Business

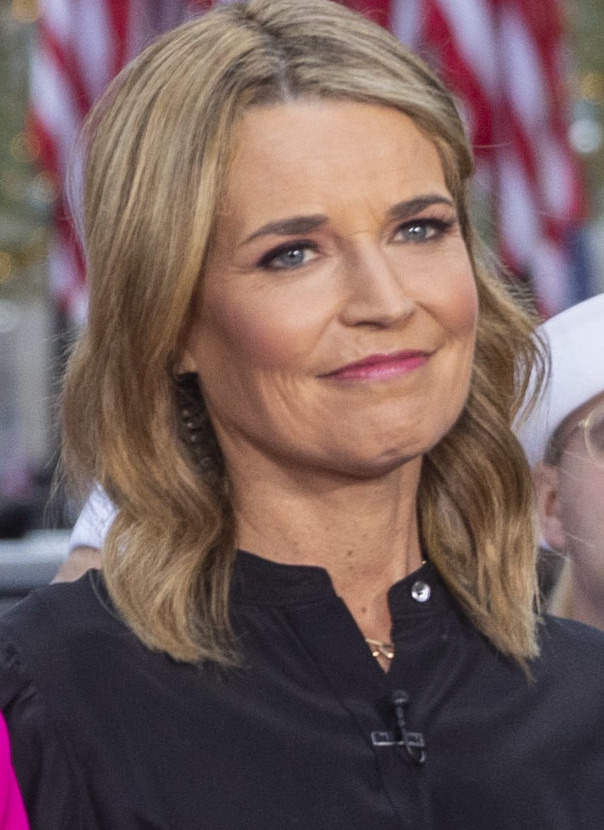

Chilling Bitcoin Ransom Demand Emerges in Search for Savannah Guthrie’s Mother

The investigation into the suspected abduction of Nancy Guthrie, the 84-year-old mother of Today show co-anchor Savannah Guthrie, has taken a high-tech and harrowing turn. Federal and local authorities confirmed Friday that multiple ransom notes, including a demand for millions of dollars in Bitcoin, are being treated as credible leads in the search for the missing octogenarian.

Nancy Guthrie was reported missing from her home in the Catalina Foothills, north of Tucson, on Feb. 1 after failing to appear for a Sunday church service. Five days into the search, the Pima County Sheriff’s Department and the FBI are racing against a ticking clock, complicated by the victim’s fragile health and the digital wall of a cryptocurrency ransom.

A ‘Credible’ Digital Ransom

The FBI’s Phoenix field office revealed that several media organizations, including TMZ and local station KOLD-TV, received messages purportedly from the kidnappers. According to FBI Special Agent in Charge Heith Janke, these notes contained “specific details” about the Guthrie residence that had not been released to the public, including references to a floodlight and an Apple Watch.

The primary demand is for a “substantial amount” of Bitcoin, reportedly totaling millions of dollars. The kidnappers established a hierarchy of deadlines: an initial cutoff of 5 p.m. on Thursday, followed by a secondary deadline this coming Tuesday.

“Every transaction in Bitcoin is logged on an open public ledger,” noted Ari Redbord, a former Department of Justice official now with TRM Labs. While the semi-anonymous nature of cryptocurrency often appeals to criminals, experts say law enforcement’s ability to “follow the money” on the blockchain provides a digital trail that cash or gold cannot match.

Evidence of a Struggle

The case was upgraded from a missing person report to a criminal investigation early in the week. Pima County Sheriff Chris Nanos confirmed that DNA testing of blood found on the porch of Nancy Guthrie’s home matched the 84-year-old.

Additional forensic evidence paints a chilling timeline of the abduction:

- Saturday, 9:30 p.m.: Family members drop Nancy off at her home after dinner.

- Sunday, 1:45 a.m.: The home’s doorbell camera is physically disconnected.

- Sunday, 2:28 a.m.: Software monitors indicate that Nancy’s pacemaker disconnected from her personal device, suggesting she was moved out of range of her home network.

“We believe Nancy is still out there,” Sheriff Nanos said during a press conference. “Our protocol is to assume she is alive until we are told otherwise, and we’re going to continue thinking that way until we find her.”

The Family’s Heartfelt Plea

Savannah Guthrie, who has taken an indefinite leave of absence from NBC, released a poignant video alongside her siblings, Annie and Camron. In the footage, Savannah’s voice breaks as she addresses the captors directly.

“We are ready to talk. However, we live in a world where voices and images are easily manipulated. We need to know without a doubt that she is alive.”

The plea for “proof of life” highlights the modern challenges of kidnapping in the age of AI. The family expressed fears that deepfake technology could be used to simulate Nancy’s voice or likeness to extract a ransom without her actually being safe.

The family also emphasized Nancy’s medical needs. The 84-year-old requires daily medication for heart issues and high blood pressure. “Her heart is fragile. She lives in constant pain,” Savannah said. “She needs her medicine to survive.”

Hoaxes and Red Herrings

The high-profile nature of the case has already attracted opportunists. On Thursday, authorities arrested Derrick Callella in Los Angeles. Callella is accused of sending “imposter” ransom notes to the Guthrie family demanding Bitcoin. Investigators clarified that Callella is a “scammer” attempting to profit from the tragedy and is not believed to be involved in the actual disappearance.

Ongoing Investigation

The FBI is currently offering a $50,000 reward for information leading to Nancy Guthrie’s return. President Donald Trump has also reportedly directed federal resources to assist in the search, calling the circumstances “very unusual.”

As the Tuesday deadline approaches, the Catalina Foothills community remains on edge. Neighbors have turned the local Saint Philip’s in the Hills Episcopal Church into a site for continuous prayer vigils, with a large photo of Nancy Guthrie illuminated by hundreds of candles.

Authorities are asking anyone with information, or anyone who may have seen a white van reported in the neighborhood prior to the disappearance, to contact the Pima County Sheriff’s Department immediately.

Business

Why India’s ‘mother of all deals’ with the EU could be a game changer

Why India’s ‘mother of all deals’ with the EU could be a game changer

Business

Form 144 PROTAGONIST THERAPEUTICS For: 7 February

Form 144 PROTAGONIST THERAPEUTICS For: 7 February

Business

India’s NSE to set up unit for proposed national coal trading exchange

Last year, India announced plans to establish a coal trading platform to buy and sell domestically produced coal amid surging output.

NSE will hold at least a 60% stake in the coal exchange, with the remaining 40% to be potentially allocated to other shareholders, the exchange operator said in a filing.

“The platform will enable electronic trading of physical coal through standardised contracts and facilitate physical delivery and, in future, derivative products, subject to regulatory approval,” NSE said.

The exchange operator said the lack of a unified trading platform has resulted in price inefficiencies, limited access for smaller participants and the absence of a reliable spot benchmark.

State-owned Coal India currently accounts for about three-quarters of the more than 1 billion tonnes of coal mined in India, the world’s second-largest coal market after China.

NSE said it will submit a licence application to the Coal Controller Organisation of India for the proposed exchange.

Business

S&P Global Dividend 100 Index: Where High Yield Meets Quality

At S&P Dow Jones Indices, our role can be described in one word: essential. We’re the largest global resource for index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based upon our indices than any other index provider in the world; with over 1,000,000 indices, S&P Dow Jones Indices defines the way people measure and trade the markets. We provide essential intelligence that helps investors identify and capitalize on global opportunities. S&P Dow Jones Indices is a division of S&P Global, which provides essential intelligence for individuals, companies and governments to make decisions with confidence. For more information, visit www.spdji.com.Copyright © 2016 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visitwww.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

Business

Two airports in Poland closed due to Russian strikes on Ukraine

Two airports in Poland closed due to Russian strikes on Ukraine

Business

ETJ: Expect Continued Underperformance From This CEF

Power Hedge has been covering both traditional and renewable energy since 2010. He targets primarily international companies of all sizes that hold a competitive advantage and pay dividends with strong yields.

He is the leader of the investing group Energy Profits in Dividends where he focuses on generating income through energy stocks and CEFs while managing risk through options. He also provides micro and macro-analysis of both domestic and international energy companie. Learn more.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

120 smallcaps deliver double-digit returns in a week. Is this the recovery everyone’s looking for?

Stocks such as VTM, Gokaldas Exports, Garware Hi-Tech Films, Faze Three and United Foodbrands surged between 35% and 45% in just five trading sessions, while several others posted weekly gains in the 20% to 30% range. Even traditionally steady names in pipes, engineering, auto components and consumer discretionary joined the rally, signalling a sharp improvement in risk appetite.

The move comes after months of relentless selling in small and midcaps, during which valuations corrected sharply despite earnings holding up in several pockets. Analysts estimate that over a third of the smallcap universe, representing nearly Rs 16 lakh crore in market capitalisation, is now trading at fair or even undervalued levels compared with historical averages.

According to Ponmudi R, CEO of Enrich Money, the overall market has entered a consolidation phase after digesting major policy triggers. “With the Union Budget 2026 and the RBI’s monetary policy decisions now largely priced in, investor focus has shifted to implementation, capex execution and the pace of actual spending,” he said, adding that sentiment remains cautiously optimistic and event-driven in the near term.

Currency movements and foreign portfolio investor flows are also playing a role. The recent recovery in the rupee from record lows, aided by the India-US trade agreement announcement, has improved near-term confidence. At the same time, easing foreign selling pressure has reduced the supply overhang that weighed heavily on smallcaps through the previous quarter.

Also Read | Radhika Gupta urges investors to ignore ‘cats’ and think like a goldfish amid market chaos

Arjun Guha Thakurta of Anand Rathi Wealth believes the recent correction created a disconnect between stock prices and business fundamentals. He points out that while many smallcap stocks fell sharply, earnings growth across the segment remained reasonably healthy. Much of the selling, he said, was driven by risk aversion, global uncertainty and foreign outflows rather than a collapse in underlying business performance.

“When weak hands have already sold, even modest improvements in confidence can lead to sharp recoveries, especially in segments that have underperformed for extended periods,” Thakurta said, cautioning, however, that selectivity remains crucial.

Not all experts are convinced that the rally marks the start of a sustained uptrend. Ravi Singh, Chief Research Officer at Master Capital Services, said investors should differentiate between structural stories and tactical trades.

“Smallcap companies typically operate with narrow product lines or concentrated business models. Benefits from policy changes such as lower tariffs will be meaningful only for companies with direct exposure to export-linked sectors,” he said.

Macro risks also remain on the radar. Investors are closely tracking January consumer price inflation data, which will be released using a revised base year of 2024 and is expected to offer a more accurate picture of consumption trends. Global developments, particularly geopolitical negotiations involving the US and Iran, could also inject volatility into commodity prices and risk assets if tensions escalate.

Data: Ritesh Presswala

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

Investor angst turns to earnings after trade clouds clear

Earnings growth has lagged for months, the rupee has weakened, and foreign investors have treated India as a source of funding to chase artificial intelligence-driven rallies in China, Taiwan and South Korea. Adding to the gloom, Indian tech heavyweights such as Tata Consultancy Services Ltd. and Infosys Ltd. have been swept up in a global software selloff, as Anthropic’s latest AI advances threaten to disrupt traditional outsourcing business models.

“India will continue to be seen as a funding market, at least for now,” said Vivek Dhawan, a fund manager at Candriam NV. “In terms of earnings growth recovery, where we see weakness is on the software services side.”

Bloomberg

BloombergEarnings for the MSCI India Index are projected to grow about 8.3% over the next year, trailing regional peers, according to data compiled by Bloomberg. That compares with forecast growth of roughly 16% for China, about 108% for South Korea and close to 30% for Taiwan.

The index trades at about 22 times forward earnings estimates, in-line with its long-term average. Relative to other emerging markets, however, India still trades at a premium.

The valuations are less attractive, “accounting for the growth trajectory and scope for earnings recovery, which is likely to stay selective rather than broad based,” said Ecaterina Bigos, chief investment officer Asia ex-Japan, at BNP Paribas Asset Management’s at AXA IM. The balance “points to a cautious optimism on Indian equities, with focus on strategic areas of growth for now.”

Bloomberg

BloombergThe sentiment underscores one of the most challenging periods since India emerged as a favorite among global investors betting on the world’s fastest-growing major economy and its vast domestic market. Persistent geopolitical risks and pockets of economic slowdown have dulled the appeal of Indian equities since the start of 2025.

The result was India’s worst underperformance versus emerging markets in decades last year. Foreign investors pulled a record $19 billion from local stocks even as economic growth outpaced rivals. Over the past 12 months, the MSCI India Index has gained 8%, with dollar returns eroded by rupee weakness. In contrast, the MSCI Emerging Markets Index has surged almost 38%.

To be sure, there are signs of tentative improvement. Indian equities are on track for a second straight week of foreign inflows — a streak not seen since October.

“The tariffs were hurting Indian exporters and, more importantly, significantly hurting the rupee,” said Ashish Chugh, head of global emerging-market equities at Loomis, Sayles & Co. “That created a negative feedback loop — rupee weakness led to foreigners selling equities, which led to more rupee weakness. The trade deal stops that loop and, in my view, reverses it.”

US President Donald Trump signed an executive order to eliminate a punitive 25% tariff on Indian goods imposed for the country’s purchase of Russian oil. A joint statement by both the countries showed that a so-called “reciprocal” duty on Indian goods was also cut to 18% from 25%.

The new rate offers significant relief to Indian exporters after they were tariffed at 50%, among the highest in Asia. The South Asian nation also agreed to purchase $500 billion worth of American products over five years including aircrafts, graphics processing units and energy, while promising to reduce non-tariff barriers for US companies.

Bloomberg

BloombergThe rupee now looks undervalued, with India’s real effective exchange rate near a decade low, according to Chugh. He expects macroeconomic fundamentals to remain supportive, with earnings accelerating next year after a period of subdued profit growth.

More bullish investors argue that the trade deals, combined with the recent state budget, could ignite a major rally.

“Now’s the time to buy India,” said James Thom, senior investment director of Asian equities at Aberdeen Investments, who said his Asia ex-Japan equity portfolio has been consistently overweight India. “Quality companies are well positioned for the next cycle.”

Markets initially welcomed the tariff truce, with the US cutting its levy on Indian goods to 18% from 25% — lower than for most Asian peers — while scrapping an additional 25% punitive duty linked to purchases of Russian oil. Indian stocks jumped the most in eight months after US President announced the deal, while the rupee gained 1.1% against the dollar. The longer-term impact, however, remains uncertain.

While the agreement acts as a “booster of confidence,” it does not necessarily change his view on GDP growth outlook over the next 12 months or that for equity earnings, Sanjay Mookim, JPMorgan Chase & Co.’s India strategist said in an interview with Bloomberg Television on Friday.

Business

Pultegroup director Folliard sells $4.9 million in stock

Pultegroup director Folliard sells $4.9 million in stock

Business

Form 144 KEYCORP /NEW/ For: 7 February

Form 144 KEYCORP /NEW/ For: 7 February

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech12 hours ago

Tech12 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports4 hours ago

Sports4 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports22 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat18 hours ago

NewsBeat18 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat5 hours ago

NewsBeat5 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”