Business

Fractal Analytics raises Rs 1,249 crore from anchor investors ahead of IPO; Morgan Stanley, Goldman Sachs among key backers

The IPO will open for public subscription on Monday, February 9, and close on Wednesday, February 11. The price band has been fixed at Rs 857 to Rs 900 per equity share of face value Rs 1 each, with a minimum bid lot of 16 equity shares.

Out of the total anchor allocation, 52,77,680 equity shares (38.05%) were allotted to 11 domestic mutual funds through a total of 22 schemes, indicating strong participation from domestic institutions.

The anchor book witnessed demand from several leading mutual funds including SBI Mutual Fund, ICICI Prudential Mutual Fund, Motilal Oswal Mutual Fund, UTI Mutual Fund, Trust Mutual Fund, Bandhan Mutual Fund, Invesco Mutual Fund, Baroda BNP Paribas Mutual Fund, and Sundaram Mutual Fund, among others.

Insurance companies that participated in the anchor round included Life Insurance Corporation of India (LIC), HDFC Life Insurance, SBI Life Insurance, Bharti AXA Life Insurance, and Edelweiss Life Insurance.

The issue also drew strong interest from global investors, including marquee long-only and institutional names such as Morgan Stanley Investment Funds and Goldman Sachs Bank Europe, along with Ashoka WhiteOak Emerging Markets Funds, Jupiter Global Fund, Societe Generale – ODI, Flumen Investment Trust, Optimix Wholesale Global Emerging Markets Share Trust, Neo Prime Fund, and Neo Secondaries Fund, among others.

Fractal Analytics describes itself as India’s first pure-play artificial intelligence company and a global provider of AI-powered analytics and decision science solutions to Fortune 500 companies, enabling enterprises to unlock business value through advanced data science, artificial intelligence and deep domain expertise.The IPO comprises a fresh issue of equity shares aggregating up to Rs 1,023 crore and an offer for sale (OFS) aggregating up to Rs 1,810 crore. The OFS is being undertaken by existing shareholders including Quinag Bidco Ltd, TPG Fett Holdings Pte., Satya Kumari Remala, Rao Venkateswara Remala, and GLM Family Trust. The issue also includes an employee reservation portion of up to Rs 600 million.

Kotak Mahindra Capital Company, Morgan Stanley India Company, Axis Capital, and Goldman Sachs (India) Securities are the book running lead managers to the offer.

Business

Barrick Mining: Meet The New Boss, Not The Same As The Old Boss

Barrick Mining: Meet The New Boss, Not The Same As The Old Boss

Business

Marzetti moving deeper into sauces

Latest acquisition comes on heels of strong second quarter.

Business

(OFRM) starts trading on the New York Stock Exchange

Jennifer Garner, co-founder of Once Upon a Farm, center, and Cassandra Curtis, co-founder of of Once Upon a Farm, center right, during the company’s initial public offering (IPO) on the floor of the New York Stock Exchange (NYSE) in New York, US, on Friday, Feb. 6, 2026.

Michael Nagle | Bloomberg | Getty Images

Once Upon a Farm made its public market debut on Friday, trading on the New York Stock Exchange under the ticker “OFRM.”

The stock opened at $21 per share, up 16% from its initial public offering price. The shares rose 20% in afternoon trading.

The organic children’s nutrition company priced its IPO at $18 per share on Thursday, in the middle of the expected range of $17 to $19. Once Upon a Farm and backers sold about 11 million shares, raising $197.9 million and valuing the company at $724 million.

Founded in 2015 by Cassandra Curtis and Ari Raz, the Berkeley-based company sells a range of organic cold-processed, refrigerated baby foods and kid snacks. In 2017, actress Jennifer Garner and former Annie’s Homegrown CEO John Foraker joined the company as co-founders. Garner sits on the company’s board and holds the formal title “Farmer Jen,” while Foraker, whom she calls the “Grand Poobah of organic,” is CEO.

“We want to feed babies to big kids, as we’re helping make parents lives easier,” Garner told CNBC.

Once Upon a Farm’s market debut comes as shoppers and policymakers alike have pushed back on ultra-processed foods, particularly when consumed by children. For example, the “Make America Healthy Again” movement, spearheaded by Health and Human Services Secretary Robert Kennedy Jr., has found evangelists in so-called “MAHA moms,” who agree with his opinions on everything from junk food to childhood vaccinations.

The shift in behavior has hurt Big Food, while fueling growth for insurgent brands like Once Upon a Farm. In 2024, the company recorded net sales of $156.8 million, up 66% from the prior year, although its losses widened from $17.6 million to $23.8 million, according to a regulatory filing.

“With these tailwinds and consumer trends being in the right spot, we’re really trying to take advantage of that and deliver more for consumers,” Foraker said.

Retailers have taken note of the shift and are allotting prime shelf space to organic foods, a far cry from Foraker’s early days at Annie’s, when its products were relegated to the undesirable “organic” corner in grocery stores, he said.

Once Upon a Farm, which is officially designated as a public benefit corporation, aims to “drive systemic change in childhood nutrition,” according to its mission statement. Foraker said its commitment to that goal is why it chose to go public rather than seek a sale, a much more common ambition for upstart consumer goods businesses.

While Foraker said he had a good experience with General Mills after it bought Annie’s in 2014, he noted that across the food and beverage industry, many companies do not stick to the promises that they make to brands they are buying and honor their mission. (Look no further than the yearslong dust-up between Ben & Jerry’s and its former owner Unilever and current parent Magnum Ice Cream Company, which spun out from the Dove owner last year.)

Once Upon a Farm was planning to go public last year, before the longest-ever government shutdown disrupted those plans. Once Upon a Farm plans to spend the IPO proceeds to pay down its debt, purchase new equipment and fund general corporate purposes, according to a regulatory filing.

Broadly, more IPOs are expected this year, thanks to interest rate cuts and a large backlog of companies that have been scared off by market volatility and recession fears. This week alone saw seven companies go public through IPOs that raised at least $150 million, including Bob’s Discount Furniture, according to Renaissance Capital data.

Business

Capri Holdings Still Has A Lot To Prove

Capri Holdings Still Has A Lot To Prove

Business

Post Consumer Brands ushers in new CEO

Greg Pearson to succeed Nicolas Catoggio, newly named COO of Post Holdings.

Business

Amazon and Biogen Earnings: Still to Watch This Week

Amazon and Biogen Earnings: Still to Watch This Week

Business

What to Consider Before Starting a Home Extension

UK property prices keep climbing year after year. Many homeowners find that moving costs more than improving their current space. A well-planned home extension adds living area and boosts property value.

Rushing into construction without proper prep leads to budget blowouts. Smart property owners treat extensions like business investments. They research requirements, compare options, and grasp the full scope before signing contracts.

Planning Permission and Building Regulations

Most home extensions need approval from your local planning authority. Single-story rear extensions under certain sizes may fall under permitted development rights. These rights vary by property type and location though. Properties in conservation areas face tighter rules.

Building regulations apply to almost all extension work. These cover structural safety, fire protection, ventilation, and energy standards. Your local authority building control must inspect work at different stages. Some homeowners hire approved inspectors instead, but standards stay the same.

Getting this wrong creates expensive problems down the line. Unauthorized work can force you to demolish completed extensions. Mortgage companies and buyers spot missing certificates during property sales. The UK Government’s Planning Portal breaks down what needs approval for your property.

Structural Assessment and Design Feasibility

Your property’s existing structure determines which extensions work best. Different factors play a role here:

- Load-bearing walls affect what you can modify or remove

- Foundation type influences how much extra weight you can add

- Roof design dictates upward extension possibilities

- Building age may require reinforcement before adding weight

Victorian terraces have different structural needs than 1960s semi-detached houses. Older properties often need extra support before taking on additional load.

Upward extensions offer space gains without eating into your garden. A West London loft conversion company can check structural feasibility and recommend the best approach. Different conversion styles suit different roof structures and ceiling heights.

Professional structural surveys spot potential issues before construction starts. Soil conditions affect foundation requirements for ground floor work. Party wall agreements become necessary when work affects shared boundaries. These surveys cost money upfront but prevent costlier surprises during building.

Budget Planning and Hidden Costs

Extension projects regularly blow past initial estimates. Setting a real budget means accounting for more than construction costs. Professional fees add up fast. Architects, structural engineers, and planning consultants all charge separately.

Expected Professional Fees

Building control fees run several hundred pounds minimum. Party wall surveyor costs can hit thousands on complex projects. Skip hire and waste removal add another expense many forget about.

Building in Contingency

Most experts say add 10 to 15 percent for unexpected issues. Ground conditions may need deeper foundations than planned. Asbestos removal in older properties creates unplanned costs. Matching existing materials often costs more than using modern options.

VAT applies to most extension work at standard rates. Some conversions may qualify for reduced rates, but rules change often. Hidden costs also include temporary housing if you move out during work. Mortgage fees for releasing equity deserve consideration too. Council tax bands may jump once work finishes, affecting running costs long-term.

Choosing the Right Type of Extension

Different extension types suit different needs and budgets. Your choice depends on several factors working together.

Common Extension Types

Single-story rear extensions provide ground floor living space with simpler construction. Side returns work well on terraced properties. They fill that awkward gap between house and boundary. Two-story extensions maximize space gains but cost more and face stricter planning review.

Loft conversions offer excellent cost per square meter ratios. Dormer conversions add headroom and floor space by extending the roof outward. Hip to gable conversions work on semi-detached and detached houses. Mansard conversions provide maximum space but need planning permission and major structural work.

Factors That Influence Your Choice

Your available budget obviously matters most. How much space you actually need comes next. Some conversion types suit your property better based on existing structure. Planning restrictions in your area may block certain options completely. The Royal Institute of British Architects offers guidance on matching extension types to different property styles.

Managing Disruption and Timeline Expectations

Construction work disrupts daily life more than most people think. Noise starts early and runs throughout working hours. Dust travels farther than you expect, even with protective sheets. Kitchen and bathroom access gets limited during certain work phases.

Realistic timelines prevent frustration and help you plan around disruption. Small single-story extensions typically take two to three months from start to finish. Loft conversions usually finish within six to eight weeks once work begins. Larger two-story projects often run four to six months or longer.

Weather delays affect outdoor work, particularly during winter. Material delivery delays have become more common recently. Coordinating multiple trades needs careful scheduling, and one delay creates a domino effect. Good contractors build buffer time into schedules, but expect some overrun on completion dates.

Planning Your Extension Project

Home extensions represent major financial commitments that deserve careful thought. The cheapest quote rarely delivers the best value over time. Experienced contractors cost more initially but typically finish on schedule with fewer problems. Poor work creates ongoing maintenance issues and hurts resale value.

Start planning several months before you want construction to begin. This allows time for designs, planning applications, and comparing contractor quotes properly. Rushing decisions to meet random deadlines usually backfires. Speak to neighbors early about your plans, especially if party wall work becomes necessary. Their cooperation makes the process smoother and maintains good relationships after building finishes.

Business

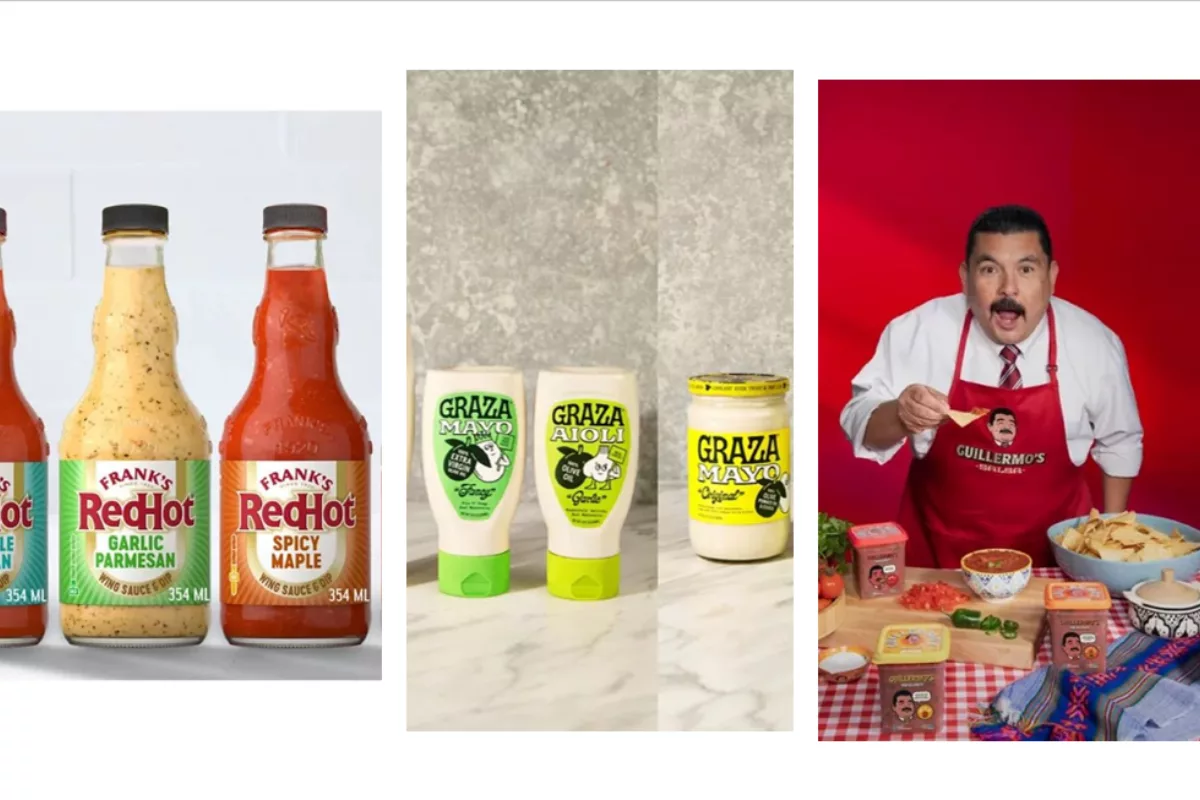

Slideshow: New products from Graza, Guillermo’s and McCormick & Co.

New products are shaking up the condiment category.

Business

Should you overpay your mortgage or save?

Martin Lewis explains.

Business

Smart motorways not delivering value, new reports show

In a statement, the Department for Transport said that although it would not be rolling out any new smart motorways, they remained among our safest roads in terms of deaths and serious injuries, and were just as safe, or safer, than the roads they replaced.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports9 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat5 hours ago

NewsBeat5 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined

-

Crypto World1 day ago

Crypto World1 day agoHeads Up! Bitcoin Enters Capitulation Mode, Trades In a ‘Phase That Rewards Discipline Over Prediction’