Crypto World

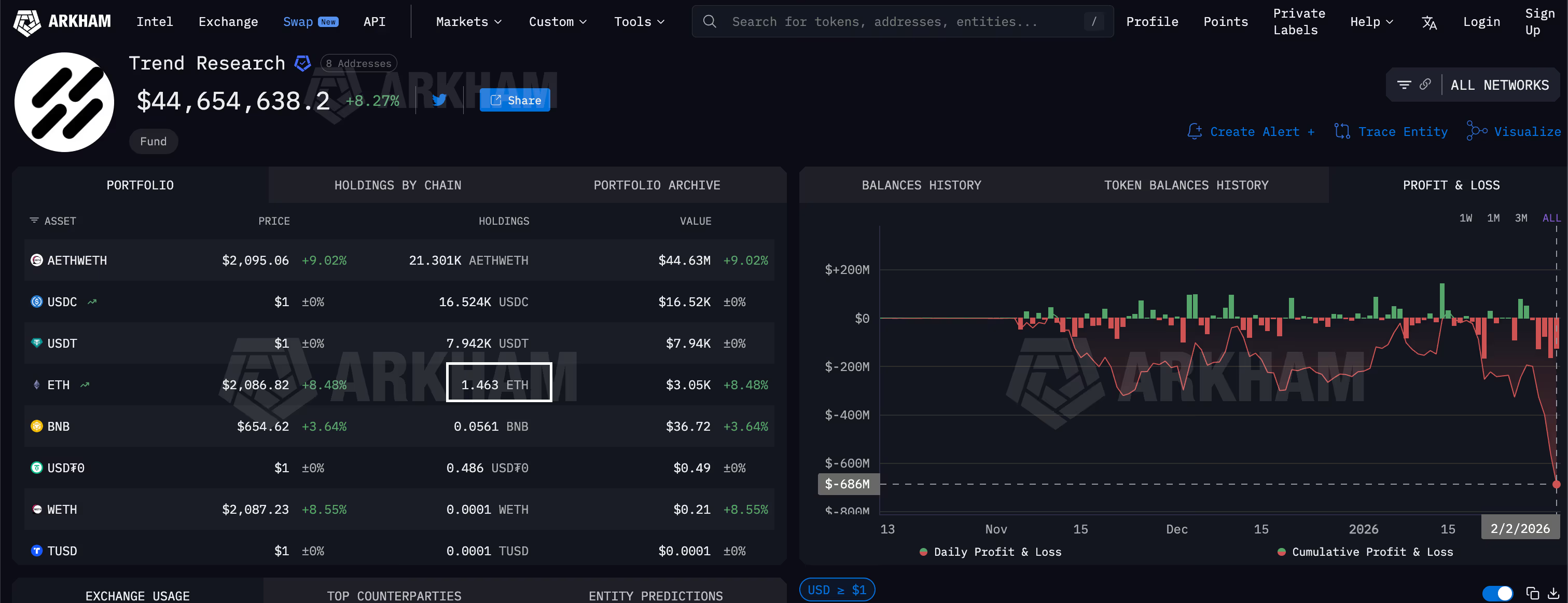

Ether’s crash leaves $686 million gaping hole in trading firm’s book

An ether bull was caught leaning hard into the upside this week as the cryptocurrency tanked, turning the whale bet into a multi-million dollar horror story.

That bull is Trend Research, a trading firm headed by Liquid Capital founder Jack Yi. The firm spent recent months building a bullish (long) bet worth $2 billion on ether by borrowing stablecoins from DeFi giant Aave, which were reportedly collateralized by ether.

The position blew up this week, leaving the firm with a $686 million loss, according to Arkham.

The blow up underscores the crypto market’s unchanged reality: Volatility can still make or break traders in a single week. It also shows how traders keep chasing risky leveraged loop plays – borrowing stablecoins against ETH collateral – despite these bets exploding spectacularly every downtrend.

How it went down

The team was convinced of ether’s long-term potential and expected a quick rebound from its October drop below $4,000.

But that never materialized – ether kept sliding, endangering their “looped ether” long position. As prices fell, the stablecoin collateral backing the leveraged bet shrank, while the fixed debt loomed large in classic leveraged fashion.

The final blow came this month as ether started falling rapidly with bitcoin and on Feb. 4 prices tanked to $1,750, the weakest level since April 2025. Trend Research responded by liquidating over 300,000 ether, according to data source Bubble Maps.

“Trend Research started sending large amounts of ETH to Binance to repay debt on AAVE In total, this cluster moved 332k ETH worth $700M to Binance over 5 days,” Bubble Maps said on X. The firm now holds just 1.463 ETH.

Jack Yi described these sales as a risk-control measure.

“As multi-heads in this round, we remain optimistic about the performance of the new bull market: ETH reaching over $10,000, BTC exceeding $200,000 USD. We’re just making some adjustments to control risk, with no change in our expectations for the future mega bull market,” Yi said in a post on X.

He added that now is the best time to buy tokens, calling volatility as the biggest feature of the crypto circle. “Historically, countless bulls have been shaken off by this volatility, but often what follows is a doubled rebound,” he noted.

Crypto World

Dollar Trades Steady After Shrugging Off Weak Jobs Data

The dollar was trading steady after reaching a two-week high on Thursday as investors shrug off weak U.S. jobs data.

U.S. job openings fell to the lowest level in more than five years in December, the Labor Department said Thursday. However, the focus is on upcoming nonfarm payrolls data, which will be published Wednesday after being delayed due to the recent partial government shutdown.

Moreover, President Trump’s nomination of Kevin Warsh as Federal Reserve chair has lifted the dollar as markets bet that he will take a restrictive policy stance and uphold central bank independence. Markets are not fully pricing in another interest-rate cut until June, LSEG data show.

Crypto World

US Senator Lummis Says Banks Should Adopt Digital Assets, Not Resist Them

U.S. Senator Cynthia Lummis said banks should embrace digital assets rather than resist them, arguing that cryptocurrencies and stablecoins offer new products and revenue opportunities for traditional financial institutions.

Summary

- Senator Cynthia Lummis said banks should embrace digital assets, arguing that stablecoins and crypto services create new products and revenue opportunities for financial institutions.

- She said blockchain-based payments can make transactions faster and cheaper for consumers, particularly for cross-border transfers.

- Lummis emphasized the need for strong safeguards, saying lawmakers and regulators are working to ensure digital assets integrate safely into the financial system.

In a Fox News interview shared on X, the Wyoming Republican said blockchain-based payments can make financial services faster and cheaper while expanding what banks can offer their customers.

Lummis says digital assets offer new opportunities for banks

“One of the things I don’t understand about the bank’s resistance is this gives them an entirely new financial product that they can offer to their customers,” Lummis said.

She pointed to digital asset custody and stablecoin payments as areas where banks could play a larger role.

“Whether it’s custody of digital assets, which three states already allow, or the use of stablecoins as a payment mechanism that’s faster and cheaper than a debit card,” she said, banks stand to benefit.

Faster and cheaper payments for consumers

Lummis emphasized that the primary benefit of digital assets would be felt by consumers. She said blockchain technology allows money to move more efficiently than existing banking infrastructure, especially for cross-border payments.

“For consumers, it’s going to be faster and cheaper to do business, whether it’s across the country or overseas,” she said. “Money can be transmitted on the blockchain more quickly than it can if you’re going through existing bank structures.”

She argued that these efficiencies could lower costs for everyday transactions and international transfers. She also noted that lawmakers and regulators have been working to ensure consumer protection as digital assets become more widely used.

“We want to make sure that not only is it faster and cheaper, but that it’s still safe,” she said. Lummis added that discussions with the Federal Reserve have focused on ensuring appropriate safety mechanisms are in place.

The senator framed digital assets as a natural evolution of financial services rather than a threat to the existing system. She said a range of stakeholders are working to integrate blockchain-based products into modern finance.

“There are a lot of interested parties in making sure that as we integrate this into the 21st century financial services industry, that it integrates beautifully,” she said.

Crypto World

Investors Pour $258M Into Crypto Startups Despite $2T Market Wipeout

Venture funding is continuing to flow into digital asset companies even as the broader crypto market struggles with heavy losses.

Key Takeaways:

- Crypto startups raised $258M in one week despite a $2T market downturn.

- Funding focused on infrastructure, compliance and institutional services, led by Anchorage Digital’s $100M round.

- Venture firms continue betting on long-term growth in AI and blockchain innovation.

Roughly $258 million was invested in crypto firms during the first week of February, according to data from DeFiLlama, underscoring that investors are still backing infrastructure and services tied to blockchain networks despite a market drawdown estimated at about $2 trillion.

Decentralized finance projects led activity with four deals, followed by payments startups with three.

Anchorage Digital Raises $100M in Tether-Led Funding Round

The largest raise came from Anchorage Digital, which secured $100 million in strategic financing led by stablecoin issuer Tether.

The federally chartered crypto bank offers custody, trading and crypto-native banking services to institutions and plans to use the funding to expand its operational infrastructure as demand from asset managers and corporations grows.

Tether said the investment reflects efforts to align stablecoins with regulated financial systems and deepen ties with institutional partners exploring tokenized payments and settlement.

Blockchain analytics provider TRM Labs raised $70 million in a Series C round led by Blockchain Capital, reaching a $1 billion valuation.

The company develops software used by exchanges, banks and government agencies to monitor blockchain transactions, detect fraud and track illicit activity.

The fresh capital will support expansion into new markets and enhance investigative tools, highlighting the growing role compliance technology plays as regulators increase scrutiny of crypto markets.

Meanwhile, Solana-based decentralized exchange aggregator Jupiter completed a $35 million strategic round backed by ParaFi Capital.

The investment was settled using JupUSD, the project’s stablecoin, with ParaFi purchasing JUP tokens and agreeing to a long-term lockup.

Jupiter also announced that prediction market platform Polymarket will integrate with its ecosystem on Solana, signaling continued development across trading applications even during weak market conditions.

Andreessen Horowitz Raises $15B to Back AI and Crypto Innovation

Last month, Andreessen Horowitz secured more than $15 billion in fresh capital, strengthening its standing as one of the most powerful venture capital firms in the US tech sector.

The funds span multiple strategies, including infrastructure, applications, healthcare, growth investments and its “American Dynamism” initiative.

In 2025 alone, the firm represented over 18% of total venture capital deployed in the United States.

Co-founder Ben Horowitz said the fundraising reflects the firm’s core philosophy that venture capital exists to give people opportunities to build companies and create value.

He framed startups as engines of social mobility, arguing that innovation ecosystems work best when individuals are free to pursue success and experimentation.

Horowitz also linked the firm’s mission to broader geopolitical competition. He warned that US leadership in technology is not guaranteed and could weaken if the country falls behind in foundational innovations.

According to the firm, technological leadership carries economic, military and cultural consequences globally.

The new capital will focus heavily on artificial intelligence and crypto, which the firm views as defining technologies of the next era.

The post Investors Pour $258M Into Crypto Startups Despite $2T Market Wipeout appeared first on Cryptonews.

Crypto World

Bitcoin’s drop below $63k sparks BlackRock’s IBIT’s biggest trading day on record

BlackRock’s iShares Bitcoin Trust ETF has hit a new all-time high in daily trading volume as the bellwether cryptocurrency posted one of its largest intraday drops on Thursday.

Summary

- BlackRock’s IBIT set a new daily trading volume record near $10 billion on Feb. 5.

- Bitcoin dropped as much as 15% intraday as investors digested a plethora of negative headlines.

As noted by Bloomberg ETF analyst Eric Balchunas, IBIT reportedly “crushed its daily volume record” on Feb. 5 as nearly $10 billion worth of shares were traded.

Last time the fund posted a volume record was on Nov. 21, when it saw $8 billion in volume, and over the past several trading sessions, it has recorded daily volumes above $5 billion.

Thursday also marked the ETF’s “second-worst daily price drop since it launched,” as it fell 13% on the day.

As of Feb 4, IBIT recorded outflows totaling $373.4 million following two subsequent days of inflows where over $200 million had flowed in. Likewise, it has struggled to maintain a steady inflow pattern, primarily due to Bitcoin’s persistent downtrend since its October all-time high of $126,080.

According to Unlimited Funds chief asset manager Bob Elliot, by last week’s close, IBIT was already underwater on average investment cost, with many holders sitting on losses.

Bitcoin (BTC) has dropped over 49% since hitting its all-time high, and has posted one of its largest single-day drops on Thursday as it fell by 15% from $73,100 at open to a low near $62,400.

Risk sentiment seems to have faded from the market as investors reacted to weak jobs data and tightening macroeconomic and geopolitical factors, alongside concerns over artificial intelligence sector-related spending.

The situation could worsen from here on, as Bitcoin has slashed through multiple key support areas and was trading just above $64,800 at press time.

According to Bloomberg analysts, the recent global market stress could push Bitcoin as low as $10,000 as the current situation bears similarities to the 2008 financial crisis and the 2000–2001 dot-com downturn.

Crypto World

Crypto VC Funding Reaches $252M Led by Anchorage Digital

The week of February 1-7, 2026, recorded $251.9 million in crypto VC funding across 12 projects, with Anchorage Digital’s $100 million strategic round leading.

Summary

- Crypto VC funding reached $251.9M across 12 projects during Feb. 1–7, 2026.

- Anchorage Digital led with a $100M strategic round backed by Tether.

- TRM Labs raised $70M.

Here’s a deep dive into this week’s crypto funding activity as per Cryptofundraising data.

Anchorage Digital

- Anchorage Digital raised $100 million in a strategic round

- Backed by Tether

- Anchorage Digital is a regulated global crypto platform

- The project has raised $587 million so far

TRM Labs

- Secured $70 million in a Series C round

- Fully diluted valuation of $1 billion

- Investors include Blockchain Capital, CMTDigital, and Goldman Sachs

- TRM Labs is a blockchain intelligence company and has raised $219.9 million so far

Jupiter

- Raised $35 million in a strategic round

- Jupiter is a Solana-based decentralized exchange aggregator

Bluff

- Bluff gathered $21 million in a strategic round

- Backed by 1k(x), Makers Fund, and MEV Maximum Extraction

- Bluff is a social-centric betting and entertainment platform

Opinion

- Raised $20 million in a Series A round

- Investors include Hack VC, Jump, and Primitive

- Opinion is a social prediction markets platform

Relay Protocol (Reservoir)

- Secured $17 million in a Series B round

- Backed by Archetype and Union Square Ventures

- Reservoir is an open-source developer platform

Funding under $5 million

- Ruvo (ex Cacao), $4.60 million in an unknown round

- Hurupay, $3 million in a public sale

- Kairos, $2.50 million in an unknown round

- Plutus, $2.30 million in an unknown round

- Penguin Securities, $1.80 million in a Series A round

- Bitte (Mintbase), $1.70 million through M&A

Crypto World

BTC, ETH, BNB, XRP record double-digit losses as crypto liquidations surpass $2.5B

BTC, ETH, BNB, and XRP prices continued their freefall on Friday, triggering over $2.5 billion in liquidations across leveraged markets.

Summary

- Bitcoin, along with other major cryptocurrencies, fell by double digits as they mirrored weakness in tech stocks.

- Over $2.6 billion worth of positions have been liquidated across crypto leveraged markets.

- Market sentiment hit fear levels last seen during the 2022 Terra collapse.

According to data from crypto.news, Bitcoin (BTC) price fell 18% from Thursday’s high of $73,639 to an intraday low of $60,255 on Friday morning. This marked its lowest level since October 2024. While it has recovered from part of its losses, trading around $64,600 at press time, it remains 34% below this year’s high of $97,538.

Ethereum (ETH) price fell 10% to a nine-month low of $1,756 before settling at a little above $1,900, down 10% over the past 24 hours. The largest altcoin by market cap had fallen 43.6% from its yearly high. BNB (BNB) fell under $600 before recovering the support zone and standing 11% lower on the day.

Other large-cap cryptocurrencies such as XRP (XRP), Solana (SOL), Dogecoin (DOGE), and Cardano (ADA) remained with losses ranging between 12-16%. Some of the top laggards of the day were LEO Token (LEO), Monero (XMR), and Official Trump (TRUMP). Altogether, the crypto market fell 8.2% to $2.27 trillion at the time of writing.

The market drop triggered massive liquidations across leveraged markets. Data from CoinGlass shows that over $2.6 billion worth of positions were liquidated in the past 24 hours, with $2.31 billion, roughly 89%, stemming from long positions.

Bitcoin led the carnage with $1.08 billion in long wipeouts, followed by Ethereum at nearly $455 million. In total, approximately 590,810 traders were liquidated, including a single $12 million position on Binance.

The primary catalysts triggering today’s liquidations were Bitcoin’s drop below $70,000 and subsequently $65,000, where large clusters of leveraged long positions were located.

When a leading asset loses major key support levels where bullish bets are concentrated, they trigger forced sell orders, which can quickly develop into a liquidation cascade that is a self-reinforcing loop of falling prices. Bitcoin’s sharp decline effectively pulled the floor out from under other large-cap digital assets.

Notably, the largest crypto asset has fallen over 20% so far this week as it suffers from the weakness in U.S. tech stocks such as Microsoft, AMD, and Nvidia.

Microsoft shares stood over 8% lower in the past five days, while chip-making giants AMD and Nvidia shares were down 18.5% and 10%, respectively, over the same period. These declines come amid disappointing earnings and concerns related to heavy AI infrastructure spending. AI-based cryptocurrencies have been some of the leading losers of the day, with the sector as a whole down 42% in the past 24 hours.

Risk sentiment was also hurt as investors reacted to weak U.S. jobs data, including rising unemployment claims that raise doubts about sustained economic strength and potential Fed caution on aggressive rate cuts this year.

Waning institutional demand has added another layer of pressure to already fragile retail confidence. Most notably, spot Bitcoin ETFs faced a brutal three-day streak of outflows, with investors pulling over $1.2 billion from the funds.

Compounding this bearish momentum, World Liberty Financial, the crypto venture backed by the Trump family, reportedly offloaded more than $5 million in Bitcoin holdings just a day before the crash.

In the midst of the market bloodbath, the Crypto Fear and Greed Index plunged to a score of 9 on Friday, signaling extreme fear among investors and marking the lowest level recorded in over three and a half years. The last time the sentiment score fell this low was during the catastrophic Terra blockchain collapse of 2022.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Metaplanet doubles down on Bitcoin buying amidst market crash

Japan’s Metaplanet will continue buying Bitcoin even as the crypto market downturn has weighed heavily on the company’s shares.

Summary

- Metaplanet said it will continue accumulating Bitcoin despite a sharp market selloff that has pushed its shares down more than 63% over the past 6 months.

- The firm added roughly $451 million worth of Bitcoin in Q4 2025, lifting total holdings to 35,102 BTC.

As Bitcoin price touched $60,000 around the Asia open, Metaplanet CEO Simon Gerovich took to X to reaffirm the company’s decision to continue stockpiling the flagship cryptocurrency.

“We are fully aware that, given the recent stock price trends, our shareholders continue to face a challenging situation,” Gerovich wrote, before adding that the current market scenario will not affect Metaplanet’s Bitcoin buying strategy.

“We will steadily continue to accumulate Bitcoin, expand revenue, and prepare for the next phase of growth,” Gerovich said.

Metaplanet shares were down over 6% at the time of writing after falling from the day’s open. Losses have been more prominent over the past six months, with the stock dropping more than 63.4% over that period.

Bitcoin is down over 47% from its all-time high as of press time, but the persistent downturn over the past month did not deter Metaplanet from inflating its reserves.

Throughout the last quarter of 2025, Metaplanet acquired roughly $451 million worth of the largest cryptocurrency, which pushed its total holdings to 35,102 BTC.

According to data from Bitcoin Treasuries, the company’s average cost of acquisition is around $107,716. That puts the company at an unrealized loss of nearly 39% based on current prices.

Metaplanet is not the only Bitcoin hoarder that is currently underwater, as Strategy, the largest corporate holder, reported a $12.6 billion net loss for Q4 2025. With an average acquisition cost of $76,052 per BTC, its holdings are also in the red, with losses of over 13%.

However, like Gerovich, Strategy CEO Michael Saylor has assured that the company will continue buying Bitcoin and even dismissed fears of liquidation by noting that BTC would have to crash to $8,000 before it becomes a concern.

Metaplanet, on the other hand, is gearing up to raise as much as $137 million using a combination of common shares and stock acquisition rights to fatten its reserves and reduce debt.

The announcement, however, did not bode well with company shareholders, as the company’s stock fell by over 3.5% on the day.

Crypto World

Tether deepens tokenized gold strategy with $150m Gold.com deal

Tether has made a $150 million strategic investment in precious metals platform Gold.com, acquiring a roughly 12% stake as part of a broader push to expand access to both tokenized and physical gold.

Summary

- Tether invested $150 million in Gold.com, acquiring a roughly 12% stake to expand access to tokenized and physical gold.

- The deal aims to strengthen XAU₮, Tether’s gold-backed digital asset, with Gold.com committing $20 million into the token.

- The partnership includes board representation and plans to integrate stablecoins into Gold.com’s precious metals platform.

The investment is aimed at strengthening XAU₮, Tether’s gold-backed digital asset, which is pegged to physical gold held in reserve.

XAU₮ is one of the largest tokenized gold stablecoins in terms of market share, and the investment boosts its global credibility and distribution.

Tether deepens push into tokenized gold

As part of the partnership, Gold.com agreed to invest $20 million from the proceeds into XAU₮, further aligning both firms’ interests.

“Our investment in Gold.com reflects a long-term belief that gold should be as accessible, transferable, and usable as modern digital money, without compromising on physical backing or ownership,” said Paolo Ardoino, CEO of Tether.

The news comes as Tether has been steadily accumulating bullion in secure Swiss vaults, buying more than a ton of gold each week to support its stablecoin and gold-backed products. Tether now holds approximately 140 tons of physical gold valued at about $23 billion.

Under the agreement, Tether will purchase approximately 3.37 million common shares at a discount to recent market prices and will be entitled to nominate a board member at Gold.com.

The companies also plan to explore commercial arrangements, including promoting Tether stablecoins on Gold.com’s platform and enabling gold purchases with digital currencies such as USD₮ and USA₮.

For context, Gold.com is a vertically integrated alternative assets platform that offers a broad range of precious metals, numismatic coins, and collectibles. Founded in 1965, the company operates across the U.S. and international markets.

Greg Roberts, CEO of Gold.com, said the investment “builds upon Gold.com’s 60+ year legacy and expands our reach beyond traditional bullion into digital gold and stablecoins,” adding that the capital will help strengthen the company’s offerings and support future innovation.

The deal reflects broader trends in tokenizing real-world assets, as investors and issuers increasingly seek to merge physical commodities with blockchain-based financial infrastructure.

Crypto World

Trend Research Slashes Ether Holdings After Market Crash to Repay Loans

Crypto treasury firm Trend Research has sharply reduced its Ether position following the recent market downturn, moving large amounts of ETH to exchanges as it works to service outstanding debt.

Key Takeaways:

- Trend Research sold over 400,000 ETH and moved large holdings to exchanges to manage debt after the price drop.

- Ether’s nearly 30% weekly decline pushed leveraged positions close to liquidation thresholds.

- The downturn is also hitting other corporate ETH treasuries, highlighting risks of concentrated crypto holdings.

Blockchain data shows the firm held roughly 651,170 Ether on Sunday in the form of Aave-wrapped ETH. By Friday, the balance had fallen to about 247,080 ETH, a drop of more than 404,000 tokens in less than a week.

Onchain analytics platform Arkham reported that 411,075 ETH has been transferred to Binance since the start of the month.

Ether Drops Nearly 30% in a Week Before Partial Rebound

The movements coincided with a steep decline in Ether’s price, which slid nearly 30% over the past week to a low near $1,748 before recovering to around $1,967.

Trend Research built its position using a leveraged strategy. The company, linked to Liquid Capital founder Jack Yi, purchased Ether and posted it as collateral on the lending protocol Aave to borrow stablecoins, then used the borrowed funds to buy additional ETH.

The falling market has placed the position under pressure. According to Lookonchain, the firm faces several potential liquidation levels between $1,698 and $1,562, meaning further price declines could trigger automatic collateral sales on the lending platform.

Yi acknowledged in a post on X that his earlier call on the market bottom came too soon but said he remains optimistic and will continue managing risk while waiting for a recovery.

Trend Research first drew attention after the $19 billion crypto liquidation cascade in October 2025, when it began aggressively accumulating Ether.

At one point in December, the firm would have ranked among the largest holders of ETH globally, although it does not appear on most public corporate treasury trackers because it is privately held.

BitMine’s $7B Paper Loss Tests Corporate Ethereum Treasury Strategy

BitMine Immersion Technologies, led by Fundstrat’s Tom Lee, is also under pressure after Ether’s sharp decline pushed the company deep into unrealized losses.

With roughly 4.28 million ETH on its balance sheet, the firm is sitting on more than $7 billion in paper losses after the token fell near $2,100.

The company had accumulated its holdings at much higher prices, making it one of the largest single-asset corporate bets in crypto.

The firm shifted from Bitcoin mining to an “Ethereum-first” treasury model in 2025, buying ETH at an estimated $3,800–$3,900 average.

The market downturn has dragged down both its portfolio and stock price, drawing comparisons to Michael Saylor’s Bitcoin-heavy Strategy, which is also facing sizable unrealized losses.

Analysts say both companies highlight the risk of concentrated crypto treasury strategies tied to volatile assets.

Despite the drawdown, Lee remains confident. He argues Ethereum’s fundamentals are strengthening, pointing to record transaction activity and rising active addresses.

The company now holds about 3.55% of Ethereum’s supply and is targeting 5% while expanding staking operations.

Nearly $6.7 billion worth of ETH is staked, and BitMine plans to launch its Made in America Validator Network in 2026.

The post Trend Research Slashes Ether Holdings After Market Crash to Repay Loans appeared first on Cryptonews.

Crypto World

Bitcoin options worth $2.1B set to expire: Will $60K hold?

Bitcoin price entered Friday under pressure as $2.1 billion in options contracts approach expiry.

Summary

- A large Bitcoin options expiry is approaching with limited upside support.

- Most call positions sit far above current prices, reducing hedging demand.

- Traders are watching whether $60K can hold after the contracts settle.

Bitcoin is facing another key test as a large batch of derivatives contracts reaches maturity. Bitcoin options worth about $2.1 billion are set to expire at 8:00 a.m. UTC on Feb. 6, according to data from Deribit.

About 34,000 contracts are covered by the expiry, which comes at a time when market sentiment is still shaky. Call options still outnumber puts, as shown by the put-to-call ratio, which is close to 0.60.

This implies that a large number of traders had positioned themselves for higher Bitcoin (BTC) prices in earlier weeks. The so-called max pain level, where most option buyers would lose money, sits around $80,000. That level is well above current market prices.

Ethereum (ETH) options worth about $390 million are also expiring alongside BTC options. These contracts have a put-to-call ratio of 1.01 and a max pain level near $2,450.

Bitcoin has struggled to regain its footing after dropping to an intraday low of $60,286, later stabilizing in a narrow $63,000–$65,000 range. Due to a mix of forced liquidations and widespread rotation from risk assets, the cryptocurrency is now nearly 50% below its 2025 high of above $126,000.

How Bitcoin options expiry could affect price

While many put options are already profitable, the majority of call options are far out of the money with max pain close to $80,000.This setup limits the usual pull toward the max pain level that sometimes appears around major expiries.

In simple terms, dealers and large traders have little incentive to push prices higher to protect call positions. At the same time, there is limited pressure to buy Bitcoin for hedging purposes. As a result, price action after the expiry may stay soft and follow the existing trend.

If selling pressure continues, the market could drift back toward nearby support levels rather than stage a strong rebound.

Analysts are watching the $60,000 area closely. This zone has acted as short-term support during recent sell-offs. A sustained break below it could deepen losses, while a firm hold may allow for a temporary bounce.

Bitcoin price technical analysis

Bitcoin has clearly broken below the 100-day moving average, which served as trend support for the majority of 2025. Several recovery attempts failed near $83,000, showing strong selling interest at higher prices.

The price structure has now flipped lower following a range breakdown and a clear lower high. As Bitcoin fell below the lower Bollinger Band, the decline accelerated, suggesting disorderly selling rather than consistent profit-taking.

The weakness is confirmed by momentum indicators. The relative strength index fell below levels observed in previous cycles, approaching 20. No bullish divergence has appeared, and many sessions closed near their lows. This suggests limited interest from dip buyers.

A former support zone around $75,000 failed to hold. With that area broken, attention has shifted to the $60,000 level as the next major psychological support.

If $60,000 holds on a daily close, short-term relief rallies could develop as selling pressure eases. In that case, price may move toward the $70,000 to $75,000 range, where past support has turned into resistance. Without a recovery above the 100-day average near $83,000, such moves would likely stay corrective.

If $60,000 breaks and price settles below it, the market could open the path toward the mid-$50,000 region. Under that scenario, downside momentum would remain intact, and sentiment-driven rebounds may struggle until the overall structure improves.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech14 hours ago

Tech14 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports6 hours ago

Sports6 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 day ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat20 hours ago

NewsBeat20 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat7 hours ago

NewsBeat7 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”