Crypto World

Is a hidden hedge fund blowup behind bitcoin’s crash to $60,000?

Bitcoin’s plunge to nearly $60,000 on Thursday, a nearly 30% drop over 7 days, has got traders on X began floating theories that the selloff was not purely macro or risk-off, but various reasons that contributed to the asset’s worst single-day performance since FTX crashed in 2022.

Flood, a prominent crypto trader, called it in an X post the most vicious selling he’s seen in years and said it felt “forced” and “indiscriminate,” floating possibilities ranging from a sovereign dumping billions to an exchange balance sheet blowup.

Few theories: – Secret Sovereign dumping $10B+ (Saudi/UAE/Russia/China) – Exchange blowup, or Exchange that had tens of billions of dollars of Bitcoin on the balance sheet forced to sell for whatever reason.

Pantera Capital general partner Franklin Bi offered a more detailed theory. He suggested the seller could be a large Asia-based player with limited crypto-native counterparties, meaning the market would not “sniff them out” quickly.

My guess is that it’s not a crypto-focused trading firm but someone large outside of crypto, likely based in Asia, with very few crypto-native counterparties. hence why no one has sniffed them out on CT. comfortably leveraged & market-making on Binance –> JPY carry trade unwind –> 10/10 liquidity crisis –> ~90-day reprieve granted –> backfired attempt to recover on gold/silver trade –> desperate unwind this week.

In his view, the chain of events may have started with leverage on Binance, then worsened as carry trades unwound and liquidity evaporated, with a failed attempt to recover losses in gold and silver accelerating the forced unwind this week.

But the more unusual narrative emerging from the crash is not about leverage. It is about security.

Charles Edwards of Capriole argued that falling prices may finally force serious attention on bitcoin’s quantum security risks.

Edwards said he was “serious” when he warned last year that bitcoin might need to go lower to incentivize meaningful action, calling recent developments the first “promising progress” he has seen so far.

$50K not that far away now. I was serious when I said last year that price would need to go lower to incentivize proper attention to Bitcoin quantum security. This is the first promising progress we have seen to date. I genuinely hope Saylor is serious about establishing a well funded Bitcoin Security team.

He would have significant sway across the network in affecting change. I am concerned that his statement today is a false flag, to simply diminish mounting quantum fear without substantive action, but I would love for this to be wrong. We have a lot of work to do, and it needs to be done in 2026.

Parker White, COO and CIO at DeFi Development Corp., pointed to unusual activity in BlackRock’s spot bitcoin ETF (IBIT) as a possible culprit behind Thursday’s washout.

He noted IBIT posted its biggest-ever volume day at $10.7 billion, alongside a record $900 million in options premium, arguing the pattern fits a large options-driven liquidation rather than a typical crypto-native leverage unwind.

The last small piece of evidence I have is that I personally know a number of HK-based hedge funds that are holders of $DFDV, which had the worst single down day ever, with a meaningful mNAV decline. The mNAV had been holding steady surprisingly well throughout this pull back until today. One of these fund(s) could have been connected to the IBIT culprit, as I highly doubt a fund taking that large of a position in IBIT and using a single entity structure would only have the one fund.

Now, I could easily see how the fund(s) could have been running a levered options trade on IBIT (think way OTM calls = ultra high gamma) with borrowed capital in JPY. Oct 10th could very well have blown a hole in their balance sheet, that they tried to win back by adding leverage waiting for the “obvious” rebound. As that led to increased losses, coupled with increased funding costs in JPY, I could see how the fund(s) would have gotten more desperate and hopped on the Silver trade. When that blew up, things got dire and this last push in BTC finished them off.

“I have no hard evidence here, just some hunches and bread crumbs, but it does seem very plausible,” White wrote on X.

Bitcoin’s drop over the past week has been less about a slow grind lower and more about sudden air pockets, with sharp intraday swings replacing the orderly dip-buying seen earlier this year.

The move has dragged BTC back toward levels last traded in late 2024, while liquidity has looked thin across major venues. With altcoins under heavier pressure and sentiment collapsing to post-FTX style readings, traders are now treating each rebound as suspect until flows and positioning visibly reset.

Crypto World

Coinbase UK CEO Says Tokenised Collateral Is Moving Into Market Mainstream

Tokenised collateral is shifting from experimental pilots into core financial market infrastructure, according to comments from Keith Grose, UK CEO of Coinbase, as central banks and institutions accelerate real-world deployment.

Grose explains growing engagement from central banks signals that tokenisation has moved beyond the crypto-native ecosystem and into mainstream financial plumbing, particularly around liquidity and collateral management.

From Pilots to Production

“When central banks start talking about tokenised collateral, it’s a sign this technology has moved beyond crypto and into core market infrastructure,” Grose said.

He pointed to new data from Coinbase, showing that 62% of institutions have either held or increased their crypto exposure since October, despite periods of market volatility.

According to Grose, this sustained institutional presence reflects a shift in priorities. Rather than speculative exposure, firms are increasingly focused on operational tools that allow them to deploy digital assets at scale within existing risk frameworks.

Demand for Institutional-Grade Infrastructure

Coinbase said it is seeing growing institutional demand for services such as custody, derivatives and stablecoins, which Grose said are essential for managing risk and supporting day-to-day financial activity. “That tells us the market is building for real-world use,” he said.

He added that tokenised assets and stablecoins are expected to move from being conceptual possibilities to becoming everyday instruments for liquidity and collateral management. This transition, Grose said, will define the next phase of market development through 2026 as infrastructure matures and regulatory clarity improves.

The Role of UK Regulation

Grose highlighted the importance of the UK regulatory environment in unlocking further capital allocation into tokenised markets. While the UK has made progress in developing a framework for digital assets, he said policy choices around stablecoins will be critical to sustaining momentum.

“In the UK, to grow tokenisation we need no limits or blocking of stablecoin rewards,” Grose said. He argued that allowing investors to keep funds circulating within the digital economy would help unlock a genuinely liquid, 24/7 tokenised marketplace.

As institutions move from testing to deploying tokenised collateral in live market environments, Grose expects adoption to accelerate across custody, derivatives and stablecoin-based settlement.

With central banks increasingly engaged and institutional exposure holding firm, tokenisation is positioning itself as a foundational layer of modern financial infrastructure rather than a niche crypto application.

What Is Tokenisation and Why It Matters

Tokenisation is the process of representing a real-world asset on a blockchain. Tokens can stand for a wide range of assets both financial and non-financial, including cash, gold, stocks and bonds, royalties, art, real estate and other forms of value.

In practice, anything that can be reliably tracked and recorded can be tokenised, with the blockchain acting as a shared ledger that records ownership and transfers in a transparent and verifiable way.

As tokenisation continues to develop, its implications for markets, infrastructure and risk management are becoming clearer, prompting further research and analysis into how on-chain assets can reshape financial systems.

The post Coinbase UK CEO Says Tokenised Collateral Is Moving Into Market Mainstream appeared first on Cryptonews.

Crypto World

Pump.fun Expands Trading Infrastructure With Vyper Acquisition

Pump.fun has acquired crypto trading terminal Vyper, which will wind down its standalone product and migrate its infrastructure into the Solana memecoin launchpad’s ecosystem.

On Friday, Vyper said core parts of its product will begin shutting down on Tuesday, while limited functions will remain accessible. Users were directed to Pump.fun’s Terminal (formerly Padre) to continue using the tools.

The move reflects a broader strategy by Pump.fun to consolidate more of the trading workflow, from token launches to execution and analytics, as memecoin activity cools from the speculative frenzy of late 2024 and early 2025.

The companies did not disclose the financial terms of the deal. Pump.fun did not respond to a query from Cointelegraph before publication.

Expansion beyond token launches

Pump.fun’s acquisition of Vyper follows earlier moves into trading infrastructure. On Oct. 24, Pump.fun acquired trading terminal Padre to strengthen liquidity and improve execution for tokens launched on its platform. Padre was later rebranded and now operates as Terminal.

In January, Pump.fun also launched an investment arm called Pump Fund, marking what the company described as a pivot away from a pure memecoin focus.

On Jan. 20, Pump Fund debuted alongside a $3 million hackathon aimed at backing early-stage projects, including those not directly related to crypto.

Related: MEV trading returns to court in Pump.fun class-action lawsuit

Consolidation amid a cooling memecoin market

The expansion comes as memecoin activity has fallen from peaks when celebrities and several government leaders launched their own tokens. Pump.fun’s growth was driven by intense speculative activity on Solana, but revenue has since fallen as the popularity of memecoins weakened.

Data from DefiLlama shows that Pump.fun’s monthly revenue peaked at more than $137 million in January 2025. That figure fell 77% over the following year, with the platform generating about $31 million in January 2026.

In December 2024, the estimated market capitalization of memecoins tracked by CoinMarketCap surpassed $100 billion. At the time of writing, the sector was valued at about $28 billion, a decline of about 72%.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

GBP/USD Declines After Bank of England Decision

Yesterday’s decision by the Bank of England came as a surprise to forex traders. While the Official Bank Rate was left unchanged at 3.75%, markets were caught off guard by the notably dovish signals regarding future policy.

According to media reports, four out of nine Monetary Policy Committee members voted for an immediate rate cut. This has brought forward expectations of easing by the Bank of England, making the pound less attractive to hold and triggering its weakness yesterday.

Technical Analysis of GBP/USD

Price action in GBP/USD has been forming an upward trend (outlined by a channel) since November last year. However, yesterday’s move has put this channel at risk of a downside break.

It is worth noting that the market had only recently been in a very strong bullish phase. GBP/USD was advancing along the blue support line and even pushed above the upper boundary of the ascending channel.

Sentiment then shifted abruptly. Bears stepped in aggressively, driving the pair lower and breaking through several technical levels in sequence:

→ the blue trendline;

→ the upper boundary of the channel;

→ the channel median, reinforced by the 1.3640 level.

As a result, the price fell towards the lower boundary of the channel, strengthened by the 1.3530 level, which had acted as resistance in late December and early January.

Almost all of the bullish gains made in late January have now been erased. It cannot be ruled out that today’s rebound in GBP/USD is merely a technical recovery — a pause that allows bears to regroup before attempting a break below the lower boundary of the ascending channel, potentially steering the market into a downward trajectory (shown in red).

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

U.S. layoffs spike to 17-year high on UPS, Amazon cuts

The U.S. jobs market is cooling fast, a timely blow that could force the Federal Reserve to loosen its purse strings and potentially put a floor under the price of bitcoin .

Planned layoffs, the job cuts that companies have announced but not yet executed, surged by 205% to 108,435 in January, according to data tracked by global outplacement firm Challenger, Gray & Christmas. That’s the highest reading since January 2009, months after Lehman Brothers collapsed and pushed the global economy into recession.

Year-on-year, the announced cuts rose 118%, indicating a sharp weakening in the labor market in the first year of Donald Trump’s second stint as president. The technology industry announced 22,291 reductions, with Amazon (AMZN) accounting for most, while United Parcel Service (UPS) announced 31,243 planned cuts.

Andy Challenger, workplace expert at Challenger, Grey & Christmas, called it a high figure for January, in any case a seasonally weak month for hiring.

“It means most of these plans were set at the end of 2025, signaling employers are less-than-optimistic about the outlook for 2026,” Challenger said.

This data clashes with the Bureau of Labor Statistics’ monthly payrolls report, which still paints a resilient labor market picture.

Private reports are increasingly becoming early warning flags, signaling cracks forming before the official figures. Earlier this month, the blockchain-based Truflation showed a precipitous drop in real-time inflation, to under 1%, even as the official CPI lingers well above the Fed’s 2% target.

Together, these unofficial indicators suggest the Fed may soon need to relax policy by lowering borrowing costs to support the economy. The potential easing could bode well for assets like bitcoin, which is now down nearly 50% from its record high of over $126,000.

The Fed this month left the benchmark borrowing rate unchanged in the 3.5%-3.75% range, while flagging concerns about inflation. Analysts’ projections on what it will do next are all over the place.

JPMorgan expects the Fed to keep rates unchanged throughout this year and then increase sometime in 2027, while other banks expect at least two 25-basis-point rate cuts this year.

An economist who correctly predicted Japan’s fiscal issues expects Trump’s nominee for Fed chairman, Kevin Warsh, to cut rates by 100 basis points before the mid-term elections in November.

Crypto World

Strategy to initiate a BTC security program addressing quantum uncertainty

Quantum computing is moving from theory to long term strategic consideration, and Strategy (MSTR) has made it clear it intends to be proactive rather than reactive during the company’s Q4 earnings call on Thursday.

Strategy, the largest corporate holder of bitcoin, plans to initiate a bitcoin security program to coordinate with the global cyber, crypto, and bitcoin security community.

The company addressed growing discussion around quantum risk and reaffirmed its commitment to bitcoin security, framing quantum not as an immediate threat but as a future engineering challenge the network can prepare for.

Strategy reported a net loss of $12.4 billion for the quarter. Shares fell 17% on the day, trading as low as $104, but market focus quickly shifted to executive chairman Michael Saylor’s commentary.

Saylor revisited a long list of historical Bitcoin FUD (fear, uncertainty and doubt) that the network has already overcome quantum concerns, while acknowledging that quantum deserves serious long term planning.

The company outlined a range of key points on quantum computing, predicting that quantum technology is likely more than a decade away and pointing out that the Bitcoin community is already researching quantum-resistant cryptography.

Shares are up 6% in pre-market trading as bitcoin has rebounded to $65,000.

Read More: Galaxy CEO Mike Novogratz doesn’t see quantum as big threat for bitcoin

Crypto World

Crowd Fear Triggers Bitcoin Bounce, $70K Rally in Focus

Santiment says extreme fear after Bitcoin’s $60K drop helped trigger a rebound, with a potential push toward $70K.

Bitcoin (BTC) slipped to around $60,000 earlier today before rebounding toward $65,000, following one of the sharpest daily sell-offs in its history.

The move has split traders between those calling the rebound a temporary technical reaction and others pointing to extreme fear as a setup for a recovery toward $70,000.

Fear Spikes as Bitcoin Rebounds From Sell-Off

On February 6, Santiment noted that social media mentions calling for Bitcoin to go “lower” or “below” shot up after the drop to $60,000, a pattern the analytics firm said often appears near short-term price rebounds.

The asset did indeed bounce back to about $65,000, with the uptick coming after what The Kobeissi Letter described as BTC’s first-ever daily drop of more than $10,000, alongside claims that a large leveraged position had been liquidated.

“Is this nothing but a dead cat bounce?” Santiment asked, while positing that enough retail may have been shaken out to justify a quick rally back up to the $70,000s.

The sell-off capped weeks of heavy downside pressure, as CryptoPotato previously reported, with Bitcoin wiping out gains seen after Donald Trump’s re-election and dragging most major altcoins lower. XRP fell 13% on the day, while Ethereum, Solana, and BNB also posted steep losses.

Meanwhile, on-chain and derivatives data are painting a mixed picture beneath the rebound. According to DeFi commentator Marvellous, “smart money” has taken a net short position, while whales and public figures are adopting long positions. The market watcher argued the move looked more like a mechanical response after $2.2 billion in long liquidations than renewed conviction, noting that open interest remained elevated and funding rates had stayed flat.

You may also like:

Elsewhere, trader Sykodelic highlighted a lopsided liquidation map, claiming the market had cleared most long positions, leaving roughly $29 billion in shorts versus about $100 million in longs over a one-year view.

Price Action Shows Heavy Damage Despite Short-Term Bounce

Bitcoin was trading around the $65,000 level at the time of writing, down nearly 9% in the last 24 hours and more than 21% over the past seven days. Across the previous month, the losses stand close to 30%, pushing BTC about 48% below its peak from October 2025, when it surpassed the $126,000 mark.

Analysts from CryptoQuant have said that the current downturn is developing faster than the 2022 bear market, with their data showing the OG cryptocurrency fell 23% within 83 days of losing its 365-day moving average, compared with a 6% decline over the same period in early 2022.

Santiment added that sentiment toward both Bitcoin and Ethereum (ETH) had turned “extremely bearish,” a condition that can coincide with short-lived relief rallies when retail fear stays elevated.

For now, traders remain divided. Some see the concentration of short positions and fearful sentiment as fuel for a move back toward $70,000, while others have warned that without a collapse in open interest and prolonged sideways trading, the recent bounce may only be the precursor to another test of lower levels.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin’s Lightning Network clears record $1M transfer to Kraken

Secure Digital Markets sent $1M in Bitcoin to Kraken over Lightning, showcasing near-instant, low-fee settlement for institutional-size payments.

Summary

- Secure Digital Markets completed a $1M Bitcoin transaction to Kraken via Lightning on Jan. 28, the largest publicly reported Lightning payment so far.

- The pilot, powered by Voltage’s enterprise Lightning infrastructure, aimed to test high-value settlement between regulated counterparties with near-zero fees.

- SDM, Kraken, and Voltage executives say the transfer signals Lightning’s readiness for institutional treasury, venue-to-venue settlements, and faster exchange payments.

Secure Digital Markets (SDM) completed a $1 million Bitcoin transaction via the Lightning Network on January 28 in a pilot project with cryptocurrency exchange Kraken, the companies announced.

The transaction represents the largest Lightning payment ever publicly recorded, according to the companies. The payment settled almost instantly with minimal fees.

The operation was facilitated by Voltage’s Lightning enterprise infrastructure. Voltage is a Bitcoin payments and infrastructure provider focused on institutional clients.

The pilot project was designed to test whether the Lightning Network can support high-value transfers between regulated counterparties, according to SDM. The institutional trading and lending desk said the pilot demonstrated how Lightning can support use cases such as internal treasury movements, high-value settlements, and transfers between trading venues without the delays associated with on-chain settlement.

“Moving $1 million to Kraken via Lightning Network marks a definitive shift in global settlement architecture,” said Mostafa Al-Mashita, co-founder and director of sales and trading at SDM. “We have moved beyond the era of questioning Bitcoin’s institutional capacity.”

Kraken has supported Lightning for retail payments for several years. The company said the transaction reflects growing demand from institutional clients for faster settlement options.

Bitcoin Lightning Network used in investment

“Milestones like this demonstrate what’s possible when innovation meets real-world demand,” said Calvin Leyon, head of on-chain at Kraken. “By drastically reducing settlement times, Lightning Network unlocks Bitcoin’s potential on a global scale.”

Graham Krizek, founder and CEO of Voltage, said the transaction highlights the network’s maturity and its ability to meet enterprise requirements.

Crypto World

Kalshi Ramps Up Surveillance Ahead of Super Bowl

Kalshi is expanding its surveillance framework on its prediction markets platform through an independent advisory committee and strategic partnerships designed to deter insider trading and market manipulation, a move announced just days before a major U.S. betting event. The company said the committee will provide a quarterly briefing to outside counsel and publish statistics detailing investigations into suspicious activity on the platform. In parallel, Kalshi is partnering with Solidus Labs, a crypto trading surveillance platform, and Daniel Taylor, director of the Wharton Forensic Analytics Lab, to bolster detection, auditing, and response to potential market abuse. The timing places the initiative squarely ahead of Super Bowl 60, as Kalshi’s bet volume continues to climb well ahead of the big game. The company disclosed that more than $168 million in bets had already been placed on Kalshi ahead of the event, underscoring the scale of activity in its event-contract market.

Key takeaways

- Kalshi formalizes an independent advisory committee that will deliver quarterly oversight reports to external counsel and publish platform-cleaning statistics on investigations into suspicious activity.

- The collaboration with Solidus Labs and Wharton’s Daniel Taylor signals a structured, cross-disciplinary approach to detecting and mitigating market abuse on prediction markets.

- As regulators and lawmakers intensify scrutiny of prediction markets, Kalshi faces ongoing regulatory attention while seeking to expand access to institutional participants.

- Market context around margin trading for event contracts is evolving, with Kalshi reported by the Financial Times to be seeking U.S. regulatory approval for margin-enabled trading, potentially broadening participation beyond accredited or high-net-worth investors.

- Key personnel in the enforcement and analytics sphere—Lisa Pinheiro of Analysis Group, Kalshi’s head of enforcement Robert DeNault, and former U.S. Treasury official Brian Nelson—anchor the program’s governance and compliance posture.

- State regulator focus on whether sports-event contracts constitute gambling persists, highlighting a broader regulatory risk backdrop for Kalshi and peers in the prediction-market space.

Sentiment: Neutral

Market context: The move comes amid heightened regulatory attention on prediction markets and a broader push toward compliant, institution-friendly structures in crypto-related markets. As lawmakers debate the boundaries of insider trading and official influence, Kalshi’s governance enhancements and potential margin-trading roadmap align with a sector-wide push toward transparency and risk controls.

Why it matters

The expansion of Kalshi’s surveillance apparatus marks a significant step in maturing prediction markets as legitimate financial venues. By embedding an independent advisory committee and engaging third-party researchers and surveillance firms, the platform seeks to reduce the risk of manipulation and improve trust among users and potential institutional participants. The quarterly reporting obligation to outside counsel and the public release of investigation statistics could create a measurable benchmark for the platform’s compliance processes, offering a model that other prediction-market operators may emulate in a landscape where regulatory expectations are converging with industry practices.

Partnering with Solidus Labs, a known surveillance provider in the crypto trading space, and with Daniel Taylor of Wharton’s Forensic Analytics Lab signals a deliberate attempt to fuse technocratic oversight with academic rigor. This combination can enhance anomaly detection, forensic tracing, and incident response. In a market where a single high-profile manipulation incident or insider-trading allegation could reverberate across platforms, a robust governance framework is not merely a compliance checkbox but a practical risk-management tool.

At the same time, the industry faces a regulatory environment that can shift quickly. The sector has seen proposals in Congress and state-level actions that challenge the legality or structure of prediction-market contracts, especially when they intersect with political events or government insiders’ moves. Kalshi’s effort to cement a governance layer alongside external expertise is thus as much about resilience against ongoing regulatory scrutiny as it is about preventing abuse. If the market can demonstrate lower risk through transparent processes and independent oversight, it may unlock broader participation from institutional players who have been hesitant to engage with prediction markets under uncertain compliance regimes.

The Financial Times reporting that Kalshi is pursuing margin-trading authorization in the United States adds another dimension to the story. Margin trades could allow participants to leverage bets on event outcomes in a manner eerily reminiscent of traditional futures markets, potentially expanding the pool of capital and the depth of liquidity. Kalshi is said to be in discussions with the Commodity Futures Trading Commission for months to enable this feature, which would structure margin exposure similarly to other futures contracts—depositing a fraction of the contract value and settling at close. If approved, such a feature could attract a broader spectrum of investors, from hedge funds to family offices, while heightening the need for robust surveillance and risk controls to manage leverage and systemic risk.

The governance roster backing Kalshi’s new program includes prominent names. Lisa Pinheiro, a managing principal and data scientist at Analysis Group with a focus on market manipulation, brings a rigorous analytics lens to the effort. Kalshi’s own enforcement head, Robert DeNault, has been positioned to coordinate enforcement with the new committee, ensuring alignment between policy and day-to-day operations. Adding to the advisory depth is Brian Nelson, a former U.S. Treasury official who previously handled terrorism financing and financial-intelligence matters, who has been brought in to advise on trading surveillance and compliance issues. This blend of academic insight, legal enforcement leadership, and government-facing regulatory experience suggests a holistic approach to risk management that goes beyond surface-level compliance checks.

While the shift toward enhanced governance is framed as a proactive defense against abuse, it also occurs within a broader debate about the legal status of prediction markets. Kalshi remains among a handful of prediction-market operators that regulators have scrutinized, with some states arguing that sports-event contracts can resemble illegal gambling. Kalshi and its peers dispute that characterization, highlighting their compliance posture and the distinctions between prediction-market mechanics and gambling. The evolving regulatory dialogue—coupled with potential margin-trading approvals—could reshape how prediction markets function in practice, potentially increasing their legitimacy in the eyes of mainstream financial markets and mainstream regulators alike.

Finally, the strategic angles extend beyond regulatory maneuvering. The Kalshi announcements come as the broader market looks to how prediction markets can coexist with traditional financial infrastructure and institutions. The push toward more formal governance, transparency, and risk controls may help anchor the industry’s legitimacy in a landscape that is increasingly sensitive to issues of surveillance, data integrity, and governance. If Kalshi’s approach proves effective, it could become a blueprint for how prediction-market platforms demonstrate resilience, attract capital, and operate within a stricter regulatory framework that emphasizes accountability as a condition for growth.

What to watch next

- Publication of Kalshi’s quarterly surveillance report to outside counsel and any accompanying public statistics.

- Regulatory developments from the CFTC regarding margin trading for event contracts and Kalshi’s progress on any required approvals.

- State regulator updates related to the classification of sports-event contracts and any enforcement actions affecting Kalshi and peers.

- Updates on Super Bowl 60 betting volumes and any shifts in participant composition or contract availability on the Kalshi platform.

Sources & verification

- Kalshi press release announcing an independent advisory committee and quarterly reporting on investigations into suspicious activity: https://news.kalshi.com/p/kalshi-surveillance-insider-trading-prevention

- Financial Times report on Kalshi seeking regulatory approval to offer margin trades in the US

- U.S. congressional coverage of insider-trading concerns in prediction markets, including the Ritchie Torres bill

- Related market coverage on Polymarket/Circle and USDC settlement context

Market reaction and key details

Kalshi is actively expanding governance and surveillance as it positions itself for broader participation and potential product expansion. The combination of an independent advisory committee, external partnerships, and leadership with enforcement and analytical credentials aims to strengthen confidence in the platform’s integrity, particularly during a peak betting period like Super Bowl 60 and amid regulatory uncertainty. The reported margin-trading initiative, if approved, would mark a notable shift in the platform’s approach to liquidity and investor access, coordinating with ongoing regulatory dialogue and risk-management enhancements to support a more institutional-grade operation.

Why it matters

Kalshi’s governance push matters because it signals a maturing industry that recognizes the need for structured oversight to sustain growth. Independent advisory input and transparent reporting can improve user trust, reduce perceived risk, and potentially attract a wider array of participants who require verifiable controls before committing capital. For developers and operators building in the prediction-market space, the Kalshi framework may serve as a reference point for blending legal compliance with advanced analytics and cross-industry surveillance expertise.

From an investor perspective, enhanced risk controls and the prospect of margin trading represent both opportunities and caveats. While the potential for deeper liquidity and broader participation can support price discovery and volatility management, it also heightens the importance of robust risk management, real-time monitoring, and clear compliance protocols. In an environment where regulators are increasingly attentive to how digital markets operate, platforms that can demonstrate proactive governance are more likely to withstand regulatory shocks and sustain long-term growth.

For users, the development promises more transparency around how suspicious activity is identified and handled. Quarterly reports and external oversight may illuminate how the platform handles investigations, how often corrective actions occur, and how such actions influence market integrity. If the surveillance and enforcement ecosystem expands as described, users could benefit from a more predictable, accountable trading environment, especially during high-stakes events that generate outsized betting activity.

What to watch next

- Kalshi’s first quarterly surveillance report rollout and any accompanying data releases.

- Regulatory decisions from the CFTC on margin-trading approvals for event contracts.

- State-level regulatory actions related to prediction markets and sports contracts.

- Updates on Kalshi’s collaboration outcomes with Solidus Labs and Wharton analytics researchers.

Crypto World

XRP Plunges 17% in Steepest One-Day Drop Since 2025 as $46M in Leveraged Longs Get Wiped

A wave of leveraged liquidations totaling $46 million dragged XRP to its steepest one-day drop in over four months. This drop contrasts Ripple’s successful bids for new regulatory approvals across Europe.

Key Takeaways:

– XRP fell more than 17% to about $1.25 on Thursday, its worst one-day performance since October 2025, as broader crypto markets plunged.

– Roughly $46 million in XRP derivatives were liquidated in 24 hours, with $43 million coming from leveraged long positions, according to CoinGlass data.

– Despite the sharp drop, XRP spot ETFs have continued attracting net inflows, pulling in roughly $24 million this week and bringing cumulative inflows past $1.2 billion since their November 2025 launch.

The XRP price dropped more than 17% over the past 24 hours to around $1.25, making it the worst-performing major token on the day. Bitcoin fell roughly 10% toward $65,000 during the same period, while Ethereum slid below $2,000 and Solana traded near $82, as the selloff widened across the entire crypto market.

The move extended XRP’s weekly losses to nearly 30% and pushed its market cap down to approximately $75 billion, a steep fall from its July 2025 peak of $210 billion. XRP is now trading 45% below its January 2026 high of $2.41. This decline has been further fueled by deteriorating broader market conditions.

Leveraged Liquidations Amplified the Selloff Across Derivatives Markets

Data from CoinGlass showed roughly $46 million in XRP derivatives liquidations over 24 hours, with bullish bets accounting for about $43 million of that figure.

Prices bled slowly through most of Thursday before a sharp drop late in the session triggered a cascade of stop-loss orders and forced closings.

The break below the $1.44 support zone flipped that area into overhead resistance, leaving $1.00 as the next widely watched psychological level.

Across the broader market, traders saw approximately $1.42 billion in total crypto liquidations on Thursday, with long positions accounting for $1.24 billion.

XRP ETF Inflows Hold Up Despite the Price Collapse

Despite the steep decline, institutional flows into XRP exchange-traded funds have remained positive.

Since launching in November 2025, XRP spot ETFs have posted inflows on all but four trading days, according to SoSoValue data. Looking at this week’s performance, inflows totaled roughly $24 million, bringing cumulative net inflows past $1.2 billion.

That resilience stands in sharp contrast to Bitcoin ETFs, which recorded approximately $545 million in outflows on Wednesday alone.

Ripple’s Regulatory Wins Failed to Cushion the Drop

The selloff came during an otherwise active stretch for Ripple. Earlier this week, Ripple announced it had received full approval of an Electronic Money Institution license from Luxembourg’s Commission de Surveillance du Secteur Financier, enabling it to scale regulated payment services across the EU.

The Luxembourg approval followed a separate EMI license from the UK’s Financial Conduct Authority in January, bringing Ripple’s global license count past 75.

None of these developments cushioned XRP against the broader risk-off move. This price development underscores that the token’s valuation remains driven primarily by positioning and momentum rather than adoption narratives.

The post XRP Plunges 17% in Steepest One-Day Drop Since 2025 as $46M in Leveraged Longs Get Wiped appeared first on Cryptonews.

Crypto World

Bitcoin Price Faces 25% Risk as Buy-the-Dip Narrative Weakens

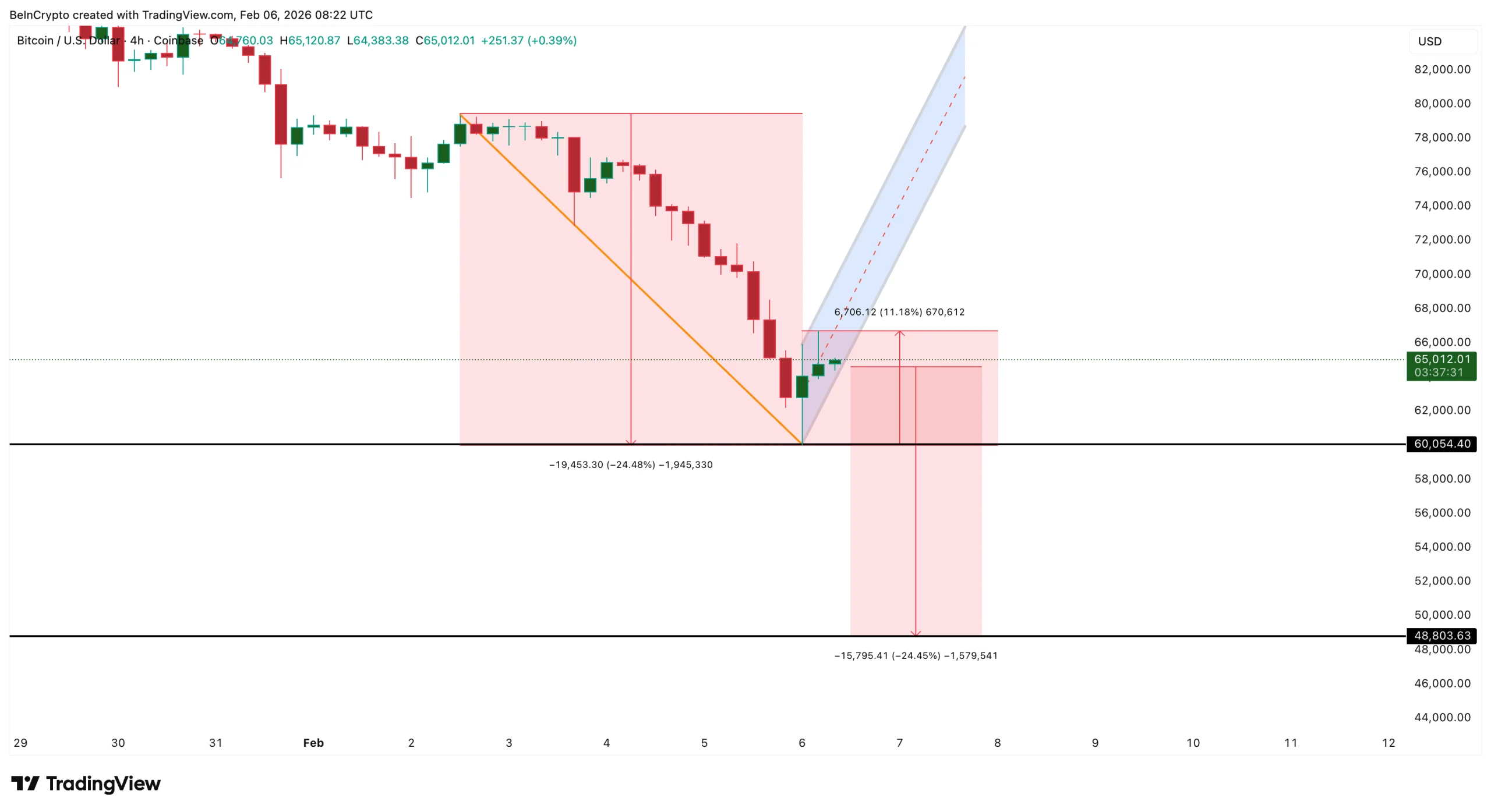

Bitcoin’s recent rebound has revived the buy-the-dip narrative, but the data tells a more complicated story. After falling nearly 15% and briefly touching the $60,000 zone, the Bitcoin price bounced more than 11%, drawing traders back into long positions.

At first glance, the bounce looks encouraging. However, bearish chart patterns, rising leverage, and fragile spot demand suggest the market may not be out of danger yet. With a potential 25% downside still in play, the latest bounce is now facing serious scrutiny.

Bear Flag, Rising Leverage, and Falling Exchange Supply Signal Risky Optimism

Bitcoin’s short-term risk is already visible on the 4-hour chart.

Sponsored

Sponsored

After the sharp sell-off toward $60,000, the Bitcoin price formed a rebound structure that now resembles a bear flag pattern. This setup typically appears when the price pauses after a strong drop before continuing lower. If the lower trendline breaks, the pattern points to a downside move of nearly 25%, targeting the $48,000–$49,000 zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Despite this technical warning, leverage is rising again.

Following the 11.18% rebound, more than $540 million in new long positions were built on Binance alone. This shows that traders are once again using heavy leverage, betting that the bottom is already in. Similar behavior has preceded major liquidations in past downturns.

At the same time, spot market behavior reflects a growing buy-the-dip mindset.

Bitcoin supply on exchanges fell from around 1.23 million BTC to 1.22 million BTC between February 5 and February 6. This decline suggests that traders are withdrawing coins, possibly for short-term holding, expecting higher prices.

Public figures and social media sentiment have also turned more optimistic, reinforcing the ‘Buy-the-Dip’ narrative.

Sponsored

Sponsored

Together, these signals possibly show misplaced confidence.

A fragile chart pattern, rising leverage, and early dip buying are forming at the same time. When optimism builds before structural weakness is resolved, downside risk often increases rather than fades.

Long-Term Holders Keep Selling as Realized Price Support Comes Into Focus

While short-term traders are turning bullish, long-term holders, the most stable folks, are moving in the opposite direction.

The Long-Term Holder Net Position Change, which tracks the 30-day supply shift among investors holding for more than one year, has remained deeply negative since early January. On January 6, this metric showed net selling of around 2,300 BTC. By February 5, that figure had worsened to roughly 246,000 BTC.

This represents a nearly 10,500% increase in long-term distribution in just one month. In simple terms, the most conviction-driven investors are still reducing exposure.

Sponsored

Sponsored

This behavior becomes more concerning when combined with the long-term holder realized price.

The realized price represents the average acquisition cost of coins held by long-term investors. Historically, when Bitcoin approaches or falls below this level, it signals deep market stress. In past cycles, major rallies only began after the price stabilized around this zone; however, not immediately.

Currently, the long-term holder realized price sits near $40,260.

As Bitcoin moves closer to this level, more long-term investors approach breakeven. If the price drops below it, many enter losses, often accelerating capitulation. This dynamic played out in late 2022 before the final bear market bottom formed.

So far, that reset has not happened.

Long-term holders are still selling, not accumulating. Their realized price is becoming a key downside magnet. This suggests the market has not completed its full deleveraging and redistribution phase.

Sponsored

Sponsored

Key Bitcoin Price Levels Show Why $48,000 and $40,000 Matter Next

All technical and on-chain signals now converge around a few critical price zones.

On the downside, the first major support sits near $53,350. A failure here would expose the $48,800 region, which aligns with the bear flag target and prior consolidation zones.

If $48,800 breaks, attention shifts to the long-term holder realized price near $40,260.

This zone represents the deepest structural support in the current cycle. A move into this region would indicate broad capitulation among long-term investors and confirm a deeper bear phase.

In a worst-case scenario, extended weakness could even open the door toward $37,180, based on longer-term projections and historical support clusters.

On the upside, Bitcoin must reclaim $69,510 on a sustained 4-hour closing basis to regain short-term credibility. A move above $73,320 would be required to invalidate the bearish pattern.

Until that happens, rallies remain vulnerable.

With leverage rebuilding, long-term holders still selling, and critical support levels approaching, the current rebound lacks structural confirmation. Under these conditions, buy-the-dip strategies remain exposed to sharp reversals rather than sustained upside.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business17 hours ago

Business17 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat23 hours ago

NewsBeat23 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World17 hours ago

Crypto World17 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World16 hours ago

Crypto World16 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

Bitcoin’s slide to $64,000 sparked a record $3.2B in realized losses, a capitulation event that surpassed even the Luna and FTX era market shocks, an on-chain analyst said.

Bitcoin’s slide to $64,000 sparked a record $3.2B in realized losses, a capitulation event that surpassed even the Luna and FTX era market shocks, an on-chain analyst said.