Politics

Autistic children’s school difficulties aren’t reason to cut support

UK-based autism charity Ambitious About Autism has released results of a survey which show that one in six autistic pupils have not been to school since the beginning of this academic year. They polled nearly one thousand young people and their families, finding a variety of reasons for their absence.

One thing is crystal clear: the consistent factor amongst the reasons for absence is the hostility caused by the school system and the government failing disabled students. 62% cited mental health issues, and a fifth said their school was not suitable.

For autistic people who have made it through to the other side of education, these statistics are entirely unsurprising. Schools are hostile environments in more ways than one, based in both the sensory and the social. Fluorescent lighting, loud echoing hallways, and intense dining room smells are just a few of the offensive sensory inputs that all combine with the heavy load of masking needed in order to try to fit in, navigate harsh rules, and attempt to focus on your work.

Autistic children are not your scapegoat

In the survey, 45% of the respondents said they felt blamed by the government for the absences. This should be validated, seen through the endless attacks on autistic people and their families to make the public see them as the enemy of the working class for needing more funding and support.

Neoliberalism sees these children as inconvenient. Not only do they cost more money, they cannot fit into the cookie-cutter system meant to spit out adults who are ready to assimilate straight into a workplace. This is where ableism is shown to be deeply intertwined with capitalism, where anyone who does not fit the mould is seen as a problem.

You may have heard autistic people referred to as ‘canaries in the coal mine’ before. This is the idea that we are the first to see threats or distress, which should be seen as a warning of something more systemic that will come to affect everyone. In the neoliberal education system, autistic children fit this: these environments are not truly built for anyone, and the higher levels of distress faced are only indicative of the fact that all children are being treated in a way that is problematic and misaligned with their needs.

This is a crucial moment for SEND support

This survey comes at a point in time where the government is planning to reform the special educational needs and disabilities (SEND) system. This proposes that it will improve outcomes for disabled children, but those more cynical can argue it is a money mission.

The reforms are apparently aiming to address delays and poor outcomes – and, of course, ‘unsustainable costs’. At this stage, Education, Health and Care Plans (EHCPs) are apparently not being scrapped, but it appears that schools will have their own responsibilities around assessment. This is significantly concerning due to lack of expertise and the possible lack of accountability.

It should not matter that more children than ever fall into the SEND category or need EHCPs. Every single individual deserves access to the support they need, whether that is in a specialist setting or in mainstream, where 70% of (diagnosed) autistic children are educated. We need more specialist settings where autistic children can thrive in environments that are built for them, with the right transport, properly trained staff, and supported transitions. 20% of those surveyed were out of school due to unsuitable school placement.

If schools were changed at a fundamental level, given an entirely different culture, accommodating many autistic young people would still be necessary but could become an easier task. Softer sensory environments, more regulated nervous systems and social support help every child regardless of their need. We will always need individual accommodations, and many autistic children will still need specialist support, but the current system sets everyone up for failure.

This is a critical moment in how we see, hear and support autistic children and their families. They deserve holistic care, in the right environment, and an inclusive system. The focus remaining on money is not the answer.

We have to take autistic children and families seriously

While Ambitious About Autism is using these statistics to raise awareness of why non-attendance occurs for autistic young people, mass media has latched onto them to fuel their debates on the lives of disabled people. Many of the discussions are intentionally inflammatory and lead to further stigma for autistic children and their families, who are simply trying to survive a system that is built to work against them.

Terms like ‘school refusal’ and ‘non-compliance’ are thrown around constantly. The implication is heavily that this is a choice, that young people are simply acting up or their parents should just be parenting better. That is not the reality faced by thousands of families. They have been abandoned by the system and are having to fight every day, often losing their jobs or income as collateral.

Mental health crisis, autistic burnout, and exclusions are almost normalised when it comes to autistic children and young people. It should not be seen as acceptable that huge swathes of children are being failed.

There is a deep irony at how many people on the right use ‘we need to look after our own’ to justify their bigotry, until it is disabled children and parents who are drowning in a system that refuses to care.

This survey should prove the gaps we know exist, not justify the perpetuation of horrific narratives which target such a vulnerable group. Autistic children and their families are not asking for too much: simply advocating for something that is their right.

Featured image via the Canary

Politics

Labour said Scottish nuclear study could be a waste of money

The UK government has admitted that a study into the suitability of Scottish sites for new nuclear power projects could have been “a waste” of money. The government commissioned Great British Energy-Nuclear (GBE-N), a public body, to carry out the study.

The revelation came after Department for Energy Security and Net Zero (DESNZ) secretary of state Ed Miliband told Scottish journalists in October 2025 that:

given the growing interest in nuclear in Scotland, I’m asking GBE-N to assess Scotland’s capability for new nuclear power stations, including at Torness and Hunterston.

This is going to be a very, very big issue in the Scottish election campaign. We are saying yes to new nuclear in Scotland.

Labour hoping to end SNP ban on new nuclear in Scotland

Scotland is due to go to the polls to elect a new Scottish parliament and Scottish government in May 2026. Labour is hoping to wrest back control from the Scottish National Party (SNP).

In an article about the same interview published in October 2025, the Scotsman newspaper reported that a “senior UK government source” had said they were considering submitting planning applications for new nuclear developments at Torness and Hunterston because they expected a Scottish Labour victory at the Holyrood election.

The UK Labour Party and Scottish Labour support nuclear power and nuclear weapons. This position is coming under pressure as the Green Party of England and Wales, which vehemently opposes all nuclear, increasingly challenges Labour in public opinion polls.

Under the Freedom of Information (FOI) Act, the government released documents to the Canary about Miliband’s request to GBE-N. These included a Q&A document prepared by DESNZ officials. It revealed that officials knew there would be concerns about new nuclear proposals in Scotland.

No new nuclear can be built in Scotland because planning policy is a devolved matter, and the ruling SNP opposes nuclear power. The rebuttal in the DESNZ Q&A was that there is “cross-party interest in new nuclear” in Scotland.

Energy department officials contradict each other on responsibility for study

The documents released under FOI also revealed that a DESNZ official, whose name was redacted, had sought to reassure GBE-N colleagues that DESNZ was not “behind the briefing” in an email sent on 22 October 2025 at 4:02pm.

That position was contradicted by an email in a separate earlier conversation where, on 21 October 2025 at 6:46pm, John Staples, DESNZ director for new nuclear strategy and fusion energy, said:

our SpAds [special advisors] want SoS [secretary of state] to be able to say the below to Scottish journalists.

‘Below’ in the email were lines drafted for Miliband which included:

I will ask Great British Energy – Nuclear to begin assessing Scotland’s capability for new nuclear power stations.

The internally prepared Q&A included a question which asked:

Isn’t this study a waste of money?

The DESNZ answer said:

New nuclear projects can deliver millions of pounds of investment and thousands of high-quality jobs to a region – UK ministers want to understand the potential for new projects right across Great Britain.

The Canary approached the Labour Party for comment, which deferred to DESNZ. DESNZ did not respond to a request for comment.

‘Obvious’ that study would be ‘waste of money’ – Scottish CND

A Scottish Campaign for Nuclear Disarmament (CND) spokesperson told the Canary:

It is obvious that an assessment of the viability of new nuclear sites in Scotland would be a waste of money, since the foremost issue is not the viability of sites but Scottish government policy.

Energy policy is devolved to Holyrood and the Scottish government very sensibly opposes new nuclear plants in Scotland.

There are a whole host of reasons why new nuclear plants in Scotland would be a terrible idea, including the absolutely exorbitant cost of nuclear plant construction, the reliance on destructive and unjust international uranium supply chains, and the enormous and cross-generational burden of decommissioning nuclear plants, which in the case of Dounreay is expected to take hundreds of years.

In particular, the notion that Scotland, which is a net energy exporter and has the potential to become an international renewables powerhouse, should pivot to costly nuclear projects at this stage is somewhat absurd.

Investing the same sums invested in nuclear power plants – scores of billions and climbing for Hinkley Point C and Sizewell C – into the grid, home insulation and the renewables sector across Scotland would be an immeasurably better investment.

For Scottish CND, another concerning element of the renewed push for nuclear power is the deep imbrication [overlapping] of the ‘civil’ and military nuclear industries, as openly promoted in the 2025 Industrial Strategy.

From this perspective, investment in new nuclear power plants can be seen as defence spending by stealth and a means of shoring up the UK nuclear weapons industry – something which is of no benefit to Scotland and indeed causes major risks and harms in Scottish communities.

New nuclear would be incredibly expensive – Scottish government minister

Cross-party Scottish politicians elected to the Holyrood and Westminster parliaments criticised the commissioning of the study.

Scottish government energy secretary Gillian Martin MSP told the Canary:

The Scottish government does not support the creation of new nuclear reactors in Scotland.

New nuclear would be incredibly expensive and the levy placed on energy bills to pay for nuclear reactors will cost Scottish electricity bill payers £300m over the next decade.

Nuclear reactors also produce a legacy of dangerous radioactive waste. Instead, we are focused on supporting the development of Scotland’s immense renewable energy potential – which provides more jobs, is faster to deliver, is safer, and more cost effective than the creation of new nuclear reactors.

Significant growth in renewables is providing key opportunities for our future energy workforce in Scotland, with independent scenarios from Ernst and Young showing that with the right support, Scotland’s low carbon and renewable energy sector could support nearly 80,000 jobs by 2050.

SNP criticises ‘Westminster obsession with nuclear’

The SNP’s Westminster energy spokesperson Graham Leadbitter MP told the Canary:

People in Scotland are already paying a tax for new nuclear power stations in England they neither want nor need, driving up energy bills at a time households are already under serious financial pressures.

Scotland is blessed with an abundance of clean, renewable energy already, enough to power our nation many times over.

So this Westminster obsession with nuclear isn’t based on need, or even any desire from people living here who would rather not pay hand over fist for expensive and unnecessary nuclear power.

Instead what they should be focusing on is delivering on their promise to cut energy bills by £300 which have instead, under Labour’s rule, risen significantly higher.

People in Scotland are tired of these out-of-touch diktats from Westminster politicians about what should be built here, all while ignoring the genuine concerns of the people who live and work here.

It’s no wonder more and more people are concluding that decisions about Scotland should be made in Scotland with the full powers of independence.

‘New nuclear would waste time, money and political attention’ – Scottish Greens

Scottish Greens net zero spokesperson Patrick Harvie MSP told the Canary:

There is a clear majority against new nuclear power programmes in Scotland.

New nuclear would waste time, money and political attention which should be spent on the real challenges we face on climate and energy policy.

Scotland has made impressive progress in building an energy system based on renewables, which are cheaper, faster to deliver and far safer for people and the environment. There’s still plenty of potential for renewables to keep growing.

The UK government shouldn’t be wasting money trying to push nuclear projects on Scotland, against the wishes of Scotland’s parliament.

If they care about cutting emissions and cutting fuel poverty, they’d be changing electricity price regulation to pass on the low cost of renewable generation to billpayers, which would cut the cost of living and create a powerful incentive to switch away from fossil fuels for heat and transport.

If the UK government won’t do that, it should give Scotland the power to do so for ourselves.

Scotland should not have to deal with the distraction of UK Labour’s nuclear fantasy, when we need both governments to scale up and speed up in eradicating fuel poverty and in the race to net zero.

Featured image via the Canary

Politics

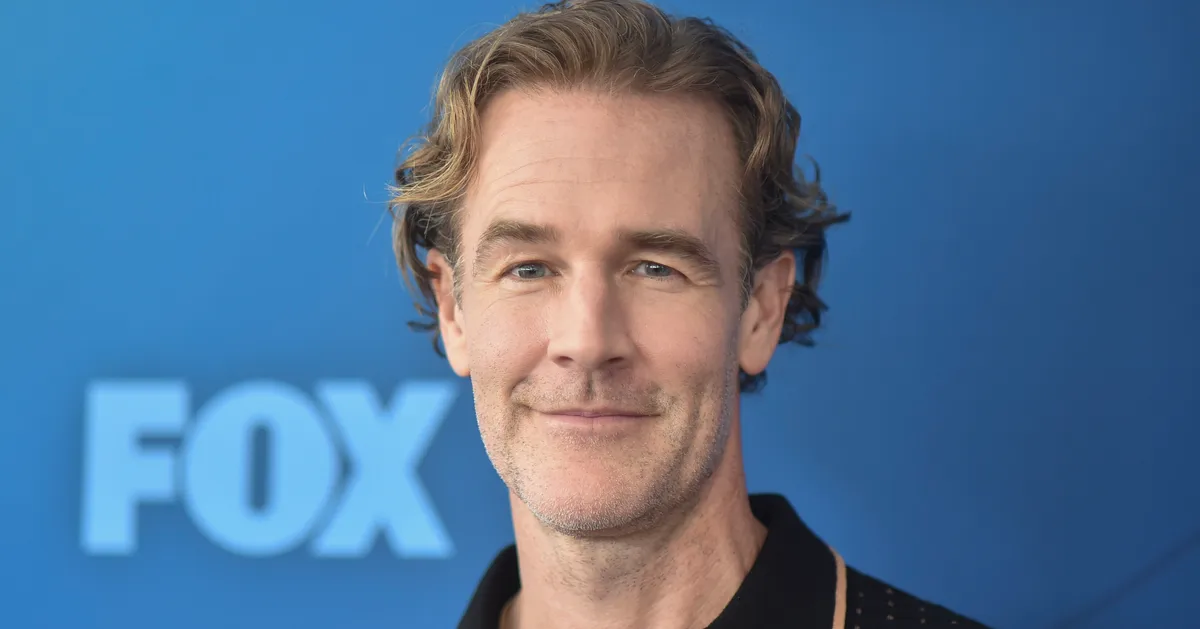

‘Dawson’s Creek’ Star James Van Der Beek Dead At 48

!function(n){if(!window.cnx){window.cnx={},window.cnx.cmd=[];var t=n.createElement(‘iframe’);t.display=’none’,t.onload=function(){var n=t.contentWindow.document,c=n.createElement(‘script’);c.src=”//cd.connatix.com/connatix.player.js”,c.setAttribute(‘async’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c)},n.head.appendChild(t)}}(document);(new Image()).src=”https://capi.connatix.com/tr/si?token=19654b65-409c-4b38-90db-80cbdea02cf4″;cnx.cmd.push(function(){cnx({“playerId”:”19654b65-409c-4b38-90db-80cbdea02cf4″,”mediaId”:”69ff0776-0868-403b-9d77-f09aa1a5fa19″}).render(“698ce24ee4b01dbafe69309c”);});

Politics

Labour double standards called out

Novara Media’s Ash Sarkar has laid bare the blatant double standard in the Labour Party’s vetting process:

Worth remembering that Faiza Shaheen was deselected as a Labour candidate for liking tweets from the Greens *before* she was ever a Labour member.

What could possibly explain such an intensive vetting process for the left, and such an apparently shoddy one for the right? https://t.co/hSxjZfYKfN

— Ash Sarkar (@AyoCaesar) February 11, 2026

Labour have one rule for one lot, another for the rest

Sarkar’s interjection followed a post from the Times assistant political editor Geri Scott. Scott referred to a comment from Education minister Georgia Gould, who insisted the government were ‘unaware’ of Matthew Doyle’s links to Sean Morton when announcing his peerage.

Doyle reportedly campaigned for Morton, a former Moray Labour councillor. A court sentenced Morton in 2018 for possessing Child Sexual Abuse Materials (CSAM). Authorities brought charges against him in 2016, yet Labour waited a year before suspending him from the party. A recent investigation found that Doyle was jailed for further similar offences last year, shining a spotlight on Labour’s selective vetting.

Despite Gould’s deflection, Scott has pointed out the government were aware prior to the letters patent being sealed and passed to the King, adding:

A govt source says: “There is no established precedent for withdrawing a peerage nomination after the announcement stage.”

An X account responded and challenged Gould’s links to Mandelson herself:

Georgia Gould? daughter if Philip Gould? Appointed by Peter Mandelson ? See? dots dots dots all joining up

Sarkar points out this double standard by referring to the Labour party’s treatment of Faiza Shaheen. The party suspended Shaheen prior to the general election. The scandalous suspension came after old posts showed Shaheen liking content from the Green Party. Sarkar astutely points out those likes were prior to being a member of the Labour Party, whilst shining a light on what is (or isn’t) a ‘sackable offence’ in the eyes of Labour leader and PM Keir Starmer.

One X account commented:

You can’t say they’re not thorough when investigating things they are bothered about, it’s such a shame they have really bad priorities.

They can hardly say they weren’t warned, with the leader of the SNP tabling a motion 4 weeks ago in response to Doyle’s peerage:

It’s just 4 weeks since I tabled a motion opposing this very appointment to the House of Lords.

Why did Keir Starmer ignore the warnings, and the victims, and appoint him anyway?https://t.co/oBXOdUm9hF https://t.co/NJxMbFujGm pic.twitter.com/IiVFNQwt6O

— Stephen Flynn MP (@StephenFlynnSNP) February 10, 2026

Vetting process clearly works, but the boss shouldn’t get to decide

This issue once again exposes a blatant double standard at the heart of government. It also reveals the autonomy afforded to those in charge when it comes to deciding what ‘issues’ matter to them.

Sexual offences against children should really be on that list of concerns. And Starmer must answer why it doesn’t seem to actually bother him in the first place.

Featured image via the Canary

Politics

James Van Der Beek, Dawson’s Creek Actor, Dies Aged 48

James Van Der Beek has died at the age of 48.

She wrote: “Our beloved James David Van Der Beek passed peacefully this morning. He met his final days with courage, faith, and grace.

“There is much to share regarding his wishes, love for humanity and the sacredness of time. Those days will come. For now we ask for peaceful privacy as we grieve our loving husband, father, son, brother, and friend.”

James began his acting career in the early 90s with a number of small roles, before landing the title role in Dawson’s Creek in 1998.

The show ran for six seasons before coming to an end in 2003, with the cast also including the likes of Katie Holmes, Michelle Williams and Joshua Jackson.

His other TV work included recurring roles in How I Met Your Mother and another teen drama, One Tree Hill, as well as playing a fictionalised version of himself in the sitcom Don’t Trust The B– In Apartment 23.

Meanwhile, James’ film work included Varsity Blues (for which he won a Teen Choice Award in the late 1990s), The Rules Of Attraction, Labor Day and, more recently, Bad Hair.

In November 2024, James disclosed that he had been diagnosed with stage-three cancer and was undergoing treatment.

Last year, he took part in the US version of The Masked Singer as “Griffin”, as well as making a well-received cameo in the comedy Overcompensating.

Around this time, he had been due to take part in a one-off Dawson’s Creek reunion with his former castmates, but was ultimately unable to attend due to illness.

Prior to his death, he had completed work on the Legally Blonde TV prequel Elle, in which he will be seen as the recurring character Dean Wilson in his final TV role.

James is survived by his wife, Kimberly, and their six children.

Politics

Six in ten young people fear false claims could mislead voters

Findings from a new national survey from Internet Matters and Full Fact highlight a significant challenge to the government’s intention to lower the voting age. Extending the vote to 16 and 17-year-olds risks becoming a missed opportunity to strengthen democratic participation and trust in politics, unless young people get more support to navigate political information online.

The survey quizzed more than 550 young people aged 13-17, and over 800 parents and carers across the UK. It found that young people do not feel well-equipped to assess the political information they are encountering online from a young age.

Key findings – young people want to know more

Children are navigating political content well before voting age. 74% of those aged 13-14 have seen content about news, politics or current affairs online.

Children lack foundational skills for evaluating political information. Only 53% of young people aged 13-17 who have seen political information online are confident in telling whether it’s true or false. And just 59% feel confident distinguishing fact from opinion online.

Misinformation and AI are undermining trust in elections. 63% of young people say they’re concerned about voters being misled by false or misleading claims during elections. 60% are concerned that AI-generated content may affect the results of a general election. And the same number ignore what politicians and political parties say because they don’t know if they can trust them.

Parents think children aren’t ready to make informed electoral decisions. 52% of parents think young people are unprepared to vote. Only 49% express confidence in their child’s ability to recognise satire.

Young people believe there’s a shared responsibility for helping them to identify false or misleading information online. This spans across schools, parents and carers, government, and social media companies.

Recommendations – institutions need to do better

Internet Matters and Full Fact are calling on parliament and government to take four immediate steps to ensure support for newly enfranchised voters to participate confidently in democratic life.

1. Schools need support to strengthen media and digital literacy across the curriculum through access to high-quality resources and comprehensive teacher training. A recent independent review of the curriculum in England highlighted the need to equip young people with the ability to make informed decisions and to help them to understand how opinions, AI-generated content and satire can all influence democratic participation.

2. The government needs to establish a clear, coordinated national approach to media literacy. This should involve supporting young people and adults, including parents and carers. The government should urgently publish its ‘vision statement’ on media literacy, setting out objectives, priorities and measures of success.

3. The government must commit to sustained funding to deliver media literacy education outside schools. This should include the Electoral Commission delivering evidence-based public information campaigns on issues such as misinformation.

4. Parliament must require social media companies to support users’ media literacy on platforms, including labelling AI-generated content, design features that support critical evaluation (e.g. read-before-you-share prompts and source information labels), and user controls for recommender systems.

Rachel Huggins, CEO of Internet Matters, said:

Young people are growing up in a digital world where much of their political information comes from online platforms, where it can be difficult to judge what is a fact and, with the rise of AI-generated content, even what is real.#

Lowering the voting age will only succeed if young people – and the parents and carers supporting them – are given the tools to navigate and engage successfully within that world, rather than attempting to shut them out of it.

Mark Frankel, Head of Public Affairs at Full Fact, said:

By the age of 13, many young people are engaging with political information. Rather than banning them from social media, we need to teach children the skills to navigate and assess these sources of political information.

MPs debating the Elections Bill need to send a clear message that future elections will be protected from disinformation and AI, to keep young people engaged with politics.

Emily Darlington MP, Member of the Science, Innovation and Technology Committee said:

We have seen from the Committee’s inquiry into the 2024 summer riots just how damaging misinformation can be for our democracy. This research shows that a majority of kids agree, and that they’re worried about how safe our democracy is in this new age of AI and mis/disinformation.

If the next generation of voters doesn’t have confidence in our democracy, we have a responsibility to act before it’s too late. Online platforms must be participants in the fight to protect trust in our democratic processes, rather than undermine it.

Kirsty Blackman MP, Co-Chair of the APPG on Political and Media Literacy, said:

These findings underline what members of the APPG have long argued: extending the franchise to 16 and 17-year-olds must come with a whole-of-society commitment to equipping young people to navigate the digital information environment they already inhabit.

When 6 in 10 young people are concerned about the potential for misinformation and AI-generated content affecting elections, protecting our democracy means embedding political and media literacy education in the National Curriculum, supporting teachers to deliver it, and holding tech platforms to account through media literacy by design.

Stella, a student aged 14, told Internet Matters:

I think it’s important for children and young people to be taught how to navigate the information they see online from a young age, so they can feel confident forming their own views about politics and voting. The earlier this support starts, the better prepared young people will be to take part.

Featured image via the Canary

Politics

Why Europe’s elites have embraced sneering anti-Americanism

In recent months, anti-Americanism has emerged yet again as a respectable prejudice in Europe. It is widely promoted through the mainstream media and enthusiastically endorsed by the continent’s cultural elites. There are now even numerous campaigns to boycott American goods – most respondents to a survey in France said they would support a boycott of US brands like Tesla, McDonald’s and Coca-Cola. As a piece in Euractiv put it, anti-Americanism is ‘in vogue across Europe’.

This has become all too clear at the Winter Olympics, currently being held in northern Italy. At the opening ceremony for Milano Cortina 2026, Team USA and vice-president JD Vance were booed by a crowd of over 65,000 people. Someone I know who attended the event told me that the booing was spontaneous and quickly became widespread. According to the European Union’s foreign-policy chief, Kaja Kallas, those booing were displaying ‘European pride’. It seems that for the Brussels elites, anti-Americanism bolsters Europe’s self-esteem.

The explicit target of this resurgent anti-American animus is, of course, US president Donald Trump. But it’s implicitly aimed at all those who voted for him, too. In a piece on boycotting American goods in the normally sober Financial Times, published last March, the author gave the game away. While saying it is ‘wrong to conflate Americans and their president’, he argued that ‘it’s [also] wrong to disentangle them entirely… Trump reflects half of America. He reflects a society where a democratic majority is prepared to tolerate mass shootings and a warped political system.’

Certain politicians are being boosted by this wave of anti-Americanism. Canadian prime minister Mark Carney, in particular, has been turned into the unexpected hero of the European political establishment. His defiance of Washington has turned him into the posterboy for this new brand of anti-Americanism. ‘Europe has a lot to learn from Mark Carney’, was the verdict of the New Statesman. The Guardian echoed this sentiment: ‘Europe must heed Mark Carney – and embrace a painful emancipation from the US.’

Expressing anger against America appears to be the one emotion that binds the European political establishment. As one Financial Times commentator explained earlier this month, ‘Trump is Europe’s best enemy yet’. He has apparently provided Europe with the ‘common foe’ it needs. It appears that anti-Americanism is now the glue holding together otherwise disoriented and divided European elites.

The reason usually given for this turn against the US is Trump’s behaviour towards Europe, specifically his threats to annex Greenland, impose tariffs and downgrade America’s NATO commitments. No doubt these policies have played an important role in putting Europe’s ruling classes on the defensive. However, they are not the leading cause of this wave of anti-Americanism. Rather, they have merely brought to the surface pre-existing prejudices deeply entrenched within Western Europe’s elite culture.

In his fascinating study, Anti-Americanism in Europe (2004), Russell Berman linked the growth of anti-Americanism during the 1990s and 2000s to the project of European unification. Berman claimed that, in the absence of an actual pan-European identity, anti-Americanism ‘proved to be a useful ideology for the definition of a new European identity’. He noted that the main way Europe defines itself as European is precisely by underscoring its difference from the United States.

Berman’s argument has been echoed by political scientist Ivan Krastev. He observed in 2007 that anti-Americanism is particularly strident among Europe’s elites and its young people. ‘Elites in search of legitimacy and a new generation looking for a cause’, he wrote, ‘are the two most visible faces of the new European anti-Americanism’.

The elite hostility to America was captured well by Matthew Karnitschnig in Politico: ‘It’s got cold in Europe, the economy is tanking and the natives are getting restless. There’s only one answer: Blame America.’ As Karnitschnig put it, ‘pointing across the Atlantic has long been a favorite diversionary tactic for Europe’s political elites when things start to get dicey on the continent’.

Historically, European anti-Americanism often emphasised the moral inferiority of American people and their way of life. Jesper Gulddal’s review of anti-Americanism in 19th-century European literature showed that authors from France, Britain and Germany ‘argued emphatically that America’s lack of tradition and culture, as well as its materialism, vulgarity, religious bigotry and political immaturity constituted not only the essence of this country’s very being but that they would also somehow infest Europe’.

Contempt for the American way of life has always been particularly widespread among European intellectual and the cultural elites. Writing at the turn of the 20th century, British economist Sydney Brooks attributed the hostility to America to ‘envy of her prosperity and success’. Europeans, he wrote, ‘intensely resent the bearing of Americans… They hate the American form of swagger.’ They saw a country ‘crudely and completely immersed in materialism’.

One of the most famous slurs against the US came in the early 20th century, when French prime minister Georges Clemenceau sneered that, ‘America is the only nation in history which miraculously has gone directly from barbarism to degeneration without the usual interval of civilisation’.

During the Cold War years, Europe’s cultural elite continued to view America with a mixture of resentment and contempt. ‘America the violent, America the crass, America the inept have all become everyday images in Europe’, concluded the US ambassador in London in early 1987. This attitude has got much worse since. The well-known British author Margaret Drabble wrote in May 2003, two months after the invasion of Iraq:

‘It has possessed me like a disease. It rises in my throat like acid reflux… I can’t keep it down any longer. I detest Disneyfication. I detest Coca-Cola. I detest burgers. I detest sentimental and violent Hollywood movies that tell lies about history.’

Drabble’s visceral disgust towards America was shared throughout Europe. German theatre director Peter Zadek gave full vent to his prejudices against the American people during the Iraq War:

‘The Bush administration was more or less democratically elected, and it had the support of the majority of Americans in its Iraq War. One can therefore be against the Americans, just as most of the world was against the Germans in the Second World War. In this sense, I am an anti-American.’

Today, the European elites’ anti-American ideology has acquired a new dimension. It is now interwoven with their fear and loathing of the right-wing populism now rising within Europe itself. As Mark Leonard, director of the European Council on Foreign Relations, wrote in the Guardian last week:

‘European governments are terrified of Donald Trump’s threats on trade, Greenland and the future of NATO. But the biggest threat is not that Trump invades an ally or leaves Europe at the mercy of Russia. It is that his ideological movement could transform Europe from the inside.’

Leonard warned that ‘a year after Trump’s return to the White House, his “second American revolution” is radiating outward into Europe’. Like Leonard, the EU elites are worried that the Trump administration could boost the populist challenge to their rule. Several commentators have drawn attention to the alliance between European populist movements and Washington. As one put it earlier this year, ‘European democracies are facing a pincer attack: externally taking fire from the US administration and Silicon Valley companies, internally from the European far right.’

The argument that Europe is under siege from Washington without and populists within is not without merit. After all, the recently published US National Security Strategy explicitly promotes ‘cultivating resistance to Europe’s current trajectory within European nations’. But for all that, this ‘resistance’ really is a home-grown phenomenon. Its future does not depend on external encouragement, but on its capacity to continue to provide a voice for the people of Europe.

There is no reason to think that the populist surge in Europe will abate when Trump departs the White House. European elites, uncomfortable with the principle of national sovereignty, have long channelled decision-making away from the people and towards expert institutions, non-governmental organisations and international bodies. It is this profound democratic deficit, not the Trump White House, that has provided populist movements with their energy. They appeal to vast swathes of Europe’s national publics – to those, that is, who believe that they have been excluded from the decision-making that impacts their lives.

It is therefore unlikely that European elites’ increasingly shrill anti-Americanism will do much to dent the growing influence of populist parties. Nor can it create a European identity with widespread public appeal. As matters stand, European anti-Americanism is likely to emulate the post-Brexit ‘Remainer’ identity. Like Remainerism’s antipathy to British national sovereignty, this new Europeanism has little substantive content beyond its opposition to Trump’s America.

In the end, anti-Americanism serves as a distraction. European leaders would far rather sneer at Trump’s America than confront their own profound failures and unpopularity. Anti-Americanism might help the elites feel better about themselves, but it is growing increasingly clear that it won’t save them at the ballot box.

Frank Furedi is the executive director of the think-tank, MCC-Brussels.

Politics

Jewish activists disrupt Nigel Farage at launch of Reform UK’s “Jewish Alliance”

Jewish activists from Jewish Anti-Zionist Action, and other grassroots groups within the Jewish Bloc for Palestine have protested and interrupted the launch event of the “Reform Jewish Alliance”.

As Reform UK leader Nigel Farage took the stage to address the launch event’s attendees at London’s Central Synagogue, a group of protesters in the audience disrupted his speech. They loudly accused him and members the Reform party of “inciting attacks” on refugees and minority groups. And they claimed that Farage’s party “would have deported” the protesters’ ancestors when they arrived in Britain as Jewish refugees in the first half of the 20th century.

Jewish protesters criticise synagogue for hosting Reform

Protesters also gathered outside the Central Synagogue to picket the launch event and protest against the use of Jewish religious spaces to host such events. They accused the venue of providing a platform for racism, xenophobia and antisemitism. And protesters held signs highlighting a series of high-profile controversial quotes by Reform UK-affiliated politicians. Several referenced antisemitic remarks which Nigel Farage allegedly made during his time at Dulwich College.

Max Hammer, a spokesperson for the Jewish Bloc for Palestine, said:

It’s not surprising to see disgraced right-wing provocateurs and former spokespeople for Israel’s genocidal government make overtures to Farage’s Reform.

But we’re dismayed and disgusted to see the Central Synagogue play along. How can a synagogue provide a platform to a man who allegedly spent his school days saying that Hitler was right?

We cannot stay silent when known antisemites use our sacred spaces to try and launder their reputation. Farage and his ilk are dangerous to Jews, dangerous to Muslims, and dangerous to all minority groups in the UK. No one in our community should let him forget that.

A coalition of progressive Jewish groups had previously decried the launch of Reform Jewish Alliance. Reporting suggests the group will aim to provide members with a programme of regular events featuring senior politicians from the far-right party and figures in the Jewish community.

The Jewish Bloc for Palestine previously released a statement denouncing the Synagogue’s plans to host the Reform Jewish Alliance launch. They called it a “desecration of [the synagogue’s] purpose” and encouraged Jewish community leaders to condemn the event.

The Reform Jewish Alliance was reportedly initiated by noted right-wing Jewish activist Gary Mond. And its leader will be Jason Pearlman, a former advisor to Israeli president Isaac Herzog.

Amid the high-profile accusations of antisemitism against Farage, the controversy surrounding its launch symbolises the growing political polarisation within the UK Jewish community. Recent polling by the Institute for Jewish Policy Research indicates that support for Reform UK has risen sharply among Jews in the past year. Although at 11%, it remains substantially below the levels of support in the overall British population.

Featured image via Talia Woodin / Jewish Anti-Zionist Action

Politics

Maximus is advising employers staff with ME need to exercise more

Infamous outsourcing company Maximus is telling employers their staff living with myalgic encephalomyelitis (ME) need to exercise more to “boost energy” and “get more done”.

Amid a shocking and, likely, wilful misrepresentation of the devastating chronic systemic neuroimmune disease, the notorious privatisation giant is promoting dangerous treatment “strategies”, namely, Graded Exercise Therapy (GET) and Cognitive Behavioural Therapy (CBT), that a leading UK health body roundly discredited in 2021.

Maximus peddling ME advice to employers

Maximus, with its decades of hoovering up government contracts to profit from making chronically ill and disabled people’s lives hell, appears to have appointed itself the oracle of:

Creating inclusive workplaces for people with disabilities.

Setting aside the first red flag that it’s clearly not operating from the Social Model of Disability and using community-preferred ‘disabled people’, its history of benefit deaths and harm hardly screams authority on inclusivity. Nevertheless, the ‘Kill Yourself’ scandal benefit assessor has a whole host of advice for employers with disabled staff — because of course it does.

Specifically, it’s providing this in the form of free ‘toolkits’ on particular health conditions and disabilities.

One of these offers information to employers on ME. The first issue to note here is that, instead of ME, it heads its webpage:

Chronic fatigue, fibromyalgia and multiple sclerosis toolkit

So to start with, Maximus is ignoring the community-preferred term. Not only that, but it’s also conflating ‘chronic fatigue’; the symptom, with ‘chronic fatigue syndrome’; the condition.

And naturally, with that strong start, it’s all only further downhill from there.

Exercise yourself better

A sparsely-informative three-page spread tells employers that ME is a:

long-term chronic fluctuating illness affects many parts of the body, including the nervous and immune systems.

It then states that:

The most common symptoms are severe fatigue or exhaustion, problems with memory, concentration and muscle pain.

Predictably, the toolkit fails to even mention the hallmark of ME — post-exertional malaise (ME). This involves a disproportionate worsening of other symptoms after even minimal physical, social, mental, or emotional exertion. And it’s the key reason that Graded Exercise Therapy (GET) is dangerous for people living with ME.

So with this omission, it opens the door to the guide promoting GET and GET-type rebrands (‘activity management’). This is despite the fact that in 2021, the National Institute for Health and Care Excellence (NICE) removed GET as a treatment recommendation in the treatment of ME.

There’s a brief mention of pacing. However, any good work it does highlighting this, it quickly undoes with talk of increasing activity.

A separate page on its website gives further alarming advice to employers around staff with ME. In an A-Z of Disabilities, Maximus tells employers to give “onsite exercise classes” and “discounts on gym memberships”.

This is because, according to the self-appointed ME expert (emphasis ours):

Symptoms may be worsened by over-exercising or too much inactivity

Think yourself better

Of course, no gaslighting guide to cover for employers unprepared to make genuine accommodations for people with ME would be complete without an undercurrent of psychologisation.

Maximus was only too happy to hawk this psychosomatic intimation. In the toolkit, it lists CBT amid its “treatment strategies”. NICE downgraded this ‘think yourself better’ garbage for people living with ME in 2021 as well. For years, psychologising clinicians have used it as a stick to beat ME patients with. The unsubtle implication is always that it’s all in their heads.

The A-Z is no less minimising. It tells employers to “reduce stress by promoting mindfulness” and signposts to Maximus’s own Access to Work Mental Health Support Service.

Parts of the guidance point to “large or unhealthy meals” and “lack of relaxation” as exacerbating symptoms. People with ME will likely have specific dietary requirements due to symptoms and co-occurring conditions. However, the suggestion that it’s their unhealthy lifestyle that’s making their ME worse is insulting. The aim — and effect — is to shift responsibility away from employers and the medical profession who are failing ME patients everywhere.

A brand new toolkit — entirely out-of-date

If all this weren’t bad enough, another toolkit gives practically the same advice to employers over long Covid.

Maximus might be forgiven (though still wrong) for hosting an error-riddled toolkit like this in 2021. But over four years after NICE published its updated guidelines, it’s indefensible that the outsourcing giant is STILL peddling these harmful stereotypes and treatments for people living with ME.

According to source page information, the A-Z webpage is from 29 September 2022. In other words, it published this nearly a year after the NICE guideline changes. And Maximus even updated this again in January 2025.

To make matters worse, in the toolkit’s case, source information dates the toolkit to 2 December 2025. Maximus seems to have even modified the page in early January 2026. So, this is essentially brand new guidance it’s promoting to employers.

Not the first time Maximus has done this

This isn’t the first time Maximus has produced flawed information around ME either. The Canary previously exposed how alongside other outsourcing giants like Serco and Capita, it compiled problematic ME training materials for staff administering Work Capability Assessments (WCA).

It’s another glaring example of why profit-driven private companies should be nowhere near services supporting chronically ill and disabled people inside or outside of work. In this instance, the information is out-of-date and actively dangerous.

What’s patently clear is that it should not be posing as any sort of expert in ME or long Covid. But Maximus’s fallacious advice is very convenient for corporate capitalists and a government hell-bent on coercing chronically ill and disabled people into low-waged, inaccessible, and inappropriate work.

And at the end of the day, misinformation and manipulations like this are nothing you wouldn’t expect from a money-grubbing megacorporation like Maximus.

Featured image provided via the author

Politics

MAGA think tanks being funded by US are targeting Europe

US plans to fund MAGA-aligned think tanks in Europe could reshape debates over Britain’s Online Safety Act and global platform regulation.

A new transatlantic political debate is emerging around Britain’s Online Safety Act. The issue is now being shaped not only in Westminster but also in Washington.

Reporting by the Financial Times says the US State Department plans to fund MAGA-aligned think tanks and charities across Europe. The programme links to the upcoming 250th anniversary of American independence. Officials say it will promote what they describe as “American values,” including free speech.

A “freedom of speech tour” for MAGA

According to the report, US Under-Secretary of State for Public Diplomacy Sarah B. Rogers travelled to London, Paris, Rome, and Milan last year. Officials described the trip as a “freedom of speech tour.” During the visit, she met right-wing think tanks and political figures and discussed how grant funding could support their activities.

The MAGA-linked programme is expected to focus in part on opposing online-regulation laws such as the UK’s Online Safety Act and the EU’s Digital Services Act. US officials argue these rules threaten American technology companies and free expression online.

Across Europe, governments are tightening rules aimed at protecting children and reducing harmful online content. Countries such as Australia have also introduced tougher limits on children’s access to social media. This shows how global regulation in this area is moving in a stricter direction.

At the same time, Washington has increased criticism of these measures, arguing that they unfairly target US-based platforms.

State Department response

In response to questions from the Canary, a State Department spokesperson said the MAGA think tank funding represents “a transparent, lawful use of resources to advance U.S. interests and values abroad.” The spokesperson added that officials were “not shy” about supporting American aims overseas. They rejected claims the programme was a “slush fund,” stating that every grant would be publicly disclosed and accountable.

Campaigners and digital-policy researchers take a different view. Dr. Elinor Carmi of City St George’s, University of London, told the Canary:

Just like any democratic society, freedom must be regulated so people are not harmed.” She added that the same principle should apply to digital platforms, where regulators have taken years to address harms affecting children and other vulnerable users.

The issue is especially sensitive in Britain, where the Online Safety Act has already generated intense political debate between those calling for stronger protections and those warning about the risks of expanding state oversight of online speech.

A growing influence debate

For the UK, the question is no longer only how the Online Safety Act will be enforced. It is also whether state-funded international MAGA-linked networks will begin to play a more visible role in shaping domestic regulatory debates. As these efforts expand, some observers ask a broader question: are we seeing routine diplomatic advocacy, or the gradual normalisation of what critics once described as dark-money politics, now operating more openly through state-backed influence campaigns?

Featured image via the Canary

Politics

Farage is a rank hypocrite

Marina Purkiss has renewed scrutiny of Reform leader Nigel Farage, arguing that his conduct does not match his divisive public rhetoric.

Farage…

Rails against WFH while employing his wife to WFH

Rails against the EU while taking the EU pension

Rails against “elites” while being bankrolled by them and happily hobnobbing with them

Rails against people speaking other languages while his own kids speak German.… pic.twitter.com/npFfX6Q3uk

— Marina Purkiss (@MarinaPurkiss) February 10, 2026

Farage: ‘rules for thee, but not for me’

The post in full reads:

Farage…

Rails against WFH while employing his wife to WFH

Rails against the EU while taking the EU pension

Rails against “elites” while being bankrolled by them and happily hobnobbing with them

Rails against people speaking other languages while his own kids speak German.

Do you spot the pattern?

Rules for thee, but not for me.

Purkiss’ rebuttal to Farage comes following his calls for an end to working from home and the ‘focus’ on employees having a work-life balance. Farage instead stated that it was a ‘nonsense’ that people are more productive working from home, suggesting that being with ‘fellow human beings’ would be best.

Yesterday, our own HG hit back at the attack and argued it would have serious negative consequences in practice, saying:

A Reform government would push even more disabled and chronically ill people into work.

Importantly, working from home allows some disabled people to hold down a job. Farage’s attempts to end work-from-home whilst also claiming to want more disabled people to have jobs are contradictory and bullshit. If he actually cared about disabled people, he would be encouraging work-from-home, or work from wherever the hell you want to, as long as the work gets done.

Farage is a hypocrite. And basically, you can’t work from home unless it serves him and his pumped-up little agenda.

Given the above, we can’t help but think Farage is thinking more of ensuring bosses can oversee their inferior staff members, putting them ‘back in their place’, than anything to do with the wellbeing of workers.

We even wrote at the end of 2025 a roundup of the hypocrisy running rife in Reform, with our own Willem Moore reporting on one of their lies used to gain votes:

As we reported in October, Kent County Council was also eyeing up a 5% Council Tax rise. You’ll be glad to know that they did not proceed with this ridiculous 5% figure. They did, however, raise Council Tax by 4.989%.

So really, when you think about it, that’s a saving of 0.11 percentage points for the people of Kent who were worried about the 5% rise.

Purkiss’ timely reminder of Farage’s well-documented hypocrisy has been well-received on X, with one account reminding us:

Reform is a scam https://t.co/Is6XApc1Cr

— Trevor McArdle (@McardleTrevor) February 11, 2026

This account points out yet again the double standard for people who work for Farage and co:

On the side of the bosses, not the workers

Once again, Reform and its privileged MP’s prove that they will never be on the side of ordinary people. Instead, they will always be on the side of the already-rich and powerful, or those who work directly for them.

After all, working from home is good for Farage’s wife, but not for ordinary people living ever more strenuous lives.

Featured image via the Canary

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech17 hours ago

Tech17 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

![Sick Luke - MONEY MACHINE (feat. Lazza & Tony Effe) [Official Visual]](https://wordupnews.com/wp-content/uploads/2026/02/1770843044_maxresdefault-80x80.jpg)