Crypto World

How Long Can It Stay Above?

Bitcoin has bounced roughly 17% from Friday’s $60,150 trough, but the rebound has not erased the undercurrent of caution rippling through the derivatives market. Traders remain wary of chasing fresh upside exposure as the price hovers near the $70,000 level, with liquidity dynamics painting a mixed picture. In the past five sessions, leveraged bullish futures liquidations totaled about $1.8 billion, fueling speculation that major hedge funds or market makers may have faced sizable losses. The market’s struggle to sustain momentum after Thursday’s skid highlights how fragile appetite for risk remains, even as the price attempt to reclaim ground continues.

Key takeaways

-

Bitcoin’s derivatives signals point to elevated caution, with the options skew measuring roughly 20% on the week as traders weigh a potential second wave of fund liquidations.

-

While the price retraced some of Thursday’s losses, the rally is not translating into broad demand for new long exposure, especially when compared with gold and technology equities.

-

Aggregate futures liquidations indicate a recent wave of forced liquidations, but open interest on major venues remains steady, suggesting mixed conviction among bulls and sellers.

-

The futures market shows cooling demand for bullish leverage, with the BTC futures basis rate sinking to the lowest in over a year, underscoring a cautious stance despite a price move above key levels.

Tickers mentioned: $BTC

Sentiment: Bearish

Market context: The current dynamics unfold against a backdrop of tepid leverage appetite in crypto markets, with options and futures signals diverging from spot-price gains. Investors are reevaluating risk, liquidity, and potential catalysts that could reaccelerate a broader uptrend, while systemic concerns about market-makers and liquidity have kept participants cautious.

Why it matters

The present mood in the Bitcoin market illustrates a broader tension between price action and risk appetite embedded in derivatives markets. The rally from Friday’s low has been constrained by a thinning of upside demand, suggesting that buyers are selective and selective exposure remains the name of the game. For market participants, the key takeaway is not a lack of interest in Bitcoin per se, but a hesitation to deploy fresh leverage when volatility remains high and liquidity conditions are not uniformly supportive.

The liquidation backdrop underscores how fragile liquidations can ripple through the marketplace. When approximately $1.8 billion of leveraged bullish futures contracts liquidate over a five-day window, it can prompt a reassessment of risk by major players, potentially widening bid-ask spreads and triggering protective selling pressures that outlive the immediate move. This environment makes it harder for bulls to build sustained momentum, even as the price tests and briefly surpasses notable thresholds.

On the sentiment front, the skew in options markets provides a counterpoint to price recovery. A 20% two-month options skew signals persistent fear and a premium placed on downside protection. In calmer times, a higher demand for calls—indicative of optimism—would push the skew down toward neutral readings. Instead, the market appears more attuned to the risk of further losses than to a runaway rally. The lack of a clear catalyst for a renewed surge adds to the sense that any upside may be incremental and exposed to negative surprises if liquidity tightens or macro risk shifts.

Traders will be watching whether institutions that have been operating behind the scenes—market makers, hedge funds, or proprietary desks—adjust their risk models in the near term. The fear of an unseen balance-sheet event can weigh on market psychology, particularly when combined with ongoing questions about systemic leverage in the crypto space. While some bulls have been adding exposure as prices attempt to climb toward and beyond $70,000, the overall tone remains cautious, with the derivatives landscape signaling that risk-off tendencies could reassert themselves if new liquidity concerns or regulatory headlines surface.

The current narrative also invites a closer look at the relationship between price movements and hedging behavior. The apparent dissonance between a late-week price rally and dwindling leverage demand raises questions about what comes next for Bitcoin’s trajectory. If the price can sustain its gains without drawing in a broader wave of leverage, a potential scenario could involve a gradual reaccumulation of long positions. Conversely, any renewed shock—whether from leverage unwind, a regulatory development, or macro catalysts—could accelerate a fresh wave of selling pressure, given the fragile confidence that currently characterizes the market.

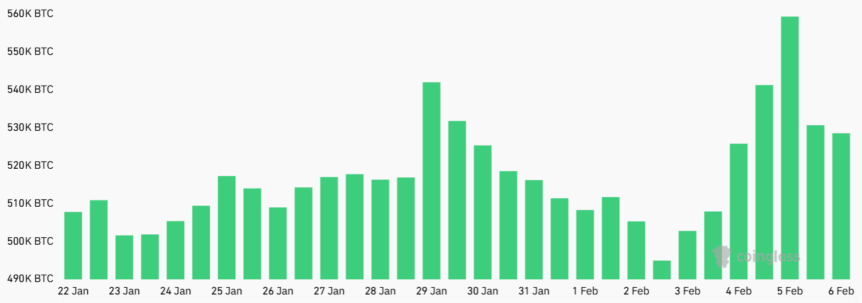

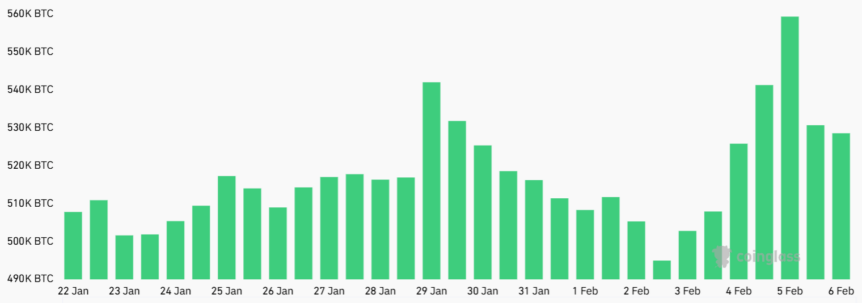

The data paints a picture of a market tentatively treading water near critical levels. The aggregated Bitcoin futures open interest across major exchanges stood at roughly 527,850 BTC on Friday, essentially flat versus the prior week, even as the notional value of those contracts declined from about $44.3 billion to $35.8 billion. The juxtaposition—steady open interest with a sharp drop in notional exposure—reflects a snapshot of risk being redistributed rather than a wholesale shift in bullish conviction. It implies that while some traders are choosing to run hedges or reduce exposure, others are still accumulating, albeit cautiously, with a renewed emphasis on margin discipline as prices move in and out of the $70,000 region.

To contextualize whether larger players are reconsidering risk, the BTC futures basis rate—an indicator of the premium paid for futures relative to spot over a set horizon—fell to about 2% on Friday, the lowest in more than a year. In neutral conditions, the annualized premium would typically sit in a 5%–10% range to compensate for the settlement lag. The decline signals a cooling appetite for bullish leverage, even as the price manages to breach the psychological threshold of $70,000. This divergence between price strength and leverage appetite helps explain why the market has yet to embark on a fresh, sustained ascent and why traders remain alert to potential pullbacks if liquidity tightens or risk sentiment worsens.

Options dynamics add another layer of caution. The BTC options market has shown a growing tendency to put protection against downside moves, a hallmark of risk-averse positioning. A prominent feature in the latest readings is the elevated put-call skew, which suggests traders were willing to pay a premium to insure against declines. The skew’s elevation aligns with periods of market stress in which fear and uncertainty dominate price action. While some participants might anticipate a sharper comeback if macro conditions stabilize, the absence of a compelling bullish catalyst leaves room for continued volatility and potential dissipations in sentiment as the market digests new information.

The current mood sits within a broader narrative where fear and uncertainty have grown even without a singular, obvious catalyst. A widely cited discussion—What’s really weighing on Bitcoin? Samson Mow breaks it down—highlights structural concerns in the market’s structure and liquidity dynamics. While there is no single event driving the downturn, the combination of forced liquidations, a fragile risk appetite, and a cautious options market reinforces a narrative of vulnerability that could persist in the near term.

Traders are likely to continue weighing the possibility that a large market maker or hedge fund could be facing distress, and this sentiment tends to erode conviction and raise the odds of downside moves. In such an environment, the probability of a durable bullish breakout remains tempered, even as Bitcoin shows signs of breaking beyond key price levels. As the market digests ongoing data and seeks stability, participants should prepare for continued volatility and carefully monitor leverage, funding dynamics, and macro headlines that could tilt sentiment anew.

Crypto World

Russia’s Sovcombank Becomes First Russian Bank to Publicly Offer Bitcoin-Backed Lending

TLDR:

- Sovcombank rolled out bitcoin-backed loans for individuals and firms that legally own digital assets in Russia.

- The launch follows an earlier pilot by state-owned Sberbank with a mining company in December.

- Russian miners are seeking liquidity solutions that allow them to retain long-term bitcoin exposure.

- The product aligns with recent regulatory changes legalizing mining and reopening crypto markets.

Sovcombank bitcoin-backed loans signal a gradual shift in Russia’s banking approach to digital assets.

The lender has launched financing options secured by bitcoin, targeting miners and legal crypto holders seeking liquidity without selling their holdings.

Sovcombank expands regulated crypto lending

Sovcombank is the first Russian bank to publicly offer bitcoin-backed loans. The product is available to individuals and corporations that legally own digital assets.

The bank emphasized that bitcoin serves strictly as collateral. Borrowers can therefore access capital while retaining ownership of their holdings.

This approach aligns with growing demand among crypto holders for non-dilutive financing. As a result, banks are reassessing how digital assets fit within lending frameworks.

In online statements, Sovcombank executives described the product as business-focused. Financing is positioned to support expansion rather than speculative activity.

State-owned Sberbank launched a similar offering earlier through a pilot program. That initiative issued a bitcoin-secured loan to mining firm Intelion Data.

However, Sberbank’s product remains limited in scope. Sovcombank’s rollout marks a broader public-facing step in crypto-secured lending.

Regulatory clarity remains uneven across the sector. Still, banks appear more willing to test products tied to digital assets.

Crypto mining became legal in Russia on November 1, 2024. The law allows registered entities to operate without energy restrictions.

Unregistered miners may operate only within strict electricity limits. This framework narrowed participation but improved oversight.

Soon after, authorities imposed a six-year mining ban in ten regions. The decision addressed power grid strain rather than crypto activity itself.

In December 2025, regulators reopened the crypto market to the public. The central bank introduced rules governing participation and compliance.

Sovcombank referenced these developments in public remarks shared online. Executives framed bitcoin-backed lending as compatible with the evolving framework.

Focus on miners, liquidity, and banking services

Russian miners and crypto businesses increasingly seek access to liquidity. Many prefer borrowing against bitcoin rather than selling during volatile market cycles.

Bitcoin-backed loans address this preference directly. They provide working capital while preserving long-term asset exposure.

Sovcombank stated that mining is no longer viewed as a niche activity. Instead, it is treated as an investment class with defined financial metrics.

Executives noted predictable returns and clearer payback periods. These factors support structured lending products tied to mining operations.

Alongside the loan launch, Sovcombank introduced a promotion for miners and hosting providers. The campaign targets registered market participants.

Corporate clients receive free account management and online banking services. Preferential terms for currency control are also included.

Small and medium enterprises benefit from free internal transfers. The limit is set at one million rubles per transaction.

Only new clients listed in the official miners’ registry qualify. This condition reinforces compliance with national regulations.

Sovcombank also confirmed it offers bitcoin-backed loans to corporate clients. Legal entities and sole proprietors may access the product.

The bank outlined broader plans for crypto-sector partnerships. These include miners, data center operators, exchanges, and money changers.

Public statements referenced specialized cash management tools. Project financing and risk management services were also mentioned.

Together, these offerings signal deeper engagement with the crypto economy. Russian banks are gradually integrating digital assets into traditional finance under defined rules.

Crypto World

Crypto crash to end soon? Recovery possible, indicators show

The crypto crash accelerated this week, with Bitcoin price plunging to $60,500, its lowest level since October 2024, and the market capitalization of all coins moving to $2.2 trillion.

Summary

- The crypto crash accelerated this week as most coins tumbled.

- The Fear and Greed Index has fallen to extreme levels.

- Technical analysis suggests that it has become highly oversold.

Why the crypto crash is happening

The ongoing crypto market retreat is influenced by a mix of global economic concerns and investor sentiment. Rising tensions between the U.S. and Iran have added uncertainty, with both sides issuing warnings that any escalation could impact the region and potentially affect oil prices. However, there are no confirmed reports of U.S. military action, and any link between geopolitical fears and crypto price movements is speculative.

Bitcoin and altcoins also dropped as investors rotated out of risk assets and into value ones. A good example of this is the stock market, where the tech-heavy Nasdaq 100 Index has slumped, while value ETFs like the Vanguard Value ETF and the Schwab US Dividend ETF have soared to record highs.

Additionally, the rising crypto ETF outflows and soaring liquidations put more pressure on these assets. Spot Bitcoin (BTC) ETFs shed over $689 million in assets this year and are in their fourth consecutive month in the red. Similarly, Ethereum ETFs have shed over $149 million in assets.

Crypto liquidations have also soared in the past few days. That jumped by over 122% in the last 24 hours to over $2 billion.

On the positive side

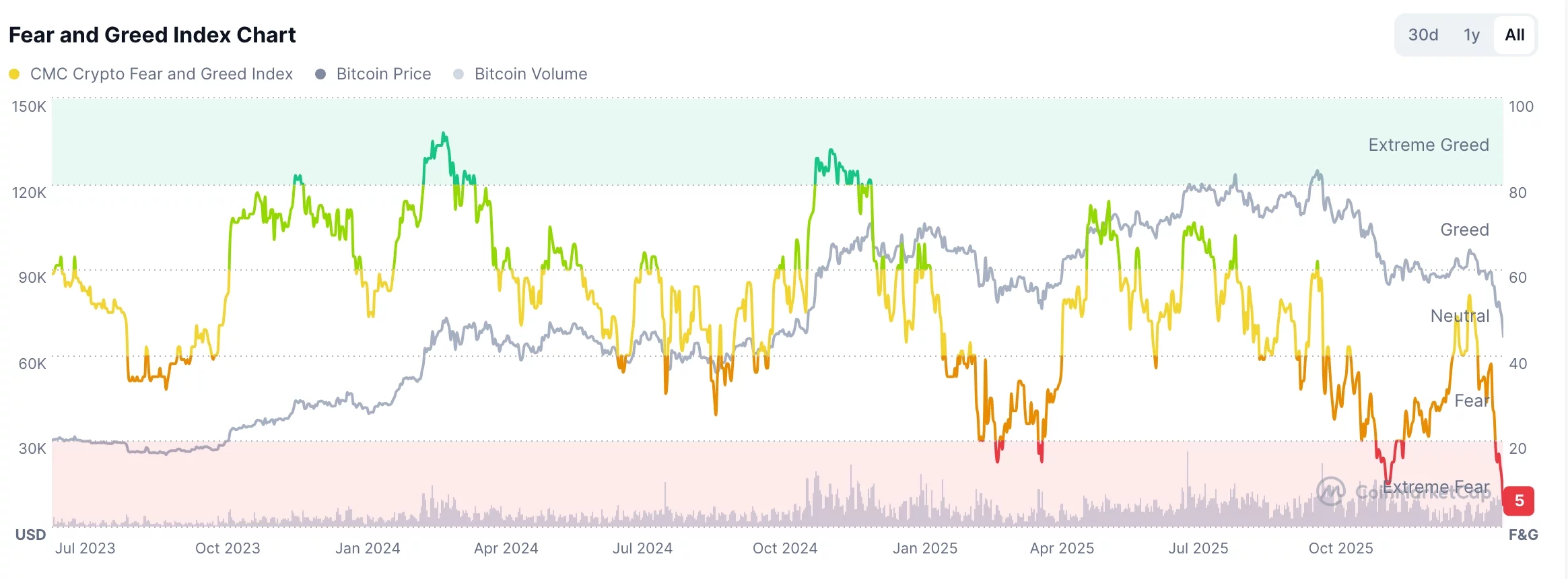

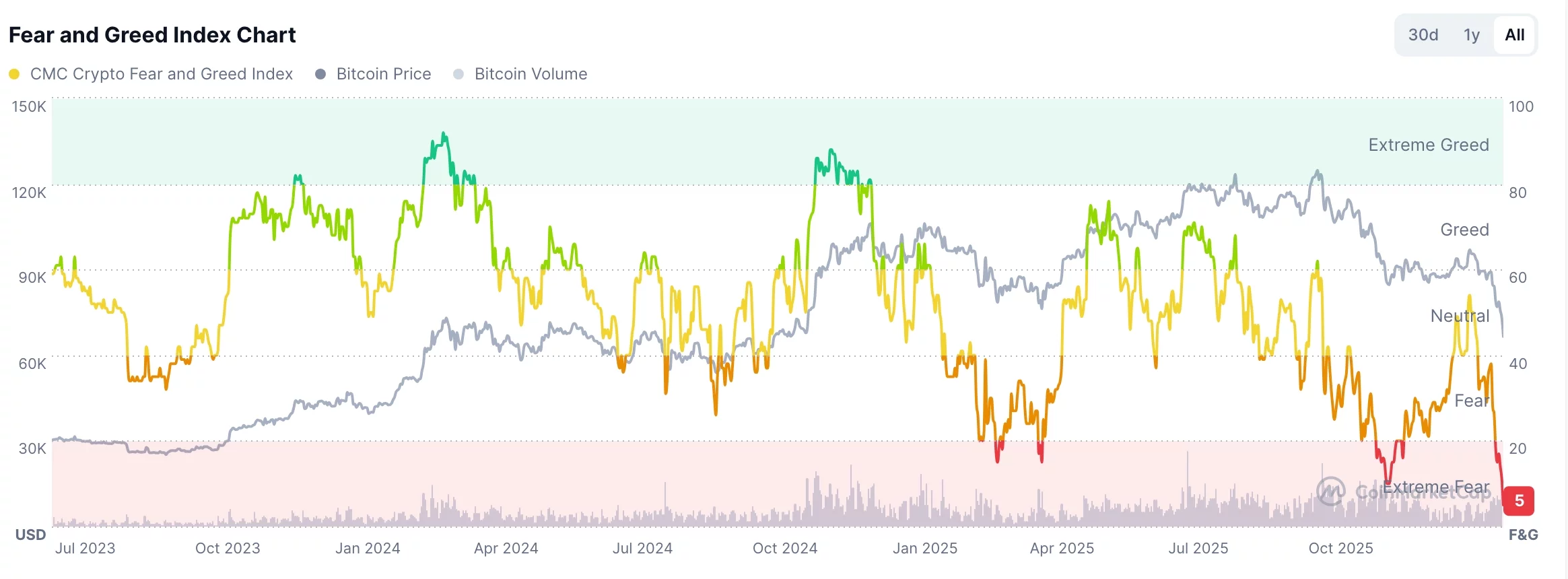

There are some key signs that suggest a crypto recovery is coming soon. First, the Crypto Fear and Index has slipped to 5. That’s the lowest level in years.

In most cases, crypto bull runs normally start when the index moves to the extreme fear zone. Similarly, crypto prices typically drop when they move into the extreme greed zone.

A good example of this is what happened in December, when it moved into the extreme greed zone at 10. Bitcoin and other altcoins rebounded in January, with BTC nearing $100,000. Before that, the index moved to the extreme fear zone in April last year and then rebounded to a record high after Trump changed his tune on tariffs.

Technical analysis also suggests that Bitcoin may rebound soon. For example, Bitcoin’s Relative Strength Index has moved to the oversold level of 27 for the first time since November 2022. Bitcoin has always rebounded whenever it moved to these oversold levels.

At the same time, Bitcoin has fallen to the rising wedge target. As the chart below shows, the widest point of this pattern was ~42%. It has then fallen by over 42% from the breakout point.

Crypto World

Remittix’s 300% bonus goes live

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Remittix 300% bonus sparks buzz on X, Telegram, and Discord, highlighting real product utility over hype.

Summary

- Remittix sparks crypto buzz with an exclusive 300% bonus, backed by 703m+ tokens sold and $28.9m raised.

- Analysts highlight Remittix’s working wallet, strong funding, and growth plan as drivers of this week’s crypto talk.

- Crypto communities react to Remittix’s rare bonus, emphasizing urgency, scarcity, and verified project progress.

This week, crypto users on X, Telegram, and Discord are talking about one thing: the Remittix 300% bonus. While the market as a whole is still slow, this brings in new excitement. Experts have said that this incident is important because it is not just about promises or hype around cryptocurrency; this time, it is about an actual product.

In past cycles, big bonuses were often linked to risky or unfinished projects. Remittix is different because it already has a working wallet, strong funding, and a clear growth plan. That is why many analysts are calling this one of the most talked-about crypto events of the week.

Why this Remittix bonus is getting so much attention

The main reason for the buzz is that a 300% bonus is extremely rare in today’s cryptocurrency market. Even more surprisingly, this bonus is not open to everyone. It is exclusive and requires a special code that can only be gotten through email. The code is not public, and you cannot find it in any online articles.

This setup has piqued the curiosity of many users. It evokes a sense of urgency and scarcity for the bonus offer. Experts have noted that this is why the topic is trending in crypto communities at the moment. Analysts have all agreed that the true reason for the interest in the topic is what Remittix is working on behind the scenes.

Another reason this event is getting attention is Remittix’s strong fundraising performance. The project has sold over 703.7 million tokens, raised more than $28.9 million, and is currently trading at $0.123 per token. Experts say this level of progress shows that many investors are backing the idea even before the full platform launch.

Remittix: A project focused on real use

Remittix is a PayFi project, and this means it focuses on payments, not just trading or speculation. Its goal is to help people use crypto in real life by making it easy to move money across borders. Many crypto users face the same problem. They hold digital assets, but turning them into cash that they can actually spend is slow and costly. Banks charge high fees, and transfers can take days. Remittix is designed to fix this.

For instance, with Remittix, you can send cryptocurrency, and the recipient receives the funds in local currency and is directly deposited into their bank account. This is especially useful for freelancers, remote workers, and those in countries with poor banking systems. What sets Remittix apart is that it has already made progress.

Remittix: Real progress that builds trust

Unlike many crypto projects, Remittix already has a functional product. The wallet is already available on the Apple App Store, so users can use it anytime they want. The Google Play Store version will be available very soon. Another major milestone is the full PayFi platform launch scheduled for February 9, 2026. Experts believe this date is important because it marks the move from early testing into full-scale use.

Here are some of the key features driving interest in Remittix:

- Remittix is fully verified by the CertiK team KYC

- The project ranks #1 on pre-launch tokens

- The platform offers lower fees than traditional remittance services

- It is built for everyday users and not just crypto traders

Conclusion: More than just a bonus event

While the headlines focus on the Remittix 300% bonus, experts say the bigger picture is more important. Remittix already has a live wallet, a clear mission to fix real payment problems, and a confirmed PayFi platform launch on February 9, 2026.

This week’s buzz is not just about free value. It is about a project that combines strong incentives with real-world utility. That combination is rare, and it explains why Remittix has become the crypto event everyone is talking about right now.

For more information, visit the official website, and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bithumb Mistakenly Airdrops $30 Billion of Bitcoin

The Korean crypto exchange intended to send 2,000 WON to some users but accidentally sent 2,000 BTC instead.

Bithumb, one of Korea’s leading centralized exchanges (CEX), made a multi-billion dollar mistake overnight when management accidentally sent 2,000 BTC, worth almost $140 million, to more than 200 users instead of 2,000 WON, which is worth less than $1.5.

As users received the BTC, they immediately attempted to sell and offramp funds, briefly sending BTC on Bithumb almost 18% below the market price according to LookOnchain.

The exchange addressed the situation in a notice that read, “During today’s event payment process, an abnormal amount of Bitcoin was paid to some customers. As sales were made on some accounts that received the Bitcoin, the Bitcoin price temporarily fluctuated rapidly. Bithumb immediately recognized abnormal transactions through its internal control system and quickly restricted transactions to related accounts.”

Korean outlet The Chosun Daily broke the news and said that “most” of the 240 users who partook in Bithumb’s Random Box promo event received 2,000 BTC in each of their wallets, and roughly $3 billion was withdrawn from the exchange.

According to the local news outlet, the Financial Services Commission (FSC) and Financial Supervisory Service (FSS) in Korea are actively investigating the incident due to its magnitude.

The exact number of BTC distributed has not been disclosed, but based on information provided by Chosun, the airdrop could have been worth up to $30 billion.

Crypto World

MegaETH Unveils Token Buyback and TGE Plan

The highly anticipated Ethereum Layer 2 blockchain will launch its mainnet on Monday.

MegaETH, the real-time blockchain and Ethereum Layer 2, is launching its mainnet on Feb. 9, but the token generation event (TGE) will be dependent on network performance milestones.

The MegaLabs team has defined three key performance indicators (KPIs), and at least one of these must be met for the TGE to proceed. The chain must either establish a baseline of $500 million in USDM circulating, see 10 “mafia mainnet”- aligned apps deployed with more than 100,000 transactions across at least 25,000 wallets, or host three apps that generate at least $50,000 in daily fees for 30 days.

Once the token is circulating, MegaETH will use priority fees from its proximity markets and yield from its native stablecoin, USDM, for MEGA token buybacks.

In an article, MegaETH co-founder Shuyao Kong said, “The largest issue that’s faced our industry over the past few years was a simple question: why does a token need to exist? Equity has acted as king, with every successful story over the past few years, barring hyperliquid, having some variation of equity.”

The community-focused approach has been well received, but pre-market derivatives still price MEGA at just a $1.3 billion fully diluted valuation, only 40% higher than its initial coin offering (ICO) price in October.

This comes just days after Ethereum cofounder Vitalik Buterin said the current Ethereum Layer 2 landscape “makes no sense” and stated that Layer 2’s must offer something completely unique outside of Ethereum scaling.

Crypto World

Why is crypto down? 6 key factors from Bitwise’s Matt Hougan

Bitcoin has taken a significant hit recently, falling 14% in a single day and 25% over the past week. And this bear market could extend for several months before it fully bottoms, according to Bitwise’s Matt Hougan.

Summary

- Bitcoin’s recent drop is driven by factors like investors preemptively adjusting to the four-year cycle, competition from AI and metals, and a major leveraged liquidation event.

- While the market has fallen 54% from its peak, previous downturns have been more severe, Hougan says.

- Regulatory progress and innovation will drive future growth, Hougan says. Fortune favors patient investors.

Although Bitcoin has shown a brief recovery, trading nearly 50% below its all-time high, investors are left grappling with questions: Why is the market down? Could it fall further? And when will it bottom?

6 key factors

According to Hougan, Bitwise’s chief investment officer, there are several complex reasons behind the current crypto market downturn, but six primary factors stand out.

- The Four-Year Cycle: A major reason for the pullback is that long-term investors have been selling to preemptively adjust for the four-year market cycle, where crypto sees strong bull years followed by inevitable pullbacks. Investors, wary of a repeat of previous cycles, have sold significant portions of their holdings—estimated to be over $100 billion in Bitcoin last year alone.

- Competition from Other Markets: Crypto has enjoyed significant retail interest, but now AI stocks and precious metals are pulling some attention away. “Attention investors,” who flocked to crypto in recent years, are now diverting their capital elsewhere.

- The October 10 Leverage Liquidation: The crypto market also faced the largest leveraged liquidation event in history following an unexpected announcement by former President Donald Trump. This event triggered panic selling in the absence of traditional market liquidity, further depressing prices.

- Concerns Over Federal Reserve Leadership: President Trump’s nomination of Kevin Warsh for Federal Reserve Chair raised concerns, particularly among investors who feared Warsh’s hawkish stance on interest rates, creating unease in broader markets, including crypto.

- Rising Fears of Quantum Computing: There’s a growing anxiety within the crypto community about the potential threat of quantum computing, which could undermine the security of Bitcoin. While many believe it’s a long-term issue, the lack of visible action has led some investors to retreat from the market.

- Macro Risk-Off Sentiment: A broader shift in global markets towards risk-off sentiment has affected Bitcoin. Alongside Bitcoin’s struggles, other assets like gold, silver, and tech stocks have also seen steep declines.

Could crypto fall further?

While the market’s current drawdown of 54% from its peak seems severe, Hougan cautions that it could go lower.

Previous downturns have been much larger—Bitcoin fell 86% in 2014, 84% in 2018, and 77% in 2022.

Historical trends suggest that bear markets typically last 12-13 months, so this current slump might not be over yet. However, given crypto’s maturing nature, a 77% drop seems unlikely, though it remains a possibility.

What could help it recover?

For many seasoned investors, this moment feels similar to past bear markets in 2018 and 2022, which were followed by massive rallies. Investors who bought the dip in those years saw substantial returns—around 2,000% from 2018 and 300% from 2022.

The fundamentals supporting crypto are still in place: a growing demand for digital currencies, increasing regulatory clarity, and innovations like tokenization and stablecoins continue to drive the sector forward.

The timing of the market bottom remains uncertain, but recovery often comes through time and exhaustion. Specific catalysts could accelerate recovery, such as regulatory developments like the Clarity Act, the continued rise of AI-linked crypto projects, or a return to risk-on market sentiment.

For now, Hougan advises patience. While it’s impossible to predict the exact moment the market will turn, the long-term outlook for crypto remains promising for those with the fortitude to weather the storm.

Crypto markets are volatile, and the current downturn could continue in the short term, Hougan adds. However, for investors with a long-term perspective, history suggests that bear markets often precede significant growth.

With key factors like regulatory advancements and growing adoption still in play, he argues that crypto’s future still holds substantial upside, making the current moment a potential buying opportunity for those prepared to wait.

Crypto World

Nancy Guthrie Kidnapping Tied to Bitcoin Ransom?

Nancy Guthrie, an elderly 84-year-old woman, vanished overnight in Arizona, triggering a high-stakes investigation with alleged crypto demands.

She is the mother of popular NBC journalist and TODAY show host Savannah Guthrie. Authorities believe she was likely taken from her home after a violent encounter.

Sponsored

Sponsored

Blood at the Doorstep Turns Missing Case Criminal

Investigators found blood spatter at the entrance of her residence in the Catalina Foothills area near Tucson, Arizona. Forensic testing confirmed the blood belonged to Nancy Guthrie, according to law enforcement.

As a result, what began as a missing-person report has escalated into a suspected kidnapping investigation.

Nancy Guthrie lived a private, low-profile life and was not a public figure. She became nationally known only because of her daughter’s role as a senior anchor on NBC’s Today.

Family members last saw her on the evening of January 31 after dropping her home. She failed to attend church the next morning, raising immediate concern.

Her phone, wallet, car, and medication were all left behind.

The Pima County Sheriff’s Department, with assistance from the FBI, is leading the investigation.

Sponsored

Sponsored

Deputies also discovered that her doorbell camera had been removed or disabled, reinforcing concerns that she did not leave voluntarily.

So far, authorities have named no suspects and confirmed no proof of life.

Bitcoin Ransom Claims Add a Crypto Twist

The case took a darker turn after multiple alleged ransom communications surfaced, some referencing Bitcoin payments.

Sponsored

Sponsored

Media reports describe a purported ransom note demanding “millions of dollars’ worth of Bitcoin”, complete with deadlines and a wallet address.

However, police have not confirmed the authenticity of any ransom demand or verified that it came from whoever took her.

Crucially, investigators stress that no confirmed captor has made direct contact with the family.

Sponsored

Sponsored

Fake Bitcoin Extortion Attempt Clouds the Case

Separately, authorities arrested Derrick Callella, a California man accused of sending fraudulent Bitcoin-related messages to members of the Guthrie family.

Law enforcement says Callella is not connected to the kidnapping and acted independently, highlighting the rise of opportunistic crypto scams during high-profile cases.

Investigation Ongoing, Answers Still Missing

Savannah Guthrie has stepped away from broadcasting duties as the search continues.

For now, investigators say the focus remains on locating Nancy Guthrie and determining who took her, how, and why—with the Bitcoin angle still unverified and under review.

Crypto World

Bitcoin Selloff Sparks Hedge Fund Speculation Around BlackRock ETF

Traders suggest unusual activity in IBIT may point to Hong Kong–based hedge funds, though no hard evidence has emerged.

Unusual trading in BlackRock’s bitcoin ETF, iShares Bitcoin Trust (IBIT), has led traders to speculate that this week’s sharp Bitcoin drop may have been triggered by one or more Hong Kong–based hedge funds, rather than selling pressure from crypto traders.

The theory was laid out in a post on X by Parker White, the COO and CIO of DeFi Development Corp, and centers around record trading and options activity in IBIT.

Bitcoin (BTC) fell sharply over the past week, dropping 16%, and trading as low as $62,000 on Thursday before rebounding to around $70,400 on Friday, per CoinGecko. On Thursday, IBIT recorded its highest daily trading volume to date, with about $10.7 billion traded. Despite the heavy volume, IBIT recorded only $175 million in net outflows, according to SoSoValue.

White cited several signals suggesting that selling pressure did not come from crypto-native traders, including relatively low liquidations on centralized crypto exchanges and unusual price action in BTC and Solana (SOL).

“Given these facts and the way $BTC and $SOL traded down in lockstep today (normally SOL trades with beta) + the relatively lower liquidations on CeFi exchanges, this leads me to believe that the nexus of the problem lies with a large IBIT holder,” the post reads. “IBIT has become the #1 venue for BTC options trading, so my guess is that a hedge fund trading IBIT options is the culprit.”

White said public filings show that some funds hold a very large share (and in some cases nearly all) of their assets in IBIT. He added that many of those IBIT-focused funds are based in Hong Kong and do not normally trade crypto, which could explain why traders didn’t see warning signs ahead of the selloff.

He also pointed to activity in $DFDV, a fund tied to DeFi Development Corp, which he said posted its worst single-day decline on record, alongside a sharp drop in its net asset value.

“I personally know a number of HK-based hedge funds that are holders of $DFDV… the mNAV had been holding steady surprisingly well throughout this pull back until today.” White wrote, adding that he finds it unlikely a fund running a large IBIT position through a single-entity structure would operate only one vehicle.

White cautioned that while he has no hard evidence, “just some hunches and bread crumbs,” he believes his theory seems “very plausible.” Other experts echoed parts of White’s view, noting that the size and structure of the move did not resemble a typical crypto-driven selloff.

Rob Wallace, co-founder of BitcoinNews.com, agreed that the combination of factors mentioned by White looks more like institutional selling than a retail panic. He also said IBIT has become an important link between traditional markets and BTC trading.

Still, White and other traders emphasized that the clearest confirmation would come from regulatory filings showing a large IBIT position being reduced to zero.

Crypto World

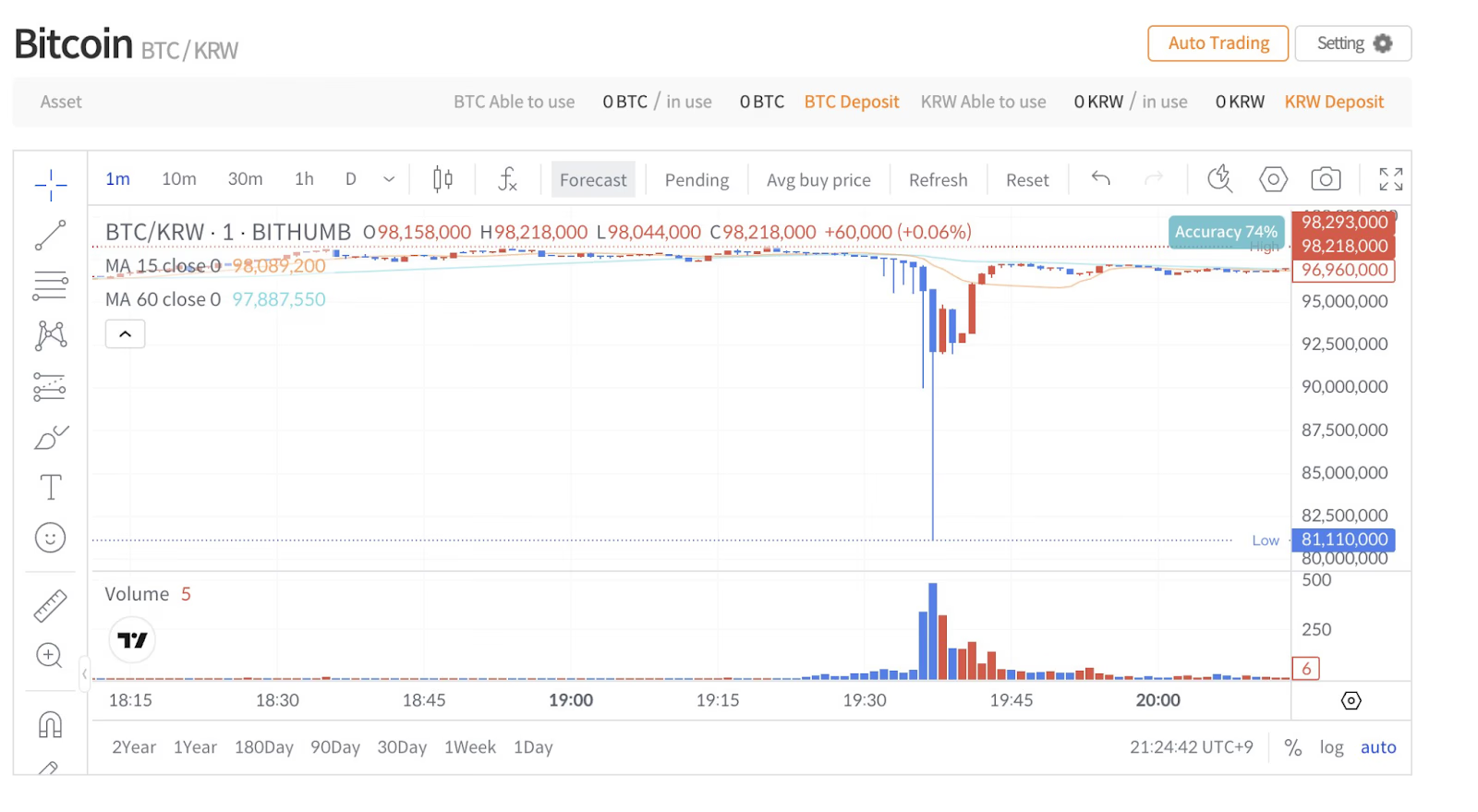

Bithumb Fat-Finger Error: 2,000 BTC Mistakenly Credited, Triggering Local Flash Crash

TLDR

- Bithumb mistakenly credited 2,000 BTC to hundreds of users, triggering a flash crash.

- Bitcoin briefly traded 10% below global prices due to sudden localized sell-offs.

- Exchange reserves limited withdrawals, preventing larger-scale market disruption.

- Immediate action by Bithumb aimed to recover wrongly deposited BTC and stabilize trading.

Bithumb fat-finger error briefly sent Bitcoin prices tumbling on the exchange after a system mistake credited around 2,000 BTC (~$130 million) to users instead of the intended 2,000 KRW reward, triggering large sell orders and a local flash crash before prices rebounded.

Prices on Bithumb sank to roughly ₩81.1 million, far below other markets, before stabilizing.

Accidental Bitcoin Distribution and Market Reaction

Bithumb, South Korea’s second-largest cryptocurrency exchange, mistakenly deposited around 2,000 BTC into hundreds of user accounts.

Reports indicate a staff member intended to send a 2,000 KRW reward, but accidentally selected BTC as the currency.

Once the Bitcoin landed in user accounts, some recipients quickly sold it, likely anticipating recovery actions by the exchange. This sudden sell-off caused Bitcoin on Bithumb to trade nearly 10% below global market levels.

The local market experienced a sharp liquidity shock rather than a broader Bitcoin decline. One-minute trading charts show a near-vertical drop, followed by a long downside wick, reflecting the sudden surge in sell orders.

Arbitrage traders and automated bots quickly responded, buying BTC at prices significantly lower than those on other exchanges. The bounce back in price demonstrates short-term market corrections due to mispricing rather than a return of investor confidence.

Users on social media reported the flash crash in real time, noting the extreme volatility. The combination of human error, thin order books, and automated trading created a brief but dramatic market distortion.

The incident highlights the speed at which operational errors can impact local exchange markets.

Exchange Reserves and Recovery Measures

Despite the massive credited amount, Bithumb’s actual Bitcoin reserves prevented full withdrawals. The exchange reportedly holds about 50,000 BTC, limiting the possibility of large-scale asset outflows despite system-recorded deposits far exceeding actual holdings.

More than 500 BTC were sold immediately, causing price disruption, but a broader market collapse was avoided. The exchange acted quickly by suspending deposits and withdrawals and inspecting servers.

Bithumb confirmed that most wrongly deposited BTC could be recovered, although assets already sold or transferred overseas may be difficult to reclaim fully.

Regulatory scrutiny is ongoing, as Bithumb faces potential fines related to anti-money laundering compliance. The incident occurred amid volatile Bitcoin markets, emphasizing that centralized exchanges are single points of operational risk.

Even minor errors, such as event reward distributions, can lead to rapid price swings and localized market instability.

The episode provides a clear example of how technical mistakes intersect with liquidity and trading behavior. While the immediate threat was contained, the incident shows the vulnerabilities that centralized exchanges face when internal controls fail.

Crypto World

Sell-Off Slams Treasuries, ETFs & Mining Infrastructure

Crypto’s latest sell-off isn’t just a price story. It’s shaping balance sheets, influencing how spot ETFs behave in stressed markets and altering the way mining infrastructure is used when volatility rises. This week, Ether’s slide has pushed ETH below the $2,200 mark, testing treasury-heavy corporate crypto strategies, while Bitcoin ETFs have handed a new cohort of investors their first sustained taste of downside volatility. At the same time, extreme weather has reminded miners that hash rate remains tethered to grid reliability, and a former crypto miner turned AI operator is illustrating how yesterday’s mining hardware is becoming today’s AI compute backbone.

Key takeaways

- BitMine Immersion Technologies, led by Tom Lee, is dealing with mounting paper losses on its Ether-heavy treasury as ETH dips and market liquidity tightens, with unrealized losses surpassing $7 billion on a roughly $9.1 billion Ether position that includes the purchase of 40,302 ETH.

- BlackRock’s iShares Bitcoin Trust (IBIT) has seen underwater performance for investors as Bitcoin’s retreat from peak levels deepens, underscoring how quickly ETF exposure can shift from upside to downside in a volatile market.

- A late-January US winter storm disrupted bitcoin production, highlighting the vulnerability of grid-dependent mining operations. CryptoQuant data show daily output for publicly listed miners fell sharply during the worst of the disruption, then began to rebound as conditions improved.

- CoreWeave’s transformation from a crypto mining backdrop into AI-focused infrastructure underscores a broader trend: yesterday’s mining hardware and facilities are increasingly repurposed to support AI data centers, a shift reinforced by major financing—Nvidia’s $2 billion equity investment.

- Taken together, the latest developments illustrate how crypto sell-offs ripple through treasuries, ETFs and the physical infrastructure that underpins the network, prompting a re-evaluation of risk management and asset allocation in the sector.

Tickers mentioned: $BTC, $ETH, $IBIT, $MARA, $HIVE, $HUT

Market context: The drawdown comes as institutional crypto exposure faces a confluence of price volatility, liquidity concerns and cyclical demand for compute capacity. ETF inflows and outflows tend to respond quickly to price moves, while miners’ production patterns reveal how power and weather can shape output in a grid-sensitive ecosystem.

Why it matters

The balance-sheet story around crypto treasuries is front and center again. BitMine’s exposure underscores the risk of anchoring large corporate reserves to volatile assets that can swing meaningfully within a single quarter. When assets sit in the treasury, unrealized losses are a function of mark-to-market moves; they become a real talking point when prices slip and capital-mix decisions come under scrutiny. The company’s $9.1 billion Ether position — including a recent 40,302 ETH purchase — highlights the scale of the risk, especially for a firm that seeks to model ETH performance as a core axis of its treasury strategy.

On the ETF side, investors in the IBIT fund have learned a hard lesson about downside risk in a bear market. The fund, one of BlackRock’s notable crypto vehicles, surged to become a flagship allocation for many buyers before the price retraced. As Bitcoin traded lower, the average investor’s position moved into negative territory, illustrating how quickly ETF performance can diverge from early expectations in an abrupt market reversal.

Weather and energy costs are still a significant constraint for miners. The winter storm that swept across parts of the United States in late January disrupted energy supply and grid stability, forcing miners to reduce or curtail production. CryptoQuant’s tracking of publicly listed miners showed daily Bitcoin output contracting from a typical 70–90 BTC range to roughly 30–40 BTC at the storm’s height, a striking example of how energy grid stress translates into on-chain results. As conditions improved, production resumed, but the episode underscored the vulnerability of hash-rate operations to external shocks beyond price cycles.

The AI compute cycle is reshaping the crypto infrastructure landscape. CoreWeave’s trajectory—from crypto-focused computing to AI data-center support—illustrates a broader redeployment of specialized hardware. As GPUs and other accelerators pivot away from proof-of-work demand, operators like CoreWeave have become a blueprint for repurposing mining-scale footprints to power AI workloads. Nvidia’s reported $2 billion equity investment in CoreWeave adds a regional confidence boost, reinforcing the view that the underlying compute fabric developed during the crypto era is now a critical layer for AI processing and data-intensive workloads.

Altogether, the latest data points outpace simple price narratives. They illuminate how markets, capital structures and infrastructure intersect in a bear environment, revealing both fragility and resilience across different segments of the crypto ecosystem. The convergence of treasuries exposed to ETH, ETF holders re-evaluating allocations, weather-driven production swings, and infrastructure migration toward AI all signal a period of recalibration for investors, builders and miners alike.

What to watch next

- BitMine’s forthcoming disclosures or earnings updates to gauge whether unrealized Ether losses translate into realized losses or further balance-sheet write-downs.

- Performance of IBIT as BTC prices stabilize or fall further, and whether new inflows offset earlier drawdowns for long-term holders.

- Mining sector resilience data, including weekly production numbers and energy-grid reliability metrics, to assess ongoing sensitivity to weather and energy costs.

- CoreWeave and similar AI-focused infrastructure players’ investment milestones and capacity expansions, particularly any additional financing or partnerships with AI developers.

Sources & verification

- BitMine Immersion Technologies’ Ether-related balance-sheet disclosures and references to unrealized losses as ETH trades below prior highs.

- Performance and investor commentary regarding BlackRock’s iShares Bitcoin Trust (IBIT) amid BTC price moves and ETF liquidity.

- CryptoQuant data detailing miner output fluctuations during the US winter storm and the subsequent recovery.

- Reporting on CoreWeave’s transition from crypto mining to AI infrastructure and Nvidia’s equity investment in the company.

Crypto market stress and the AI-backed data-center shift

Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH) remain the two largest macro anchors in the crypto market, and their price trajectories continue to drive a wide array of spillover effects. The current pullback has placed a spotlight on how corporate treasuries are risk-managed during drawdowns, as well as how ETFs react when underlying assets encounter extended price pressure. BitMine’s Ether-heavy treasury is a case in point: with ETH hovering around the low-$2,000s, unrealized losses have mounted, illustrating the trouble with balance sheets anchored to a single, volatile asset. The company’s substantial Ether position, including a notable addition of 40,302 ETH, points to strategic bets on long-term exposure that, in the near term, translate into large mark-to-market swings. In this environment, even if losses remain unrealized, they shape investor sentiment and the risk calculus behind future capital raises or debt covenants.

The ETF angle adds another dimension to risk transfer. IBIT, the flagship BlackRock product, has exposed investors to Bitcoin price action in a new cycle, and the downturn has drawn attention to the sensitivity of ETF performance to rapid price moves. The fact that the fund’s investors have found themselves underwater — a reminder of how quickly market timing can unravel in a bear phase — underscores the need for robust risk controls around ETF allocations in crypto portfolios. The ETF’s ability to scale rapidly to a substantial asset base is impressive, but downtrends reveal the volatility that sits just beneath the surface of even the most sophisticated products.

Meanwhile, miners faced a concrete operational test in late January as a winter storm swept across the United States. The weather disrupted power delivery and grid operations, forcing several public miners to dial back production. CryptoQuant’s daily output data for major operators tracked a sharp decline from the usual 70–90 BTC per day to roughly 30–40 BTC during the storm’s peak, illustrating how grid stress translates into lower on-chain activity. This temporary slowdown is a reminder that mining is not a purely financial activity; it remains deeply connected to physical infrastructure and regional energy dynamics. As grid conditions improved, production began to rebound, revealing the sector’s capacity to adapt under adverse circumstances.

Against this backdrop, CoreWeave’s pivot from crypto mining to AI infrastructure emphasizes how the compute ecosystem evolves across cycles. The company’s transformation, coupled with Nvidia’s $2 billion investment, reinforces the idea that the compute fabric built during the crypto era has broad relevance for AI workloads and high-performance computing. This shift is not merely tactical—it signals a longer-term trend where hardware and facilities originally designed to support crypto mining become foundational for AI data centers and other compute-intensive applications. For operators, the challenge is to manage this transition smoothly, align financing with new business models, and keep services competitive in an environment where demand for AI-ready infrastructure remains strong.

In sum, the latest market moves illuminate a market in transition: from price-driven narratives to structural ones where balance sheets, ETF dynamics, weather-sensitive operations and AI compute needs converge. The next few quarters will reveal whether this confluence accelerates consolidation, prompts more diversified treasury strategies, or fuels a new wave of infrastructure repurposing across the crypto space and beyond.

https://abs.twimg.com/widgets.js

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech6 hours ago

Tech6 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports16 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat12 hours ago

NewsBeat12 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined