Crypto World

After sharp drops in BTC, ETH prices, the next move for XRP is becoming crucial

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As XRP searches for a price floor amid broader market weakness, some holders are shifting focus from short-term price moves to strategies designed to stay steady through volatility.

Summary

- XRP’s recent stabilization has moved market sentiment from panic toward cautious evaluation of whether a durable bottom can form.

- With price direction still uncertain, some investors are exploring fixed-income style participation models instead of relying on rebounds alone.

- Arc Miner positions itself as one such option, offering USD-settled, contract-based cloud mining designed to generate predictable daily income regardless of XRP price swings.

After a significant decline, XRP has begun to show signs of stabilization, and market focus is gradually shifting from panic to a potential recovery. Although the entire cryptocurrency market remains under considerable downward pressure, whether XRP can establish a sustainable price bottom is a core issue discussed by investors and analysts, which will determine whether it will rebound or continue to face pressure.

Recent XRP price volatility once again reflects the direct impact of changes in the market environment on its valuation. In the absence of a clear market direction, relying solely on price increases for profits remains highly uncertain.

Therefore, XRP enthusiasts choose to use the Arc cloud mining platform to obtain relatively stable passive income during market downturns or periods of volatility, without the need for frequent trading, and to reduce overall risk while waiting for the market to recover.

Does a drop in cryptocurrency prices affect returns?

- Cryptocurrency price fluctuations do not affect Arc Miner. The platform returns a fixed amount of USD daily.

- Recent cryptocurrency volatility has had a significant impact. The platform’s current mining projects offer the highest returns in history.

- Moreover, the income is fixed. Return decisions are made by senior UK financial analysts, and principal and returns are guaranteed on the platform under unified regulatory oversight.

- Arc Miner has a professional team to hedge, ensuring no losses even during market downturns. User income is fixed during the contract period and unaffected by cryptocurrency price fluctuations.

- Users will earn profits in USD and can convert them daily to their desired cryptocurrency.

How can one generate stable passive income during periods of market downturn and volatility?

Step 1: Register an account. Users can visit the Arc Miner official website and register using an email address. New users will receive $15 in initial funding.

Step 2: Deposit into the account. Users can obtain their personal deposit address and transfer funds; the minimum investment is only $100.

Step 3: Choose a contract. Users can choose from a variety of cloud mining contracts with different terms and capacities. Once confirmed, the mining process will begin automatically.

Step 4: Receive earnings. After contract activation, earnings will be automatically credited to user accounts daily, which users can withdraw or reinvest at any time.

Getting started is easy: Register, deposit $100 or more, choose a contract, and earnings are credited daily and available anytime.

Arc Miner contract options, examples:

⦁【Daily Sign-in Contract】Principal: $15, Term: 1 day, Total Return: $15.6

⦁【Classic Contract】Principal: $500, Term: 6 days, Total Return: $540.5

⦁【Classic Contract】Principal: $2500, Term: 20 days, Total Return: $3225

⦁【Advanced Contract】Principal: $10000, Term: 40 days, Total Return: $16560

⦁【Super Contract】Principal: $100000, Term: 50 days, Total Return: $205500

About Arc Miner

Arc Miner is headquartered in the UK and complies with EU MiCA and MiFID II regulations. The company prioritizes transparency, security, and institutional standards. Features include:

- Regular audits by PwC

- Digital asset insurance through Lloyd’s of London

- Enterprise security using Cloudflare and McAfee

- Support for BTC, ETH, USDC, USDT, BCH, LTC, DOGE, XRP, and SOL.

Final thoughts

In the context of volatile crypto markets, Arc Miner provides users with stable, daily passive income settled in USD through cloud mining and smart contracts. Without relying on rising cryptocurrency prices, it helps investors maintain cash flow and reduce risk during downturns and periods of market volatility, making it a robust choice in the current market environment.

To learn more about Arc Miner, visit the official website and download iOS and Android mobile apps. Contact email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin’s (BTC) Free Fall, Ethereum’s (ETH) Collapse, and More: Bits Recap Feb 6

The past few days have been nothing but a massacre for the majority of the leading cryptocurrencies. Bitcoin (BTC) crashed to levels last seen in 2024, whereas Ethereum (ETH) tumbled well below $2,000.

Interestingly, Hyperliquid (HYPE) has shown notable resilience amid the crisis, with its price soaring by 60% in the past two weeks. In the following lines, we will touch upon these three cryptocurrencies and their latest performance.

BTC Bleeds Out

The primary cryptocurrency started the year on the right foot and at one point even challenged the $100K milestone. The past few weeks, though, have been brutal, with the price collapsing to as low as $60,000 on February 5. As of press time, BTC trades at approximately $66,400, representing a 20% weekly decline.

Pessimism among analysts has since dominated, with many suggesting that bears may simply be stepping in. Ali Martinez recently reminded that since 2015, every time BTC has lost the 100-week simple moving average (SMA), it has failed to reclaim it quickly and continued toward the 200-week SMA. Based on his chart, the asset’s valuation could plunge to $57,600.

For their part, PlanB (the anonymous creator of the Stock-to-Flow (S2F) model) presented several possible scenarios, including a devastating crash to $25,000.

The recent behaviour of the large investors supports the bearish thesis. Santiment’s data shows that whale and shark wallets have been selling BTC over the past few days, while smaller players have increased their exposure.

“This combination of key stakeholders selling and retail buying is what historically creates bear cycles. Until there is a sign of clear capitulation from the crowd, smart money will continue to gladly sell off their bags and not have any urgency to buy back in until the crowd has decided to move on from crypto,” the analysis reads.

Meanwhile, the popular Fear & Greed Index (which measures the current sentiment of BTC investors) has fallen to 9, the lowest point since the summer of 2022. Extreme fear is a sign that investors are overly worried and may sound alarming, but it can also indicate that the bottom is in.

After all, prominent investors, including Warren Buffett, have advised over the years that the best buying opportunities occur when there’s blood on the streets. The exact words of the Oracle of Omaha are: “Be fearful when others are greedy and greedy when others are fearful.”

Bad Days for ETH

The second-largest cryptocurrency has also been significantly affected by the market crisis, with its price briefly falling to a nine-month low of approximately $1,750. Currently, it hovers around $1,900, down 30% over the last seven days.

Its negative performance coincides with substantial outflows from spot ETH ETFs, suggesting a decline in institutional investor interest. It also follows news that Vitalik Buterin (one of Ethereum’s co-founders) has sold millions of dollars’ worth of the asset.

One popular analyst who touched upon ETH’s recent downtrend is X user Ted. He claimed that the next major support zone for the price is around the April 2025 lows. Recall that at that time, ETH nosedived below $1,400.

Ali Martinez argued that the coin historically bottoms when the Market Value to Realized Value (MVRV) drops under 0.80. On February 5, the metric stood at 0.96, indicating that an additional slump isn’t out of the question.

HYPE Stands Its Ground

Contrary to BTC, ETH, and countless other cryptocurrencies, Hyperliquid (HYPE) is actually in green territory. Its price has rallied by 60% over the past two weeks, driven by significant developments, including support from Ripple and growing interest in HIP-3 activity amid increased trading volume and open interest.

A few days ago, the team behind the decentralized platform revealed that HIP-3 markets reached new all-time highs of $1 billion in open interest and $4.8 billion in 24-hour volume.

Analysts like Crypto General and Zach are quite bullish. The former predicted short-term volatility and an eventual spike beyond $100 sometime this year, whereas the latter claimed there are “so many reasons to buy and hold HYPE.”

The post Bitcoin’s (BTC) Free Fall, Ethereum’s (ETH) Collapse, and More: Bits Recap Feb 6 appeared first on CryptoPotato.

Crypto World

Balance Sheet Stable Unless BTC Falls Below This Critical Level

Strategy’s Bitcoin reserves cover debt, and only a prolonged drop to $8,000 could possibly force restructuring.

Strategy CEO Phong Le told investors on Thursday that the company’s balance sheet remains stable despite recent crypto market turbulence, though extreme scenarios could pose challenges.

The firm, the world’s largest corporate Bitcoin (BTC) holder, says it would only need to consider restructuring or additional capital if the cryptocurrency fell to $8,000 and remained there for five to six years.

Balance Sheet Holds Amid Bitcoin Sell-Off

According to reporting by The Block, Le, speaking during Strategy’s fourth-quarter earnings call, emphasized that even after recent market losses, the company’s Bitcoin reserves comfortably cover its convertible debt.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price, and the price was $8,000, that is the point at which our Bitcoin reserve equals our net debt, and we would then look at restructuring, issuing additional equity, issuing additional debt,” he said.

The call came after a sharp sell-off across crypto markets, with BTC down roughly 7% in 24 hours, trading just under $66,000 at the time of writing. Strategy’s stock, MSTR, slid 17% to $107, erasing much of its gains from late 2025 and leaving it down about 72% over six months.

Analysts on social media noted that today’s session saw Bitcoin drop more than $10,000, the first time it has ever dipped by such an amount in a single day, according to The Kobeissi Letter. The dramatic loss in value was part of a structural market downturn that has wiped out $2.2 trillion in crypto market value since mid-October 2025.

Executive Chairman Michael Saylor also spoke in the call, dismissing concerns about quantum computing threats to Bitcoin as “horrible FUD” and outlining plans for a security initiative to support potential upgrades, including quantum resistance.

He reiterated that Strategy’s long-term approach is designed to withstand volatility, pointing to supportive U.S. regulatory developments and the growing integration of Bitcoin into credit markets and corporate balance sheets.

You may also like:

Strategic Outlook

Strategy is still expanding its Bitcoin holdings despite short-term price swings. Earlier this week, the company acquired 855 BTC for $75.3 million at an average price near $88,000, bringing its total reserves to over 713,500 units.

The buy followed a $25 billion accumulation in 2025 and a $1.25 billion purchase in early 2026, funded largely through capital raises.

Saylor has argued that the significance of Bitcoin treasury companies lies in credit optionality and institutional adoption rather than daily price action. According to him, firms holding BTC on balance sheets can leverage assets for debt issuance, lending, or financial services, giving them flexibility that ETFs lack.

While sentiment has deteriorated sharply in recent months, he framed these developments as part of a long-term integration of digital capital into global financial systems, rather than a short-term price event.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

US Recession Fears Trigger Sharp Crypto Market Crash

Key Insights

- US layoffs rise sharply, weakening consumer spending and market confidence.

- Crypto market cap drops 8%, with forced liquidations hitting 1.34B in Bitcoin.

- Bitcoin shows strong correlation with S&P 500 and gold amid macro selloff.

What Sparks Recession Debate?

The US economy shows signs of stress, with rising layoffs and weak hiring fueling recession fears. In January 2026, companies reported over 108,000 job cuts, the highest since 2009. Meanwhile, vacancy opportunities declined to 6.9 million, which is significantly below the projections. Such a decline in jobs could decrease consumer expenditure, impacting economic growth and investor confidence in high-risk assets like cryptocurrencies.

Housing data also contributes to economic issues. The gap between the home sellers and buyers is at an all-time high of 530,000. Reduced housing demand also affects construction employment, bank lending, and general consumer confidence that can add even more strain on financial markets.

Tech Debt and Bond Market Pressures

Stress in the technology credit sector is intensifying. Tech loan distress reached 14.5%, while bond distress climbed to 9.5%, highlighting challenges in debt management. Around $25 billion in software loans are trading at deep discounts. Previously, crypto and stock markets operated independently, but the correlation between the two has increased in recent years, causing crypto to respond sharply to stock market declines.

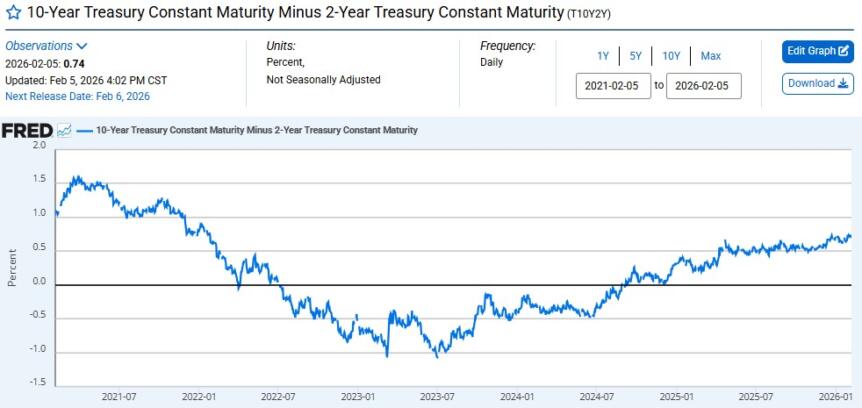

The bond market also signals caution. The 2-year versus 10-year Treasury yield spread moved to approximately 0.74%, known as bear steeping.

This trend, seen historically before recessions, indicates rising long-term yields relative to short-term rates, which can signal investor concern over future economic growth.

Crypto Market Reacts to Macro Risks

The crypto market tracked declines in traditional markets. The crypto market cap fell by 8% in 24 hours, to approximately $2.22 trillion. Trading volume rose more than 80% as liquidations increased. Bitcoin alone saw more than $1.34 billion of positions liquidated, while leading altcoins such as XRP and Solana posted sizable intraday losses.

Statistics show a 92% correlation between Bitcoin and the S&P 500 and an 80% correlation between cryptocurrency and gold, suggesting macroeconomic factors drove Bitcoin’s decline.

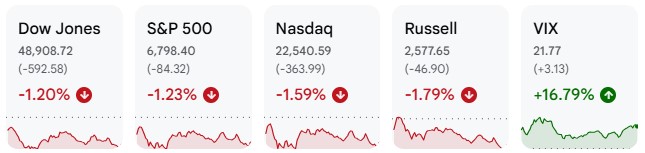

According to U.S. stock market data: S&P 500 fell 84.32 points to around -1.23%, Dow Jones dropped 1.20%, Nasdaq fell 1.59% to 363.99, and the Russell fell 1.79%.

Source: Google Finance

Analysts hope that any Federal Reserve open market operations or changes in rates would inject liquidity and take pressure off risk assets, potentially leading to a market recovery.

Crypto World

Bithumb Corrects Payout Error After Abnormal Bitcoin Trades

Bithumb said it identified and corrected an internal payout error after an “abnormal amount” of Bitcoin was credited to some user accounts during a promotional event, briefly causing sharp price fluctuations on the exchange.

In a company announcement on Friday, the South Korean crypto exchange said the price dislocation occurred after some recipients sold the mistakenly credited Bitcoin, but that it quickly restricted the affected accounts through internal controls, allowing market prices to stabilize within minutes and preventing any chain liquidations.

Bithumb said the incident was unrelated to any hacking or security breach and did not result in losses to customer assets, adding that trading, deposits and withdrawals are operating normally. The company said that customer funds remain safely managed and that it will transparently disclose follow-up actions to prevent similar errors.

While Bithumb did not disclose the amount involved, several users on X claimed that some accounts were erroneously credited with roughly 2,000 Bitcoin (BTC), a claim that has not been independently verified.

The news comes after Bithumb said in January that it had identified roughly $200 million in dormant customer assets spread across 2.6 million accounts that had been inactive for more than a year, as part of a recovery campaign.

According to CoinGecko, Bithumb currently carries a trust score of 7 out of 10 and reported roughly $2.2 billion in 24-hour trading volume at the time of writing.

Related: Bithumb halves crypto lending leverage, slashes loan limits by 80%: Report

Operational issues at centralized cryptocurrency exchanges

Beyond price volatility, the past year has exposed operational challenges at centralized cryptocurrency exchanges that have affected users during routine activity and periods of market stress.

In June, Coinbase acknowledged that restrictions on user accounts had been a major issue for the exchange, and claimed it had reduced unnecessary account freezes by 82% following upgrades to the exchange’s machine-learning models and internal infrastructure.

The disclosure followed years of complaints from users who reported being locked out of their accounts for months, sometimes during periods of heightened market volatility, even when no security breach or external attack had occurred.

During the Oct. 10 market sell-off that triggered billions of dollars in liquidations, Binance faced user complaints that technical issues prevented some traders from exiting positions at peak volatility.

Although Binance said its core trading infrastructure remained operational, and attributed the liquidations primarily to broader market conditions rather than internal failures, the exchange later distributed about $728 million in compensation to users affected by the disruptions.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

The record breaking stats from BTC’s capitulation on Thursday signal a bottom is near

Bitcoin’s Feb. 5 collapse will go down as one of the most historic selloffs on record. Below are the key statistics that help define the event and indicate how much further there may be to fall.

The bitcoin price started the day near $73,000 and fell to a low around $62,000, a drop — or, as some market participants call it, a candle — of more than $10,000. The day’s 14% decline was the largest single-day drop since November 2022, during the implosion of crypto exchange FTX.

The Fear and Greed Index dropped into single digits, a level seen only a handful of times in bitcoin’s 17-year history. At the same time, bitcoin was the third most oversold it has ever been on the RSI, an indicator that measures the speed and change of price movements.

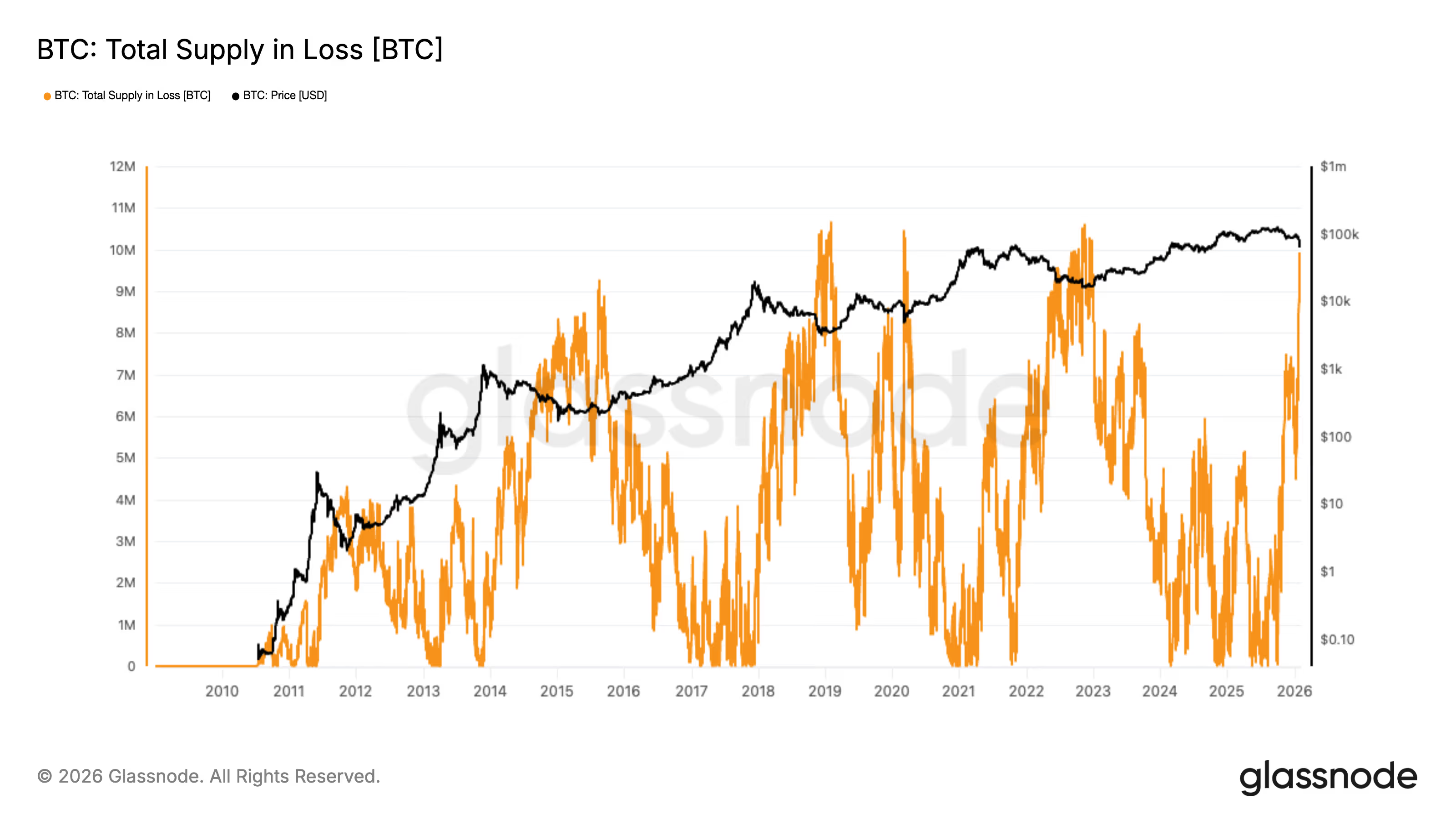

Supply in profit and loss

The circulating supply in loss, meaning the number of coins that last moved at prices higher than the market price, surged to almost 10 million BTC. That is the fourth-highest level ever, comparable with the 2015, 2019 and 2022 bear-market bottoms.

Another measure, the amount of long-term holders’ circulating supply that is at a loss, reached 4.6 million BTC. At the lows of previous bear markets, the figure exceeded 5 million BTC, suggesting this metric is approaching, but has not yet fully matched, prior extremes.

Supply in profit and supply in loss have nearly converged, a condition that has historically aligned with the bottom of major market declines. At present, roughly 10 million BTC sit in profit and 10 million BTC sit in loss.

While nobody knows for certain whether the bottom is in for bitcoin, history suggests it is likely close, especially with bitcoin already recovering toward $68,000.

Still, market participants may be waiting for bitcoin to test its 200-week moving average, currently near $58,011.

Crypto World

Crypto grinding out a bottom as fundamentals diverge from price, Bitwise says

Bitwise contends that the crypto industry’s obsession with timing a market bottom overlooks a historical pattern where peak investor anxiety often signals the start of a recovery.

Having navigated the 2018 and 2022 winters, the crypto asset manager suggested the current “anxious feeling” in the market is a trailing indicator of historical recovery zones.

Bitwise CIO Matt Hougan noted that investors who bought the dip during the 2018 nadir saw returns of approximately 2,000%, while those who entered during the 2022 lows are up roughly 300% in just over three years. For those with a long-term horizon, the firm views the current disconnect between price and progress as a repeat of these specific cycles.

The global crypto market has faced a bruising start to 2026, with over $2 trillion in value wiped out since the October 2025 peak. Bitcoin recently plummeted to a 16-month low near $60,000, a psychological breach that triggered nearly $5.4 billion in leveraged liquidations over a single 72-hour window.

Analysts attributed the carnage to a perfect storm of macro headwinds: the nomination of Kevin Warsh as Federal Reserve Chair signaling a hawkish hard money shift, massive outflows from U.S. spot exchange-traded funds (ETFs) totaling billions, and a broader de-risking trend that has seen investors flee both digital assets and high-growth tech stocks.

The world’s largest cryptocurrency was trading around $68,800 at publication time.

According to the Friday blog post, the fundamental case for the asset class remains unchanged despite the price action.

Hougan argued that the world is increasingly digital and demands non-fiat currencies, pointing to the ascendancy of stablecoins, the rise of tokenization, and the emergence of prediction markets and “AiFi” as evidence of a maturing ecosystem.

He emphasized that while prices do not currently reflect this progress, Wall Street’s continued integration with blockchain technology suggests that fundamentals will eventually drive the next leg up.

Regarding a potential turnaround, Bitwise acknowledged that crypto bear markets typically end in exhaustion rather than a sudden burst of excitement. However, the asset manager identified several specific triggers that could serve as a catalyst for a recovery.

These include the potential passage of the CLARITY Act, a shift back toward risk-on market sentiment, rising interest rate-cut expectations, and technological breakthroughs at the intersection of AI and crypto. In the absence of a sudden positive shock, Bitwise expects the market to “grind out a bottom,” prescribing a strategy of patience and a focus on the long-term destination.

Read more: Deutsche Bank says bitcoin’s selloff signals a loss of conviction, not a broken market

Crypto World

Why Markets Care About This White House Drug Site

President Donald Trump this week launched TrumpRx, a government-backed platform aimed at lowering prescription drug prices for Americans paying out of pocket. While the announcement initially raised concerns about pricing pressure, financial markets have delivered a clear response.

Major pharmaceutical stocks rallied on February 6, signaling that investors do not see TrumpRx as a near-term threat to earnings. That reaction also matters for broader markets, including crypto, because it shapes overall risk sentiment.

Sponsored

What TrumpRx Actually Is

TrumpRx is a pricing and discount portal, not a price-control regime. The platform lists dozens of commonly used drugs and directs users to discounted cash prices offered voluntarily by drugmakers and pharmacies.

Crucially, it targets cash-paying and uninsured consumers. It does not affect insurance-negotiated prices, Medicare reimbursement formulas, or long-term supply contracts, which make up the bulk of US pharmaceutical revenue.

But Investors Aren’t Panicking About Drug Profits

Markets are signaling that TrumpRx trims the edges of pricing, not the core. Most pharmaceutical revenue comes from insured and institutional channels that remain untouched by the program.

Sponsored

For dominant players in high-demand categories like weight-loss and specialty drugs, pricing power remains strong.

In some cases, lower cash prices may even boost volumes without materially hurting margins.

Voluntary Discounts, Not Forced Controls

Another key factor is structure. Participation in TrumpRx is voluntary and tied to broader trade and supply-chain cooperation, including tariff relief.

Sponsored

For global drugmakers, reduced trade and regulatory risk can offset limited pricing concessions. That trade-off helps explain why the sector moved higher instead of lower.

What This Means For Broader Markets

The pharma rally sends a wider signal. Investors are not pricing in aggressive government intervention or profit-destroying regulation.

That matters for equities and crypto alike. When policy actions appear contained and predictable, risk appetite stabilizes across markets.

Sponsored

Crypto Cares, Even Indirectly

TrumpRx has no direct link to digital assets. However, crypto remains highly sensitive to policy uncertainty and financial conditions.

By failing to trigger a regulatory shock or worsen inflation expectations, TrumpRx reduces the chance of a hawkish policy response from the Federal Reserve. Stable rate expectations ease pressure on volatile assets like Bitcoin and Ethereum.

Markets are treating TrumpRx as a political signal, not a systemic shock. The positive reaction in pharma stocks shows investors see the policy as narrow, voluntary, and economically contained.

For crypto and risk assets, the takeaway is simple. TrumpRx does not tighten financial conditions or raise regulatory risk.

Instead, it supports a backdrop of policy stability that allows markets to focus on liquidity, rates, and fundamentals rather than fear.

Crypto World

Samson Mow Explains the Bitcoin Market Crash

In a recent interview, Bitcoin veteran Samson Mow shares a measured read on the latest pullback in BTC and what may lie behind the churn. He frames Bitcoin (CRYPTO: BTC) not merely as a store of value but as the most liquid asset in global markets, whose 24/7 trading may amplify downside spillovers during stress. The discussion traverses the seeming disconnect between stronger on-chain fundamentals and a prolonged price decline, the rising strength in gold and silver, and the idea that capital rotation among hard assets could set the stage for Bitcoin’s next breakout. The interview also tackles the idea of a looming “quantum threat” and whether it belongs in today’s risk calculus.

Key takeaways

- Bitcoin’s liquidity and around-the-clock trading are highlighted as factors that can magnify downside moves during periods of market stress, according to Mow.

- The narrative emphasizes capital rotation into hard assets, with gold and silver rallies potentially influencing BTC demand as investors reassess risk exposure.

- Discussion of the so‑called quantum threat is treated as a theoretical risk rather than an imminent trigger for BTC price action.

- Despite months of selling pressure, the interview suggests BTC could recover if risk sentiment improves and liquidity conditions shift, even amid strong on-chain fundamentals.

- The long‑standing fiat-devaluation thesis for Bitcoin is debated, with no consensus on whether it remains the primary driver of price moves.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: In the broader market, Bitcoin’s price action sits amid shifting liquidity and risk appetite. Traders weigh macro signals, cross-asset flows, and structural factors in crypto, with BTC acting as a liquidity proxy that can move sharply on liquidity crises or shifts in risk sentiment.

Why it matters

The interview provides a framework for interpreting a complex price environment where on-chain health does not always translate into immediate price appreciation. By centering Bitcoin’s role as the most liquid asset, the discussion helps readers understand how systemic stress can reverberate through BTC markets even when miners, network security, and transaction metrics remain robust. For investors, the conversation offers a reminder that liquidity dynamics—how quickly assets can be traded without moving price—play a critical role in short- to medium-term volatility. For traders, the emphasis on capital rotation into gold and silver as a macro signal that could precede crypto demand introduces a potential cross-asset tool for assessing sensitivity to risk-on or risk-off shifts. For builders and researchers, the dialogue underscores the need to monitor not just on-chain metrics but the evolving risk sentiment that shapes liquidity and price discovery in crypto markets.

What to watch next

- Watch BTC price action and liquidity indicators in the coming weeks for signs of capitulation easing or a sustainable bounce.

- Monitor the pace of gold and silver rallies and any corresponding shifts in capital flows that could reallocate demand toward BTC.

- Look for any new discourse on the quantum threat and whether market participants translate it into practical risk models or hedging strategies.

- Track macro risk sentiment, including inflation data and central bank signals, for indications that the broader risk appetite is shifting in favor of crypto assets.

Sources & verification

- Interview with Samson Mow discussing BTC’s pullback, catalysts for recovery, and cross-asset dynamics.

- YouTube video of the interview: https://www.youtube.com/watch?v=5VaqkszkWp8

- Discussion points on gold/silver rallies as a backdrop to BTC demand and capital rotation.

- References to the theoretical nature of the “quantum threat” within crypto risk discourse.

Bitcoin market reaction and catalysts for the next move

In a recent exchange, the market’s focus shifts beyond最近 price levels to the mechanics that drive BTC’s moves in a liquidity-driven system. In this framing, Bitcoin (CRYPTO: BTC) is not simply a late-stage risk-on asset waiting for fundamentals to align; it is a constantly tradable currency in a global pool of capital that reacts quickly to shifts in risk appetite. Samson Mow outlines a nuanced picture: the same liquidity that enables Bitcoin to function as the most liquid asset in traditional markets also makes it susceptible to rapid downdrafts when liquidity tightens or risk aversion spikes. The result is a price action that can diverge from longer-term fundamentals, particularly in episodes marked by forced liquidations and cross-asset selling. This perspective emphasizes structure as much as signal, inviting readers to consider how order books, funding rates, and leverage levels contribute to the size and speed of BTC moves during market stress.

One of the central threads in the discussion is the relationship between Bitcoin and the metals complex. After a robust rally in gold and silver, capital rotation becomes a focal point: if investors seek safe havens or hedges against inflation, where does crypto stand in the pecking order? The interview presents a plausible scenario in which BTC could benefit after a metals-led reallocation cycle cools or consolidates. In such an environment, BTC’s liquidity and distribution across exchanges could attract new demand as risk premia recalibrate. The argument does not insist on an immediate rebound; rather, it frames recovery as a gradual reversion supported by improved risk sentiment, reduced forced liquidations, and a rebalancing of portfolios that previously parked capital in gold, silver, or other hard assets.

The discussion also touches on what many in the space consider a longer-term risk: the so‑called quantum threat. This is framed as a theoretical risk to crypto security and ecosystem confidence, not a near-term catalyst for price rallies or crashes. By keeping the focus on present market dynamics—liquidity, leverage, and risk‑on vs. risk‑off cycles—the interview distinguishes between potential future risks and the more immediate drivers of price action. In other words, while the quantum threat may merit attention for risk modeling and contingency planning, it is not presented as the catalyst for Bitcoin’s next move in the near term.

Beyond these threads, the interview revisits the long-standing narrative that Bitcoin’s price can be tied to fiat devaluation. This is a topic that has attracted both staunch believers and critics. The conversation presents a thoughtful counterpoint: even if fiat erosion remains a macro driver, market dynamics—such as liquidity, risk sentiment, and capital flows—can overshadow the fiat narrative in the short and medium term. The net takeaway is not a prediction but a careful reckoning of the multiple forces at play. In practice, readers are reminded to watch for shifts in funding markets and liquidity regimes that may signal the next inflection point for BTC.

For readers seeking a complete sense of the interview’s tone and content, the full video remains a key source. The embedded YouTube presentation provides direct access to Mow’s remarks and the nuances of his argument, offering a useful complement to the written summary. The format underscores a broader industry shift toward multi-source analysis—combining on-chain data, macro context, and participant perspectives—to form a more robust view of Bitcoin’s evolving trajectory.

Crypto World

China expands crypto crackdown to stablecoins, asset tokenization

Chinese regulators have broadened their crackdown on crypto activities, imposing strict oversight on tokenization and stablecoin issuance in a Friday notice.

“Recently, influenced by various factors, speculative activities related to virtual currencies and the tokenization of real-world assets have occurred frequently, posing new challenges and situations for risk prevention and control,” said the notice, issued jointly by eight national organizations including the People’s Bank of China (PBOC) and the China Securities Regulatory Commission (CSRC).

The notice reiterates China’s blanket ban on crypto, saying that trading, issuing or facilitating transactions involving digital currencies such as bitcoin , ether , or stablecoins like Tether’s USDT is illegal.

The prohibition extends to foreign entities and individuals offering such services within China. It also bans domestic entities from issuing digital currencies overseas without regulatory approval.

The notice singles out stablecoins — cryptocurrencies pegged to fiat currencies — for special scrutiny. Authorities argue stablecoins replicate key functions of sovereign money and therefore threaten monetary control.

The new rules make clear that no entity, Chinese or foreign, may issue a stablecoin linked to the renminbi abroad without government approval. That includes overseas branches of domestic firms.

The rules also tighten control over tokenization, the fast-growing trend of turning ownership of real-world assets like equities, real estate or funds into digital tokens.

Chinese firms that want to tokenize assets overseas now must obtain approvals or file with regulators, and their financial and tech partners are required to meet heightened compliance standards, the notice said.

China’s crackdown on cryptocurrencies and related activities have been a staple over the past years. The new set of rules build on Chinese authorities in 2021 deeming all crypto-related business activities illegal and prohibiting crypto mining, often called a “China ban.” In 2017, authorities banned Initial Coin Offerings (ICOs), labeling them as illegal fundraising and financial fraud, and ordered domestic cryptocurrency exchanges to shutter fiat-to-crypto trading operations.

Read more: China Never Completely Banned Crypto

Crypto World

What’s surging Friday? Bitcoin, Litecoin lead the crypto

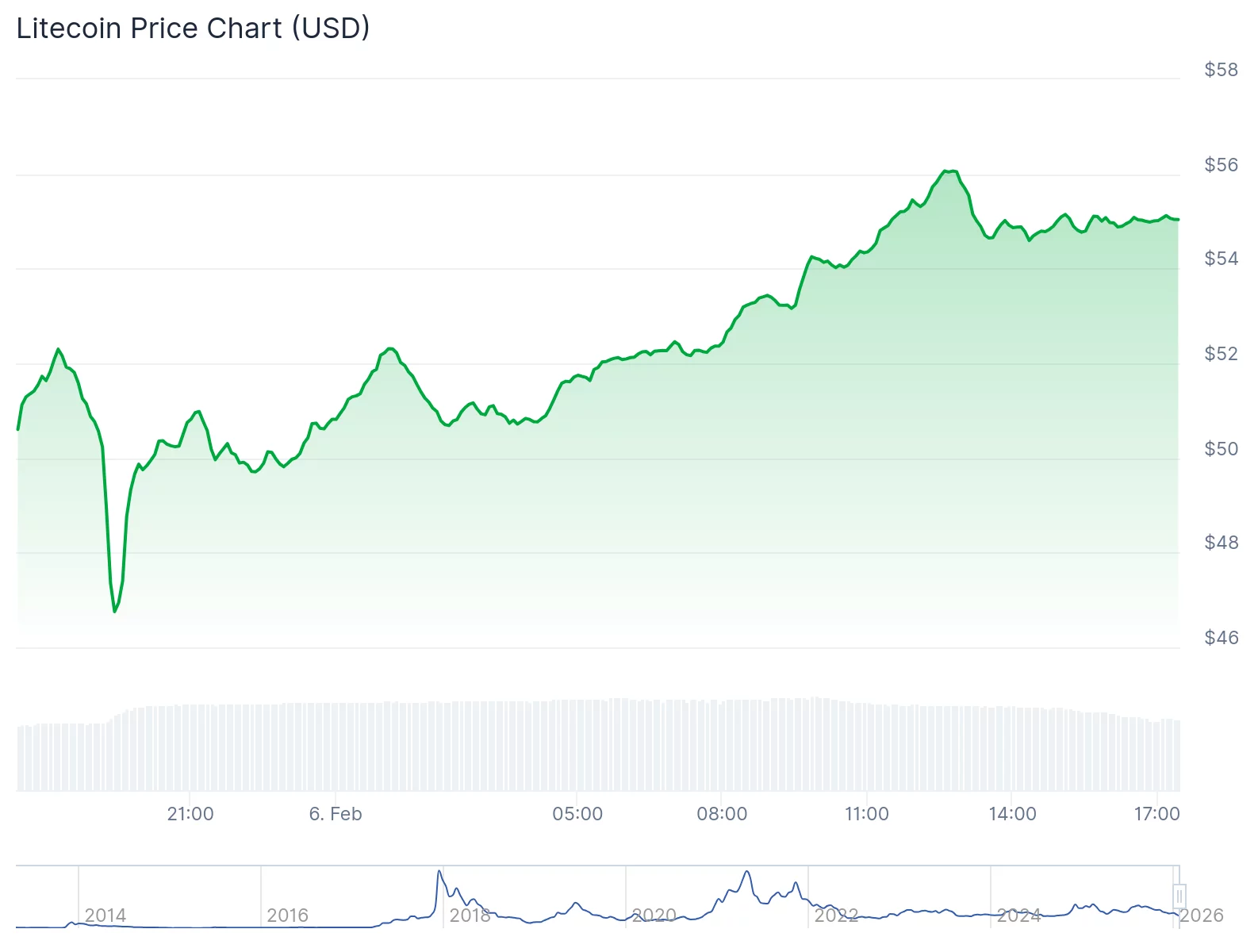

Friday’s market saw a notable recovery in cryptocurrency prices, with Bitcoin and Litecoin leading the charge. Bitcoin’s bounce from the $60,000 level helped ease fears of a deeper market correction, as it rose nearly 8% to reclaim the $70,000 mark.

This surge also supported riskier altcoins like Litecoin, which is up about 8% for the day.

Summary

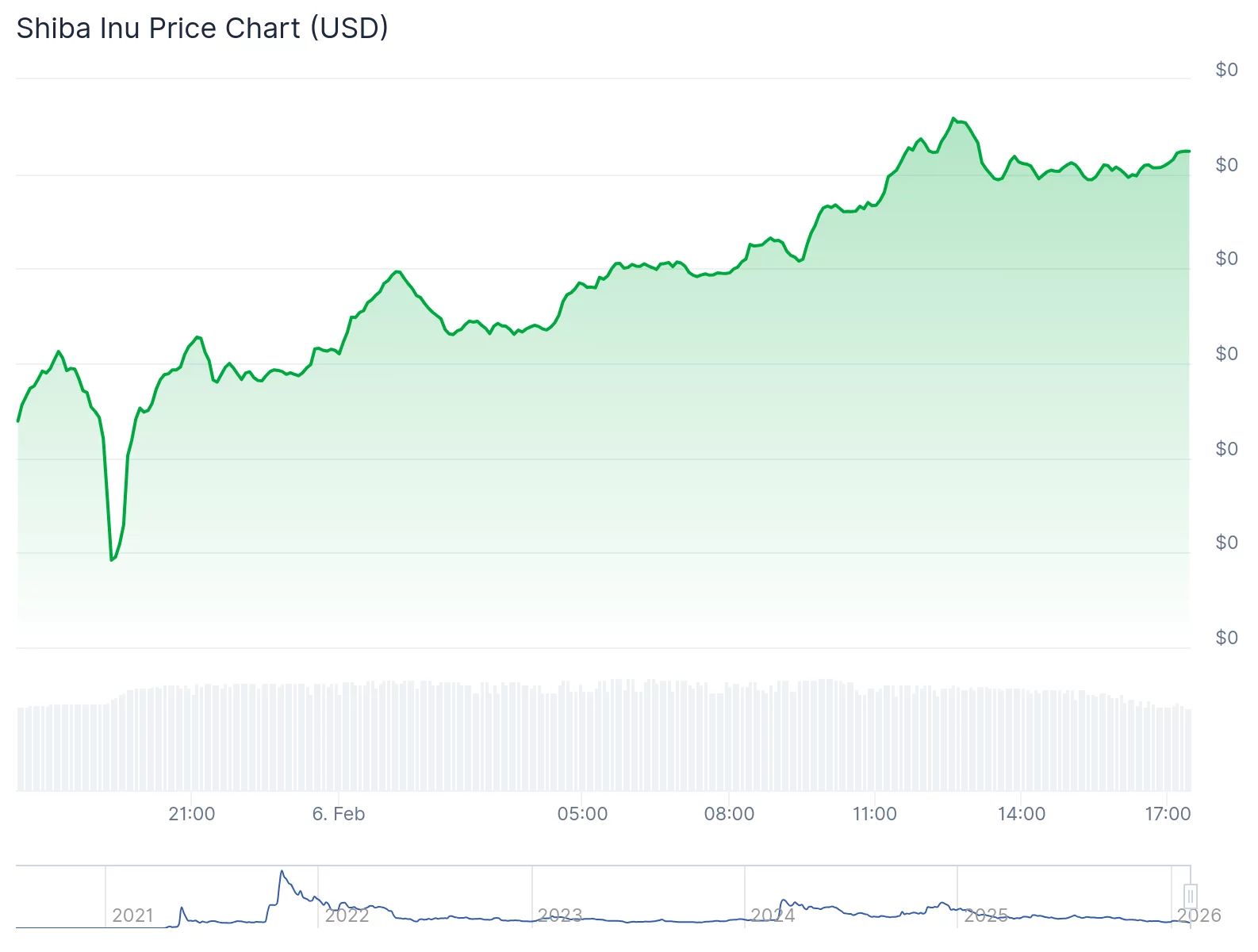

- Bitcoin surged nearly 8% to reclaim the $70,000 level on Friday, easing fears of a deeper correction and supporting altcoins like Litecoin and Shiba Inu.

- Litecoin saw an 8% increase, trading around $54, as traders rotated into altcoins following Bitcoin’s recovery and reduced margin stress.

- Shiba Inu climbed about 7%, benefiting from Bitcoin’s rebound and renewed investor interest in higher-beta tokens.

Why Bitcoin’s rise bodes well for Litecoin

Bitcoin remains the benchmark asset in the crypto space, and when it rallies, traders typically rotate into altcoins like Litecoin. As Bitcoin stabilizes, the risk of forced selling and liquidation cascades decreases, allowing traders to take fresh positions in altcoins.

This is particularly important after Bitcoin touched the $60,074 mark earlier on Friday, a key level that had traders on edge. The rebound reduced margin stress and bolstered sentiment across the market.

Bitcoin’s price recovery also helped offset the concerns raised by figures like Michael Burry, who warned that miners could be forced to sell their Bitcoin holdings if the price dropped below $50,000.

Litecoin’s Friday spike

Litecoin, created in 2011 by Charlie Lee, has seen an uptick in interest as Bitcoin recovers. Known as the “silver to Bitcoin’s gold,” Litecoin benefits from a long track record and strong exchange support. As of Friday, Litecoin is trading around $54, having hit an intraday high of $56.25.

Shiba Inu follows Bitcoin’s lead

Alongside Litecoin, meme-coin Shiba Inu (SHIB) also gained traction, climbing about 7%.

As Bitcoin recovered from its Thursday slump, large investors redeployed capital across the market, pulling speculative coins like Shiba Inu back into the green.

SHIB, which had faced pressure earlier in the week from market weakness and liquidations, is now benefiting from improved market sentiment.

What’s next for crypto?

Bitcoin’s recovery is giving traders a window to reposition in the market, but caution remains. Analysts suggest that while short-term bounces are possible, broader market trends still point to volatility. Key resistance for Bitcoin sits in the $70,000 to $75,000 range, with some traders speculating on further upward movement.

For now, the surge in Bitcoin’s price is driving positive sentiment in the market, with altcoins like Litecoin and Shiba Inu benefiting from the rebound.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech4 hours ago

Tech4 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports14 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat10 hours ago

NewsBeat10 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined