Crypto World

Trump Fed Mistake Remark Everyone Is Getting Wrong

President Donald Trump sparked a viral debate on social media after a February 9 interview on Fox Business’s Kudlow show, where he discussed his decision-making around Kevin Warsh, his nominee for Federal Reserve (Fed) Chair.

Short clips circulating on X (Twitter) show Trump saying he “made a big mistake,” fueling confusion over whether he now regrets nominating Warsh.

Sponsored

Sponsored

Trump Admits a “Big Mistake”—But Is It About Kevin Warsh or Powell?

In full context, Trump was reflecting on 2017, when he chose Jerome Powell over Warsh, who had been the “runner-up” at the time.

Trump said the decision was influenced by advice from then-Treasury Secretary Steven Mnuchin, calling it a “really big mistake.”

Far from expressing current regret, Trump praised Warsh, describing him as a “high-quality person” capable of delivering extraordinary results if confirmed.

Trump’s comments included an eye-catching claim: if Warsh “does the job that he’s capable of,” the US economy could grow as much as 15%. Notably, this projection is far beyond historical peaks of 4–7% growth in strong years.

This bold statement has sparked widespread debate, with speculation that Warsh will be set up as a “fall guy” if such ambitious expectations are not met.

“…drive economic growth to 15%—a highly optimistic claim that highlights the pressure Warsh would face if confirmed…signal Trump’s push for aggressive stimulus ahead of midterm elections and suggest a challenging path for Warsh,” remarked Walter Bloomberg, a popular market commentator.

Sponsored

Sponsored

Meanwhile, the remarks also have clear market implications. Analysts and crypto commentators have interpreted Trump’s enthusiasm for Warsh as a signal that the next Fed leadership could favor lower interest rates, stronger liquidity, and pro-growth policies.

“Trump is directly signaling lower rates and stronger liquidity support…This is the clearest signal yet that the next Fed direction could be more growth-focused and liquidity-friendly,” analyst Bull Theory commented.

With a Fed chair who will cut rates and dismiss concerns about inflation, such growth would normally push prices sharply higher.

Posts on X highlight potential implications for Bitcoin, gold, and other risk assets. The general sentiment is that Warsh’s policy approach could lead to easier monetary conditions, reminiscent of “yield curve control” or coordinated Treasury-Fed operations.

Sponsored

Sponsored

However, misleading captions and out-of-context clips have driven a spike in engagement, with some speculating about alternative nominees like Judy Shelton or questioning whether Warsh could be withdrawn.

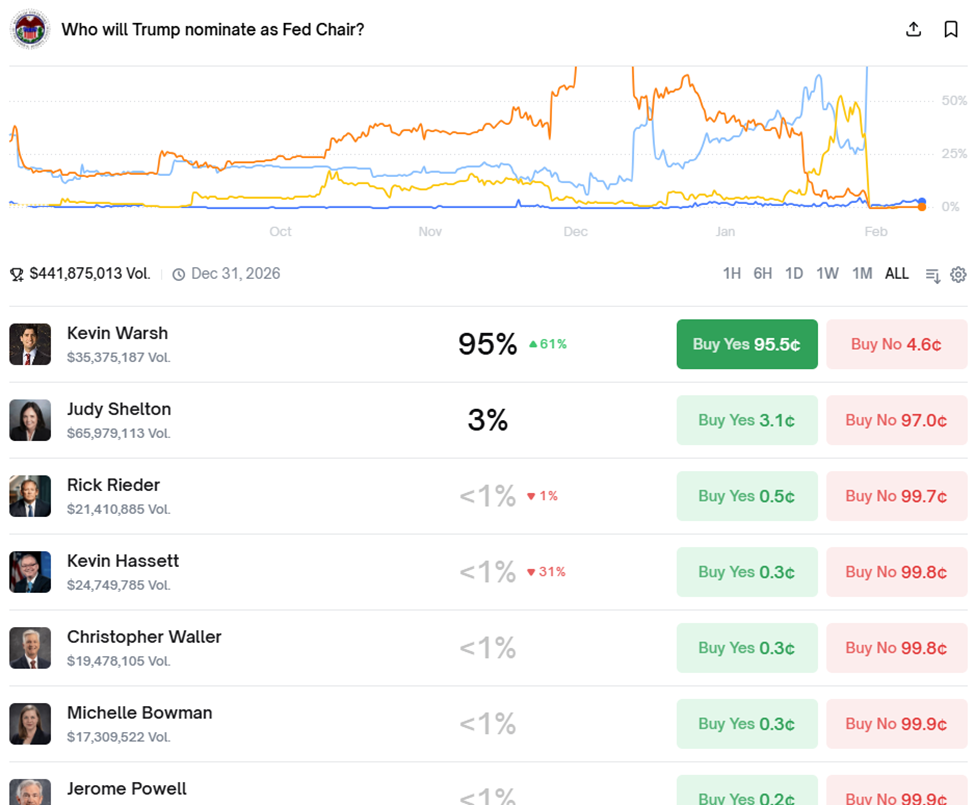

However, data on Polymarket shows a modest 3% probability of Trump nominating Shelton, against 95% odds in favor of Warsh.

Fact-check threads and full-clip posts are attempting to clarify that Trump’s “mistake” comment referred to the past, not the present nomination.

Memes, commentary, and speculation about inflation, debt levels, and Fed independence have made the discussion one of the most viral economic topics on X in recent days.

Sponsored

Sponsored

Warsh himself has a history that blends traditional central banking experience with a measured openness to financial innovation.

A former Fed Governor (2006–2011) and Hoover Institution senior fellow, he is known as an inflation hawk who favors fiscal restraint and a smaller Fed balance sheet.

He has personal exposure to crypto, investing in projects such as Basis and Bitwise, though he views Bitcoin primarily as a store of value rather than a transactional medium.

Sentiment suggests his tenure could indirectly support risk assets by providing macro stability and eventual clarity on rate policies. However, any direct crypto rally is unlikely until he assumes office in May 2026 and policy actions materialize.

Crypto World

Bybit becomes the title partner of Stockholm Open

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Bybit EU has secured a three-year title partnership with the Stockholm Open, renaming the tournament the Bybit Stockholm Open from 2026 to 2028.

Bybit EU, the European arm of Bybit and a MiCAR-licensed crypto-asset service provider, is entering a three-year title partnership with the Stockholm Open that will see the tournament compete under the name Bybit Stockholm Open from 2026 through 2028.

The partnership marks a long-term commitment from Bybit EU and provides the historic tennis tournament with a stable partner to support its continued development for players and spectators. As part of the agreement, the tournament will reclaim its classic name, reinforcing its identity and long-standing ties to Stockholm and Swedish tennis.

Bybit views the Nordic region as a strategically important market and considers the Stockholm Open a strong platform for building a lasting presence. Gustav Buder, Regional Partner Nordics at Bybit EU, said the tournament’s strong history, high credibility, and audience that values quality and long-term commitment made it a natural fit. He noted that the partnership represents an important step in establishing trust and a durable presence in the Nordic market.

Since its start the Stockholm Open has served as a meeting point for sport, business, and the public, with a long tradition of collaboration with partners from the financial sector. The tournament attracts an audience with a strong interest in finance and business, aligning closely with Bybit EU’s profile.

The partnership will enable Bybit to engage its premium client base through the Bybit VIP program, offering select clients curated access to the tournament and bespoke experiences that bridge finance, sport, and long-term value creation.

Rasmus Hult, CEO of Bybit Stockholm Open, said the tournament has extensive experience working with financial partners and views Bybit as a strong, long-term partner that shares its ambition to continue developing the event. He added that jointly reclaiming the tournament’s classic name clearly reflects its home and heritage.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Will ETH & SOL bounce back?

Crypto markets are definitely under pressure. The year got off to a shaky start, and weakness has continued as traders remain cautious in a low-liquidity, macro-uncertain environment. That’s left Ethereum and Solana stuck in corrective moves for now.

Let’s take a closer look at ETH and SOL, analyzing recent price moves and network fundamentals to gauge their near-term price predictions.

Summary

- Crypto markets remain volatile and risk-off as of February 10, 2026, with large-cap coins like Ethereum and Solana trading below last year’s highs.

- ETH is around $2,016, showing short-term bearish momentum, with key support at $1,760 and resistance near $2,150–$2,500.

- SOL trades near $84 in a clear downtrend, with short-term support at $80–$90, major downside at $70–$65, and resistance at $100, keeping the SOL outlook cautious.

Current market scenario

As of February 10, crypto markets remain unsettled. Volatility is elevated, sentiment is fragile, and rallies are quickly met with selling pressure. Many large-cap coins are still trading below last year’s highs, highlighting a risk-off environment.

Altcoins have borne the brunt of selling, with investors either rotating into cash or waiting for confirmation of trends. Ethereum and Solana remain technically bearish for now, although network activity continues in the background.

Ethereum price prediction

Ethereum (ETH) is currently trading around $2,016, having failed to hold above the key $2,100 resistance zone. Year-over-year, ETH is down roughly 20–25%, showing the ongoing pressure on large-cap altcoins. Short-term momentum hasn’t helped either, with the ETH price falling 0.9% in the last 24 hours and 11.6% over the past week.

Technically, the short-term trend is still bearish. On Sunday, a bearish pin bar showed up just under $2,100, meaning sellers are in control there. If price can’t get past this level, the next downside target is around $1,760, which acted as support the last time price dipped this low.

From a fundamentals perspective, things are still solid for Ethereum. Developers are busy, users are active, and Layer-2 adoption keeps expanding. These network improvements ease congestion and boost throughput, even if the ETH price doesn’t show it yet. They remain a key part of the longer-term ETH forecast.

If buyers step in and push Ethereum over $2,150 for a daily close, the bearish trend would start to fade. After that, a move toward $2,500 looks more likely.

Solana price prediction

Solana (SOL) is currently trading near $84. While the SOL price is up 0.5% on the day, the bigger picture remains ugly, with the token down nearly 18.4% over the past week.

From a technical standpoint, Solana is still in a clear downtrend. Price recently dropped below a descending channel and is now holding in the $80–$90 zone as short-term support. Trend-wise, nothing much has changed— lower highs and lower lows remain dominant.

If this support breaks, the next downside area to watch is $70–$65, which marks the last strong demand zone before liquidity dries up. On the flip side, $100 is the key resistance bulls need to reclaim to shift sentiment.

For now, the SOL outlook remains cautious, at least until we see buyers show real strength.

Final thoughts

Right now, Ethereum and Solana aren’t having an easy time. Bears are in control in the short term, but Ethereum’s bigger picture is still intact. Until the price can get back above key resistance levels, rallies are likely to be shaky. Patience and waiting for confirmation will be important for anyone following ETH or SOL.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Bitcoin’s sharp correction at the start of the month may represent a critical “halfway point” in the current bear market, according to Kaiko Research.

Bitcoin (BTC) fell to $59,930 on Friday, marking its lowest level since October 2024, before the re-election of US President Donald Trump, according to TradingView data.

The decline suggests the market has moved out of the euphoric post-halving phase and into what Kaiko described as a historically typical bear market period that lasts about 12 months before a new accumulation phase begins.

In a research note shared with Cointelegraph on Monday, Kaiko said Bitcoin’s 32% crash was the most significant correction since the 2024 Bitcoin halving and may mark the “halfway point” of the current bear market.

“Analysis of on-chain metrics and comparative performance across tokens reveals a market approaching critical technical support levels that will determine whether the four-year cycle framework remains intact,” Kaiko said.

Related: Trend Research cuts ETH exposure by over 400K as liquidation risk rises

Kaiko’s report highlighted several emerging onchain bear market signals, including a 30% drop in aggregate spot crypto trading volume across the 10 leading centralized exchanges, from around $1 trillion in October 2025 down to $700 billion in November.

At the same time, combined Bitcoin and Ether (ETH) futures open interest declined from $29 billion to $25 billion over the past week, a 14% reduction that Kaiko said reflects ongoing deleveraging.

While Bitcoin has realigned with the historical four-year halving cycle since the beginning of the year, determining the depth of the current bear market is complex, as “many catalysts that fueled BTC’s rally to $126,000 are still in effect,” said Shawn Young, chief analyst, MEXC Research.

“With oversold indicators emerging on multiple timeframes, the rebound conversation around BTC is more a question of when, not if,” Young said, adding that Bitcoin may be entering a new cycle that will only become clear over the next year.

Related: Binance adds $300M in Bitcoin to SAFU reserve during market dip

Is $60,000 the bear market bottom?

The key question for investors is whether the dip to $60,000 represents the low of the current bear market. The level roughly aligns with Bitcoin’s 200-week moving average, which has historically acted as long-term support.

Still, more market volatility is expected in the absence of crypto-specific market catalysts, Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen, told Cointelegraph, adding:

“With that said, it is still very hard to say if it means we are going back to the conventional 4-year cycle. I have seen many prominent figures in the space air the idea, but equally many who do not think so.”

However, Kaiko pointed to a 52% retracement from Bitcoin’s previous all-time high being “unusually shallow” compared to previous bear market cycles.

A 60% to 68% retracement would “align more closely” with historical drawdowns, which implies a Bitcoin cycle bottom around $40,000 to $50,000, Kaiko said.

Still, some market participants argue that $60,000 already marked a local bottom. Analyst and MN Capital founder Michaël van de Poppe called the crash to $60,000 the local market bottom for Bitcoin’s price, citing a record low in investor sentiment and a critical low in the relative strength index, which sank to values last seen in 2018 and 2020.

Crypto World

Ripple (XRP) News Today: February 10th

Here’s everything most interesting related to Ripple and its ecosystem.

Ripple remains among the most discussed topics in the crypto space due to constant news and developments across its ecosystem.

Meanwhile, the company’s cross-border token partially recovered from the February 6th crash, which sent shockwaves through the broader crypto market.

Partnerships and More

Due to regulatory uncertainty in its home country, primarily driven by the already resolved legal case between Ripple and the SEC, the company was mainly focused on global expansion over the past few years. The United Arab Emirates (UAE) has been a key area, and in 2025, the firm teamed up with the local bank Zand.

Just hours ago, Reece Merrick (Managing Director, Middle East and Africa at Ripple) revealed that the partnership has been extended “to explore a range of initiatives.” Some of the goals include supporting Ripple’s RLUSD stablecoin within Zand’s regulated digital asset custody.

The firm has also expanded its footprint in other Middle Eastern markets in recent months, with notable progress in Bahrain and Saudi Arabia.

Besides its advancement in the region, Ripple made headlines for another reason. Some members of the XRP Army disclosed that the entity has entered the prestigious list of the top 10 most valuable private companies across the world. Data shows that it has a valuation of $40 billion and ranks in the 10th spot. Some of those ahead include Revolut, xAI, SpaceX, and OpenAI.

The Big Event

Ripple’s XRP Community Day (a global event dedicated to the entire ecosystem and its community of investors, backers, and developers) will kick off on February 11. There will be many sessions, and participants include high-ranking individuals from Bitwise, Grayscale, Gemini, and more.

You may also like:

The first “fireside chat” will feature Ripple’s CEO, Brad Garlinghouse, and the crypto podcaster Tony Edward. They are expected to delve into topics such as XRP’s growing usage, the macro shift in institutional adoption and acceptance of crypto, and other subjects.

The ETFs

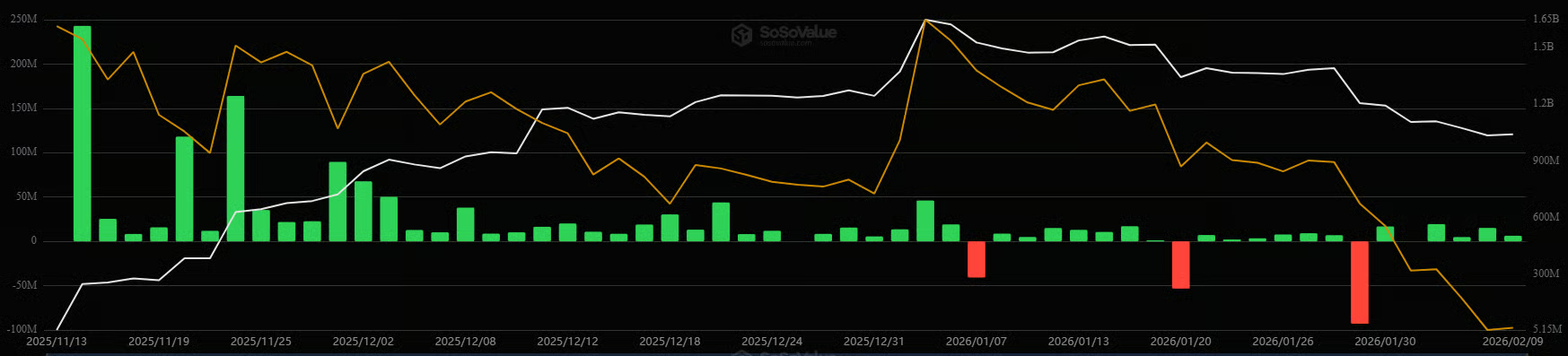

2025 has been a milestone year for Ripple for many reasons. One of the key achievements is the launch of the first spot XRP ETF, which has 100% exposure to the asset.

Canary Capital was the pioneer in that field, introducing its product, XRPC, in mid-November. Shortly after, Bitwise, Franklin Templeton, 21Shares, and Grayscale followed suit.

The investment vehicles have attracted significant interest, and cumulative net inflows have surpassed $1.23 billion. In the past several days (despite the market’s turbulence), the netflows remained positive. In fact, the last day with a red candle was January 29.

XRP Price Outlook

Ripple’s native cryptocurrency nosedived to as low as $1.11 last week amid heavy bleeding across the entire market. Over the following days, the bulls reclaimed some lost ground, and XRP currently trades at around $1.42, representing a 3% weekly gain.

Some analysts believe there might be a new correction in the near future. X user Robert Mercer envisioned a plunge to $1.10 “very soon,” whereas Crypto Seth claimed that losing the area at around $1.41 could result in a drop to $1.

Of course, optimists are not completely absent. X user EGRAG CRYPTO noted that a few years ago, XRP was worth only $0.30, and in 2025, it surged above $3. Based on that, they believe the price could skyrocket to $30 in the future.

Such a rally would require XPR’s market capitalization to explode above $1.8 trillion, which seems quite unrealistic (at least as of now).

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Toobit Celebrates Valentine’s Day with $300,000 in Rewards for Trading Duos

Toobit is a popular and award-winning global cryptocurrency exchange, which has an exciting surprise for its users as one of the most celebrated days of the year approaches.

Toobit’s Valentine’s Day Trading Campaign

Toobit, the award-winning global cryptocurrency exchange, today announces the launch of its 2026 Valentine’s Day trading campaign.

In a bid to break away from the otherwise solitary nature of the crypto markets, the campaign invites traders to pair up and get a chance to share a prize pool of 300,000 USDT between February 10th and February 24th.

This initiative emphasizes the strength of partnership in navigating today’s landscape. By joining forces with a friend or trading partner, participants will work together to reach a combined team volume of 214,000 USDT and unlock rewards.

Teams that hit this milestone will unlock a 214 USDT mystery box, which contains Trial Funds, Event Contracts Trial Funds, or Bonuses. The primary 300,000 USDT prize pool is distributed based on leaderboard rankings, with rewards allocated on a first-come, first-served basis to the most active duos.

“Trading is often seen as a solitary pursuit, but we believe the community is our greatest asset,” said Mike Williams, Chief Communication Officer at Toobit. “This Valentine’s Day, we wanted to create a campaign that celebrates connection and teamwork, allowing our traders to share the thrill of the market with someone special while earning rewards.”

How to Participate in the Challenge

To join the challenge, traders must first ensure they have at least 10 USDT in their Futures Account to form or join a team. Participants are required to visit the campaign page to register. For a comprehensive breakdown of the campaign’s rules, traders are encouraged to review the announcement page.

The initiative highlights a defining trend in the 2026 digital asset landscape: the move toward collaborative market participation. Recent industry projections estimate the global social trading market will reach $10 billion this year, with the crypto segment alone growing at a rate of nearly 18% annually.

As retail participation evolves, traders are increasingly moving away from isolated decision-making in favor of team-based strategies and shared market analysis, which often lead to more disciplined and informed outcomes.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and to do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BTC trading like a tech stock with failing growth

Bitcoin’s slide to around $60,000 earlier this month looked familiar, not to gold bugs, but to tech investors, crypto asset manager Grayscale said in a Monday report.

As high-growth software stocks sold off, bitcoin fell in near lockstep, reinforcing the view that, for now, the world’s largest cryptocurrency trades more like an emerging technology than a mature store of value, the report said.

The cryptocurrency’s design, capped supply, independence from governments and a resilient, decentralized network, gives it the long-term qualities of a store of value. But at just 17 years old, bitcoin is still early in its monetary journey, especially compared with gold’s millennia-long history, the firm argued.

“Bitcoin can be considered a long-term store of value: the network will likely continue operating well beyond our lifetimes and the asset may retain its value in real terms,” wrote analyst Zach Pandl.

The crypto’s claim to being digital gold has looked increasingly thin in recent months. Rather than serving as a safe haven, it has fallen sharply from its highs and moved in tandem with risk assets as investors turned defensive.

At the same time, physical gold has surged to record levels, drawing inflows just as bitcoin saw capital exit. The split has weakened the case that the cryptocurrency reliably holds value during market stress, suggesting that scarcity alone has yet to make it behave like gold when protection matters most.

Investing in bitcoin today is fundamentally a bet on adoption, Pandl said. Until bitcoin is widely accepted as a global monetary asset, its price will likely remain sensitive to risk appetite, rising and falling with growth-oriented portfolios rather than acting as a hedge during market stress.

Recent market mechanics support that view. The report pointed to U.S.-led selling pressure, outflows from spot bitcoin exchange-traded funds (ETFs) and a sharp deleveraging across crypto derivatives, signals that look more like a growth unwind than a crisis of confidence in the network itself.

Spot bitcoin ETFs have logged a sustained run of outflows, pointing to a cooling in institutional appetite. In recent weeks, U.S.-listed funds have shed hundreds of millions of dollars as investors pulled back amid market volatility and falling prices. The withdrawals have dragged down total assets under management and left many positions underwater, underscoring softer demand for ETF-based bitcoin exposure even as inflows continue elsewhere in crypto.

Looking ahead, Grayscale sees the foundations of a recovery forming beyond short-term price action. Regulatory momentum around stablecoins and tokenized assets, combined with continued innovation in blockchain infrastructure, could drive the next phase of adoption. Platforms such as Ethereum and Solana, along with middleware like Chainlink, stand to benefit, the firm said.

Bitcoin’s own long-term test is still unfolding. Questions around scaling, fees and even quantum resistance loom large. But the report argued that if the crypto clears those hurdles, its volatility should fall, correlations with equities should fade and its behavior may eventually resemble gold’s, just with a digital backbone.

Wall Street bank JPMorgan said the crypto’s lower volatility relative to gold could make it “more attractive” in the long term.

Crypto World

Bitcoin price prediction ahead of White House meeting puts Clarity Act in focus

Bitcoin price is trading in a tight consolidation range near $68,000 as markets await signals from an upcoming White House meeting on digital asset regulation, with the proposed Clarity Act emerging as a potential sentiment driver for the next directional move.

Summary

- Bitcoin is consolidating near $68,000, with price hovering around a key long-term moving average as traders wait for signals from today’s White House meeting on digital asset regulation.

- Momentum remains weak, with the Relative Strength Index (RSI) stuck in the low-30s, suggesting upside may remain limited unless BTC can reclaim resistance near $70,000.

- Regulatory tone could act as the trigger, as discussions around the Clarity Act may influence sentiment and determine whether Bitcoin breaks higher toward $72,000 or revisits support near $66,000.

Price action suggests Bitcoin (BTC) is stabilizing after a volatile start to the year, with traders increasingly cautious as policy expectations collide with key technical levels.

Bitcoin price consolidates near key moving average

As shown on the chart, Bitcoin price has been oscillating around a major long-term moving average, which has acted as dynamic resistance and support over recent weeks.

After briefly pushing above the level earlier in January, BTC failed to sustain upside momentum and slipped back into a sideways range.

The repeated interaction with this moving average highlights market indecision, as buyers step in on dips while sellers cap rallies near the same zone.

Momentum indicators reinforce the cautious tone. The Relative Strength Index (RSI) is currently hovering in the low-30s, remaining below the neutral 50 level and indicating weak underlying momentum.

While RSI has stabilized after dipping closer to oversold territory, it has yet to show a convincing bullish reversal. This suggests that any upside attempt may struggle without a clear catalyst or a decisive break above resistance.

From a market structure perspective, Bitcoin remains range-bound, with higher lows forming since mid-January but upside attempts repeatedly stalling near the same resistance band.

If Bitcoin manages a daily close above $70,000, momentum could improve, opening the door for a move toward the $72,000–$73,000 resistance zone. A breakout accompanied by RSI pushing back above 40–50 would strengthen the bullish case.

On the downside, failure to hold the $66,000–$67,000 support area could expose BTC to a deeper pullback toward $63,000–$64,000, where buyers previously stepped in.

Why the Clarity Act is back in focus

Today’s White House meeting on digital asset regulation is expected to bring together policymakers, regulatory officials, and industry representatives to discuss frameworks for the sector’s oversight — including the Clarity Act.

While no immediate legislative outcome is expected, market participants are watching closely for tone and any signs of progress toward regulatory clarity.

Bitcoin, widely viewed as a commodity, is seen as a potential beneficiary of clearer regulatory definitions. Momentum from today’s discussions could shift sentiment, particularly if leadership signals bipartisan support for structured oversight.

Crypto World

Unified Liquidity Across All Blockchains

For years, the crypto industry has treated liquidity as a finite resource that projects must compete for through incentives and marketing. This approach has created fragmentation across networks, with the same assets requiring separate liquidity pools on different chains. Georges Chouchani, founder of Euclid Protocol, believes the industry has been solving the wrong problem.

In this exclusive interview, Chouchani explains how Euclid is building infrastructure that generates and optimizes liquidity rather than simply moving it between networks. With a recent $3.5 million raise from strategic investors, the protocol is preparing for its mainnet launch and token generation event.

Q: Liquidity has been a problem in crypto for years. What made you think the industry was solving it the wrong way?

A: I don’t think it’s about solving it the wrong way, but with the existing tech at that time, it was treated as a finite resource that applications and chains compete to grab through incentives and huge marketing spends. This is what we always term the “Zero Sum Game”. This hurt the industry by focusing on short-term tactics to acquire this liquidity, which is, by itself, mercenary (follows the highest returns). Protocols could not focus on the bigger picture or spend on improving their product and attracting long-term users. 90% of protocols fail due to a lack of liquidity available to tap into. With our tech, this changes.

Q: Most solutions today focus on moving liquidity between networks. Why did you believe generating and optimizing liquidity was the more durable approach?

A: Bridges and solutions to move liquidity between networks make this liquidity less efficient because the moved liquidity is no longer the “same” as the original asset and liquidity it originally was on the origin chain. This is why we see pools for ETH and WETH (wrapped ETH) as completely different; this means instead of having one efficient pool for ETH, it’s broken down into tens of pools across different protocols and chains. This means it will never be enough to onboard retail liquidity to decentralized protocols.

With Euclid, we allow this liquidity to be accessible from any network and protocol, removing the need to move, wrap and fragment assets. This means protocols no longer spend millions on incentives for short-term access to liquidity and focus on their business model and initial product.

Q: You describe Euclid as a unified liquidity layer. In simple terms, how is that different from what most projects call “unified liquidity”?

A: Unified Liquidity is usually a term used by a protocol to explain that you can use an asset on any chain directly without directly bridging, or you can easily move assets between chains. Although a great solution for fragmentation, it does not tap into liquidity available in markets (where assets can be bought and sold), since the liquidity still exists inherently on different protocols or networks (by liquidity, we mean how much you can sell without a big impact on the amount you receive, or the best quote).

When we say a unified liquidity layer, we mean where markets are unified and accessible from 50+ networks. Before Euclid, if there is a $1M pool on 10 chains, you can only trade against $1M in liquidity, although $10M of liquidity actually exists.

We can think of aggregators in the traditional sense as brokers that help traders settle a trade easily by finding the best path and taking a small fee for the effort. But the path still depends on the most liquid market for the trade.

Euclid, however, you can think of it as the New York Stock Exchange, where all brokers trade across the world, as it is the most liquid venue to access. This is what our infrastructure offers. The goal is to power thousands of protocols, traders, and market makers by offering 24/7 highly liquid markets across any network. A goal so far thought impossible.

Q: Instead of finding prices from other markets, Euclid sets prices itself using an AMM and its own orderbook. Why was that an important choice?

A: Finding prices from other markets defeats our original goal of unifying liquidity. We would become like any aggregator out there. We do not want to find the best price in the market for users; we want to be the best price in the market. It is not an important choice for us; it is the only way to do it. We all build on decentralized markets because we want to get rid of middlemen that charge fees and have access to privileged information that can be directly given to the user.

Our infrastructure allows products and protocols to offer direct access to markets, investment opportunities, and more liquidity to users directly without bridges, aggregators, solvers, or whatever you want to call them, in a way that is both time and cost-efficient as well as more secure long-term.

Q: Euclid allows one liquidity pool to work across more than 50 networks. What does that change for teams that usually manage liquidity chain by chain?

A: Assuming a lending protocol that plans to go multichain across 50 networks, it requires liquidations and hence markets to liquidate assets on these 50 networks, else they need to rebalance or bridge assets to where it’s liquid enough. Also, liquidity fragmented across these 50 networks will mean that there is less liquidity in one pool, hence less optimized prices, more slippage and hence tighter spreads and worse liquidations for users, making the whole user experience and business model worse.

With Euclid, we take care of the liquidity and offer you the best markets for the protocol to liquidate and trade from anywhere. No need to rebalance assets on the backend, hedge, or bridge. The protocol can spend more time and money on building a better protocol as well as generating more revenue to invest in it long-term.

This is a game-changer for anyone looking to build and deploy decentralized protocols.

Q: A lot of Euclid’s efficiency happens behind the scenes. What kinds of costs or complexity does it remove for users and protocols?

A: I could talk on and on about this. What we offer is more than a better quote when you buy Bitcoin; our infrastructure allows the efficiencies to show in all areas of the user experience using an integrated protocol.

First of all, interacting with assets on different chains or having a multichain portfolio is as easy as using Binance; you don’t have to worry about gas management, bridging, or asset rebalance. Although a few dollars here and there don’t seem like a big improvement, this saves the protocols millions every year that they can reinvest in the product and user experience.

$1M in volume a year for an average trader could lose over $10,000 to capital inefficiencies in fragmented markets. Over 1,000 traders, this is $10M in lost capital to the users and protocol. These numbers scale fast and are the “wasted energy” of Web3 that could be put to good use instead. This is one of the major reasons the NYSE was created and became the biggest market for people, brokers, and institutions to trade on a daily basis.

Q: Euclid is sometimes grouped with interoperability or chain abstraction projects. Why do you think that comparison misses the point?

A: Our infrastructure DOES improve interoperability and offer better chain abstraction, but it is definitely not what we are building. Unified markets onchain does make building multichain protocols or offering it to users much easier, but this is an effect of what we are building and not our main goal.

The mess that chain abstraction and interoperability are solving exists because fragmentation exists across networks. Euclid solves this for liquidity. Liquidity no longer is fragmented and it trickles down directly to the user experience.

Today, protocols tackling chain abstraction require fillers or solvers in the backend to complete a user intent instantly, which is expensive and is the main reason behind capital inefficiency. If these protocols use Euclid instead (which they will be very soon), they won’t need middlemen of any kind to fill user intents, and will provide a much more seamless user experience to users.

Q: Euclid recently raised $3.5 million from strategic investors. What was hardest about raising funds for an infrastructure project like this in the current market?

A: Although the market is harder than ever to raise in and liquidity is drying up, the main benefit is that only investors who are close and passionate about our vision decided to participate, which shapes us as long-term believers and supporters of the protocol and what we do. We’ve received support from strategic partners with whom we will work long-term to achieve our vision, and we are really grateful for this.

I also believe that today it is clearer than ever that infrastructure that permanently solves fragmentation and offers efficient markets is needed more than ever. As they say, you can predict the future of tomorrow by what is funded today.

Q: Several of the investors and partners are closely tied to the broader ecosystem. How do these relationships shape what Euclid is building next?

A: Capital is just one part of what we look for in investors. The access to integrate Euclid and put it on the map is what we are looking for. We are more confident than ever that our product fits in the ecosystem, but introductions are needed to start the flywheel as well.

It also creates the feedback loop of understanding what our partners need and their biggest problems, so we can make sure that our product solves this for them and keep iterating and updating our infrastructure to match the demand out there.

Q: As Euclid moves toward mainnet and a token, how are you thinking about the token’s role within the system rather than as a standalone asset?

A: The token is a value-accruing asset that aligns the entire ecosystem’s incentives. Every trade directly and indirectly accrues value to the holders, as well as it allows the protocol to use this token to incentivize more integrations (hence volume) and liquidity for even more efficient markets, and hence even more demand on trades, creating what we call the liquidity flywheel.

It will also offer governance rights to its stakers to participate in voting on future incentives, fee structures, and next iterations of the product.

Crypto World

US Court Sentences Fugitive in Major $73 Million Crypto Scam

A US federal court has sentenced a fugitive to the maximum statutory prison term for his role in a $73 million crypto fraud operation that targeted victims through fake investment platforms and online deception.

This case illustrates the growing risk of transnational crypto fraud. Scams like these have prompted US authorities to intensify investigations and enforcement targeting international money-laundering operations.

Sponsored

Sponsored

The Anatomy of a $73 Million Crypto Scam Operation

According to the Department of Justice, Daren Li, a dual national of China and St. Kitts and Nevis, played a key role in an international cryptocurrency investment scam. It operated out of scam centers in Cambodia.

The operation relied on social engineering, fake trading platforms, and money laundering networks to steal funds from victims in the US. Prosecutors said unindicted members of the conspiracy contacted victims through unsolicited social media messages, phone calls, and online dating services.

After building trust through professional or romantic relationships, often using end-to-end encrypted messaging apps, the scammers directed victims to spoofed websites designed to resemble legitimate cryptocurrency trading platforms.

“While technology has made it possible for people to quickly communicate with others who live oceans away, it also has made it easier for criminals to prey on innocent victims,” First Assistant US Attorney Bill Essayli for the Central District of California stated.

In other variations of the scheme, scammers told victims that they were representatives of customer support or tech service companies. They then pressured victims into sending funds via wire transfers or cryptocurrency platforms to resolve fake computer issues or non-existent security threats.

Sponsored

Sponsored

From Arrest to Escape: The Fugitive’s Flight

Li was arrested in April 2024 at Hartsfield-Jackson Atlanta International Airport. He pleaded guilty on November 12, 2024, to conspiring to launder proceeds from cryptocurrency scams and related fraud.

As part of his plea agreement, he admitted that at least $73.6 million in victim funds was deposited into bank accounts controlled by him and his co-conspirators. Of that total, at least $59.8 million flowed through US shell companies used to launder the proceeds.

Li also revealed that he directed others to open US bank accounts for shell companies, monitored international and domestic wire transfers, and oversaw the conversion of stolen funds into cryptocurrency to obscure their origin and ownership.

Prosecutors said Li is the first defendant in the case to be sentenced at that level of involvement. Eight co-conspirators have already pleaded guilty.

However, before sentencing, Li fled. Prosecutors said he cut off his electronic ankle monitoring device in December 2025 and absconded. He remains a fugitive.

Despite his disappearance, the court proceeded with sentencing. On February 9, 2026, a federal judge sentenced Li to the statutory maximum of 20 years in prison. This would be followed by three years of supervised release.

“The Criminal Division will work with our law enforcement partners around the world to ensure that Li is returned to the United States to serve his full sentence,” said Assistant Attorney General A. Tysen Duva of the Justice Department’s Criminal Division.

The sentencing marks the latest move in a broader Justice Department crackdown on global scam centers and crypto-related fraud. Last month, BeInCrypto reported that a US court sentenced a Chinese national to nearly 4 years in prison. The court also ordered him to pay more than $26 million in restitution for his involvement in a $36.9 million crypto scam.

Crypto World

Kyndryl (KD) Stock Plummets 53% After Delayed Filing and CFO Departure

TLDR

- Kyndryl (KD) stock tanked 53% to $11.05 after company delayed filing quarterly report over internal control problems

- Material weaknesses in financial reporting controls identified across fiscal 2025 and first half of fiscal 2026

- CFO David Wyshner and Global Controller Vineet Khurana departed, both replaced with interim executives

- Company reduced fiscal 2026 revenue forecast to -2% to -3% year-over-year on constant currency basis

- Shares touched 52-week low of $10.82, extending 12-month decline to 46% before Monday’s crash

Kyndryl stock suffered a devastating blow Monday, plunging 53% to $11.05. The IT services company delivered a trifecta of bad news that sent investors running for the exits.

The company announced it would delay filing its December quarter report. Internal control weaknesses over financial reporting forced the postponement.

These aren’t isolated problems. The material weaknesses stretch back through all of fiscal year 2025 and the first two quarters of fiscal 2026.

Kyndryl tried to calm nerves by saying financial statements won’t be affected. The company claims balance sheets, income statements, and cash flows remain accurate.

Wall Street wasn’t buying it.

Financial Leadership Vanishes Overnight

CFO David Wyshner walked out the door effective immediately. His sudden exit raised questions about what’s really happening behind the scenes.

Harsh Chugh took over as interim CFO. He currently serves as global head for corporate development and administration. Previous experience as Chief Operating Officer helps, but investors want permanent leadership.

Global Controller Vineet Khurana also left his position. That’s two top finance executives gone in one announcement.

Bhavna Doegar stepped up as interim corporate controller. She previously held the senior vice president of Finance and Strategy role.

When pressed about whether these exits connected to the accounting problems, Kyndryl refused to comment. The company’s silence only fueled more speculation.

Revenue Outlook Takes Major Hit

Kyndryl released third quarter earnings alongside brutal revised guidance. Fiscal 2026 revenue now expected to fall 2% to 3% on a constant currency basis.

Extended sales cycles drove the downgrade. Deals are taking longer to close across the business.

Kyndryl Consult, one of the company’s fastest-growing segments, saw particularly stretched deal timelines. Legacy IBM contracts from before the spinoff continue creating headwinds.

Oppenheimer analyst Ian Zaffino responded swiftly. He downgraded Kyndryl from Outperform to Perform and removed his price target completely.

The downgrade cited the shift in business dynamics and increased uncertainty from the CFO departure. Extended sales cycles in key growth areas added to concerns.

Shares hit a 52-week low of $10.82 during Monday’s rout. The stock had already fallen 46% over the previous 12 months.

Trading metrics show a P/E ratio of 13.91 and beta of 1.93, reflecting high volatility. Gross margins of 21.4% lag industry peers.

The company now faces extended uncertainty while working through accounting issues and filling two critical finance positions with permanent hires.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat18 hours ago

NewsBeat18 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World6 hours ago

Crypto World6 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Sports17 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World6 hours ago

Crypto World6 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout