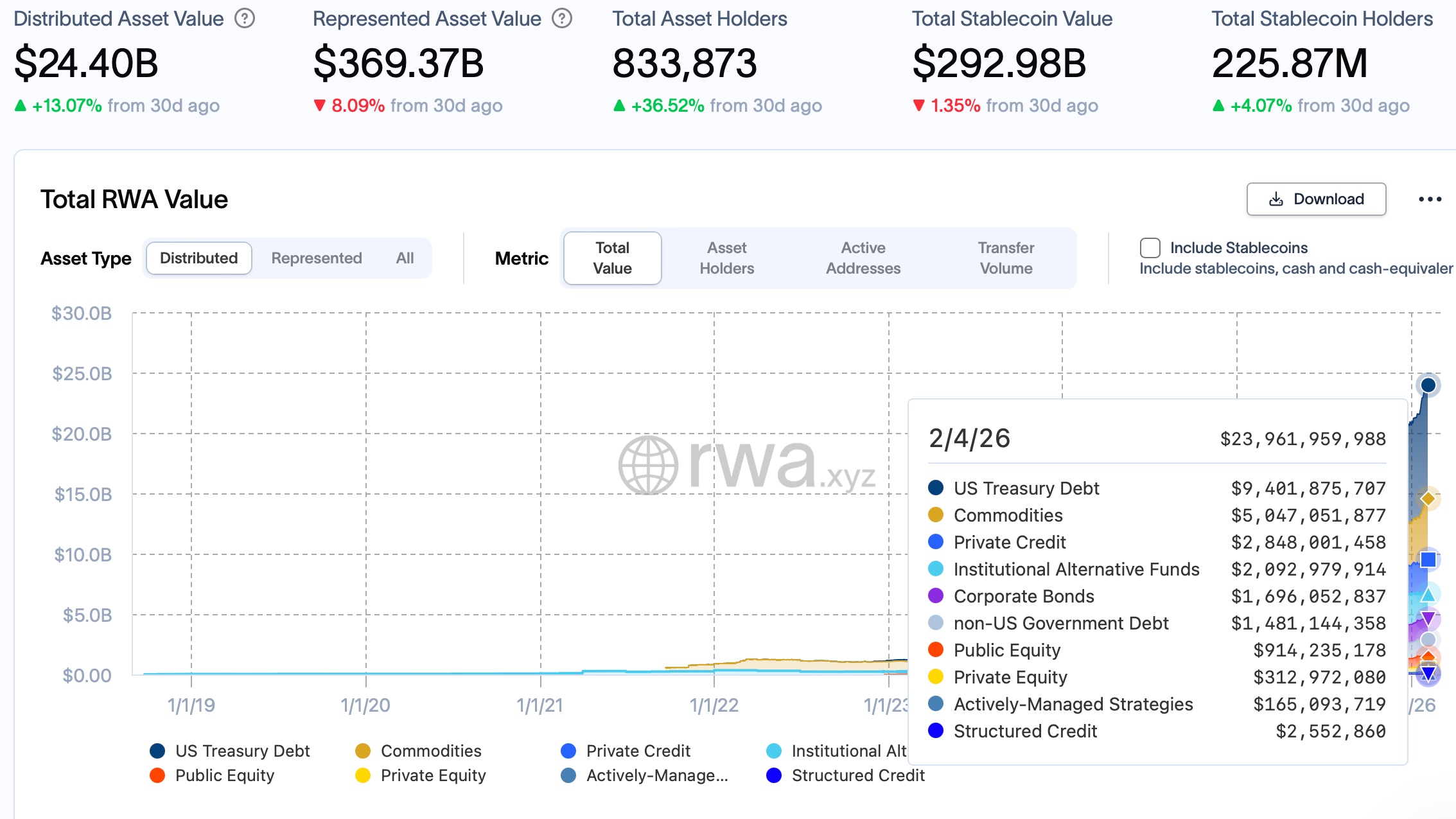

- Solana has emerged as a growing venue for tokenized RWAs, with about $1.2 billion represented across 343 assets, according to RWA.xyz data, roughly 0.31% of the market.

- Within the broader ecosystem, Canton Network dominates by total RWAs (> $348 billion), followed by Ethereum (CRYPTO: ETH) and Provenance, each with around $15 billion in tokenized assets.

- The initiative is partly a response to liquidity risks highlighted by the BIS, underscoring the need for scalable liquidity rails in tokenized markets.

Market context: The launch reflects a broader industry push to build on-chain liquidity infrastructure for tokenized real-world assets, aligning with macro trends toward institutional-grade mechanisms that bridge traditional finance and crypto markets while navigating evolving regulatory signals.

Why it matters

For investors and traders, the new facility could reshape how tokenized RWAs are funded and redeemed. By providing a standing buyer that can absorb redemption pressure, the mechanism reduces the time needed to convert on-chain asset positions into stablecoins, mitigating liquidity squeeze risks that can arise when redemptions spike. This is particularly important for assets such as tokenized Treasuries and other income-oriented products, where sudden shifts in demand could otherwise lead to volatile pricing or forced liquidations.

From a technology and market structure perspective, the arrangement showcases how traditional financial concepts—repo markets, prime brokerage and overnight lending—can be mirrored on a blockchain layer. Uniform Labs’ role in offering the pricing and market-support framework, backed by Multiliquid’s pricing contracts and settlement logic, demonstrates a clear path to scalable, auditable, and compliant on-chain liquidity for RWAs. The emphasis on compliance enforcement within the smart contracts is also notable, given the need to align on-chain activity with real-world asset issuance standards.

The inclusion of issuers such as VanEck, Janus Henderson and Fasanara points to a pragmatic roadmap: established asset managers are willing to pilot tokenized offerings on Solana, signaling confidence in the ecosystem’s ability to deliver timely redemptions and predictable pricing. As tokenized assets proliferate, the ability to redeem quickly into stablecoins becomes a differentiator for platforms seeking to attract institutional capital while maintaining liquidity resilience in stressed markets.

On the ecosystem side, Solana’s growing share in tokenized RWAs underscores diversification in the sector. The latest data from RWA.xyz places Solana at about $1.2 billion across 343 assets, contributing roughly 0.31% of the total market value—but with momentum: annualized growth in RWA value on Solana exceeded 10% over the past month. Within the same market, Canton Network remains the largest chain by RWAs, surpassing $348 billion in total value, while Ethereum (CRYPTO: ETH) and Provenance sit behind with approximately $15 billion each. This hierarchy reflects a multi-chain landscape where liquidity, settlement speed, and regulatory alignment are all critical to realizing scalable tokenized markets.

The BIS warning cited last year—about liquidity mismatches in tokenized money market funds—serves as a cautionary backdrop for these developments. The new facility aims to address that risk by introducing a predictable liquidity backstop, reducing the likelihood that redemptions outpace available liquidity and forcing asset managers to liquidate positions at unfavorable prices. While the approach is still early-stage and focused on a subset of RWAs, it signals an important shift toward institutional-grade liquidity infrastructure in the tokenized asset space.

What to watch next

- Live deployment: Monitor the first issuances and the timing of the facility’s onboarding of tokenized RWAs on Solana.

- Expansion of asset roster: Track new issuers and additional asset classes added to the platform beyond VanEck, Janus Henderson and Fasanara.

- Pricing and settlement dynamics: Observe how the dynamic discount to NAV behaves under stressed conditions and how settlement latency evolves.

- Regulatory signals: Watch BIS and other regulators for updates that could influence tokenized money market standards and liquidity facilities.

- Ecosystem integration: Look for interoperability with other Solana-based liquidity layers and DeFi protocols to broaden the utility of tokenized RWAs.

Sources & verification

- The official announcement detailing the liquidity facility and its participants, shared with industry press.

- Bank for International Settlements, Liquidity in tokenized money market funds report, BIS Bulletin 115.

- RWA.xyz data on Solana’s tokenized asset value and asset count.

- Asset issuers’ materials and publicly available press releases from VanEck, Janus Henderson, and Fasanara regarding tokenized product offerings.

Liquidity rails for tokenized RWAs on Solana

Multiliquid and Metalayer Ventures have introduced a structured liquidity facility designed to address a core hurdle in tokenized real-world assets: the speed and reliability of redemptions. By establishing a standing buyer that purchases tokenized RWAs at a dynamic discount to net asset value, the system creates an immediate exit path for holders who wish to convert on-chain positions into stablecoins. The mechanism is underpinned by a clear division of labor: Metalayer Ventures supplies the capital that backs redemptions, while Multiliquid’s smart-contract layer handles pricing, compliance checks, and settlement. Uniform Labs, the developer behind Multiliquid’s infrastructure, provides the market-support framework that makes pricing and enforcement practical at scale.

The initial rollout focuses on tokenized assets issued by traditional asset managers, with a baseline emphasis on tokenized Treasury funds and select alternative investments. This implies that a portion of the on-chain market will be anchored by established asset-management brands, which could help attract institutional participants seeking predictable redemption dynamics and on-chain visibility. The protocol’s design uses a dynamic discount to NAV rather than a fixed price, allowing the vehicle to respond to changing market conditions and redemptions pressures in real time while maintaining capital efficiency for the purchaser.

Solana’s position as the launch platform highlights a broader narrative about where tokenized RWAs can flourish. The network is increasingly viewed as a venue for on-chain asset customization and rapid settlement, supported by a growing ecosystem of tooling and standards for real-world asset tokenization. Data from RWA.xyz show that Solana hosts around $1.2 billion in tokenized RWAs across roughly 343 assets, representing about 0.31% of the total market—yet the tiered growth in value over the last month points to a steady acceleration in on-chain RWAs. In the wider market, Canton Network holds the lion’s share of tokenized RWAs, with more than $348 billion, while Ethereum (CRYPTO: ETH) and Provenance sit at about $15 billion apiece, highlighting a multi-chain environment where liquidity, speed and regulatory alignment influence where issuers select to tokenize real-world assets.

Last year’s BIS warning emphasized the fragility that can accompany liquidity mismatches in tokenized money-market funds. The newly announced facility responds by providing an on-chain liquidity backstop designed to absorb redemption surges and deliver certainty to counterparties. While the initiative is still in early stages and focused on a limited set of assets, it signals a meaningful evolution in how on-chain liquidity can be engineered to support broader adoption of tokenized RWAs, bridging traditional finance risk controls with blockchain-based settlement and compliance mechanisms.

Crypto World

Binance Shifts From Exchange to Crypto Infrastructure Backbone in MENAP

Editor’s note: The press release below outlines how Binance is repositioning its role in the MENAP region as crypto markets mature, shifting emphasis from pure trading activity to regulated infrastructure and institutional integration. It details recent regulatory approvals, compliance milestones, and partnerships across the UAE, Pakistan, and Bahrain, highlighting a strategy focused on long-term adoption rather than rapid user growth. The announcement reflects broader market trends toward regulatory alignment, embedded financial services, and scalable digital-asset infrastructure as governments and institutions across the region formalize their approach to crypto.

Key points

- Binance is emphasizing infrastructure, compliance, and institutional partnerships over speculative trading growth.

- The ADGM FSRA license positions Binance within one of the world’s most stringent regulatory frameworks.

- In Pakistan, Binance has secured AML registration and begun a phased path toward local licensing.

- A Bahrain partnership aims to integrate regulated crypto services directly into a bank’s mobile app.

Why this matters

The MENAP region is moving quickly from crypto experimentation to regulated adoption. As governments and banks seek compliant ways to offer digital-asset services, platforms with proven scale, governance, and regulatory credibility gain a structural advantage. Binance’s recent milestones illustrate how crypto firms are increasingly aligning with traditional financial systems, shaping how digital assets may be accessed, supervised, and used by institutions and consumers across the region.

What to watch next

- Final regulatory approvals tied to announced licenses and registrations.

- Implementation timelines for bank-led crypto integrations in Bahrain.

- Further regional partnerships with financial institutions or regulators.

As the global crypto market enters a more mature phase, a quiet transformation is underway. What was once driven by speculative trading and rapid experimentation is increasingly being shaped by institutional participation, regulatory clarity, and real-world financial integration.

At the center of this shift is a growing focus on infrastructure, the systems, liquidity, compliance frameworks, and technical rails that allow digital assets to operate at scale. Binance, long known as the world’s largest cryptocurrency exchange, currently serving more than 300M users, is repositioning itself to reflect this new reality: not simply as a trading platform, but as core crypto infrastructure supporting the next generation of digital finance.

This evolution is particularly visible across the region, where regulators and financial institutions are actively building frameworks for digital-asset adoption. From the UAE to Bahrain to Pakistan, Binance’s recent regulatory milestones and partnerships point to a strategy centered on long-term integration rather than short-term growth.

From Trading Venue to Infrastructure Layer

Global market data illustrates how crypto usage is changing. On-chain activity reached record levels in 2025, with both spot and derivatives volumes rising, signaling a transition from early experimentation to consistent execution. At the same time, stablecoins have become a foundational settlement layer, processing more than $3.5 trillion in daily volume, surpassing traditional payment networks. These trends favor platforms that can operate at scale, with deep liquidity, technical reliability, and regulatory alignment. In 2025 alone, more than $34 trillion was traded on Binance’s platform, with spot volume exceeding $7.1 trillion. All-time trading volumes across products have now surpassed $145 trillion, underlining Binance’s central role in global crypto liquidity.

Compliance Becomes a Catalyst for Growth

As crypto markets mature, compliance is increasingly seen not as a constraint, but as a driver of sustainable growth. Binance’s compliance investments have expanded significantly alongside its growth. In 2025, the company’s controls prevented $6.69 billion in potential fraud and scam losses, protecting more than 5.4 million users. Binance also processed over 71,000 law-enforcement requests globally, reflecting deeper cooperation with authorities and an increasingly formalized compliance posture. For MENAP markets in particular, where regulators are designing digital-asset frameworks in parallel with rapid fintech growth this compliance-first approach has become central to Binance’s regional strategy.

ADGM License Sets a New Regulatory Benchmark

A key milestone in this shift was Binance securing a comprehensive global license from Abu Dhabi Global Market’s Financial Services Regulatory Authority (FSRA), widely regarded as one of the world’s most respected financial regulators. The authorization represents a world-first for the crypto industry and positions Binance among a select group of global financial institutions operating under ADGM’s regulatory framework. The license confirms compliance with stringent international standards covering governance, risk management, and consumer protection. The FSRA license therefore serves as a gateway for deeper institutional relationships, from custody and payments to cross-border partnerships.

Pakistan: Phased Regulation and Market Entry

Binance is advancing a phased regulatory strategy in Pakistan, one of the region’s largest and fastest-growing digital economies. Following high-level engagements with government stakeholders, Binance has obtained Anti-Money Laundering (AML) registration under Pakistan’s Virtual Assets Regulatory Authority (PVARA). The move marks a significant step toward full local licensing and incorporation.

In parallel, Binance has signed memorandums of understanding with local fintech players, including JazzCash, to explore cooperation on education initiatives and compliant digital-asset products, signaling a longer-term commitment to ecosystem development rather than transactional market entry.

Bahrain: Integrating Crypto Into Banking

In Bahrain, Binance’s strategy has moved further into traditional financial infrastructure through a partnership with Bank of Bahrain and Kuwait (BBK), one of the Kingdom’s leading retail and corporate banks. Under a memorandum of understanding, BBK plans to integrate Binance Bahrain’s regulated Crypto-as-a-Service (CaaS) solution directly into its mobile banking app, subject to final approval from the Central Bank of Bahrain. The integration would allow customers to trade and manage crypto assets within their existing banking environment, alongside traditional financial products.

The partnership positions BBK as the first bank in the GCC to join the Binance Link Program and reflects a broader trend toward embedded digital-asset services within mainstream financial platforms. For regulators and policymakers, such models offer a pathway to crypto adoption that maintains oversight while expanding access through established banking channels.

Infrastructure for the Next Phase of Digital Finance

Across the MENAP region, the emphasis is on how digital assets can be integrated responsibly into national financial systems, payment networks, and institutional investment frameworks.

“The next chapter of crypto is being built on infrastructure, not speculation,” said Tarik Erk, Regional Head for MENAT and Senior Executive Officer Abu Dhabi at Binance. “In MENAP, we’re working closely with regulators, financial institutions, and partners to create a compliant, secure, and scalable digital-asset ecosystem. Our ADGM license, regulatory progress in Pakistan, and partnerships in Bahrain reflect a clear shift from standalone platforms to integrated financial infrastructure that supports long-term adoption and institutional trust.”

As the region positions itself as a global hub for digital finance, platforms that can combine scale, liquidity, regulatory credibility, and technical depth are likely to play a defining role. For Binance, the message is clear: the future of crypto in the region is being built not on trading alone, but on the infrastructure that makes digital finance sustainable.

Crypto World

Bitwise Files S-1 With SEC to Launch Uniswap-Focused ETF, UNI Token Slumps 16%

Crypto asset manager Bitwise has become the first to file with the US regulator to launch an exchange-traded fund (ETF) dedicated to Uniswap.

The fund targets exposure to Uniswap (UNI), the governance token of the leading decentralized exchange protocol. The ETF filing marks one of the pivotal moments for DeFi.

“The Trust’s investment objective is to seek to provide exposure to the value of Uniswap held by the Trust, less the expenses of the Trust’s operations and other liabilities,” the Thursday filing with the US Securities and Exchange Commission (SEC) read.

Uniswap is a decentralized exchange (DEX) built on Ethereum that offers token swaps without an intermediary. The regulatory authorities are currently reviewing the Bitwise application.

Bitwise Forms Delaware Statutory Trust for Uniswap ETF

The asset manager initially registered a Delaware statutory trust for a potential Uniswap fund on January 27, as a routine legal step that usually precedes an SEC filing.

The move positioned Bitwise to pursue a decentralized finance protocol-tied ETF to later advance to a federal filing.

The registration follows after the SEC backed off its investigation into Uniswap Labs, the Brooklyn-based company, in February 2025. The SEC charged Uniswap for operating as an unregistered securities exchange and issuing an unregistered security.

If approved by the regulator, the Coinbase Custody Trust Company would act as the custodian for the Bitwise Uniswap ETF.

Wider Crypto Market Slump Pulls UNI Token Down by Over 16%

UNI, the native token of Uniswap, has plummeted 16.59% to $3.15 in the past 24 hours, underperforming a broader market sell-off.

The drop is part of a severe crypto-wide correction. The total market cap fell 9.84% in 24 hours, with the Fear & Greed Index hitting “Extreme Fear” at 5.

Besides, a key driver was a massive $1.03 billion in Bitcoin long liquidations, which forced leveraged positions to unwind across the board. UNI is trading at $3.15 at press time, per CoinMarketCap data.

The post Bitwise Files S-1 With SEC to Launch Uniswap-Focused ETF, UNI Token Slumps 16% appeared first on Cryptonews.

Crypto World

Bitcoin’s volatility spikes to its highest since FTX’s collapse as prices crater to nearly $60,000

Bitcoin’s Wall Street-like fear gauge has spiked to its highest level since the collapse of the FTX exchange in 2022, signaling intense market panic as prices plummeted to nearly $60,000.

Volmex’s bitcoin volatility index (BVIV), which represents the annualized expected price turbulence over four weeks, jumped to nearly 100% from 56% on Thursday.

The index serves as a crypto equivalent to Cboe’s VIX, the so-called fear/panic gauge, which indicates the 30-day implied volatility of the S&P 500 and rises during market panics as traders bid up options prices to hedge against declines in the index.

The BVIV does the same more often than not, rising during market panics as observed on Thursday.

“A wave of panic swept through crypto markets this week, correlated to a sharp risk-off move across various asset classes. Bitcoin’s 30-day implied volatility, as measured by the BVIV Index, surged from just over 40 to 95 in a matter of days, levels not seen since the infamous collapse of FTX at the end of 2022,” Cole Kennelly, founder and CEO of Volmex Labs, told CoinDesk in a Telegram chat.

Implied volatility is influenced by demand for options, or derivative contracts that help traders make asymmetrical gains from uptrends in the underlying asset and hedge downside risks. Call options are used to bet on the upside, while put options are typically bought as insurance against price drops.

On Thursday, traders scrambled to buy Deribit-listed options, especially puts, as bitcoin’s price tanked from $70,000 to nearly $60,000. The top five most traded options of the past 24 hours are all puts at strikes ranging from $70,000 to $20,000, according to data source Deribit Metrics. The $20,000 put represents a bet that prices will fall below that level.

“Volatility markets reacted sharply to last night’s price drop. Front-end volatility surged as dealers adjusted for gamma [near-term risks]. Short-dated vols led the surge, showing higher demand for protection, while longer-dated vols lagged, keeping the volatility curve steeply inverted,” Jimmy Yang, co-founder of institutional liquidity provider Orbit Markets, told CoinDesk.

Yang’s clients rushed to buy downside protection, fearing the price crash could devastate digital asset treasuries that bought bitcoin at higher levels. These firms could now liquidate at a loss, leading to a deeper slide in bitcoin’s price.

“With significant uncertainty still ahead — particularly around the DATs and the risk of further unwind cascades, we’ve seen a lot of client demand for downside protection,” he added.

Bitcoin’s price has bounced to over $64,000 at the time of writing, an over 5% recovery from overnight lows, according to CoinDesk data. Yang expects volatility to stabilize.

“Sentiment is deep in extreme fear, but bitcoin’s price seems to have found a base near $60K. If price action stabilizes, volatility looks stretched and could quickly pull back,” he said.

Crypto World

Bitcoin Crashes to $60K as Sentiment Hits 2022 Lows

Crypto market sentiment has slumped to its lowest level in over three and a half years amid Bitcoin falling by double-digit percentage points to a low of around $60,000.

The Crypto Fear & Greed Index fell to a score of 9 out of 100 on Friday, indicating “extreme fear” in the market and hitting its lowest point since June 2022, when sentiment and the market fell in the wake of the collapse of the Terra blockchain a month earlier.

The index has been at a low for the last fortnight as Bitcoin (BTC) has tanked 38% from its 2026 high of $97,000 in just three weeks, wiping out all gains for the past sixteen months.

Bitcoin falls to $60,000 on Coinbase

Bitcoin fell to its lowest level since October 2024 at a little over $60,000 on Coinbase in early trading on Friday morning, according to TradingView.

It is currently trading at just over $64,000 after dumping 13% over the past 24 hours and losing over $10,000 in its largest daily loss since mid-2022.

Related: Coinbase premium hits yearly low, hinting at institutional selling

Bitcoin has now collapsed below the 200-week exponential moving average, a long-term trend indicator, which has only previously happened in the depths of a bear market. It is currently 50% down from its all-time high of $126,000 in early October.

Over the past 24 hours, more than 588,000 traders were liquidated for $2.7 billion, 85% of them were leveraged longs predominantly in Bitcoin, according to CoinGlass.

Tech stock slump and Fed caution behind the crash

Jeff Ko, chief analyst at CoinEx Research, told Cointelegraph that Bitcoin’s more than 20% drawdown in a week comes alongside a selloff in US tech stocks “where stretched valuations and lingering concerns around an artificial intelligence-driven bubble have long been highlighted by the market.”

“Even Amazon suffered a double-digit decline overnight following a mixed earnings release,” he added. “Investors are increasingly reassessing Bitcoin’s failure to function as a safe haven compared to gold.”

LVRG Research director Nick Ruck said Bitcoin’s fall and a broader market decline comes amid “heightened risk aversion” triggered by “softer US job market signals, including rising unemployment claims that raise doubts about sustained economic strength and potential Fed caution on aggressive rate cuts.”

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

Nvidia, Palantir stocks sink amid growth, value rotation

Nvidia shares slid to their lowest level since December, falling roughly 20% from record highs as an accelerating rotation from growth to value pushed the world’s most valuable company into bear-market territory.

Similarly, Palantir stock dropped to $130 as crypto.news predicted before its earnings.

Summary

- NVIDIA share price dropped into a bear market on Thursday.

- There are signs that investors are dumping growth stocks.

- Technical analysis points to a drop to $150.

Why is Nvidia down?

The ongoing Nvidia stock crash mirrors that of other growth companies. For example, AMD, its key competitor, tumbled to $194, down 27% from its December high.

The software sector slid into a technical bear market, with the iShares Expanded Tech-Software ETF (IGV) down more than 20% as investor anxiety around AI disruption fueled what some are calling a “SaaSpocalypse.” Fears that autonomous AI agents could replace traditional software licenses have weighed on stocks such as Palantir, which continued to sink.

Wedbush analyst Dan Ives pushed back on the pessimism, calling the selloff a “software garage sale” and arguing the market is pricing in an unrealistic doomsday scenario. Ives said enterprise software remains deeply embedded, citing data security risks and migration costs. He named Palantir, Microsoft, Snowflake, Salesforce, and CrowdStrike as long-term winners despite the recent panic.

On the other hand

Value companies are doing well, with the Vanguard Value ETF and the Schwab U.S. Dividend ETF (SCHD) rising by nearly 10% this year. They are all trading at their all-time highs.

Nvidia stock has crashed as traders reflect on key concerns. For example, there are concerns about whether big-tech companies will continue their spending. These concerns accelerated after Microsoft’s report showed that its cloud revenue slowed in the fourth quarter. Its stock has dropped to $400, down by 27 from its all-time high.

Therefore, there is a risk that the company and other top hyperscalers will begin to pare back their spending to please investors concerned about return on investment.

NVIDIA stock has sunk as investors remain concerned about its Chinese business. A report by the Financial Times said that the Trump administration was still conducting a review on sales of H200 chips to China. Beijing has allowed ByteDance, Tencent, and Alibaba to buy 400k chips.

At the same time, Nvidia’s biggest customers are working on their own ASIC chips. Google is working on its TPU chips, while Amazon, Microsoft, and OpenAI are hoping to launch theirs soon. This development may lead to competition and lower sales in the long-term.

The next key catalyst for Nvidia’s stock price is its financial results, which will provide more information about its business. Analysts anticipate its revenue will come in at $67 billion, up over 50% from 2024. Its annual revenue is expected to exceed $500 billion by 2027 or 2028.

NVIDIA share price technical analysis

The daily chart shows that the NVDA share price is flashing red signals. It has formed a head-and-shoulders pattern and is now at the neckline. This is one of the most common bearish reversal sign.

It has moved below the 23.6% Fibonacci Retracement level. Also, it retreated below the 50-day moving average and the Supertrend indicator. Therefore, the most likely forecast is that it continues falling, potentially to $150, the 50% retracement level.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business11 hours ago

Business11 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat17 hours ago

NewsBeat17 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World11 hours ago

Crypto World11 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

UPDATE: Bitwise registers for a

UPDATE: Bitwise registers for a