Crypto World

US Recession Fears Trigger Sharp Crypto Market Crash

Key Insights

- US layoffs rise sharply, weakening consumer spending and market confidence.

- Crypto market cap drops 8%, with forced liquidations hitting 1.34B in Bitcoin.

- Bitcoin shows strong correlation with S&P 500 and gold amid macro selloff.

What Sparks Recession Debate?

The US economy shows signs of stress, with rising layoffs and weak hiring fueling recession fears. In January 2026, companies reported over 108,000 job cuts, the highest since 2009. Meanwhile, vacancy opportunities declined to 6.9 million, which is significantly below the projections. Such a decline in jobs could decrease consumer expenditure, impacting economic growth and investor confidence in high-risk assets like cryptocurrencies.

Housing data also contributes to economic issues. The gap between the home sellers and buyers is at an all-time high of 530,000. Reduced housing demand also affects construction employment, bank lending, and general consumer confidence that can add even more strain on financial markets.

Tech Debt and Bond Market Pressures

Stress in the technology credit sector is intensifying. Tech loan distress reached 14.5%, while bond distress climbed to 9.5%, highlighting challenges in debt management. Around $25 billion in software loans are trading at deep discounts. Previously, crypto and stock markets operated independently, but the correlation between the two has increased in recent years, causing crypto to respond sharply to stock market declines.

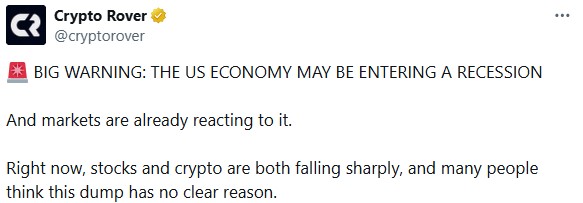

The bond market also signals caution. The 2-year versus 10-year Treasury yield spread moved to approximately 0.74%, known as bear steeping.

This trend, seen historically before recessions, indicates rising long-term yields relative to short-term rates, which can signal investor concern over future economic growth.

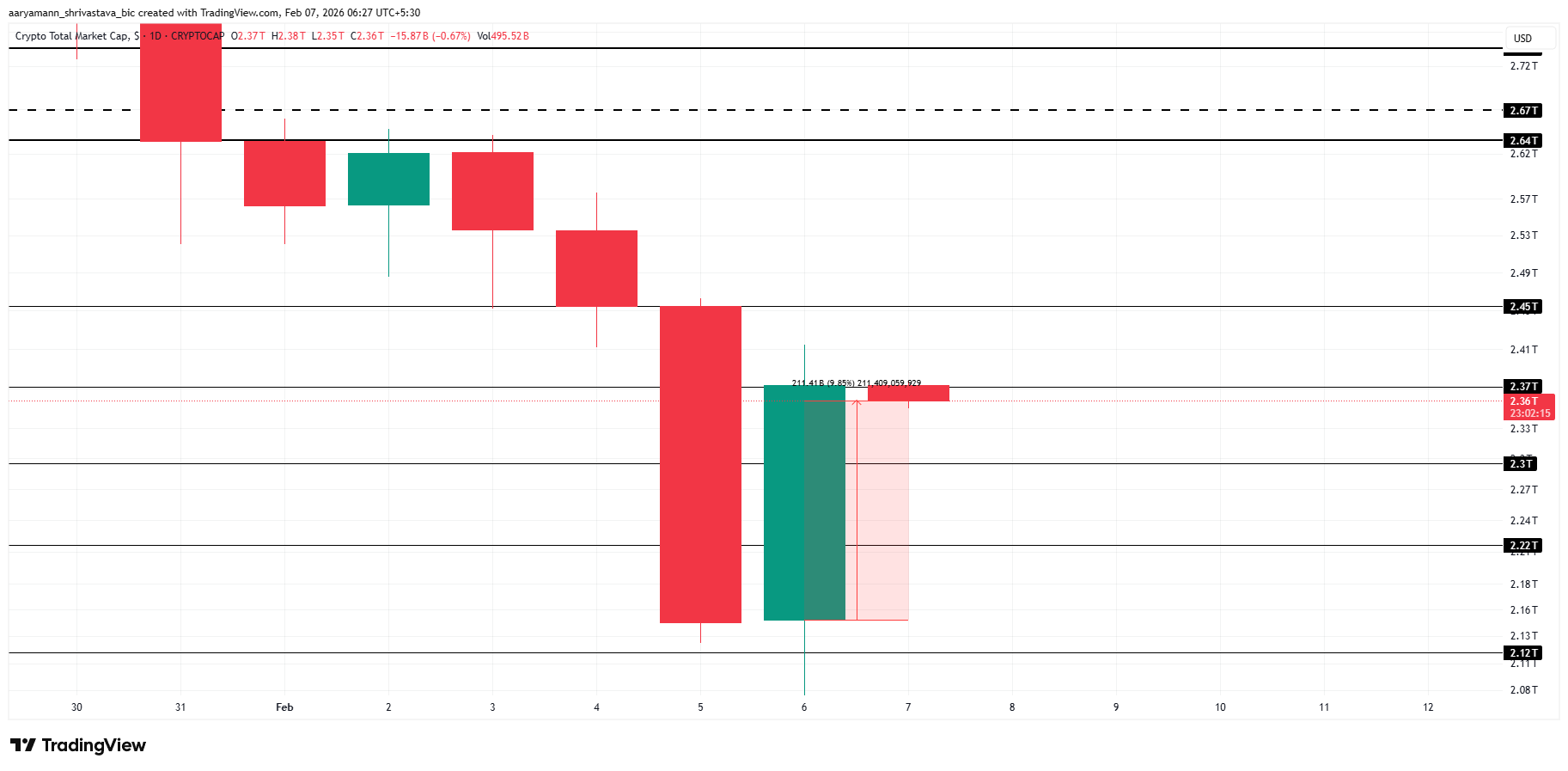

Crypto Market Reacts to Macro Risks

The crypto market tracked declines in traditional markets. The crypto market cap fell by 8% in 24 hours, to approximately $2.22 trillion. Trading volume rose more than 80% as liquidations increased. Bitcoin alone saw more than $1.34 billion of positions liquidated, while leading altcoins such as XRP and Solana posted sizable intraday losses.

Statistics show a 92% correlation between Bitcoin and the S&P 500 and an 80% correlation between cryptocurrency and gold, suggesting macroeconomic factors drove Bitcoin’s decline.

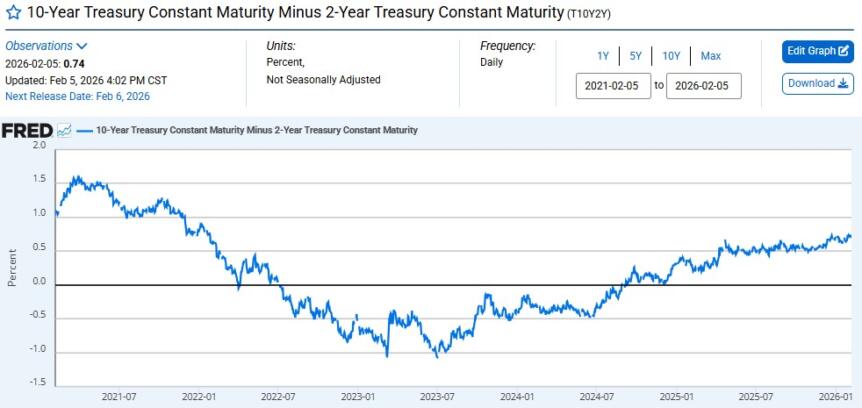

According to U.S. stock market data: S&P 500 fell 84.32 points to around -1.23%, Dow Jones dropped 1.20%, Nasdaq fell 1.59% to 363.99, and the Russell fell 1.79%.

Source: Google Finance

Analysts hope that any Federal Reserve open market operations or changes in rates would inject liquidity and take pressure off risk assets, potentially leading to a market recovery.

Crypto World

CryptoQuant CEO warns of cascading institutional BTC sell-off risk

CryptoQuant’s Ki Young Ju warns that absent a near-term Bitcoin rebound, forced liquidations and cascading institutional selling could hit ETFs, miners, and trust.

Summary

- CryptoQuant CEO Ki Young Ju says large BTC releases may signal forced institutional liquidations that pressure prices and ETF flows.

- He warns that if Bitcoin does not rebound within a month, structural, chain institutional selling could rise and push miners toward bankruptcy risk.

- Ju notes institutions that capitulate near market lows may struggle to re-enter, with trust in Bitcoin markets taking a long time to rebuild.

CryptoQuant CEO Ki Young Ju stated that the risk of institutional selling in cryptocurrency markets could increase significantly if Bitcoin does not experience a strong recovery in the short term, according to a statement dated February 6.

CryptoQuant analyst warns of pain in Bitcoin recovery

Ju’s comments addressed potential reasons behind sharp movements in spot Bitcoin exchange-traded funds, particularly responding to observations from DeFi Development manager Parker White regarding a notable ETF decline. White suggested one or more Hong Kong-based non-crypto hedge funds may have contributed to the drop.

The CryptoQuant executive argued that large-scale Bitcoin releases into the market could indicate a forced sell-off scenario. Ju outlined a potential domino effect in which fund liquidations could drive prices lower, creating additional selling pressure in the market and potentially pushing miners toward bankruptcy risk.

“If Bitcoin fails to achieve a significant rise from current levels in the next month, the risk of structural and chain institutional selling increases significantly,” Ju stated.

According to Ju’s analysis, institutional investors who exit positions at market lows may face difficulty returning to the market, with trust rebuilding potentially requiring extended time periods.

The statement included a disclaimer noting the information does not constitute investment advice.

Bitcoin ETFs have experienced increased volatility in recent weeks, with market participants monitoring institutional trading activity closely. The cryptocurrency sector remains sensitive to large-scale transactions from institutional holders, according to market analysts.

Crypto World

How options on the BlackRock bitcoin ETF may have worsened crypto meltdown

BlackRock’s spot bitcoin exchange-traded fund has been a massive hit since launch, pulling in billions from investors seeking exposure to the cryptocurrency without the hassle of crypto wallets or exchanges. Traders and analysts religiously track inflows into the fund to gauge how institutions are positioning in the market.

Now they might have to do the same with options tied to the ETF, as activity exploded during Thursday’s crash. According to one observer, the record activity stemmed from a hedge fund blowup, while others disagreed, citing routine market chaos as a catalyst.

What really stood out

On Friday, as the ETF tanked 13% to its lowest level since October 2024, options volume exploded to a record 2.33 million contracts, with puts narrowly outpacing calls.

The fact that puts saw more volume than calls on Thursday indicates a higher demand for downside protection, a typical occurrence during price sell-offs.

Options are derivative contracts that provide built-in insurance against swings in the price of the underlying asset, in this case, IBIT. You pay a small fee (premium) for the right, but not the obligation, to buy or sell IBIT at a set price by a deadline or expiry.

A call option lets you lock in IBIT at a set price today for a small premium. If it rallies above that level later, you buy cheap and sell for profit; if not, you only lose the premium. A put option locks in the sale of IBIT at that price. If it slides below, you sell high and pocket the difference; otherwise, you lose just the premium. Calls offer leveraged upside bets, while puts protect against downside drops.

Another standout figure was the record $900 million in premiums paid by IBIT options buyers that day—the highest single-day total ever. To put it in context, that’s equivalent to the market cap of several crypto tokens ranking beyond the top 70.

Speculative theory: record activity tied to hedge fund blowup

A post by market analyst Parker, which has gone viral on X, argues that the $900 million premium payments resulted from the blowup of a large hedge fund (one or a few) with nearly 100% of money invested in IBIT. Funds often focus on just one asset, avoiding spreading out risk exposure elsewhere.

Parker’s post alleges that this fund initially bought cheap “out of the money” call options on IBIT following the October crash, anticipating a quick recovery and bigger rally.

These OTM calls are like cheap lottery tickets at levels well above the ongoing price of the underlying asset. If the asset rallies past these levels, these calls make significant money; if it doesn’t, buyers of these calls lose the initial premium paid.

However, the fund bought these calls using borrowed money. As IBIT continued to drop, they doubled down on their bet.

On Thursday, as IBIT crashed, these calls tanked in value and brokers hit the fund with margin calls demanding cash/collateral. The fund, having bled money elsewhere, was unable to provide the same and ended up dumping large amounts of IBIT shares in the market, resulting in a record $10 billion spot volume.

The fund also desperately replaced expiring calls or closed loss-making calls, resulting in a record $900 million in total premium payments. Essentially, Parker associates the record activity with one or a few massive players scrambling, not routine trading.

Shreyas Chari, director of trading and head of derivatives at Monarq Asset Management put it best: “Systematic selling across the majors yesterday probably tied to margin calls especially in the ETF with the highest crypto exposure IBIT.”

“Rumors swirled of a short options entity that had to sell the underlying far more aggressively after 70k and then 65k broke, probably tied to liquidation levels. This exacerbated the move down to 60k,” he explained in a Telegram chat.

Options expert disagrees

Tony Stewart, founder of Pelion Capital and an options expert, believes IBIT options added to the market chaos, but doesn’t go so far as to blame a single fund blowup for the whole crash and record activity.

He argued on X, citing Amberdata, that $150 million of the $900 million in premiums came from buying back put options. In short, traders who had previously sold (shorted) puts faced significant losses as IBIT crashed and those puts surged in value, so they repurchased them to cut their risk.

Those were “certainly painful” closes, he said on X, adding that the remaining portion of the $900 in premiums comprised mostly smaller trades, which is pretty standard for the hectic trading day.

In essence, to Stewart, the record activity is just the messy noise of a broadly panicked market, not a smoking gun pointing to a single way. “This [hedge fund blowup theory] is inconclusive from the Options standpoint. It also doesn’t seem enough tbh in size,” he concluded.

Still, he acknowledged the possibility that some activity could have been hidden in over-the-counter (privately negotiated) deals.

Conclusion

While Parker connected the dots to point to a hedge fund blowup, Stewart challenged the same with hard data.

In any case, this episode highlights that IBIT options are now large enough to wield influence, and traders might want to keep track of them just as they do ETF inflows.

Crypto World

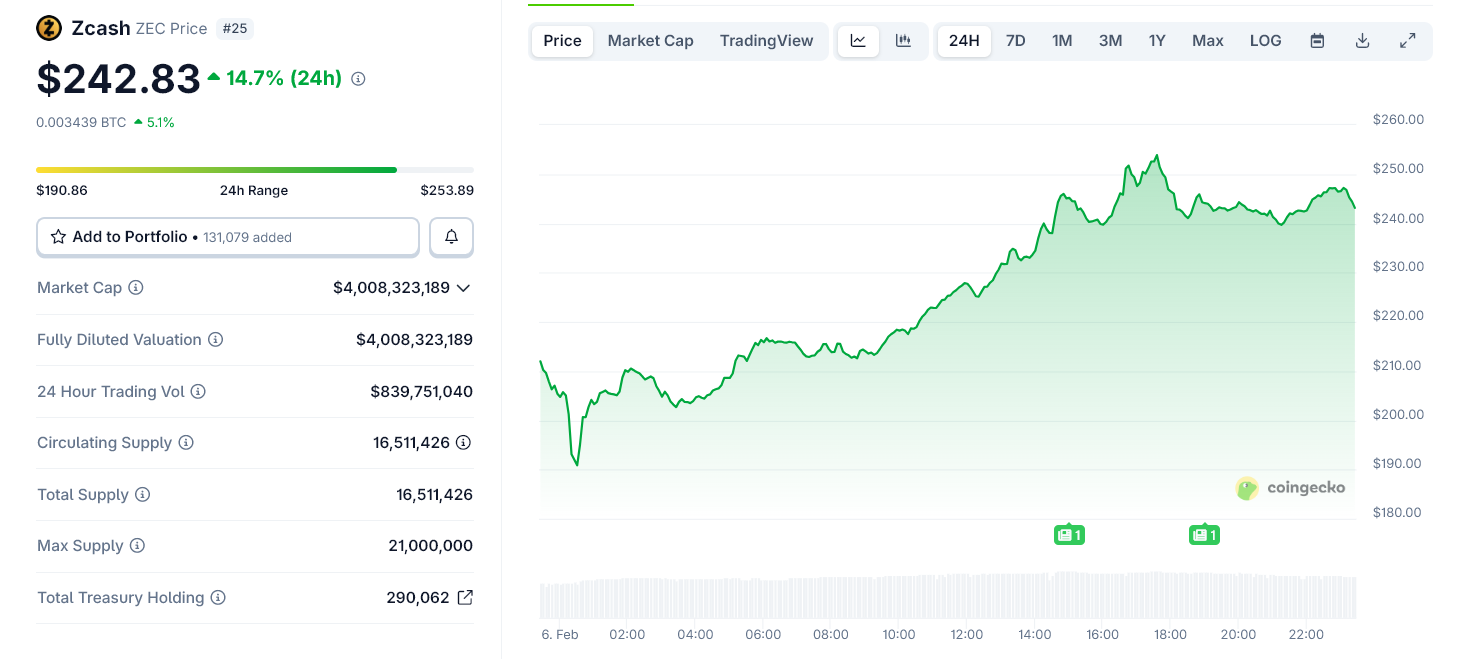

Ethereum’s Vitalik Buterin Makes a New Bet on Zcash and Privacy

Ethereum founder Vitalik Buterin has donated to Shielded Labs, backing development of Crosslink, a proposed consensus upgrade for Zcash.

The move signals a deepening commitment by Buterin to privacy-preserving infrastructure, as well as growing interest in strengthening finality and settlement guarantees in proof-of-work blockchains.

Sponsored

Vitalik Doubles Down on Privacy Infranstructure in Crypto

Shielded Labs is developing Crosslink, a parallel finality layer designed to sit on top of Zcash’s existing proof-of-work consensus.

In simple terms, Crosslink adds a second confirmation system that locks in transactions faster and more decisively. This reduces the risk of chain reorganizations, rollbacks, and double-spend attacks.

As a result, exchanges can shorten confirmation times, cross-chain bridges gain stronger security guarantees, and applications become easier to build on Zcash.

Sponsored

What Shielded Labs Does for Zcash

Shielded Labs is a Zcash-focused research and engineering group working on core protocol upgrades rather than applications or tooling.

Its mandate centers on improving Zcash’s long-term security, usability, and cryptographic guarantees—especially around shielded transactions and privacy-first design.

Buterin’s support comes amid a broader shift in his public advocacy toward privacy and resilience over growth metrics or convenience.

In recent months, he has repeatedly argued that blockchains must optimize for worst-case scenarios, not best-case user experience.

That includes resisting censorship, minimizing trust assumptions, and protecting users even under hostile conditions.

Sponsored

Privacy, in that framing, is not optional. It is core infrastructure.

The Privacy Push Is More Critical Than Ever

Buterin has warned that financial transparency without strong cryptographic privacy creates long-term risks, including surveillance, coercion, and systemic fragility.

He has increasingly praised systems that embed privacy at the protocol level rather than layering it on as an optional feature. Zcash’s shielded transaction model aligns closely with that philosophy.

Sponsored

By backing Shielded Labs, Buterin is effectively endorsing privacy-preserving design paired with stronger settlement guarantees—two areas he sees as underinvested across the industry.

A Signal to the Broader Crypto Ecosystem

The donation also lands at a moment when Ethereum itself is reassessing parts of its scaling and security roadmap.

While Buterin has criticized superficial innovation and “copy-paste” infrastructure elsewhere, his support for Zcash highlights what he sees as meaningful progress: protocol-level upgrades that improve safety, finality, and user protection.

In that sense, the move is less about Ethereum versus Zcash—and more about the kind of blockchain architecture Buterin believes will survive long term.

Crypto World

RNBW Tanks 65% Below ICO Price on First Day of Trading

The launch was plagued by reports of delayed token distribution to early investors and technical issues.

Self-custodial Ethereum wallet Rainbow debuted its native token RNBW yesterday, Feb. 5. But the project’s token generation event (TGE) on Base, and the token’s debut for trading across exchanges, were met with reports of delayed distribution to ICO participants, which contributed to the token’s poor day-one performance.

According to Coinbase data, RNBW hit a high of $0.05 on its first day of trading, but fell quickly and closed the daily session around $0.034, down more than 30%, putting its fully diluted valuation around $34 million.

That left most bettors on Polymarket scrambling, having expected the FDV to hit roughly $100 million just a day after the TGE.

Today, RNBW fell further, trading around $0.032 by press time, making its FDV around $32.17 million.

ICO Investors in the Red

The price is far below what early buyers paid. Rainbow conducted its initial coin offering (ICO) in mid-December 2025 via CoinList, where investors were offered RNBW at $0.1 per token. The sale saw 30 million RNBW tokens, or 3% of total supply, sold at an FDV of $100 million, meaning participants in that sale are now down more than 65% on their investments.

For U.S. investors, the situation could be even worse as their full token unlock won’t happen until December of this year, according to CoinList’s terms and conditions.

Back in 2022, Rainbow raised $18 million in a Series A funding round led by Seven Seven Six, the VC firm from Reddit co-founder Alexis Ohanian, bringing total funding to $21 million. The multi-chain wallet is known for its rewards program and gamification, where users can earn points for their on-chain activity.

The firm explicitly connected RNBW with its points system when it first announced the token in September, and later specified that users who earned points in the wallet were eligible for a token airdrop.

‘No Better Day for TGE’

The token’s drop came amid a broader market bloodbath that wiped out $2.6 billion in liquidations in a single day. Total crypto market capitalization fell to $2.3 trillion as Bitcoin slid toward $60,000, reaching roughly 50% below its all-time high of $126,080, set in October.

Soon after its TGE, Rainbow’s cofounder Mike Demarais indicated in an X post that some users had not received their claimed tokens, explaining “it’s because our backend token indexer has been getting slammed.”

As frustration over the messy launch mounted, Rainbow CEO Alex LaPrade took to X on Thursday evening eastern time to say he still believes “there was no better day for TGE than today,” noting that the project had planned to launch its token on Feb. 5 back in December. LaPrade added:

“TGE isn’t the finish line. Having a token live in market brings more scrutiny — both positive and negative.”

But the CEO’s public statement didn’t succeed in calming all investors. Some quickly fired back at the CEO, accusing the project of late token distribution to CoinList pre-sale participants, as well as to points earners, calling it a scam and demanding refunds.

Last year, MetaMask confirmed that it has plans to launch its own token, after years of hinting and speculation.

Crypto World

Bitcoin price bounces from multi-year channel support, is the bottom in?

Bitcoin price has rebounded from a critical multi-year channel support near $62,500, raising the question of whether a high-timeframe bottom may be forming.

Summary

- $62,500 marks multi-year channel support, active since March 2021

- Confluence with value area high strengthens the bounce, increasing reaction probability

- Accumulation is required, to confirm a sustainable move toward the channel midpoint

Bitcoin (BTC) price action has recently reacted from a major technical support zone that has defined market structure for several years. After an extended bearish expansion, BTC has revisited the lower boundary of a multi-year ascending channel that has remained intact since March 2021. This reaction has drawn renewed attention from traders, as the level coincides with additional technical confluence that historically has led to meaningful high-timeframe pivots.

While short-term volatility remains elevated, the broader structure suggests Bitcoin may be entering a critical decision phase. Whether this bounce develops into a sustained recovery or fails into another leg lower will largely depend on how the price behaves around this key support region in the coming sessions.

Bitcoin price key technical points

- $62,500 aligns with multi-year channel low, active since March 2021

- Confluence with value area high strengthens support, increasing reaction probability

- Accumulation behavior is needed, to confirm a sustainable rotation higher

From a higher-timeframe perspective, Bitcoin’s current location is technically significant. The multi-year channel, which has guided price action since early 2021, has consistently acted as both support and resistance during major market cycles. Each historical retest of the channel’s lower boundary has resulted in strong reactions, often marking the transition from bearish phases into broader recovery structures.

The recent bounce from the $62,500 region once again highlights the importance of this channel. This level not only represents the channel low but also aligns with the value area high of the prior range, adding further structural relevance. When multiple high-timeframe levels converge, the probability of a meaningful reaction increases substantially.

Importance of holding value area support

Beyond the channel structure, Bitcoin’s ability to hold above the value area high is a key factor in determining whether this move can evolve into a sustained rotation. Acceptance above this region suggests that buyers are willing to transact at higher prices following the recent sell-off, a necessary condition for trend stabilization.

If price continues to defend this zone on a closing basis, it reinforces the idea that the recent bearish expansion may be transitioning into a consolidation or accumulation phase. Failure to hold, however, would indicate that demand remains insufficient and could expose Bitcoin to another test of lower liquidity zones.

Accumulation phase remains the missing piece

Although the initial bounce is technically constructive, confirmation remains incomplete without evidence of accumulation. Accumulation phases typically follow sharp bearish expansions and are characterized by sideways price action, declining volatility, and gradual absorption of supply by stronger hands.

In Bitcoin’s case, such a phase would help establish a durable base around the $62,000–$63,000 region. Without this basing behavior, any upside movement risks being corrective rather than trend-defining. Traders should closely monitor volume behavior, as rising participation during consolidation signals increasing confidence among buyers.

Potential rotation toward channel midpoint

If accumulation develops and support remains intact, the technical roadmap opens the door to a rotational move toward the midpoint of the multi-year channel. Historically, these rotations have provided substantial upside opportunities, particularly when initiated from channel extremes.

However, it is important to distinguish between a rotation and a full trend reversal. While a move toward the channel midpoint would be constructive, reclaiming higher resistance levels would still be required to confirm a broader bullish continuation.

What to expect in the coming price action

From a market structure, price action, and support perspective, the $62,000–$62,500 region represents a pivotal zone for Bitcoin. Holding above this level keeps the multi-year channel intact and supports the case for a developing bottom. A failure to maintain support would invalidate the bullish rotation thesis and reopen downside risk.

For now, Bitcoin remains at a high-timeframe inflection point. Confirmation through basing, accumulation, and improving volume will be essential before declaring a definitive bottom. Until then, traders should expect volatility and remain focused on how price behaves around this critical support zone.

Crypto World

PI Network price rises after a major Kraken development

Pi Network price stabilized near its all-time low as optimism rose that it would be listed on Kraken, a top crypto exchange.

Summary

- Pi Network price crashed to a record low amid the ongoing crypto crash.

- Kraken, a top crypto exchange, has added it to its listing roadmap.

- Technical analysis suggests that it has more downside to go in the coming days.

Pi Network (PI) rose to $0.1450, a few points above the all-time low of $0.1300. It remains significantly lower than the all-time high of $3, with its market capitalization falling from nearly $20 billion to $1.3 billion today.

One major catalyst for the coin is its addition to Kraken’s page for potential listings. It is listed in the Chains category, which also includes tokens such as TX, Conflux, Pepecoin, MegaETH, and Quai.

Being listed on this page does not guarantee future listing. However, it has given the community hope that it will be available on one of the largest crypto exchanges today.

Kraken has over 15 million users globally, with 1.5 million active each month. It generated over $2.2 billion in revenue last year and raised $800 million at a $20 billion valuation in November ahead of its IPO.

A Kraken listing would be a big thing as Pi has failed to attract any additional exchanges since its mainnet launch in February last year. Most of its trading occurs on a handful of exchanges, including OKX, Gate, Bitget, and MEXC.

Additionally, the listing will likely encourage more exchanges to list it as well. Some of the most important exchanges that would trigger a Pi Coin price surge are Binance, Coinbase, and Upbit. Binance is the most important, while Coinbase and Upbit have large market shares in the US and South Korea.

Pi Network price technical analysis

The daily timeframe chart shows that the Pi coin price has been in a steep freefall in the past few months. It dropped to a record low of $0.1304 as the crypto market crash intensified,

The coin has moved below all moving averages and the crucial support level at $0.1530, its previous all-time low. All oscillators are pointing downward, indicating that downward momentum is continuing.

Therefore, the most likely Pi Network price outlook is bearish, with the next key target being the psychological $0.10 level. However, the main risk of going against it is that a Kraken listing would fuel a short-term short squeeze.

Crypto World

Why Is the Crypto Market Up Today?

The total crypto market cap (TOTAL) and Bitcoin (BTC) finally broke free from the bearish curse they had been under for the past 12 days. As BTC neared $70,000, it sparked a rally amongst the altcoins as well, led by XDC Network (XDC).

In the news today:-

Sponsored

Sponsored

The Crypto Market Breaths a Sigh Of Relief

The total crypto market cap rebounded by $211 billion over the past 24 hours, signaling a relief rally after Thursday’s sharp sell-off. The recovery has improved short-term sentiment across digital assets. Closing the week in positive territory could help stabilize markets and support risk appetite through the weekend.

TOTAL is trading near $2.36 trillion at the time of writing, hovering just below the $2.37 trillion resistance. A decisive flip of this level into support would confirm strengthening momentum. Such a move could open the path for a continued advance toward the $2.45 trillion zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risk remains if bullish momentum fades. Failure to secure $2.37 trillion in support may trigger renewed selling pressure. Under this scenario, TOTAL could slip below the $2.30 trillion level and fall toward $2.22 trillion, erasing a significant portion of the recent recovery.

Sponsored

Sponsored

Bitcoin Attempts Recovery

Bitcoin is trading near $69,972 at the time of writing as it attempts to reclaim $70,000. This level remains a key psychological threshold for market participants. A successful flip into support would signal renewed buyer confidence and mark the early stages of a broader recovery attempt.

The immediate objective is to secure $70,000 as support and push higher toward $75,000. Achieving this would confirm improving momentum and strengthen bullish structure. If buying pressure persists, Bitcoin could regain traction and set its sights on the $80,000 level in the near term.

Failure to reclaim $70,000 would weaken the recovery narrative. Renewed selling pressure could drag Bitcoin back toward $65,000 or lower. Such a move would invalidate the bullish thesis, reinforce downside risk, and prolong market uncertainty amid fragile investor sentiment.

XDC Network Jumps Sharply

XDC led the altcoin market, surging 23% over the past 24 hours to trade near $0.0370 at the time of writing. The rally reflects renewed buying interest and improving sentiment. Securing this level of support is critical for sustaining momentum and confirming the strength of the current price move.

XDC is now targeting a move toward $0.0413, but a breakout requires clearing the $0.0392 resistance. Rising inflows and sustained investor participation could provide the needed catalyst. A decisive breach would validate bullish continuation and strengthen confidence in XDC’s short-term recovery trajectory.

Downside risk remains if support fails to hold. A loss of $0.0370 could push XDC back toward $0.0345. Breaking below that level would expose price to a deeper pullback near $0.0299, erasing much of the recent recovery and weakening the bullish setup.

Crypto World

Trump-Linked World Liberty Finance Sells 173 WBTC Amid Bitcoin Volatility

TLDR:

- 173 WBTC sold at $67K, totaling $11.75M in USDC during a volatile Bitcoin session.

- Initial trades were fast and decisive, signaling structured exits amid price weakness.

- Bitcoin dipped to low $60Ks but quickly recovered to $70K, showing market absorption.

- WBTC to USDC rotation reflects liquidity preference and defensive risk management strategy.

Trump-linked World Liberty Finance sold 173 WBTC near $67K, moving $11.75M into USDC. The trades were fast and decisive, coinciding with Bitcoin’s dip into the low $60Ks.

Liquidity thinned, stops triggered, but buyers quickly stepped in. Bitcoin rebounded to $70K, showing the market absorbed pressure efficiently. The sale signaled caution, yet strength remained clear.

Timing and Market Mechanics of the WBTC Sale

Trump-linked World Liberty Finance executed 173 WBTC sales on February 5, coinciding with Bitcoin’s decline from the mid-$70Ks to the low-$60Ks. Initially, 40 WBTC were sold for $2.761M USDC, immediately followed by 33 WBTC for $2.276M USDC.

Both trades occurred within a minute. Consequently, the market saw a clear signal of urgency rather than routine rebalancing.

Later, 100 WBTC were sold for $6.711M USDC as Bitcoin accelerated downward. This final trade appeared as a towering spike on the chart, coinciding with a steep price drop.

Therefore, the sequence indicates that the sales were structured and decisive, creating a liquidity event during volatility.

Moreover, moving from WBTC to USDC demonstrates a defensive approach. USDC preserves value while offering flexibility for future actions. Thus, the strategy prioritizes liquidity over exposure.

Market participants noted that sales at the $67K level influenced sentiment. Even if independent, the “Trump-linked” label amplified attention, making the timing appear cautious.

In addition, the total volume, while meaningful, is not existential for Bitcoin liquidity. The $11.75M converted into USDC represents a tactical adjustment rather than a complete exit.

Consequently, the trades reinforced short-term bearish momentum but also created opportunities for buyers. The compressed timing, coupled with large trade sizes, allowed other market players to anticipate liquidity points.

Bitcoin’s Reaction and Market Absorption

Following the WBTC sales, Bitcoin briefly dipped into the low $60Ks on February 6. This drop coincided with the heavy USDC conversions.

As a result, liquidity thinned, stop orders triggered, and weaker traders exited positions. Consequently, the session recorded an emotional low that reflected short-term fear.

However, Bitcoin quickly recovered to $65K and continued a controlled ascent. By evening, the price approached $70K, nearly erasing earlier losses.

Therefore, the market absorbed the $11.75M sell pressure without structural breakdown. This V-shaped rebound indicates strong buying interest.

Furthermore, the transaction demonstrates how tactical exits interact with market depth. Large holders rotated positions, yet equally serious buyers absorbed the coins efficiently.

Consequently, the market interpreted the Trump-linked sales as a liquidity event rather than a persistent sell-off.

As a result, Bitcoin’s quick rebound reinforced confidence in liquidity and market resilience. Finally, the WBTC sale highlights how high-profile players manage risk while maintaining market stability.

Crypto World

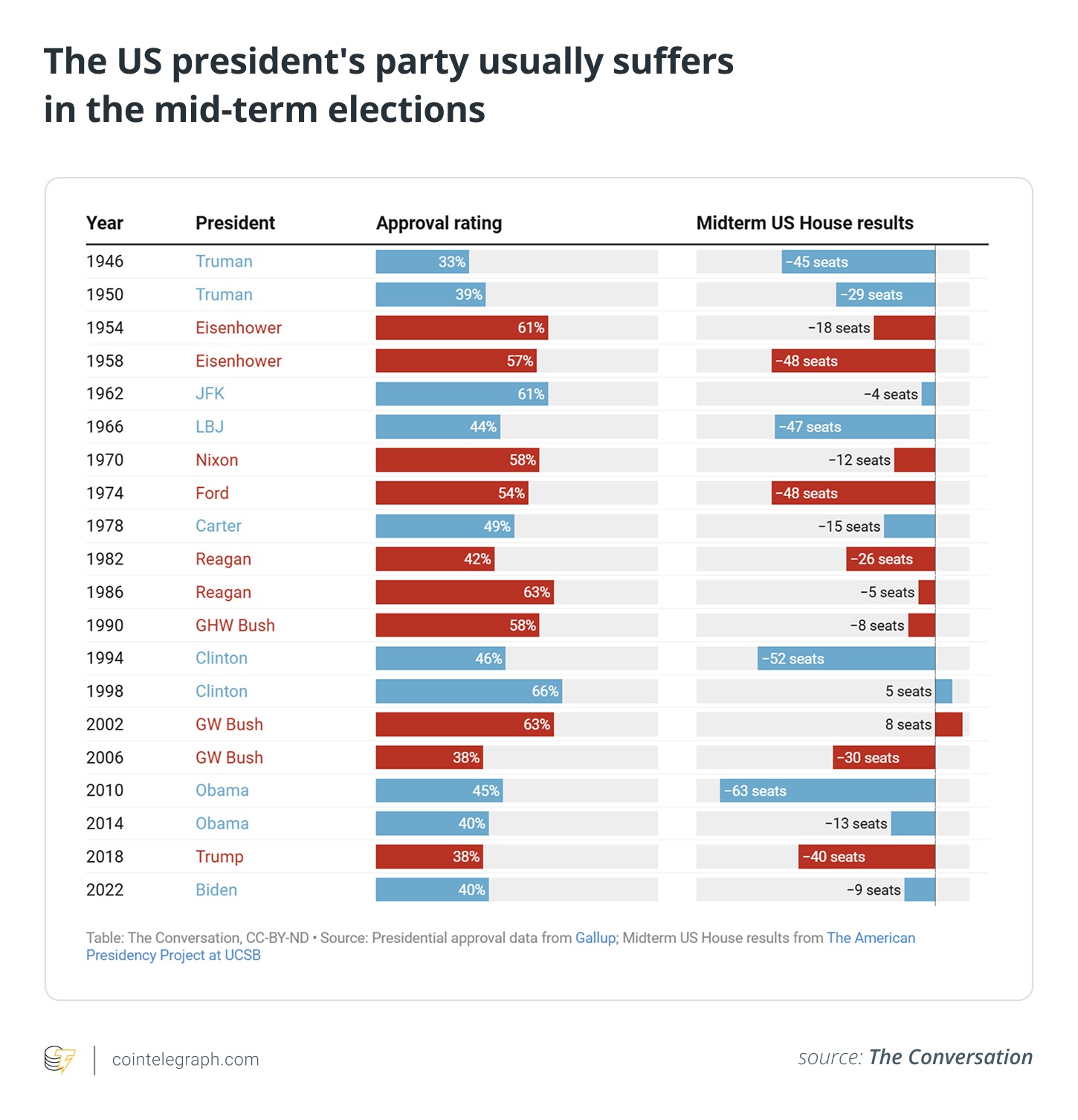

Crypto PACs Stack Millions Ahead of Midterms

Political action committees (PACs) representing the interests of the crypto industry have already secured millions of dollars in funding as the US heads toward its midterm elections.

Super PACs are the uber-rich, no-limits, non-disclosure counterparts to crypto PACs. Last year, the industry spent at least $245 million in campaign contributions alone.

The main super PAC funded by the cryptocurrency industry, Fairshake, raised some $133 million in 2025, bringing its total cash on hand up to over $190 million. Venture capital firm a16z contributed an initial $24 million, while Coinbase and Ripple each donated $25 million.

This influx of cash has alarmed activist and election reform groups. Saurav Ghosh, director of the Campaign Legal Center — a legal center concentrated on voting rights, fair districting and campaign finance reform — told Cointelegraph:

“This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry’s deregulatory desires.”

Bipartisan support ensures crypto lobby’s success

The US crypto industry’s main goal is to pass a large framework law, the CLARITY Act, which passed in the House of Representatives this summer and moved on to the Senate. The bill still hasn’t managed to satisfy the crypto industry, particularly Coinbase, nor the ethics and oversight concerns of Senate Democrats.

Now, the CLARITY Act is in limbo, and Congress is shifting its attention to the 2026 midterm elections. For nearly 80 years, the president’s party has almost always lost the midterms, the federal elections in the off-year between presidential elections. This is particularly important for the crypto industry, which enjoys more full-throated support among the Republican Party. Take, for example, the roll call for the Senate’s vote on the GENIUS Act: Nearly twice as many Democrats voted against the motion compared to those in support of it.

Some in the crypto space have taken this to mean they need to take a partisan stance. Cameron and Tyler Winklevoss, founders of the crypto exchange Gemini, have poured millions into the conservative PAC Digital Freedom Fund, which aims to boost pro-crypto and pro-Trump candidates.

Others have stressed the need for bipartisan support, warning that backing one party is bound to backfire once the other eventually takes power.

Representative Sam Liccardo, a crypto-friendly Democrat, told Politico in October 2025, “I don’t think anybody in this town would recommend that an industry put their eggs in one party’s basket.”

One major lobby, Fairshake, has shown it’s more than willing to support Democrats, so long as they are sufficiently pro-crypto. The Super PAC actually spent more money in support of Democrats than it did Republicans from 2023 to 2024, according to Open Secrets.

Whether it be among Republicans or Democrats, the crypto industry’s political strategy has changed significantly both in how much and where it spends its dollars.

How did we get here?

Crypto made headlines in 2024 for donating nearly a quarter of a billion dollars to different political campaigns and super PACs — the largest contribution of any single industry.

But this wasn’t crypto’s first step in the political arena. During the crypto bull run of 2020-2021, crypto companies made massive ad buys. Celebrities like Matt Damon were advertising crypto investment platforms. Now-convicted fraudster Sam Bankman-Fried slapped the name of his now-defunct crypto exchange, FTX, onto the home of the Miami Heat basketball team.

At the same time, crypto increased its lobbying efforts in Washington. Major platforms like Coinbase and fintech developers like Ripple padded their budgets as the industry gained visibility.

Coinbase raised spending from $1.5 million in 2020 to $3.9 million in 2021. Ripple more than tripled the amount it spent on lobbying over the same period, spending $330,000 in 2020 and more than $1.1 million in 2021.

One major donor from the crypto space was Bankman-Fried. He made more than $100 million in political campaign contributions in the 2022 midterms. “He leveraged this influence, in turn, to lobby Congress and regulatory agencies to support legislation and regulation he believed would make it easier for FTX to continue to accept customer deposits and grow,” federal prosecutors said in a later indictment.

By Bankman-Fried’s own admission, he supported campaigns on both sides of the aisle, though he found Republicans “far more reasonable” on crypto.

The crypto market crashed soon after. FTX went bust, the Terra stablecoin system collapsed, and the Securities and Exchange Commission (SEC), the US’ main finance regulator under then-Chair Gary Gensler, opened enforcement actions against many crypto companies operating in the US.

Related: SBF always played both sides of the aisle despite new Republican plea

In 2023, the presidential election cycle began. Trump ran against ex-Vice President Kamala Harris. Crypto, for the first time, was on the presidential platform. Trump visited a Bitcoin (BTC) conference and made promises of ending “regulation by enforcement.

Crypto poured money into the race through PACs and super PACs. For the 2024 selections, these were namely:

Fairshake raised a whopping $260 million from 2023 to 2024, at least $92 million of which came from Coinbase. It made $126 million in independent expenditures and transfers to affiliated committees.

Independent expenditures are expenditures “for a communication that expressly advocates the election or defeat of a clearly identified candidate and which is not made in coordination with any candidate or their campaign or political party,” per the FEC.

According to Follow the Crypto, the two other single-issue crypto PACs are affiliated with Fairshake, despite one being liberal and the other conservative. Defend American Jobs made $57 million in independent expenditures, and Protect Progress made $34.5 million over the same 2023-2024 period.

This vast amount of money entering PACs reflects a broader shift in how companies seek political influence.

“Super PACs are increasingly becoming in vogue for special interests who want to make their presence known in Washington,” Michael Beckel, research director of Issue One — a bipartisan political reform organization watching big money in politics — told Cointelegraph.

“Industry-aligned super PACs with huge bank accounts have made a huge splash and helped thwart new regulations on their business interests.”

Just a few years ago, “corporate influence operations focused more on lobbying and direct campaign contributions,” Beckel explained. “Now we’re seeing sector-specific super PACs with massive bank accounts.”

And it’s changing how laws are made in Washington.

Crypto lobby affects policy as Trump seeks to “nationalize” elections

Blockchain bigwigs now regularly visit Washington to meet with lawmakers and advise policymakers on how to regulate the industry.

Issue One vice president of advocacy Alix Fraser said, “The Trump administration is packed with tech industry insiders who have acted in the interest of their own companies — not the American people — to rig policy for their own profit.”

The degree to which the crypto industry is involved in the legislative process is no more apparent than with the market structure bill making its way through the Senate. Work on the bill stalled in mid-January after Coinbase withdrew its support.

The exchange’s CEO, Brian Armstrong, wrote on X:

The main point of contention is a provision that would outlaw one of Coinbase’s products: stablecoin yields for consumers. Banks are pushing to outlaw the practice, saying a flight of deposits from insured lenders could threaten financial stability. The crypto industry and Coinbase argue that the ban stifles innovation and is anti-competitive.

Earlier this week, the White House scheduled a closed-door summit for leaders from the crypto and banking industries to hash out their differences, but according to Reuters, no deal was made.

According to reporter Eleanor Terrett, Senate Democrats said that the talks were “constructive” and were optimistic about the chances of passing a bill. Reporter Sander Lutz said that Senate Minority Leader Chuck Schumer is “desperate” to get the bill finished, as Fairshake alone now has $193 million in its coffers.

“These payments help explain the crypto industry’s success in curtailing efforts to meaningfully regulate their business model, which is consistent with a well-established practice of wealthy corporate special interests using lobbying and political contributions to influence policy decisions,” Ghosh told Cointelegraph.

“This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry’s deregulatory desires.”

Rick Claypool, research director at consumer rights advocacy group Public Citizen, told Cointelegraph that big money from lobbies like crypto pushes out the priorities of most voters from the agenda.

“This feeds cynicism — the sense that our elected officials prioritize the interests of wealthy donors over all other constituents — and erodes faith in our democratic institutions.”

Related: US crypto market structure bill in limbo as industry pulls support

The increased influence of monied interests in Washington comes at a time when election integrity itself is under threat. Trump has recently said Republicans should “nationalize” the midterm elections.

“The Republicans should say, ‘We want to take over. We should take over the voting, the voting in at least many — 15 places … the Republicans ought to nationalize the voting,’” he said.

He added that he will only accept the results if they are “honest,” while claiming that there was widespread voter fraud in many American cities. Election experts have refuted the claims. House Speaker Mike Johnson has admitted that he himself has no evidence of his own claims of voter fraud.

Marc Elias, a partner at Elias Law Group, said that Trump “is not interested in following the Constitution. As we have seen before, he prefers to act by force.”

Crypto is set to increase its influence in Washington as the very elections themselves are at risk of tampering and interference from the highest levels of government.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Russia’s Sovcombank Becomes First Russian Bank to Publicly Offer Bitcoin-Backed Lending

TLDR:

- Sovcombank rolled out bitcoin-backed loans for individuals and firms that legally own digital assets in Russia.

- The launch follows an earlier pilot by state-owned Sberbank with a mining company in December.

- Russian miners are seeking liquidity solutions that allow them to retain long-term bitcoin exposure.

- The product aligns with recent regulatory changes legalizing mining and reopening crypto markets.

Sovcombank bitcoin-backed loans signal a gradual shift in Russia’s banking approach to digital assets.

The lender has launched financing options secured by bitcoin, targeting miners and legal crypto holders seeking liquidity without selling their holdings.

Sovcombank expands regulated crypto lending

Sovcombank is the first Russian bank to publicly offer bitcoin-backed loans. The product is available to individuals and corporations that legally own digital assets.

The bank emphasized that bitcoin serves strictly as collateral. Borrowers can therefore access capital while retaining ownership of their holdings.

This approach aligns with growing demand among crypto holders for non-dilutive financing. As a result, banks are reassessing how digital assets fit within lending frameworks.

In online statements, Sovcombank executives described the product as business-focused. Financing is positioned to support expansion rather than speculative activity.

State-owned Sberbank launched a similar offering earlier through a pilot program. That initiative issued a bitcoin-secured loan to mining firm Intelion Data.

However, Sberbank’s product remains limited in scope. Sovcombank’s rollout marks a broader public-facing step in crypto-secured lending.

Regulatory clarity remains uneven across the sector. Still, banks appear more willing to test products tied to digital assets.

Crypto mining became legal in Russia on November 1, 2024. The law allows registered entities to operate without energy restrictions.

Unregistered miners may operate only within strict electricity limits. This framework narrowed participation but improved oversight.

Soon after, authorities imposed a six-year mining ban in ten regions. The decision addressed power grid strain rather than crypto activity itself.

In December 2025, regulators reopened the crypto market to the public. The central bank introduced rules governing participation and compliance.

Sovcombank referenced these developments in public remarks shared online. Executives framed bitcoin-backed lending as compatible with the evolving framework.

Focus on miners, liquidity, and banking services

Russian miners and crypto businesses increasingly seek access to liquidity. Many prefer borrowing against bitcoin rather than selling during volatile market cycles.

Bitcoin-backed loans address this preference directly. They provide working capital while preserving long-term asset exposure.

Sovcombank stated that mining is no longer viewed as a niche activity. Instead, it is treated as an investment class with defined financial metrics.

Executives noted predictable returns and clearer payback periods. These factors support structured lending products tied to mining operations.

Alongside the loan launch, Sovcombank introduced a promotion for miners and hosting providers. The campaign targets registered market participants.

Corporate clients receive free account management and online banking services. Preferential terms for currency control are also included.

Small and medium enterprises benefit from free internal transfers. The limit is set at one million rubles per transaction.

Only new clients listed in the official miners’ registry qualify. This condition reinforces compliance with national regulations.

Sovcombank also confirmed it offers bitcoin-backed loans to corporate clients. Legal entities and sole proprietors may access the product.

The bank outlined broader plans for crypto-sector partnerships. These include miners, data center operators, exchanges, and money changers.

Public statements referenced specialized cash management tools. Project financing and risk management services were also mentioned.

Together, these offerings signal deeper engagement with the crypto economy. Russian banks are gradually integrating digital assets into traditional finance under defined rules.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech7 hours ago

Tech7 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports17 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat13 hours ago

NewsBeat13 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech7 days ago

Tech7 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined