Check out what’s clicking on FoxBusiness.com.

American Airlines’ leadership is facing a rare public rebuke from within its own ranks as the unions representing flight attendants and pilots have publicly questioned and criticized CEO Robert Isom’s leadership.

The Association of Professional Flight Attendants (APFA) on Monday issued a vote of no confidence in Isom. The union, which represents more than 28,000 American Airlines flight attendants, noted the vote of no confidence was the first in its history against an American Airlines CEO.

In an announcement about the vote, the APFA said “management decisions” have left American Airlines “dangerously behind” its competitors. Additionally, the union said that the vote was a signal that the airline’s “largest unionized workgroup has no confidence or trust” in Isom’s leadership. The union demanded leadership change at the airline in addition to accountability and “improved operational support.”

AMERICAN AIRLINES PLANS TO RESUME NONSTOP SERVICE TO VENEZUELA

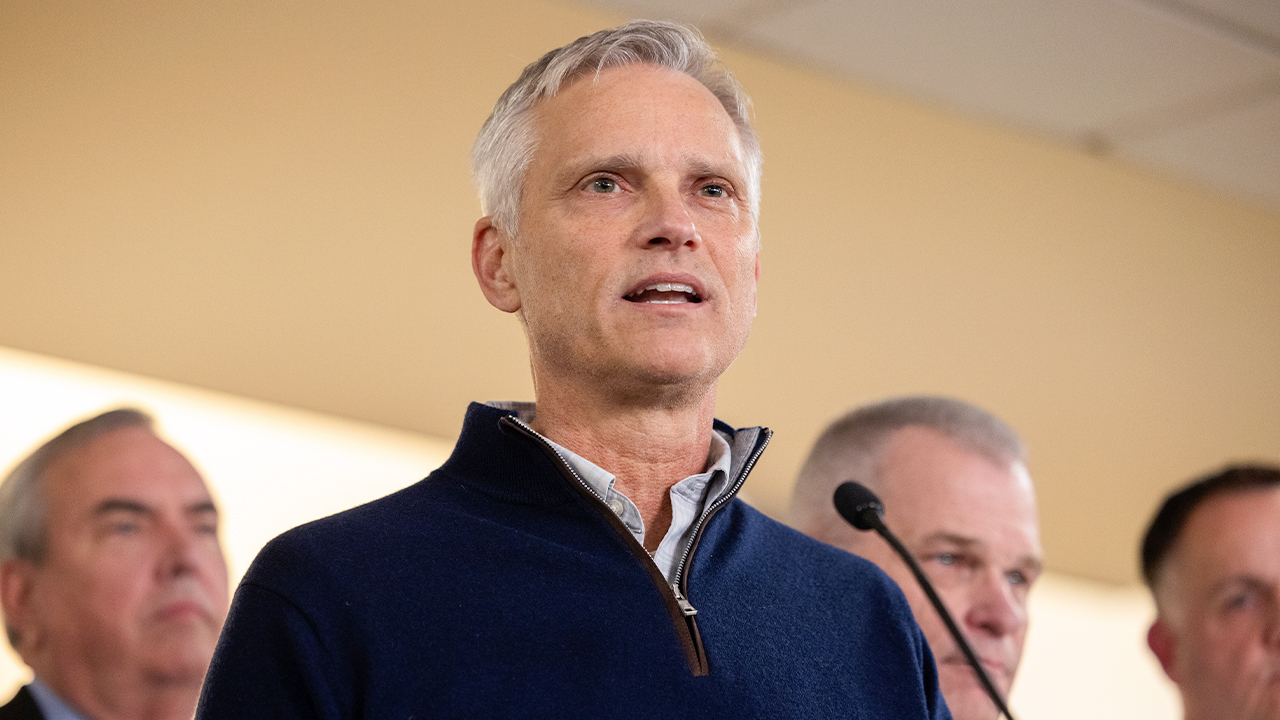

American Airlines CEO Robert Isom speaks at a press conference with other officials to give updates following a collision between an American Airlines plane and an Army helicopter in Washington, D.C., on Jan. 30, 2025. (Nathan Posner/Anadolu via Getty Images / Getty Images)

American Airlines has faced challenges that have caused it to lag behind its competitors. The airline made $111 million last year, while Delta Air Lines brought in $5 billion and United Airlines earned more than $3.3 billion, according to CNBC. The outlet noted that the discrepancy comes even as American Airlines flew at a similar capacity to its competitors in 2025.

“From abysmal profits earned to operational failures that have front-line Workers sleeping on floors, this airline must course-correct before it falls even further behind,” APFA President Julie Hedrick said in a statement following the vote. “This level of failure begins at the very top, with CEO Robert Isom.”

In response to FOX Business’ request for comment, American Airlines referred to remarks Isom made during the airline’s recent earnings call, which took place on Jan. 27.

“Our strategy to deliver on American’s revenue potential centers on four key areas: delivering a consistent, elevated customer experience, maximizing the power of our network and fleet, building partnerships that deepen loyalty and lifetime value, and continuing to advance our sales, distribution and revenue management efforts. While this has been a multi-year effort, 2026 will be the year these efforts start to bear fruit,” Isom said during the call in excerpts provided to FOX Business.

“I’ve been in this business for a long time, and I’m incredibly excited about what lies ahead for American. The foundation we built in 2025, combined with our go-forward strategy, positions us to deliver sustainable growth and create long-term value for our customers, team members, and shareholders,” he added.

AFPA cited several reasons behind its board’s unanimous vote of no confidence in Isom, including lagging competitiveness against rival airlines, excessive executive compensation despite financial losses, an allegedly botched sales strategy that tanked industry rankings and deepening operational instability.

An American Airlines passenger plane is parked at a gate at Ronald Reagan Washington National Airport on Aug. 24, 2025, in Arlington, Va. (DANIEL SLIM/AFP / Getty Images)

DELTA FLIGHT ABRUPTLY MAKES MIDAIR U-TURN AFTER SMOKE REPORTED FROM ENGINE

Captain Dennis Tajer, spokesperson for the Allied Pilots Association (APA) Communications Committee, told FOX Business that the pilots’ union “understands” the APFA’s “deep frustration” with Isom.

The “APA understands and respects their deep frustration with Mr. Isom’s leadership and his stewardship of American’s lack luster financial recovery to include the lack of a long-term strategy to catch Delta and United while defining an identity and positive culture for our airline. We have similar frustration,” Tajer said.

On Feb. 6, just days before AFPA issued its vote of no confidence, the APA sent a letter to the American Airlines Group Board of Directors requesting a formal meeting amid concerns about the airline’s leadership decisions. In its letter, the union noted that it represents more than 16,000 American Airlines pilots.

“Our airline is on an underperforming path and has failed to define an identity or a strategy to correct course,” the APA’s letter read. “This assessment is not the result of a single interaction with management, an isolated operational disruption, or an individual earnings report; it is the result of persistent patterns of operational, cultural, and strategic shortcomings. Copying competitors’ initiatives and reactive repairs to the mistakes of the past is not a strategy to a future that closes the gap between American and our premium competitors, Delta Air Lines and United Airlines.”

A Boeing 737-800 aircraft, operated by American Airlines, at Cincinnati & Northern Kentucky International Airport (CVG) in Hebron, Ky., on Friday, Feb. 6, 2026. (Bing Guan/Bloomberg via Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The union said that the airline’s management failed to “articulate a credible strategy and demonstrate measurable improvement,” despite the APA voicing its concerns “for more than a year.” The APA accused American Airlines leadership of praising “efficiency” while failing “to fully monetize the assets under their charge.”

“While our premium competitors’ market capitalization has soared, American’s has soured. As their free cash flow is sustained and growing, ours is inconsistent and stumbles,” the APA letter read.

Tajer said that the APA’s leadership was continuing to “consider all the options available,” though it was focused on “seeking engagement with the American board.”

The APA said it has yet to receive a response from the board of American Airlines.

FOX Business reached out to APFA for comment.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source