Crypto World

Balance Sheet Stable Unless BTC Falls Below This Critical Level

Strategy’s Bitcoin reserves cover debt, and only a prolonged drop to $8,000 could possibly force restructuring.

Strategy CEO Phong Le told investors on Thursday that the company’s balance sheet remains stable despite recent crypto market turbulence, though extreme scenarios could pose challenges.

The firm, the world’s largest corporate Bitcoin (BTC) holder, says it would only need to consider restructuring or additional capital if the cryptocurrency fell to $8,000 and remained there for five to six years.

Balance Sheet Holds Amid Bitcoin Sell-Off

According to reporting by The Block, Le, speaking during Strategy’s fourth-quarter earnings call, emphasized that even after recent market losses, the company’s Bitcoin reserves comfortably cover its convertible debt.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price, and the price was $8,000, that is the point at which our Bitcoin reserve equals our net debt, and we would then look at restructuring, issuing additional equity, issuing additional debt,” he said.

The call came after a sharp sell-off across crypto markets, with BTC down roughly 7% in 24 hours, trading just under $66,000 at the time of writing. Strategy’s stock, MSTR, slid 17% to $107, erasing much of its gains from late 2025 and leaving it down about 72% over six months.

Analysts on social media noted that today’s session saw Bitcoin drop more than $10,000, the first time it has ever dipped by such an amount in a single day, according to The Kobeissi Letter. The dramatic loss in value was part of a structural market downturn that has wiped out $2.2 trillion in crypto market value since mid-October 2025.

Executive Chairman Michael Saylor also spoke in the call, dismissing concerns about quantum computing threats to Bitcoin as “horrible FUD” and outlining plans for a security initiative to support potential upgrades, including quantum resistance.

He reiterated that Strategy’s long-term approach is designed to withstand volatility, pointing to supportive U.S. regulatory developments and the growing integration of Bitcoin into credit markets and corporate balance sheets.

You may also like:

Strategic Outlook

Strategy is still expanding its Bitcoin holdings despite short-term price swings. Earlier this week, the company acquired 855 BTC for $75.3 million at an average price near $88,000, bringing its total reserves to over 713,500 units.

The buy followed a $25 billion accumulation in 2025 and a $1.25 billion purchase in early 2026, funded largely through capital raises.

Saylor has argued that the significance of Bitcoin treasury companies lies in credit optionality and institutional adoption rather than daily price action. According to him, firms holding BTC on balance sheets can leverage assets for debt issuance, lending, or financial services, giving them flexibility that ETFs lack.

While sentiment has deteriorated sharply in recent months, he framed these developments as part of a long-term integration of digital capital into global financial systems, rather than a short-term price event.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Justin Sun’s ‘ex’ claims he slid into her DMs to get articles deleted

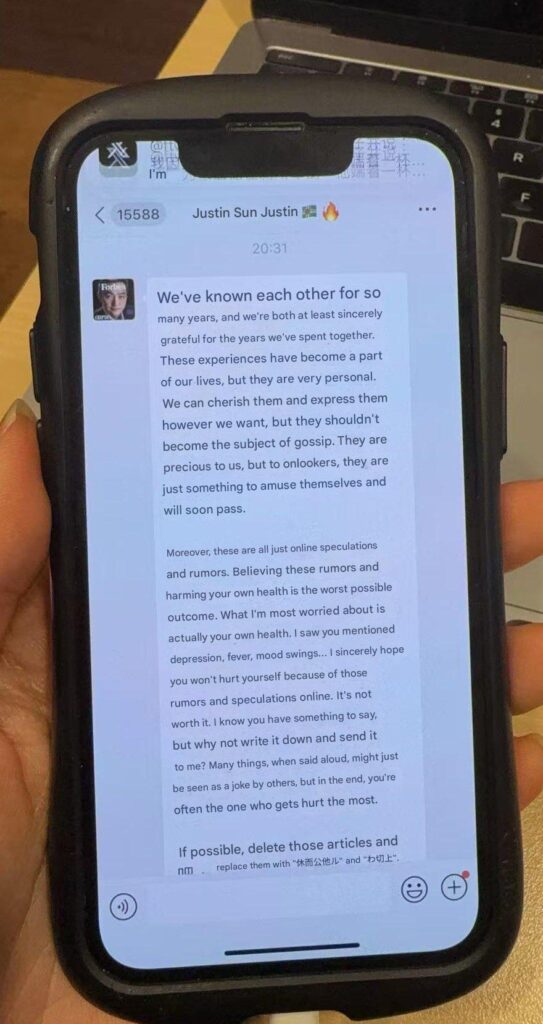

A crypto blogger claiming to be Justin Sun’s ex-girlfriend has shared what appears to be a message from the Tron founder asking her to delete numerous articles while admitting that he “cherishes” their personal time together.

Zeng Ying, otherwise known as Ten Ten, started making accusations against Sun last weekend, accusing him of manipulating the price of TRX with Binance accounts wash trading on his behalf, and also directing crypto accounts to spread misinformation about her.

Her latest post appears to reveal a message she received from Sun, in which he admits that he’s known her for many years and shared “very personal” experiences with her.

In the alleged message, translated using Google, he tells Ten Ten that the two can “cherish” and “express” these experiences, but that they “shouldn’t become the subject of gossip.”

Read more:Justin Sun’s alleged ex accuses him of market manipulation, insider trading

“They are precious to us, but to onlookers, they are just something to amuse themselves and will soon pass.”

He additionally downplays her accusations as “online speculations and rumors,” and tells her that “Believing these rumors and harming your own health is the worst possible outcome.”

“I know you have something to say, but why not write it down and send it to me?” he asks. “Many things, when said aloud, might just be seen as a joke by others, but in the end, you’re often the one who gets hurt the most.”

In the message, Sun apparently also asks Ten Ten to delete some articles and replace them with different text. However, the screenshot shared online doesn’t reveal what specific text this would be.

When sharing the message, Ten Ten said, “So you bought all those water army accounts to smear me, all to help me strengthen my body and build fitness, huh?”

Justin Sun denies all of Ten Ten’s claims

Sun claimed yesterday that “rumors regarding an ‘ex-girlfriend’ and our compliance status are unequivocally false.”

He claims that his firm “cooperates fully with global judicial and law enforcement agencies to crack down on embezzlement, fraud, hacking, other forms of cybercrime, to protect our users’ lawful assets.”

Ten Ten posted minutes later that, “Sun finally got hard for once — he never really got hard when we were together before. I’ll send the full verdict later.” This post was later deleted.

Read more: Justin Sun directed wash trading scheme from his US apartment, SEC claims

The crypto blogger claims to have started publicly attacking Sun after she says she witnessed him become “an insurmountable gate of corruption and wrongdoing.”

She also claims that he offered to marry her later in life, only for him to then announce that he was in a relationship with the skier Eileen Gu.

Protos has reached out to Ten Ten for comment on her allegations and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Macro ‘Accomodative Policies’ May Not Be The Next Big Catalyst For Bitcoin

Bitcoin’s next major catalyst may come from the common assumption being flipped on its head that interest rates are bullish for Bitcoin only when they fall, according to a crypto analyst.

“I think we should expect that having more accommodative policies may in fact actually not be the catalyst to help us go into a bull market,” ProCap Financial chief investment officer Jeff Park said during an interview with Anthony Pompliano on Thursday.

“We have to accept that reality and possibility,” Park said. Accomodative policies, such as lowering interest rates, are employed by the US Federal Reserve to stimulate economic growth, reduce unemployment, and increase liquidity. Bitcoiners often see these conditions as more favorable for riskier assets such as Bitcoin (BTC), as traditional investments like bonds and term deposits become less attractive.

Rising interest rates are usually seen as a negative for Bitcoin, but Park said that may not be the case forever. He said Bitcoin’s next biggest upside catalyst — and potentially its “endgame” — may be its entry into what he called a “positive row Bitcoin,” where the asset’s price continues to rise even as US Federal Reserve interest rates rise.

“Perfect holy grail” for Bitcoin

“This is the mythical, elusive perfect holy grail of what Bitcoin is meant to be, which is when Bitcoin goes up as interest rates go up, which is very counterintuitive to the QE theory,” he said.

However, Park said this idea would undermine the “risk-free rate itself.”

Park emphasizes the monetary system “is broken”

“In that world, what we’re saying is actually because the risk-free rate is not the risk-free rate, because the dollar hegemony is not the dollar hegemony, and we are no longer able to price the yield curve in the ways we’ve known,” Park said.

Related: Bitcoin price rebounds 11% above $65K: Who is buying the dip?

Park explained that the monetary system is “broken” and the relationship between the Fed and the US Treasury is “not at the level it should be” to drive the direction of national securities.

Traders on the crypto prediction platform Polymarket are giving the highest probability, 27%, to three total Fed interest rate cuts in 2026.

Bitcoin is trading at $70,503 at the time of publication, down 22.53% over the past 30 days, according to CoinMarketCap.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

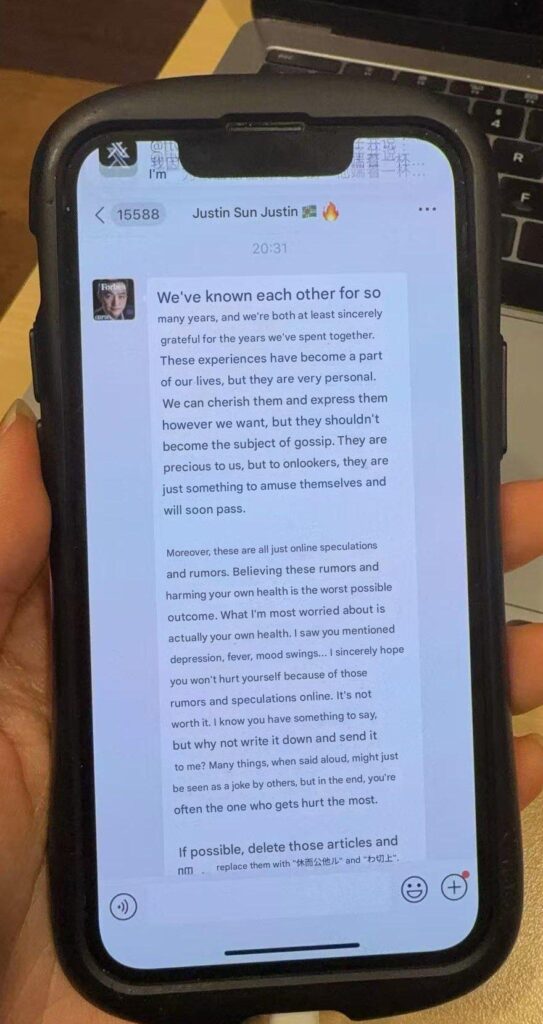

Ethereum Price Falls to 9-Month Low as Investors Panic Sell

Ethereum has suffered a sharp correction, with price falling nearly 29% over the past week and slipping below the $2,000 mark. ETH is now trading at levels last seen nine months ago, reflecting severe weakness across the market.

Diminishing buyer support has worsened conditions, with on-chain data confirming growing stress among Ethereum holders.

Sponsored

Sponsored

Ethereum Holders Move Back To Selling

Ethereum holders have increasingly resorted to panic selling as broader market conditions deteriorated. On-chain data from the Realized Profit/Loss indicator shows investors selling despite being underwater. Realized losses surged past $1.2 billion within 24 hours, highlighting widespread capitulation as holders prioritize risk reduction over recovery.

Such elevated realized losses often extend declines by reinforcing negative momentum. As more ETH is sold at a loss, the price faces additional downward pressure. This behavior suggests confidence remains fragile, limiting the ability of Ethereum to stabilize until selling activity meaningfully subsides across the network.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ETH Long-Term Investors Change Stance

Long-term holder behavior reflects similar stress. The HODLer Net Position Change has declined, with bars flipping red, signaling net outflows from long-term wallets. This shift is notable because long-term holders are typically considered the backbone of Ethereum’s market structure and price stability.

Sponsored

Sponsored

When long-term holders distribute rather than accumulate, it often signals deep concern. Their decision to sell amid mounting losses indicates rising panic even among conviction-driven investors. This development adds macro-level pressure and increases the risk that Ethereum’s decline could deepen before a meaningful recovery begins.

ETH Price Could Note A Reversal

Ethereum price is trading near $1,920 at the time of writing after a 29% drop in one week. The move below $2,000 has reinforced bearish structure across multiple timeframes. Given the prevailing on-chain and sentiment indicators, ETH remains vulnerable to additional downside in the near term.

ETH is currently holding above the $1,796 support level. If this level fails, price could slide toward $1,671 or lower. Ethereum is already at a nine-month low, last seen in May 2025, increasing the risk of further liquidation-driven selling if support breaks.

A recovery scenario remains possible if selling pressure eases. Ethereum could reclaim $2,000, supported by oversold conditions. The Money Flow Index sits well below the 20.0 threshold, indicating selling pressure has likely saturated. Historically, such readings have preceded short-term relief rallies.

A similar rebound could unfold if investors refrain from further selling. Holding supply off exchanges may allow ETH to regain momentum. Under this scenario, Ethereum could push beyond $2,000 and advance toward $2,500. Securing that move would invalidate the bearish thesis and restore market confidence.

Crypto World

CryptoQuant CEO warns of cascading institutional BTC sell-off risk

CryptoQuant’s Ki Young Ju warns that absent a near-term Bitcoin rebound, forced liquidations and cascading institutional selling could hit ETFs, miners, and trust.

Summary

- CryptoQuant CEO Ki Young Ju says large BTC releases may signal forced institutional liquidations that pressure prices and ETF flows.

- He warns that if Bitcoin does not rebound within a month, structural, chain institutional selling could rise and push miners toward bankruptcy risk.

- Ju notes institutions that capitulate near market lows may struggle to re-enter, with trust in Bitcoin markets taking a long time to rebuild.

CryptoQuant CEO Ki Young Ju stated that the risk of institutional selling in cryptocurrency markets could increase significantly if Bitcoin does not experience a strong recovery in the short term, according to a statement dated February 6.

CryptoQuant analyst warns of pain in Bitcoin recovery

Ju’s comments addressed potential reasons behind sharp movements in spot Bitcoin exchange-traded funds, particularly responding to observations from DeFi Development manager Parker White regarding a notable ETF decline. White suggested one or more Hong Kong-based non-crypto hedge funds may have contributed to the drop.

The CryptoQuant executive argued that large-scale Bitcoin releases into the market could indicate a forced sell-off scenario. Ju outlined a potential domino effect in which fund liquidations could drive prices lower, creating additional selling pressure in the market and potentially pushing miners toward bankruptcy risk.

“If Bitcoin fails to achieve a significant rise from current levels in the next month, the risk of structural and chain institutional selling increases significantly,” Ju stated.

According to Ju’s analysis, institutional investors who exit positions at market lows may face difficulty returning to the market, with trust rebuilding potentially requiring extended time periods.

The statement included a disclaimer noting the information does not constitute investment advice.

Bitcoin ETFs have experienced increased volatility in recent weeks, with market participants monitoring institutional trading activity closely. The cryptocurrency sector remains sensitive to large-scale transactions from institutional holders, according to market analysts.

Crypto World

How options on the BlackRock bitcoin ETF may have worsened crypto meltdown

BlackRock’s spot bitcoin exchange-traded fund has been a massive hit since launch, pulling in billions from investors seeking exposure to the cryptocurrency without the hassle of crypto wallets or exchanges. Traders and analysts religiously track inflows into the fund to gauge how institutions are positioning in the market.

Now they might have to do the same with options tied to the ETF, as activity exploded during Thursday’s crash. According to one observer, the record activity stemmed from a hedge fund blowup, while others disagreed, citing routine market chaos as a catalyst.

What really stood out

On Friday, as the ETF tanked 13% to its lowest level since October 2024, options volume exploded to a record 2.33 million contracts, with puts narrowly outpacing calls.

The fact that puts saw more volume than calls on Thursday indicates a higher demand for downside protection, a typical occurrence during price sell-offs.

Options are derivative contracts that provide built-in insurance against swings in the price of the underlying asset, in this case, IBIT. You pay a small fee (premium) for the right, but not the obligation, to buy or sell IBIT at a set price by a deadline or expiry.

A call option lets you lock in IBIT at a set price today for a small premium. If it rallies above that level later, you buy cheap and sell for profit; if not, you only lose the premium. A put option locks in the sale of IBIT at that price. If it slides below, you sell high and pocket the difference; otherwise, you lose just the premium. Calls offer leveraged upside bets, while puts protect against downside drops.

Another standout figure was the record $900 million in premiums paid by IBIT options buyers that day—the highest single-day total ever. To put it in context, that’s equivalent to the market cap of several crypto tokens ranking beyond the top 70.

Speculative theory: record activity tied to hedge fund blowup

A post by market analyst Parker, which has gone viral on X, argues that the $900 million premium payments resulted from the blowup of a large hedge fund (one or a few) with nearly 100% of money invested in IBIT. Funds often focus on just one asset, avoiding spreading out risk exposure elsewhere.

Parker’s post alleges that this fund initially bought cheap “out of the money” call options on IBIT following the October crash, anticipating a quick recovery and bigger rally.

These OTM calls are like cheap lottery tickets at levels well above the ongoing price of the underlying asset. If the asset rallies past these levels, these calls make significant money; if it doesn’t, buyers of these calls lose the initial premium paid.

However, the fund bought these calls using borrowed money. As IBIT continued to drop, they doubled down on their bet.

On Thursday, as IBIT crashed, these calls tanked in value and brokers hit the fund with margin calls demanding cash/collateral. The fund, having bled money elsewhere, was unable to provide the same and ended up dumping large amounts of IBIT shares in the market, resulting in a record $10 billion spot volume.

The fund also desperately replaced expiring calls or closed loss-making calls, resulting in a record $900 million in total premium payments. Essentially, Parker associates the record activity with one or a few massive players scrambling, not routine trading.

Shreyas Chari, director of trading and head of derivatives at Monarq Asset Management put it best: “Systematic selling across the majors yesterday probably tied to margin calls especially in the ETF with the highest crypto exposure IBIT.”

“Rumors swirled of a short options entity that had to sell the underlying far more aggressively after 70k and then 65k broke, probably tied to liquidation levels. This exacerbated the move down to 60k,” he explained in a Telegram chat.

Options expert disagrees

Tony Stewart, founder of Pelion Capital and an options expert, believes IBIT options added to the market chaos, but doesn’t go so far as to blame a single fund blowup for the whole crash and record activity.

He argued on X, citing Amberdata, that $150 million of the $900 million in premiums came from buying back put options. In short, traders who had previously sold (shorted) puts faced significant losses as IBIT crashed and those puts surged in value, so they repurchased them to cut their risk.

Those were “certainly painful” closes, he said on X, adding that the remaining portion of the $900 in premiums comprised mostly smaller trades, which is pretty standard for the hectic trading day.

In essence, to Stewart, the record activity is just the messy noise of a broadly panicked market, not a smoking gun pointing to a single way. “This [hedge fund blowup theory] is inconclusive from the Options standpoint. It also doesn’t seem enough tbh in size,” he concluded.

Still, he acknowledged the possibility that some activity could have been hidden in over-the-counter (privately negotiated) deals.

Conclusion

While Parker connected the dots to point to a hedge fund blowup, Stewart challenged the same with hard data.

In any case, this episode highlights that IBIT options are now large enough to wield influence, and traders might want to keep track of them just as they do ETF inflows.

Crypto World

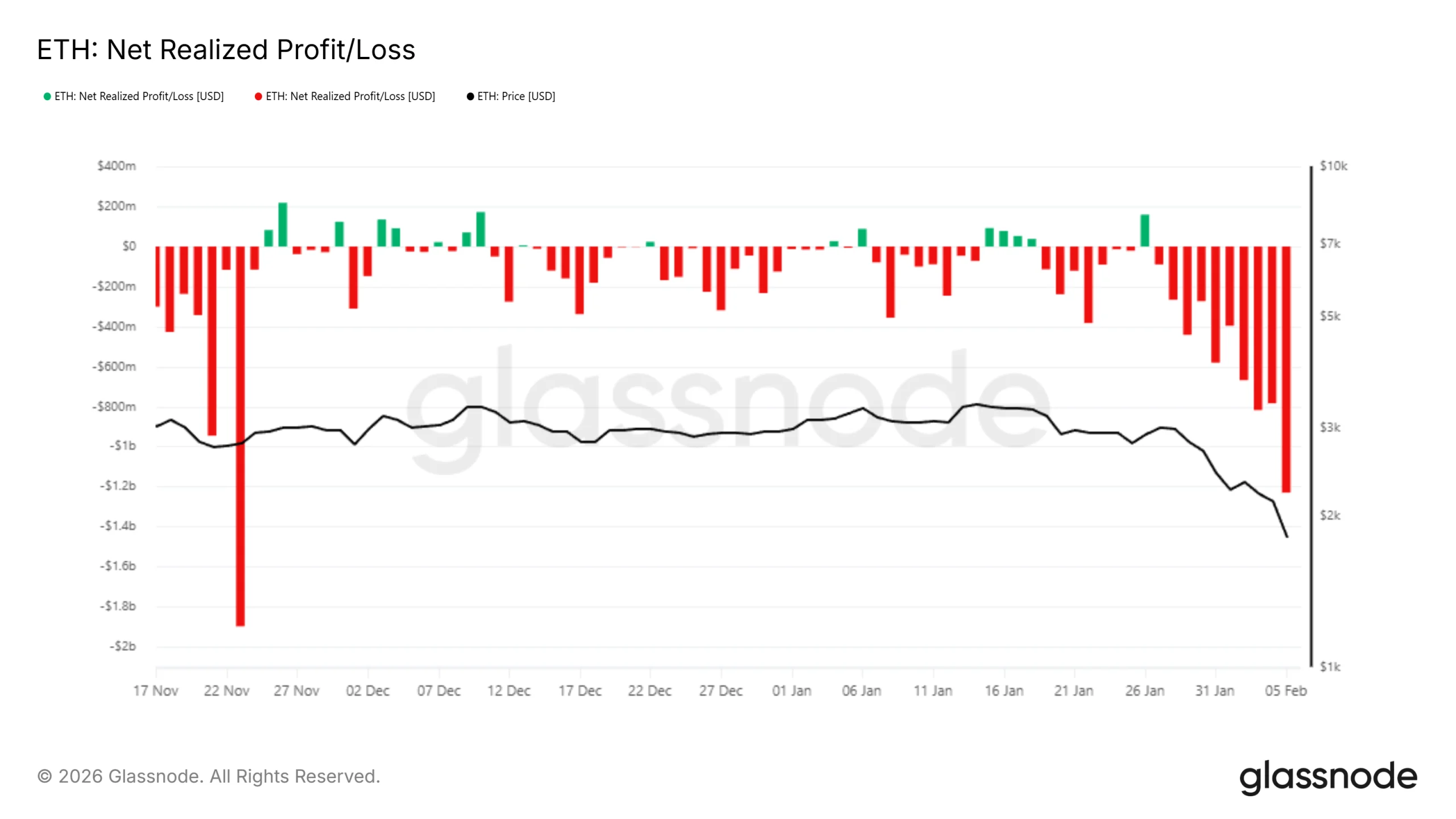

Ethereum’s Vitalik Buterin Makes a New Bet on Zcash and Privacy

Ethereum founder Vitalik Buterin has donated to Shielded Labs, backing development of Crosslink, a proposed consensus upgrade for Zcash.

The move signals a deepening commitment by Buterin to privacy-preserving infrastructure, as well as growing interest in strengthening finality and settlement guarantees in proof-of-work blockchains.

Sponsored

Vitalik Doubles Down on Privacy Infranstructure in Crypto

Shielded Labs is developing Crosslink, a parallel finality layer designed to sit on top of Zcash’s existing proof-of-work consensus.

In simple terms, Crosslink adds a second confirmation system that locks in transactions faster and more decisively. This reduces the risk of chain reorganizations, rollbacks, and double-spend attacks.

As a result, exchanges can shorten confirmation times, cross-chain bridges gain stronger security guarantees, and applications become easier to build on Zcash.

Sponsored

What Shielded Labs Does for Zcash

Shielded Labs is a Zcash-focused research and engineering group working on core protocol upgrades rather than applications or tooling.

Its mandate centers on improving Zcash’s long-term security, usability, and cryptographic guarantees—especially around shielded transactions and privacy-first design.

Buterin’s support comes amid a broader shift in his public advocacy toward privacy and resilience over growth metrics or convenience.

In recent months, he has repeatedly argued that blockchains must optimize for worst-case scenarios, not best-case user experience.

That includes resisting censorship, minimizing trust assumptions, and protecting users even under hostile conditions.

Sponsored

Privacy, in that framing, is not optional. It is core infrastructure.

The Privacy Push Is More Critical Than Ever

Buterin has warned that financial transparency without strong cryptographic privacy creates long-term risks, including surveillance, coercion, and systemic fragility.

He has increasingly praised systems that embed privacy at the protocol level rather than layering it on as an optional feature. Zcash’s shielded transaction model aligns closely with that philosophy.

Sponsored

By backing Shielded Labs, Buterin is effectively endorsing privacy-preserving design paired with stronger settlement guarantees—two areas he sees as underinvested across the industry.

A Signal to the Broader Crypto Ecosystem

The donation also lands at a moment when Ethereum itself is reassessing parts of its scaling and security roadmap.

While Buterin has criticized superficial innovation and “copy-paste” infrastructure elsewhere, his support for Zcash highlights what he sees as meaningful progress: protocol-level upgrades that improve safety, finality, and user protection.

In that sense, the move is less about Ethereum versus Zcash—and more about the kind of blockchain architecture Buterin believes will survive long term.

Crypto World

RNBW Tanks 65% Below ICO Price on First Day of Trading

The launch was plagued by reports of delayed token distribution to early investors and technical issues.

Self-custodial Ethereum wallet Rainbow debuted its native token RNBW yesterday, Feb. 5. But the project’s token generation event (TGE) on Base, and the token’s debut for trading across exchanges, were met with reports of delayed distribution to ICO participants, which contributed to the token’s poor day-one performance.

According to Coinbase data, RNBW hit a high of $0.05 on its first day of trading, but fell quickly and closed the daily session around $0.034, down more than 30%, putting its fully diluted valuation around $34 million.

That left most bettors on Polymarket scrambling, having expected the FDV to hit roughly $100 million just a day after the TGE.

Today, RNBW fell further, trading around $0.032 by press time, making its FDV around $32.17 million.

ICO Investors in the Red

The price is far below what early buyers paid. Rainbow conducted its initial coin offering (ICO) in mid-December 2025 via CoinList, where investors were offered RNBW at $0.1 per token. The sale saw 30 million RNBW tokens, or 3% of total supply, sold at an FDV of $100 million, meaning participants in that sale are now down more than 65% on their investments.

For U.S. investors, the situation could be even worse as their full token unlock won’t happen until December of this year, according to CoinList’s terms and conditions.

Back in 2022, Rainbow raised $18 million in a Series A funding round led by Seven Seven Six, the VC firm from Reddit co-founder Alexis Ohanian, bringing total funding to $21 million. The multi-chain wallet is known for its rewards program and gamification, where users can earn points for their on-chain activity.

The firm explicitly connected RNBW with its points system when it first announced the token in September, and later specified that users who earned points in the wallet were eligible for a token airdrop.

‘No Better Day for TGE’

The token’s drop came amid a broader market bloodbath that wiped out $2.6 billion in liquidations in a single day. Total crypto market capitalization fell to $2.3 trillion as Bitcoin slid toward $60,000, reaching roughly 50% below its all-time high of $126,080, set in October.

Soon after its TGE, Rainbow’s cofounder Mike Demarais indicated in an X post that some users had not received their claimed tokens, explaining “it’s because our backend token indexer has been getting slammed.”

As frustration over the messy launch mounted, Rainbow CEO Alex LaPrade took to X on Thursday evening eastern time to say he still believes “there was no better day for TGE than today,” noting that the project had planned to launch its token on Feb. 5 back in December. LaPrade added:

“TGE isn’t the finish line. Having a token live in market brings more scrutiny — both positive and negative.”

But the CEO’s public statement didn’t succeed in calming all investors. Some quickly fired back at the CEO, accusing the project of late token distribution to CoinList pre-sale participants, as well as to points earners, calling it a scam and demanding refunds.

Last year, MetaMask confirmed that it has plans to launch its own token, after years of hinting and speculation.

Crypto World

Bitcoin price bounces from multi-year channel support, is the bottom in?

Bitcoin price has rebounded from a critical multi-year channel support near $62,500, raising the question of whether a high-timeframe bottom may be forming.

Summary

- $62,500 marks multi-year channel support, active since March 2021

- Confluence with value area high strengthens the bounce, increasing reaction probability

- Accumulation is required, to confirm a sustainable move toward the channel midpoint

Bitcoin (BTC) price action has recently reacted from a major technical support zone that has defined market structure for several years. After an extended bearish expansion, BTC has revisited the lower boundary of a multi-year ascending channel that has remained intact since March 2021. This reaction has drawn renewed attention from traders, as the level coincides with additional technical confluence that historically has led to meaningful high-timeframe pivots.

While short-term volatility remains elevated, the broader structure suggests Bitcoin may be entering a critical decision phase. Whether this bounce develops into a sustained recovery or fails into another leg lower will largely depend on how the price behaves around this key support region in the coming sessions.

Bitcoin price key technical points

- $62,500 aligns with multi-year channel low, active since March 2021

- Confluence with value area high strengthens support, increasing reaction probability

- Accumulation behavior is needed, to confirm a sustainable rotation higher

From a higher-timeframe perspective, Bitcoin’s current location is technically significant. The multi-year channel, which has guided price action since early 2021, has consistently acted as both support and resistance during major market cycles. Each historical retest of the channel’s lower boundary has resulted in strong reactions, often marking the transition from bearish phases into broader recovery structures.

The recent bounce from the $62,500 region once again highlights the importance of this channel. This level not only represents the channel low but also aligns with the value area high of the prior range, adding further structural relevance. When multiple high-timeframe levels converge, the probability of a meaningful reaction increases substantially.

Importance of holding value area support

Beyond the channel structure, Bitcoin’s ability to hold above the value area high is a key factor in determining whether this move can evolve into a sustained rotation. Acceptance above this region suggests that buyers are willing to transact at higher prices following the recent sell-off, a necessary condition for trend stabilization.

If price continues to defend this zone on a closing basis, it reinforces the idea that the recent bearish expansion may be transitioning into a consolidation or accumulation phase. Failure to hold, however, would indicate that demand remains insufficient and could expose Bitcoin to another test of lower liquidity zones.

Accumulation phase remains the missing piece

Although the initial bounce is technically constructive, confirmation remains incomplete without evidence of accumulation. Accumulation phases typically follow sharp bearish expansions and are characterized by sideways price action, declining volatility, and gradual absorption of supply by stronger hands.

In Bitcoin’s case, such a phase would help establish a durable base around the $62,000–$63,000 region. Without this basing behavior, any upside movement risks being corrective rather than trend-defining. Traders should closely monitor volume behavior, as rising participation during consolidation signals increasing confidence among buyers.

Potential rotation toward channel midpoint

If accumulation develops and support remains intact, the technical roadmap opens the door to a rotational move toward the midpoint of the multi-year channel. Historically, these rotations have provided substantial upside opportunities, particularly when initiated from channel extremes.

However, it is important to distinguish between a rotation and a full trend reversal. While a move toward the channel midpoint would be constructive, reclaiming higher resistance levels would still be required to confirm a broader bullish continuation.

What to expect in the coming price action

From a market structure, price action, and support perspective, the $62,000–$62,500 region represents a pivotal zone for Bitcoin. Holding above this level keeps the multi-year channel intact and supports the case for a developing bottom. A failure to maintain support would invalidate the bullish rotation thesis and reopen downside risk.

For now, Bitcoin remains at a high-timeframe inflection point. Confirmation through basing, accumulation, and improving volume will be essential before declaring a definitive bottom. Until then, traders should expect volatility and remain focused on how price behaves around this critical support zone.

Crypto World

PI Network price rises after a major Kraken development

Pi Network price stabilized near its all-time low as optimism rose that it would be listed on Kraken, a top crypto exchange.

Summary

- Pi Network price crashed to a record low amid the ongoing crypto crash.

- Kraken, a top crypto exchange, has added it to its listing roadmap.

- Technical analysis suggests that it has more downside to go in the coming days.

Pi Network (PI) rose to $0.1450, a few points above the all-time low of $0.1300. It remains significantly lower than the all-time high of $3, with its market capitalization falling from nearly $20 billion to $1.3 billion today.

One major catalyst for the coin is its addition to Kraken’s page for potential listings. It is listed in the Chains category, which also includes tokens such as TX, Conflux, Pepecoin, MegaETH, and Quai.

Being listed on this page does not guarantee future listing. However, it has given the community hope that it will be available on one of the largest crypto exchanges today.

Kraken has over 15 million users globally, with 1.5 million active each month. It generated over $2.2 billion in revenue last year and raised $800 million at a $20 billion valuation in November ahead of its IPO.

A Kraken listing would be a big thing as Pi has failed to attract any additional exchanges since its mainnet launch in February last year. Most of its trading occurs on a handful of exchanges, including OKX, Gate, Bitget, and MEXC.

Additionally, the listing will likely encourage more exchanges to list it as well. Some of the most important exchanges that would trigger a Pi Coin price surge are Binance, Coinbase, and Upbit. Binance is the most important, while Coinbase and Upbit have large market shares in the US and South Korea.

Pi Network price technical analysis

The daily timeframe chart shows that the Pi coin price has been in a steep freefall in the past few months. It dropped to a record low of $0.1304 as the crypto market crash intensified,

The coin has moved below all moving averages and the crucial support level at $0.1530, its previous all-time low. All oscillators are pointing downward, indicating that downward momentum is continuing.

Therefore, the most likely Pi Network price outlook is bearish, with the next key target being the psychological $0.10 level. However, the main risk of going against it is that a Kraken listing would fuel a short-term short squeeze.

Crypto World

Why Is the Crypto Market Up Today?

The total crypto market cap (TOTAL) and Bitcoin (BTC) finally broke free from the bearish curse they had been under for the past 12 days. As BTC neared $70,000, it sparked a rally amongst the altcoins as well, led by XDC Network (XDC).

In the news today:-

Sponsored

Sponsored

The Crypto Market Breaths a Sigh Of Relief

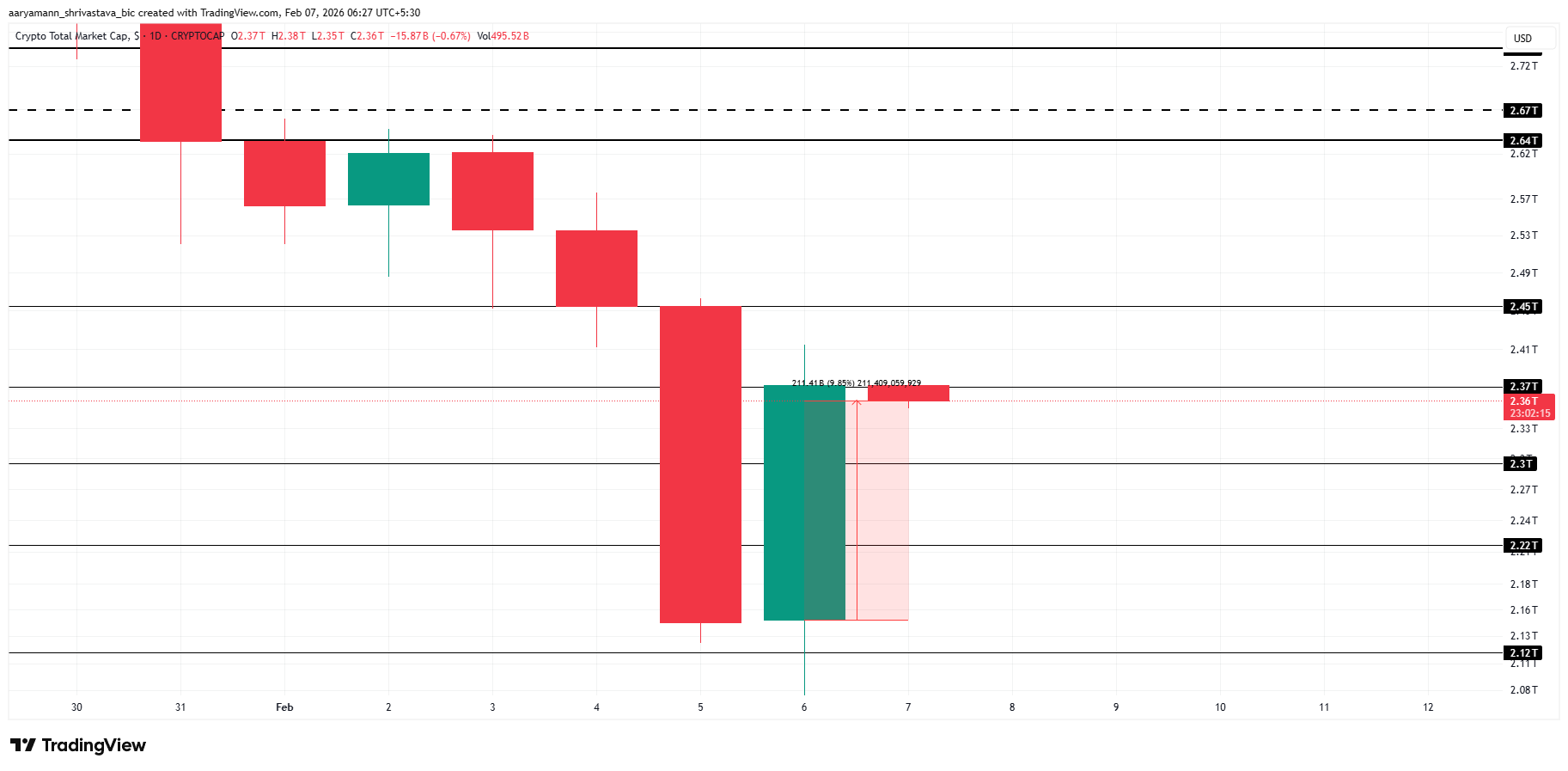

The total crypto market cap rebounded by $211 billion over the past 24 hours, signaling a relief rally after Thursday’s sharp sell-off. The recovery has improved short-term sentiment across digital assets. Closing the week in positive territory could help stabilize markets and support risk appetite through the weekend.

TOTAL is trading near $2.36 trillion at the time of writing, hovering just below the $2.37 trillion resistance. A decisive flip of this level into support would confirm strengthening momentum. Such a move could open the path for a continued advance toward the $2.45 trillion zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risk remains if bullish momentum fades. Failure to secure $2.37 trillion in support may trigger renewed selling pressure. Under this scenario, TOTAL could slip below the $2.30 trillion level and fall toward $2.22 trillion, erasing a significant portion of the recent recovery.

Sponsored

Sponsored

Bitcoin Attempts Recovery

Bitcoin is trading near $69,972 at the time of writing as it attempts to reclaim $70,000. This level remains a key psychological threshold for market participants. A successful flip into support would signal renewed buyer confidence and mark the early stages of a broader recovery attempt.

The immediate objective is to secure $70,000 as support and push higher toward $75,000. Achieving this would confirm improving momentum and strengthen bullish structure. If buying pressure persists, Bitcoin could regain traction and set its sights on the $80,000 level in the near term.

Failure to reclaim $70,000 would weaken the recovery narrative. Renewed selling pressure could drag Bitcoin back toward $65,000 or lower. Such a move would invalidate the bullish thesis, reinforce downside risk, and prolong market uncertainty amid fragile investor sentiment.

XDC Network Jumps Sharply

XDC led the altcoin market, surging 23% over the past 24 hours to trade near $0.0370 at the time of writing. The rally reflects renewed buying interest and improving sentiment. Securing this level of support is critical for sustaining momentum and confirming the strength of the current price move.

XDC is now targeting a move toward $0.0413, but a breakout requires clearing the $0.0392 resistance. Rising inflows and sustained investor participation could provide the needed catalyst. A decisive breach would validate bullish continuation and strengthen confidence in XDC’s short-term recovery trajectory.

Downside risk remains if support fails to hold. A loss of $0.0370 could push XDC back toward $0.0345. Breaking below that level would expose price to a deeper pullback near $0.0299, erasing much of the recent recovery and weakening the bullish setup.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech7 hours ago

Tech7 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports17 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat13 hours ago

NewsBeat13 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech7 days ago

Tech7 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined