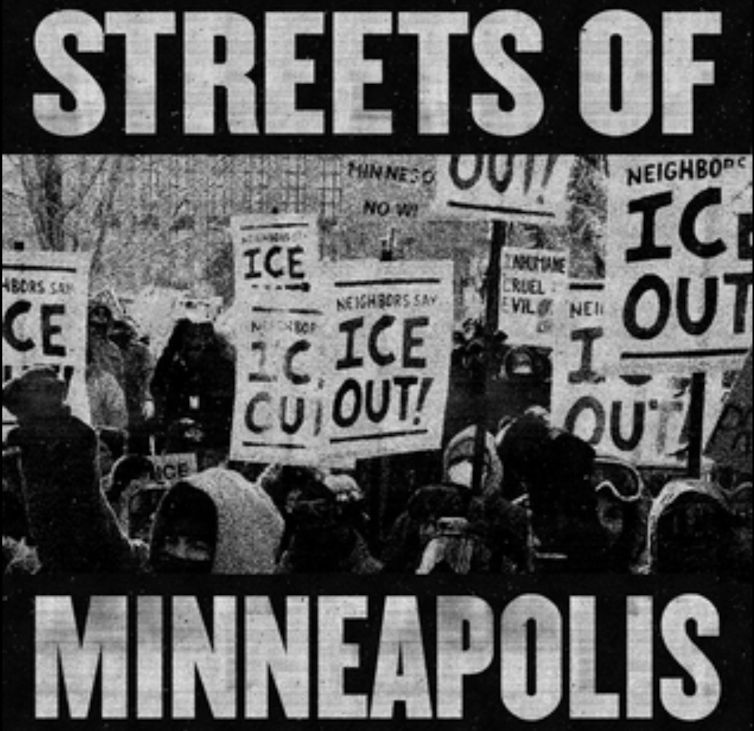

In moments of creeping authoritarianism, culture sometimes reacts faster than institutions. Bruce Springsteen’s rush-released song in the wake of killings of two Minneapolis residents by agents of US Immigration and Customs Enforcement (ICE) was not just an act of commentary, but a deliberate intervention in public discourse.

Streets of Minneapolis operates as an alarm signal, its directness placing it in the public square, where naming and narration carry political weight. What also distinguishes Streets of Minneapolis is not just its fidelity to the tradition of the protest song, but its mode of circulation as a rapid response in the digital age.

This is Springsteen at his most declarative, operating not in the interior emotional space of the confessional singer-songwriter but in the outward-facing register of public address. His specificity – naming people, streets, organisations and the “winter of ’26” – marks the song as political communication rather than personal reflection.

His framing of the killings involves a shift from individual tragedies towards a shared civic injury. The repeated invocation of “our Minneapolis” performs rhetorical work, translating private loss into a shared collective experience and situating it as a wider public concern that extends beyond the city itself.

That movement from the individual to the collective places Streets of Minneapolis within a wider lineage of protest song, creating narratives out of real events so they can be remembered and acted upon. In this sense, the song does not simply respond to politics, but actively participates in political thought and action. “We’ll take a stand” is not a metaphorical flourish but a direct appeal.

Springsteen makes this lineage explicit through the early acoustic section, replete with insistent harmonica, and a vocal delivery and intonation that consciously signal Bob Dylan’s early protest music. Structurally, too, Springsteen’s call to action echoes Dylan works like The Lonesome Death of Hattie Carroll – moral force emerging through the accumulation of detail and reportage.

While Dylan’s later career moved away from direct protest toward the personal and allegorical, Springsteen here leans into that more direct mode of storytelling. It follows the protest song logic whereby narration becomes an engine of persuasion, reshaping contemporary events into historical record.

The reference carries added resonance given Dylan’s Minnesota roots, serving as a reminder that place, memory and music have long been intertwined in American protest culture.

Springsteen quotes himself, too, both musically and thematically, with a clear nod in the title to Streets of Philadelphia and a closing musical call-back to Born in the USA, its own tub-thumping aesthetic belying the portrait of a disillusioned Vietnam veteran in the lyrics.

These are not just nostalgic gestures but also markers of continuity. By folding earlier works into this new song, he situates the current moment within a longer trajectory of American struggle, via musical linkages between himself and Dylan – and Woody Guthrie before that.

Zuma Press / Alamy

Digital circulation and rapid response

Where protest songs once depended on live performance, radio play and physical distribution, they now travel through platforms. Within hours of release, Streets of Minneapolis was embedded in news coverage, shared across social media and dissected in comment threads and reaction videos.

Listeners encounter it not only as a song but as a reference point to be reposted, quoted, argued or aligned with. In that process, its energy comes less from a single, fixed message than from how it is used, repeated and spread through ongoing conversations.

This dynamic places protest music alongside other contemporary forms of political communication, particularly those shaped by meme culture and the logic of the online platforms through which much creative work is experienced. Short excerpts, lyrical fragments and recognisable musical cues circulate easily across feeds, videos and posts, where they are paired with captions, visuals and commentary.

In recent election cycles, for instance, music has functioned less as a background soundtrack or simple celebrity endorsement than as material that can be repurposed – looped in clips, used ironically, set against images, or mobilised to signal approval or dissent. In this environment, music functions as a part of the communicative infrastructure, enabling participation as much as persuasion.

Wikipedia

This also comes amid growing political conflict around culture itself. While there is a longer history of public disputes between the Trump administrations and the artistic community, these tensions have recently escalated into direct interventions, including the cancellation of shows and the temporary closure of the Kennedy Center, pointing to an environment in which music and performance are increasingly politicised and directly entangled with power.

Seen in this context, Streets of Minneapolis is both traditional and distinctly contemporary. It draws on the narrative starkness and moral framing of folk protest, but gains traction through digital circulation. The killings in Minneapolis of Renée Good and Alex Pretti were the immediate catalyst, but the song’s significance lies in how it carries that moment forward.

As authoritarian power shifts gear, from creeping practice to open and violent assertion, the protest song adjusts its form and reach. Streets of Minneapolis reflects that transition, drawing on Springsteen’s longstanding role as a public narrator of American life. It can’t halt state action, but it can help to prevent it from going unnoticed and unrecorded.

Looking for something good? Cut through the noise with a carefully curated selection of the latest releases, live events and exhibitions, straight to your inbox every fortnight, on Fridays. Sign up here.