Crypto World

Bitcoin Dips to $60k, TRM Labs Reaches Crypto Unicorn Status

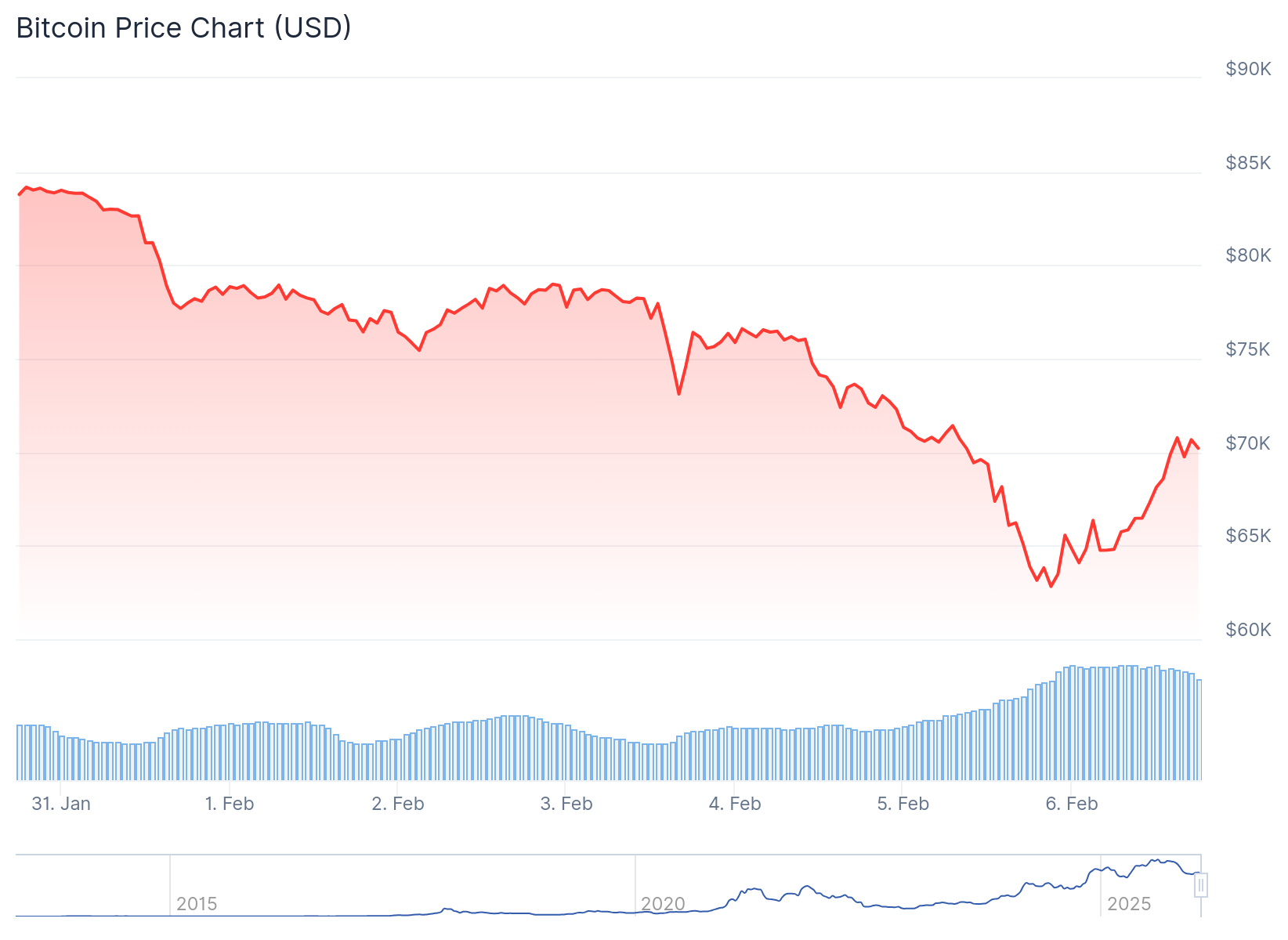

Cryptocurrency markets experienced a brutal sell-off this week as investor concerns grew over stagnating US liquidity following US President Donald Trump’s nomination of Kevin Warsh to lead the Federal Reserve.

Bitcoin exchange-traded funds (ETFs) recorded three consecutive days of outflows, with $431 million exiting on Thursday, according to data from Farside Investors. Bitcoin’s (BTC) price briefly dipped to $60,074 on Friday before recovering above $64,930 as of 7:49 a.m. UTC.

Warsh — who previously served as a Fed governor from 2006 to 2011 — is expected to continue the interest rate cut trajectory. His nomination may also signal that broader market liquidity is expected to “stabilize rather than meaningfully expand,” Thomas Perfumo, economist at crypto exchange Kraken, told Cointelegraph.

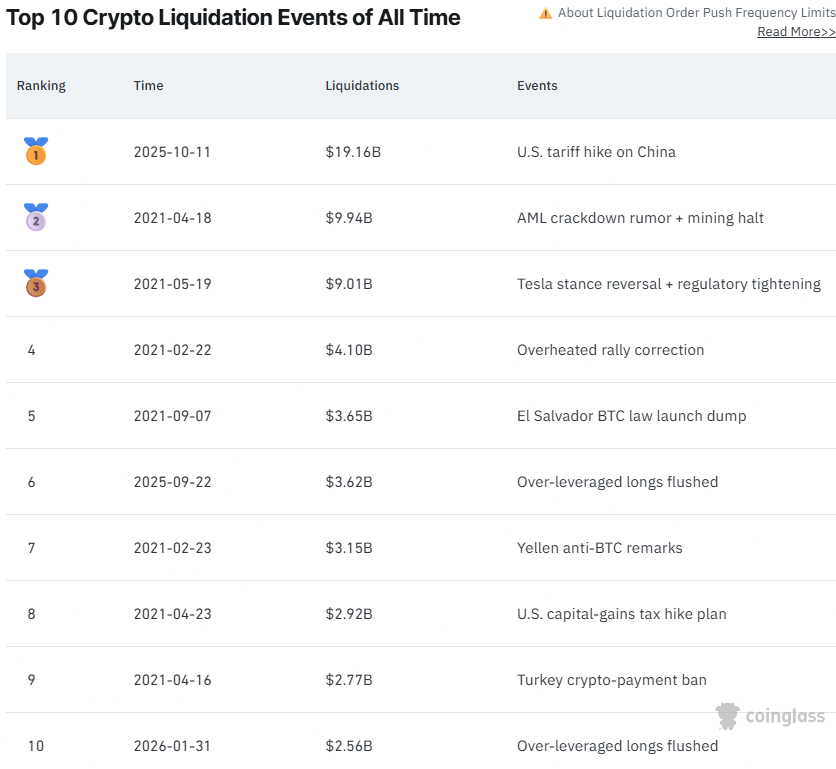

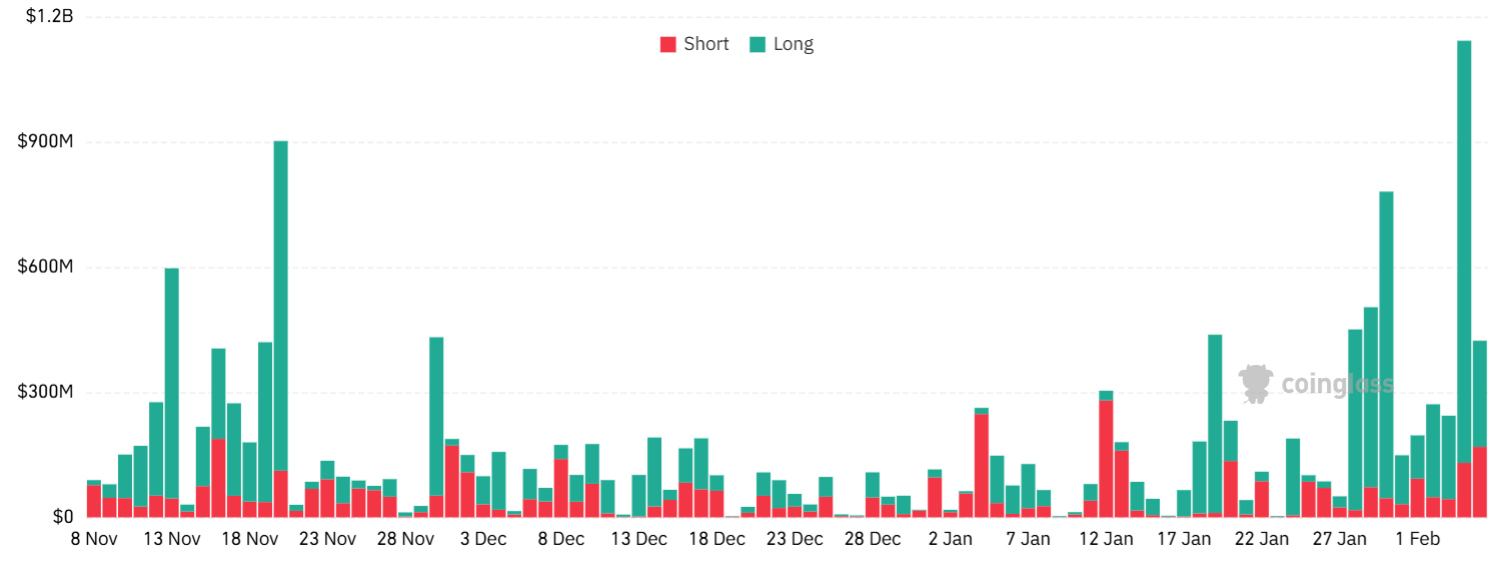

The industry recorded its 10th-largest liquidation event on Jan. 31, as more than $2.56 billion in leveraged positions were wiped out, according to derivatives data platform CoinGlass.

TRM Labs completes $70M investment round at $1B, becomes crypto unicorn

Blockchain intelligence platform TRM Labs completed a $70 million Series C funding round, valuing it at $1 billion, becoming the latest crypto company to reach unicorn status.

The investment round was led by seed investor Blockchain Capital, with participation from Goldman Sachs, Bessemer Venture Partners, Brevan Howard Digital, Thoma Bravo, Citi Ventures and Galaxy Ventures, according to a Wednesday news release.

TRM Labs seeks to equip public and private institutions with AI solutions that combat cybercrime. The company defends against illicit activities that increasingly rely on automation.

“At TRM, we’re building AI for problems that have real consequences for public safety, financial integrity, and national security,” wrote Esteban Castaño, co-founder and CEO of TRM Labs.

“This funding allows our world-class team — and the people who will join us next — to innovate alongside institutions on the front lines of the most consequential threats, and expand the potential of AI to meaningfully improve how our critical systems are protected.”

The $70 million round shows that capital is flowing into blockchain analytics platforms seeking to stop the spread of AI-fueled scams and cyberattacks, including from large traditional institutions.

Avalanche tokenization hits Q4 high as BlackRock’s BUIDL expands onchain

Blockchain network Avalanche saw increasing institutional adoption across tokenized money market funds, loans and indexes in the fourth quarter, driving the value of real-world assets (RWAs) on the layer 1 to a new high.

The total value locked of tokenized RWAs on Avalanche rose 68.6% over the fourth quarter of 2025 and nearly 950% over the year to more than $1.3 billion, boosted by the $500 million BlackRock USD Institutional Digital Liquidity Fund (BUIDL) that launched in November, Messari research analyst Youssef Haidar said in a Jan. 29 report.

Fortune 500 fintech FIS partnered with Avalanche-based marketplace Intain to launch tokenized loans in November, further boosting Avalanche’s TVL, Haidar said. Intain enables 2,000 US banks to securitize over $6 billion worth of loans on Avalanche.

The S&P Dow Jones also partnered with Dinari, an Avalanche-powered blockchain, to launch the S&P Digital Markets 50 Index, which tracks 35 crypto-linked stocks and 15 crypto tokens on Avalanche.

Traditional finance firms are increasingly confident about experimenting with tokenization, as the Securities and Exchange Commission has become more open to crypto products over the past year.

ParaFi Capital makes $35M investment in Solana-based Jupiter

Jupiter said it has secured a $35 million strategic investment from ParaFi Capital, marking the first time the Solana-based onchain trading and liquidity aggregation protocol has taken outside capital after years of bootstrapped growth.

The transaction involved token purchases at market prices with no discount and an extended lockup period and was settled entirely in Jupiter’s JupUSD stablecoin, the companies said. Financial terms beyond the $35 million investment were not disclosed.

The investment comes as Jupiter has processed more than $1 trillion in trading volume over the past year and expanded beyond swap routing into perpetuals, lending and stablecoins, according to the company.

The deal also included warrants allowing ParaFi Capital to acquire additional tokens at higher prices, a structure the companies said was intended to reflect long-term alignment.

The investment follows a recent expansion of Jupiter’s product offerings. In October, Jupiter rolled out a beta version of its onchain prediction market developed with Kalshi, followed in January by the launch of JupUSD, a Solana-native, dollar-pegged stablecoin built in partnership with Ethena Labs.

Jupiter’s native token (JUP) was up around 9% over the past 24 hours, according to CoinGecko data.

Aave winds down Avara, phases out Family wallet in DeFi refocus

Aave Labs said it is sunsetting its “umbrella brand” Avara in the company’s latest move to refocus on decentralized finance and simplify its branding.

Aave founder and CEO Stani Kulechov posted Tuesday on X that Avara, a company encompassing projects including the Family crypto wallet and previously the social media platform Lens, “is no longer required as we go all in on bringing Aave to the masses.”

Kulechov said the Apple iOS-based Family crypto wallet was also being wound down as the team has “learned that onboarding millions of users requires purpose-built experiences, such as savings, rather than generic, open-ended wallet experiences.”

The move marks Aave’s latest effort to refocus on products such as its flagship lending protocol as the project handed stewardship of Lens to the Mask Network last month, with Kulechov saying Aave’s participation in the protocol would be reduced to an advisory role so it can focus on DeFi.

Kulechov said in his latest post that Aave was “now united as one team of world-class designers, engineers, and smart contract experts, aligned around a single mission: bringing DeFi to everyone.”

Step Finance treasury wallets breached, $27M in SOL drained as STEP crashes 90%

Step Finance, a decentralized finance portfolio tracker on Solana, disclosed a security breach that led to the compromise of several treasury wallets, triggering a sharp sell-off in its native token.

“Earlier today, several of our treasury wallets were compromised by a sophisticated actor during APAC hours. This was an attack facilitated through a well-known attack vector,” the platform wrote in a post on X, adding that they have taken “remediation” steps.

Onchain data reviewed by blockchain security firm CertiK shows that roughly 261,854 Solana (SOL) (worth around $27.2 million) was unstaked and transferred from Step Finance-controlled wallets.

Step Finance has not yet confirmed the total scale of the losses. The team also did not disclose how the attacker gained access, nor whether the incident stemmed from a smart contract flaw, compromised keys or an internal access issue. It also remains unclear whether any user funds were affected, beyond protocol-owned assets.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the red.

The privacy-preserving Zcash (ZEC) token fell 35% to record the week’s biggest decline in the top 100, followed by the Story (IP) token, down 34% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Crypto World

Why Bitcoin’s Latest Sell-Off Echoes The 2022 Crypto Winter

Bitcoin has recently experienced a sharp freefall in the past 48 hours, scaring retail investors and raising serious concerns over its future viability. Though its price has improved slightly on Friday, traders are bracing themselves for the next big dip– and how much worse it might be.

Luckily for the crypto industry, this year wouldn’t be the first time that the future seemed dire. In times like these, history is the best anchor for knowing what happens next, which moves to avoid, and for overall assessing just how bad the situation currently is. Many of these answers lie in the 2022 collapse.

The Conditions That Preceded the 2022 Collapse

Though a lot has changed since then, the 2022 crypto winter provided the backdrop for what most in the community believed would be the end of the industry.

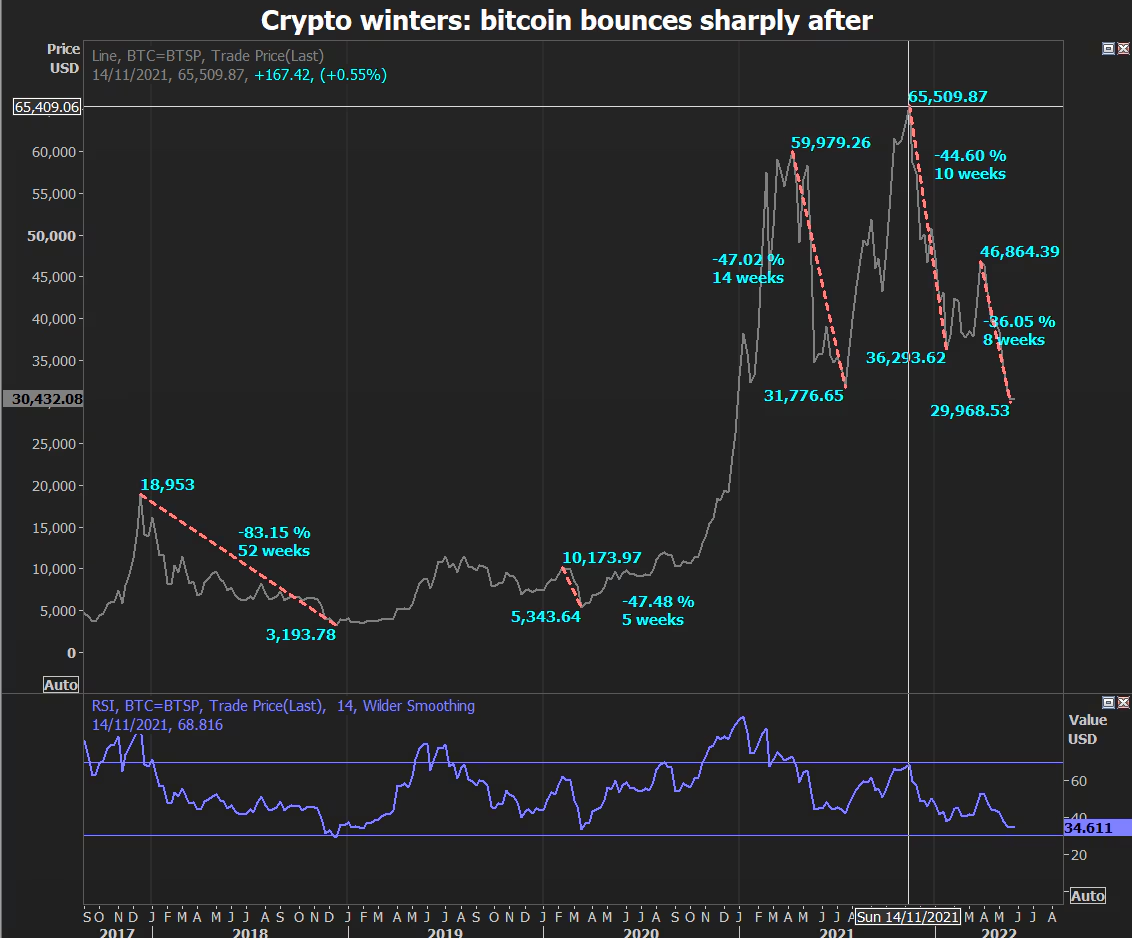

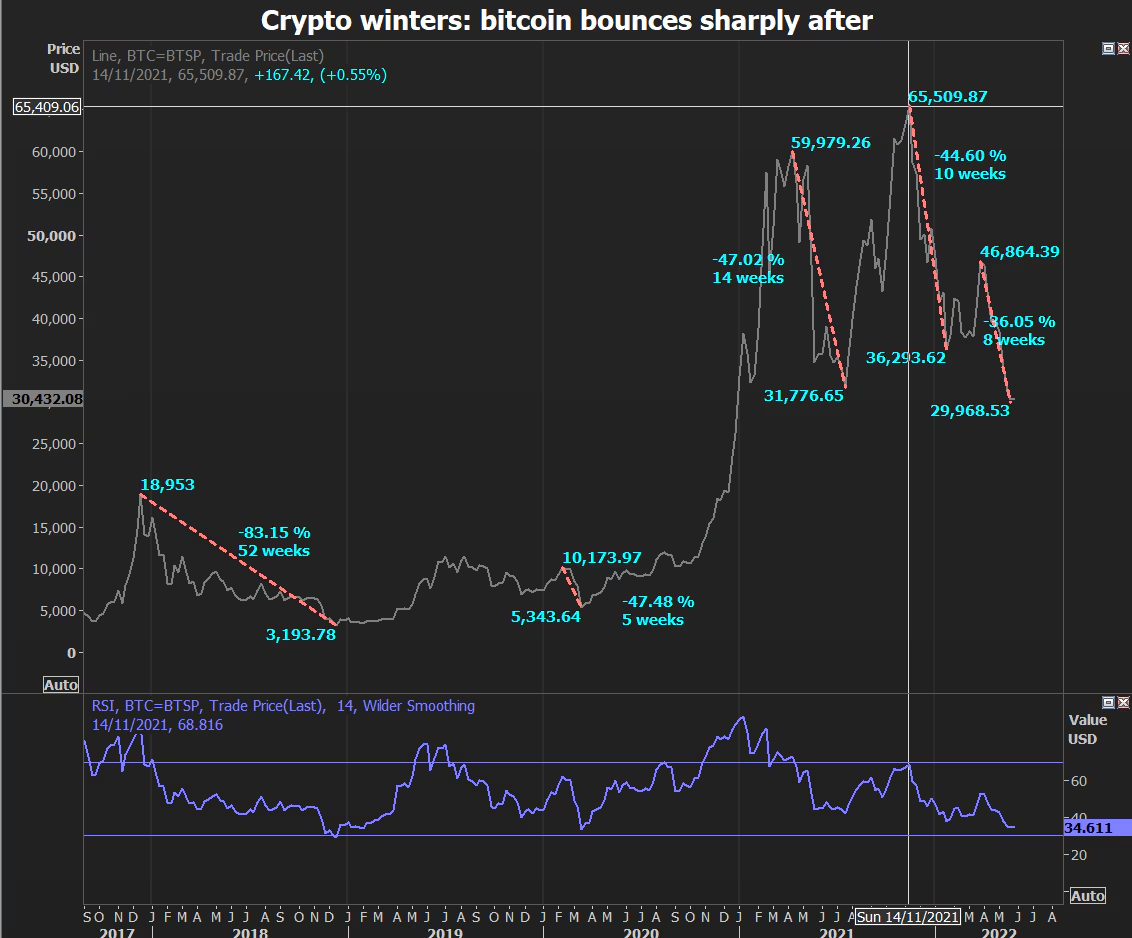

The narrative began in 2020, when, over the course of a year, cryptocurrencies grew enormously. Funding poured into the market, driving prices sharply higher until they peaked around November 2021. During that time, Bitcoin rose from around $8,300 to $64,000 over 10 months.

Sponsored

Sponsored

High-yield products were central to the allure some of the leading crypto firms offered at the time. The idea of receiving a generous, guaranteed interest rate on purchases such as Bitcoin or stablecoins was highly attractive.

Yet, the narrative began to dismantle, partly due to broader macroeconomic factors.

The US Federal Reserve had raised interest rates due to persistent inflation, limiting consumers’ access to liquidity. The stock market suffered a deep correction, partially in response to the outbreak of war in Europe.

These factors led crypto investors to withdraw funds from the most speculative assets.

What ensued was a scenario similar to a bank run. But as consumers rushed to withdraw their funds, bigger issues began to appear– ones that caused investors to seriously distrust the industry.

The Domino Effect That Followed

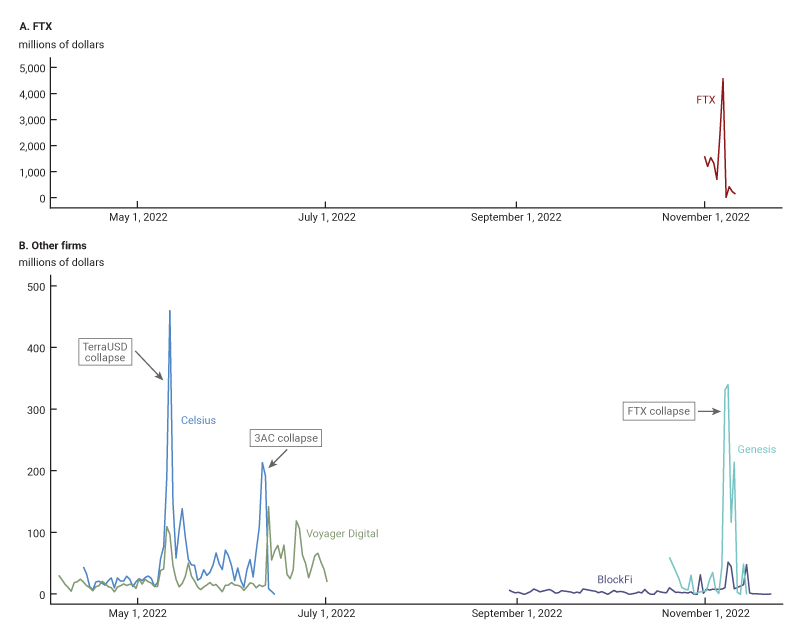

The first shock was the collapse of the TerraUSD (UST) stablecoin in May 2022, when its price nosedived over 24 hours. The event raised serious distrust in its ability to maintain its dollar peg.

According to an analysis by the Federal Reserve Bank of Chicago, Celsius and Voyager Digital, leading centralized exchanges at the time, saw respective outflows of 20% and 14% in customer funds in the 11 days following the news.

Then came the collapse of Three Arrows Capital (3AC). At the time, the hedge fund managed about $10 billion in assets. The generalized plunge in crypto prices and a particularly risky trading strategy wiped out its assets, obligating the firm to file for bankruptcy.

Sponsored

Sponsored

Centralized exchanges suffered even more greatly, incurring another round of steep outflows.

After that came the infamous FTX collapse in November 2022. Outflows reached 37% of customer funds, all of which were withdrawn within 48 hours. According to the Chicago Fed, exchanges Genesis and BlockFi respectively withdrew roughly 21% and 12% of their investments in that month alone.

During 2022, at least 15 crypto-related firms ceased operations or entered insolvency proceedings. The failures revealed structural liquidity weaknesses in several business models, particularly their vulnerability to rapid withdrawals during periods of market stress.

These events underscored an increasingly important lesson: financial promises must be aligned with underlying liquidity, and contingency planning is essential during periods of stress.

Against today’s market backdrop, those lessons have regained renewed relevance.

Why Today’s Bitcoin Behavior Matters

Over the past week, leading cryptocurrencies Bitcoin and Ethereum fell nearly 30%. This drop wiped out an estimated $25 billion in unrealized value across digital asset balance sheets.

This data comes as global markets sold off sharply this week, hitting crypto, equities, and even traditional safe havens like gold and silver. The synchronized decline points to a broader liquidity shock rather than asset-specific weaknesses.

As a result, traders facing margin calls liquidated their liquid assets first. For crypto, this broader backdrop indicated a market reset rather than a complete loss of confidence. With positive consumer data on Friday reducing near-term macro pressure, Bitcoin saw its price refloat back up to $70,000.

Sponsored

Sponsored

Nonetheless, Bitcoin’s behavior has signalled something more structural. It hasn’t exclusively reacted to liquidity conditions.

For the past year, Bitcoin has failed to reclaim momentum even on relief rallies. According to previous BeInCrypto analyses, this drawdown is being driven primarily by long-term holders who have consistently sold off their holdings.

That behavior sends a powerful negative signal into the market. Newer retailers have followed their moves closely, understanding that when conviction hodlers sell, upside attempts lose credibility.

Price action, however, is often only the first visible layer of stress. While markets tend to price fear quickly, institutions respond more slowly and more structurally, adjusting operations long before a full-blown crisis becomes evident.

In periods of prolonged uncertainty, these strategic shifts can serve as early warning signs.

Institutions Begin Pulling Back Quietly

Beyond price movements, early indicators of stress are already emerging at the institutional level.

One recent example has been Gemini’s decision to scale back operations and exit certain European markets. The move does not point to insolvency, nor can it be directly attributed to the latest price downturn.

Sponsored

Sponsored

However, it does reflect a strategic adjustment to a higher-compliance environment, illustrating how prolonged uncertainty often prompts institutions to reassess regional exposure and operating efficiency before stress becomes visible in balance sheets or market prices.

Meanwhile, last month Polygon carried out a large internal round of layoffs, dismissing roughly 30% of its staff. The move marked the third time it did so in the past three years.

Historically, similar operational pullbacks appeared quietly in late 2021 and early 2022, well before broader industry failures became visible. Firms began freezing hiring, scaling back expansion plans, and reducing incentives as liquidity tightened. These moves were often framed as efficiency or regulatory alignment rather than distress.

Attention is also returning to digital asset treasuries, where prolonged drawdowns tend to expose balance-sheet sensitivity. MicroStrategy has once again emerged as a bellwether.

MicroStrategy Highlights Early Structural Stress

Bitcoin’s largest digital asset treasury faced renewed market pressure after Bitcoin slid to $60,000 this week. The event pushed its vast crypto treasury deeper below its average acquisition cost and reigniting concerns about balance-sheet risk.

MicroStrategy’s shares fell sharply as Bitcoin extended its sell-off, while the stock’s decline also pushed its market valuation below the value of its underlying Bitcoin holdings.

If price volatility persists, such balance sheets will become increasingly reflexive, amplifying both confidence and fragility.

In fact, MicroStrategy has already moved away from its once-unmovable promise to never sell. In November, CEO Phong Le acknowledged for the first time that the company could sell its holdings under specific crisis conditions.

Today’s indicators appear earlier and more subdued, which may make them easier to overlook. Yet their quiet nature may be precisely what makes them significant, offering a glimpse into how prolonged confidence erosion begins to reshape the industry from the inside out.

Crypto World

New ChatGPT Predicts the Price of XRP, Ethereum and Pi Coin By the End of 2026

ChatGPT draws on large-scale datasets and market patterns to generate forward-looking crypto analysis, and when prompted with a well-defined framework, the AI predicts head-turning 2026 price outlooks for XRP, Ethereum, and Pi Network.

According to ChatGPT’s assessment, a prolonged crypto bull market paired with more transparent and supportive regulation in the United States could accelerate price discovery for major digital assets, pushing them to new record highs sooner than many investors expect.

Below is ChatGPT’s projected trajectory for the three leading altcoins over the next eleven months.

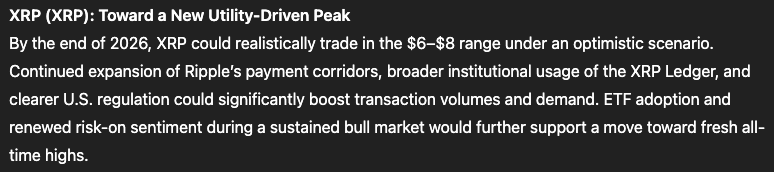

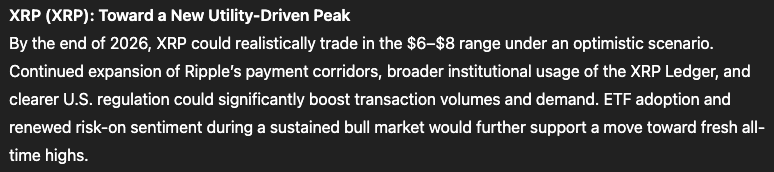

XRP ($XRP): ChatGPT Predicts a Potential Move Toward $8 by 2027

Ripple’s XRP ($XRP) currently changing hands near $1.36, but ChatGPT forecasts that broader XRP adoption and supportive legislation could drive XRP to $8 by the end of 2026, implying gains of nearly 500% from current prices.

Last July, it notched its first new all-time high (ATH) in seven years, surging to $3.65 after Ripple achieved a decisive courtroom victory against the U.S. Securities and Exchange Commission.

That ruling lifted a major regulatory overhang and helped ease broader market fears that the SEC planned to treat altcoins as unregistered securities.

From a technical perspective, XRP’s Relative Strength Index (RSI) is hovering near 27, placing it firmly in oversold territory. The fact that it’s uptrending again suggests that selling pressure may be losing steam, setting the stage for investors to buy back in over the weekend at a relative discount.

As XRP’s price gradually realigns with its 30-day moving average, positive industry or macro developments could spark a sudden surge in the weeks or months ahead.

When combined with anticipated ETF inflows from the newly launched US spot XRP ETFs and anticipation for the U.S. CLARITY bill, a proposed comprehensive crypto regulatory framework, ChatGPT’s ambitious price target appears increasingly plausible.

Ethereum ($ETH): ChatGPT Anticipates a 5x Opportunity for Current Holders

Ethereum ($ETH), the dominant blockchain for smart contracts, decentralized applications, and decentralized finance, remains the backbone of much of the Web3 ecosystem.

With a market capitalization of roughly $233 billion and more than $59 billion in total value locked (TVL) across DeFi protocols, Ethereum continues to serve as the main hub of on-chain commercial activity.

Its long-standing security track record, reliable settlement layer, and early leadership in stablecoins and real-world asset tokenization position Ethereum well for expanding institutional participation.

Momentum could intensify if U.S. lawmakers pass the CLARITY bill, offering the regulatory clarity institutions need to deploy capital through Ethereum-based infrastructure, either through stablecoins, crypto, or real world asset tokenization.

ETH is currently trading just below $2,000, with significant resistance expected near the $5,000 mark after peaking at an all-time high of $4,946.05 last August.

If ChatGPT’s bullish outlook plays out, a decisive breakout above $5,000 could open the door to multiple new highs in 2026, with upside potential going as high as $10,000 during a full-scale 2026 bull run.

Pi Network (PI): ChatGPT Sees a 2,700% Rally This Year

Pi Network ($PI) is best known for its mobile mining model that rewards daily user participation. Simply open the app and tap when prompted to earn crypto.

According to ChatGPT’s analysis, a strong bullish phase could lift Pi Network from its current price of $0.1445 to as high as $5, representing potential gains of more than 2,668%.

The token recently outperformed several large-cap cryptocurrencies following Pi Network’s announcement of a partnership with AI firm OpenMind. The collaboration highlights how Pi node operators can provide decentralized computing resources to external organizations, reinforcing a tangible real-world use case.

Additional momentum stems from recent testnet upgrades, including decentralized exchange functionality, automated market makers, enhanced liquidity systems, and a revamped KYC framework, all of which significantly broaden the platform’s scope.

Maxi Doge (MAXI): A New Meme Coin Challenger Enters the Spotlight

Although not part of ChatGPT’s primary forecasts, Maxi Doge ($MAXI) has rapidly become one of the most talked-about meme coin presales of 2026, raising approximately $4.6 million ahead of its public launch.

The project revolves around Maxi Doge, a high-octane gym bro parody (and distant cousin) of Dogecoin/ According to its tongue-in-cheek lore, Maxi Doge spent the last decade watching Dogecoin from the sidelines, while pumping weights and shitcoins, now he’s stepping into the limelight to take control of the meme coin scene.

Bold, chaotic, and deliberately over-the-top, Maxi Doge relishes in the degen energy that originally catapulted meme coins into a global phenomenon.

MAXI is an ERC-20 token operating on Ethereum’s proof-of-stake network, giving it a substantially smaller environmental footprint compared with Dogecoin’s proof-of-work design.

During the presale, participants can stake MAXI tokens for yields of up to 68% APY, with rewards gradually declining as the staking pool grows.

The token is currently priced at $0.0002802 in the latest presale phase, with automatic price increases triggered at each funding milestone. Purchases are available via MetaMask and Best Wallet.

Dogecoin may be the progenitor, but Maxi Doge is the new alpha in Memesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post New ChatGPT Predicts the Price of XRP, Ethereum and Pi Coin By the End of 2026 appeared first on Cryptonews.

Crypto World

Ai.Com, Founded by Kris Marszalek, Announces Upcoming AI Agents

Proponents of AI agents say the new technology will simplify crypto trading and other financial activities for the average user.

AI platform ai.com, founded by Crypto.com co-founder and CEO Kris Marszalek, announced on Friday that it will be launching an autonomous AI agent for retail consumers.

The agentic AI will be able to execute functions including trading stocks, workflow automation and simple tasks like calendar updates and managing changes to online social profiles, according to an announcement from the company.

The agents will feature segregated user data, secured by encryption keys unique to each user, and run according to user-set restrictions on what the agent is allowed to do, the announcement said.

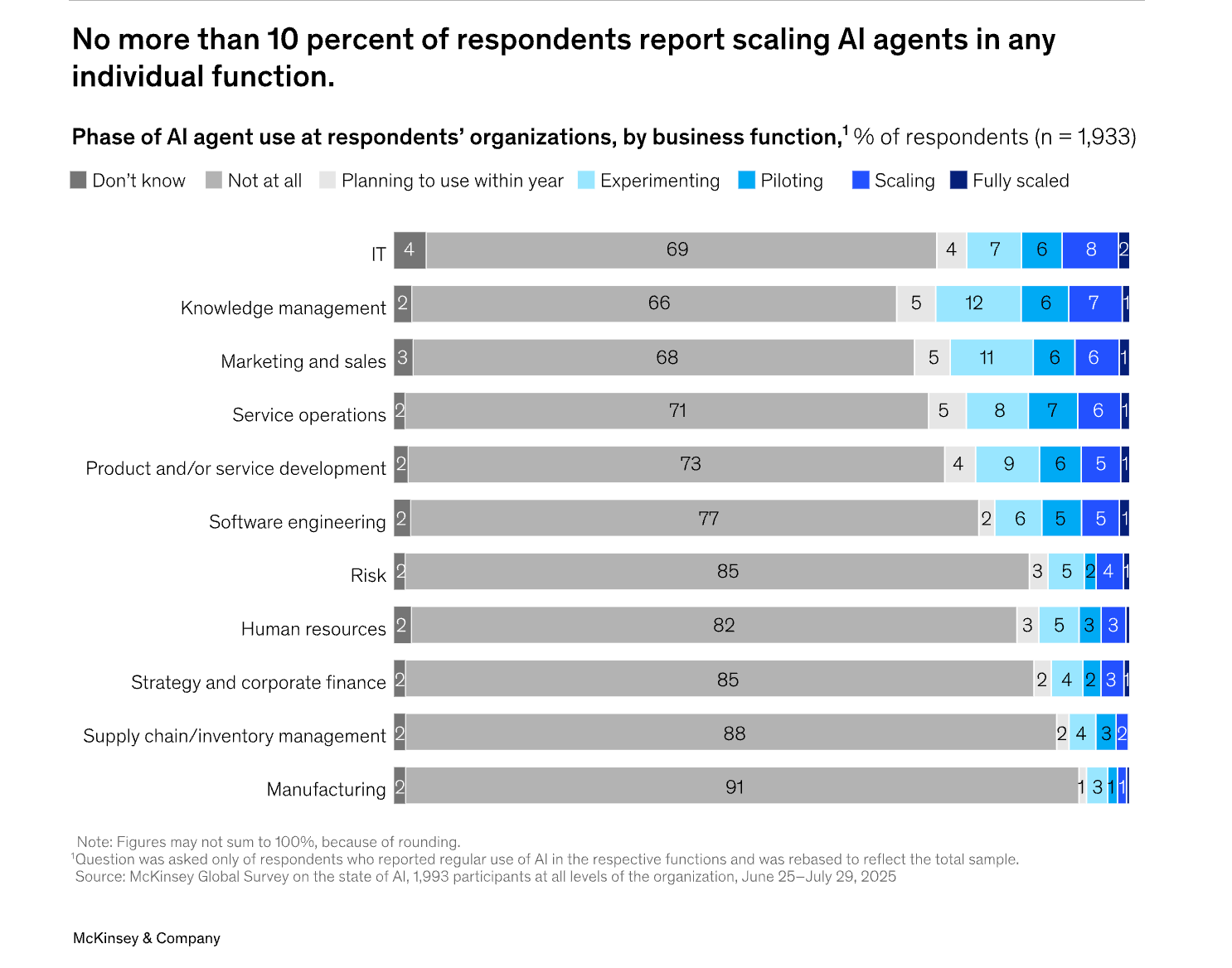

AI agents have garnered significant attention from users over the last year. About one quarter (23%) of respondents surveyed by investment research firm McKinsey indicated that their organizations were expanding the use of AI agents, according to a November report from the company.

The growth of autonomous AI agents can automate crypto trading strategies and wallet management, removing the technical barrier-to-entry for new users unfamiliar with blockchain systems and onchain transaction execution, proponents of the technology say.

Related: Crypto dev launches website for agentic AI to ‘rent a human’

How agentic AI can remove the barrier to entry for cryptocurrencies and Web3

These technical barriers include choosing the correct blockchain network and token protocols to send funds to, and complex user interfaces that are harder to navigate for new users, according to Jonathan Farnell, CEO of crypto exchange Freedx.

Agentic AI can abstract away the technical complexity of cryptocurrencies by selecting the cheapest and fastest execution pathways and simplifying stablecoin usage, according to Tether co-founder Reeve Collins.

This can include optimization for arbitrage or yield-bearing opportunities, Collins told Cointelegraph.

“When AI is integrated, all of the complexity in this space will be gone,” Collins said, adding that autonomous AI agents will allow users to hold and navigate larger portfolios of increasingly diverse token standards.

Magazine: Why AI sucks at freelance work and real-life tasks: AI Eye

Crypto World

Michael Saylor’s Strategy’s (MSTR) big Q4 loss looks dramatic, but bitcoin would have to fall below $8K to trigger trouble

Wall Street analysts covering Strategy (MSTR) broadly agree on one point after the company’s fourth-quarter earnings on Thursday: the headline losses look dramatic, but they do not signal a liquidity crisis or forced bitcoin selling.

Strategy reported a $17.4 billion operating loss and a $12.6 billion net loss for the quarter, figures driven largely by non-cash mark-to-market accounting tied to bitcoin’s price decline. Both TD Cowen and Benchmark said the market reaction missed that context, sending shares down about 17% on a day when bitcoin and other risk assets were already under pressure.

Shares are higher by 21% on Friday as bitcoin climbs from yesterday’s low of $60,000 to back above $70,000.

The two analysts agree the core debate centers on solvency, not profitability. Strategy holds 713,502 bitcoin, worth nearly $50 billion at current prices, against about $8.2 billion in convertible debt. Benchmark analyst Mark Palmer said the company would only face true balance-sheet stress if bitcoin fell below $8,000 and stayed there for years. Management emphasized on the earnings call that none of its debt carries covenants or triggers tied to bitcoin’s price or its average purchase cost.

TD Cowen’s Lance Vitanza also focused on the durability of the capital structure. He argued that Strategy was built to amplify bitcoin’s volatility by design, with common equity trading at roughly 1.5 times bitcoin’s swings. That leverage cuts both ways. Vitanza said the company’s $2.25 billion cash reserve and staggered debt maturities mean there is no reasonable scenario where Strategy would be forced to sell bitcoin in the near term, even if prices remain depressed.

Where analysts differ is less about risk and more about framing. TD Cowen leaned into Strategy’s role as a “digital credit engine,” highlighting its growing preferred equity business and the liquidity of its STRC preferred stock, which pays an 11.25% annualized dividend. Benchmark placed more weight on bitcoin’s long-term price path and the optionality embedded in Strategy’s equity if bitcoin rallies.

Both firms remain constructive on the stock. Benchmark reiterated a Buy rating with a $705 price target, based on a sum-of-the-parts model that assumes bitcoin reaches $225,000 by the end of 2026. TD Cowen also maintained a Buy rating, arguing that Strategy remains one of the most efficient ways for investors to gain leveraged bitcoin exposure outside of ETFs, though it did not disclose a specific price target in its note.

Crypto World

Why normalization of digital asset treasuries is the next big business trend

For a brief moment, the digital asset treasury (DAT) was Wall Street’s bright, shiny object.

But in 2026, the novelty has worn off.

The star of the “passive accumulator” has dimmed, and rightly so. Investors have realized that simply announcing a bitcoin purchase is no longer a magic trick that guarantees stock appreciation. The easy money trade is over.

But this cooling-off period is not a death knell; it is a reckoning. It is stripping away the hype to reveal a stark reality: Dozens of public operating companies are attempting to transform themselves into unregulated hedge funds—often without the risk architecture of a fund or the governance standards of a public company.

The playbook was alarmingly simple: raise capital, accumulate cryptocurrency, and pray for appreciation.

But as a securities attorney and CEO who has overseen more than $5 billion in capital raises, including as the General Counsel to MARA Holdings during its run to a $6 billion valuation, I know that accumulation is not a sound business strategy. It’s a crapshoot. And as we approach annual reporting deadlines, the bill for those bets is coming due.

If the DAT sector is to mature from a speculative frenzy and gain credibility as a respected fintech strategy, we must stop treating governance as an afterthought. It must be the foundation.

The risk of the “blind buy”

The prevailing DAT model has been defined by a singular mandate: raise cash, buy assets, hold. While this works in a bull market, it exposes shareholders to catastrophic downside in a bear market or during times of volatility, as we’ve all seen recently.

Without a clear, articulated strategy for why a specific asset is being chosen or how liquidity will be managed, these companies are essentially gambling with shareholder value. Both retail and institutional investors are beginning to ask harder questions. They are no longer satisfied with“we believe in crypto.” They want to know: How are you balancing capital allocation? What are the specific risks of the protocol you are invested in, and what are you doing in terms of risk mitigation? If the current strategy stalls, do you have a plan B?

A fair number of periodic reports filed by DATs today appear to offer generic boilerplate risk factors. They tend to reiterate warnings about volatility and hacking, but fail to address the idiosyncratic risks of their specific treasury assets. This is where the new generation of DATs will need to distinguish themselves to survive and be competitive.

Using the annual report as a storytelling tool

As reporting deadlines loom, management and counsel at DATs need to revamp their filings. For instance, the Risk Factor section of a 10-K should not be a regurgitation of every risk factor that has appeared on EDGAR, the SEC’s primary digital database; it should be a thoughtful assessment of realistic short- and long-term risks, specifically addressing the issuer’s business at hand.

A mature DAT must move beyond the basics and explain the trade-offs transparently. Investors deserve to know why a dollar is going into AVAX (or BTC) versus R&D or marketing, and exactly how the company generates solid revenue streams outside of asset appreciation to keep the lights on during a crypto winter. Furthermore, companies must disclose the specific protection mechanisms and controls they have in place to prevent the treasury from becoming a single point of failure.

The “governance alpha”

The next wave of successful DATs will be defined by their governance architectures. This isn’t just about regulatory compliance; it is about shareholder trust and the fulfillment of fiduciary duty.

We recently navigated this at AVAX One. We recognized the insufficiency of simply announcing a pivot to a DAT model, which meant going to our shareholders—the true owners of the capital—and asking for explicit approval for our digital asset strategy.

The result was telling. Over 96% of voting shareholders approved the move. This was not just a vote for another crypto treasury. It was a vote mandating a governance strategy for crypto.

It gave us a license to operate that “blind buy” DATs simply do not have, and we intend to use that mandate to support fintech through utilizing the Avalanche ecosystem.

The regulatory shield

Finally, we cannot ignore the SEC and the broader regulatory landscape. While many in the industry view regulation as a hindrance, for a public DAT, it is a necessary and welcome shield.

SEC disclosure obligations force a level of transparency that protects shareholders from the worst excesses of the crypto market. It is a strong tool that enables public DATs to distinguish themselves from opaque private entities.

By embracing these obligations rather than doing the bare minimum to scrape by, we build a moat of credibility and provide verifiable behavior and safety assurance.

We are entering a new phase. The “wild west” days of treasury management are ending. The market will soon punish those who are merely collecting coins and reward those who are building durable, governed financial fortresses.

Your annual report is your final term paper, and market reaction is your report card. Make sure you’ve done your homework.

Crypto World

Crypto in crisis, DeFi doomerism

002

Welcome back to Inside DeFi

It’s been an especially painful week for crypto markets and DeFi. So bad, in fact, that even the FT was reduced to posting wojaks with the rest of us.

With bitcoin dipping below the previous cycle’s peak, and ether (ETH) sub-$2,000, it may feel like there’s not much further to fall. But remember, even when down 99%, there’s still another 99% to go.

The bloodbath has also seen DeFi’s TVL drop to under $100 billion for the first time since May last year. Reactions ranged from sober doomerism to gallows humor.

Charts aside, InsideDeFi 003 returns to catch up with the week’s goings on.

Security scares

The week was, despite the ugly backdrop, thankfully light on DeFi hacks, with just two significant incidents. A failed attempt at a third was spotted and publicly mocked on-chain.

On Friday, an “arbitrary call vulnerability” in one of Gyroscope’s cross-chain contracts allowed a hacker to grant themself “full allowance to the escrow’s GYD holdings.”

Around $700,000 was lost, a third of which Gyroscope later decided to offer to the exploiter as a bounty.

A larger attack then hit CrossCurve’s bridge on Sunday. BlockSec put the losses, estimated at $2.7 million, down to an “authorization bypass,” while a post-mortem report from MixBytes claimed $1.4 million.

Puzzle Network’s founder has claimed that $700,000 of his own funds were amongst the losses in an on-chain message.

In a series of subsequent messages, he continued to request the return of his funds, even offering to buy the exploiter a beer in exchange.

According to Spearbit researcher “sujith,” the same attack vector had been previously identified but the report was dismissed as “invalid.”

While not a smart contract hack, a significantly larger loss affected the so-called frontpage of Solana, Step Finance, on Friday.

Read more: 2025’s biggest crypto hacks: From exchange breaches to DeFi exploits

A later update confirmed that approximately $40 million worth of assets were drained from the project’s treasury after executives’ devices were compromised.

Almost $5 million was subsequently recovered.

MetaMask’s Taylor Monahan implied that the theft was tied to a spate of incidents linked to hijacked Telegram accounts which, she estimates, is responsible for a total of over $300 million of losses, so far.

In better news, The DAO’s Griff Green followed up last week’s announcement of a 75,000 ETH security fund with a whitehat operation on a decade-old The DAO contract, rescuing a further 50 ETH to be added to the pot.

Read more: The DAO hacked again, but this time it’s the good guys

L2s left behind?

Ethereum co-founder Vitalik Buterin made a lengthy post on Tuesday, arguing that “the original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path.”

He pointed to drastic improvements in mainnet scaling (which are set to continue, 1,000-fold), along with the slow progress on L2 decentralization, as evidence that L2s must offer a specific “value add” to remain relevant.

He followed up, underlining that pursuing more “copypasta” EVM L2s and chains is a “dead end” and suggesting that networks offering something specific, such as “privacy, app-specific efficiency [or] ultra-low latency” should be the goal.

For all his confidence in Ethereum’s future, reportedly dumping $13 million on-chain definitely didn’t do ETH sentiment any favors.

Perhaps waiting to sell until after using a mixer would be preferable in future.

Elsewhere in L2 land, a few days before Vitalik’s comments, Base suffered its latest bout of disruption, with “intermittent transaction inclusion delays.”

An incident report clarifies that, over a period of two hours and 26 minutes, approximately 80% of transactions (2.1 million) were dropped.

The network’s status page registers an outage of 11 minutes on January 31.

Transaction inclusion delays were again showing on February 5, leading to a mempool upgrade. Delays are currently ongoing, with improvements including a “transaction propagation redesign” expected to take “four to six weeks.”

Read more: Coinbase Base network halts for 44 minutes due to ‘unsafe head delay’

AAVE whale in danger

Also on Thursday, all eyes turned to a highly leveraged whale, borrowing $28 million USDC against AAVE tokens.

As prices dropped, the position entered dicey territory, which would lead to further pain for AAVE holders if liquidated.

Against the backdrop of an ongoing debate over future control of the Aave brand, the assumption the position belonged to Aave founder Stani Kulechov was apparently too tempting for some to resist.

Parallels to the DeFi founder playbook of aggressively borrowing stables against their own project’s governance tokens, especially given this week’s news of Kulechov’s purchase of a £22 million London mansion, were hard to miss.

However, Kulechov roundly denied the position was him, insisting he stakes his AAVE rather than borrowing against it.

Read more: AAVE whale crashes token 10% amid ‘disgraceful’ governance vote

Most notably, Curve Finance’s Michael Egorov used this approach long term, whilst buying up a pair of luxury properties in Melbourne.

After striking a gentleman’s agreement in the wake of 2023’s Curve hack, Egorov managed to dodge disaster before ultimately being stung in a $20 million liquidation cascade in June 2024.

Rune Christensen of Sky (formerly Maker) also uses the same approach, which occasionally leads to its own governance dramas.

Kulechov though, with no need to worry about getting liquidated, instead celebrated the protocol’s resiliency at scale, after over $450 million was liquidated this week.

Cambodia scam compound crackdown ongoing

News out of Cambodia continues to outline the sheer scale of the nationwide crackdown on online “pig butchering” scam syndicates.

The widespread disruption has led to over 100,000 foreigners leaving the country since the beginning of the year, according to local media reports, citing the country’s Secretariat of Commission for Combating Technology Crimes.

Authorities claim to have shut down 190 locations, including 44 casinos, across the country and made over 2,500 arrests.

Additionally, almost 500 people, mostly Chinese and Philippine nationals, have reportedly been deported, though it’s unclear how many of these cases were related to the scamming industry.

As well as raids on compounds, the organizations involved have been hit with high profile arrests and executions of leaders in China.

The operations are now rumored to be on the move, with Sri Lanka being the next destination.

Crypto World

HYPE Price Hits $33.98 with $1.25B Volume Amid Strong Bullish Momentum

TLDR:

- HYPE price rises to $33.98 with a 5.69% gain in the last 24 hours, showing strong market activity.

- Weekly gains reach 13.52%, signaling increasing investor confidence and positive market momentum.

- $1.25B trading volume indicates high liquidity and sustained active participation from traders.

- Accumulation zones and chart structure support potential continued upward price movement.

The price of Hyperliquid (HYPE) is $33.98 today with a 24‑hour trading volume of $1,256,990,922. This represents a 5.69% increase in the last 24 hours and a 13.52% gain over the past week.

HYPE’s current trading dynamics underscore heightened trading activity and renewed interest in the asset’s trend trajectory.

Shorting Strength and Accumulation Setup

HYPE reached $50 after moving along the upper boundary of a rising channel. Momentum indicators clearly showed weakening strength, and repeated attempts to push higher were met with selling pressure.

This structure allowed traders to identify a short opportunity at $50. The short strategy targeted the $20 demand zone while ignoring intraday noise and social sentiment.

Price respected this zone precisely, resulting in a 60% decline. Spot trading without leverage ensured risk remained controlled, demonstrating disciplined execution instead of emotional reaction.

After the price drop, HYPE entered the $20–$15 accumulation zone. This region coincided with previous high-volume support levels and long-term structural lows.

Retail sentiment had incorrectly anticipated further declines to much lower levels, but the chart indicated selling pressure was nearly exhausted.

Price began consolidating and absorbing supply, confirming this as an optimal accumulation point. Buyers could establish positions without chasing price, allowing a stress-free entry.

This accumulation phase reinforced the importance of timing trades according to structure rather than market noise.

Shorting into strength and identifying the accumulation zone together formed a high-probability setup. Traders following trend channels and structural support avoided emotional trading and ensured disciplined entry points, laying the foundation for the next phase of the cycle.

Long Flip and Controlled Bullish Expansion

Once short profits were secured, the bias flipped long at $20. Traders maintained spot positions without leverage, reducing risk and avoiding unnecessary stress.

Price steadily advanced to $35–$38, achieving an 86% gain from the accumulation entry. February derivatives data showed OI-weighted funding rates largely positive, signaling sustained bullish participation.

Occasional red dips coincided with minor pullbacks, which were quickly absorbed as the price reclaimed higher levels. This pattern reflected a balanced and controlled market expansion.

Funding spikes near the $35–$38 zone remained contained. This indicated market participants were positioning for continuation rather than overleveraging.

Price respected structure while forming higher lows and reclaiming mid-channel ranges, creating a predictable environment for trend-following traders.

This phase highlights disciplined execution. Controlled entries based on accumulation, trend channels, and monitoring derivatives data ensure stress-free, sustainable gains.

Traders following this structured approach benefited from predictable price action while minimizing risk.

Crypto World

A $5,000 investment in Remittix could turn into $25,000 this month

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Remittix gains attention with live utility and 300% bonus, attracting selective investors amid market turbulence.

Summary

- Remittix leads the crypto rotation with live PayFi utility, a 300% bonus, and $28.9m raised in private funding.

- Built on Ethereum, Remittix targets $19 trillion cross-border payments, enabling real-time crypto-to-fiat transfers globally.

- Investor confidence rises as Remittix completes CertiK audit, ranks top on Skynet, and secures BitMart and LBank listings.

This week in Crypto has been characterized by heavy selling on centralized exchanges as Bitcoin dropped to new lows in 2026 following the violation of key support levels. Risk appetite has calmed down a lot, and fund managers of top institutions are also rebalancing their portfolios as macroeconomic challenges continue to hit many digital assets.

The majority of altcoins have followed the same free-fall Bitcoin has shown, and with correction taking place, capital flows now paint a more stratified image. An increasing number of investors are choosing to place selective investments in projects that show real progress, solid schedules, and strong asymmetric potential.

One name now dominating that rotation is Remittix, a PayFi-focused Ethereum protocol that is rapidly gaining attention thanks to a rare combination of live utility and a time-limited 300% bonus window that analysts say materially changes the short-term risk-reward profile.

Remittix’s PayFi model is built for real adoption, not market cycles

Remittix is positioning itself squarely at the intersection of crypto and real-world finance. Built on Ethereum, the protocol is here to bridge the inefficiencies that businesses and individuals encounter when trying to send money internationally.

The top Defi project is on course to become one of the biggest players in the $19 trillion global cross-border payments market, enabling direct crypto-to-fiat transfers with real-time settlement to bank accounts in 30+ countries, providing real-time utility to businesses, merchants, and individual clients. This execution-only strategy is among the reasons why investor interest has been so strong despite the broader markets retreating.

Strong backing has also helped boost confidence. According to recent reports, Remittix has already raised over $28.9 million in private capital, which reflects continued involvement of institutional and high-net-worth investors.

On the exchange front, listings on BitMart and LBank are already confirmed, with additional centralized exchange discussions reportedly ongoing. From a security standpoint, the project has completed a full CertiK audit and currently holds a leading pre-launch ranking on CertiK Skynet, adding an independent layer of credibility at a time when trust matters.

Remittix latest bonus incentive fuels aggressive capital influx

While infrastructure and adoption underpin the long-term thesis, near-term momentum around Remittix is being driven by its active deposit incentive tied to the native RTX token. According to official project updates, participants can receive up to a 300% bonus on qualifying deposits, one of the most aggressive incentive structures currently available in the market.

This dynamic is why some analysts suggest scenarios where relatively modest capital allocations can be meaningfully amplified during the campaign window. With the bonus applied, a $5,000 deposit can translate into substantially higher effective token exposure, creating a setup that many market commentators have described as unusually favorable under current conditions.

Additional factors reinforcing momentum include:

- Confirmed listings on BitMart and LBank

- Live crypto-to-fiat settlement across 30+ countries

- A growing and active global holder community

- A functional Remittix wallet is already live

- A clear roadmap centered on measurable PayFi adoption

February 9, 2026 PayFi launch anchors the long-term thesis

Beyond the bonus-driven surge, Remittix has confirmed that its full PayFi platform will officially go live on February 9, 2026. That milestone provides a concrete timeline, something increasingly valued as markets mature and speculative narratives lose favor.

As volatility reshapes capital allocation strategies, investors are becoming more selective. Projects with audited security, working products, exchange access, and real-world relevance are increasingly separated from the noise. With its PayFi infrastructure already live and a limited-time bonus amplifying early exposure, Remittix is being framed less as a short-term trade and more as a calculated positioning play ahead of broader adoption.

For more information, visit the official website, and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

XRP price risks drop to 50 cents, single-print candle theory holds

XRP price remains vulnerable to further downside as unresolved single-print imbalances continue to exert technical pressure toward the $0.50 support zone.

Summary

- Value area low has been lost, confirming bearish continuation

- Single-print imbalance remains unfilled, acting as a downside magnet

- $0.50 is critical support, where a potential macro pivot may form

XRP (XRP) price action has turned decisively bearish following an impulsive move to the downside, with structural weakness continuing to dominate the chart. After losing key value levels, the market has failed to regain bullish control, despite short-lived buying reactions.

From a long-term perspective, XRP appears to be trading within a broader corrective phase, with unfinished price structures remaining exposed below current levels.

One of the most notable technical features influencing the current outlook is the presence of a single-print candle imbalance. This structure, which often acts as a magnet for price, suggests that XRP may need to trade lower to complete unfinished auction activity before any meaningful macro pivot can occur.

XRP price key technical points

- Value area low has been lost, confirming bearish continuation

- Single-print imbalance remains partially unfilled, creating downside magnet

- $0.50 marks the base of the single-print structure, a critical high-timeframe level

XRP’s decline accelerated after the price failed to hold above the value area low, a key indication that buyers were unable to maintain acceptance at higher prices. Once this level was lost, the price fell aggressively, producing a bearish impulse that established a new swing low around $1.11.

Although price has since printed a buying tail, suggesting short-term demand, this reaction has not altered the broader market structure. Lower highs and weak follow-through continue to define price behavior, indicating that any upside moves remain corrective rather than trend-changing. As long as XRP remains below reclaimed value, downside risk stays elevated.

Understanding the single-print candle imbalance

Single-print candles occur when price moves rapidly through a zone without sufficient two-way trade, leaving behind an area of inefficiency. From a market profile and auction theory perspective, these zones are often revisited as price seeks to rebalance and complete unfinished business.

In XRP’s case, a high-timeframe single-print structure has been exposed, with only part of the imbalance filled during the recent decline. The upper portion of the single prints has already been retraced, but the base of the structure remains open. This unfinished area is located near the $0.50 level, creating a strong technical incentive for price to rotate lower.

Historically, markets show a high probability of revisiting these imbalances, particularly when broader structure aligns with bearish momentum, as is currently the case with XRP.

$0.50 emerges as a critical support zone

The $0.50 region is not only the base of the single-print candle but also aligns with a high-timeframe support zone. This convergence increases the importance of this level and makes it a key decision point for the market.

A move toward $0.50 would likely represent a continuation of the current corrective phase rather than a breakdown into uncharted territory. Such moves are often necessary to flush remaining weak hands and reset positioning before a potential macro pivot can form.

However, reaching support does not automatically imply a reversal. The reaction quality at $0.50, including volume expansion, rejection wicks, and structural behavior, will ultimately determine whether XRP can form a durable bottom or continue consolidating at lower levels.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, XRP remains biased toward further downside until the exposed single-print imbalance is fully resolved. The $0.50 level stands out as the most likely target for this rebalancing process and a zone where the market may attempt to establish a macro pivot.

If price reaches this level and shows strong acceptance and demand, it could mark the beginning of a broader base-building phase. Conversely, a weak reaction or continued acceptance below support would suggest prolonged consolidation before any sustained recovery.

For now, XRP remains structurally weak despite a short-term balance, with incomplete auction dynamics favoring a continuation of the lower trend. Traders should closely monitor how price behaves as it approaches the $0.50 region, as this area is likely to define the next major phase of XRP’s market cycle.

Crypto World

Bitcoin Reclaims $71K, But How Long Will It Hold?

Key takeaways:

-

Bitcoin’s derivatives signal caution, with the options skew hitting 20% as traders fear another wave of fund liquidations.

-

Bitcoin price recovered some of its Thursday losses, but it still struggles to match the gains of gold or tech stocks amid low leverage demand.

Bitcoin (BTC) has gained 17% since the $60,150 low on Friday, but derivatives metrics suggest caution as demand for upside price exposure near $70,000 remains constrained. Traders fear that the liquidations of $1.8 billion of leveraged bullish futures contracts in five days indicate that major hedge funds or market makers may have blown up.

Unlike the Oct. 10, 2025, market collapse that culminated with a record $4.65 billion liquidation of Bitcoin futures, the recent price weakness has been marked by three consecutive weeks of downside pressure. Bulls have been adding positions between $70,000 and $90,000, as aggregate futures open interest increased despite forceful contract liquidations due to insufficient margins.

The aggregated Bitcoin futures open interest on major exchanges totaled 527,850 BTC on Friday, virtually flat from the prior week. Although the notional value of those contracts dropped to $35.8 billion from $44.3 billion, the 20% change perfectly reflects the 21% Bitcoin price decline in the seven-day period. Data indicates that bulls have been adding positions despite the steady price decline.

To better understand if whales and market makers have turned bullish, one should assess the BTC futures basis rate, which measures the price difference relative to regular spot contracts. Under neutral circumstances, the premium should range between 5% and 10% annualized to compensate for the longer settlement period.

The BTC futures basis rate dropped to 2% on Friday, the lowest level in more than a year. The lack of demand for bullish leverage is somewhat expected, but bulls will take longer than users to regain confidence even as Bitcoin price breaks above $70,000, especially considering that BTC is still 44% below its all-time high.

Bitcoin derivatives metrics signal extreme fear

Traders’ lack of conviction in Bitcoin is also evident in the BTC options markets. Excessive demand for put (sell) options is a strong indicator of bearishness, pushing the skew metric above 6%. Conversely, when fear of missing out kicks in, traders will pay a premium for call (buy) options, causing the skew metric to flip negative.

The BTC options skew metric reached 20% on Friday, a level that rarely persists and typically represents market panic. For comparison, the skew indicator stood at 11% on Nov. 21, 2025, following a 28% price correction to $80,620 from the $111,177 peak reached twenty days earlier. Since there is no specific catalyst for the current downturn, fear and uncertainty have naturally intensified.

Related: What’s really weighing on Bitcoin? Samson Mow breaks it down

Traders are likely to continue speculating that a major market maker, exchange, or hedge fund may have gone bankrupt, and this sentiment erodes conviction and implies a high probability of further price downside. Consequently, the odds of sustained bullish momentum remain low while BTC derivatives metrics continue to signal extreme fear.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech2 hours ago

Tech2 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports12 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat8 hours ago

NewsBeat8 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

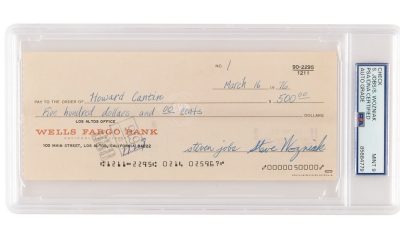

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined