Crypto World

Bitcoin Volatility Climbs as Investors Deploy Strategic Solutions Amid Market Uncertainty

TLDR:

- Bitcoin volatility spiked significantly on October 10 and remained elevated through November and February.

- Nexo received nearly 1,500 BTC in November, triple the previous month, totaling over 43,000 BTC deposited.

- Excess leverage in derivatives markets amplifies liquidations that mechanically intensify price movements.

- Investors increasingly use collateralization platforms to generate yield while preserving capital exposure.

Bitcoin volatility continues to climb as the cryptocurrency undergoes an ongoing correction phase. Market observers note increased stress within the fragile crypto ecosystem. Investors now face a choice between enduring turbulent conditions or deploying strategic solutions.

Some platforms report growing inflows as traders seek yield-generating opportunities during uncertain times. The pattern reveals how behavior shifts when price swings intensify across digital asset markets.

Volatility Surge Marks Recent Market Conditions

Bitcoin volatility has accelerated since late summer, creating challenging conditions for market participants. The cryptocurrency experienced a notable spike on October 10 during a historic liquidation event.

This event affected the entire crypto market and led to heightened volatility. Since then, price swings remained pronounced throughout November, late January, and early February.

Macroeconomic uncertainty compounds the existing market fragility. Incomplete data following recent economic disruptions adds to investor concerns.

Heightened geopolitical tensions further contribute to an unstable trading environment. These factors combine to create additional stress on an already weakened market structure.

Derivatives markets exhibit excess leverage that amplifies price movements. Chain liquidations occur mechanically when positions reach critical thresholds.

These liquidations intensify downward price action and reinforce volatility patterns. The feedback loop between leverage and liquidations creates cascading effects across exchanges.

According to analyst @Darkfost_Coc, this environment reflects logical market behavior given prevailing conditions. The combination of factors produces expected stress responses in crypto markets.

Traders navigate these conditions with varying strategies and risk tolerances. Market dynamics continue to evolve as volatility remains elevated.

Platform Activity Reflects Strategic Positioning

Nexo, a platform offering CeFi services, demonstrates a correlation between volatility and Bitcoin inflows. November recorded approximately 1,500 BTC transferred to the platform.

This figure represents nearly triple the previous month’s deposit activity. The trend suggests investors actively seek collateralization and yield-generation solutions during volatile periods.

January saw roughly 1,100 BTC flow into Nexo as market stress continued. February has already accumulated over 630 BTC in new deposits.

The sustained pattern extends across multiple months of heightened volatility. Platform data reveals consistent investor interest in these financial strategies.

Nexo currently holds more than 43,000 BTC deposited by users. The total represents over $2.7 billion in Bitcoin value.

Cumulative deposits illustrate a strong appetite for leveraging existing holdings productively. Investors utilize these services to optimize exposure while maintaining capital preservation.

Near-term sentiment around Bitcoin remains cautious among market participants. However, the longer-term outlook maintains a constructive perspective on the asset.

Solutions offered by platforms allow investors to navigate uncertainty strategically. These approaches enable capital optimization without requiring complete position liquidation during turbulent market phases.

Crypto World

Why the CPI Release Matters for the Price of Bitcoin

The previous Consumer Price Index (CPI) report was published on 13 January and had a significant impact on Bitcoin’s price. As the BTC/USD chart shows:

→ shortly after the release, the price surged aggressively to the 14 January peak;

→ it then reversed sharply lower (a sign of a bull trap), creating a bearish outlook — which we highlighted on 21 January;

→ subsequently, it broke through multi-month support and entered an accelerated decline towards the $60k area.

For this reason, today’s US inflation report (16:30, GMT+3) is drawing close attention across multiple markets, as it may have a substantial effect on both the dollar and traders’ appetite for risk assets, including Bitcoin.

Technical Analysis of the BTC/USD Chart

Bitcoin’s price swings have formed a descending channel, shown in red. Within this framework:

→ the lower boundary (L) appears to be key support. When the price dipped below it on 6 February, aggressive buyers stepped in, resulting in a candle with a long lower shadow;

→ the QL line, which divides the lower half of the channel into two sections, is acting as resistance — as reflected in price action on 9 February.

The ATR indicator is trending lower, signalling declining volatility, which suggests the market is awaiting important news. Higher inflation is generally seen as a factor that could delay interest rate cuts, strengthen the dollar and bond yields, and weigh on BTC/USD. Conversely, softer inflation would be supportive for cryptocurrencies.

If the CPI release does not produce major surprises, Bitcoin may continue to trade within the broad L–QL range.

FXOpen offers the world’s most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Qzino Introduces Token-Based Revenue Model for Web3 iGaming Platform

[PRESS RELEASE – Valletta, Malta, February 13th, 2026]

Qzino, a Web3-based crypto casino platform, has officially launched, introducing an ecosystem that integrates profit-sharing mechanisms, token-based rewards, and a broad gaming offering. The platform provides access to more than 10,000 games, including proprietary Qzino Originals, and incorporates token utility into its operational model.

Positioned as an alternative to traditional online casinos, Qzino integrates a revenue participation structure through its native QZI token. The token is designed to function as a profit-sharing mechanism within the platform’s ecosystem, allowing holders to receive distributions linked to overall platform performance, including during periods when they are not actively playing.

Simple and Transparent Profit-Sharing Model

QZI functions as a participation token within the Qzino ecosystem. According to the project, the token is structured to enable holders to receive distributions tied to the platform’s performance.

The model includes:

- Allocation of 30% of Qzino’s Net Gaming Revenue (NGR) to eligible participants

- A staking mechanism under which 3% of the staking pool is distributed daily to QZI holders

Under this structure, rewards may be generated both through platform activity and through token holding. The distribution framework is designed to operate according to predefined parameters outlined by the project.

Staking Mechanism and Token Supply Structure

The Qzino ecosystem incorporates a token model centered on mining and staking mechanisms. The QZI token has a capped total supply of 7,777,777,777 tokens and follows a predefined distribution framework outlined by the project.

Through the staking mechanism, eligible participants may receive daily distributions from the platform’s staking pool, subject to the platform’s terms and performance. The structure is designed to support ongoing token utility within the ecosystem and to align participation incentives with platform activity over time.

Cashback and Rakeback Program

Qzino includes a structured cashback and rakeback program as part of its platform model. According to the project, the system is designed to provide ongoing rewards tied to user activity.

The program includes:

- Cashback of up to 40%, distributed twice weekly, subject to platform terms

- Rakeback of up to 15%, calculated automatically and applied to eligible bets

These mechanisms are integrated into the platform’s broader rewards structure and form part of its operational framework within the crypto iGaming sector.

Integrated Mining Mechanism

At launch, Qzino includes a built-in mining mechanism integrated into platform activity. The system enables users to accumulate QZI tokens through participation, without requiring external hardware or specialized technical setup.

According to the project, the mining framework is designed to distribute tokens through user engagement prior to the activation of additional features such as profit-sharing and staking. The mechanism forms part of the platform’s broader token distribution model within its ecosystem.

Sports Betting Coming to Qzino

In addition to its casino offering, Qzino plans to integrate sports betting into the platform. The feature is intended to allow users to place cryptocurrency-based bets on major international sporting events.

According to the project, sports betting activity will be incorporated into the existing rewards framework, including cashback, rakeback, and token-based mechanisms. With this addition, Qzino aims to broaden its platform scope beyond casino gaming to include multiple forms of crypto-based betting within a single ecosystem.

AI-Supported Tools and Platform Accessibility

Qzino incorporates AI-based tools designed to support user experience within the platform. These tools assist with functions such as personalized game recommendations, basic analytics, and navigation, while gameplay decisions remain user-directed.

The platform is mobile-responsive, supports multiple languages, and is accessible to users in various jurisdictions, subject to local regulations. According to the project, registration is streamlined, KYC requirements are limited, and deposits and withdrawals are processed in cryptocurrency.

Affiliate Program and Market Positioning

In parallel with its player-facing features, Qzino has introduced a global affiliate program aimed at crypto-focused influencers, communities, and media partners. The program offers revenue share of up to 35%, including sub-affiliate commissions, with real-time performance tracking. Additional components include token-based incentives, airdrop campaigns, and free-to-play funnels, as outlined by the project.

“Our mission with Qzino is to create a platform where players don’t just gamble — they participate,” said Matero, Co-Founder of Qzino. “By combining profit-sharing, staking, and industry-leading cashback, we’re building an ecosystem where users genuinely benefit from the platform’s growth.”

The launch takes place amid continued growth in the crypto iGaming sector, particularly among platforms emphasizing transparency and blockchain-based mechanics. By combining gaming services with token-based participation models, Qzino seeks to establish a presence within the evolving Web3 gaming landscape.

For more information about Qzino and to join the platform, users can visit www.qzino.com.

About the Project

Qzino is a Web3-based crypto gaming platform designed to combine casino entertainment with tokenized revenue participation. Built around the QZI token, the project integrates profit-sharing, staking, mining mechanics, and a loyalty-driven rewards system into a single ecosystem.

The platform provides access to over 10,000 games, including proprietary Qzino Originals, with sports betting integration underway. By aligning platform growth with token holder participation, Qzino aims to introduce a sustainable, community-oriented model within the evolving crypto iGaming sector.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

China’s Baidu adds OpenClaw AI into search app for 700 million users

Chinese tech company Baidu, best known for its search engine, also operates cloud, mapping and other internet-based services.

Bloomberg | Bloomberg | Getty Images

BEIJING — Baidu plans to give users of its main smartphone app direct access to the wildly popular artificial intelligence tool OpenClaw, according to a spokesperson for the Chinese tech company.

Starting later on Friday, users who opt in can message the AI agent through Baidu’s main search app to complete tasks such as scheduling, organizing files and writing code.

AI agents such as OpenClaw have surged in popularity recently for their ability to automate tasks, including managing email and using online services.

Previously, the Austrian-developed open-sourced AI agent could only be accessed from chat apps such as WhatsApp or Telegram. Chinese companies such as Alibaba, Tencent and Baidu have already allowed users to run OpenClaw on their cloud systems.

Baidu claims 700 million monthly active users for its search app. The company is also rolling out OpenClaw’s capabilities to its e-commerce business and other services.

The rollout comes just days ahead of China’s Lunar New Year holiday, as Chinese internet tech giants race to attract new users and monetize their AI investments.

Alibaba has also integrated its e-commerce platforms, such as Taobao and travel site Fliggy, with its AI chatbot Qwen, and claimed it received more than 120 million consumer orders through the app in the six days through Feb. 11.

Qwen users can compare personalized product recommendations before completing payment through Alipay — all within the chatbot. Previously, the AI tool could suggest products based on prompts, but shoppers had to leave the app and navigate multiple platforms to complete their transactions.

Despite growing interest in AI agents such as OpenClaw, cybersecurity firms including CrowdStrike have warned the public about granting OpenClaw unfettered access to enterprise systems.

Crypto World

Boerse Stuttgart Digital Merges With Tradias In Crypto Push

Boerse Stuttgart Group, operator of one of Europe’s largest stock exchanges, said it will merge its cryptocurrency business with Frankfurt-based digital asset trading firm Tradias in a strategic move to expand its presence in institutional crypto markets.

The transaction will consolidate about 300 employees under a joint management team from both companies, according to a Friday announcement.

The combined unit aims to cover multiple digital asset services, including brokerage, trading, custody, staking and tokenized assets. It will serve banks, brokers and other financial institutions across Europe, providing fully regulated crypto infrastructure, the announcement said.

Financial terms of the deal were not disclosed. Boerse Stuttgart and Tradias representatives declined to comment to Cointelegraph on the deal’s terms. Bloomberg reported the transaction could value Tradias at about 200 million euros ($237 million) and the combined entity at more than $590 million.

MiCA-compliant crypto custodian joins forces with BaFin-licensed bank

Boerse Stuttgart has been developing its regulated crypto infrastructure through its Boerse Stuttgart Digital arm, which provides trading, brokerage and custody services in accordance with the European Union’s Markets in Crypto-Assets Regulation (MiCA).

In 2025, Boerse Stuttgart reported tripling crypto trading volumes, accounting for a quarter of its total revenue in 2024. CEO Matthias Voelkel expressed a bullish stance on crypto and disclosed personal Bitcoin (BTC) holdings at the time.

The platform’s existing footprint in regulated digital assets positions the exchange group to expand offerings by combining technology with Tradias’ execution capabilities.

Operating as the digital assets arm of Bankhaus Scheich, Tradias is licensed as a securities trading bank by the German Federal Financial Supervisory Authority (BaFin).

“With the planned merger of Boerse Stuttgart Digital and Tradias, Boerse Stuttgart Group is driving the development and consolidation of the European crypto market,” Voelkel said.

Related: Denmark’s Danske Bank allows clients to buy Bitcoin and Ether ETPs

“We have built strong growth momentum in recent years. By merging with Boerse Stuttgart Digital, we will take the next logical step in our corporate development,” Tradias founder Christopher Beck noted, adding:

“Together, we will cover the entire value chain for digital assets and create a new European champion with significantly greater reach, strategic depth, and creative power for further market consolidation.”

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Your Definitive Guide on P2P Crypto Wallet Development For 2026 & Beyond

Capital in Web3 is moving with intent, not experimentation, and P2P crypto wallet solutions sit at the center of that shift. In 2025 alone, cross-border P2P transaction volume expanded by 51%, while embedded finance adoption advanced 36% as enterprises embedded native payment rails into digital ecosystems. Biometric authentication reached 58% penetration across leading platforms, and 71% of users actively favored contactless scan-and-pay experiences, signaling a decisive move toward frictionless yet secure finance. Voice-enabled payments grew 24%, reinforcing the demand for intelligent, always-on payment infrastructure. These are not usage anomalies but structural indicators of where capital efficiency, user trust, and platform defensibility converge for long-term value creation.

What is a P2P Crypto Wallet?

A P2P crypto wallet is a software wallet designed to enable peer-to-peer exchange and settlement of digital assets directly between users, without routing trades through a central matching engine. P2P wallets can be non-custodial, meaning users keep their private keys, or hybrid, offering optional custody services. They typically provide on-wallet order books or secure on-chain trade settlement, atomic swap or smart contract mediated exchanges, and in-app messaging or negotiation layers so counterparties can discover and agree on terms. The key differentiator is that trades are executed directly between participants and settled on-chain or via cryptographic settlement channels. Now, let us scroll through the blog to deeply understand the factors impacting the rise of peer-to-peer transactions and how a crypto wallet supports it.

What is The Hype About P2P Transactions & Web3 Wallet Solutions?

The momentum behind P2P Web3 crypto wallets stems from multiple converging forces. Institutional demand for self-custody and transparency has grown, while retail users seek lower fees and censorship-resistant rails. Regulators have tightened oversight of custodial services, which increases the attractiveness of non-custodial and privacy-preserving mechanisms for compliance-conscious players. At the same time, infrastructure improvements such as cross-chain messaging, layer 2 settlement, and programmatic escrow primitives make direct peer settlement practical at scale. These advances position P2P wallets as a market segment where decentralization and enterprise needs can be reconciled.

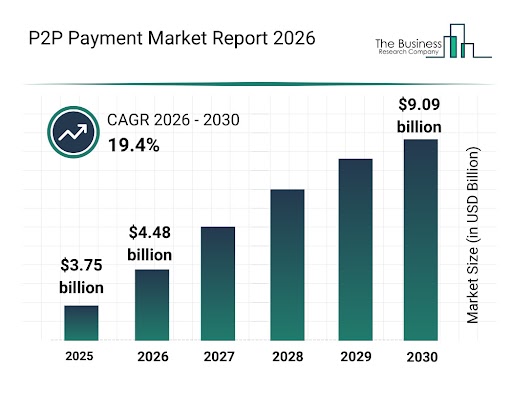

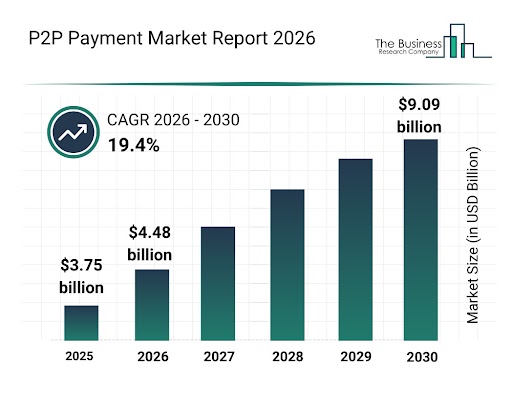

Source link: https://www.thebusinessresearchcompany.com/report/p2p-payment-global-market-report

Core P2P Payment Market Trend

- Cross-border P2P transfers jumped 51% in 2025, driven by lower fees and wider access.

- Embedded finance grew 36% as more brands added native P2P options in 2025.

- Gen Z and millennials fueled a 28% rise in social-payment P2P apps in 2025, prioritizing social features.

- Voice-activated payments via AI assistants rose 24% in 2025, reflecting demand for hands-free convenience.

- 71% of users favored apps with contactless scan-and-pay in 2025, accelerating innovation.

- Biometric authentication reached 58% adoption across major P2P apps in 2025, strengthening security.

- Real-time processors like Zelle maintained the industry standard by settling transactions in seconds in 2025.

Key market context to consider: analysts place the global cryptocurrency wallet development market in the multi-billion dollar range in 2026, underlining the rapid adoption and strong commercial opportunity for wallet providers.

Advantages of P2P Crypto Wallet Development

Investors should view P2P crypto wallet development as more than technology; it is a strategic lever that creates durable business advantages. A thoughtfully designed P2P wallet builds network effects, predictable revenue channels via platform services, and clear pathways to enterprise partnerships and bank integrations. It makes product roadmaps measurable, governance models transparent, and M&A or tokenization outcomes cleaner. Understanding these levers today lets you quantify upside, stress test assumptions, and negotiate terms from a position of strength when the market demands scale and regulatory clarity.

1. Greater user control and trust retention- Users hold keys or retain control over keys, improving trust metrics and reducing counterparty risk exposure for the product.

2. Reduced counterparty solvency risk- Direct settlement reduces dependence on exchange ledgers and central custody, lowering systemic risk from exchange failures.

3. Lower ongoing regulatory capital and reserve requirements- Operators of non-custodial P2P wallets avoid some capital and reserve obligations that custodial exchanges face, while still being able to provide compliance tooling where required.

4. New monetization channels without custody- Fees on on-chain settlement, premium matching, liquidity brokering, and enterprise SDK licensing create recurring revenue with lower operational overhead.

5. Increased resilience and censorship resistance- P2P structures reduce single points of failure and make it harder for a single authority to interrupt user access.

6. Competitive edge in markets with high fiat friction- P2P wallets that integrate local payment rails and stablecoin flows can capture remittance and cross-border volumes where traditional rails are slow or expensive.

7. Better alignment with institutional treasury policies- Institutional clients increasingly demand custody flexibility and programmable controls that P2P flows can support via multisig, time locks, or policy engines.

Features Essential for P2P Crypto Wallets Built For Success

Basic feature set

- Secure key management and mnemonic handling with clear recovery flows

- Simple send and receive UX with transparent gas and fees

- Multi-chain support for major EVM chains and Bitcoin via compatible bridges

- On-chain settlement support and clear transaction status indicators

- Address book, QR scanning, and transaction history auditing

- Basic wallet encryption, PIN, and biometric unlock

Advanced Enterprise Grade Capabilities

- Integrated P2P order matching and negotiation engine with optional on chain escrow contracts

- Smart routing: atomic swaps, cross-chain bridges, and layer 2 settlement channels

- Role-based access and enterprise wallet profiles for treasury management

- Multi-signature workflows and threshold signature schemes for institutional custody

- Real-time blockchain analytics and risk scoring integrated with compliance pipelines

- Decentralized identity integration and selective disclosure using verifiable credentials

- Replay protection, transaction batching, and gas optimization modules for cost efficiency

- Insurance orchestration and proof of reserves integration for optional custody guarantees

- API and SDK suites for partners and white-label customers.

You can always achieve this level of success and acquire the wide range of advantages mentioned above by hiring an accredited team of blockchain experts from a renowned cryptocurrency wallet development company. Apart from this, the company will also help you achieve success after with their alternative solutions, like customized solutions as per business needs.

Plan Your P2P Wallet Strategy With Our Experts

Are White Label P2P Crypto Wallets the Winning Path?

White-label blockchain wallet solutions are an attractive route for enterprises and institutional entrants because they compress time to market and offer proven building blocks. For investors, a professionally engineered white-label product reduces execution risk and often includes battle-tested security modules, audit trails, and compliance hooks. This allows businesses to focus on customer acquisition and integrations rather than building cryptographic infrastructure from scratch. However, the trade-off is customization. For high compliance or differentiated product strategies, a hybrid approach where a white-label core is extended with bespoke modules often yields the best risk-adjusted return.

Market practitioners report that high-quality white label cryptocurency wallet service providers can deliver robust deployments quickly, while providing upgrade paths for enterprise integrations and regulatory controls.

How Much Does a P2P Crypto Wallet Development Cost?

The cost of a P2P crypto wallet development is primarily determined by the level of customization required, rather than a fixed pricing model. A basic white-label wallet with minimal modifications typically requires lower investment because the core architecture, UI framework, and security modules are already prebuilt, and development mainly involves branding and minor configuration.

As customization increases, the cost rises due to the need for deeper integrations, extended multi-chain support, tailored compliance workflows, and enterprise-grade APIs or SDKs. These requirements involve additional engineering, testing, and infrastructure setup.

A fully custom P2P crypto wallet requires the highest investment since the architecture, smart contracts, security layers, and user experience are designed specifically for the business model. Advanced capabilities such as multisignature custody, cross-chain routing, escrow mechanisms, and bespoke dashboards demand extensive development time, third-party audits, and ongoing maintenance, all of which significantly influence the overall cost.

How Much Time Does It Take To Create a P2P Crypto Wallet?

A P2P crypto wallet development timeline differs by approach. Below are practical estimates mapped to development phases.

1. White label deployment with light customization

-

- Typical duration: 1 to 4 weeks

- Activities: branding, token preloads, basic compliance toggles, testing, and deployment.

2. White label with enterprise integrations and moderate customization

-

- Typical duration: 4 to 10 weeks

- Activities: integrate KYC provider, analytics, and fiat on-ramp; add off-chain order features, QA, and security checks.

3. Full custom enterprise build

-

- Typical duration: 3 to 6 months or longer

- Activities: architecture design, smart contract development, multisig and custody integrations, compliance workflow construction, security audits, penetration testing, user acceptance testing, and regulatory sign-offs.

Note that parallelizing activities such as UI design, smart contract audit, and legal compliance work reduces overall calendar time. Real-world schedules also depend on the availability of third-party integrations, audit timelines, and regulatory filings.

Security & Compliance Realities Investors Must Weigh

Security is not optional. Rising on-chain criminal flows and targeted attacks are reshaping risk models, and platforms must invest in proactive controls. Threats include hot wallet exploits, social engineering, private key compromise through coercion, and off-chain identity fraud. Monitoring, anomaly detection, wallet heuristics, and safe recovery models are required to maintain institutional trust. Recent industry reports highlight notable rebounds in illicit on-chain flows and reaffirm the need for rigorous analytics and cooperation with law enforcement.

Regulation is also evolving. Many jurisdictions now distinguish custodial and non-custodial wallet development services more clearly, and AML KYC expectations are tightening, including live selfie verification and geo-tagging in some markets. For global deployments, you must design compliance as a first-class component rather than an afterthought.

Why Partner With Antier?

P2P crypto wallets are a high-potential and high-responsibility segment of the market. For investors, the opportunity lies in products that combine strong cryptography, pragmatic compliance, and enterprise integrations.

Connect with our team today to learn about our offerings and the entire process. We build white label P2P wallet solutions with an emphasis on security, auditability, and regulatory readiness. Our team combines cryptography engineers, compliance experts, and product designers who can guide you from requirements to launch, including policy design for KYC and AML, architecture for multisig custody, and production-grade smart contract audits. We also assist with jurisdictional analysis so your rollout aligns with local supervisory expectations. If you are evaluating investments or planning a wallet product, we can provide a technical due diligence brief, a costed implementation roadmap, and a compliance checklist tailored to your target markets.

Frequently Asked Questions

01. What is a P2P crypto wallet?

A P2P crypto wallet is a software wallet that enables direct peer-to-peer exchange and settlement of digital assets between users, without relying on a central matching engine. It can be non-custodial or hybrid, offering features like on-wallet order books and secure trade settlement.

02. Why are P2P transactions gaining popularity in Web3?

P2P transactions are gaining popularity due to increased institutional demand for self-custody, lower fees sought by retail users, tighter regulatory oversight of custodial services, and advancements in infrastructure that facilitate direct peer settlement.

03. What are the benefits of using P2P crypto wallets?

P2P crypto wallets offer benefits such as enhanced privacy, lower transaction fees, and the ability for users to maintain control over their private keys, making them attractive for both compliance-conscious players and those seeking decentralized financial solutions.

Crypto World

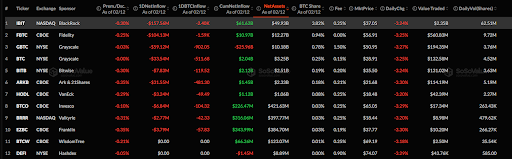

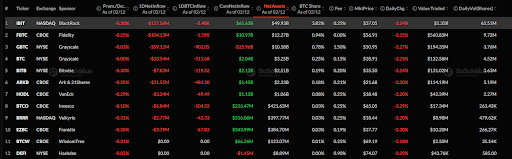

Bitcoin ETFs Bleed $410M as IBIT ETF by BlackRock Suffers the Largest Loss

TLDR

- Bitcoin ETFs faced a daily outflow of $410.37 million on February 12, with a cumulative net inflow of $54.31 billion.

- IBIT and FBTC experienced heavy losses, with daily outflows of $157.56M and $104.13M, respectively.

- Grayscale’s BTC ETF saw a minor outflow of $33.54 million, with a 3.25% decline in value.

- Mid-tier Bitcoin ETFs like HODL, BTCO, and BRRR also faced losses, reporting outflows and declines.

- BTCW and DEFI ETFs showed stable performance, with no inflows or outflows recorded.

According to a recent SoSoValue update on Bitcoin ETFs as of February 12, the market experienced a daily outflow of $410.37 million. Cumulative net inflow now reads at $54.31 billion with total value traded at $3.56 billion. Total net assets for Bitcoin remain solid at $82.86 billion, representing 6.34% of Bitcoin’s market cap.

Bitcoin ETFs Face Outflows as IBIT and FBTC Take Heavy Losses

Tracking the market performance of individual ETFs, the IBIT ETF, listed on NASDAQ and sponsored by BlackRock, saw a daily outflow of $157.56 million. The FBTC ETF, listed on the CBOE and sponsored by Fidelity, experienced an outflow of $104.13 million. Its daily change was a decrease of 3.25%, with a trading price of $56.91. GBTC ETF, listed on the NYSE and sponsored by Grayscale, saw a small outflow of $59.12 million.

Grayscale’s BTC ETF, listed on the NYSE, reported a minor outflow of $33.54 million. It saw a 3.25% decline in value. BITB ETF, listed on the NYSE and sponsored by Bitwise, reported a daily outflow of $7.83 million. Its cumulative net inflow is -$119.52 million. It experienced a daily decrease of 3.24%.

ARKB ETF, listed on the CBOE and sponsored by Ark & 21Shares, faced an outflow of $31.55 million. ARKB has assets totaling $1.45 billion, with a market share of 0.18%. The ETF saw a daily drop of 3.30%.

Other Mid-Tier ETFs Record Outflow While BTCW and DEFI Maintain Stability

The HODL ETF, listed on the CBOE and sponsored by VanEck, saw an outflow of $3.24 million. It recorded a daily decrease of 3.20%, trading at $21.68. The BTCO ETF, listed on the CBOE and sponsored by Invesco, experienced a smaller outflow of $6.84 million. BTCO traded at $65.05, down 3.29% on the day.

The BRRR ETF, listed on NASDAQ and sponsored by Valkyrie, reported an outflow of $2.77 million. Its total net assets stand at $316.06 million. The ETF has a market share of just 0.03% and has declined 3.20%, trading at $18.44.

The BTCW ETF experienced stable performance, with no daily inflows or outflows, as indicated by both 1-day net inflows and cumulative net inflows. It recorded a 3.24% drop in daily value, trading at $69.19. Just like the BTCW ETF, the DEFI ETF remained stable, with no daily inflows or outflows and a cumulative net inflow.

Crypto World

Standard Chartered Hints at $50,000?

Bitcoin price remains under pressure, down around 1.2% over the past 24 hours and trading close to $66,000 at press time. While short-term rebounds continue to appear, the broader structure still looks weak.

Now, even major institutions are turning cautious on their Bitcoin price predictions. New on-chain signals and long-term holders suggest the downside risk is not finished yet.

Sponsored

Sponsored

Standard Chartered’s Warning Matches Weak ETF and Institutional Flows

Standard Chartered recently reiterated that Bitcoin could still fall toward $50,000 before any sustained recovery. The bank pointed to weakening ETF demand and fading institutional participation as key risks. When this view is compared with current market data, it lines up perfectly.

On the price chart, Bitcoin has broken down from a bear flag structure. A bear flag forms when prices consolidate after a sharp fall and then resume the downtrend. This pattern suggests that selling pressure remains dominant, even when short-term rebounds appear.

At the same time, institutional flow indicators are weakening. Chaikin Money Flow, or CMF, which tracks whether large capital is entering or leaving the market, has dropped sharply. CMF now looks weaker than it did during the January–April 2025 correction, when Bitcoin fell around 31%.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This time, the decline is steeper. Bitcoin has already dropped nearly 38% from its peak, and CMF has fallen faster than in early 2025. This confirms that institutional buying is not returning yet. Without sustained inflows from large investors, rallies struggle to hold.

It is worth noting that during the April-October 2025 phase, when BTC peaked, there were only a few instances when the CMF fell under the zero line, and that too marginally. But now, the CMF dip looks way scarier.

Sponsored

Sponsored

This is why Standard Chartered’s caution makes sense. The breakdown on the chart and weak ETF-linked flows are telling the same story. But institutional weakness is not the only concern.

On-Chain Profits and Long-Term Holders Still Point to More Downside

Beyond ETFs, on-chain data shows that investor confidence remains fragile.

One key indicator is Net Unrealized Profit and Loss, or NUPL. NUPL measures how much profit or loss holders are sitting on by comparing current prices with when coins were last moved.

During the April 2024 rebound, NUPL was near 0.42. That showed minimal unrealized profits and supported a recovery. Today, NUPL has dropped much lower. It fell to around 0.11 in early February and is now near 0.17. This means most of the leftover profits from the bull cycle have already been wiped out. But this doesn’t confirm a bottom if the bigger picture is taken into consideration.

Sponsored

Sponsored

History shows NUPL can still fall further. In March 2023, NUPL dropped to near 0.02 when Bitcoin traded around $20,000. That marked deep capitulation before the next major rally began. Compared to that period, current NUPL levels remain relatively elevated. This suggests the market may not be fully washed out yet.

Long-term holder behavior supports this view. Long-term BTC holders are wallets that have held Bitcoin for more than one year. These investors usually accumulate during major bottoms and help stabilize prices.

Right now, they are still net sellers. In early February 2025, long-term holders reduced holdings by more than 170,000 BTC. At the peak of recent selling, in February 2026, outflows reached nearly 245,000 BTC. This is a heavier distribution than during the January–April 2025 correction.

Back then, demand from long-term holders had already started recovering before prices bounced. Today, that recovery has not appeared. In simple terms, institutions are cautious, profits are shrinking, and long-term holders are not stepping in yet. This combination makes a strong rebound unlikely in the near term.

Sponsored

Sponsored

Why the $53,000–$48,000 Zone Still Matters on the Bitcoin Price Chart

With fundamentals and on-chain data aligned to the downside, the Bitcoin price levels now become critical.

The current bear flag projection points toward a broad support zone between $53,200 and $48,300. This range aligns with key Fibonacci retracement levels.

The midpoint of this zone sits close to $50,000, which remains a major psychological level. Round numbers often attract strong buying and selling activity, making them natural magnets during corrections. This is why Standard Chartered’s $50,000 view fits the technical structure. It is not an arbitrary target. It sits directly inside the main support band.

If selling pressure continues and ETF flows remain weak, Bitcoin could test this region in the coming months. In a deeper risk-off scenario, downside could even extend toward $42,400, which matches longer-term breakdown projections and historical support.

For this bearish Bitcoin price prediction to slow down, BTC would need to reclaim and hold above the $72,100 region with strong volume and renewed institutional inflows. That would signal that demand has returned and that the bear flag has failed. So far, there is no evidence of that.

Crypto World

Playnance Turns Creators Into Platform Owners With $1 Digital Businesses

[PRESS RELEASE – Tel Aviv, Israel, February 12th, 2026]

Playnance has expanded Be The Boss, its global partner program, through PlayW3, the Web3 social gaming platform built and operated by Playnance. The program enables individuals to launch a fully branded, fully operational Social Casino platform within minutes, with no technical setup or onboarding required. For a symbolic $1 entry, partners receive a live platform under a unique subdomain, capable of generating daily on-chain earnings and payouts through PlayW3’s infrastructure, operating on a 50/50 revshare model, which is among the highest in the industry, with daily automated on-chain payments sent directly to partners’ wallets.

More broadly, the $1 entry point reflects a growing shift in the digital economy, where platform infrastructure and distribution are no longer reserved for those with significant capital, technical resources, or development teams. Instead, digital business ownership becomes immediate, operational, and globally accessible from day one.

Unlike affiliate or referral-based models, Be The Boss provides real platform ownership rather than traffic monetization alone. Each partner, referred to as a “Boss,” operates a complete Social Casino experience powered end-to-end by Playnance’s proprietary blockchain infrastructure. Once activated, platforms go live immediately, allowing partners to focus on community growth, engagement, and distribution.

Each Boss platform also acts as a decentralized distribution node for the PlayW3 ecosystem, introducing new communities, audiences, and localized user bases into the network. As more Bosses launch and grow their platforms, the ecosystem expands organically through community-led reach rather than centralized marketing alone.

Each platform includes access to over 10,000 on-chain social casino games, alongside social prediction markets, sports-based social events, crash-style games, interactive financial markets, cash tournaments, jackpots, and built-in bonuses and retention mechanics. All technology, player support, on-chain settlement, and payouts are handled directly by Playnance via PlayW3, ensuring transparency and operational simplicity.

The Be The Boss program is already live and operating globally, with more than 2000 partners already joined and actively running platforms, and over $1.9 million paid out to Bosses to date. A $250 million partner pool has been allocated to support long-term earnings as the network expands, with each new platform strengthening network-wide reach and engagement.

Pini Peter, CEO of Playnance, said: “We believe access to digital opportunity should not be limited by capital or technical barriers. Be The Boss was built to make platform ownership accessible and practical, allowing creators and communities to operate real digital businesses from day one. What’s important is that this model is already live, operating at scale, and driven by engagement rather than hype.”

At the core of the ecosystem is G Coin, the utility token powering platform activity, rewards, and daily on-chain earnings distribution. As more Boss platforms go live and onboard new communities, activity across PlayW3 increases — driving greater usage of G Coin across gameplay, participation mechanics, and rewards. This creates a compounding economic loop where partner growth expands distribution, increased user activity drives token demand through real usage, and token-powered rewards further reinforce engagement across the network.

About Playnance

Playnance is a Web3 infrastructure and consumer platform company founded in 2020. The company develops and operates live, non-custodial, on-chain platforms designed to enable mainstream users to interact with blockchain systems through familiar Web2 experiences. Playnance focuses on reducing friction between user behavior and on-chain execution by operating consumer products at scale.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

And It Just Happened Again

Bitcoin slipped 3% the last time this whale made a substantial deposit, is another decline on its way?

Bitcoin’s overall market state has been more than dire for the past several weeks, with the asset plummeting from over $90,000 on January 28 to its lowest position in over a year at $60,000 last Friday.

While this is a painful decline of its own, the broader market’s state has not improved much since then, and Lookonchain just published another potential sell signal.

You need to watch this whale!

Over the past 2 days, he has deposited 8,200 $BTC($559M) into #Binance.

Every time he deposits $BTC, the price drops.

Yesterday, I warned when he made a deposit — and soon after, $BTC dropped over 3%.https://t.co/8D2y9MbfFn pic.twitter.com/IyjYXvW8sx

— Lookonchain (@lookonchain) February 13, 2026

The analytics company noted that the unknown whale had transferred 8,200 BTC (worth roughly $560 million) into Binance in the past 2 days alone.

Shortly after their previous deposit to the world’s largest exchange, the cryptocurrency’s price dipped yesterday by 3% within minutes, going from nearly $69,000 to $65,000.

In a subsequent post, Lookonchain added that the whale continued to transfer BTC to Binance, sending another batch of over 2,000 units with the likely intention to sell.

8,200 BTC to exchanges is not noise — it’s intent.

Large inflows often signal distribution or hedging.

Liquidity tells the story before price does. 👀📊

— Global Rashid (@globalrashid007) February 13, 2026

You may also like:

In contrast, Binance just completed the conversion of its entire $1 billion SAFU fund into bitcoin by purchasing roughly 15,000 BTC. Additionally, Strategy continues to make weekly acquisitions, but BTC’s price fails to rebound in a meaningful manner.

More volatility is expected later today when the US January CPI numbers are released.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

AI Security, Governance & Compliance Solutions Guide

Artificial Intelligence is no longer confined to innovation labs; it is now production-grade infrastructure powering credit underwriting, healthcare diagnostics, fraud detection, supply chain optimization, and generative enterprise copilots. As enterprises scale AI adoption, the need for advanced AI security services becomes critical to protect sensitive data, proprietary models, and distributed AI infrastructure. AI systems directly influence revenue decisions, risk exposure, regulatory standing, operational efficiency, customer trust, and brand reputation. Yet as adoption accelerates, so do the risks. AI expands the enterprise attack surface, increases regulatory complexity, and raises ethical accountability, making structured enterprise AI governance essential for long-term stability. Traditional IT security models cannot protect adaptive, data-driven systems operating across distributed environments.

To scale responsibly, organizations must implement structured and robust AI governance solutions, proactive AI risk management services, and integrated AI compliance solutions, all grounded in the principles of responsible AI development. Achieving this level of security, transparency, and regulatory alignment requires collaboration with a trusted, secure AI development company that understands the technical, operational, and compliance dimensions of enterprise AI transformation.

Why AI Introduces an Entirely New Category of Enterprise Risk ?

Artificial Intelligence is not just another layer of enterprise software; it represents a fundamental shift in how systems operate, decide, and evolve.

Traditional software systems are deterministic. They:

- Execute predefined logic

- Produce predictable, repeatable outputs

- Change only when developers modify the code

AI systems, however, operate differently. They:

- Learn patterns from historical and real-time data

- Continuously adapt through retraining

- Generate probabilistic, not guaranteed, outputs

- Process unstructured inputs such as text, images, and voice

- Evolve over time without explicit rule-based programming

This dynamic behavior introduces a new and complex category of enterprise risk.

1. Decision Risk

AI systems can produce inaccurate or biased outcomes due to flawed training data, insufficient validation, or model drift. Since decisions are probabilistic, even high-performing models can fail under edge conditions; impacting revenue, customer trust, or compliance.

2. Security Risk

AI models are high-value digital assets. They can be manipulated through adversarial attacks, extracted via repeated API queries, or compromised during training. Unlike traditional systems, AI introduces model-level vulnerabilities that require specialized protection.

3. Regulatory Risk

AI-driven decisions—particularly in finance, healthcare, insurance, and hiring—may unintentionally violate compliance regulations. Without structured oversight, organizations face legal scrutiny, fines, and operational restrictions.

4. Ethical & Reputational Risk

Biased or opaque AI decisions can trigger public backlash, regulatory investigations, and long-term brand damage. Ethical lapses in AI are not just technical failures—they are governance failures.

5. Operational Risk

AI performance can silently degrade over time due to data drift, environmental changes, or shifting user behavior. Unlike traditional systems that fail visibly, AI models may continue operating while gradually producing unreliable outputs.

Because AI systems function with varying degrees of autonomy, failures are often subtle and delayed. By the time issues surface, financial, regulatory, and reputational damage may already be significant.

This is why AI risk must be managed differently and more proactively than traditional enterprise software risk.

AI Security: Protecting Data, Models, and Infrastructure

AI security is not limited to perimeter defense or endpoint protection. It requires safeguarding the entire AI lifecycle from raw data ingestion to model deployment and continuous monitoring. Enterprise-grade AI security services are designed to protect not just systems, but the intelligence layer itself.

A secure AI architecture begins with the foundation: the data pipeline.

Layer 1: Securing the Data Pipeline

AI models depend on vast volumes of data flowing through ingestion, preprocessing, labeling, training, and storage environments. If this pipeline is compromised, the model’s integrity is compromised.

Key Threats in AI Data Pipelines

Data Poisoning: Attackers deliberately inject malicious or manipulated data into training datasets to influence model behavior, potentially embedding hidden vulnerabilities or bias.

Data Drift Manipulation: Subtle, gradual changes in incoming data can alter model outputs over time, leading to performance degradation or skewed predictions.

Unauthorized Data Access: Training datasets often include sensitive financial, healthcare, or personal information. Weak access controls can result in data breaches or regulatory violations.

Synthetic Data Injection: Maliciously generated or low-quality synthetic data may distort learning patterns and corrupt model accuracy.

Deep Mitigation Strategies

A mature AI security framework incorporates layered safeguards, including:

- End-to-end encryption for data at rest and in transit

- Secure, segmented data lakes with strict access control policies

- Dataset hashing and tamper-evident logging mechanisms

- Comprehensive data lineage tracking to trace the dataset origin and transformations

- Role-based access control (RBAC) for training and experimentation environments

- Differential privacy techniques to prevent memorization of sensitive data

- Federated learning architectures for privacy-sensitive industries

Data integrity validation is not optional; it is the bedrock of trustworthy AI. Without a secure data foundation, even the most advanced models cannot be considered reliable, compliant, or safe for enterprise deployment.

Layer 2: Model Security & Integrity Protection

While data is the foundation of AI, the model itself is the strategic core. Trained AI models represent years of research, proprietary algorithms, curated datasets, and competitive advantage. They are high-value intellectual property assets and increasingly attractive targets for cybercriminals, competitors, and malicious insiders.

Unlike traditional applications, AI models can be attacked both during training and after deployment. Securing model integrity is therefore a critical component of enterprise-grade AI risk management services.

Advanced AI Model Threats

Adversarial Attacks: These attacks introduce subtle, often imperceptible perturbations into input data, such as minor pixel modifications in images or slight token manipulation in text that cause the model to produce incorrect predictions. In high-stakes environments like healthcare or autonomous systems, such manipulations can lead to catastrophic outcomes.

Model Extraction Attacks: Attackers repeatedly query publicly exposed APIs to approximate and replicate a proprietary model’s behavior. Over time, they can reconstruct a functionally similar model, effectively stealing intellectual property without breaching internal systems directly.

Model Inversion Attacks: Through systematic querying and output analysis, attackers can infer or reconstruct sensitive data used during training posing serious privacy and regulatory risks, particularly in healthcare and finance.

Backdoor Attacks: Malicious actors may insert hidden triggers into training data. When activated by specific inputs, these triggers cause the model to behave unpredictably or maliciously while appearing normal during testing.

Prompt Injection Attacks (Large Language Models): For generative AI systems, attackers can manipulate prompts to override guardrails, extract confidential information, or bypass operational restrictions. Prompt injection is rapidly becoming one of the most exploited vulnerabilities in enterprise LLM deployments.

Enterprise-Grade Model Protection Controls

Professional AI risk management services and advanced AI security services deploy multi-layered defensive strategies, including:

- Red-team adversarial testing to simulate real-world attack scenarios

- Robustness training and gradient masking techniques to reduce model sensitivity to adversarial perturbations

- Model watermarking and fingerprinting to establish ownership and detect unauthorized duplication

- Secure API gateways with rate limiting, anomaly detection, and behavioral monitoring

- Token-level input filtering and validation in generative AI systems

- Output moderation engines to prevent unsafe or non-compliant responses

- Encrypted model storage and artifact signing to prevent tampering

- Isolated inference environments to restrict lateral movement in case of compromise

Without structured model integrity protection, AI systems remain vulnerable to exploitation, IP theft, and operational sabotage. Model security is no longer optional; it is a strategic necessity.

Layer 3: Infrastructure & MLOps Security

AI systems do not operate in isolation. They run on complex, distributed infrastructure that introduces its own set of vulnerabilities.

Enterprise AI environments typically rely on:

- High-performance GPU clusters

- Distributed containerized workloads

- Kubernetes orchestration layers

- Continuous integration and deployment (CI/CD) pipelines

- Cloud-hosted inference APIs and microservices

Each layer, if improperly configured can expose sensitive models, training data, or deployment credentials.

A mature secure AI development company integrates infrastructure security directly into AI architecture through:

- Zero-trust security models across all AI workloads and services

- Continuous container image scanning for vulnerabilities and misconfigurations

- Infrastructure-as-code (IaC) validation to detect security flaws before deployment

- Encrypted and access-controlled model registries

- Secure key management systems (KMS) for API tokens, credentials, and encryption keys

- Runtime intrusion detection and anomaly monitoring across GPU clusters and containers

- Secure multi-party computation (SMPC) or confidential computing for highly sensitive use cases

Infrastructure security must align with broader AI governance solutions and enterprise compliance requirements. AI security cannot be retrofitted after deployment. It must be engineered into development workflows, embedded into MLOps pipelines, and continuously monitored throughout the system’s lifecycle. Only when data, models, and infrastructure are secured together can AI systems operate with the level of trust required for enterprise-scale deployment.

Secure Your AI Systems Today — Talk to Our AI Security Experts

AI Governance: Building Structured Oversight Mechanisms for Enterprise AI

As AI systems become deeply embedded in business-critical operations, governance can no longer be informal or policy-driven alone. AI governance is the structured framework that ensures AI systems operate with accountability, transparency, fairness, and regulatory alignment across their entire lifecycle.

Modern AI governance solutions go far beyond static documentation or compliance checklists. They integrate oversight directly into development pipelines, MLOps workflows, approval processes, and monitoring systems—making governance operational rather than theoretical. At the enterprise level, governance is what transforms AI from experimental technology into regulated, board-level infrastructure.

Pillar 1: Ownership & Accountability Framework

Every AI system deployed within an organization must have clearly defined ownership and control mechanisms. Without accountability, AI becomes a shadow asset; operating without oversight or traceability.

A structured enterprise AI governance framework requires:

- A clearly defined business purpose and intended use case

- Formal risk classification (low, medium, high, critical)

- A designated model owner responsible for performance and compliance

- Defined escalation authority for risk incidents or model failures

- A documented governance approval process prior to deployment

In mature governance environments, no AI system moves into production without formal compliance, risk, and ethics review.

This structured control prevents:

- Shadow AI deployments by individual departments

- Unapproved generative AI experimentation

- Regulatory blind spots

- Unmonitored third-party AI integrations

Ownership ensures responsibility. Responsibility ensures control.

Pillar 2: Explainability & Transparency Mechanisms

Explainability is no longer optional—particularly in regulated sectors such as finance, healthcare, and insurance. Regulatory bodies increasingly require organizations to justify automated decisions, especially when those decisions affect individuals’ rights, credit eligibility, employment opportunities, or medical outcomes.

To meet these expectations, organizations must embed transparency into AI architecture through:

- Model interpretability frameworks such as SHAP and LIME

- Decision traceability logs that record input-output relationships

- Version-controlled documentation of model changes

- Model cards outlining purpose, limitations, training data scope, and known risks

- Human-in-the-loop override capabilities for high-risk decisions

Transparency reduces legal exposure and strengthens stakeholder trust. When decisions can be explained and traced, enterprises are better positioned for audits, regulatory reviews, and board-level oversight. Explainability is not just a technical feature; it is a governance safeguard.

Pillar 3: Bias & Fairness Governance

AI bias represents one of the most significant ethical, reputational, and regulatory challenges in enterprise AI. Biased outcomes can lead to discrimination claims, regulatory penalties, and public backlash.

Bias can originate from multiple sources, including:

- Skewed or non-representative training datasets

- Historical discrimination embedded in legacy data

- Proxy variables that indirectly encode sensitive attributes

- Imbalanced class representation

- Inadequate validation across demographic segments

Effective AI governance solutions implement structured bias management protocols, including:

- Pre-training bias audits to assess dataset representation

- Fairness metric benchmarking (demographic parity, equal opportunity, equalized odds)

- Continuous fairness drift monitoring post-deployment

- Regular demographic impact assessments

- Threshold-based alerts for fairness deviations

Bias governance is central to responsible AI development. It ensures that AI systems align not only with performance metrics but also with societal expectations and regulatory standards. Without fairness monitoring, even technically accurate models may fail ethically and legally.

Pillar 4: Lifecycle Governance

AI governance cannot be limited to pre-deployment review. It must span the entire model lifecycle to ensure long-term reliability and compliance.

A comprehensive governance framework covers:

- Design: Risk assessment, ethical review, and use-case validation

- Data Collection: Dataset quality checks and compliance alignment

- Training: Secure model development with audit documentation

- Validation: Performance, bias, and robustness testing

- Deployment: Governance approval and secure release management

- Monitoring: Continuous drift, bias, and anomaly detection

- Retirement: Controlled decommissioning and archival documentation

Continuous lifecycle governance prevents silent model degradation, regulatory violations, and operational surprises. In high-performing enterprises, governance is not a bottleneck; it is an enabler of sustainable AI scale. By embedding structured oversight mechanisms into every stage of AI development and deployment, organizations ensure their AI systems remain secure, compliant, ethical, and aligned with strategic objectives.

AI Risk Management: From Initial Identification to Continuous Oversight

Effective AI risk management is not a one-time compliance activity, it is a structured, lifecycle-driven discipline. Professional AI risk management services implement comprehensive frameworks that govern AI systems from conception to retirement, ensuring resilience, compliance, and operational integrity.

Stage 1: Comprehensive AI Risk Identification

Every AI initiative must begin with structured risk discovery. Organizations should conduct a multidimensional evaluation that examines:

- Business impact and criticality: What operational or financial consequences arise if the model fails?

- Regulatory exposure: Does the system fall under sector-specific regulations (finance, healthcare, public sector)?

- Data sensitivity: Does the model process personally identifiable information (PII), financial records, or protected health data?

- Model autonomy level: Is the AI advisory, assistive, or fully autonomous?

- End-user exposure: Does the system directly affect customers, patients, or employees?

High-risk AI systems particularly those influencing critical decisions which require elevated scrutiny and governance controls from the outset.

Stage 2: Structured Risk Assessment & Categorization

Once risks are identified, AI systems must be classified using structured assessment frameworks. This tier-based categorization determines the depth of oversight, documentation, and control mechanisms required.

High-risk AI categories typically include:

- Credit scoring and lending decision systems

- Healthcare diagnostic and treatment recommendation models

- Insurance underwriting and claims automation engines

- Autonomous industrial and manufacturing systems

- AI systems used in public policy or critical infrastructure

These systems demand enhanced governance measures, including formal validation protocols, regulatory documentation, and executive-level oversight. Risk categorization ensures proportional governance thus allocating more stringent safeguards where impact and exposure are highest.

Stage 3: Embedded Risk Mitigation Controls

Risk mitigation must be operationalized within AI workflows not layered on as an afterthought. Mature AI risk management frameworks integrate technical and procedural safeguards such as:

- Human-in-the-loop review checkpoints for high-impact decisions

- Real-time anomaly detection systems to identify unusual behavior

- Secure retraining pipelines with validated data sources

- Documented incident response and escalation frameworks

- Access segregation and role-based permissions

- Audit trails for model updates and configuration changes

By embedding mitigation mechanisms directly into development and deployment processes, organizations reduce exposure to operational failure, regulatory penalties, and reputational damage.

Stage 4: Continuous Monitoring & Audit Readiness

AI risk is dynamic. Models evolve, data distributions shift, and regulatory landscapes change. Static governance approaches are insufficient.

Continuous monitoring frameworks include:

- Data and concept drift detection algorithms

- Performance degradation alerts and threshold monitoring

- Bias trend analysis across demographic groups

- Security anomaly detection and adversarial activity tracking

- Automated compliance reporting and audit documentation generation

This ongoing oversight transforms AI governance from reactive damage control to proactive risk anticipation.

Organizations that implement continuous monitoring achieve:

- Faster issue detection

- Reduced compliance risk

- Greater operational stability

- Stronger stakeholder trust

From Reactive Risk Management to Proactive AI Resilience

True AI risk management extends beyond compliance checklists. It builds adaptive systems capable of detecting, responding to, and learning from emerging threats.

When implemented effectively, structured AI risk management:

- Protects business continuity

- Safeguards sensitive data

- Enhances regulatory alignment

- Preserves brand reputation

- Enables responsible innovation at scale

AI risk is inevitable. Unmanaged AI risk is not.

AI Compliance: Navigating Global Regulatory Frameworks

Regulatory pressure around AI is accelerating globally. Enterprises require structured AI compliance solutions integrated into development pipelines.

EU AI Act

The EU AI Act mandates:

-

- Risk classification

- Conformity assessments

- Transparency obligations

- Incident reporting

- Technical documentation

Non-compliance may result in fines up to 7% of global revenue.

U.S. AI Governance Directives

Emphasis on:

-

- Algorithmic accountability

- National security risk assessment

- Bias mitigation

- Model transparency

Industry-Specific Compliance

- Healthcare:

- HIPAA compliance

- Clinical validation protocols

- Finance:

- Model risk management frameworks

- Fair lending audits

- Insurance:

- Anti-discrimination controls

- Manufacturing:

- Autonomous system safety standards

Integrated AI compliance solutions reduce audit risk and regulatory exposure.

Secure Build Compliant & Secure AI Solutions — Get a Free Strategy Session

Responsible AI Development: Engineering Ethical Intelligence

Responsible AI development operationalizes ethical principles into enforceable technical standards.

It includes:

- Privacy-by-design architecture

- Inclusive dataset sourcing

- Clear documentation standards

- Sustainability-aware model training

- Transparent stakeholder communication

- Ethical review committees

Responsible AI improves:

- Regulatory alignment

- Customer trust

- Investor confidence

- Long-term scalability

Ethics and engineering must operate in alignment.

Why Enterprises Need a Secure AI Development Partner ?

Deploying AI at enterprise scale is no longer just a technical initiative; it is a strategic transformation that intersects cybersecurity, regulatory compliance, risk management, and ethical governance. Building secure and compliant AI systems requires deep cross-disciplinary expertise spanning data science, infrastructure security, regulatory law, model governance, and operational risk frameworks. Few organizations possess all these capabilities internally.

A strategic, secure AI development partner brings structured oversight, technical rigor, and regulatory alignment into every phase of the AI lifecycle.

Such a partner provides:

- Advanced AI security services to protect data pipelines, models, APIs, and infrastructure from evolving threats

- Structured AI governance frameworks embedded directly into development and deployment workflows

- Lifecycle-based AI risk management services covering identification, assessment, mitigation, and continuous monitoring

- Regulatory-aligned AI compliance solutions tailored to global and industry-specific mandates

- Demonstrated expertise in responsible AI development, including bias mitigation, explainability, and transparency controls

Without governance and security, AI innovation can amplify enterprise risk, exposing organizations to regulatory penalties, operational failures, intellectual property theft, and reputational damage. With the right secure AI development partner, innovation becomes structured, resilient, and strategically sustainable. AI innovation without governance increases enterprise exposure. AI innovation with governance builds long-term competitive advantage.

Trust Is the Infrastructure of AI

AI is reshaping industries at unprecedented speed, but innovation without trust creates fragility, risk, and long-term instability. Sustainable AI adoption demands more than advanced models; it requires strong foundations. Enterprises that embed robust AI security services, scalable governance frameworks, continuous risk management processes, regulatory-aligned compliance systems, and structured responsible AI practices will define the next phase of digital leadership. In the enterprise AI era, security protects innovation, governance protects reputation, compliance protects longevity, and trust protects growth. Trust is not a soft value; it is operational infrastructure. At Antier, we engineer AI systems where innovation and governance evolve together. We help enterprises scale AI securely, responsibly, and with confidence.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle