Crypto World

EY warns firms they must own the wallet to keep their customers

In the evolving landscape of digital finance, Big Four consultancy firm EY has zeroed in on what it believes is the next defining frontier: wallets.

Wallets are fast becoming the critical interface for the next era of financial services, not just tools for holding cryptocurrency, according to Mark Nichols, principal at EY.

“The wallet is the strategy,” Nichols who co-leads the firm’s digital assets consulting business, told CoinDesk in an interview. “Who owns the wallet, who provisions the wallet, will win the client relationship.”

Nichols and his West Coast counterpart, Rebecca Carvatt, view wallets as more than infrastructure. They’re the gateway to storing, moving and managing tokenized value in a world where financial instruments, from payments to private credit, are increasingly moving onchain, he said.

Not just custody: Wallets as the hub of tokenized finance

The vision is expansive. Far from being a niche utility for crypto enthusiasts, wallets are becoming the connective tissue of a broader tokenized financial system. Wallets will soon be indispensable for retail investors, asset managers, treasurers and even commercial banks, according to Carvatt, co-leader of EY’s digital assets consulting business.

“They’re going to be the access point for everything — payments, tokenized assets and stablecoins,” she said.

EY’s perspective positions wallets as the new bank accounts of the future, with services tailored not just to individuals, but to corporates and institutional investors who require sophisticated integration with risk systems, compliance tools and real-time capital flows.

The implication is clear: whoever controls the wallet controls the relationship. For financial institutions already losing ground to crypto-native platforms, the shift is existential.

Beyond liquidity: The real promise of tokenization

The broader shift to tokenization is often framed as a play for liquidity, but EY believes that narrative undersells the true impact. “It’s not just about liquidity,” Nichols says. “Liquidity isn’t the be-all and end-all, it’s about the utility that onchain finance enables.”

What EY sees instead is the emergence of blockchain as a real-time infrastructure for financial markets, one that allows for programmable transaction chains, and fundamentally reshapes how capital is managed. Tokenization enables atomic settlement, sure, but its real power lies in margin optimization and operational efficiency.

Nichols points to scenarios where firms can use stablecoins or tokenized assets to meet margin calls more frequently and precisely. That, in turn, reduces initial margin requirements, freeing up capital for investment. “It’s about better risk alignment and real-time capital management,” he says. “And the wallet becomes the gateway to making that possible.”

A decade in the space: EY’s deep crypto bench

While some firms are racing to catch up, EY has been building in the digital asset space for more than 12 years. Its early investments in crypto-native audit and compliance practices now span thousands of professionals, supporting everything from hedge fund tax returns to tokenized M&A advisory.

“We’ve worked with every client profile – large banks, asset managers, exchanges, digital natives, infrastructure providers,” Nichols says. “and have been working in the digital asset ecosystem for over a decade.”

EY’s hedge fund audit business was one of the earliest to support crypto, and its advisory team has helped firms prepare for public listings and complex regulatory environments. The firm has developed bespoke services for wallet monitoring, onchain compliance, and token-native tax reporting. It also continues to advise traditional financial institutions on how to design safe, compliant digital asset strategies, particularly as they begin to develop or integrate wallet infrastructure.

Wallets for everyone: A segment-by-segment view

EY is clear that wallet needs are not monolithic. Consumers want seamless UX and secure access to payments and crypto. Corporates need integration with treasury functions and regulatory compliance across jurisdictions. Institutional clients demand secure custody, connectivity to decentralized finance (DeFi) and staking products, and embedded risk tooling.

Self-custody, EY argues, won’t be mainstream. The average user or institution doesn’t want to manage their own private keys. Instead, trusted wallet providers will emerge, banks, fintechs, or specialized custodians; each tailoring their offering based on the segment they serve.

Provisioning wallets, then, becomes a strategic imperative. Whether firms choose to build their own, acquire providers, or form partnerships, the wallet is the new front door to financial services. Firms that act now will reduce future customer acquisition costs and own a more defensible position in the digital asset ecosystem.

Regulation: A catalyst, not a roadblock

One of the most persistent beliefs about tokenization is that regulation is a blocker. But EY’s leaders disagree. “We already have the regulatory framework in core markets, and alongside the broader industry, the passage of market structure legislation will allow for remaining issues to be ironed out,” Nichols says. “A security is a security, a commodity is a commodity. Blockchain is technology.”

In the U.S., the GENIUS Act and existing Securities and Exchange Commission (SEC) exemptions provide pathways for compliant tokenized products. Globally, jurisdictions are racing to attract digital asset innovation with evolving licensing regimes. While harmonization is still in progress, the momentum is unmistakable.

EY sees this moment as a call to maturity, an inflection point where infrastructure is catching up to vision. “We’re past the experimentation phase,” Carvatt says. “Now it’s about safe, scalable implementation.”

Rethinking asset management from the ground up

Perhaps nowhere is the impact of tokenization and wallet infrastructure more profound than in asset management. A typical fund currently requires a distribution network, an investment team, a custodian, a fund administrator, and regulatory reporting channels. With tokenization and smart contracts, much of that stack becomes programmable, and potentially obsolete.

“Asset managers just want to build great portfolios,” Nichols says. “Blockchain lets them do that without all the legacy friction.”

By tokenizing fund underliers and embedding logic into smart contracts, asset managers can automate functions like distribution, compliance, and reporting. This opens the door to lower fees, broader investor access, and new types of products, particularly in private credit and alternatives, where cost has historically been a barrier.

“From the unbanked to the unbrokered, we’re seeing more people gain exposure to assets that were previously out of reach,” Carvatt says. “That’s powerful.”

The future of finance is onchain

Whether for crypto, payments, or tokenized assets, wallets will be the gateway to a new financial reality. Firms that ignore this will risk irrelevance. Those that embrace it will own the infrastructure, and the customer relationship, at the heart of digital finance.

“The future of finance is on-chain,” Nichols says. “And the wallet is at its center.”

Read more: R3 bets on Solana to bring institutional yield onchain

Crypto World

BTC’s downside volatility is a feature, not a crisis, says hedge funder

Bitcoin’s sharp decline — nearly 50% from its all-time highs reached just months ago — has reignited debate over the cryptocurrency’s stability, but hedge fund veteran Gary Bode says the selloff is a feature of the asset’s inherent volatility rather than a sign of a broader crisis.

In a post on X, Bode noted that while the recent price drop is “unpleasant and jarring,” it is not unusual in bitcoin’s history. “80% – 90% drawdowns are common,” he said. “Those who have been willing to stomach the always-temporary volatility have been well-rewarded with incredible long-term returns.”

Much of the recent turbulence, he said, can be traced to market reactions to the nomination of Kevin Warsh to succeed Jerome Powell as Federal Reserve chair. Investors interpreted the move as a signal that the Fed might adopt a hawkish stance, raising interest rates and making zero-yield assets such as bitcoin, gold, and silver relatively less attractive. Margin calls on leveraged positions amplified the decline, causing a cascade of forced selling.

Bode, however, disputes the market’s interpretation. He pointed to Warsh’s public statements supporting lower rates and notes from President Trump suggesting Warsh promised a lower fed funds rate. Combined with Congress’ ongoing multi-trillion-dollar deficits, Bode argued, the Fed has limited ability to influence longer-term Treasury yields — a key factor in corporate borrowing and mortgage rates. “I think the market got this one wrong” he said, emphasizing that perception, rather than fundamentals, drove much of the recent selling.

Other commonly cited explanations, he said, also fail to tell the full story. One theory is that “whales” — early bitcoin holders who mined or purchased coins when prices were near zero — are offloading holdings. While Bode acknowledges that large wallets have been active and some big sellers have emerged, he frames these moves as profit-taking rather than an indication of long-term weakness. “The technical skill of the early adopters and miners is something to be applauded,” he said. “That doesn’t mean that their sales (full or partial) tell us much about the future of bitcoin.”

Bode also flagged Strategy ($MSTR) as a potential source of short-term pressure. The company’s stock fell after bitcoin slid below the prices at which Strategy purchased many of its holdings, prompting fears that Saylor might sell. Bode described this risk as real but limited, comparing it to when Warren Buffett buys a large stake in a company: investors like the support but worry about eventual sales. He stressed that bitcoin itself would survive such events, though prices could temporarily dip.

Another factor is the rise of “paper” bitcoin — financial instruments such as exchange-traded funds (ETFs) and derivatives that track the crypto asset’s price without requiring ownership of the underlying coins. While these instruments increase the effective supply available for trading, they do not alter bitcoin’s hard cap of 21 million coins, which Bode said remains a crucial anchor for long-term value. He drew parallels to the silver market, where increased paper trading initially suppresses prices until physical demand pushes them higher.

Some analysts have suggested that rising energy prices could hurt bitcoin mining and reduce the network’s hash rate, potentially lowering long-term prices. Bode calls this theory overblown.

Historical data shows that past bitcoin price drops did not consistently result in hash rate declines, and when declines did occur, they lagged months behind the price drop.

He also pointed to emerging energy technologies — including small modular nuclear reactors and solar-powered AI data centers — that could provide low-cost power for mining in the future.

Bode also addressed critiques that bitcoin is not a “store of value.” While some argue that its volatility disqualifies it from this role, Bode points out that nearly every asset carries risk — including fiat currencies backed by heavily indebted governments. “[…] Gold does require energy to secure unless you’re comfortable leaving it on your front porch,” he said. “Paper Bitcoin can influence the short-term price, but long-term, there are 21MM coins that will be issued and if you want to own Bitcoin, that’s the real asset. Bitcoin is permissionless and requires no trust in a counterparty.”

Ultimately, Bode’s assessment frames the recent decline as a natural consequence of bitcoin’s design. Volatility is part of the game and those willing to endure it may ultimately be rewarded. For investors, the key takeaway is that price swings, no matter how dramatic, are not necessarily a signal of systemic risk.

Crypto World

DOGE TD Sequential 9 Signals Seller Exhaustion Near $0.090

TLDR:

- DOGE hits TD Sequential 9, signaling sellers may be exhausted after weeks of downside.

- Price finds support near $0.090, creating a potential zone for short-term relief rallies.

- RSI and MACD show fading bearish momentum, hinting at early strength returning.

- The monthly accumulation range of $0.077–$0.055 could set up DOGE for long-term upside toward $1.

DOGE TD Sequential indicates potential trend exhaustion after a persistent downtrend. The completed nine-count setup aligns with key support near $0.090, pointing toward a likely relief bounce or sideways consolidation before the next directional move.

TD Sequential Signals Short-Term Relief

DOGE’s daily chart shows a completed TD Sequential buy setup after nine consecutive bearish closes. This occurs at the end of a clear downtrend marked by lower highs and lower closes.

TD Sequential focuses on trend fatigue rather than strength, making this setup notable. Moreover, price action around the TD 9 marker confirms selling exhaustion.

The sharp, impulsive sell-off led into the signal, followed by a small-bodied candle with long lower wicks. This indicates that bears pushed hard but failed to hold control.

Consequently, buyers entered quietly near the $0.095–$0.090 zone, coinciding with prior support levels. Additionally, momentum indicators support the TD read.

RSI rose from oversold territory into the mid-40s, showing gradual strength. Meanwhile, MACD histogram compression suggests fading bearish momentum.

Therefore, the setup favors a short-term relief bounce. Furthermore, tweets from market observers emphasize that the 4-hour TD Sequential setup confirms seller exhaustion.

Price stabilized above $0.090 instead of breaking lower, carving higher intraday lows. As a result, fresh short positions face limited potential.

Finally, completed TD 9s often precede either a multi-candle relief rally or sideways consolidation. If DOGE holds above $0.088–$0.090, it may reach $0.105–$0.112 during the next mean reversion phase.

Consequently, statistical timing indicates that downside momentum is running out rather than signaling hype-driven strength.

Macro Accumulation Zone Suggests Long-Term Upside

On the monthly chart, DOGE trades within a macro accumulation range of $0.077–$0.055. This zone follows a deep correction from its all-time high and marks a re-accumulation phase.

Down ~89% from ATH, DOGE remains in extended high-timeframe demand. Furthermore, phased accumulation is recommended over lump-sum entries.

Pullbacks into $0.077–$0.070, combined with shifts in low-timeframe structure, provide higher-probability setups. Conversely, a monthly close below $0.055 would invalidate the long-term thesis.

Additionally, liquidity targets indicate potential upside. Price could test $0.156, $0.306, $0.48, and eventually $1 if monthly support holds.

Therefore, the macro accumulation zone combined with the TD Sequential buy setup signals that the market may quietly reset for the next upward move.

Ultimately, DOGE’s short-term relief bounce aligns with longer-term accumulation dynamics. Price stabilization, improving momentum, and statistical exhaustion suggest that the current levels offer a risk-reward opportunity for both swing and long-term positions.

Crypto World

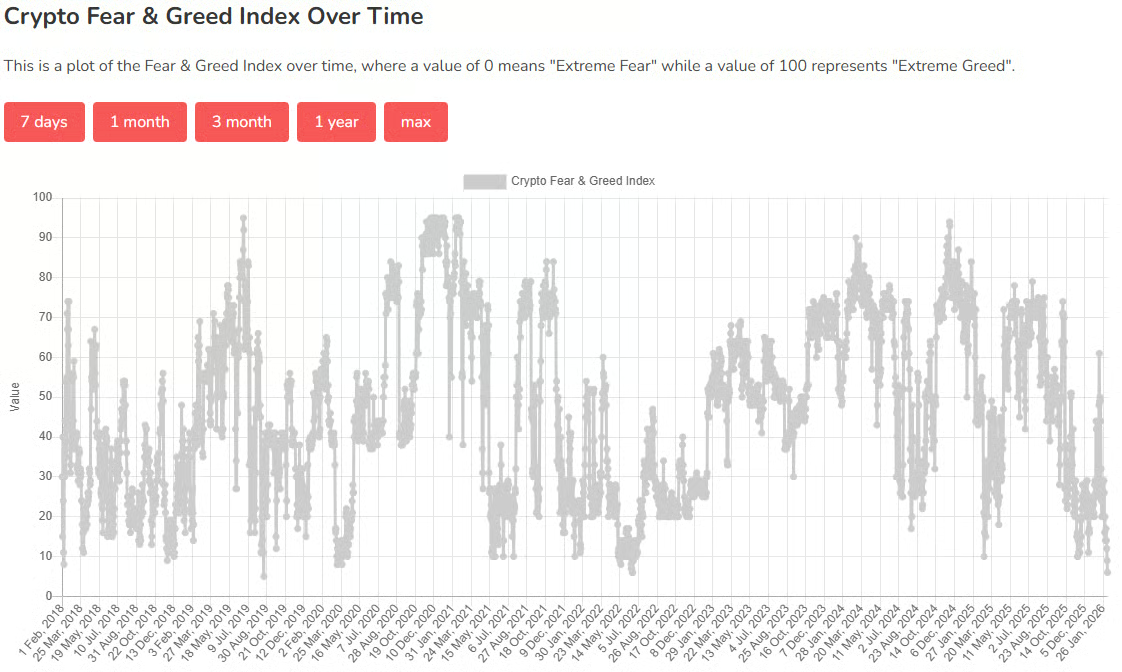

Bitcoin Fear and Greed Index Plummets to 6-Year Low: Is The Worst Over?

Does this mean that BTC has finally bottomed out or is there more pain ahead?

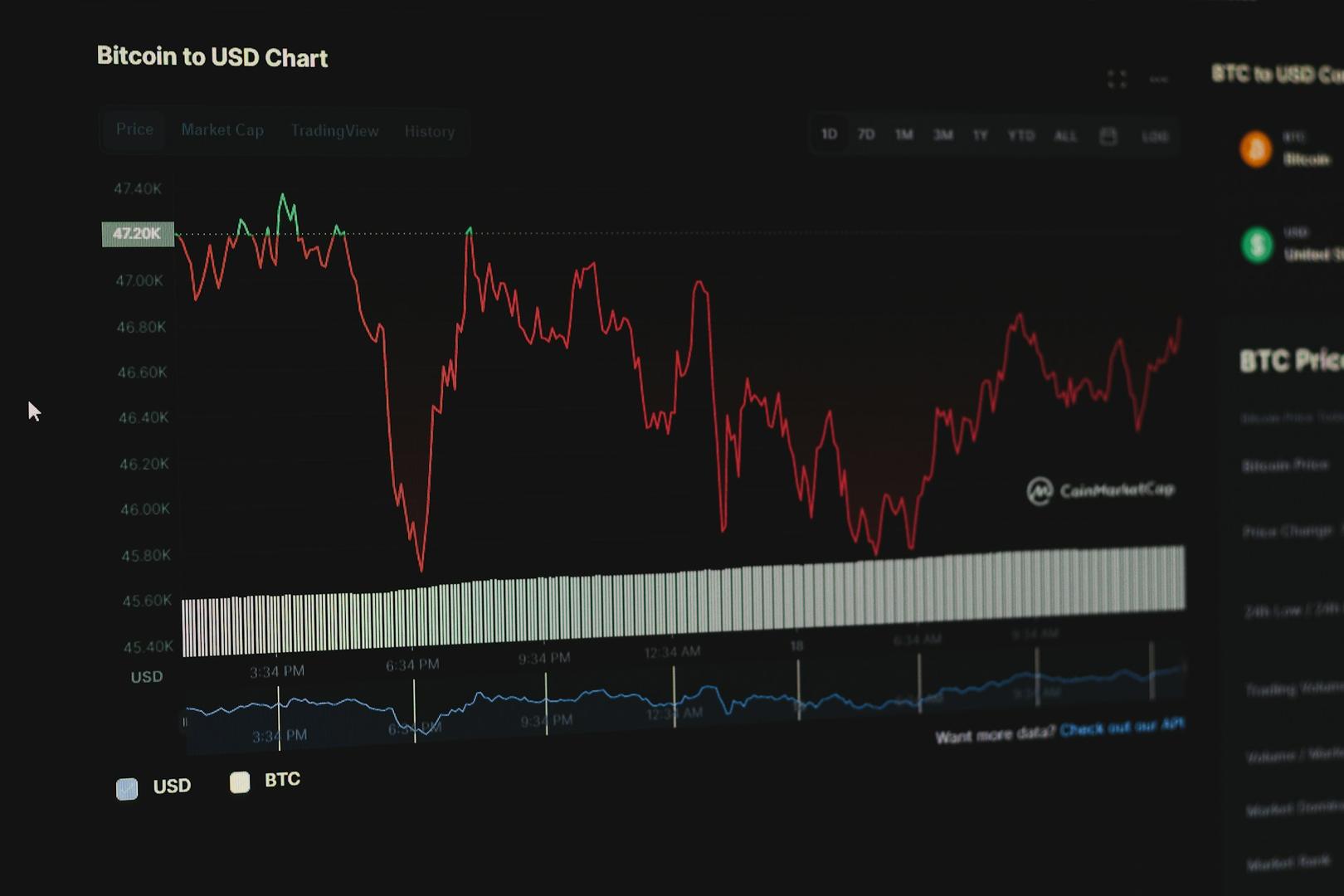

The past few weeks have been brutal for BTC and the rest of the market. The largest digital asset plummeted by roughly $30,000 in less than ten days, and bottomed out (at least for now) on Friday morning with a drop to $60,000.

Given this calamity, it’s almost expected that the overall investor sentiment has plunged just as badly. In fact, it has reached multi-year lows.

Fear Continues to Dominate

Since the cryptocurrency markets (as well as most other financial fields) can be highly emotional, the Fear and Greed Index was created to demonstrate the rapid changes. Market momentum and overall volatility are responsible for half of the index’s final result, which ranges from extreme fear (0) to extreme greed (100).

As such, it’s no wonder that it has been mostly downhill lately. Bitcoin’s price peaked at over $95,000 in mid-January, and stood above $90,000 just over ten days ago – on January 28. However, what happened next was difficult (if not impossible) to predict, as the asset plunged by $30,000 in days to its lowest price levels in well over a year.

Although it rebounded to $69,000 as of press time, this hasn’t been sufficient to move the needle on the Index. The metric has consistently declined lately and tanked to 6, its lowest level since August 2019.

Is a Rebound Next?

As Warren Buffett has said in the past, investors should be fearful when others are greedy and vice versa. As such, they should be greedy now, right? Previous instances of sharp increases or declines in the metric have led to immediate trend reversals, which could finally bring some hope for the bulls.

However, if we go back to the developments back in 2019, history does not exactly support this narrative. At the time, BTC had actually begun to recover from its late 2018/early 2019 bear market and traded 2-3x higher than the $3,500 bottom. Nevertheless, it couldn’t penetrate the $10,000 barrier and failed to do so for months.

You may also like:

Then came 2020 and a major black swan event (the COVID-19 crash), and BTC dumped further before it finally went on the offensive. It took the cryptocurrency over a year to break beyond $10,000. But the good news is that it never looked back and has never traded within a four-digit price territory since then.

The moral of the story now is that yes, extreme fear dominates the markets, which is typically followed by a sharp trend reversal. However, the current market environment is quite uncertain given the rising geopolitical tension, internal issues, market instability, different asset classes exploding, and so on.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Forward Industries (FWDI) is well positioned to consolidate the digital asset treasury sector

Nasdaq-listed Forward Industries (FWDI) is uniquely positioned to consolidate the beaten-down digital asset treasury space because it carries no corporate debt and is completely unlevered, giving it room to play offense while peers retrench, according to Ryan Navi, the company’s chief investment officer.

“Scale plus an unlevered balance sheet is a real advantage in this market. We can play offense when others are playing defense,” Navi told CoinDesk in an interview.

“Forward Industries has strategically avoided leverage and debt by design, giving us the flexibility to responsibly deploy leverage when market opportunities arise, Navi said. “The foundation we’ve built for Forward allows us to operate effectively in market conditions with abundant opportunity, and positions us to act as a net consolidator rather than a forced seller,” he added.

Digital asset treasury companies, firms whose balance sheets are heavily weighted toward cryptocurrencies, have come under growing pressure amid the recent market downturn. Falling crypto prices have squeezed asset values and pushed leverage higher, forcing some companies to sell portions of their crypto holdings to service debt and shore up liquidity, raising questions about the model’s sustainability in prolonged bear markets.

Forward Industries is no exception. With about 7 million solana tokens acquired at an average price of $232, the company stack is worth about $600 million at SOL’s current level just above $85. That represents a paper loss of roughly $1 billion. FWDI’s stock has slumped from a high near $40 at last year’s peak of the digital asset treasury company frenzy to the current price just above $5.

Becoming a solana treasury giant

Forward Industries’ center of gravity shifted sharply in 2025, when it raised roughly $1.65 billion in a private investment in public equity led by Galaxy Digital, Jump Crypto and Multicoin Capital. The deal transformed the firm into the largest solana-focused treasury company in the public markets, with holdings larger than its next three competitors combined. The strategy is straightforward: accumulate SOL, stake it to earn onchain yield and use the firm’s cost-of-capital advantage to drive per-share accretion over time.

Buying in a dislocated market

Navi, who joined the firm in December after stints as a principal at KKR and as managing director at ParaFi Capital, said crypto equities remain deeply dislocated, creating opportunities for disciplined capital allocation to be highly accretive. When sentiment improves and the stock trades above net asset value, Forward can issue equity to buy more crypto; when markets are weaker, accretion can be easier to generate, he said, as prices and expectations are already compressed.

Why Solana

The bet on Solana is as much about fundamentals as it is about positioning. While Ethereum remains the dominant smart-contract platform by market capitalization and decentralization, Navi argues it has become slower and more expensive, with layer-2 networks fragmenting liquidity and, in his view, diluting value at the base layer.

Solana, by contrast, is optimized for speed, cost and finality, qualities that matter most for consumer applications and capital-markets use cases. Viral moments like last year’s meme-driven surge in activity proved the chain can handle millions of users and extraordinary transaction throughput, even if those applications themselves were fleeting. “That showed what’s possible,” Navi said. “It’s a question of when, not if, the next breakout app arrives.”

A lower cost of capital

Forward’s balance-sheet flexibility extends beyond simple buy-and-hold. The company stakes its SOL at roughly a 6% to 7% yield, a rate that will gradually decline as Solana’s programmed issuance falls and supply becomes increasingly disinflationary.

It has also partnered with Sanctum to issue a liquid staking token, fwdSOL, which earns staking rewards while remaining usable as collateral in decentralised finance (DeFi). On venues like Kamino, Navi said, Forward can borrow against that collateral at costs below the staking yield, creating a more capital-efficient structure than most peers can access.

A permanent-capital play

Longer term, Navi sees Forward as a permanent-capital vehicle rather than a trade, more akin to a Berkshire Hathaway than a fund with redemptions or a fixed life. That opens the door to underwriting real-world assets, tokenized royalties and other cash-flowing businesses that clear the company’s cost of capital and can eventually be brought in-house.

“We’re not running a trading book, we’re building a long-term Solana treasury,” Navi said. “What differentiates Forward is discipline: no leverage, no debt, and a long-term view on Solana as strategic infrastructure rather than a short-term bet.”

In the near term, he added, widespread stress across the sector has left many digital asset treasury companies trading at steep discounts, setting the stage for consolidation.

With no leverage, deep backing from blue-chip crypto investors and the largest SOL balance in the public markets, Navi believes Forward is one of the few firms positioned to lead that roll-up.

Kyle Samani said Wednesday that he was stepping down as managing director of Multicoin Capital while remaining chairman of Forward Industries. He notably is taking his exit from the Multicoin Master Fund in FWDI shares and warrants instead of cash.

Read more: Forward Industries Launches $4B ATM Offering to Expand Solana Treasury

Crypto World

Cardano’s (ADA) Hoskinson isn’t selling after losing $3 billion in market crash

founder Charles Hoskinson said he is sitting on more than $3 billion in unrealized losses during the current crypto market downturn, offering a rare look at his personal exposure during a period of sharp declines.

Speaking from Tokyo in a live broadcast, Hoskinson addressed a market rattled by forced liquidations and falling prices in an inspirational message. Bitcoin dropped to around $60,000 during the week, losing about 16% of its value, while the broader CoinDesk 20 (CD20) index fell 17%. dropped by 15.6% in the week.

Hoskinson said he shared the figure to counter claims that crypto founders are insulated from losses that affect retail investors. He told viewers that his financial position has taken a larger hit than most people following the market.

“I’ve lost more money than anyone listening to this. Over $3 billion now. It would’ve been real easy to cash out, just walk away,” Hoskinson said.

“Do you think I honestly care if I lose it all? There’s a reason I’m not in the Epstein files, there’s a reason I didn’t get rolled up in FTX,” he added.” “It’s not because no one likes me, it’s because my default answer is no. I don’t care if I lose money, I don’t care if it means I get put in the little kids’ table and I don’t get to go to the White House and all of these other things.”

In his remarks, Hoskinson emphasized building for the long-term growth of the ecosystem rather than focusing on short-term price movements.

The comparison framed the downturn as part of a longer cycle rather than a breaking point. Hoskinson added that “every foot forward on that difficult road” is progress, adding he’s “here for life, this is who I am and is always going to be who I am.”

He also said he has no plans to exit his positions. Instead, he described the selloff as a transition period as financial systems adjust to new technology.

For example, he pointed to Cardano-based projects such as Starstream and Midnight, which he said are designed for data-integrity and privacy-focused applications.

Crypto World

XRP price forms hammer candle ahead of permissioned DEX launch

XRP price is slowly forming a giant hammer candlestick pattern, pointing to an eventual rebound, as Ripple prepares the launch of its permissioned DEX features to the network.

Summary

- XRP price has dropped in the last five consecutive weeks as the crypto market crash accelerated.

- Ripple plans to launch its permissioned DEX tool that will boost the XRP utility soon.

- Technical analysis suggests that it has formed a hammer candlestick pattern on the weekly chart.

Ripple (XRP) token was trading at $1.4120, up by 25% above its lowest level this week, matching the performance of other top tokens like Ethereum, Bitcoin, and Solana.

XRP’s rebound happened after the developers published the roadmap for bringing institutional decentralized finance (DeFi) with XRP token at the core of the network.

The team launched permissioned domains, which enable regulated environments, where access is controlled by Credentials, which enable KYC and AML tools in the network.

It will now launch Permissioned DEX tools, which will build on permissioned domains by allowing secondary markets for forex and stablecoins. All these features will leverage the use of Ripple USD (RLUSD), which will settle on the XRPL network.

Every transaction on the decentralized exchange will burn XRP token, reducing its supply. This will happen at a time when the XRP burn rate has dwindled in the past few months. In a note, Messari noted that the network has burned 14.3 million XRP tokens since inception, a low burn it attributed to its low transaction fee.

Meanwhile, XRP ETFs managed to score inflows this week despite the crypto market crash. Its ETFs added over $39 million in assets this week, while Bitcoin and Ethereum continued their outflows.

XRP price technical analysis

The weekly chart shows that the XRP token price has retreated sharply in the past few months. It retreated in the last five consecutive weeks and is now nearing its lowest level since November 2024.

The coin has constantly remained below all moving averages and the 61.8% Fibonacci Retracement level.

On the positive side, the Relative Strength Index is nearing the oversold level at 30. It has also formed a hammer candlestick pattern, which happens when it has a small body and a long lower shadow. A hammer is one of the most common bullish reversal sign.

Therefore, there is a possibility that the token will rebound in the coming weeks as investors buy the dip. If this happens, the next key target to watch being the psychological level at $2.0. However, a drop below the key support level at the $1.1210 will invalidate the bullish outlook and point to more downside.

Crypto World

BTC erases post-election gains during ‘sell at any price’ rout

Bitcoin has recovered from a low near $60,000 to now stand around $69,000, having effectively given back the gains it made after Donald Trump’s election in November 2024 this week.

The cryptocurrency’s drop was accompanied by a broader market sell-off that saw the CoinDesk 20 (CD20) index lose more than 17% of its value in a week.

While bitcoin dropped around 16.5% in the last 7-day period, other cryptocurrencies fared worse. Ether lost 22.4% of its value, BNB dropped 23.4%, and solana 25.2%. Shares of crypto-linked firms registered significant declines despite a Friday rebound, as the price of BTC briefly retook $70,000.

The move followed a violent drop a day earlier that Wintermute described as the worst single-day drawdown in bitcoin since the FTX collapse.

The sell-off was driven by market-wide liquidations and what “felt like a ‘sell at any price’ working order,” said Jasper De Maere, desk strategist and OTC trader at Wintermute in an emailed statement.

De Maere said institutional desks reported “small but manageable liquidation,” which did not fully explain the size of the move, fueling debate over where the stress sat in the system.

De Maere added that the cascade came alongside a wider cross-asset deleveraging. The Nasdaq 100 tracker QQQ fell about 500 basis points over three sessions, while silver and gold dropped roughly 38% and 12% below their cycle highs, respectively.

In crypto options, implied volatility jumped into the 99th percentile, with skew tilting toward unusually expensive puts, he said.

De Maere flagged ether as the “epicenter of the pain,” saying many traders rushed to buy protection against further losses using put options, which can pay out if prices fall and give the holder the right to sell at a set price. In bitcoin, he said positioning pointed to expectations of continued turbulence, with traders focused on a wide range that could run from about $55,000 to $75,000.

Further hitting sentiment, this week crypto exchange Gemini said it plans to shutter operations in the U.K., European Union and Australia, and cut about 25% of staff as part of a restructuring.The firm will enter withdrawal-only mode for users in affected regions and partner with brokerage platform eToro for users to transfer their assets.

Meanwhile, Bitfarms (BITF) saw its shares rise after ditching its “bitcoin company” identity to instead focus on artificial intelligence (AI) infrastructure.

Market structure has added to the turbulence. Bitcoin’s average 1% market depth, a measure of how much can be traded near the current price without moving the market, has fallen to around $5 million from more than $8 million in 2025, Kaiko research analyst Thomas Probst told Reuters. Lower depth can make price moves more abrupt.

Flows in spot bitcoin ETFs have also turned negative. Data from SoSoValue shows about $1.25 billion of net outflows over the past three days. Jim Bianco of Bianco Research estimated on social media that the average ETF cost basis is near $90,000, leaving holders with about $15 billion in unrealized losses.

“It has been said that crypto is ‘programmable money.’ If so, BTC should trade like a software stock,” Bianco said in an X post, adding that the recent decline shows it is trading alongside software stocks.

Software stocks tumbled this week after Anthropic released a new automation tool for its AI models targeting legal and other knowledge-focused workflows. Shares of Salesforce (CRM), Adobe (ADBE), and ServiceNow (NOW) lost 8%, 9%, and 13% respectively over the week, to name a few.

BTIG chief market technician Jonathan Krinsky also said bitcoin has been correlated with software stocks lately. “There’s some pretty compelling evidence both of those [bitcoin and software stocks] have put in tactical lows,” Krinsky said during an interview with CNBC. “[Bitcoin] bottomed last night right around $60,000 so I think that’s a pretty good level to trade against.”

“On the upside you really need to see it back above $73,000, that was the key breakdown level, that would kind of confirm a tradable low is certainly in,” he added.

The Trump administration has maintained a pro-crypto stance, which helped the price of bitcoin hit a new all-time high above $125,000 last year, before a correction kicked in.

Crypto World

Crypto.com CEO Is Going Into AI Agents With $70 Million

Crypto.com CEO Kris Marszalek is steering the company into the artificial intelligence sector, unveiling a platform for personalized AI agents.

A $70 million acquisition of the “ai.com” domain supports the initiative, which debuts February 8 during a Super Bowl LX commercial.

Sponsored

Sponsored

The launch represents a significant strategic pivot for Marszalek. His firm previously made headlines—and drew skepticism—for spending $700 million on naming rights for the Los Angeles arena formerly known as the Staples Center.

Nonetheless, the move signals a high-stakes capital commitment to the convergence of blockchain technology and generative AI.

According to the company, the new platform allows retail users to deploy “agentic” AI tools in under 60 seconds without technical coding knowledge.

These agents are designed to execute autonomous tasks, such as organizing workflows, sending messages, and managing cross-application projects.

The interface targets mainstream consumers, though Marszalek described the long-term vision as a “decentralized network” where billions of agents self-improve and share capabilities.

“Ai.com is on a mission to accelerate the arrival of AGI by building a decentralized network of autonomous, self-improving AI agents that perform real-world tasks for the good of humanity,” he stated.

Sponsored

Sponsored

Notably, this structure mirrors the distributed ethos of the cryptocurrency industry.

The company said agents will operate in a “dedicated secure environment” where data is encrypted with user-specific keys. This architecture ostensibly limits the platform’s access to personal information.

The move underscores a broader trend of crypto executives seeking new growth narratives as the digital asset market matures.

By launching with a Super Bowl spot, Marszalek is betting that mainstream appetite for automated personal assistants will outpace fatigue around crypto-adjacent projects.

The platform plans to roll out financial services integration and an agent marketplace in future updates.

This trajectory points toward a hybrid business model that blends subscription tiers with transaction-based economics.

However, the venture faces a steep climb.

The venture must compete in an increasingly crowded market dominated by well-capitalized incumbents such as OpenAI and Google.

Simultaneously, it faces the challenge of convincing users to trust a crypto-native firm with their intimate personal data.

Crypto World

As ‘Sell America’ market volatility rages on, look to your bonds

Amid recent debate over the so-called “Sell America” trade and capital rotating out of U.S. markets, foreign stocks have received most of the attention. But international bonds, especially emerging market bonds, have also been riding high.

“The best performing area in fixed income year to date, and also last year, was emerging markets,” said Joanna Gallegos, co-founder of fixed-income ETF company BondBloxx on this week’s CNBC “ETF Edge.”

As an example, the iShares JPMorgan USD Emerging Markets Bond ETF (EMB) generated over a 13% return in 2025. BondBloxx’s JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD) had a similar 2025.

Weakness in the U.S. dollar, concerns about the fiscal health of the U.S. at a time of high spending and deficits, and the investing impact of President Trump’s foreign policy, plus the recent performance trends, are all contributing to more interest from investors to diversify internationally.

But for Gallegos, it start with the currency and performance chasing rather than a view that the U.S. is losing favor as a market. “The dollar pressure is putting more of a view on non-U.S. assets,” Gallegos said. “I think people are just seeing the returns from last year and looking for a way to take advantage of those opportunities more so than anything else,” she said. “The U.S. trade is not going away,” she added.

The performance of the iShares JPMorgan USD Emerging Markets Bond ETF versus the iShares Core US Aggregate Bond ETF over the past five years.

Morningstar data for the month of January backs up the view that U.S. investors are not abandoning the domestic market, whether it is stocks or bonds being debated and even as more assets move overseas.

U.S. market ETFs brought in an estimated $156 billion of net inflows in January, which was the best January ever, according to Morningstar. But investors also added $51 billion in net positive flows to international equity ETFs, which was a monthly record for that category. And taxable bond ETFs popped, with $46 billion from investors in net inflows for the month, led by Vanguard Total Bond Market ETF (BND) and the Vanguard Intermediate-Term Corporate Bond ETF (VCIT).

Despite fears about a private credit bubble, the U.S. continues to offer “the strongest fixed income market,” according to Gallegos, and “the biggest opportunity set for the world to continue to invest in it.”

Investors are expanding their portfolios and adding new sources of return while keeping U.S. assets at the core. “I think we still see resilient economy,” Gallegos said, pointing to steady earnings and a strong corporate balance sheet. In the bond market, specifically, she said, “the yield curve looks like it’s steepening, behaving appropriately, with rates on the long end being higher than the rates on the shorter end.”

Todd Sohn, technical strategist at Strategas Securities, said on “ETF Edge” that the scale of potential change on the fixed-income side of the portfolio is even larger than what is happening with equity assets, but it is not necessarily an international-first story. Money market funds have dominated flows for the past few years, with “trillion in assets” sitting on the sidelines as cash accounts have generated decent returns with no risk. But as central bank interest rates begin to drift lower, Sohn says more capital will move into the credit markets and bonds. “That money is going to get deployed to fixed-income products,” he said.

Gallegos says investors no longer need to stretch as far for yield. She highlighted investment-grade credit, and in particular, investors seizing the opportunity to move “out on the rate spectrum to BBB,” where yields are higher but default risk remains historically low. And she emphasized that bonds are no longer solely a defensive tool. “Bonds are not just necessarily the safety part of your portfolio, but also the opportunity and the income set as well,” Gallegos said.

Top bond ETFs by assets

Crypto World

What Caused Bitcoin Crash? 3 Theories Behind BTC’s 40% Dip in a Month

Bitcoin (CRYPTO: BTC) has endured one of its steepest drawdowns in weeks, sinking more than 40% over the past month to a year-to-date low near $59,930 on Friday. The retreat leaves the asset roughly 50% off its October 2025 all-time high around $126,200. Market participants point to a mix of leverage, ETF-linked products, and shifting risk appetite as the accelerants behind the move. The episode has intensified scrutiny of the nexus between funding channels, hedging activity, and mining economics as liquidity tightens and option markets unwind.

Key takeaways

- Analysts highlight Asia-linked flow dynamics—including leveraged bets tied to Bitcoin ETFs and yen funding—as potential catalysts for the sell-off.

- Short-term risk to miners remains elevated, with BTC hovering near the $60k mark and the possibility of renewed pressure if the level fails to hold.

- A widely discussed theory posits that banks could have been forced to unwind exposure to structured notes tied to spot BTC ETFs, amplifying selling pressure during the slide.

- The mining sector is reportedly pivoting toward AI data-center workloads, contributing to hash-rate shifts and changing the economics of mining operations.

- Hash-rate indicators and production-cost data suggest mounting stress for some operators if prices stay depressed, particularly for producers with higher energy costs.

Tickers mentioned: $BTC, $IBIT, $SOL, $RIOT

Sentiment: Bearish

Price impact: Negative. The price collapse has heightened risk across mining cash flows and lenders’ hedging obligations, reinforcing a downside tilt.

Market context: The move unfolds amid thinning liquidity, ongoing ETF flow considerations, and macro risk sentiment that shape crypto pricing and funding conditions.

Why it matters

At its core, the current bout of volatility underscores how crypto price action remains tethered to leverage cycles and funding dynamics. If large holders and miners face balance-sheet stress as prices retreat, the resilience of BTC could hinge on liquidity restoration and the capacity of major players to manage hedges and collateral calls. The episode also highlights the growing integration between traditional finance instruments and crypto exposure—for example, ETF-linked notes and over-the-counter hedges—where the mechanics of delta-hedging can intensify price moves in fast-moving markets.

From a mining perspective, the evolving energy and capacity landscape matters for network security and long-term dynamics. Reports about miners reallocating capital toward AI data-center projects signal a shift in how hardware is deployed and priced into production costs. The tension between a falling price floor and rising or variable energy expenses can widen the gap between theoretical profitability and actual cash flow for operators. This has implications for hash-rate stability, miner incentives, and the broader health of BTC mining outside of bull-market phases.

On the regulatory and institutional front, the unfolding narrative intersects with how large banks and asset managers interact with crypto products. If organized hedging around spot BTC ETFs remains sizable, any further price shocks could trigger feedback loops that amplify volatility until markets reach a clearer equilibrium between funding costs, risk appetite, and crypto demand. The conversation around Morgan Stanley and other banks’ hedging behavior—whether tied to structured notes or other instruments—adds a layer of complexity to understanding who bears the cost of volatility and how liquidity is distributed during stress episodes.

What to watch next

- Bitcoin’s price behavior around the $60,000 level: does it defend the level, or does renewed downside pressure test nearby support?

- Hash-rate and mining economics: will energy costs and capital reallocation toward AI data centers reshape the mining landscape in the coming weeks?

- ETF flows and bank hedging: how do institutional exposures to BTC-linked products evolve, and what does that imply for liquidity during stress periods?

- Corporate pivots in mining: how are operators like Riot Platforms (RIOT) and others adjusting capital plans in response to price volatility?

- Macro and regulatory cues: what new developments could alter risk sentiment or the availability of liquidity to crypto markets?

Sources & verification

- BTC price level and price-action narrative tied to the week’s moves and the year-to-date low near $59,930, with reference to the BTC/USD daily chart from TradingView.

- Activity around BlackRock’s IBIT and related volume/option data cited as a trigger for stress and unwind in ETF-linked bets.

- Discussion of structured-note hedging and potential bank involvements, anchored to the Morgan Stanley product documentation and related regulatory filings.

- Hash-rate and mining-cost indicators, including the Hash Ribbons signal and underlying cost data for mining operations (electricity costs and net production expenditure).

- Company-level mining shifts and past activity, such as Riot Platforms’ December actions and IREN’s pivot to AI data-center deployments, as cited in related articles.

Bitcoin price reaction and miner vulnerabilities

Bitcoin (CRYPTO: BTC) has endured a rapid re-pricing as liquidity conditions tightened and carry trades unwound. After a run that had carried the asset close to $126,200 in October 2025, BTC retraced to around $59,930 by Friday, exposing a more than 40% drop from recent highs and placing the year-to-date performance in the red. The pullback comes amid a confluence of factors: patience in risk markets, sudden squeezes in leveraged bets, and the energy of ETF-linked products that amplify price movements when flows reverse. The narrative has centered on Asia-based players who had pursued aggressive bets on BTC appreciation using options tied to Bitcoin ETFs and financing through yen borrowings. As one participant described, this funding dynamic allowed bets to scale quickly, only to reverse with the worsening price trajectory.

The tension around ETF-linked products is exemplified by BlackRock’s IBIT discussions, where a surge in volume and options activity was observed on one of the largest days for the instrument. Parker White, COO and CIO of Nasdaq-listed DeFi Development Corp. (DFDV), noted that participants used yen-based funding to support bets on BTC and related assets, recycling capital across currencies in search of outsized gains. In the period in question, IBIT recorded about $10.7 billion in trading volume, roughly doubling typical activity, while approximately $900 million in options premium changed hands—an unusually energetic display given the broader price weakness. The price action across BTC and SOL in that session underscored how sensitive the market remains to funding-driven dynamics.

This was the highest volume day on $IBIT, ever, by a factor of nearly 2x, trading $10.7B today. Additionally, roughly $900M in options premiums were traded today, also the highest ever for IBIT. Given these facts and the way $BTC and $SOL traded down in lockstep today (normally…

— Parker (@TheOtherParker_) February 6, 2026

As BTC momentum faltered and yen-funding costs rose, those leveraged bets began to sour quickly. Lenders demanded more cash, and asset liquidations accelerated, reinforcing the downturn. The episode has fed into a broader conversation about how banks and market makers hedge exposures tied to crypto products. In particular, the idea that banks—potentially including Morgan Stanley—might have needed to liquidate Bitcoin or related positions to manage structured-note exposure tied to spot BTC ETFs has gained traction among observers who see delta-hedging as a potential catalyst for negative gamma risk. When prices fall sharply, dealers must hedge by selling underlying BTC or futures, which can accelerate price declines in a feedback loop.

Beyond the banking-hedge narrative, some market observers have pointed to the mining sector’s evolving strategy as a factor shaping price dynamics. A school of thought argues that an ongoing mining exodus toward AI data-center capacity could reduce BTC hashing power at a pace that complicates mining economics during a prolonged bear phase. Judge Gibson emphasized this point in a recent post on X, noting that AI demand is already drawing equipment away from pure BTC mining toward data-center deployments. Riot Platforms (NASDAQ: RIOT) confirmed a broader pivot toward AI data-center infrastructure in December 2025, while IREN and other miners have reported similar strategic shifts. Hash-rate data, including the Hash Ribbons indicator, show a 30-day moving average slipping below the 60-day line, a setup historically associated with stress on miner margins and potential capitulation risk.

Current production-cost estimates place the breakeven edge for miners in the vicinity of BTC’s price level. The latest figures show the average electricity cost to mine a single BTC around $58,160, with net production expenditure near $72,700. If BTC’s price remains anchored below the $60,000 mark, some mining operations could face true financial strain, forcing balance-sheet adjustments or, in extreme cases, asset sales to cover operating costs. Meanwhile, the long-term holder cohort appears to be pruning exposure, with wallets containing 10 to 10,000 BTC representing a smaller share of circulating supply than in nine months past, a sign that large holders may be reducing positions amid heightened volatility.

The market remains in a fragile balance, where price levels and mining economics are inextricably linked to funding costs, energy prices, and macro risk appetite. As BTC navigates this terrain, the outcome will likely hinge on a combination of liquidity restoration, continued mining-capacity realignments, and the ability of institutional actors to manage risk without adding to volatility. If the price holds above critical thresholds, miners may regain some breathing room; if not, the financial stress could intensify across the ecosystem, with knock-on effects for crypto lending, derivatives, and the broader risk-on appetite that has defined the asset class in recent years.

//platform.twitter.com/widgets.js

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech21 hours ago

Tech21 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports13 hours ago

Sports13 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports3 hours ago

Former Viking Enters Hall of Fame

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 day ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat1 day ago

NewsBeat1 day agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat14 hours ago

NewsBeat14 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”