Crypto World

Why is Hybrid tokenization model gaining traction in 2026?

Tokenization has rapidly evolved from a niche blockchain experiment into a strategic enabler for enterprises seeking greater liquidity, operational efficiency, and transparency across asset classes. However, as enterprises move beyond proof-of-concept initiatives, it has become increasingly clear that early, fully on-chain tokenization models are not designed to meet real-world enterprise requirements.

Enterprises operate within complex ecosystems defined by regulatory oversight, data privacy mandates, legacy infrastructure, and multi-jurisdictional compliance obligations. While public blockchain networks offer decentralization and transparency, they often lack the governance controls enterprises require. Conversely, fully private systems limit interoperability and long-term scalability.

This gap is being decisively filled by hybrid tokenization, a pragmatic and future-ready framework that blends blockchain innovation with enterprise-grade control. Hybrid models are emerging as the preferred foundation for enterprise asset tokenization, enabling organizations to unlock tokenized value without compromising compliance, privacy, or operational stability.

What Is Enterprise Asset Tokenization and Why Are Enterprises Re-Evaluating Tokenization Models in 2026?

Enterprise asset tokenization is the practice of using tokens built on blockchain technology to digitally represent ownership, rights and economic value of an enterprise’s asset[s] while embedding the governance, compliance, and operational controls that large organizations require.

Assets that can be tokenized include but are not limited to financial securities; portfolios of real estate; interests in private equity; commodities; infrastructure-related assets; intellectual property; and instruments for sharing revenue.

Numerous large structural shifts are influencing how organizations view and approach the tokenization of their assets:

- The regulatory landscape has matured. As such, regulators are now requiring that asset tokenization projects be auditable and provide investor protection through jurisdictional enforcement rather than being experimental efforts.

- Institutional participation has increased in the tokenization of assets. Institutional investors are establishing higher standards for how organizations should protect the confidentiality of their data, accurately report their results and mitigate risk.

- There has been an expansion of operational scale; enterprises have progressed from conducting small pilots of tokenizing their assets to developing and implementing broad-based strategies for tokenizing multiple types of assets in multiple markets.

- Enterprises can no longer avoid integrating their legacy systems and other operational platforms into their tokenization platforms. Tokenizing assets and developing tokenized asset-based products will require seamless integration between the tokenization platform and legacy ERP systems, the provider of custodial services, banks, and systems for complying with regulations.

These developments are causing organizations to rethink their evaluation of enterprise tokenization models by prioritizing those models that align with how they operate on a day-to-day basis rather than those that require organizations to alter their methods of operation.

Evaluate whether Hybrid Tokenization fits your Enterprise Roadmap

What Is a Hybrid Tokenization Model?

A hybrid tokenization model is an architectural approach that strategically distributes tokenization functions across blockchain networks and off-chain enterprise systems. Instead of forcing all processes onto a decentralized ledger, hybrid models apply blockchain selectively—where it delivers the greatest value—while retaining centralized control where required.

The following three components are integral to the hybrid tokenization architectural:

- A blockchain layer for token issuance, ownership tracking, and transaction immutability

- An off-chain enterprise layer for compliance, identity management, legal documentation, and sensitive data

- Middleware that synchronizes on-chain events with off-chain business logic and enterprise workflows

The Hybrid Tokenization Models provide a method for Enterprises to maximize the use of Blockchain technology while minimizing their exposure to regulatory and operational risks.

How Hybrid Tokenization Architecture Combines On-Chain and Off-Chain Tokenization

The success of tokenization of hybrid assets is dependent upon how well the on-chain and off-chain tokenization functions are coordinated. Each layer has been specifically designed to carry out the operations that will work most effectively in that environment.

1. On-chain Tokenization Layer

The on-chain tokenization layer has responsibility for activities that can be carried out in a decentralized, immutable, and automated manner:

- Issuing Tokens and Managing Their Life Cycle

Tokens will be generated on chain as a method of providing a cryptographic proof of ownership of the asset they represent. When life cycle events occur (minting, burning, freezing, or unlocking tokens), they are executed in an open and transparent manner to ensure that the integrity of the asset is maintained.

- Records of Transfer of Ownership

All transfers of the token from one holder to another will be recorded on the blockchain, resulting in an unalterable record of who owns an asset. The result is a reliable record for enterprises, investors & regulators to rely upon to establish provenance of the asset and validate any corresponding transactions.

Smart contracts provide an automated means of enforcing all contractual obligations (e.g., transfer restrictions, vesting schedules, dividend distributions, redemption of asset rights). As a result of using smart contract execution, manual interventions can be reduced, reducing the likelihood of operational errors. All contractual obligations will be consistently enforced.

Auditability in real time is possible due to the recordkeeping of the blockchain. Regulators and internal compliance departments can verify the validity of transactions with no reliance on reconciled reports, thereby creating far greater trust and transparency with all parties involved.

2. Off-chain enterprise layer

The off-chain layer provides functionality that requires privacy, flexibility, and regulatory discretion.

- KYC/AML Verification & Investor Accreditation

Identity verification in different jurisdictions has different processes and is continuously changing. By managing these workflows off-chain, businesses can quickly adapt their compliance logic to accommodate changing regulations and apply eligibility checks before participating on-chain.

- Legal Agreements & Contractual Governance

Ownership of assets is determined by legal documentation (prospectuses, shareholder agreements, and regulatory filings). Off-chain storage of these documents provides the ability to keep them updated and still be cryptographically linked to the on-chain token.

- Asset Valuation, Reporting, and Metadata Management

Many types of assets will need to be valued periodically, sometimes using third-party data feeds or human intervention. An off-chain system can facilitate accurate financial reporting and mitigate the risk of unnecessary oracle dependency.

- Integration to Enterprise Systems

Hybrid architectures facilitate the integration of ERP systems, accounting packages, custodial services and banking infrastructure. This enables tokenization to build on existing operations and not disrupt them.

Tokenization Models Comparison: Public, Private, and Hybrid Enterprise Tokenization Models

A comprehensive tokenization models comparison highlights why hybrid approaches are increasingly favored by enterprises.

Public tokenization models

Public models operate entirely on open blockchains, offering transparency and composability. However, they present challenges such as:

- Exposure of sensitive transaction data

- Limited jurisdictional enforcement capabilities

- Unpredictable transaction costs and network congestion

- Governance dependency on public network consensus

While suitable for open ecosystems, public-only models struggle to meet enterprise governance and compliance standards.

Private tokenization models

Private models emphasize control and confidentiality but introduce other limitations:

- Restricted interoperability and liquidity

- Heavy reliance on centralized administrators

- Limited external auditability

- Reduced long-term flexibility

These constraints can hinder scalability and investor confidence.

Hybrid enterprise tokenization models

Hybrid models combine the strengths of both approaches:

- Selective transparency with controlled access

- Built-in compliance and governance mechanisms

- Scalable participation across markets and asset classes

- Future adaptability to regulatory and technological change

For enterprises pursuing long-term digital asset strategies, hybrid models offer the most resilient foundation.

Why Hybrid Tokenization Will Define Enterprise Asset Strategies

As enterprises consider tokenization as long-term infrastructure, decision-makers are increasingly prioritizing frameworks that align with governance, compliance, and scalability. In this shift, the hybrid tokenization model is emerging as the most practical and future-ready choice for enterprise asset tokenization.

Key factors contributing to the adoption of hybrid tokenization by enterprises:

- Hybrid tokenization architecture balances decentralization with enterprise governance

Unlike fully public systems, hybrid tokenization architecture allows enterprises to use blockchain for immutable ownership and auditability while retaining off-chain control over compliance, identity, and legal enforcement—an essential requirement for regulated enterprise environments.

- Supports regulatory-ready enterprise tokenization models

Enterprise tokenization models will enable the enterprise to manage compliance regulations, jurisdictional limitations, and reporting procedures off-chain, therefore enabling the enterprise to update its compliance regulations more easily and with fewer disruptions than if using a fully decentralized architecture.

- Optimized use of on-chain and off-chain tokenization layers

A hybrid implementation allows an enterprise to maximize the benefits of implementing on-chain and off-chain tokenization while providing transparency, as appropriate, and confidentiality as needed on its blockchain infrastructure.

- Delivers superior results in tokenization models comparison

In any realistic tokenization models comparison, hybrid tokenization approaches often surpass completely public and completely private tokenization approaches by delivering selective transparency, controlled access, and long-term scalability—critical factors in determining whether enterprises will adopt tokenized assets.

- Enables scalable hybrid asset tokenization across multiple asset classes

With hybrid asset tokenization, enterprises can tokenize a variety of assets (e.g., securities, funds, real estate, RWAs) over a single shared blockchain layer while applying customized off-chain governance, valuation, and compliance workflows for each asset type.

- Reduces cost volatility and operational risk at scale

Enterprises using fully public or private on-chain systems experience significant volatility in fees due to fluctuating network congestion and stable fees. In contrast, hybrid tokenization models move the majority of high-volume and compliance-centric processes off-chain and deliver a more predictable level of performance and cost savings as a result of this approach.

- Strengthens institutional trust and accelerates market participation

Institutional investors require a high level of trust based upon the governance and enforceability of how assets are tokenized. Hybrid frameworks provide on-chain transparency coupled with off-chain legal and compliance controls to create a more credible and investable enterprise asset tokenization.

- Best implemented with an experienced asset tokenization development company

In order to implement hybrid tokenization solutions, it is important to partner with an experienced asset tokenization development company with expertise in blockchain, compliance, and enterprise integration so that the architecture supports legislative and operational realities.

Explore Enterprise-Ready Hybrid Tokenization

A Strategic Enterprise Outlook

With more organizations starting to implement their tokenization initiatives instead of merely experimenting with these new technologies as they come to market, hybrid tokenization models are clearly proving to be one of the leading approaches for enterprise asset tokenization due to their ability to combine on-chain and off-chain tokenization in a manner that ensures transparency, governance, and flexibility to operate in various asset classes and jurisdictions.

Of all the various tokenization models being evaluated today, hybrid tokenization models stand out because they achieve a proper balance between innovation and control; thus, providing enterprises with the means to execute their long-term tokenization strategy through 2026.

Organizations cannot achieve hybrid tokenization at scale without deep technical and regulatory knowledge. As an established and reliable asset tokenization development company, Antier is able to assist these enterprises by not only providing the asset tokenization development services and expertise needed to design and deploy compliant hybrid tokenization architectures but also by providing the blockchain, Web3, and enterprise integration capabilities necessary to create tokenization platforms that will meet future regulatory requirements in an efficient and secure manner.

Crypto World

Changpeng Zhao fires back on X, says traders must own their risk, not blame Binance

Changpeng Zhao uses X to slam scapegoating, telling traders to own their risk as Bitcoin, Ethereum and BNB prices slide across the market.

Summary

- Changpeng Zhao says critics “make stuff up” about Binance and must “take responsibility” for their own trades.

- He argues compliance flags and police cases, not social media outrage, decide when funds are frozen or released.

- Community voices frame the backlash as noise while BTC, ETH and BNB trade lower, testing sentiment around Binance’s ecosystem.

Binance’s co‑founder is done playing scapegoat. On X, Changpeng “CZ” Zhao fired back at critics, insisting that users—and the media—have to stop outsourcing responsibility for their trades.

CZ’s message: stop blaming Binance

“Not saying we are perfect, but at this point, smart people actually triple check any negative ‘news’ on Binance. They are just making stuff up,” CZ wrote on X, adding that “words like ‘blame’ are designed to only attract people who are unwilling to take responsibility for their own actions.” The post, viewed more than 36,000 times within hours, directly challenges a familiar reflex in crypto: when prices fall, blame the exchange.

He doubled down in replies. To a user complaining that Tether’s Paolo Ardoino should “unfreeze my wallet,” CZ replied, “I don’t know any details of your case with USDT of course… I’d imagine your funds was somehow related to a police case, or it was flagged (hopefully incorrectly) by some AML tool. Give it some time, it should be resolved properly.” The subtext is brutal: enforcement flags and compliance tools—not Twitter outrage—decide when funds move.

Community reaction: consolidation under pressure

Supporters framed the storm as a stress test the Binance ecosystem can absorb. “Nothing is perfect anyway. Frustration needs a target. They pick the number 1. And ‘quadruple check’ negative comments is a must,” wrote user @Spigg1115. Another BNB community account argued, “It would be better if everyone spent their time building a stronger, higher-quality crypto world that can reach all 8 billion people on this planet. They are wasting their time for nothing.” As one trader put it bluntly: “Red candles bring creative headlines.”

Price tape: reality check in numbers

While the blame game rages, the market is delivering its own verdict. Bitcoin (BTC) trades around $70,096, down about 0.63% over the last 24 hours and roughly 27.4% below its level a year ago. Ethereum (ETH) changes hands near $2,104, slipping about 2% over the same period. Binance’s own BNB (BNB) token is priced around $636, with a 24‑hour range between roughly $617 and $645 and recent highs above $640.

Crypto World

I’m not confident we hit a true capitulation in bitcoin, derivatives expert says

About a week ago, bitcoin dropped more than 10% in a day to around $60,000 before rebounding to $70,000 in recent days. The question is, did the slide mark “capitulation,” when holders panic-sell at a loss, exhaust bearish pressure and set the stage for a new bull run?

The futures market says no, suggesting there’s scope for another leg lower, according to Amberdata’s director of derivatives, Greg Magadini.

“[The] lack of ‘reaction’ in the futures basis doesn’t make me confident we hit a true CAPITULATION moment,” Magadini said in a market note Monday.

Magadini is referring to how futures typically trade in relation to the spot price during bearish trends and capitulation phases.

Futures are standardised derivative contracts to buy or sell an underlying asset, like bitcoin, at a set price on a future date. Traders use futures to bet on price direction, buying contracts when they expect a rally or shorting when they anticipate a decline, without actually owning the asset itself.

The price difference, or basis, between futures and spot markets reveals market sentiment and trader positioning. When futures trade at a significant premium to spot prices, it signals bullish optimism among investors. Conversely, a discount indicates bearish pressure.

Historically, bitcoin bear markets have tended to bottom out, with standard futures and perpetual futures trading at significant discounts to spot on major exchanges. These massive discounts represented capitulation and mark the final bear-market flush.

Last week, however, futures slipped into a discount only for a short time.

“Although the 90-day basis dropped lower on each leg down for BTC, these moves barely ranged -100bps. Today, fixed basis remains around 4% for BTC (inline with risk-free treasury yields),” Magadini said.

Compare that with the end of the 2022 bear market, when the 90-day futures traded at a 9% discount as the bitcoin price bottomed out below 20,000. So, if history is a guide, bitcoin could see another leg lower where futures traders capitulate, pushing prices into a steep discount relative to the spot price.

Bitcoin recently changed hands near $69,000, a 1% drop since midnight UTC, according to CoinDesk data.

Crypto World

BitMine’s Tom Lee Makes Bold Ethereum Price Prediction for 2026

BitMine Immersion Technologies purchased more than 40,000 Ethereum (ETH) in a single day, continuing its aggressive accumulation strategy even as unrealized losses rise to over $7 billion.

The latest accumulation comes as Ethereum continues to trend downwards, with prices down approximately 62% from 2025 highs. Despite this, BitMine Chairman Tom Lee has expressed confidence in a potential V-shaped recovery for Ethereum.

Sponsored

BitMine Adds Over 40,000 ETH to Its Treasury

In a recent press release, BitMine disclosed that it acquired 40,613 ETH last week. As of February 8, 2026, at 3:00 pm ET, the company’s total Ethereum holdings stood at 4.325 million.

The announcement appeared to boost investor sentiment. BitMine’s stock, BMNR, closed at $21.45 on February 9, marking a 4.79% increase by the end of the trading session.

BitMine’s accumulation did not stop there. On-chain analytics platform Lookonchain reported additional Ethereum purchases after the disclosure.

According to the data, the firm first acquired 20,000 ETH through FalconX, followed by another 20,000 ETH, worth approximately $42.3 million, via BitGo.

Sponsored

“Today alone, it has bought 40,000 ETH ($83.4 million),” Lookonchain wrote.

ETH Declines Sharply as BitMine Treats Pullback as Entry Point

The continued buying suggests that BitMine remains committed to expanding its Ethereum treasury, even amid market uncertainty. According to data from BeInCrypto Markets, ETH has dropped 13.2% over the past week.

At the time of writing, the second-largest cryptocurrency traded at $2,012, down 3.28% over the past day.

Sponsored

Lee suggested that the company views the price pullback as a strategic buying opportunity, citing improving network fundamentals.

He also noted network strength despite falling prices. Ethereum daily transactions hit 2.5 million and active addresses reached 1 million in 2026, as stated in BitMine’s official announcement. These figures imply rising adoption regardless of market swings.

“In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance,” he said.

Sponsored

Furthermore, Lee pointed to Ethereum’s historical price behavior to support his optimism. Since 2018, ETH has experienced 8 separate declines of 50% or more from recent highs.

He highlighted a similar pattern in 2025, when Ethereum fell by 64% between January and March before rallying sharply later in the year. At the time, it surged from approximately $1,600 to nearly $5,000.

According to Lee, Ethereum has historically staged V-shaped recoveries following major downturns. He stated that such rebounds occurred after each of the previous 8 drawdowns. Based on this trend, he expects a comparable recovery to unfold in 2026.

“The best investment opportunities in crypto have presented themselves after declines. Think back to 2025, the single best entry points in crypto occurred after markets fell sharply due to tariff concerns,” Lee stated.

Whether BitMine’s aggressive Ethereum bet will pay off remains uncertain for now. Its ability to withstand market weakness, alongside strong staking revenue, could generate significant advantages if a V-shaped recovery appears. But ongoing price declines or a prolonged market slump may further challenge BitMine’s strategy.

Crypto World

Crypto Token Development & ICO Software Development Guide

If you are reading this, you are not looking to launch “just another token.” You are building a serious digital asset venture with real fundraising goals and long-term ambition. This guide was written for founders who want clarity before committing capital, time, and reputation. It breaks down how crypto token development should be approached when the end goal is investor trust, regulatory alignment, and sustainable fundraising. By following this roadmap, you learn how to:

- Design a crypto business model that investors can evaluate and trust

- Build a secure, scalable token infrastructure that passes audits and due diligence

- Prepare your project for regulatory and institutional review

- Structure an ICO that attracts quality investors instead of short-term speculators

- Deploy professional fundraising platforms that reduce operational risk

- Manage capital responsibly and protect long-term value after fundraising

More importantly, this guide shows you how to think like your future investors. You now understand what decision-makers look for before backing a project, how risks are evaluated, and why execution quality determines fundraising outcomes. Instead of guessing, experimenting, or relying on hype, you have a structured framework to move from idea to investable venture with confidence. If your goal is serious capital, long-term credibility, and scalable growth, this is the foundation you build on.

Understanding the Foundation of Token-Based Business Models

Before writing code, founders must define how their project creates real value. A fundable crypto business model answers five critical questions:

- What problem does the token solve?

- Who are the primary users?

- How does the ecosystem generate revenue?

- Why will users hold or use the token?

- How does demand scale over time?

Professional token development begins with aligning token utility to business outcomes. Tokens should support governance, access, rewards, or infrastructure, rather than exist only for speculation. Investors prioritize projects where token economics reflect long-term platform growth. Without a strong business model, even technically sound projects struggle to raise capital. Weak fundamentals often lead to low investor confidence and poor long-term adoption.

At this stage, founders should also analyze competitors, market size, and regulatory exposure. A well-defined economic foundation increases investor confidence and reduces the need for future pivots. Many teams also rely on structured Token Development Services to validate their models and ensure that business strategy, technology, and compliance remain aligned from the start.

Check If Your Project Is Investor-Ready

Planning Your Cryptocurrency Before Writing Code

Once the business model is clear, development begins. Building a reliable token requires structured technical planning and disciplined execution. This is where professional token development services play a critical role in translating strategy into a secure, scalable infrastructure that supports long-term growth.

At this stage, founders must focus on building systems that are not only functional but also resilient under real-world usage and investor scrutiny. Key development components include:

1. Token Architecture

- Supply structure

- Issuance model

- Burn or inflation controls

- Governance logic

- Reserve management

A well-designed token architecture ensures that supply dynamics remain predictable and transparent. It also prevents excessive dilution and protects early investors.

2. Smart Contracts

- Modular design

- Upgrade mechanisms

- Emergency controls

- Treasury management

- Access permissions

Smart contracts form the operational backbone of your cryptocurrency. They must be written with security, flexibility, and compliance in mind. Poorly written contracts often become long-term liabilities.

3. Infrastructure

- Testnet deployment

- Integration pipelines

- Gas optimization

- Performance testing

- Monitoring systems

Robust infrastructure allows teams to identify weaknesses early and resolve them before public deployment. Testing environments are essential for validating transaction logic and platform stability. High-quality crypto token development ensures that contracts are audit-ready, scalable, and aligned with regulatory standards. It also improves interoperability with exchanges, wallets, and third-party platforms.

Security must be embedded from day one. Weak contracts expose projects to exploits, legal risk, and reputational damage, often ending fundraising efforts before they begin. This is why many serious founders partner with an experienced token development company that follows industry-standard security practices and formal audit processes. Strong technical foundations signal professionalism, reduce operational risk, and significantly improve investor confidence.

How Can You Prepare Your Cryptocurrency for Legal and Investor Approval?

After technical development, the next challenge is building legal credibility and investor trust through strong compliance systems and transparent operations. Before raising funds, projects must demonstrate full regulatory and operational readiness, including:

- Jurisdiction analysis and token classification reviews to ensure alignment with local securities and digital asset regulations.

- KYC and AML system integration to verify investor identity and prevent regulatory violations.

- Data protection and privacy compliance frameworks to safeguard user and investor information.

- Formal governance documentation defining decision-making authority and operational accountability.

Partnering with a reputable crypto token development company helps founders design compliant infrastructures that meet regulatory and institutional expectations. Investor approval depends on transparent documentation and verifiable disclosures, including:

- Legal opinions and independent audit reports to validate technical and regulatory integrity.

- Detailed whitepapers and risk disclosures outlining project structure, limitations, and obligations.

- Clearly defined treasury management policies to ensure responsible allocation and reporting of funds.

- Ongoing compliance monitoring to adapt to evolving regulatory requirements.

- Projects that delay legal preparation risk exchange listing delays, frozen assets, and enforcement actions.

In today’s market, regulatory readiness is a core fundraising requirement and a foundation of long-term investor confidence. The more regulatory frameworks your crypto complies with, the broader your global fundraising and growth opportunities become.

How Do You Structure and Launch a Successful ICO Token Sale?

Once your cryptocurrency is secure and compliant, the focus shifts from development to structured fundraising execution.

1. Fundraising Readiness

Professional ICO token development ensures that your token sale is transparent, scalable, and legally aligned with investor and exchange expectations.

2. Sale Phases

A successful ICO follows clearly defined fundraising stages to manage valuation and participation:

- Private rounds for early strategic investors

- Strategic rounds for institutional partners

- Public sales for community participation

3. Allocation Design

Balanced token allocation protects long-term value and investor confidence:

- Team vesting schedules to prevent early sell-offs

- Investor lockup periods to stabilize liquidity

- Ecosystem reserves to support sustainable growth

Plan Your ICO with Fundraising Experts

4. Pricing Strategy

Well-structured pricing models reflect market demand and project maturity:

- Fixed pricing for predictable valuation

- Dynamic valuation based on participation levels

- Demand-based tiers to incentivize early contributors

5. Investor Protection

Strong protection mechanisms reinforce trust and operational integrity:

- Refund logic to safeguard participant funds

- Oversubscription controls to manage excess demand.

- Allocation audits to ensure fair distribution

6. Execution Reliability

An experienced ICO token development company ensures that fundraising systems perform reliably under high transaction volumes and peak market activity. When these elements work together, token sales run smoothly, investor confidence remains strong, and projects build lasting credibility with exchanges and institutional partners.

What Platforms and Tools Are Best for Running a Secure ICO?

Modern ICOs require enterprise-grade technology that can handle high transaction volumes, strict compliance requirements, and real-time investor interactions. A professional ICO software development partner provides the infrastructure needed to manage fundraising securely, transparently, and at scale. It ensures that every transaction, allocation, and report remains accurate throughout the fundraising lifecycle.

At this stage, founders must prioritize system reliability, data security, and regulatory compatibility to avoid operational disruptions during live token sales. Core platform components include:

1. Investor Dashboard

- Wallet connectivity

- Contribution tracking

- Vesting overview

- Claim management

- Transaction history

The investor dashboard serves as the primary interface between participants and the fundraising platform. A clean, intuitive design improves trust and reduces support overhead.

2. Admin Console

- Sale configuration

- Compliance controls

- Allocation management

- Reporting systems

- Access permissions

The administrative console allows founders to manage fundraising operations efficiently while maintaining transparency and auditability.

3. Payment Layer

- Multi-chain support

- Stable coin acceptance

- Automated reconciliation

- Fiat gateway integration

- Liquidity routing

A robust payment layer ensures smooth capital inflows across multiple networks and currencies. It also simplifies financial reporting and treasury management. To accelerate deployment, many founders adopt white label ICO development solutions. These pre-tested frameworks reduce time-to-market while maintaining strong security standards and operational reliability.

When combined with tailored white label development, teams can customize branding, workflows, analytics, and third-party integrations without rebuilding core systems from scratch. The right platform improves investor experience, strengthens compliance posture, and significantly reduces operational risk during high-pressure fundraising campaigns.

How Do You Manage, Scale, and Protect Value After an ICO?

After an ICO, founders must shift immediately from fundraising mode to institutional-grade execution. This means implementing strict treasury governance, milestone-based capital deployment, and board-level financial oversight. Many teams continue working with their Token development company to maintain system security, upgrade infrastructure, and ensure long-term technical stability. Funds should be allocated against product development, compliance expansion, and market penetration objectives, with clear accountability at every stage. Regular investor briefings, third-party audits, and transparent performance reporting are essential to sustaining credibility with strategic backers and exchanges.

Scaling successfully requires more than feature releases. Leadership teams must focus on building defensible market positions through enterprise partnerships, regulatory alignment, and ecosystem integration. At the same time, liquidity management, risk controls, and community governance structures must be strengthened to protect long-term token value. Projects that maintain close coordination with experienced development and compliance partners are better positioned to adapt to market shifts and regulatory changes. Teams that treat post-ICO operations as a regulated financial enterprise, rather than a startup experiment, are the ones that attract institutional capital and achieve durable growth.

Plan Your ICO with Fundraising Experts

Conclusion: Build First, Raise Second, Scale Third

Great ideas alone do not raise capital. Execution does. Successful founders build secure products, follow regulatory frameworks, and launch fundraising campaigns with precision. This is where Antier becomes your competitive advantage. As a full-cycle token development company, Antier helps founders design strong token ecosystems, deploy compliant ICO platforms, and prepare projects for serious investor scrutiny. Every solution is built for scalability, transparency, and long-term value creation. With Antier, you move faster without sacrificing credibility. If you are preparing for fundraising in the next 1 to 2 months, now is the time to partner strategically.

Get your token and ICO strategy reviewed by Antier’s experts. Position your project for confident investor participation.

Frequently Asked Questions

01. What is the purpose of this guide for founders in the crypto space?

This guide aims to provide clarity and a structured roadmap for founders looking to build a serious digital asset venture, helping them design a viable business model, prepare for regulatory review, and attract quality investors.

02. What are the five critical questions a fundable crypto business model should answer?

A fundable crypto business model should address what problem the token solves, who the primary users are, how the ecosystem generates revenue, why users will hold or use the token, and how demand will scale over time.

03. Why is it important for tokens to have utility beyond speculation?

Tokens should support governance, access, rewards, or infrastructure to align with long-term platform growth, as investors prioritize projects with strong token economics, which enhances investor confidence and adoption.

Crypto World

Ethereum Adopts Zero-Knowledge Proof Validation in 2026 L1-zkEVM Roadmap Shift

TLDR:

- Ethereum EIP-8025 allows validators to verify blocks using ZK proofs instead of re-executing transactions

- zkAttesters can sync in minutes without holding execution layer state or running full EL clients

- The 3-of-5 proof threshold preserves client diversity while enabling proof-based block validation

- ePBS extends proving window to 6-9 seconds, making real-time proof generation feasible for L1-zkEVM

Ethereum is implementing a major architectural change in block validation, transitioning from transaction re-execution to zero-knowledge proof verification.

The L1-zkEVM 2026 roadmap introduces EIP-8025, which enables validators to confirm blocks through cryptographic proofs rather than running full execution clients.

This optional framework allows zkAttesters to verify blocks without maintaining execution layer state. The first L1-zkEVM workshop is set for February 11, 2026, at 15:00 UTC, marking the formal start of this development phase.

Technical Framework for Proof-Based Validation

The new validation pipeline operates through several coordinated steps. Execution layer clients generate an ExecutionWitness containing all necessary data for block validation without full state storage.

A standardized guest program then processes this witness to validate state transitions. Subsequently, a zkVM executes the program while a prover creates proof of correct execution. Consensus layer clients verify these proofs instead of calling execution clients to repeat computations.

Ethereum Foundation member ladislaus.eth described the transformation in a post explaining how proof verification changes the validation paradigm. “Instead of repeating the computation, you verify a cryptographic proof that someone else did it correctly. One proof. Compact. Constant verification time regardless of what happened inside the block,” the post stated.

This approach contrasts sharply with current methods where every node re-executes every transaction independently.

EIP-8025 establishes the consensus layer mechanics enabling this transition. Proofs from different execution client implementations circulate through a dedicated peer-to-peer gossip network.

The specification modifies block processing to allow attesters to verify proofs rather than execute transactions directly.

A preliminary 3-of-5 threshold requires attesters to verify three out of five independent proofs before accepting a block’s execution as valid.

Benefits Across the Validator Ecosystem

Solo stakers and home validators receive the most direct operational improvements. The ladislaus.eth post noted that zkAttesters eliminate the need for full execution layer operation and state storage.

“A zkAttester does not need to hold EL state. It does not need to sync the full execution layer chain,” the explanation clarified. Syncing reduces to downloading proofs for recent blocks since the last finalization checkpoint.

The resource savings extend beyond basic operation. Current validators must run both consensus and execution clients, with the latter consuming significant storage, processing power, and bandwidth.

These requirements scale linearly with gas limit increases. Proof verification replaces this scaling burden with constant-time verification regardless of block activity levels.

Multiple stakeholders gain from this infrastructure shift. Execution client teams can develop implementations as proving targets within a standardized framework.

zkVM vendors including RISC Zero, openVM, and ZisK can build against clear interfaces while working on what could become the largest zero-knowledge application globally.

Layer-2 teams benefit from infrastructure convergence, as validator proof verification enables shared proving infrastructure for native rollups through an EXECUTE precompile.

Development Status and Dependencies

EIP-8025 has been integrated into the consensus-specs features branch for eventual inclusion consideration. The 2026 L1-zkEVM roadmap divides work across six sub-themes: execution witness and guest program standardization, zkVM-guest API standardization, consensus layer integration, prover infrastructure, benchmarking and metrics, and security with formal verification.

The system depends on ePBS (Enshrined Proposer-Builder Separation) targeted for the Glamsterdam hardfork. Without ePBS, the proving window spans only 1-2 seconds, creating unrealistic constraints for real-time proof generation.

ePBS extends this window to 6-9 seconds through block pipelining, making single-slot proving feasible for production use.

Proving infrastructure remains under active discussion. The design assumes a 1-of-N liveness model where one honest prover maintains chain operation.

The ladislaus.eth post emphasized that “proving should remain viable outside of data centre infrastructure,” addressing concerns about centralization. Several zkVM vendors already prove Ethereum blocks, demonstrating technical feasibility ahead of protocol integration.

The February 11 workshop will address the full scope of development themes as teams move toward implementation.

Crypto World

24/7 Futures Trading for Modern Markets

Markets have modernized in almost every way—except one. Trading infrastructure has gone digital, execution is instantaneous, and information moves globally in real time. Yet most traditional markets still shut down on nights, weekends, and holidays.

This is where TradFi intersects with crypto-native infrastructure. Platforms like Phemex are narrowing that gap by listing TradFi futures—price-tracking contracts tied to assets such as gold and silver—on infrastructure built for continuous markets.

Spot trading vs futures contracts

Spot and futures markets work differently, and that difference explains why TradFi futures matter. Put simply, spot trading means you buy the asset itself at the current price, whereas a futures contract tracks price under contract terms rather than giving direct ownership.

In traditional spot trading, buying a share or commodity involves a complex chain of custody, legal ownership transfer, and T+2 settlement cycles. This infrastructure requires banks and clearinghouses to be open, which is why trading halts on weekends and holidays.

A futures contract is a derivative, an agreement based on the price of an asset, not the exchange of the asset itself. Because of this, there is no physical action or need for a transfer in the event of a closed exchange market.

When the market closes, only the conventional infrastructure ceases to function; assets retain their worth. Phemex fills this gap by delivering a marketplace where price discovery and risk management continue uninterrupted.

Macro News Don’t Wait for Monday

Traditional finance (TradFi) and cryptocurrency markets are increasingly moving in the same direction. As crypto trading has matured, digital asset prices have become more closely linked to macroeconomic indicators that have long driven equities and commodities.

Interest rate decisions by the U.S. Federal Reserve, inflation data, labor market reports, and geopolitical developments now influence both stock indices and major cryptocurrencies. This growing correlation has reshaped how traders think about risk, timing, and market access across asset classes.

The introduction of TradFi futures on crypto-native trading platforms allows traders to respond to macroeconomic developments in real time. Instead of waiting for traditional market hours, traders can hedge positions or manage volatility as events unfold—an approach that is increasingly central to modern risk management.

Whether it is hedging a position or capitalizing on volatility, the ability to execute trades based on real-time macro news is no longer a luxury,; it is a necessity for modern risk management.

Why TradFi Futures Matter for 24/7 Market Access

The 24/7 openness of markets, remaining functional even during holidays and non-working days, is not merely a new generation innovation; it represents the natural evolutionary progression of trading. In the traditional financial world, when the market is closed, uncertainty and suspense tend to take hold.

If a major event occurs over the weekend, traditional investors face significant gap risk, where the price jumps or drops substantially between Friday’s close and Monday’s open.

Through TradFi futures trading found on Phemex, traders can manage their positions at any time, day or night. This eliminates the waiting game that often leaves investors vulnerable to global news cycles that do not stop for bank holidays.

Unified Trading Across Crypto and TradFi Futures on a Single Platform

Phemex focuses on reducing the liquidity and access friction typical of traditional markets.

The platform offers USDT-settled derivatives linked to traditional assets such as gold, silver, and selected stocks, alongside crypto derivatives. This structure allows traders to access multiple asset classes from a single account, without opening separate brokerage relationships or navigating lengthy funding and settlement processes.

(USDT-settled derivatives mean that profits and losses are settled in USDT rather than through delivery of the underlying asset.)

Phemex operates a unified margin system, enabling the same USDT balance to be used across gold, silver, and crypto futures. Because these contracts track price rather than involve physical settlement, custody and operational complexity are reduced.

As with cryptocurrency perpetual contracts, TradFi futures can be traded with leverage, allowing traders to increase exposure and improve capital efficiency without committing the full notional amount typically required by traditional brokers. Historically, access to equities or commodities—whether via direct ownership, ETFs, or futures—often required substantial upfront capital and fragmented infrastructure.

As demand grows for continuous market access and more flexible risk management, crypto-native platforms are increasingly addressing these structural limitations. Phemex positions itself within this shift by offering infrastructure designed for continuous, multi-asset trading.

The Modern Market Is Open 24/7

Market evolution is no longer a question of if, but how. As crypto and traditional assets increasingly respond to the same macro forces, their separation at the infrastructure level has started to break down.

The objective isn’t to replicate stock exchanges on crypto platforms. It’s to build faster, more flexible systems that allow traders to access traditional asset exposure with the efficiency they expect from modern markets.

Phemex is approaching this by replacing ownership friction with futures-based access. By using price-tracking contracts rather than physical settlement, traditional assets can be traded alongside crypto within a unified, USDT-settled environment.

Moving into the second quarter of 2026, trading across asset classes from a single margin currency is no longer a differentiator; it’s becoming the baseline for how modern markets operate.

As part of the launch of its TradFi futures offering, Phemex has introduced a limited-time campaign aimed at familiarizing traders with the new product. The campaign includes a temporary zero-fee trading period, loss-protection incentives for first trades, trading leaderboards, and task-based rewards. The initiative is designed to support early adoption and allow traders to explore TradFi futures within a controlled, risk-aware framework.

Crypto World

Monero Price Crash To Continue As $150 Risk Builds?

The Monero price is down about 2% over the past 24 hours and nearly 31% over the past month. Since peaking near $799 in mid-January, XMR has already fallen more than 65%. A rebound followed the drop to $276, pushing the price back toward the $330 area. At first glance, this looked like stabilization after heavy selling.

But a closer look tells a different story.

Bear Flag and Moving Averages Show the Downtrend Is Still Intact

On the daily chart, Monero is trading inside a bear flag structure.

A bear flag forms when the price drops sharply and then moves sideways or slightly higher in a narrow range. This pattern usually represents a pause before another decline, not a trend reversal. In XMR’s case, the fall from $799 to $276 created the flagpole. The recent XMR price consolidation is forming a flag.

Sponsored

Sponsored

As long as the price remains inside this range, the dominant trend stays bearish. A breakdown below the lower boundary would likely trigger another major leg lower.

Trend indicators are reinforcing this view.

Exponential moving averages, or EMAs, are weighted price averages that give more importance to recent data. They help identify whether momentum is strengthening or weakening. When shorter-term EMAs fall below longer-term EMAs, it signals deteriorating trend strength.

Right now, Monero’s 50-day EMA is moving toward the 100-day EMA. At the same time, the 20-day EMA is drifting toward the 200-day EMA.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

These developing bearish crossovers suggest that short-term momentum continues to weaken relative to the broader trend. If these looming crossovers confirm while the XMR price flirts with the lower trendline of the flag, the breakdown theory would likely get validated.

Spot Flows Show Rebounds Are Being Used to Exit, Not Accumulate?

Exchange flow data reveals how investors are behaving during this consolidation.

In early February, Monero briefly showed strong outflows (buying pressure). During the week ending February 2, net outflows reached about $7.1 million. This suggested that some buyers were stepping in after the crash.

Sponsored

Sponsored

But this support faded quickly.

By the week ending February 9, flows flipped to net inflows of around $768,000. More XMR was moving back onto exchanges than leaving them. This shift happened while the price dipped to $276 and then rebounded to the $327 zone.

This tells an important story. As soon as the price bounced, selling possibly resumed. Instead of holding for a recovery, many investors possibly used the rebound to reduce exposure. Loss exits replaced by accumulation.

When outflows turn into inflows during consolidation, it usually signals distribution. Supply is returning to the market. Without steady spot demand, rallies struggle to survive. This also explains why recent recoveries have been shallow. Buyers are not strong enough to absorb the returning supply.

With spot demand fading, the burden shifts to derivatives traders. But derivatives data show growing caution.

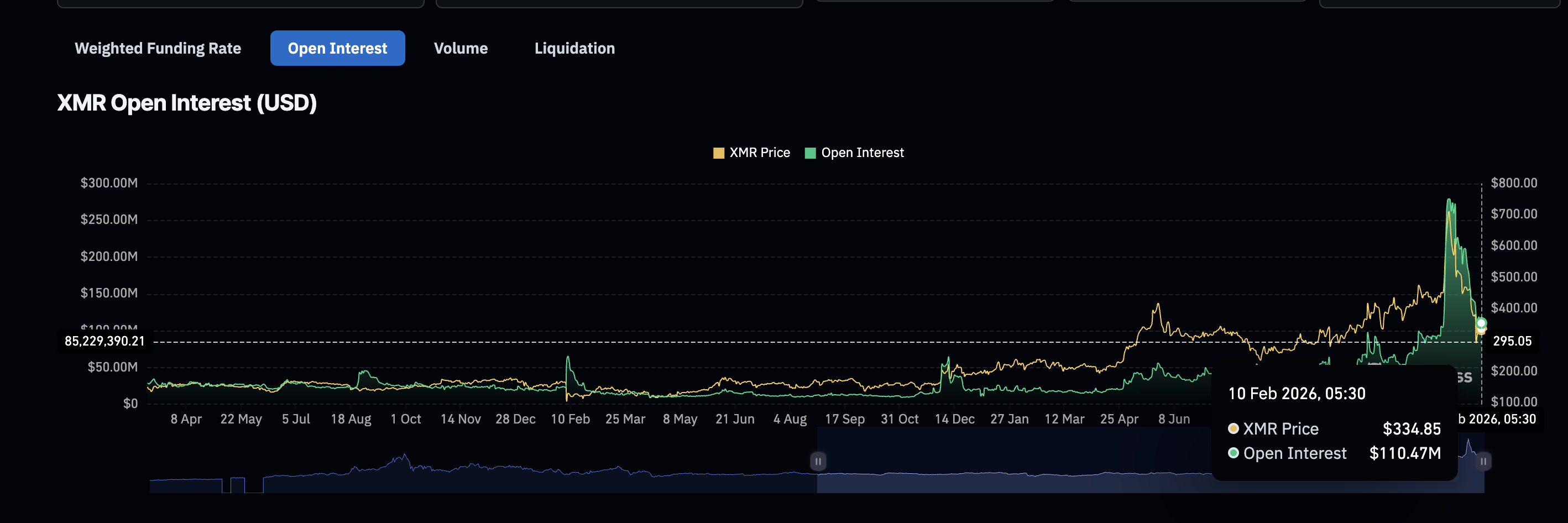

Falling Open Interest and Weak Funding Limit the XMR Recovery Potential

Derivatives markets provide insight into trader confidence and leverage. Open interest measures the total value of active futures contracts. Rising open interest shows that traders are building positions. Falling open interest shows that traders are closing positions and stepping away.

Sponsored

Sponsored

In mid-January, Monero’s open interest stood near $279 million. By February 10, it had dropped to around $110 million. This represents a decline of more than 60%.

Such a sharp drop indicates that leverage is leaving the market. Traders are reducing risk rather than preparing for a major rebound.

At the same time, funding rates remain mildly positive. Funding rates reflect the cost traders pay to hold futures positions. When funding is positive, long traders are dominant. When it is negative, short traders dominate.

XMR’s funding remains slightly positive, meaning most remaining traders still lean bullish. But without rising open interest, this bias lacks conviction.

This combination is weak. Fewer traders are participating, yet optimism has not fully reset. It also limits the chance of a short squeeze. A short squeeze requires heavy bearish positioning. Without that pressure, upside accelerations are unlikely.

With leverage shrinking and spot buyers hesitant, the price lacks fuel for sustained recovery.

Sponsored

Sponsored

Why $150 Is Becoming Key Target for the Monero Price

With technical, spot, and derivatives signals aligned, downside levels become increasingly important.

The first major support sits near $314. This area aligns with recent lows and the lower boundary of the bear flag. A decisive break below it would likely confirm continuation lower.

If $314 fails, downside opens quickly.

The next major demand zone is near $150, according to a key Fibonacci retracement level. A move from current levels toward $150 would represent another drop of more than 50%, consistent with the size of the first decline.

Below $150, deeper levels such as $114 and $88 exist. But $150 stands out as the first major zone where long-term buyers may realistically reappear, thanks to its psychological significance. That is why it has become the primary downside reference point.

For now, Monero remains trapped between weak demand and persistent supply. The bear flag shows consolidation, not recovery. Spot flows show selling, not accumulation. Open interest shows retreat, not confidence. Funding shows optimism without commitment.

To weaken and invalidate the bearish pattern, the Monero price must close above $350 and $532, respectively, on a daily candle close.

Crypto World

LMAX unveils new exchange to break the wall down between crypto and FX

Institutional crypto exchange provider LMAX Group has unveiled Omnia Exchange, designed to allow users to seamlessly convert FX, crypto, stablecoins and other digital assets in one platform, the company said on Tuesday.

Described as a “a unified multi-asset infrastructure layer,” Omnia allows users to trade any asset directly against any other 24/7, without restrictions on size or type, and to settle on traditional rails or instantly on the blockchain, according to a press release.

LMAX’s cryptocurrency-focused business has long been a major player when it comes to institutional crypto trading, reporting $8.2 trillion in institutional volume last year.

Whereas LMAX Digital is an institutional crypto execution venue and custodian, focused on crypto-FX pairs, Omnia aims to bring FX, crypto, stablecoins and other digital assets under one roof, allowing any asset to be traded directly against any other (not just crypto vs fiat), a spokesperson for LMAX said via email.

LMAX CEO David Mercer said Omnia “crosses the rubicon” between traditional markets and digital marketplaces.

“Omnia Exchange is the foundation for a new paradigm in capital markets delivering the ability for institutions to exchange any asset, anytime, anywhere,” Mercer said in a statement. “By opening access to wholesale FX and digital asset markets globally, we’re removing barriers, reducing friction and unlocking liquidity. Institutions can exchange value as simply as sending a message, creating hyper-efficient capital.”

A recent deal between LMAX Group and Ripple to integrate the latter’s RLUSD reflects broader momentum behind stablecoins as tools for institutional market access, not just crypto-native use.

Crypto World

Ripple (XRP) Price Predictions for This Week

Let’s have a look at some numbers and try to understand where is the XRP price headed this week.

XRP returns above $1.4, but can it hold there?

Ripple (XRP) Price Predictions: Analysis

Key support levels: $1.4, $1

Key resistance levels: $1.6

XRP Price Reclaims $1.4

After the massive drop last Thursday, XRP recovered somewhat and returned above the support at $1.4. If this key level holds, buyers could retest the $1.6 resistance level in the future. Any failure there could see the price resume its downtrend.

Sellers Dominate

A review of the volume shows that sellers have been dominating since late December on the weekly chart. Worst, the selling volume has accelerated in early February, showing no signs of a change. However, increased sales volume could be the first step towards finding a bottom.

Daily RSI Bounces from Oversold Area

During the crash last week, the daily RSI reached 17 points, falling deep into the oversold area. Since then, this indicator snapped back above 30. As long as the daily RSI is under 50, the bias leans bearish.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

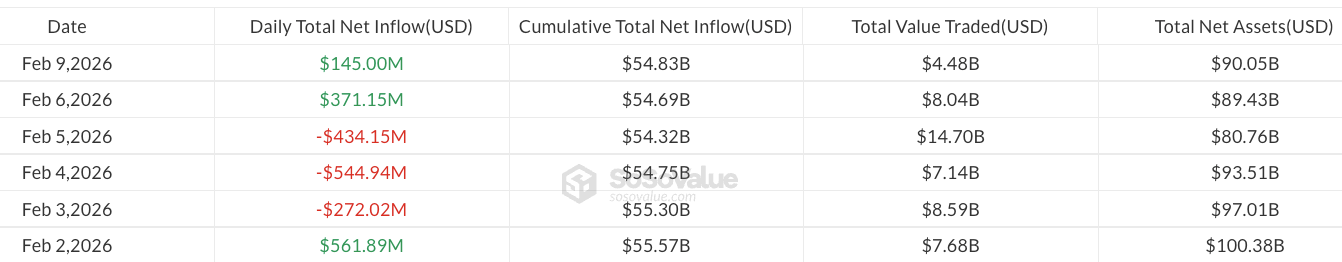

US spot Bitcoin exchange-traded funds (ETFs) extended a tentative rebound after attracting $371 million in net inflows last Friday, adding to signs that institutional demand may be stabilizing following weeks of sustained selling.

Spot Bitcoin (BTC) ETFs attracted a further $145 million in inflows on Monday as BTC hovered around $70,000, according to data from SoSoValue and CoinGecko.

The inflows have yet to offset last week’s $318 million of outflows and $1.9 billion in redemptions year-to-date, but the slowing pace of losses may point to a potential trend reversal for crypto investment products, according to CoinShares.

“Outflows slowed sharply to $187 million despite heavy price pressure, with the deceleration in flows historically signaling a potential inflection point,” CoinShares’ head of research, James Butterfill said in an update on Monday.

Early Bitcoin holders unfazed by institutional inflows, Bitwise says

Bitcoin’s growing institutional presence has not driven early investors out of the market, according to a senior executive at asset manager Bitwise, even as the ETF saw heavy outflows during the latest crypto sell-off that pushed BTC back toward October 2024 price levels.

Analysts at research firm Bernstein described the recent downturn as the “weakest bear case” in Bitcoin’s history, noting the absence of major industry failures typically associated with deeper crypto market stress.

Related: Only 10K Bitcoin at quantum risk and worth attacking, CoinShares claims

With no clear single catalyst behind the decline, some market watchers have linked the volatility to Bitcoin’s increasing institutionalization, including ETFs, and concerns that broader financialization could dilute the asset’s scarcity narrative.

Still, that shift has not meaningfully deterred early adopters, Bitwise chief investment officer Matt Hougan said in comments to Bloomberg ETF analyst Eric Balchunas.

Hougan acknowledged that a “cypherpunk, libertarian OG core” of Bitcoin supporters may be uncomfortable with the growing influence of large asset managers such as BlackRock, but described that group as a “shrinking minority.”

Many early investors are instead taking partial profits after large gains rather than exiting the market altogether, he said, adding that most remain invested even as new institutional buyers enter the space.

“They invested a few thousand dollars and ended up with millions,” Hougan said, adding:

“The vast majority are still in it, and they’re being augmented by new institutional investors. I think the story that most of OG crypto is giving up on the space just doesn’t align with the people that we talk to with the investors that are working with Bitwise.”

In line with a rebound in Bitcoin ETFs, spot altcoin ETFs also posted gains on Monday, with Ether (ETH) and XRP (XRP) seeing inflows of $57 million and $6.3 million, respectively, according to SoSoValue data.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest, Feb. 1 – 7

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat13 hours ago

NewsBeat13 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports12 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World2 hours ago

Crypto World2 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report