Crypto World

Multiliquid Metalayer Roll Out Instant Redemptions for Tokenized RWAs

Multiliquid and Metalayer Ventures have launched an institutional liquidity facility designed to unlock instant redemptions for tokenized real-world assets on Solana. The arrangement, raised and managed by Metalayer, with Uniform Labs providing the underlying infrastructure via Multiliquid’s protocol, aims to replicate traditional finance liquidity tools for crypto-backed RWAs. The facility acts as a standing buyer, ready to purchase tokenized assets at a dynamic discount to net asset value, enabling holders to swap into stablecoins immediately. The move comes as BIS warned last year that liquidity mismatches in tokenized money-market funds could amplify stress during heavy redemption periods. Initial assets include tokenized Treasuries and products from VanEck, Janus Henderson, and Fasanara.

Key takeaways

- The facility functions as a standing buyer of tokenized RWAs, purchasing assets at a dynamic discount to NAV to enable instant redemptions for holders.

- Metalayer Ventures provides and manages the capital backing redemptions, while Multiliquid supplies the smart contract infrastructure used for pricing, compliance enforcement and settlement.

- Initial inclusions encompass tokenized Treasuries and select alternative investment products issued by VanEck, Janus Henderson and Fasanara.

- Solana has emerged as a growing venue for tokenized RWAs, with about $1.2 billion represented across 343 assets, according to RWA.xyz data, roughly 0.31% of the market.

- Within the broader ecosystem, Canton Network dominates by total RWAs (> $348 billion), followed by Ethereum (CRYPTO: ETH) and Provenance, each with around $15 billion in tokenized assets.

- The initiative is partly a response to liquidity risks highlighted by the BIS, underscoring the need for scalable liquidity rails in tokenized markets.

Market context: The launch reflects a broader industry push to build on-chain liquidity infrastructure for tokenized real-world assets, aligning with macro trends toward institutional-grade mechanisms that bridge traditional finance and crypto markets while navigating evolving regulatory signals.

Why it matters

For investors and traders, the new facility could reshape how tokenized RWAs are funded and redeemed. By providing a standing buyer that can absorb redemption pressure, the mechanism reduces the time needed to convert on-chain asset positions into stablecoins, mitigating liquidity squeeze risks that can arise when redemptions spike. This is particularly important for assets such as tokenized Treasuries and other income-oriented products, where sudden shifts in demand could otherwise lead to volatile pricing or forced liquidations.

From a technology and market structure perspective, the arrangement showcases how traditional financial concepts—repo markets, prime brokerage and overnight lending—can be mirrored on a blockchain layer. Uniform Labs’ role in offering the pricing and market-support framework, backed by Multiliquid’s pricing contracts and settlement logic, demonstrates a clear path to scalable, auditable, and compliant on-chain liquidity for RWAs. The emphasis on compliance enforcement within the smart contracts is also notable, given the need to align on-chain activity with real-world asset issuance standards.

The inclusion of issuers such as VanEck, Janus Henderson and Fasanara points to a pragmatic roadmap: established asset managers are willing to pilot tokenized offerings on Solana, signaling confidence in the ecosystem’s ability to deliver timely redemptions and predictable pricing. As tokenized assets proliferate, the ability to redeem quickly into stablecoins becomes a differentiator for platforms seeking to attract institutional capital while maintaining liquidity resilience in stressed markets.

On the ecosystem side, Solana’s growing share in tokenized RWAs underscores diversification in the sector. The latest data from RWA.xyz places Solana at about $1.2 billion across 343 assets, contributing roughly 0.31% of the total market value—but with momentum: annualized growth in RWA value on Solana exceeded 10% over the past month. Within the same market, Canton Network remains the largest chain by RWAs, surpassing $348 billion in total value, while Ethereum (CRYPTO: ETH) and Provenance sit behind with approximately $15 billion each. This hierarchy reflects a multi-chain landscape where liquidity, settlement speed, and regulatory alignment are all critical to realizing scalable tokenized markets.

The BIS warning cited last year—about liquidity mismatches in tokenized money market funds—serves as a cautionary backdrop for these developments. The new facility aims to address that risk by introducing a predictable liquidity backstop, reducing the likelihood that redemptions outpace available liquidity and forcing asset managers to liquidate positions at unfavorable prices. While the approach is still early-stage and focused on a subset of RWAs, it signals an important shift toward institutional-grade liquidity infrastructure in the tokenized asset space.

What to watch next

- Live deployment: Monitor the first issuances and the timing of the facility’s onboarding of tokenized RWAs on Solana.

- Expansion of asset roster: Track new issuers and additional asset classes added to the platform beyond VanEck, Janus Henderson and Fasanara.

- Pricing and settlement dynamics: Observe how the dynamic discount to NAV behaves under stressed conditions and how settlement latency evolves.

- Regulatory signals: Watch BIS and other regulators for updates that could influence tokenized money market standards and liquidity facilities.

- Ecosystem integration: Look for interoperability with other Solana-based liquidity layers and DeFi protocols to broaden the utility of tokenized RWAs.

Sources & verification

- The official announcement detailing the liquidity facility and its participants, shared with industry press.

- Bank for International Settlements, Liquidity in tokenized money market funds report, BIS Bulletin 115.

- RWA.xyz data on Solana’s tokenized asset value and asset count.

- Asset issuers’ materials and publicly available press releases from VanEck, Janus Henderson, and Fasanara regarding tokenized product offerings.

Liquidity rails for tokenized RWAs on Solana

Multiliquid and Metalayer Ventures have introduced a structured liquidity facility designed to address a core hurdle in tokenized real-world assets: the speed and reliability of redemptions. By establishing a standing buyer that purchases tokenized RWAs at a dynamic discount to net asset value, the system creates an immediate exit path for holders who wish to convert on-chain positions into stablecoins. The mechanism is underpinned by a clear division of labor: Metalayer Ventures supplies the capital that backs redemptions, while Multiliquid’s smart-contract layer handles pricing, compliance checks, and settlement. Uniform Labs, the developer behind Multiliquid’s infrastructure, provides the market-support framework that makes pricing and enforcement practical at scale.

The initial rollout focuses on tokenized assets issued by traditional asset managers, with a baseline emphasis on tokenized Treasury funds and select alternative investments. This implies that a portion of the on-chain market will be anchored by established asset-management brands, which could help attract institutional participants seeking predictable redemption dynamics and on-chain visibility. The protocol’s design uses a dynamic discount to NAV rather than a fixed price, allowing the vehicle to respond to changing market conditions and redemptions pressures in real time while maintaining capital efficiency for the purchaser.

Solana’s position as the launch platform highlights a broader narrative about where tokenized RWAs can flourish. The network is increasingly viewed as a venue for on-chain asset customization and rapid settlement, supported by a growing ecosystem of tooling and standards for real-world asset tokenization. Data from RWA.xyz show that Solana hosts around $1.2 billion in tokenized RWAs across roughly 343 assets, representing about 0.31% of the total market—yet the tiered growth in value over the last month points to a steady acceleration in on-chain RWAs. In the wider market, Canton Network holds the lion’s share of tokenized RWAs, with more than $348 billion, while Ethereum (CRYPTO: ETH) and Provenance sit at about $15 billion apiece, highlighting a multi-chain environment where liquidity, speed and regulatory alignment influence where issuers select to tokenize real-world assets.

Last year’s BIS warning emphasized the fragility that can accompany liquidity mismatches in tokenized money-market funds. The newly announced facility responds by providing an on-chain liquidity backstop designed to absorb redemption surges and deliver certainty to counterparties. While the initiative is still in early stages and focused on a limited set of assets, it signals a meaningful evolution in how on-chain liquidity can be engineered to support broader adoption of tokenized RWAs, bridging traditional finance risk controls with blockchain-based settlement and compliance mechanisms.

Crypto World

Horizon (Points & Referral System), an Incentive Framework for Perpetual Trading

[PRESS RELEASE – San Francisco, CA, USA, February 6th, 2026]

DipCoin today announced the official launch of its Season 1: Horizon Points & Referral System, marking the activation of DipCoin’s long-term incentive framework designed to reward real trading participation, capital contribution, and community growth across its perpetual and Vault ecosystem.

Season 1: Horizon represents more than a limited-time promotion. It establishes the foundational scoring logic, risk controls, and reward architecture that will guide DipCoin’s incentive programs across future seasons. The system is built to align user rewards with meaningful platform activity (trading, liquidity commitment, position management, and referrals) while discouraging short-term manipulation and low-quality participation.

With Horizon, DipCoin takes a step toward transforming incentives from short-term marketing campaigns into a structured, sustainable ecosystem engine.

A New Chapter: Why “Horizon”

“Horizon” symbolizes the beginning of DipCoin’s transition from a standalone perpetual trading platform into a contribution-driven ecosystem. Rather than focusing only on trading volume, Season 1 expands reward eligibility to multiple forms of participation, recognizing that healthy markets are built on more than just transactions.

This season marks the first official deployment of DipCoin’s long-term points system, which will serve as a core reference for all future seasons and ecosystem benefit distribution.

Season 1 Schedule

All Season 1 calculations follow UTC time:

- Start: February 4, 2026 – 00:00 UTC

- End: March 20, 2026 – 23:59:59 UTC

The DipCoin interface automatically converts these times to each user’s local timezone for convenience.

What Users Can Earn Points For

Season 1: Horizon quantifies real participation through four core activity categories inside DipCoin’s Perp Accounts and Vault Accounts:

- TVL Points (Deposit Contribution)

- Generated from average daily deposited balances.

- Trading Volume Points (Trading Activity)

- Generated from executed perpetual trades and Vault strategy execution.

- Position Holding Points (Position Size Contribution)

- Generated from average daily effective position size.

- Liquidation Points (Loss-Based Conversion Points)

- Generated when forced liquidations occur and result in real losses.

Only Perp and Vault activity is included. Swap trades are excluded from Season 1 calculations.

This design ensures that rewards reflect real economic engagement rather than surface-level activity.

Early Bird Rewards: Honoring Early Supporters

To recognize users who traded on DipCoin before Season 1 officially begins, the platform includes historical data as Early Bird Rewards:

Included historical data:

- Trading volume points

- Liquidation loss points

These historical points receive a 3× multiplier and appear in the Early Bird Rewards section of each user’s dashboard.

TVL, position holding, team boosts, and referrals are not included in Early Bird calculations.

How Total Season Points Are Calculated

Season Points consist of four components:

- Base Points

- Boosted Points

- Referral Rewards

- Early Bird Rewards

Boosted Points are derived from team participation:

Boosted Points = Daily Base Points × (Team Multiplier − 1)

Final Season Points = Daily Base Points + Boosted Points + Referral Rewards + Early Bird Rewards (accumulated across the season)

Welcome Points for New Users

New users who bind a wallet using an invitation code receive a 3-day Welcome Bonus:

- All Base Points earn 2x during the first three natural days.

The bonus applies to:

- TVL Points

- Trading Volume Points

- Position Holding Points

- Liquidation Points

If a user invites others during the Welcome period, the 2× bonus still applies on that day. From the following day onward, the user transitions to standard inviter status and begins earning referral rewards instead.

Team Acceleration System

DipCoin introduces a team-based acceleration model that rewards collaborative growth.

Each user may:

- Create one team

- Join one team

Users can simultaneously hold inviter and invitee roles.

The system compares both team multipliers and applies the higher value as the user’s effective multiplier.

Team Participation Requirements

For a directly invited member to contribute toward team acceleration:

- Daily trading volume ≥ 2,000 USDC

- Daily average position size ≥ 500 USDC

This ensures that team growth is driven by real traders, not passive or shell wallets.

Inviters’ own points are not counted toward their team’s total.

Referral Rebate Rewards

Inviters receive:

- 10% of the Base Points generated by each qualified direct invitee.

Only invitees who accumulate at least 20 Base Points are eligible to generate referral rewards.

Referral rewards are additive and do not reduce the invitee’s own points.

Post-Season Settlement

After Season 1 concludes:

- Season data is frozen.

- Risk review and verification are completed within 7 business days.

- Final confirmed results are published and reflected in user dashboards.

Season 1 points will be archived for historical reference. New seasons will start with fresh accumulation.

Why This Matters

Many points programs reward raw volume alone. DipCoin’s Horizon system rewards capital commitment, position exposure, trading activity, and community building together.

This multi-dimensional design reflects how real markets function and encourages behavior that strengthens liquidity, depth, and long-term platform health.

Season 1: Horizon sets the baseline for how DipCoin plans to distribute ecosystem value going forward.

How to Participate

Season 1: Horizon began February 4, 2026 (00:00 UTC).

Users can start earning points by:

- Depositing into Perp or Vault accounts

- Trading perpetual contracts

- Holding positions

- Participating in Vault strategies

- Inviting qualified users

Users can learn more and get started at: https://dipcoin.io

About DipCoin

DipCoin is a decentralized perpetual trading protocol built on Sui, focused on delivering fully on-chain, non-custodial perpetual markets with professional-grade execution and transparent infrastructure. DipCoin is building trading primitives and strategy participation tools designed for long-term on-chain market participants.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Vitalik Buterin Proposes Multi-Tiered State Design to Achieve 1000x Ethereum Scaling

TLDR:

- Ethereum state grows 100 GB yearly; 20x scaling would create 8 TB state in four years for builders.

- Strong statelessness and state expiry solutions face backwards compatibility issues with existing apps.

- New temporary storage resets monthly while UTXO systems enable zero-duration expiry for cost savings.

- Developers can keep using permanent storage initially, then migrate to cheaper tiers over time gradually.

Ethereum co-founder Vitalik Buterin has unveiled a comprehensive proposal to address state scaling challenges on the network.

The plan introduces new forms of state storage alongside existing mechanisms to achieve 1000x scalability. Posted on February 5, Buterin’s proposal acknowledges that while Ethereum has clear pathways for scaling execution and data, state scaling remains fundamentally different and requires innovative solutions.

Asymmetric Scaling Challenge Creates Need for Alternative Approach

Buterin outlined in his post on X that Ethereum faces different scaling realities across three critical resources. “We want 1000x scale on Ethereum L1. We roughly know how to do this for execution and data. But scaling state is fundamentally harder,” he stated.

Execution can achieve 1000x gains through ZK-EVMs, while data scaling reaches similar levels via PeerDAS technology. However, state scaling lacks such breakthrough solutions.

Current state grows at 100 GB annually, and a 20x increase would create 2 TB yearly growth. After four years, this results in 8 TB total state size that builders must maintain.

The proposal explains that database efficiency and syncing present major obstacles. Modern client databases struggle with multi-terabyte states because writes require logarithmic tree updates.

Buterin emphasized that state differs fundamentally from computation and data. Builders need complete state to construct any block, regardless of gas limits.

This reality demands conservative scaling approaches and eliminates many sharding techniques that work for other resources. The network cannot rely on professional builders alone, as permissionless block building requires reasonable setup costs.

Strong Statelessness and Expiry Mechanisms Face Compatibility Issues

The post analyzed why previously proposed solutions fall short of requirements. Strong statelessness would require users to specify accessed accounts and storage slots while providing Merkle proofs.

This approach creates three major problems: dependency on off-chain infrastructure, backwards incompatibility with dynamic storage access patterns, and increased bandwidth costs reaching 4 KB per simple ERC20 transfer.

State expiry designs also encounter fundamental obstacles. Creating new accounts requires proving nothing existed at that address throughout Ethereum’s entire history.

Repeated regenesis schemes demand N lookups for account creation in year N. Address period mechanisms attempt mitigation but break compatibility with existing ERC20 contracts that use opaque storage slot generation.

Buterin noted these explorations reveal important patterns. “Replacing all state accesses with Merkle branches is too much, replacing exceptional-case state accesses with Merkle branches is acceptable,” he explained.

The analysis points toward tiered state systems that distinguish high-value frequently accessed state from lower-value rarely accessed state. However, backwards compatibility proves extremely difficult since lower tiers cannot support dynamic synchronous calls at all.

New Storage Types Enable Developer Choice Between Cost and Flexibility

The proposal introduces temporary storage that resets monthly and UTXO-based systems as primary solutions. Buterin described his vision: “The most practical path for Ethereum may actually be to scale existing state only a medium amount, and at the same time introduce newer forms of state that would be extremely cheap but also more restrictive.”

Temporary storage suits throwaway state for auctions, governance votes, and game events. ERC20 balances could use resurrection mechanisms with bitfields tracking historical state usage.

This design would support 8 TB of temporary state monthly with only 16 GB permanent storage for tracking. UTXO systems take expiry to its logical extreme with zero-duration periods.

Buterin envisions user accounts and smart contract code remaining in permanent storage for accessibility. NFTs and token balances would migrate to UTXOs or temporary storage, while short-term event state uses temporary mechanisms.

Core DeFi contracts would stay permanent for composability, but individual positions like CDPs could move to cheaper tiers. Developers can initially use permanent storage exclusively, then optimize over time as the ecosystem adapts.

Crypto World

Solana Price Prediction: Against All Odds, This V-Shaped Rebound Could Launch SOL Toward New Highs

The deep decline over the past week may have exhausted sellers enough for a V-shaped reversal to bring bullish Solana price predictions up to speed.

The violent sell-off over the past week bears all the hallmarks of capitulation.

Crypto’s tenth-largest liquidation event on record flushed out excess leverage, forced indiscriminate selling, and drove the altcoin down to cycle lows in a single, compressed move.

Such episodes tend to occur near market bottoms, when fear peaks and weak hands are forcibly removed. Once that process completes, selling pressure collapses rapidly, often setting the stage for sharp V-shaped reversals.

With forced selling largely absorbed and leverage reset, the market has shifted from panic to stabilization. This transition often marks the inflection point where downside momentum fades, and buyers quietly regain control.

If follow-through demand emerges from here, Solana could transition rapidly from capitulation to recovery — putting a fresh all-time high back into focus as the broader bull market matures.

Solana Price Prediction: V-Shaped Rally Sets Up New Highs

There is a technical basis for capitulation. With this final push lower, Solana has fully retraced the November breakout of its 7-month ascending channel, completing the corrective move.

The downtrend Solana has been locked into now appears exhausted, with price meeting the pattern’s original support near $100, a bottom marker over the past two years.

Momentum indicators show it. The RSI has crossed below the 30 oversold threshold, a level indicative of seller exhaustion and a pivot into a long-term uptrend as buyers step back in.

While the MACD has cratered with the liquidity event, it stands to be a setback in the previous trend towards a golden cross above the signal line.

With forced selling largely absorbed and leverage reset, any reversal attempt from here is likely to be sharp rather than gradual.

From here, the next major upside targets sit at the $200 psychological level and Solana’s prior all-time highs near $300 — a potential 240% move from current prices.

And if Solana’s bullish fundamentals are re-priced as the broader market recovers, a push into fresh price discovery could follow.

Maxi Doge: A Hedge Against Short-Term Volatility

Tried and tested altcoins like Solana are the easy bet, but for those life-changing gains crypto is renowned for, a more speculative approach is needed.

One trend has proven stubbornly consistent across cycles: capital eventually concentrates on one Doge-themed token.

The pattern is clear. Dogecoin led the charge, Shiba Inu followed in 2021, then came Floki, Bonk, Dogwifhat, and Neiro. Every bull cycle eventually sees capital rotate into a new Doge-inspired frontrunner.

This time around, Maxi Doge ($MAXI) is tapping into those same early Dogecoin vibes with a community built around sharing early alpha, trading ideas, and competitive engagement.

Engagement drives the ecosystem. Weekly Maxi Ripped and Maxi Pump competitions keep activity high, rewarding top performers with leaderboard recognition, incentives, and bragging rights.

The hype is already showing in the numbers. The $MAXI presale has raised almost $4.6 million, while early backers are earning up to 68% APY through staking rewards.

For traders who missed previous Doge-led runs, Maxi Doge could offer another early entry before meme coins swing back into full focus.

Visit the Official Maxi Doge Website Here

The post Solana Price Prediction: Against All Odds, This V-Shaped Rebound Could Launch SOL Toward New Highs appeared first on Cryptonews.

Crypto World

Oil Futures Turn Higher as U.S.-Iran Talks Put in Doubt

Crude futures shake off early lethargy and move sharply higher on reports that talks between the U.S. and Iran may not happen Friday as the two sides fail to agree on venue and matters for discussion.

“Although the expectations for the talks were low, the fact that they are potentially not going to happen I think accelerates the timeline pressure” for any U.S. action, says Rebecca Babin of CIBC Private Wealth US. Action is “much more likely if we’re not having talks.”

WTI is up 3.4% at $65.35 a barrel and Brent rises 3.2% to $69.47 a barrel.

Crypto World

Crypto market cap dips $2T from peak as investor fear rises

The crypto market is facing renewed pressure as prices and investor confidence continue to weaken.

Summary

- The total crypto market cap has fallen from $4.38T to about $2.2T.

- Heavy liquidations and derivatives unwinds are driving pressure.

- Analysts warn that volatility may stay high in the near term.

The total cryptocurrency market capitalization has fallen by about $2 trillion from its October 2025 peak of $4.38 trillion, according to data from CoinGecko. As of early February, the market is valued between $2.1 trillion and $2.3 trillion.

At the time of writing, Bitcoin (BTC) was trading close to $65,000 after briefly falling to about $60,000 on Feb. 5. The largest cryptocurrency is now down almost 50% from its peak of $126,080 in October 2025.

Large liquidations, exchange-traded fund withdrawals, and reduced risk appetite in financial markets have all contributed to the recent decline. This sharp pullback has been matched by a collapse in market sentiment.

The Crypto Fear & Greed Index, compiled by Alternative, fell three points in the past day to 9, its lowest reading since June 2022. The index tracks factors such as volatility, momentum, and social sentiment. A score at this level points to deep fear among traders and long-term investors alike.

Periods like this are often linked to heavy selling in leveraged markets. When prices fall quickly, margin calls force traders to close positions. These forced exits add more pressure and can push prices even lower. As a result, losses tend to spread across major tokens in a short period.

Liquidation pressure and institutional selling

The current sell-off has been one of the most intense since late 2022. Some market trackers estimate that more than $1 trillion in crypto value has been erased over the past month alone.

Jamie Coutts, a crypto analyst at Real Vision, wrote on X that signs of capitulation are becoming stronger. He noted that Bitcoin’s Implied Volatility Index has climbed to 88.55, close to the level seen during the FTX collapse. At the same time, Coinbase recorded daily trading volume of $3.34 billion, one of the highest in its history.

Coutts also pointed out that Bitcoin’s daily relative strength index has dropped to 15.64, below levels seen during the March 2020 market crash. According to him, this combination of margin calls and forced selling is typical during major downturns. He added that capitulation often unfolds over several days or weeks rather than in a single event.

Institutional activity is adding to the pressure. CryptoQuant contributor Darkfost said in a Feb. 6 report that the Coinbase Premium Gap has turned deeply negative.

This means that Bitcoin is trading at lower prices on Coinbase, a platform that is often used by professional and institutional investors, than on Binance, which has a larger user base of retail investors. Large investors are typically selling more when this gap widens to the downside.

The current reading is the weakest seen so far this year, suggesting that institutional demand remains soft.

Uncertain outlook amid market stress

The wider financial environment is also affecting digital assets. Tighter financial conditions, changing interest rate expectations, and geopolitical concerns have all contributed to a decline in appetite for riskier investments.

Technology stocks, commodities, and cryptocurrencies have all faced renewed selling in recent weeks. Traders are hesitant to take on big positions in this kind of environment. Because there is less liquidity, price fluctuations are more severe and unpredictable. Rapid changes in either direction can be triggered by even minor shifts in data or sentiment.

Some analysts say extreme fear levels can sometimes appear near market bottoms. Past cycles show that strong rebounds have followed periods of deep pessimism. Still, others warn that stabilization may take time, especially if selling from funds and institutions continues.

Crypto World

Will Markets Crash Further When $2B Bitcoin Options Expire Today?

Friday has come around again, which means another batch of expiring Bitcoin options as spot markets continue to melt down.

Around 34,000 Bitcoin options contracts will expire on Friday, Feb. 6, with a notional value of roughly $2.1 billion. This event is much smaller than last week’s end-of-month expiry.

Crypto markets have collapsed into bear market territory, losing around $686 billion since the start of the week, as sentiment plunges and both retail and institutional investors dump crypto assets.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.59, meaning that there are more expiring calls (longs) than puts (shorts). Max pain is around $82,000, according to Coinglass, which is well above current spot prices, so many will be out of the money on expiry.

Open interest (OI), or the value or number of Bitcoin options contracts yet to expire, remains highest at $100,000 and $70,000, which have $1.1 billion at these strike prices on Deribit. Total BTC options OI across all exchanges has been in decline for a week and is at $32.5 billion.

“BTC option flows suggesting downside plays not over,” said Deribit.

“Bitcoin’s open interest is stacked through the $80K to $90K region, with elevated put activity showing traders leaned defensive into the move.”

🚨 Options Expiry Alert 🚨

At 8:00 UTC tomorrow, over $2.5B in crypto options are set to expire.$BTC: $2.15B notional | Put/Call: 1.42 | Max Pain: $82K$ETH: $408M notional | Put/Call: 1.13 | Max Pain: $2.55K

Bitcoin’s open interest is stacked through the $80K to $90K region,… pic.twitter.com/WPCdYeS2aC

— Deribit (@DeribitOfficial) February 5, 2026

“The upcoming $60,000 range represents the consolidation zone prior to the Trump rally, where support remains relatively strong. Should a rapid dip occur in the short term, it may present a buying opportunity,” said crypto derivatives provider Greeks Live.

In addition to today’s batch of Bitcoin options, around 217,000 Ethereum contracts are also expiring, with a notional value of $400 million, max pain at $2,550, and a put/call ratio of 1.15. Total ETH options OI across all exchanges is around $7.1 billion. This brings the total notional value of crypto options expiries to around $2.5 billion.

You may also like:

Spot Market Outlook

Crypto market capitalization has tanked to a 16-month low of $2.27 trillion as the digital asset exodus continued.

Bitcoin was smashed by double digits, tanking below $60,000 in early trading in Asia on Friday. The asset has now lost 50% from its all-time high, dumping more than $60,000 in just four months.

Ether is back at bear market lows, falling below $1,800 briefly, and the altcoins have been destroyed in what appears to be the start of another long, drawn-out crypto winter.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Miner MARA Moves 1,318 BTC in 10 Hours, Traders Wary of Forced Miner Selling

Bitcoin miner Marathon Digital (MARA) has transferred 1,318 BTC, worth $86.9 million, in 10 hours as Bitcoin slumps to $64K. The miner moved to a mix of three crypto wallets, on-chain data revealed.

Per Arkham, MARA moved a large chunk of 653.773 BTC to credit and trading firm Two Prime, worth about $42.01 million in one transfer. Minutes later, a smaller amount of 8.999 BTC, worth about $578,000, was sent to the same Two Prime-tagged address.

A separate chunk of about 300 BTC was sent to crypto custodian BitGo-linked wallet, split into two transactions, worth roughly $20.4 million at the time.

Besides, MARA also moved 305 BTC to a fresh wallet address, valued at $20.72 million.

Tough Period for BTC Miners

Bitcoin has been crashing so hard in the recent past and is now hovering just above $63,000 at the time of writing, its lowest levels since October 2024.

The plunge has taken a toll on Bitcoin miners, making it far less economical for them. Bloomberg reported Thursday that the mining revenue value per unit of computing power, called the hash price index, has dropped to around 3 cents for each terahash.

Newhedge research notes that a biweekly figure mining difficulty is set to drop by over 13%, one of the largest decreases since China banned mining in 2021.

As a result, shares of major BTC miners tumbled. MARA Holdings slumped more than 18%, while CleanSpark Inc and Riot Platforms Inc fell 19.13 and 14.7%, respectively.

MARA Trading Under Pressure – Here’s Why

MARA stock is down over 30% in the past 5 days, and 34% in the last month, according to Google Finance.

The company’s share performance is also tied to MARA’s latest insider share transactions report. On January 30, 2026, 14,301 shares of common stock were withheld at $9.50 per share to cover his tax liability upon vesting of restricted stock units, per Stock Titan data.

Apart from the headwind from the Bitcoin market downturn, miners have been facing rising power costs largely due to winter storms across the US in late January.

Further, energy-rich BTC mining hubs in Texas and Tennessee faced power outages.

“It is due to the combination of both the sell-off and winter storms,” Harry Sudock, chief business officer at CleanSpark, told Bloomberg.

The post Bitcoin Miner MARA Moves 1,318 BTC in 10 Hours, Traders Wary of Forced Miner Selling appeared first on Cryptonews.

Crypto World

Bitwise Files for First Spot Uniswap (UNI) ETF With SEC

Bitwise Asset Management has filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a spot Uniswap ETF, marking a major step toward a regulated exchange-traded product tied directly to the UNI token.

Summary

- Bitwise has filed for a spot Uniswap ETF, seeking to offer regulated exposure to the UNI token through traditional markets.

- The proposed ETF would hold UNI directly, with Coinbase Custody named as custodian.

- UNI traded lower despite the filing, underscoring cautious market sentiment toward altcoins.

Uniswap ETF filing fails to lift UNI price

Despite the filing, Uniswap (UNI) showed little immediate upside. The token continued to trade lower, reflecting cautious sentiment across altcoins even as institutional interest grows.

At press time, UNI was exchanging hands at $3.22, down 14.5% over the past 24 hours.

The filing, submitted on February 5, 2026, proposes the launch of the “Bitwise Uniswap ETF,” a trust designed to hold Uniswap tokens as its primary asset. It provides investors with a regulated vehicle to gain exposure to UNI price movements through traditional brokerage accounts.

According to the SEC registration, the ETF would issue shares intended to trade on a U.S. exchange under a yet-to-be-announced ticker symbol.

Bitwise Investment Advisers will sponsor and manage the trust, while Coinbase Custody will hold the Uniswap tokens. The structure aims to offer investors exposure to Uniswap without requiring them to manage wallets or private keys.

If approved, the Bitwise Uniswap ETF would be the first regulated ETF focused on a DeFi protocol’s native token in the U.S. market. UNI is the governance token for the Uniswap decentralized exchange, one of the largest decentralized trading venues built on Ethereum.

Bitwise’s filing arrives in a market where demand for crypto ETFs is evolving. Bitwise and other issuers have recently filed for a range of altcoin-linked ETFs, including products tied to AAVE, Chainlink, and other major tokens.

Crypto World

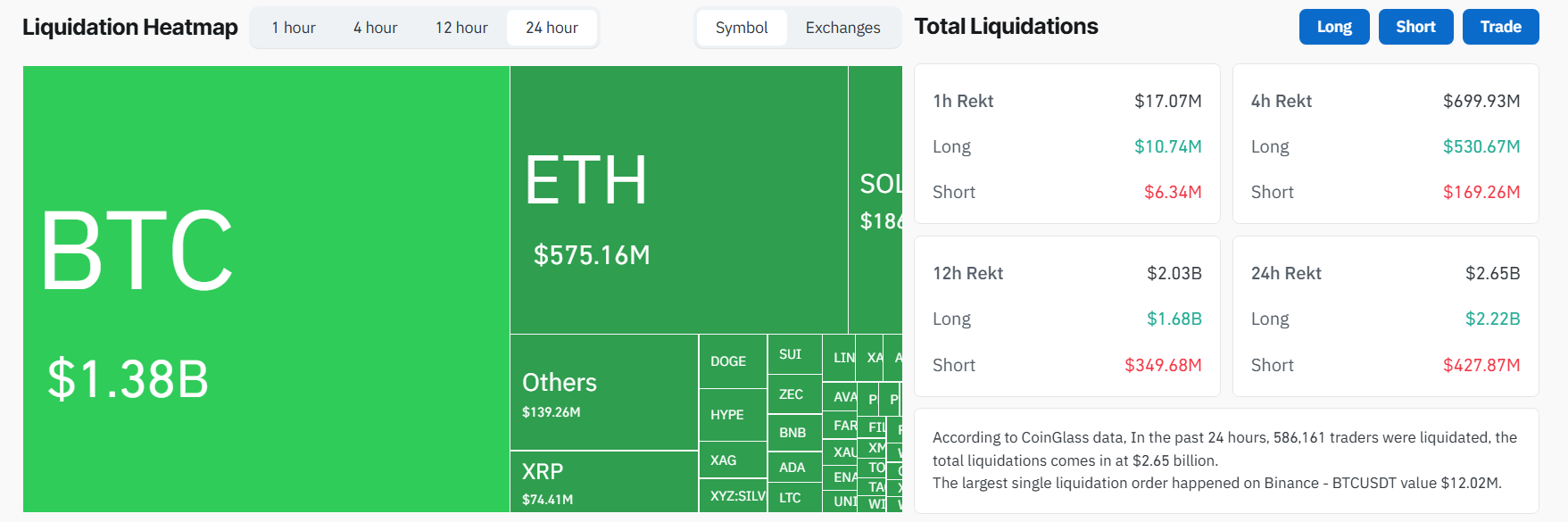

$2.65 Billion Liquidated in 24 Hours. Are Bears Near Capitulation?

Trader losses intensified during the first week of February. Liquidation volume kept rising as the market repeatedly crushed recovery expectations, driven by consecutive red candles.

However, several analyses point to light at the end of the tunnel, even though a rapid recovery remains unlikely.

Sponsored

Over $2.6 Billion Liquidated in 24 Hours Reflects Structural Market Weakness.

CoinGlass reported that total crypto market liquidations reached $2.65 billion over the past 24 hours. Long positions accounted for more than $2.2 billion of that total.

“According to CoinGlass data, in the past 24 hours, 586,053 traders were liquidated, with total liquidations reaching $2.65 billion,” CoinGlass reported.

CoinGlass data also shows that the smallest event in the Top 10 Crypto Liquidation Events of All Time occurred recently on January 31, with $2.56 billion in liquidations. This suggests the ranking could soon be reshuffled.

The market analysis account, The Kobeissi Letter, explained that this move is not a short-term shock. It reflects a structural downturn that has been developing since October last year.

Sponsored

The root causes include weak liquidity, negative sentiment, and cascading liquidation pressure across markets. The account emphasized that this is a recurring cycle: liquidations damage sentiment, and worsening sentiment triggers further liquidations.

Bitcoin’s intraday price swings of up to $10,000 were attributed to sharply reduced market depth. The current Bitcoin market depth is only 30% of its October peak. This condition mirrors the post-FTX collapse environment seen in 2022.

A BeInCrypto report noted that ongoing panic selling has pushed many crypto treasuries toward rising bankruptcy risk. Bitcoin’s drop to $60,000 pushed MicroStrategy’s holdings below cost basis, increasing balance-sheet pressure.

Against this backdrop, veteran technical analyst Peter Brandt offered a forecast based on the “Bitcoin Power Law” model. He suggested that Bitcoin could trade within a “banana peel” range, with potential support near $42,000.

Sponsored

Brandt argued that if Bitcoin enters this zone, similar to previous bear cycles, bullish investors are unlikely to remain below that level for an extended period.

Is a Major Opportunity Taking Shape?

Despite the bleak outlook, not all analysts remain pessimistic.

Sponsored

Glassnode reported that Bitcoin’s capitulation index recorded its second-largest spike in the past two years. This signals a sharp rise in forced selling. The metric tracks supply held at different price levels and measures market stress to identify potential local bottoms.

Such stress events often coincide with rapid de-risking and heightened volatility. Investors rebalance positions during these phases.

Large-scale liquidations also reduce overall market leverage. This process drives a shift away from leveraged speculation toward spot accumulation. “Weak hands” exit, making room for higher-conviction investors.

“Bitcoin deleveraging may create a strong opportunity soon,” economist Daniel Lacalle noted.

These observations suggest a buying opportunity may be forming. They do little, however, to pinpoint exactly when a recovery will begin.

Crypto World

Asia Market Open: Bitcoin Plunge to $64K Rattles Risk Assets as Tech Slump Ripples Through Asia

Bitcoin tumbled more than 10% toward $64,000, extending a brutal week for crypto as selling pressure spread across risk assets and shook markets from New York to Asia.

The drop dragged Bitcoin to its weakest level since late 2024, reversing momentum that had built after Donald Trump’s election win, when he signalled a more supportive stance on crypto during the campaign trail.

Crypto losses came as investors dumped tech stocks and even safe-haven trades turned jumpier. Volatility in precious metals also picked up, as leveraged bets and speculative flows amplified price swings.

Market snapshot

- Bitcoin: $64,798, down 9.2%

- Ether: $1,900, down 9.7%

- XRP: $1.27, down 12.4%

- Total crypto market cap: $2.29 trillion, down 8.2%

ETF Outflows Mount As Crypto Selloff Deepens Into February

CoinGecko data showed the global crypto market has lost about $2 trillion in value since its October peak, with roughly $800B erased over the past month. Bitcoin was down about 17% for the week and roughly 28% for the year so far, while Ether was headed for a 19% weekly slide and a 38% drop year-to-date.

Traders also kept an eye on the plumbing of the rally that powered crypto higher last year, especially flows into exchange-traded funds.

Analysts from Deutsche Bank said in a note that US spot Bitcoin ETFs witnessed outflows of more than $3B in January, following outflows of about $2B and $7B in December and November, respectively.

Akshat Siddhant, lead quant analyst at Mudrex, said currently bears remain in control of the crypto market.

“The recent decline was driven by softer US labour data and growing concerns around heavy capital spending in the AI sector, which weighed on broader risk sentiment,” he said.

“Continued ETF outflows and short-term holders moving nearly 60,000 BTC to exchanges have added to near-term selling pressure. That said, for long-term investors, this phase offers a favourable accumulation opportunity through disciplined, staggered buying.”

Matt Howells Barby, VP at Kraken, said Bitcoin’s recent tumble doesn’t rule out further short-term downside.

“Price is now entering a well-defined support zone between $54,000 and $69,000, but the weekly RSI has dipped below 30 for the first time since mid-2022 — a signal that has historically preceded major bottoms forming within a three-to-six-month window,” he said.

“In our view, a base is most likely to form in the $54,000–$60,000 range, particularly as the low-$50,000s align with the 200-day moving average.”

Risk Appetite Fades As Labour Data And Tech Losses Combine

In Asia, the risk-off mood hit equities early. MSCI’s broadest index of Asia-Pacific shares outside Japan fell about 1%, led by a 5% dive in South Korea’s Kospi that triggered a brief trading halt shortly after the open, and Japan’s Nikkei 225 also slipped.

US stock futures pointed lower too, after Wall Street ended sharply down overnight as tech heavyweights fell and investors questioned whether massive AI spending would translate into near-term profits.

Alphabet added to the anxiety after saying it could lift 2026 capital spending as high as $185B, part of an AI arms race that has investors watching cash burn as closely as revenue growth.

Fresh labour market signals also fed the unease, with a report showing US layoffs announced by employers surged in January to the highest level for the month in 17 years, reinforcing a broader pullback in risk appetite.

The post Asia Market Open: Bitcoin Plunge to $64K Rattles Risk Assets as Tech Slump Ripples Through Asia appeared first on Cryptonews.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business13 hours ago

Business13 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat20 hours ago

NewsBeat20 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World14 hours ago

Crypto World14 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World13 hours ago

Crypto World13 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation